Professional Documents

Culture Documents

HSBC Credit Card Cashback PDF

Uploaded by

Sampath ReddyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HSBC Credit Card Cashback PDF

Uploaded by

Sampath ReddyCopyright:

Available Formats

Credit Card (launch mailer) – Terms and Conditions

1. The cashback offer has been provided by The Hongkong and Shanghai Banking Corporation

Limited, India (HSBC/Bank) to its New to Bank (NTB) HSBC Platinum primary Credit Cardholders

(hereinafter referred to as ‘Cardholders’) who have applied for and have been issued a HSBC

Platinum Credit Card under this offer between the period of 01 October 2018 to 31 March 2019.

2. Participation in the offer is voluntary. This offer is valid for Resident Indian customers only.

3. This offer is also valid for the existing HSBC Credit Cardholders who have applied for an upgrade

to new HSBC Platinum Credit Card.

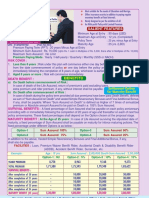

4. Under this offer, the Cardholders will be entitled to 10% cashback in the first 90 days of issuance

of the Credit Card on a minimum spend of ₹10,000 across 9 transactions subject to a maximum

of ₹2,500 as cashback (Offer).

5. The 10% cashback offer is valid only once per platinum card per customer. If a customer applies

for another platinum card he or she will not be eligible for this offer.

6. Appended illustrations explain how the cashback works.

Month No. of transactions Value of transactions Cashback

Jan 2* 12000 0

Feb 3 5000 0

Mar 3 3000 0

8 Total 0

* Since the no of transactions is <9 in January, February and March, no cashback will be credited.

Month No. of transactions Value of transactions Cashback

Jan 0 0 0

Feb 0 0 0

Mar 9 30000 2500

9 Total 2500

Month No. of transactions Value of transactions Cashback

Jan 7 *8000 0

Feb 2 *1000 0

Mar 0 0 0

9 Total 0

*Since the total value of the transactions is less than ₹10,000 in January, February and March, no

cashback will be credited

7. The month period is considered as 30 days and will be counted from the Credit Card issuance

date.

8. This is a limited period offer and HSBC in its sole discretion reserves the right to add, alter,

modify, change or vary all or any of these terms and conditions or to replace, wholly or in part, this

programme by another programme, whether similar to this programme or not, or to withdraw it

altogether at any point in time by providing appropriate intimation to the cardholder.

9. Under this offer, the Cardholder will not be eligible for the fuel surcharge waiver benefit for the first

90 days from the Credit Card issuance.

10. Eligible cashback amount will be credited within 45 days after completion of 90 days from Credit

Card issuance. The eligible cashback amount will be credited to the Credit Card account of the

Cardholder.

11. Cardholders are required to fulfil the respective spending requirements of minimum 9

transactions within 90 calendar days of the date of issuance of the new Credit Card. The amount

spent is calculated based on the spending of ₹10,000 or more made by the newly approved

Credit Card and refers to all types of sales transactions (including but without limitation, bill

payments, online purchases, mail and telephone orders and insurance payments). Non-sales

transactions, including but without limitation, finance charges, cash advance and cash advance

charges, late payment charges, balance transfer or annual fees are not included.

12. Cancelled or refunded transactions are also not included in the spending amount calculation.

13. Cardholders cannot combine any other welcome offer/introductory offer with this cashback offer.

14. HSBC Credit Cardholders, who have not made the payment of their minimum amount due, even

after 30 days of the last payment due date (mentioned on the card statement) will not be eligible

for this offer.

15. As a part of Credit Card application procedure, New to Bank HSBC Platinum Credit Card

applicants will be required to provide recent passport size photograph; PAN card copy, address

proof and self-attested copy of valid photo identity document. The applicants will be contacted by

the Bank for collection of these documents. The documents submitted along with the application

will be kept with the Bank for record purposes and will not be returned.

16. Issuance of the Credit Card is at the sole discretion of the Bank and is subject to the Bank's

internal approval norms.

17. Interest needs to be shown and express consent must be provided in writing/calling on the toll

free number or by providing an SMS to be called in relation to the offer.

18. When the Cardholder shows any interest in the offer by reaching out to the Bank by way of any of

the above modes such as writing/calling on the toll free number or by providing an SMS, the said

communication shall be treated as explicit and express consent to HSBC (including its

representatives, group companies and service providers) to call the Cardholder on the contact

number provided by the Cardholder in relation to the HSBC Credit Card irrespective of whether

the Cardholder is a part of National Do Not Call registry/Do Not Call registry/National Customer

Preference Register.

19. All conditions of the HSBC Credit Card shall apply on this offer. Please visit www.hsbc.co.in for

detailed terms and conditions.

20. The Offer is subject to force majeure events.

cc_cs_09/18

21. Tax liability, if any, will be borne by the Cardholder.

22. Disputes, if any, arising out of or in connection with or as a result of the above Offer or otherwise

relating hereto shall be subject to the exclusive jurisdiction of the competent courts/tribunals in

Mumbai only.

23. By participating in this offer, the Cardholders shall be deemed to have accepted all the

aforementioned terms and conditions.

Issued by The Hongkong and Shanghai Banking Corporation Limited, India. Incorporated in Hong Kong SAR w ith

limited liability.

Privacy and Security | Terms of use | Hyperlink Policy

© Copyright 2018. The Hongkong and Shanghai Banking Corporation Limited, India. Incorporated in

Hong Kong SAR w ith limited liability. All rights reserved.

You might also like

- HSBC Credit Card CashbackDocument1 pageHSBC Credit Card CashbackNaveen KumarNo ratings yet

- Cashback Offer Terms and ConditionsDocument1 pageCashback Offer Terms and ConditionsYogendra Kumar DubeyNo ratings yet

- eStatement1481IN - 2024 02 23Document3 pageseStatement1481IN - 2024 02 23sanjitsha2708No ratings yet

- Cash Lite Pds enDocument7 pagesCash Lite Pds enSyarmimi LiyanaNo ratings yet

- Promo Mechanics-2023MetrobankTITANIUM MC-SBFW PromoDocument3 pagesPromo Mechanics-2023MetrobankTITANIUM MC-SBFW PromoMei A. OrcenaNo ratings yet

- Citi Rewards Domestic MITC FinalDocument8 pagesCiti Rewards Domestic MITC FinalGauravkNo ratings yet

- Festive 19tncDocument1 pageFestive 19tncAnup Kumar BisoyiNo ratings yet

- Credit Card Statement: Payment Amount in PKR Debit My Silkbank A/C # Accept My Payment Through Cheque # Bank BranchDocument6 pagesCredit Card Statement: Payment Amount in PKR Debit My Silkbank A/C # Accept My Payment Through Cheque # Bank BranchTri Adi NugrohoNo ratings yet

- CC Moratorium FAQsDocument1 pageCC Moratorium FAQsTanya ChadhaNo ratings yet

- English MITC PDFDocument15 pagesEnglish MITC PDFAmit ShuklaNo ratings yet

- PNB MITC ConditionsDocument38 pagesPNB MITC Conditionswestm4248No ratings yet

- Fees and Charges-SBIDocument14 pagesFees and Charges-SBIpdevidasNo ratings yet

- E StatementDocument3 pagesE StatementAjayKumar KNo ratings yet

- Important T&CsDocument18 pagesImportant T&CsKrishna KishoreNo ratings yet

- Most Important Terms & ConditionsDocument12 pagesMost Important Terms & ConditionsshazanNo ratings yet

- HSBC TNGD Cashback-TncDocument2 pagesHSBC TNGD Cashback-TncNgHanSeongNo ratings yet

- Abenson Summer Exclusives - Promo MechanicsDocument2 pagesAbenson Summer Exclusives - Promo MechanicsBon Alexis GuatatoNo ratings yet

- Abenson Summer Exclusives - Promo Mechanics PDFDocument2 pagesAbenson Summer Exclusives - Promo Mechanics PDFBon Alexis GuatatoNo ratings yet

- Membership MITCDocument28 pagesMembership MITCCarclinicNo ratings yet

- TC Petrol 20cbDocument10 pagesTC Petrol 20cbazrael.arhamNo ratings yet

- Credit Card Statement: Payment Amount in PKR Debit My Silkbank A/C # Accept My Payment Through Cheque # Bank BranchDocument6 pagesCredit Card Statement: Payment Amount in PKR Debit My Silkbank A/C # Accept My Payment Through Cheque # Bank BranchAkhbar-ul- AkhyarNo ratings yet

- R13 - 07.09.20 PDFDocument42 pagesR13 - 07.09.20 PDFअहा मधुमक्खीपालनNo ratings yet

- Terms and Conditions For Cashback For Airtel Axis Bank Credit CardDocument5 pagesTerms and Conditions For Cashback For Airtel Axis Bank Credit CardVASTU INTACTNo ratings yet

- 411DPFHZ539384 Foreclosure LetterDocument3 pages411DPFHZ539384 Foreclosure LetterSaikiran VeepuriNo ratings yet

- IDBI Bank MITC ConditionsDocument14 pagesIDBI Bank MITC Conditionswestm4248No ratings yet

- Foreclosure Letter 13-51-59Document3 pagesForeclosure Letter 13-51-59Kavipriyan MagudeeswaranNo ratings yet

- TC - Visa Boost Rewards CBDocument10 pagesTC - Visa Boost Rewards CBg-87539325No ratings yet

- Sbi Simply SavDocument28 pagesSbi Simply SavkumbharfamilyNo ratings yet

- Accounting GR 11 Acc T3 Week 6 Budgets - 2 ENGDocument5 pagesAccounting GR 11 Acc T3 Week 6 Budgets - 2 ENGsihlemooi3No ratings yet

- Alliance - NOD (Amended 1.0)Document3 pagesAlliance - NOD (Amended 1.0)Daniel OthmanNo ratings yet

- Balance Conv TandCs Final 1Document12 pagesBalance Conv TandCs Final 1Kareena KapoorNo ratings yet

- Terms ConditionsDocument3 pagesTerms ConditionsArdenNo ratings yet

- Martin Dow Marker LimitedDocument1 pageMartin Dow Marker LimitedShan AhmadNo ratings yet

- 2023 20 11 10 51 50 Pre ClosestatementDocument2 pages2023 20 11 10 51 50 Pre ClosestatementMohit pathakNo ratings yet

- Accountancy Xi Online Exam (2) - 274Document6 pagesAccountancy Xi Online Exam (2) - 274Swami NarangNo ratings yet

- TC Spendeveryday PDFDocument10 pagesTC Spendeveryday PDFsnowidunNo ratings yet

- BillSTMT 4588260000514267Document3 pagesBillSTMT 4588260000514267Fahad AhmedNo ratings yet

- eStatement0630IN 2023-06-02 1643Document3 pageseStatement0630IN 2023-06-02 1643abhishekyadav742896No ratings yet

- CCR Cash Back Offer T CsDocument1 pageCCR Cash Back Offer T CsankitjhambNo ratings yet

- Revision of Axis Bank Credit Card Terms and ConditionsDocument4 pagesRevision of Axis Bank Credit Card Terms and ConditionsSumit MishraNo ratings yet

- Foreclosure LetterDocument3 pagesForeclosure LetterabinayaNo ratings yet

- Foreclosure 20 58 16Document3 pagesForeclosure 20 58 16Bio AllianceNo ratings yet

- Pure Savings On Your New Mashreq Credit Card!: Offer A DetailsDocument4 pagesPure Savings On Your New Mashreq Credit Card!: Offer A DetailsNibin OdukkathilNo ratings yet

- Boiler Steam GenerationDocument3 pagesBoiler Steam Generationmohammed nasarNo ratings yet

- In Rewardscard Most Important Terms and ConditionsDocument4 pagesIn Rewardscard Most Important Terms and ConditionsHichem BarkatiNo ratings yet

- MID Version XVII (Copy 1)Document1 pageMID Version XVII (Copy 1)Demo NOWNo ratings yet

- 2024 30 1 16 42 27 Pre ClosestatementDocument4 pages2024 30 1 16 42 27 Pre ClosestatementaaaNo ratings yet

- Offer Terms and Conditions:: January 2022. Sample Illustration of Transactions Done Between 07-08 Oct'21Document4 pagesOffer Terms and Conditions:: January 2022. Sample Illustration of Transactions Done Between 07-08 Oct'21Sanjay VaswaniNo ratings yet

- Pre ClosestatementDocument2 pagesPre Closestatementkhurafaat inNo ratings yet

- E StatementDocument3 pagesE Statementswati jenaNo ratings yet

- Pre ClosestatementDocument2 pagesPre ClosestatementMURALI KRISHNA MADDINENINo ratings yet

- Convert-to-Installment Terms and Conditions - 0% at 3 MonthsDocument3 pagesConvert-to-Installment Terms and Conditions - 0% at 3 MonthsJohn Eric D. WongNo ratings yet

- NariDocument3 pagesNariPaNo ratings yet

- One Bonus Interest Campaign TNC EngDocument5 pagesOne Bonus Interest Campaign TNC EngJaafar AhmadNo ratings yet

- Ecommerce (July) - Promo Mechanics (Targeted) - As of July 25Document2 pagesEcommerce (July) - Promo Mechanics (Targeted) - As of July 25MaraNo ratings yet

- Most Important Terms and ConditionsDocument7 pagesMost Important Terms and Conditionsyour mdrahamanNo ratings yet

- TC Visa CashbackDocument10 pagesTC Visa Cashbackioi123No ratings yet

- Revision of Axis Bank Credit Card Terms and ConditionsDocument4 pagesRevision of Axis Bank Credit Card Terms and Conditionsravi rahulNo ratings yet

- Loan Details Charges: Customer Portal ExperiaDocument4 pagesLoan Details Charges: Customer Portal ExperiaAlpesh KuleNo ratings yet

- Energy Brochure PDFDocument2 pagesEnergy Brochure PDFSampath ReddyNo ratings yet

- Key Progress Updates - GBM - 5th May 2019 - Ver 2.0Document30 pagesKey Progress Updates - GBM - 5th May 2019 - Ver 2.0Sampath ReddyNo ratings yet

- Credit Card StatementDocument4 pagesCredit Card StatementSampath ReddyNo ratings yet

- D List 25.07.2019 PDFDocument4 pagesD List 25.07.2019 PDFSampath ReddyNo ratings yet

- HSBC Credit Card CashbackDocument1 pageHSBC Credit Card CashbackSampath ReddyNo ratings yet

- PDFDocument2 pagesPDFSampath ReddyNo ratings yet

- Edelweiss Financial Services LTDDocument7 pagesEdelweiss Financial Services LTDMukesh SharmaNo ratings yet

- Appendix 4Document4 pagesAppendix 4Rajesh ShirwatkarNo ratings yet

- CielDocument19 pagesCielsatishgoud.20089668No ratings yet

- Chapter-3: Economy - Improving The Performance of The New Zealand Banking SystemDocument38 pagesChapter-3: Economy - Improving The Performance of The New Zealand Banking SystembablujsrNo ratings yet

- Cost Accounting System: TopicDocument2 pagesCost Accounting System: Topicsamartha umbareNo ratings yet

- School of Business & Management: Course Outline & Accompanying Teaching & Learning PlanDocument6 pagesSchool of Business & Management: Course Outline & Accompanying Teaching & Learning PlanGurmanjot KaurNo ratings yet

- 320 Accountancy Eng Lesson12Document18 pages320 Accountancy Eng Lesson12Karen Joy RevadonaNo ratings yet

- Assets & Liabilities Committee Report: Performance Management & MonitoringDocument15 pagesAssets & Liabilities Committee Report: Performance Management & MonitoringMichael OseleNo ratings yet

- Company Alembic Pharmaceuticals LTD.: Name Deepankar Tiwari Roll No 24 Class Mba HCMDocument11 pagesCompany Alembic Pharmaceuticals LTD.: Name Deepankar Tiwari Roll No 24 Class Mba HCMAryan RajNo ratings yet

- 2Document12 pages2NAVAS IIANo ratings yet

- Chase B Statement-MarDocument4 pagesChase B Statement-MarЮлия ПNo ratings yet

- Project On Spending and Saving of College StudentsDocument61 pagesProject On Spending and Saving of College StudentsKerala Techie Teens100% (1)

- Mou Mt103 One WayDocument15 pagesMou Mt103 One WayParveen Jain80% (5)

- Book-Keeping Form Three PDFDocument4 pagesBook-Keeping Form Three PDFdesa ntosNo ratings yet

- Bajaj Allianz Life InsuranceDocument22 pagesBajaj Allianz Life InsuranceShadab HasanNo ratings yet

- ACGA 504/ HCGA 507 General Accounting - Part 2Document21 pagesACGA 504/ HCGA 507 General Accounting - Part 2Eliza BethNo ratings yet

- Adobe Scan 11 Jul 2023Document1 pageAdobe Scan 11 Jul 2023Anandbabu YemulaNo ratings yet

- Reits Report by Hkis 2006Document70 pagesReits Report by Hkis 2006morrislamthNo ratings yet

- Canton, E. - General Ledger - Alabang Plumbing (Solution)Document4 pagesCanton, E. - General Ledger - Alabang Plumbing (Solution)Edmalyn CantonNo ratings yet

- United Bank of IndiaDocument5 pagesUnited Bank of IndiaRajesh DubeyNo ratings yet

- Metabank Bank StatementDocument3 pagesMetabank Bank Statementevaristus221No ratings yet

- LIC - Jeevan TarunDocument1 pageLIC - Jeevan TarunPraveen Kumar KNo ratings yet

- 3Q 2022 INDF Indofood+Sukses+Makmur+TbkDocument164 pages3Q 2022 INDF Indofood+Sukses+Makmur+TbkAdi Gesang PrayogaNo ratings yet

- Statement of Card - AccountDocument1 pageStatement of Card - AccountСергей АлексеевичNo ratings yet

- Mr. Tibbs & Mr. Finch - HO InsuranceDocument6 pagesMr. Tibbs & Mr. Finch - HO InsuranceAlex RobertsNo ratings yet

- BBA FMI Unit 2 - NoDocument34 pagesBBA FMI Unit 2 - NoRuhani AroraNo ratings yet

- Financial Reporting in Hyperinflationary EconomiesDocument4 pagesFinancial Reporting in Hyperinflationary EconomiesTricia Nicole Dimaano100% (1)

- AFAR - Mastery Class Batch 2Document5 pagesAFAR - Mastery Class Batch 2Antonette Eve CelomineNo ratings yet

- Crisl Rating Prime Bank LTD 2 PDFDocument1 pageCrisl Rating Prime Bank LTD 2 PDFgastro8606342No ratings yet

- Accounting 101 Chapter 2Document11 pagesAccounting 101 Chapter 2Kriss AnnNo ratings yet