Professional Documents

Culture Documents

Mobile Banking M Bank Ijariie1710

Mobile Banking M Bank Ijariie1710

Uploaded by

Rachana SurveOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mobile Banking M Bank Ijariie1710

Mobile Banking M Bank Ijariie1710

Uploaded by

Rachana SurveCopyright:

Available Formats

Vol-2 Issue-2 2016 IJARIIE-ISSN (O)-2395-4396

Mobile Banking(m-Bank)

Kamble Shilpa, Nakhate Nirjala, Golande Kalyani,Pawar Rohini

1

Student, Computer Department, Vishwabharti Academy’s College Of Engineering, Maharashtra, India

2

Student, Computer Department, Vishwabharti Academy’s College Of Engineering, Maharashtra, India

3

Student, Computer Department, Vishwabharti Academy’s College Of Engineering, Maharashtra, India

4

Student, Computer Department, Vishwabharti Academy’s College Of Engineering, Maharashtra, India

ABSTRACT

Mobile banking is an application of mobile computing which provides customers with the support needed to be able

to bank anywhere, anytime using a mobile handheld device and a mobile service such as Android mobile

application. Mobile banking facility removes the space and t ime limitations from banking activities such as checking

account balances or transferring money from one account to another and time saving when we go to bank and doing

some banking activities. A large multi-location bank wanted to extend mobile banking to its customer. It already had

robust Internet banking system in place. It was decided to roll out a mobile banking system (named m-Bank) in a

phased manner. The first version will include basic features like displaying a) account balance, b) last few

transactions, c) sending push notifications for the transactions above a predetermined value (to be decided by the

customer), and d) ATM locator. The integration with the banking system will be done using REST API over the

internal secured LAN. The solution has to be developed using IBM Work -light Studio and will be deployed on IBM

WAS, DB2, and Work -light Server. The target device will be an Android Phone. The development will follow the

IBMs Rational Unified Process.

Keyword: - Password, Authentication, OTP, Mobile Computing, Online Web Services, Geolocation, Rest API,

Adapters, Push Notification .

1. INTRODUCTION

A large multi-location bank wanted to extend mobile banking to its customer. It already had a robust

Internet banking system in place. It was decided to roll out a mobile banking system (named mBank) in a phased

manner. The first version will include basic features like displaying a) account balance, b) last few transactions, c)

sending push notifications for the transactions above a pre- determined value (to be decided by the customer), and d)

ATM locator. The integration with the banking system will be done using REST API over the internal secured LAN.

The solution has to be developed using IBMWorklight Studio and will be deployed on IBMWAS, DB2, an d

Worklight Server. The target device will be an Android Phone. The development will follow the IBMs Rational

Unified Process. This document is the primary input to the development team to architect a solution for this project.

The development of bank focused applications such as mobile banking and Internet banking services are

considered as important applications and that could benefit both customers and bank by improving banks

performance. Internet banking service is available to the customers only when customers are connected with devices

that have Internet connection. So it is not possible to the customer to be in touch with the bank throughout the day.

To overcome this problem in an efficient way that involves low-cost and offers maximum benefit to the bank that

implements the mobile banking application. As Internet banking has various security and privacy related issues

same problems are considered as another important problems associated with current existing system (Internet

banking). So, the problem statement of this project is to develop an alternative technology (mobile banking solution)

1710 www.ijariie.com 230

Vol-2 Issue-2 2016 IJARIIE-ISSN (O)-2395-4396

to overcome the problems associated with traditional Internet banking services. Mobile Banking refers to provision

of banking and financial services with the help of mobile telecommunication devices. The scope of offered services

may include facilities to conduct bank transactions, to administer accounts and to access customized information.

After the launch of mobile banking, transactions have seen some growth. St ill mobile banking has a long way to go

as, majority of customers prefer banking in traditional ways. Most of the customer’s problem is that they are not

well educated and not aware of the technological innovations.

The focuses on the development of a mobile application that will support the following functionalities to

enhance the banking:

Ubiquitous Banking: Customers having full access to their accounts anytime, anywhere.

Funds Transfer: Paying or receiving payments using the cellular phone.

Person to Person or business payments: Paying from the mobile phone for business or individual services.

Utility Bills payments: Get various bill amounts and pay them from the mobile phone.

Money transfer: Send money to recipients from the mobile phone wherever they are at the customers

convenience in a cost effective, secure and real time manner.

Mobile Top-Up: Airtime recharge on mobile phones.

ATM Locations: It locates the nearest ATM locations.

Push Notifications: It sends the notifications to the User about the transactons done and new available

services in the bank.

System Users: Customers i.e. the savings and current account holders of bank will primarily us the Mobile Banking

Application, m-Bank.

Bank Manager i.e. the bank manager validates the account, prov ide UserID and Password. Also validates

all transactions done.

2. MOTIVATION OF THE PROJECT

The advancements in the web technologies and their use at different levels initially made us to consider this

project. The Analysis phase mostly motivates to carry this project, because it shows the problems being currently

faced by all the Indian public sector banks mobile websites. So in order to solve listed issues and contribute to the

betterment of the Indian banks, it was necessary to provide a common framework for banks mobile websites, which

can give a boom to mobile banking in India and thus creating a healt hy customer-bank relationship.

3. LITERATURE REVIEW

Zahra Rahmani, Atusa Tahvildari, Hamideh Honarmand, Hoda Yousefi, Marjan Sadegh Daghighi,” MOBILE

BANKING AND ITS BENEFITS”, M.A. Student of Business Management, Islamic Azad University, Rasht,

Iran, 2012. Mobile banking is one of the areas mobile commerce that has extensive communications with other

areas of mobile commerce. The one hand, mobile banking is associated with customers and on the other hand, is

capable of other firms that are active in the field of electronic commerce, provide effective financial services. In this

paper we describe the definition of mobile banking, Evolution and finally to describe number of benefits for users of

these services.

Miss C.Lucia Vanitha, “A STUDY ON MOBILE BANKING”, IJSRM |Special Issue On e-Marketing

Road Ahead Of India, 2013. Mobile banking is an electronic system that provides most of the basic

1710 www.ijariie.com 231

Vol-2 Issue-2 2016 IJARIIE-ISSN (O)-2395-4396

services available in daily, traditional banking, but does so using a mobile communication device, usually a

smart phone. In some cases, a well developed mobile banking system can actually provide point -of-sale

ability similar to an ATM or credit card, except the purch aser buys by using their phone instead. With the

ease of mobile smart phones and their wide variety of applications today, it's not surprising the mobile

banking is now coming into full vogue. However, the concept and ability is not a new concept.

Renju Chandran, ” Pros and cons of Mobile banking”, International Journal of Scientific and Research

Publications, Volume 4, Issue 10, October 2014 1 ISSN 2250 -3153 . Mobile Banking refers to provision

of banking and financial services with the help of mobile telecommunication devices. The scope of offered

services may include facilities to conduct bank transactions, to administer accounts and to access

customized information. After the launch of mobile banking in India, mobile banking transactions have

seen some growth. Still mobile banking has a long way to go as, majority of customers prefer banking in

traditional ways. The basic objective is to identify the advantages and limitations of mobile banking and the

problems faced by customers in mobile banking. The banking sector reforms and introduction of e-banking

has made very structural changes in service quality, managerial decisions, operational performance,

profitability and productivity of the banks. There are various factors which have played vital role in th e

Indian banking sector for adoption of technology. So in order to run the mobile banking effectively, proper

care has been taken care of and take adequate steps to improve the quality services.

4. EXISTING SYSTEM

Inter Bank Mobile Payment Service(IMPS): Inter-bank mobile payment service (IMPS), which is a fund

transfer service through National Payment Council of India (NPCI). This service lets you transfer funds

from one account to another across banks within the country using your mobile phone. You can use the

IMPS via your banks' app, USSD’S dial-in number, encrypted SMS banking or net banking.

Bank Apps: Here you need to download your bank's application or software on your mobile phone via

internet. This works on both GSM and CDMA handsets for Andro id and iPhone platforms.

USSD-based Banking: For this type, all you have to do is dial the bank's service code and you can ask for

information on your bank account. You don't need a Smartphone or high end phone to use the USSD

platform.

SMS Based Banking: It is the most popular method of mobile banking. In which Notifications sends via

SMS on users mobile number.

Internet Based Mobile Banking: This way of banking is where you use your mobile screen like a

computer monitor. In this service you required Internet connection whenever you are using this service.

4.1 Drawbacks of Existing System

In Bank apps, it need specific bank application software on mobile phone via internet.

In SMS banking when mobile swith off, it fails to receive the message.

In internet banking, regular access of internet is must.

In internet banking, due to internet access it consumes more cost.

5. PROPOSED SYSTEM

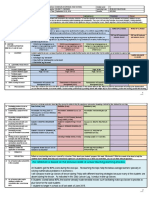

To overcome the drawbacks of the existing system, we implements this new system named as

Mobile Banking (m-bank) App. System Architecture for this system is as shown in bellow fig.1.

1710 www.ijariie.com 232

Vol-2 Issue-2 2016 IJARIIE-ISSN (O)-2395-4396

Fig.1 System Architecture of Mobile Banking App

In given architecture, we use some key concepts that are shown in below table. Used key concepts

are as Password, Authentication, OTP, Geolocation, etc.

SR.No. Keyword Desciption

1 Authentication: Authentication is a process in which bank provide the UserID and

Password to the user and whenever any transaction is done, it is

authenticated by specific bank.

2 Password: A password is a word or string of characters used for user

authentication to prove identity or access approval to gain access to a

resource which should be kept secret from those not allowed access.

3 Mobile Computing: Mobile computing is HCI by which a computer is expected to be

transported during normal usage. .

4 Service composition: A service composition is an aggregate of services collectively

composed to automate a particular task or business process.

5 Online Web Services: Web services describes a standardized way of integrating Web-based

application.

6 Geolocation: Geolacation is used for showing the nearest ATM Locations.

7 Rest API: The integration with the banking system will

be done using REST API over the internal secured LAN.

8 Adapter: The adapter framework mediates between the mobile apps& the back

end services.

1710 www.ijariie.com 233

Vol-2 Issue-2 2016 IJARIIE-ISSN (O)-2395-4396

9 Push Notifications: It is used to display the notifications about the transaction done on the

user account.

10 OTP It is used to validate the user only for one session or transaction. OTP

is generated on users mo. Number.

Table 1. Key Concepts used in Project

5.1 Algorithm For OTP

1. A seed (starting value) s is chosen.

2. A hash functionf(s) is applied repeatedly (for example, 1000 times) to the seed, giving a value of: f(f(f( ....

f(s) ....))). This value, which we will call f1000 (s) is stored on the target system.

3. The user's first login uses a password p derived by applying f 999 times to the seed, that is, f999 (s). The

target system can authenticate that this is the correct password, because f(p) is f1000 (s), which is the value

stored. The value stored is then replaced by p and the user is allowed to login.

4. The next login, must be accompanied by f998 (s). Again, this can be validated because hashing it gives f999 (s)

which is p, the value stored after the previous login. Again, the new value replaces p and the user is

authenticated.

5. This can be repeated another 997 times, each time the password will be f applied one fewer times, and is

validated by checking that when hashed, it gives the value stored during the previous login. Hash functions

are designed to be extremely hard to reverse, therefore an attacker would need to know the initial seed s to

calculate the possible passwords, while the computer system can confirm the password on any given

occasion is valid by checking that, when hashed, it gives the value previously used for login. If an

indefinite series of passwords is wanted, a new seed value can be chosen after the set for s is exhausted.

6. ADVANTAGES OF MOBILE BANKING

Time saving : Instead of allocating time to walk into a bank, you can check account balances, schedule and

receive payments, transfer money and organise your accounts when you’re on the go.

Convenient : The ability to access bank accounts, make payments, and even track investments regardless of

where you are can be a big advantage Do your banking at a time and place that suits you, instead of waiting

in queues.

Secure : Generally, good mobile banking apps have a security guarantee or send you a SMS verification

code you need to input to authorise a payment for added security. Mobile banking is said to be even more

secure than online/internet banking.

1710 www.ijariie.com 234

Vol-2 Issue-2 2016 IJARIIE-ISSN (O)-2395-4396

Easy access to your finances: with the introduction of mobile banking, you are able to access your financial

information even beyond the working hours. It helps to avail banking services even by making a call to the

bank.

Increased efficiency: mobile banking functions are functional, efficient and competitive. It also helps in

decongesting the banking halls and reduces the amount of paperwork for both the banker and the customer

Fraud reduction: one very real advantage to implementing mobile banking. “Customers are being

deputized in real time to watch their accounts.

It utilizes the mobile connectivity of telecom operators and therefore does not require an internet

connection.

You can check your account balance, review recent transaction, transfer funds, pay bills, locate ATMs,

deposit cheques, manage investments, etc.

Mobile banking is available round the clock 24/7/365, it is easy and convenient and an ideal choice for

accessing financial services for most mobile phone owners in the rural areas.

7. CONCLUSIONS

In this project, We implemented Mobile banking App (m-bank), which provides different facilities like the

display account current status, Transfere the money from one account to another, Receive notifications of

transactions which are done on users account, display the nearest ATM location, Mobile topup recharges, utility bill

payments. The existing techniques does not have that much capability to secure password from hackers or third

party location .because in this techniques only one password is used for each and every session and password is

transfer for authentications of users. So these passwords are easily hacked by hackers. We proposed a system called

Session password, in this it provides a new password for each session and need not to transfer password form server

each time for authentication purpose that’s why Session password scheme provides more security than the other

existed systems.

8. REFERENCES

[1]. Zahra Rahmani, Atusa Tahvildari, Hamideh Honarmand, Hoda Yousefi, Marjan Sadegh Daghighi,”

MOBILE BANKING AND ITS BENEFITS”.

I. Miss C.Lucia Vanitha, “A STUDY ON MOBILE BANKING”, IJSRM |Special Issue On e-Marketing

Road Ahead Of India, 2013.

II. Renju Chandran, ” Pros and cons of Mobile banking”, International Journal of Scientific and Research

Publications, Volume 4, Issue 10, October 2014 1 ISSN 2250-3153 .

III. Farnood,H.(2008).Sultanate. Soheila, "mobile banking", Journal of Information Technology Era, No. 38.

IV. Laukkanen, T. & Pasanen(2000). M. "Mobile banking innovators and early adopters". Journal of Financial

Services.18,85-91.

V. Rao, G. R.,&Prathima, K. (2003). Online banking in India.Mondaq Business Briefing, 11 April 2003.

VI. S. Wiedenbeck, J. Waters, J.C. Birget, A. Brodskiy, N. Memon, ”Design an d longitudinal evaluation of a

graphical password system”. International J. of Human-Computer Studies 63 (2005) 102-127.

1710 www.ijariie.com 235

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cooperative StripDocument1 pageCooperative Stripangelajohnson1983No ratings yet

- Second Semester 2016/2017 (February 13, 2017 - September 10, 2017)Document1 pageSecond Semester 2016/2017 (February 13, 2017 - September 10, 2017)Ridzwan NurunnainNo ratings yet

- Problems of Chapter 6Document9 pagesProblems of Chapter 6VuKhang NguyenNo ratings yet

- Limited Liabilities Partnership FirmDocument14 pagesLimited Liabilities Partnership FirmPraveen JoeNo ratings yet

- Challenges and Complexities of Meeting Family.1Document2 pagesChallenges and Complexities of Meeting Family.1Tomas EvansNo ratings yet

- WIMJ2017 Vol 4, Issue 1 Complete PDFDocument76 pagesWIMJ2017 Vol 4, Issue 1 Complete PDFarvind YadavNo ratings yet

- Designing Learning Spaces For Children On The AutiDocument17 pagesDesigning Learning Spaces For Children On The AutilalecrimNo ratings yet

- Olfactory Receptors Are Not Unique To The NoseDocument1 pageOlfactory Receptors Are Not Unique To The NoseMicheleFontanaNo ratings yet

- 22 Reasons Not To Go VegetarianDocument3 pages22 Reasons Not To Go VegetarianchicanahenoNo ratings yet

- MODULE NCM 107 - MaternalDocument6 pagesMODULE NCM 107 - MaternalJoana Grace CortezNo ratings yet

- Irregular Verbs For GroupsDocument10 pagesIrregular Verbs For GroupsdrespetoNo ratings yet

- The Mossad and The JFK AssassinationDocument22 pagesThe Mossad and The JFK AssassinationJuan Manuel Vargas75% (4)

- Advantages and DisadvantagesDocument2 pagesAdvantages and DisadvantagesJuhi BhattacharjeeNo ratings yet

- Community Diagnostic SurveyDocument2 pagesCommunity Diagnostic SurveyScribdTranslationsNo ratings yet

- Retro 160g LC 180g LCDocument20 pagesRetro 160g LC 180g LCjaviercastillogallarNo ratings yet

- Procedure For Applying:: WWW - Tnteu.ac - inDocument1 pageProcedure For Applying:: WWW - Tnteu.ac - inArangaNo ratings yet

- DLL - Araling Panlipunan-9 (Sept 26-30)Document3 pagesDLL - Araling Panlipunan-9 (Sept 26-30)G-one Paisones100% (4)

- Worshop. Units 1 and 2. Level IIIDocument5 pagesWorshop. Units 1 and 2. Level IIIYeidis Mendoza ValdezNo ratings yet

- An Implementation Study of A TPACK-based Instructional Design Model in A Technology Integration CourseDocument24 pagesAn Implementation Study of A TPACK-based Instructional Design Model in A Technology Integration CourseSRI HANDAYANINo ratings yet

- CV IsmailDocument1 pageCV IsmailIsmail RanaNo ratings yet

- Limiting Factors On Population DensityDocument2 pagesLimiting Factors On Population DensityLaarni Faye Sarmiento100% (1)

- Final ReportDocument17 pagesFinal ReportDias Teddo WNo ratings yet

- Data Master DiagnosaDocument40 pagesData Master Diagnosabagoang puskesmasNo ratings yet

- Pittsfield Public Schools New Code of Conduct, Character and SupportDocument65 pagesPittsfield Public Schools New Code of Conduct, Character and SupportThe Berkshire EagleNo ratings yet

- Department of Basic Engineering Sciences C Programming & Data Structures Lab List of Experiments For The A.Y. 2016-17Document25 pagesDepartment of Basic Engineering Sciences C Programming & Data Structures Lab List of Experiments For The A.Y. 2016-17Arun RangrejNo ratings yet

- Tendency: Measures of CentralDocument29 pagesTendency: Measures of CentralADR GARDIOLANo ratings yet

- CV Arizal Abdul MalikDocument2 pagesCV Arizal Abdul MalikSidi Arizal Abdul MalikNo ratings yet

- Student Guide 2015Document13 pagesStudent Guide 2015api-295463484No ratings yet

- As of 050120 - Essential Wedding Package 2020-21Document2 pagesAs of 050120 - Essential Wedding Package 2020-21Vic VerraNo ratings yet

- 21 Elementary Test 14Document7 pages21 Elementary Test 14Zoya AtanasovaNo ratings yet