Professional Documents

Culture Documents

Editable TD1 Form 2020.

Uploaded by

jeremy1976Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Editable TD1 Form 2020.

Uploaded by

jeremy1976Copyright:

Available Formats

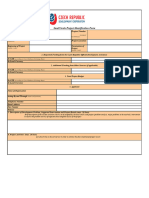

Form T.D.

-1

GOVERNMENT OF THE REPUBLIC OF TRINIDAD AND TOBAGO PRINT FORM

MINISTRY OF FINANCE

INLAND REVENUE DIVISION CLEAR FORM

EMPLOYEE’S DECLARATION OF EMOLUMENTS, DEDUCTIONS AND TAX CREDITS

Any person who fails to file a declaration or files a false declaration is liable on summary conviction to a

fine of $3,000.

(Please read Notes overleaf before completing this form-Use Block Letters)

B.I.R. File Number ....................................……………… I.D. Card Number .....................................………..

Surname ........................................................................................………………………………………………..

Other Names .................................................................................………….............................................……….

Home Address .........................................................................................................................................................

Telephone Number …………………………………….. Date of Birth ……………………………………...

Name of Spouse…............................................................................. Spouse’s B.I.R. No. ...................................

Current Emolument Income

Income from Salary, Wages or Pension: (including taxable allowances and benefits in kind)

Name and Address of Employer PAYE No. of Rate of Pay Annual

Employer Wkly/Ftnly/ Amount

Mntly

$ $

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

$ 0.00

Total Emolument Income ... ... ... ... ... ... ... ... ...

CERTIFICATION FOR OFFICIAL USE ONLY

I HEREBY CERTIFY that the information given in

this Declaration filed with* ..........................................

.......................................................................................

....................................... IS TRUE AND CORRECT.

Signature .......................................................

(Employee)

Date ...............................................................

* Insert name of Employer or Board of Inland Revenue as appropriate. Visit us at www.ird.gov.tt

This Form has been approved for use by the Board of Inland Revenue.

CLAIMS FOR DEDUCTIONS AND TAX CREDITS

1. Personal Allowance ($72,000) applicable to:

(a) Resident Individual $___________

(b) Non-Resident Individual

(in receipt of Pension Income accruing or derived from Trinidad and Tobago) $___________

Resident Individuals Only

2. Tertiary Education Expenses (See Note 3)… ... ... ... ... ... ... ... ... ... $___________

Name and Address of Institution ....................................................................................

.........................................................................................................................................

Note: Limited to $72,000 per household.

For expenses incurred where the institution is situated outside Trinidad and Tobago,

excluding Public Regional Institutions.

3. First Time Acquisition of House (See Note 4) … ... ... ... ... ... ... ... ... $___________

(Limited to $25,000) Date Acquired/Completed ………………………...

For House acquired with effect from 1/1/11

4. Contributions/Premiums paid (See Note 5)

(a) Government Widows’ and Orphans’ Fund ... ... ... ... ... ... ... $..............

(b) N.I.S (70% of Employees Contribution) … … … … … … … $..............

(c) Approved Provident, Superannuation Fund, Approved Fund or Scheme ... $..............

(d) Approved Pension Fund Plan ... ... ... ... ... ... ... ... ... ... $..............

(e) Approved Deferred Annuity Plan ... ... ... ... ... ... ... ... ... ... $..............

Name of Financial Institution ………………………………………………………….

Total [Lines 4 (a) to (e)] Limited to $50,000 ... ... ... ... ... ... ... ... ... ... ... 0.00

... $___________

5. Alimony/Maintenance ( See Note 6) ... ... ... ... ... ... ... ... ... ... ... ... ... $___________

Registered Date Name and Address B.I.R. No. Amount Payable

No. Of Deed/ Court of Recipient of $

Deed/Court Order Recipient

Order

6. TOTAL DEDUCTIONS (Sum of Lines 1 to 5) ... ... ... ... ... ... ... ... ... ... 0.00

$__________

7. TAX CREDIT:

a) Venture Capital ... ... ... ... ... ... ... ... ... $___________

b) CNG and Cylinder 25% up to a maximum cost of $10,000. $___________

c) Solar Water Heating Equipment 25% up to a maximum cost of $10,000. $___________

d) National Tax Free Savings Bonds 25% of face values $___________

WHERE CLAIMS ARE MADE ONLY IN RESPECT OF PERSONAL ALLOWANCE, NATIONAL

INSURANCE CONTRIBUTIONS AND COMPANY’S GROUP PENSION PLANS, THIS FORM DOES NOT

REQUIRE APPROVAL OF THE BOARD AND MUST BE LODGED DIRECTLY WITH YOUR EMPLOYER.

NOTES FOR YOUR GUIDANCE

1. In order to avoid excessive deductions from your emoluments, a Declaration which is for tax deduction purposes only

must be completed and lodged with:

(a) your employer/or employers on commencement of employment and annually thereafter or where there is a change in

deductions or tax credits;

(b) BIR where approval is required.

2. The Declaration should be completed and forwarded for approval to the Inland Revenue Division, Corner Queen and

Edward Streets, Port-of-Spain; South Regional Office, Cipero Street, San Fernando, East Regional Office, Prince Street,

Arima or to the Tobago Regional Office, Victor E. Bruce Financial Complex, Wilson Road, Scarborough, Tobago in the

following circumstances:

2.1 If you are in receipt of emolument income (salary, wages, pensions, bonus, commission, etc.) from two or more

sources at the same time, for example, a pensioner who is also receiving income from employment. You should

obtain from your employers, evidence of emoluments which should be attached to the Declaration Form; and/or in

addition a recent payslip showing year-to-date, Salary, NIS and PAYE must be provided.

2.2 If you are claiming deductions in respect of Alimony/Maintenance, premiums for Approved Deferred

Annuity plans, tertiary education expenses or Tax Credit(s).

A “Certificate of Approval for PAYE Tax Deductions” will be issued to Employers indicating the Personal

Allowances, Deductions and Credits Approved for the year of income.

The TD1.A will continue to be issued where employees have two or more sources of emolument income.

3. Tertiary Education Expenses – Requirement for claims where applicable:

3.1

A detailed statement of expenses incurred together with a letter of acceptance from the institution;

3.2

Evidence of remittance of funds (receipts, bankdrafts or encashed cheques).

3.2

Expenses are limited to $72,000 per household;

3.3

Only amounts paid to an Institution situated outside of Trinidad and Tobago (except a Public Regional Institution)

will be allowed.

NOTE: Expenses allowed must be paid in the current year.

4. First Time Acquisition of House –

4.1 House must be acquired by way of purchase or construction to be used as your residence on or after January 1, 2011.

4.2 Claim is limited to $25,000 and will be granted for 5 years from the date of acquisition.

Please submit:

(a) Statement from the Financial Institution/Affidavit confirming first time acquisition, date and cost of acquisition.

(b) Completion Certificate if property was constructed.

(c) Lands and Buildings Taxes receipt. (Copy of Certificate of Assessment, if applicable).

5. Contributions/Premiums –

(a) You may claim Contributions to Government Widows’ and Orphans’ Pension Fund, approved Provident and

Superannuation Funds, approved Funds or scheme, approved Pension Fund Plan and premiums paid under an

Approved Deferred Annuity plan including deduction in respect of Approved Tax Incentives savings plan

operated by Financial Institutions.

(b) You are allowed 70 per cent of your National Insurance contributions as a deduction. However if you

contribute to the Widows’ and Orphans’ Fund you will be allowed 100 per cent of your contribution to

Widows’ and Orphans’ Fund attributed to National Insurance and 70 per cent of any excess.

(c) Provide a statement of premiums paid in the previous year.

6. Alimony/Maintenance – Please submit a copy of the Registered Deed/Court Order and evidence of payment in the

previous year.

7. Tax Credits -

7.1 Venture Capital Tax Credit

(i) The credit is allowed in the year of income to the original purchaser of shares in the Venture Capital

Company;

(ii) It is computed on cost of shares x marginal rate of tax;

(iii) Unclaimed credit in an income year can be used to offset tax assessed in succeeding years;

(iv) Please submit the original and copy of Tax Credit Certificate.

7.2 CNG Kit and Cylinder Tax Credit

(i) Tax Credit is allowed in the year of purchase;

(ii) The credit is 25% of the cost up to a maximum of $10,000;

(iii) Provide receipt of purchase and installation cost of the CNG Kit and Cylinder and certified copy of ownership

of vehicle.

7.3 Solar Water Heating Equipment Tax Credit

(i) Tax Credit is allowed for Solar Water Heating Equipment purchased in the year of income for household use;

(ii) The credit is 25% of the cost up to a maximum of $10,000;

(iii) Provide the evidence of payment.

7.4 National Tax Free Savings Bond Tax Credit

(i) The credit is allowed in the year of income to the original purchaser of bonds issued under the National Tax

Free Savings Bonds Regulations;

(ii) The credit is 25% of face value limited to $5,000 where the maturity period is five, seven or ten years;

(iv) Unclaimed credit in an income year can be used to offset tax assessed in succeeding years;

(v) Provide evidence of payment.

You might also like

- Agile Organisations PDFDocument127 pagesAgile Organisations PDFjeremy1976100% (1)

- Disclaimer - : This Spreadsheet Is FreeDocument218 pagesDisclaimer - : This Spreadsheet Is FreePaul BischoffNo ratings yet

- Salary Slip TemplateDocument1 pageSalary Slip TemplateAnissuzira Othman100% (1)

- Tax Loopholes for eBay Sellers: Pay Less Tax and Make More MoneyFrom EverandTax Loopholes for eBay Sellers: Pay Less Tax and Make More MoneyRating: 2.5 out of 5 stars2.5/5 (2)

- Invoice Template Side TiltDocument1 pageInvoice Template Side TiltNAEEM MALIKNo ratings yet

- Invoice: Date 12/26/2018 Bill To: Invoice No. WD-IT-1226-18Document2 pagesInvoice: Date 12/26/2018 Bill To: Invoice No. WD-IT-1226-18Khalid NoorNo ratings yet

- Timesheet TemplateDocument1 pageTimesheet TemplateAmit RajputNo ratings yet

- Personal Profile: Signed Photograph of 1st Applicant Signed Photograph of 2nd ApplicantDocument5 pagesPersonal Profile: Signed Photograph of 1st Applicant Signed Photograph of 2nd ApplicantkasdaksdjNo ratings yet

- Description: Tags: TimesheetDocument1 pageDescription: Tags: Timesheetanon-137266No ratings yet

- Invoice TemplateDocument1 pageInvoice TemplateZoranNo ratings yet

- Invoice Template PDFDocument1 pageInvoice Template PDFKannan KumarNo ratings yet

- Employee ReimbursementDocument2 pagesEmployee ReimbursementPratima ChavanNo ratings yet

- Seleccion TimesheetDocument1 pageSeleccion TimesheetArjun KNo ratings yet

- Imprest Request - TravellingDocument2 pagesImprest Request - TravellingStephen LyimoNo ratings yet

- Annex F Tupad Payroll Template Under Accredited Co-Partner Republic of The Philippines Department of Labor and Employment Regional Office No. - VDocument1 pageAnnex F Tupad Payroll Template Under Accredited Co-Partner Republic of The Philippines Department of Labor and Employment Regional Office No. - VOremor RemerbNo ratings yet

- Program of Works: Quality FormDocument1 pageProgram of Works: Quality FormMira FlorNo ratings yet

- Non PO Voucher Expense Report InstructionsDocument3 pagesNon PO Voucher Expense Report InstructionsMthunzi MthunziNo ratings yet

- Invoice TemplateDocument1 pageInvoice TemplateSami Shahid Al IslamNo ratings yet

- Initial Report January 17Th, 2008: Analyst: Victor Sula, PHDDocument17 pagesInitial Report January 17Th, 2008: Analyst: Victor Sula, PHDbeacon-docsNo ratings yet

- Discharge of Sli Policy No. Ksid/li/101100711465 Claim No:210102202981Document1 pageDischarge of Sli Policy No. Ksid/li/101100711465 Claim No:210102202981AMUPS KODURNo ratings yet

- Identifikacni Formular AJDocument4 pagesIdentifikacni Formular AJsaid etebbaiNo ratings yet

- FNF FromatDocument1 pageFNF FromatprakashsengarNo ratings yet

- Do Not Submit Photocopies of This Form: Kansas Fiduciary Income TaxDocument4 pagesDo Not Submit Photocopies of This Form: Kansas Fiduciary Income TaxArchibald BareassoleNo ratings yet

- Raxit - AnovaDocument1 pageRaxit - AnovaRaxit PaRmarNo ratings yet

- TD1 Forms - 2011Document3 pagesTD1 Forms - 2011Rondell PaulNo ratings yet

- BP Business Plan Financial Tables FINAL - Xls Filename UTF-8 - BP Business Plan Financial Tables FINALDocument7 pagesBP Business Plan Financial Tables FINAL - Xls Filename UTF-8 - BP Business Plan Financial Tables FINALMarwan OdatNo ratings yet

- Estimate Template Doc TiltDocument2 pagesEstimate Template Doc TiltDaniel Alejandro Montes CazaresNo ratings yet

- Annual Financial Report For A Charitable OrganizationDocument5 pagesAnnual Financial Report For A Charitable Organizationtureen-dancing.0aNo ratings yet

- Invoice Template PrintableDocument1 pageInvoice Template PrintableP Kumar AnjaniNo ratings yet

- DAR+ +LUC+FORM+C+ +Assessment+of+Bond+ (As+of+13aug2019)Document1 pageDAR+ +LUC+FORM+C+ +Assessment+of+Bond+ (As+of+13aug2019)Blessy BaldeoNo ratings yet

- Go OfferDocument1 pageGo OfferOUSMAN SEIDNo ratings yet

- Initial Report September 9th, 2008: Analyst: Victor Sula, PH.DDocument18 pagesInitial Report September 9th, 2008: Analyst: Victor Sula, PH.Dbeacon-docsNo ratings yet

- InvoiceDocument1 pageInvoiceMahmoud SoltaneNo ratings yet

- Vai Final Excel Cashbook With Links 2010Document24 pagesVai Final Excel Cashbook With Links 2010sreekanthNo ratings yet

- 2009 16Document5 pages2009 16Atin SinghNo ratings yet

- 7981 Agency Wide Budget TemplateDocument12 pages7981 Agency Wide Budget TemplaterohNo ratings yet

- 5 Blue InvoiceDocument1 page5 Blue InvoiceDavina TantryNo ratings yet

- Maverick Tax Express 941 W Pioneer Pkwy ARLINGTON, TX 76013-6369 817-261-6287Document19 pagesMaverick Tax Express 941 W Pioneer Pkwy ARLINGTON, TX 76013-6369 817-261-6287Vignesh EswaranNo ratings yet

- Invoice Template 2 Excel 1Document1 pageInvoice Template 2 Excel 1Ricki ZuliantoNo ratings yet

- Pay Stub Tmplates 3Document1 pagePay Stub Tmplates 3Lekan iskilu AbdulkareemNo ratings yet

- One Stop Security (Pty) LTD: Item # Description Qty Unit Price Discount PriceDocument1 pageOne Stop Security (Pty) LTD: Item # Description Qty Unit Price Discount PriceNerena MartinNo ratings yet

- Estimate Template PrintableDocument1 pageEstimate Template PrintableMelissa BarraganNo ratings yet

- Estimate Template 4 WordDocument1 pageEstimate Template 4 WordJessicaNo ratings yet

- Temple University Travel and Expense Report: EMPLOYEE - Permanent Resident Visa Type Alien NON-EMPLOYEEDocument1 pageTemple University Travel and Expense Report: EMPLOYEE - Permanent Resident Visa Type Alien NON-EMPLOYEETaylor LaNo ratings yet

- Trading Account FormatDocument4 pagesTrading Account FormatCommerce Adda ConsultancyNo ratings yet

- Consulting Invoice Template 1 ExcelDocument1 pageConsulting Invoice Template 1 ExcelDjohnNo ratings yet

- Sample Monthly Treasurer Report 1Document1 pageSample Monthly Treasurer Report 1Ban SheraidahNo ratings yet

- Quote Template 2 WordDocument1 pageQuote Template 2 WordMostafa SayedNo ratings yet

- Quote Template PrintableDocument1 pageQuote Template PrintableMNo ratings yet

- Credit Note: Credit Note No Date Name of The ClientDocument1 pageCredit Note: Credit Note No Date Name of The ClientMukesh ShahNo ratings yet

- Credit Note FormatDocument1 pageCredit Note FormatMukesh ShahNo ratings yet

- Debit Note Format PDFDocument1 pageDebit Note Format PDFMukesh ShahNo ratings yet

- Timesheet 430-70Document2 pagesTimesheet 430-70Belvon CowlingNo ratings yet

- GSTR3B 21ahhpn3658h1zd 062021Document2 pagesGSTR3B 21ahhpn3658h1zd 062021GOOGLE NETNo ratings yet

- Receipt: PT. Adhapan Penukaran DigitalDocument1 pageReceipt: PT. Adhapan Penukaran Digitalbagas atmojoNo ratings yet

- Form GSTR-3B: (See Rule 61 (5) )Document2 pagesForm GSTR-3B: (See Rule 61 (5) )DHARMAVARAPU Bala sriramNo ratings yet

- Pro Forma InvoiceDocument4 pagesPro Forma InvoicebradleybarbadosNo ratings yet

- Book 1Document1 pageBook 1anon-143390No ratings yet

- Quote TemplateDocument1 pageQuote Templatehosmoh666No ratings yet

- Invoice PTDocument2 pagesInvoice PTSinta Rahma NitaNo ratings yet

- Lampiran 1 S.D. 5 RBADocument8 pagesLampiran 1 S.D. 5 RBAYeni IsnainiaNo ratings yet

- Purchasing & Supply Chain Management Tendering ProcessDocument24 pagesPurchasing & Supply Chain Management Tendering Processjeremy1976No ratings yet

- HRM QuestionsDocument2 pagesHRM Questionsjeremy1976No ratings yet

- Purchasing & Supply Chain Management IHRM.Document27 pagesPurchasing & Supply Chain Management IHRM.jeremy1976No ratings yet

- Digital Marketing Application For The Trinidad and Tobago Defence ForceDocument15 pagesDigital Marketing Application For The Trinidad and Tobago Defence Forcejeremy1976No ratings yet

- Letter QN-CPS-2018-113 v2 - ENDocument12 pagesLetter QN-CPS-2018-113 v2 - ENjeremy1976No ratings yet

- Food and Drugs Act 30.01 PDFDocument245 pagesFood and Drugs Act 30.01 PDFjeremy1976No ratings yet