Professional Documents

Culture Documents

Financial Accounting Past Paper BCom Part 1 PU 2019

Uploaded by

Rana Hanzila TahirOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting Past Paper BCom Part 1 PU 2019

Uploaded by

Rana Hanzila TahirCopyright:

Available Formats

Financial Accounting Past Paper B.

Com Part 1 Punjab University 2019

Question No.1

Define accounting information and briefly explain its usefulness for the creditors, shareholders,

employees, lenders and government.

Question No.2

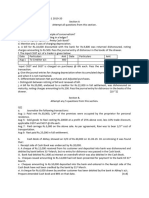

Enter the following transactions of M. Rauf in a Double column cash book.

Jan1 Cash in hand 100,000

Jan 1 Cash at bank 60,000

Jan 3 Cash sales 40,000

Jan 4 Paid M. Arshad by a cheque 14,000

Jan 6 Received a cheque from Babar 8,000

Jan 8 Cash deposited into bank 19,000

Jan 8 Babar’s cheque deposited into bank 15,000

Jan 10 Drew from bank for office use 24,000

Jan 11 Drew from bank for personal use of owner 57,000

Jan 12 Cash purchases 10,000

Jan 15 Received a cheque from S. Rashid 36,000

Jan 16 S.Rashid’s Cheque endorsed to Shakeel 1,400

Jan 17 Paid Arshad Khan by a cheque 33,000

Jan 18 S Rashid’s cheque returned dishonoured 700

Jan 19 Our cheque to Arshad khan was dishonoured 14,000

Jan 21 Received interest from bank 500

Jan 24 Cash sales 20,000

Jan 27 Incidental charges debited by bank 1,000

Jan 31 Salary paid by cheque 25,000

Question No.3

The books of Al-Habib Ltd were balanced on 31st December 2018. In checking the books and

accounts the following mistakes were discovered:

(a) Good to the value of Rs. 68,000 has been returned by smith on 30th December were taken

into stock but the entries recording the return were not passed through the books until January of

the following year.

(b) Machine to the value of Rs. 2,18,000 purchased for enlarging the factory had been debited

to purchase account.

(c) A dishonored cheque for Rs. 20,000 had been posted to allowance account instead of the

account of Riaz from whom it had been received.

(d) Several creditors’ balances amounting to Rs. 2,70,000 stood in the Purchase Ledger,

representing cash paid for goods but for which no invoice had been passed through books.

Required:

Make journal entries to correct these errors. What was the effect of these errors on the profit of the

firm?

Website: www.paksights.com Facebook: fb.com/bcomstudymaterial Punjab University

Financial Accounting Past Paper B.Com Part 1 Punjab University 2019

Question No.4

From the following figures extracted from the books of a merchant, you are required to prepare a

trading and profit and loss account for the year ended 31st December 2018 and a balance sheet as on

that date, after making the necessary adjustments:

Accounts Title Rs. Accounts Title Rs.

Capital 50,450 Discount received 400

Trade Creditors 10,000 Buildings 10,000

Bill payable 1,000 Plant & Machinery 15,000

General reserve 5,000 Book debts 16,400

Provision for bad debts 1,000 Bank Balance 3,400

Sales 75,000 Investments 10,000

Discount allowed 750 Bill receivable 5,000

Stock 15,000 Wages& Salaries 13,000

Audit fee 2,000 Repair & Renewal 1,800

Office expenses 2,000 Interest paid 700

Purchases 48,000 Bad debts recovered 200

Adjustments:

(1) The value of stock on hand on 31st December, 2018 was Rs. 18,000

(2) During December, 2018 there was a fire which destroyed goods worth Rs. 3,500. The

insurance company had admitted the claim for Rs/ 2,500.

(3) Depreciate Buildings at 2 percent p.a and plant and machinery at 10 percent p.a

(4) The manager is entitled to a commission of 10 percent of net profits after charging his

commission

Question No.5

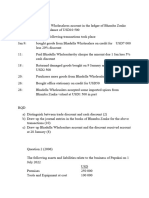

From the following receipts and payment account of the Pakistan Nursing Society for the year

ended 30th June 2018. Prepare an income and expenditure account and also balance sheet.

Receipts Rs. Payments Rs.

To Balance at Bank – 1.7.2017 2,010 By Salaries of Nurses 656

To Subscriptions 1,115 By Board, Laundry and Domestic help 380

To Fee from non-members 270 By Rent, Rates & Taxes 200

To Municipal Grant 1,000 By Cost of Car 2,000

To Donation for Building Fund 1,560 By Car Expenses 840

To Interest 38 By Drugs & Incidental Expenses 670

By Balance c/c 1,247

Total 5,993 Total 5,993

Other information:

The society own Freeholds Land Costing Rs. 8,000 on which it is proposed to build the Nurses Hostel.

A donation of Rs. 100 received to Building Fund was wrongly included in subscription account. A bill

for medicine purchased during the year amounting to Rs. 128 was outstanding.

Website: www.paksights.com Facebook: fb.com/bcomstudymaterial Punjab University

Financial Accounting Past Paper B.Com Part 1 Punjab University 2019

Question No.6

Mr. Munir is not writing his books properly. From the following information prepare a statement

showing profit or loss and statement of affairs for the year ending 30th June 2018.

Accounts Titles 01-07-2017 30-06-2018

Cash in hand Rs. 900 Rs. 2800

Debtors 22,800 21,400

Creditors 31,200 28,400

Stock 33,400 37,400

Bills receivable 30,500 28,800

Bank overdraft 40,800 39,200

Motor Van 4200 4200

Furniture 3400 3400

Other data:

(a) Drawings Rs. 4,800

(b) (b) Depreciate furniture at 10 %

(c) Write off Rs. 800 on motor van.

(d) Provide Rs.1,000 as bad debts 5% reserve on debtors

(e) Provide reserve of Rs. 1600 on Bill Receivable.

Question No.7

A firm purchase a second hand truck for Rs. 5,00,000 on 1st January, 2015 and spent Rs. 2,00,000 on

its overhauling. Depreciation is written off 20% p.a on the reducing balance. On 30th June 2019 the

truck was sold for Rs. 250,000 being unsuitable. Make journal entries in general journal and prepare

the truck account from 2015 to 2018 assuming that accounts are closed on 31st December every

year.

Question No.8

A and B are partners in a firm sharing profits and losses in the ratio of 5:3. C is admitted in the firm

for 1/5th share of profits. He is to bring in Rs. 3,00,000 as capital and Rs. 80,000 as his share of good

will. Give necessary journal entries.

1. When the amount of Goodwill is retained in the business.

2. When the amount of Goodwill is fully withdrawn.

3. When 50% of the amount of Goodwill is withdrawn.

Website: www.paksights.com Facebook: fb.com/bcomstudymaterial Punjab University

You might also like

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- Accounts from Incomplete Records AnalysisDocument8 pagesAccounts from Incomplete Records AnalysisVisha JainNo ratings yet

- Answer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120Document5 pagesAnswer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120hanumanthaiahgowdaNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Paper A1Document3 pagesTime Allowed: 3 Hours Max Marks: 100: Paper A1KashifNo ratings yet

- Basic Accounting Concepts and ModulesDocument11 pagesBasic Accounting Concepts and Modulespaul amo100% (1)

- Revision Questions for Accounting PrinciplesDocument8 pagesRevision Questions for Accounting PrinciplesFranswa MateteNo ratings yet

- CA Intermediate Accounting Test Paper Accounts from Incomplete RecordsDocument3 pagesCA Intermediate Accounting Test Paper Accounts from Incomplete RecordsAryan GuptaNo ratings yet

- 11th AccountsDocument8 pages11th AccountsShubham sumbriaNo ratings yet

- Financial Reporting, Statement & Analysis - Assignment1Document5 pagesFinancial Reporting, Statement & Analysis - Assignment1sumanNo ratings yet

- Accountancy Practice Paper - 1Document2 pagesAccountancy Practice Paper - 1Rinshi GuptaNo ratings yet

- Xi Annual NewDocument5 pagesXi Annual NewPragadeshwar KarthikeyanNo ratings yet

- Punjab University B.Com Part 1 Past Paper 2015 QuestionDocument5 pagesPunjab University B.Com Part 1 Past Paper 2015 QuestionPraver MalhotraNo ratings yet

- 12 BK Question Bank Group C 2020 21Document6 pages12 BK Question Bank Group C 2020 21PuranNo ratings yet

- Accountancy Question Bank for Class XIDocument9 pagesAccountancy Question Bank for Class XIlasyaNo ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- Accounting from Incomplete Records: Trading and Profit Loss StatementDocument21 pagesAccounting from Incomplete Records: Trading and Profit Loss StatementbinuNo ratings yet

- Home Assignment - Financial Accounting PGPM 2019-20Document3 pagesHome Assignment - Financial Accounting PGPM 2019-20SidharthNo ratings yet

- Financial Accounting Punjab University: Question Paper 2018Document4 pagesFinancial Accounting Punjab University: Question Paper 2018aneebaNo ratings yet

- Accts Project For Class Xi 2015 16-1Document2 pagesAccts Project For Class Xi 2015 16-1Narsingh Das AgarwalNo ratings yet

- Bba Bcom Ll.b-I-Fincncial Accounting CC01Document2 pagesBba Bcom Ll.b-I-Fincncial Accounting CC01vijay.s12usNo ratings yet

- Q.1. Write Short Notes On The Following (A) Business Entity Concept (B) Subsidiary Books (C) Errors of Principles (D) Promissory Notes (E) ProvisionsDocument4 pagesQ.1. Write Short Notes On The Following (A) Business Entity Concept (B) Subsidiary Books (C) Errors of Principles (D) Promissory Notes (E) ProvisionsLekha DhagatNo ratings yet

- ACCOUNTSDocument9 pagesACCOUNTSrakciyaNo ratings yet

- Baf1201 Financial Accounting I CatDocument5 pagesBaf1201 Financial Accounting I CatcyrusNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- Assignment 2023 For BPOI-102 (002) (DBPOFA Prog)Document2 pagesAssignment 2023 For BPOI-102 (002) (DBPOFA Prog)Pawar ComputerNo ratings yet

- Topic Wise Test Accounting From Incomplete RecordsDocument4 pagesTopic Wise Test Accounting From Incomplete RecordsChinmay GokhaleNo ratings yet

- Partnership - I: Change in Profit Sharing RatioDocument33 pagesPartnership - I: Change in Profit Sharing RatioUjjwal BeriwalNo ratings yet

- Questions Journal, Ledger & TBDocument9 pagesQuestions Journal, Ledger & TBHarsh GhaiNo ratings yet

- Financial Accounting 2019Document8 pagesFinancial Accounting 2019Ivy NinjaNo ratings yet

- 2017 S2 (final) (尊孔)Document5 pages2017 S2 (final) (尊孔)Khor Xing TienNo ratings yet

- Paper 1Document19 pagesPaper 1GianNo ratings yet

- Karnataka I PUC Accountancy 2019 Model Question Paper 1Document7 pagesKarnataka I PUC Accountancy 2019 Model Question Paper 1Lokesh Rao100% (1)

- Cap IDocument26 pagesCap IDristi SaudNo ratings yet

- Ministry of Education, Heritage and Arts: Strand One Nature of AccountingDocument3 pagesMinistry of Education, Heritage and Arts: Strand One Nature of AccountingShyam murtiNo ratings yet

- Topic 4 Class ExerciseDocument5 pagesTopic 4 Class ExerciseAzim OthmanNo ratings yet

- Accountin 2 (6 Files Merged)Document8 pagesAccountin 2 (6 Files Merged)Arshad KhanNo ratings yet

- Current Liabilities and Warranties p2Document4 pagesCurrent Liabilities and Warranties p2James AngklaNo ratings yet

- Accounts Paper Class 11 Sem 1 2019Document4 pagesAccounts Paper Class 11 Sem 1 2019samarthj.9390No ratings yet

- AFH Important questionDocument6 pagesAFH Important questionmanassadashiv013No ratings yet

- Accounting Send Up TestDocument3 pagesAccounting Send Up TestKashifNo ratings yet

- .Archivetemp8 - Financial Accounting (Old Syllabus)Document2 pages.Archivetemp8 - Financial Accounting (Old Syllabus)aneebaNo ratings yet

- Financial Accounting Punjab University: Question Paper 2010Document4 pagesFinancial Accounting Punjab University: Question Paper 2010ZeeShan IqbalNo ratings yet

- LHU8Q Olopr DaisyAcountXIDocument35 pagesLHU8Q Olopr DaisyAcountXIDido MuczNo ratings yet

- Accounts Test 23 Mar QPDocument3 pagesAccounts Test 23 Mar QPnavyabearad2715No ratings yet

- Source Documents and Books of Original Entry QDocument6 pagesSource Documents and Books of Original Entry QMoses IngudiaNo ratings yet

- Section A - Accounting questions and answersTITLE Section B - Partnership accounts problems and journal entriesTITLE Section C - Statement of profit or loss and final accounts for single entry systemDocument6 pagesSection A - Accounting questions and answersTITLE Section B - Partnership accounts problems and journal entriesTITLE Section C - Statement of profit or loss and final accounts for single entry systemGSNo ratings yet

- 11 AccDocument6 pages11 AccPushpinder KumarNo ratings yet

- Accounting concepts, journal entries and financial statementsDocument3 pagesAccounting concepts, journal entries and financial statementsRNo ratings yet

- MTC 821-CatDocument10 pagesMTC 821-Catbmuli6788No ratings yet

- Revision Questions-1Document6 pagesRevision Questions-1stanleymudzamiri8No ratings yet

- ACCB2003 Midterm ExamDocument2 pagesACCB2003 Midterm Exammuhammad muzzammilNo ratings yet

- 11-Acc PP1Document11 pages11-Acc PP1adityatiwari122006No ratings yet

- 11 Com Pre-ExamDocument4 pages11 Com Pre-ExamObaid Khan50% (2)

- FAA Ist AssignemntDocument9 pagesFAA Ist AssignemntRameshNo ratings yet

- Topic 3 TutorialDocument10 pagesTopic 3 TutorialMimi ArniNo ratings yet

- Final Accounts Without Adjustments: Debit Balances: Debit Balances (Contd.)Document7 pagesFinal Accounts Without Adjustments: Debit Balances: Debit Balances (Contd.)Sarath SarathkumarNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Mastering Credit - The Ultimate DIY Credit Repair GuideFrom EverandMastering Credit - The Ultimate DIY Credit Repair GuideRating: 1 out of 5 stars1/5 (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Maximizing Profits and Shareholder ValueDocument49 pagesMaximizing Profits and Shareholder ValueEDPSENPAINo ratings yet

- Investment DecisionsDocument11 pagesInvestment DecisionsNJUGUNA IANNo ratings yet

- 2020 QuickBooks Desktop Pro For Lawyers ManualDocument344 pages2020 QuickBooks Desktop Pro For Lawyers ManualRandy MarmerNo ratings yet

- UNIT 4. Operations ManagementDocument9 pagesUNIT 4. Operations ManagementSergio VázquezNo ratings yet

- FY 2019 CAFR for Arizona Public Safety Retirement PlansDocument156 pagesFY 2019 CAFR for Arizona Public Safety Retirement PlansEpicDoctorNo ratings yet

- 2.5. Case 5Document26 pages2.5. Case 5HetviNo ratings yet

- BAC103A-02a Income Tax For IndividualsDocument8 pagesBAC103A-02a Income Tax For IndividualsNovelyn Duyogan100% (1)

- Cash and Cash EquivalentsDocument2 pagesCash and Cash EquivalentsJennifer EcleNo ratings yet

- Chapter 5 Cost Volume Profit RelationshiDocument80 pagesChapter 5 Cost Volume Profit RelationshiSamad KhanNo ratings yet

- Growing Demand for Jute Bags in IndiaDocument65 pagesGrowing Demand for Jute Bags in IndiaMarienNo ratings yet

- Case Solutions For Case Studies in Finance Managing For Corporate Value Creation 6th Edition by BrunerDocument12 pagesCase Solutions For Case Studies in Finance Managing For Corporate Value Creation 6th Edition by Brunerbiwithse7en0% (1)

- Profit TestingDocument16 pagesProfit TestingBrian KipngenoNo ratings yet

- Tata Motors, Ltd. TTM: Tata Reports 2Q ResultsDocument7 pagesTata Motors, Ltd. TTM: Tata Reports 2Q ResultsMorningLightNo ratings yet

- Cape Accounting Unit 1 (Notes 1)Document21 pagesCape Accounting Unit 1 (Notes 1)DWAYNE HARVEYNo ratings yet

- Sec 4.3 - Done PDFDocument3 pagesSec 4.3 - Done PDFTimothy TranNo ratings yet

- Chapter 4 SolutionDocument104 pagesChapter 4 SolutionJames Clear0% (1)

- Negotiable Instruments (3) - ChavezDocument22 pagesNegotiable Instruments (3) - ChavezGian Reynold C. ParinaNo ratings yet

- Effect of Value Added Tax On Internally Generated Revenue in Oyo StateDocument5 pagesEffect of Value Added Tax On Internally Generated Revenue in Oyo StateRasaq MojeedNo ratings yet

- Profitability RatiosDocument1 pageProfitability RatiosdeviganuNo ratings yet

- Exercises 3Document9 pagesExercises 3Asif MasoodNo ratings yet

- SmartCAT-10720 Questions With SolutionsDocument104 pagesSmartCAT-10720 Questions With SolutionsCHITKOOSNo ratings yet

- Project Report Specimen ProformaDocument5 pagesProject Report Specimen ProformaTeja naveenNo ratings yet

- Business Finance 1Document24 pagesBusiness Finance 1Stevo papaNo ratings yet

- Cashflow Statements - 15 Questions With AnswersDocument6 pagesCashflow Statements - 15 Questions With AnswersRob WangNo ratings yet

- Equity Securities - Answer Key PDFDocument5 pagesEquity Securities - Answer Key PDFVikaNo ratings yet

- OverheadsDocument38 pagesOverheadsHebaNo ratings yet

- Chapter 4 Revenue and Other ReceiptsDocument46 pagesChapter 4 Revenue and Other Receiptsroselynm18100% (1)

- Problems On Cost of CapitalDocument4 pagesProblems On Cost of CapitalAshutosh Biswal100% (1)

- Calculate Net Pay & Deductions for Canadian PayrollDocument16 pagesCalculate Net Pay & Deductions for Canadian PayrollSoumya JainNo ratings yet