Professional Documents

Culture Documents

Ratios

Uploaded by

Talha AhmedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratios

Uploaded by

Talha AhmedCopyright:

Available Formats

a. The answer should be focused on using the current and quick ratios.

While the current

ratio has steadily increased, it is to be noted that the liquidity has not resulted from

the most liquid assets as the CEO proposes. Instead, from the quick ratio one could

note that the increase in liquidity is caused by an increase in inventories. For a fresh

food firm one could argue that inventories are relatively liquid when compared to

other industries. Also, given the information, the industry-benchmark can be used to

derive that the firm's quick ratio is very similar to the industry level and that the

current ratio is indeed slightly higher - again, this seems to come from inventories.

b. Inventory turnover, days sales in receivables, and the total asset turnover ratio are to

be mentioned here. Inventory turnover has increased over time and is now above the

industry average. This is good - especially given the fresh food nature of the firm's

industry. In 1999 it means for example that every 365/62.65 = 5.9 days the firm is

able to sell its inventories as opposed to the industry average of 6.9 days. Days' sales

in receivables has gone down over time, but is still better than the industry average.

So, while they are able to turn inventories around quickly, they seem to have more

trouble collecting on these sales, although they are doing better than the industry.

Finally, total asset turnover is went down over time, but it is still higher than the

industry average. It does tell us something about a potential problem in the firm's long

term investments, but again, they are still doing better than the industry.

c. Solvency and leverage is captured by an analysis of the capital structure of the firm

and the firm's ability to pay interest. Capital structure: Both the equity multiplier and

the debt-to-equity ratio tell us that the firm has become less levered. To get a better

idea about the proportion of debt in the firm, we can turn the D/E ratio into the D/V

ratio: 1999: 43%, 1998: 46%, 1997:47%, and the industry-average is 47%. So based

on this, we would like to know why this is happening and whether this is good or bad.

From the numbers it is hard to give a qualitative judgement beyond observing the

drop in leverage. In terms of the firm's ability to pay interest, 1999 looks pretty bad.

However, remember that times interest earned uses EBIT as a proxy for the ability to

pay for interest, while we know that we should probably consider cash flow instead of

earnings. Based on a relatively large amount of depreciation in 1999 (see info), it

seems that the firm is doing just fine.

You might also like

- Midterm FSMG ADocument2 pagesMidterm FSMG ATalha AhmedNo ratings yet

- Blanchard-3203 Mihaela 2019springDocument5 pagesBlanchard-3203 Mihaela 2019springTalha AhmedNo ratings yet

- MICRO 2 Assignment 2Document1 pageMICRO 2 Assignment 2Talha AhmedNo ratings yet

- Lecture 2 Financial AnalysisDocument38 pagesLecture 2 Financial AnalysisTalha Ahmed100% (1)

- Varian9e LecturePPTs Ch03Document54 pagesVarian9e LecturePPTs Ch03Talha AhmedNo ratings yet

- TERM REPORT: Students Are Required To Give Industry Specific Reports. Student in The Class Will Break Into Groups ofDocument2 pagesTERM REPORT: Students Are Required To Give Industry Specific Reports. Student in The Class Will Break Into Groups ofTalha AhmedNo ratings yet

- Examination Paper Fall 2017Document1 pageExamination Paper Fall 2017Talha AhmedNo ratings yet

- Malik Liquidity PakistanDocument16 pagesMalik Liquidity PakistanTalha AhmedNo ratings yet

- Maths Macro MidtermDocument1 pageMaths Macro MidtermTalha AhmedNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Speech by His Excellency The Governor of Vihiga County (Rev) Moses Akaranga During The Closing Ceremony of The Induction Course For The Sub-County and Ward Administrators.Document3 pagesSpeech by His Excellency The Governor of Vihiga County (Rev) Moses Akaranga During The Closing Ceremony of The Induction Course For The Sub-County and Ward Administrators.Moses AkarangaNo ratings yet

- ASME-Y14.5.1M 1994 Mathematical Definition of Dimensioning and Tolerancing Principles PDFDocument89 pagesASME-Y14.5.1M 1994 Mathematical Definition of Dimensioning and Tolerancing Principles PDFwulfgang66No ratings yet

- From Jest To Earnest by Roe, Edward Payson, 1838-1888Document277 pagesFrom Jest To Earnest by Roe, Edward Payson, 1838-1888Gutenberg.org100% (1)

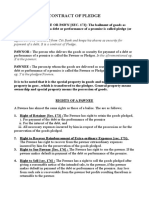

- Contract of PledgeDocument4 pagesContract of Pledgeshreya patilNo ratings yet

- 10-C# Forms InteractionDocument22 pages10-C# Forms InteractionMaria Anndrea MendozaNo ratings yet

- Rubrics For Field Trip 1 Reflective DiaryDocument2 pagesRubrics For Field Trip 1 Reflective DiarycrystalNo ratings yet

- Mwa 2 - The Legal MemorandumDocument3 pagesMwa 2 - The Legal Memorandumapi-239236545No ratings yet

- What Is Thesis Plural FormDocument8 pagesWhat Is Thesis Plural Formtracyjimenezstamford100% (2)

- Ib Physics SL - Unit 4 ReviewDocument46 pagesIb Physics SL - Unit 4 ReviewMax HudgenesNo ratings yet

- Effect of Intensive Health Education On Adherence To Treatment in Sputum Positive Pulmonary Tuberculosis PatientsDocument6 pagesEffect of Intensive Health Education On Adherence To Treatment in Sputum Positive Pulmonary Tuberculosis PatientspocutindahNo ratings yet

- A Study On Investors Perception Towards Sharemarket in Sharekhan LTDDocument9 pagesA Study On Investors Perception Towards Sharemarket in Sharekhan LTDEditor IJTSRDNo ratings yet

- Update UI Components With NavigationUIDocument21 pagesUpdate UI Components With NavigationUISanjay PatelNo ratings yet

- Echnical Ocational Ivelihood: Edia and Nformation IteracyDocument12 pagesEchnical Ocational Ivelihood: Edia and Nformation IteracyKrystelle Marie AnteroNo ratings yet

- 30 Linux System Monitoring Tools Every SysAdmin Should Know - NixcraftDocument90 pages30 Linux System Monitoring Tools Every SysAdmin Should Know - Nixcraftvignesh05No ratings yet

- Conversational Maxims and Some Philosophical ProblemsDocument15 pagesConversational Maxims and Some Philosophical ProblemsPedro Alberto SanchezNo ratings yet

- Reported SpeechDocument2 pagesReported SpeechmayerlyNo ratings yet

- Zimbabwe Mag Court Rules Commentary Si 11 of 2019Document6 pagesZimbabwe Mag Court Rules Commentary Si 11 of 2019Vusi BhebheNo ratings yet

- Delaware Met CSAC Initial Meeting ReportDocument20 pagesDelaware Met CSAC Initial Meeting ReportKevinOhlandtNo ratings yet

- Short-Term Load Forecasting by Artificial Intelligent Technologies PDFDocument446 pagesShort-Term Load Forecasting by Artificial Intelligent Technologies PDFnssnitNo ratings yet

- Introduction To PTC Windchill PDM Essentials 11.1 For Light UsersDocument6 pagesIntroduction To PTC Windchill PDM Essentials 11.1 For Light UsersJYNo ratings yet

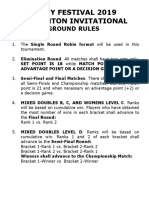

- Ground Rules 2019Document3 pagesGround Rules 2019Jeremiah Miko LepasanaNo ratings yet

- Intrauterine Growth RestrictionDocument5 pagesIntrauterine Growth RestrictionColleen MercadoNo ratings yet

- Spelling Master 1Document1 pageSpelling Master 1CristinaNo ratings yet

- Physics - TRIAL S1, STPM 2022 - CoverDocument1 pagePhysics - TRIAL S1, STPM 2022 - CoverbenNo ratings yet

- Indus Valley Sites in IndiaDocument52 pagesIndus Valley Sites in IndiaDurai IlasunNo ratings yet

- 2022 Drik Panchang Hindu FestivalsDocument11 pages2022 Drik Panchang Hindu FestivalsBikash KumarNo ratings yet

- August Strindberg's ''A Dream Play'', inDocument11 pagesAugust Strindberg's ''A Dream Play'', inİlker NicholasNo ratings yet

- Favis vs. Mun. of SabanganDocument5 pagesFavis vs. Mun. of SabanganAyra CadigalNo ratings yet

- ImpetigoDocument16 pagesImpetigokikimasyhurNo ratings yet

- Cambridge English Key Sample Paper 1 Reading and Writing v2Document9 pagesCambridge English Key Sample Paper 1 Reading and Writing v2kalinguer100% (1)