Professional Documents

Culture Documents

FED Overview

FED Overview

Uploaded by

Rori RiriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FED Overview

FED Overview

Uploaded by

Rori RiriCopyright:

Available Formats

Overview of the Federal Reserve

As the nation’s central bank, the ety of System functions, including oper-

Federal Reserve System has numerous, ating a nationwide payments system;

varied responsibilities: distributing the nation’s currency and

v conducting the nation’s monetary pol- coin; under authority delegated by the

icy by influencing monetary and Board of Governors, supervising and

credit conditions in the economy regulating bank holding companies and

v supervising and regulating banking state-chartered banks that are members

institutions, to ensure the safety and of the System; serving as fiscal agents

soundness of the nation’s banking and of the U.S. Treasury; and providing a

financial system and to protect the variety of financial services for the

credit rights of consumers Treasury, other government agencies,

v maintaining the stability of the finan- and other fiscal principals.

cial system and containing systemic A major component of the Federal

risk that may arise in financial markets Reserve System is the Federal Open

v providing financial services to de- Market Committee (FOMC), which is

pository institutions, the U.S. govern- made up of the members of the Board

ment, and foreign official institutions of Governors, the president of the Fed-

eral Reserve Bank of New York, and

The Federal Reserve is a federal sys- presidents of four other Federal Reserve

tem composed of a central, governmen- Banks, who serve on a rotating basis.

tal agency—the Board of Governors— The FOMC establishes monetary policy

and 12 regional Federal Reserve Banks. and oversees open market operations,

The Board of Governors, located in the Federal Reserve’s main tool for

Washington, D.C., is made up of seven influencing overall monetary and credit

members appointed by the President of conditions. The FOMC sets the federal

the United States and supported by a funds rate, but the Board has sole au-

staff of about 2,100. In addition to con- thority over changes in reserve require-

ducting research, analysis, and policy- ments and must approve any change in

making related to domestic and interna- the discount rate initiated by a Reserve

tional financial and economic matters, Bank.

the Board plays a major role in the Two other groups play roles in the

supervision and regulation of the U.S. functioning of the Federal Reserve:

banking system and administers most of depository institutions, through which

the nation’s laws regarding consumer monetary policy operates, and advisory

credit protection. It also has broad over- councils, which make recommendations

sight responsibility for the nation’s pay- to the Board and the Reserve Banks

ments system and the operations and regarding System responsibilities.

activities of the Federal Reserve Banks. All federally chartered banks are, by

The Federal Reserve Banks, which law, members of the Federal Reserve

combine public and private elements, System. State-chartered banks may

are the operating arms of the central become members if they meet Board

banking system. They carry out a vari- requirements. Á

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

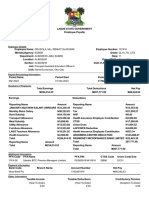

- ODUSOLA RISIKAT OLADUNNI - Mar - 2023 PDFDocument1 pageODUSOLA RISIKAT OLADUNNI - Mar - 2023 PDFOluwayemisi EbijimiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- (#3) Basic Concepts of Risk and Return, and The Time Value of MoneyDocument22 pages(#3) Basic Concepts of Risk and Return, and The Time Value of MoneyBianca Jane GaayonNo ratings yet

- Ans: D: Multiple ChoiceDocument14 pagesAns: D: Multiple ChoiceNah HamzaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- File: Chapter 04 - Consolidated Financial Statements and Outside Ownership Multiple ChoiceDocument48 pagesFile: Chapter 04 - Consolidated Financial Statements and Outside Ownership Multiple Choicejana ayoubNo ratings yet

- 128-Magazine For The Month of August-2022-FinalDocument170 pages128-Magazine For The Month of August-2022-FinalUmakanta DassNo ratings yet

- Exhibitors ECS2013Document39 pagesExhibitors ECS2013Bogdan MuresanNo ratings yet

- Doing Business in VietnamDocument66 pagesDoing Business in Vietnamtrantam88No ratings yet

- Microsoft Word - Module 1Document4 pagesMicrosoft Word - Module 1sshreyasNo ratings yet

- Tata Aia Endowment Op With 15071984-1Document35 pagesTata Aia Endowment Op With 15071984-1atul0070No ratings yet

- Trading PracticesDocument2 pagesTrading PracticesRocio FernándezNo ratings yet

- TATA Medicare PremierDocument10 pagesTATA Medicare PremierRenu SahetaNo ratings yet

- APs Report Q2 2021 enDocument26 pagesAPs Report Q2 2021 enAbdullah Ali AlGhamdiNo ratings yet

- Apana Black Book ProjectDocument35 pagesApana Black Book Projectpradeep dhobiNo ratings yet

- 1 Combine Commerce PYP (June-12 To July-18) EM PDFDocument168 pages1 Combine Commerce PYP (June-12 To July-18) EM PDFPriyanka Anuj BansalNo ratings yet

- 1 PBDocument5 pages1 PBSITI NUR HARUM PUJAYANTINo ratings yet

- 03 - Literature ReviewDocument7 pages03 - Literature ReviewPrabakaran SelvanNo ratings yet

- UCSP Q2 wk3Document67 pagesUCSP Q2 wk3Alvin BragasNo ratings yet

- 500 BonnieDocument17 pages500 BonnieMurilo Oliveira50% (2)

- PhilRice Text CenterDocument21 pagesPhilRice Text CenterRayge HarbskyNo ratings yet

- Business Plan For Starting Castor Oil Production PlantDocument4 pagesBusiness Plan For Starting Castor Oil Production PlantMaddy K KumarNo ratings yet

- Starbucks, Bank One, and Visa Launch Starbucks Duetto VisaDocument7 pagesStarbucks, Bank One, and Visa Launch Starbucks Duetto VisaDhikshaTripathiNo ratings yet

- IT Capital Gains Pt-2Document14 pagesIT Capital Gains Pt-2syedfareed596No ratings yet

- Hamdani HannesDocument30 pagesHamdani HannesOwm Close CorporationNo ratings yet

- Module 9 Receivable Financing Notes ReceivablesDocument6 pagesModule 9 Receivable Financing Notes ReceivablesMa Leobelle BiongNo ratings yet

- Check List – Revised Schedule III of Companies Act For F.Y 2021-22 - Taxguru - inDocument6 pagesCheck List – Revised Schedule III of Companies Act For F.Y 2021-22 - Taxguru - inTony VargheseNo ratings yet

- Real Feel Test 1Document50 pagesReal Feel Test 1Pragati Yadav100% (2)

- Handout 2 - Banking Products and ServicesDocument5 pagesHandout 2 - Banking Products and Servicescarolina manotasNo ratings yet

- Chapter 4. Applied EconomicsDocument7 pagesChapter 4. Applied EconomicsLovelyjade ReyesNo ratings yet

- Oligopolistic Nature and Competition in The Telecom SectorDocument9 pagesOligopolistic Nature and Competition in The Telecom SectorErikaNo ratings yet

- 2021 Instructions For Schedule E: Supplemental Income and LossDocument12 pages2021 Instructions For Schedule E: Supplemental Income and Lossjyoti06ranjanNo ratings yet