Professional Documents

Culture Documents

3 Consumer Perception Towards Digital Payment Mode PDF

3 Consumer Perception Towards Digital Payment Mode PDF

Uploaded by

shivangi boliaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 Consumer Perception Towards Digital Payment Mode PDF

3 Consumer Perception Towards Digital Payment Mode PDF

Uploaded by

shivangi boliaCopyright:

Available Formats

January - March 2019 ISSN: 2250-1940 (P), 2349-1647(O)

Available online @ www.iaraindia.com

RESEARCH EXPLORER-A Blind Review & Refereed Quarterly International Journal

ISSN: 2250-1940 (P) 2349-1647 (O)

Impact Factor: 3.655 (CIF), 2.78 (IRJIF), 2.62 (NAAS)

Volume V, Issue 22

January - March 2019

Formally UGC Approved Journal (63185), © Author

CONSUMER PERCEPTION TOWARDS DIGITAL PAYMENT MODE

WITH SPECIAL REFERENCE TO DIGITAL WALLETS

Dr.K.KAMATCHI ESWARAN

Assistant Professors of Commerce

V.H.N.S.N.College (Autonomous), Virudhunagar

Abstract

The demonetization resulted in unprecedented growth in digital payment. By February this

year, digital wallet companies had shown a growth of 271 percent for a total value of

US$2.8 billion (Rs. 191 crores), Indian government and private sector companies such as

Paytm, Freecharge and Mobikwik had been aggressively pushing several digital payment

applications, including the Aadhaar Payment app, the UPI app, and the National

Payments Corporation of India (NPCI) developed the Bharat Interface for Money (BHIM)

app. Digital transfers using apps has brought behavioural change and helped in the

adoption of digital payment. This has resulted in ease of transfer of money in rural areas

which was not touched earlier by the digital payment method.

Keywords: Demonetization, Consumer Perception, Digital Payment, Digital Wallet.

Introduction government reforms after demonetization

It has been said that every of high value currency of Rs. 500 and

disruption creates opportunities and one 1000 (86% of cash circulation). The

such disruption was the announcement of demonetization resulted in unprecedented

demonetization by Prime Minister growth in digital payment. By February

Mr.NarenderModi on 08 November 2016. this year, digital wallet companies had

Demonetization created huge growth shown a growth of 271 percent for a total

opportunity for digital payment in India value of US$2.8 billion (Rs. 191 crores),

and the digital wallet companies garbed Indian government and private sector

the opportunities with both the hands to companies such as Paytm, Freecharge and

expand their market share. Mobikwik had been aggressively pushing

Demonetization has presented a unique several digital payment applications,

platform for adoption of digital payment, including the Aadhaar Payment app, the

as an alternative to cash for Indian UPI app, and the National Payments

consumers. Corporation of India (NPCI) developed

Adoption of cashless transaction the Bharat Interface for Money(BHIM)

has been significantly pushed by Prime app. Digital transfers using apps has

Minister Mr.NarenderModi as part of brought behavioural change and helped in

Research Explorer 13 Volume VII, Issue22

January - March 2019 ISSN: 2250-1940 (P), 2349-1647(O)

the adoption of digital payment. This has services include balance enquiry, cash

resulted in ease of transfer of money in withdrawal, cash deposit, and Aadhaar to

rural areas which was not touched earlier Aadhaar fund transfers.

by the digital payment method. Now USSD: Stands for Unstructured

many foreign investors want to invest in Supplementary Service Data based

digital payment industry which is new mobile banking.It is linked to merchant’s

attractive destinations because of scope of bank account and used via mobile phone

tremendous expansion in India. on GSM network for payments up to Rs.

There are number of facilitators 5,000 per day per customer.

which are leading to the growth of digital UPI: The United Payments Interface

payment and transition from cash (UPI) envisages being a system that

economy to less cash economy. These powersmultiple bank accounts onto a

facilitators include penetration of internet single mobile application platform (of

connectivity on smart phones, non- any participating bank). Merges multiple

banking financial institution facilitating banking features, ensures seamless fund

digital payment, one touch payment, rise routing, and merchant payments. It

of financial technology sector and push by facilitates P2P fund transfers.

Government either by giving incentives or Digital payments in India have

tax breaks. These all factors are creating been experiencing exponential growth

positive atmosphere for growth of digital and with growth of internet and mobile

payment in India. penetration, in coming years the country

Digital Payment Modes in India is ready to witness a huge rush in the

There are several mode of digital adoption of digital payments. According

payment available in India. These are: to RatanWatal, principal advisor

Digital or mobile wallets: They are used NitiAayog and former finance secretary,

via the internet and through digital payments grew 55% by volume

smartphoneapplications. Money can be and 24.2% by value in 2016-17 over the

stored on the app via recharge by debit or previous year. Data from the Reserve

credit cards or net-banking. Consumer Bank of India (RBI) indicates that the rate

wallet limit is Rs. 20,000 per month and of adoption of digital payments had

the merchant wallet limit is Rs. 50,000 accelerated following demonetization last

per month after self-declaration and Rs. year but has slowed in recent months of

100,000 after KYC verification. 2017. Total digital transactions in April

Prepaid credit cards: Pre-loaded 2017 of Rs109.58 trillion are 26.78 lower

toindividual’sbank account. It is similar from Rs149.58 trillion in March2017.

to a giftcard; customers can make The volume of digital transaction

purchases using funds available on the has witnessed exponential growth in

card -and not on borrowed credit from the volume and value whether it is digital

bank. Can be recharged like a mobile wallet, interbank transfer or transaction

phone recharge, up to a prescribed limit. by debit or credit card. At merchant

Debit/RuPay cards: These are linked to places the number of card transaction at

anindividual’sbank account. Can be point of sale (PoS) terminal have

usedat shops, ATMs, online wallets, witnessed a huge serge which reflects that

micro-ATMs, and for e-commerce people have started making payment by

purchases. Debit cards have overtaken debit card instead of withdrawing cash

credit cards in India. from ATM to make payment. In January

AEPS: The Aadhaar Enabled Payment 2017 the number of transaction of debit

System uses the 12-digit unique card increased to one billion from 817

Aadhaaridentification number to allow million in previous year. It has been

bank-to-bank transactions at PoS. AEPS observed that ATM transaction are more

Research Explorer 14 Volume VII, Issue22

January - March 2019 ISSN: 2250-1940 (P), 2349-1647(O)

or less same at 700 million, the transaction etc. The focus of present

transaction at PoS terminal has increased study is to find how respondents are

three times from 109million in January adopting digital payment. The study

2016 to 328 million in Jan 2017. collected response from 150 respondents

India is heading on the path of a and analyzed their perception,

major digital revolution. The future preferences and satisfaction level of

economy will be driven by cashless digital payment. It further identifies the

transaction which will be possible only barriers and challenges to the adoption of

though digitalization of payment digital payment. The Table 1 gives the

mechanism at different location such as top five mobile payment wallet of India.

smart phone, internet banking, card

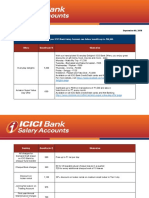

Table 1: Top five digital wallets in India

Wallet Name Key Features

Transferring money instantly to the bank from Paytm account Safe to store

customer’s CVV number. Paytm has launched an app password feature for

Paytm Paytm Wallet in order to ensure the money is safe even if the customer lose

or misplace his/her phone. A customer can use Paytm even without a

Smartphone.

Introduction of M-Wallet for easy storing and transaction of money.

Mobikwik Instant recharge without sign-up. Encrypted and highly secured transactions.

User friendly mobile application.

Auto read of OTP. Picking up the transaction where it dropped. Risk

PayUmoney

monitoring

Citrus Fastest among all the digital wallets. Citrus Pay wallet offers and discounts,

Oxigen Send money to other mobile phones Shows transaction history

Source: http://www.socialbeat.in/2015/09/29/top-10-mobile-wallets-in-india/

Literature Review money such as convenience, security and

Bamasak carried out study in affordability. Growth in technology has

Saudi Arabia found that there is a bright opened many modes of payments through

future for m-payment. Security of mobile which consumers can do transactions

payment transactions and the which are more convenient, accessible

unauthorized use of mobile phones to and acceptable, consumers have an

make a payment were found to be of great inclination towards mobile payment apps

concerns to the mobile phone users. usage. Offering various benefits such as

Security and privacy were the major flexi payment digital wallet brands are

concerns for the consumers which affect providing extra convenience to

the adoption of digital payment solutions. consumers. Major factor in adoption of

Doan illustrated the adoption of mobile digital wallet is convenience in buying

wallet among consumers in Finland as products online without physically going

only at the beginning stages of the from one location to another locatio.

Innovation-Decision Process. There has been many studies conducted

Doing payments via mobile in past on mobile payment application to

phones has been in use for many years find consumer interest and they found

and is now set to explode. Also mobiles consumer has positive inclination for the

are increasingly being used by consumers same.

for making payments. “Digital Wallet The factors such as perceived ease

“has become a part of consumers which of use, expressiveness and trust affect

are nothing but smart phones which can adoption of digital wallet as payment

function as leather wallets. Digital wallet method. These factors are termed as

offered many benefits while transferring facilitators and plays crucial role in

Research Explorer 15 Volume VII, Issue22

January - March 2019 ISSN: 2250-1940 (P), 2349-1647(O)

adoption of digital payment solution. feature of these digital apps, for instance

Usage of digital wallet among youth in the balance in your Paytm wallet can be

the state of Punjab was found to be very easily transferred to your bank

associated with societal influence and account as and when you want.

usefulness, controllability and security, Advantages of Cashless Transactions

and need for performance enhancement. Convenience

Premium pricing, complexity, a lack of Discounts

critical mass, and perceived risks are the Tracking spends

barriers to adoption of digital payment Budget discipline

systems. Lower risk

A comprehensive model ‘Payment Small gains

Mode Influencing Consumer Purchase Objectives and Hypothesis

Model’ was proposed by Braga and The objective of the study was to

Mazzon. This model considered factors find out the customer perception and

such as temporal orientation and impact of demographic factors on

separation, self-control and pain of adoption of digital mode of payment:

payment constructs for digital wallet as a In pursuance of the above objectives, the

new payment mode. Consumer following hypotheses were formulated for

perspective of mobile payments and testing:

mobile payment technologies are two H01: There is no significant difference is

most important factors of mobile perceived by respondents for

payments research. Mallat studied variousattributes of digital payment on

consumer adoption of mobile payments in the basis of gender of respondents.

Finland. Study found that mobile H02There is no significant difference is

payment is dynamic and its adoption perceived by respondents for

depends on lack of other payments variousattributes of digital payment on

methods and certain situational factors. the basis of age of respondents.

Digital wallet payments bring extra H03There is no significant difference is

convenience to shoppers by offering perceived by respondents for

flexible payment additions and variousattributes of digital payment on

accelerating exchanges. Shin and the basis of education of the respondents.

Ziderman tested a comprehensive model of H04There is no significant difference is

consumer acceptance in the context of perceived by respondents for

mobile payment. It used the unified theory variousattributes of digital payment on

of acceptance and use of technology the basis of profession of the

(UTAUT) model with constructs of respondents.

security, trust, social influence, and self- H05There is no significant difference is

efficacy. The model confirmed the perceived by respondents for

classical role of technology acceptance variousattributes of digital payment on

factors (i.e., perceived to users’ attitude), the basis of annual income of the

the results also showed that users’ attitudes respondents.

and intentions are influenced by perceived Research Methodology

security and trust. In the extended model, The current study is based on

the moderating effects of demographics on primary data collected from 150

the relations among the variables were respondents from the different parts of

found to be significant. Digital wallets Virudhunagar District. A well-structured

offer the consumers the convenience of questionnaire was designed to collect the

payments without swiping their debit or information from the respondents the

credit cards. Instant Cash availability and questionnaire was designed to study

renders seamless mobility is also a unique perception of customer towards adoption

Research Explorer 16 Volume VII, Issue22

January - March 2019 ISSN: 2250-1940 (P), 2349-1647(O)

of digital payment mode. Likert five point the reliability of the data. Frequency

scales were used for obtaining responses. analysis on the main factor under study,

The responses have been collected by indicate overall satisfaction levels of

means of face-to-face interviews by respondents with digital payment mode.

authors. ANOVA was carried out to find the

Sampling unit & size: This call is for variance in the responses and to test the

defining the target population to be hypothesis.

surveyed. In thisresearch the sampling Results and Discussion

unit was the customers who have been The respondent profile as

using the digital payment modes.In this displayed in Table 2 replicate the

survey the sample size decided was 150. population generally engaged in use of

Sampling procedure: The researcher digital payment. Most of the respondents

adopted Intercept interview method for are male (70%), employed either in

collection ofprimary data. private sector (44%) or government

Research and Statistical Tools sector (26%), are either graduate (52%)

Employed or 10+2 (18%) in the age group of 20-30

The research and statistical tools years (42%) or 31-40 years (30%). Their

employed in this study are ANOVA and annual income is Rs. 7.5 to 10 Lacs

frequency analysis. SPSS 19 was used to (63.3%). This is the ideal profile of

perform statistical analysis. digital mode & educated, employed and

Cronbach’sAlpha test was used to find having decent income

Table 2: Respondents Demographic Profile.

Variable Characteristics Frequency Percentage

Male 105 70

Gender

Female 45 30

20-30 yrs 63 42

31-40 yrs 45 30

Age group

41-50 yrs 24 16

51 yrs& above 18 12

Post-Graduation 15 10

Graduation 78 52

Education

10+2 27 18

Matriculation or below 30 20

Student 15 10

Private Sector Employee 66 44

Profession

Public Sector Employee 39 26

Self Employed 30 20

Upto 2.5 Lacs 8 5.3

2.5-5 Lacs 6 4

Annual Income 5-7.5 Lacs 32 21.3

7.5-10 Lac 95 63.3

10Lacs & above 9 6

Hypothesis testing: given below. Table 4 gives the result of

ANOVA Computation ANOVA computation on the basis of

In order to test the hypothesis gender, age education, profession and

ANOVA was carried out. The results are annual income of the respondents.

Table 4: Computation of ANOVA.

Research Explorer 17 Volume VII, Issue22

January - March 2019 ISSN: 2250-1940 (P), 2349-1647(O)

Annual

Gender Age Education Profession

Characteristics/Attributes Income

F Sig. F Sig. F Sig. F Sig. F Sig.

Mobile Payment Wallet /

.193 .648 1.109 .345 13.829 .080 3.633 .004 1.038 .371

Digital payment used

Frequency of use digital

payment to make online

.002 .972 .789 .503 90.432 .000 5.997 .001 .657 .609

payment for bills and

purchases

Brand Loyalty of Digital

.979 .314 .923 .460 216.45 .000 2.236 .069 1.903 .103

payment mode

Convenience in use of

.141 .713 2.142 .080 17.103 .000 1.427 .231 .733 .588

digital payment mode

Secured Transaction 1.902 .163 1.009 .402 13.829 .000 2.252 .067 1.828 .118

Time saving through digital

8.242 .005 2.581 .046 66.488 .000 2.321 .043 1.091 .342

payment mode

Acceptance Wallet / digital

.435 .521 1.816 .127 20.513 .000 3.213 .011 .521 .551

payment mode

Price of Using digital

payment mode (service .122 .727 .461 .764 61.579 .000 1.507 .203 2.081 .086

charges etc.,)

Mobile wallets are capable

of providing benefits to

.880 .298 1.003 .460 34.389 .000 2.220 .066 1.762 .103

individual purchase of

product

Using the mobile wallet

improves the quality of my

3.004 .564 3.913 .00 3.2 .007 1.531 .160 .721 .821

decision making for buying

products

Believe mobile wallets are

useful in buying products .531 .421 3.331 .015 13.219 .000 1.004 .413 .872 .381

than the traditional methods

Think that using online

wallets can offer me a wider

.990 .309 .883 .460 24.491 .000 2.147 .066 1.681 .110

range of banking services

and Payment options

Interacting with mobile

2.758 .099 1.296 .275 89.375 .000 2.096 .084 .947 .439

wallet is helpful.

Trust the service providers

.421 .614 1.713 .127 12.781 .000 3.399 .011 .458 .700

of mobile wallet

The result of ANOVA computation shows that no significant differences are

shows that no significant differences are perceived by the respondents on the basis

perceived by male and female respondents of age, profession and annual income. This

for majority of attributes of digital leads to acceptance of H02, H04, and H05.

payment mode/digital wallets. Hence However significant differences are

accept the H01. This indicates that both perceived by respondents for majority of

male and female customer perceive digital attributes of digital payment mode/digital

payment mode/digital wallets in similar wallets on the basis of their education.

way. Similarly the ANOVA computation Hence the researcher reject the H03. This

Research Explorer 18 Volume VII, Issue22

January - March 2019 ISSN: 2250-1940 (P), 2349-1647(O)

indicted that education play a significant negative agreement which indicate

role in acceptance of digital payment negative perception. Strongly agree and

mode. Educated person are more inclined agree responses are the supporting

to use the digital payment modes. responses of the statement related to a

Frequency Analysis particular attribute of digital payment and

In order to find out respondent’s indicates satisfaction of respondents

perception and the overall satisfaction, whereas disagree and strongly disagree

frequency analysis has been carried. The responses are those which do not support

result is presented in the Tables 5 and 6. the statement related to particular

Highly important and important attribute and indicate no satisfaction .

responses are agreement to the statement Neutral responses neither support nor

which lead to positive perception and oppose the attribute.

slightly respondents and not important is

Table 5: Frequency Analysis ofRespondent’sPerception.

Highly Moderately Slightly Not Mean

Statement Important

Important important important important Score

Brand loyalty 72 54 17 6 1 42.6

Convenience in usage 27 71 27 12 13 35.8

Secured transactions 78 53 14 5 0 43.39

Time Saving through

113 20 9 6 2 45.49

digital payment mode

Acceptance

Wallet/digital 30 75 26 12 7 37.2

payment mode

Price of Using

digital payment mode 05 71 33 11 30 30.66

(service charges etc.)

Majority of respondent said it is followed by secured transactions with

important or highly important to associate mean score of 43.39, brand loyalty with

with time saving through digital payment mean score of 42.26 regarding the overall

mode with the mean score of 45.49, satisfaction of the respondents.

Table 6: Frequency Analysis of Respondents satisfaction.

Characteristics/Attributes Strongly Agree Moderate Disagree Strongly Mean

Agree Disagree score

Mobile wallets are capable of

providing benefits to

80 42 9 11 8 41.66

individual for purchase of

product.

Using the mobile wallet

improves the quality of my

decision making for buying 113 24 8 3 2 46.13

products.

Believe mobile wallets are

useful in buying products than 126 24 0 0 0 48.4

the traditional methods.

Research Explorer 19 Volume VII, Issue22

January - March 2019 ISSN: 2250-1940 (P), 2349-1647(O)

Think that using online

wallets can offer me a wider

range of banking services and 72 54 15 6 3 43.06

Payment options

Interacting with mobile wallet

138 12 0 0 0 49.2

is helpful.

Trust the service providers of

24 75 30 11 10 36.13

mobile wallet

Majority of the respondents agree that by the digital payment method. Now

interacting with mobile wallet is helpful many foreign investors want to invest in

with the mean score of 49.2, followed by digital payment industry which is new

helpful in buying products as compared attractive destinations because of scope

to traditional methods with the mean of tremendous expansions in India.

score of 48.4, followed by mobile wallet References

improves the quality of decision making 1. Dezan Shira and Associates (2017)

for buying products with mean score of Growth of Digital Payments Systems

46.13, regarding the satisfaction in the in India. http://www.india-

usage of various attributes of mobile briefing.com/news/growth-of-digital-

wallets. payments-systems-in-india-

Conclusion 14797.html/

Present study has made an 2. Watal R (2017) Digital payments surge

attempt to understand customer 55% in 2016-17.

perception regarding digital payment. It http://www.livemint.com/Industry/hF8

was found that demographic factor D3D6bWBie6IoJzWtdZO/Digital-

except education does not have much payments-surge-55-in-FY17-Niti-

impact on the adoption of the digital Aayog.html

payment. Anova computation supported 3. Pratik B (2017) Demonetization effect:

this finding as there was no signification Digital payments India's new currency;

difference is perceived by the debit card transactions surge to over 1

respondents on the basis of gender age, billion.http://economictimes.indiatimes

profession and annual income. It was .com/industry/banking/finance/banking

only education level of the respondents /digital-payments-indias-new-

where signification difference is currency-debit-card-transactions-

perceived by the respondents. It indicates surge-to-over-1-

that adoption of digital payment is billion/articleshow/58863652.cms

influenced by the education level of the 4. Bamasak O (2011) Exploring

customer. If a person has studied beyond consumers acceptance of mobile

matriculation and internet savvy, he or payments-an empirical Study.

she will be inclined to use the digital International Journal of Information

payment mode. It was also found that in Technology, Communications and

the areas/region where education level is Convergence 1: 173-185.

high, the possibility of acceptance of 5. Dahlberg T, Mallat N, Oorni A (2003)

digital payment is much higher. Consumer Acceptance of Mobile

Digital transfers using apps has Payment Solutions-Ease of Use,

brought behavioral change and helped in Usefulness and Trust. The Second

the adoption of digital payment. This has International Conference on Mobile

resulted in ease of transfer of money in Business, Vienna, Austria, pp: 17-25.

rural areas which was not touched earlier

Research Explorer 20 Volume VII, Issue22

You might also like

- Chase Sep V 2.9Document11 pagesChase Sep V 2.9faxev8373350% (4)

- On September 1 2015 Colton Davies Established An Organizing Business PDFDocument1 pageOn September 1 2015 Colton Davies Established An Organizing Business PDFFreelance WorkerNo ratings yet

- Maryland American Water BillDocument1 pageMaryland American Water BillMasoud DastgerdiNo ratings yet

- Project SynopsisDocument14 pagesProject SynopsisPushpender Kumar100% (1)

- FINTECH RESEARCH WORK-on 24 MayDocument17 pagesFINTECH RESEARCH WORK-on 24 MaySushank Agrawal100% (1)

- Financial Inclusion PDFDocument62 pagesFinancial Inclusion PDFsindhukotaruNo ratings yet

- Vegetable Market ReportDocument6 pagesVegetable Market ReportnishantdebNo ratings yet

- Big Bazaar and D Mart PDFDocument29 pagesBig Bazaar and D Mart PDFJay KishinchandaniNo ratings yet

- A Study On Adoption of Digital Payment Through Mobile Payment Application With Reference To Gujarat StateDocument6 pagesA Study On Adoption of Digital Payment Through Mobile Payment Application With Reference To Gujarat StateEditor IJTSRDNo ratings yet

- Dissertation ReportDocument26 pagesDissertation Reportakshma tandonNo ratings yet

- A Study On PaytmDocument5 pagesA Study On Paytmpraveen kumarNo ratings yet

- Recent Trends in Cashless Economy in India: March 2020Document12 pagesRecent Trends in Cashless Economy in India: March 2020TANMAY SARRAFNo ratings yet

- Digital Payments For Rural India - Challenges and OpportunitiesDocument8 pagesDigital Payments For Rural India - Challenges and OpportunitiesIJOPAAR JOURNALNo ratings yet

- A Comparative Study of Urban and Rural Customers On Perception Towards Online Payment System at Anantapur DistrictDocument4 pagesA Comparative Study of Urban and Rural Customers On Perception Towards Online Payment System at Anantapur DistrictEditor IJTSRDNo ratings yet

- Evolution of Leasing in IndiaDocument8 pagesEvolution of Leasing in IndiaTithi Raheja100% (1)

- Brand Extension of Google IncDocument102 pagesBrand Extension of Google IncSanjeev Gupta100% (3)

- SNP - A Study On Cashless Economy and Digitalisation Shifting Patterns in Indian Payment IndustryDocument5 pagesSNP - A Study On Cashless Economy and Digitalisation Shifting Patterns in Indian Payment IndustryEr Satabdi ChowdhuryNo ratings yet

- A Study of Cashless Economy: The Effect of Demonetization On Small and Medium BusinessesDocument7 pagesA Study of Cashless Economy: The Effect of Demonetization On Small and Medium BusinessesFurkan BelimNo ratings yet

- Project Report On Brand Preference of Mobile Phone Among College Students 1Document54 pagesProject Report On Brand Preference of Mobile Phone Among College Students 1kamesh_p20013342No ratings yet

- Institute of Management Studies Banaras Hindu University VaranasiDocument56 pagesInstitute of Management Studies Banaras Hindu University VaranasiAnurag SinghNo ratings yet

- Comparative Study of Customer Satisfacti PDFDocument27 pagesComparative Study of Customer Satisfacti PDFRAJKUMAR CHETTUKINDANo ratings yet

- IRCTC Service Marketing ProjectDocument26 pagesIRCTC Service Marketing Projectragipanidinesh100% (1)

- A Study On Consumer Behaviour Towards OnDocument8 pagesA Study On Consumer Behaviour Towards Onvikash kumarNo ratings yet

- Online Marketing and Consumer Buying Behaviour of Electronic Products in Selected States in North Central Region of NigeriaDocument13 pagesOnline Marketing and Consumer Buying Behaviour of Electronic Products in Selected States in North Central Region of NigeriaInternational Journal of Business Marketing and ManagementNo ratings yet

- Self Help Group's Muthoot Pincorp Bank SindhanurDocument61 pagesSelf Help Group's Muthoot Pincorp Bank SindhanurhasanNo ratings yet

- A Study of Impact of Financial Technolog PDFDocument10 pagesA Study of Impact of Financial Technolog PDFcaalokpandey2007No ratings yet

- Analysis of Customer Satisfaction: Bank of Bhutan LimitedDocument9 pagesAnalysis of Customer Satisfaction: Bank of Bhutan LimitedHashmi SutariyaNo ratings yet

- Pocket Rocket PayTmDocument16 pagesPocket Rocket PayTmNikhil Negi100% (1)

- Comparative Study On Customer PerceptionDocument128 pagesComparative Study On Customer PerceptionKishan PatelNo ratings yet

- Impact of Advertisement in Business To Business MarketingDocument10 pagesImpact of Advertisement in Business To Business MarketingPrithivi RajNo ratings yet

- MD Wasim Ansari, Paytm, PPTDocument20 pagesMD Wasim Ansari, Paytm, PPTMd WasimNo ratings yet

- Fintech and Financial InclusionDocument22 pagesFintech and Financial InclusionHabiba KausarNo ratings yet

- 10) Impact of Financial Literacy On Investment DecisionsDocument11 pages10) Impact of Financial Literacy On Investment DecisionsYuri SouzaNo ratings yet

- Nirav ModiDocument6 pagesNirav ModiRhythm KhetanNo ratings yet

- Cardiff Metropolitan University Universal Business SchoolDocument23 pagesCardiff Metropolitan University Universal Business SchoolPradip sahNo ratings yet

- Dissertation Project ReportDocument83 pagesDissertation Project ReportSneha ShekarNo ratings yet

- The Impact of Digitalisation On Indian Banking SectorDocument5 pagesThe Impact of Digitalisation On Indian Banking SectorEditor IJTSRDNo ratings yet

- Financial Inclusion Project Shivam Baraik NewDocument63 pagesFinancial Inclusion Project Shivam Baraik NewShivam BaraikNo ratings yet

- Financial Inclusion in Rural India 28 JanDocument64 pagesFinancial Inclusion in Rural India 28 JanAarushi Pawar100% (1)

- 213 ProjectDocument63 pages213 ProjectDivyeshNo ratings yet

- ALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaDocument17 pagesALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaManipal SinghNo ratings yet

- Project Report Submitted ToDocument87 pagesProject Report Submitted ToJitendra GaudNo ratings yet

- Draft For Research ProjectDocument16 pagesDraft For Research ProjectsunnyNo ratings yet

- Financial InclutionDocument37 pagesFinancial InclutionPravash Poddar100% (1)

- Impact of Covid 19 Pandemic On Digital Marketing - A ReviewDocument8 pagesImpact of Covid 19 Pandemic On Digital Marketing - A ReviewEditor IJTSRD100% (1)

- MPR Project - Swiggy and ZomatoDocument65 pagesMPR Project - Swiggy and Zomatobmalhotra887No ratings yet

- Dissertation Topic - A Study of Consumer's Perception Towards E-Tailers and Conventional RetailersDocument21 pagesDissertation Topic - A Study of Consumer's Perception Towards E-Tailers and Conventional RetailersSanket GangalNo ratings yet

- SWOT Analysis SwiggyDocument1 pageSWOT Analysis SwiggyAdarsh Kumar RoyNo ratings yet

- Kotak FinalDocument46 pagesKotak FinalRahul FaliyaNo ratings yet

- FUNCTIONAL ANALYSIS of Digital PaymentDocument80 pagesFUNCTIONAL ANALYSIS of Digital Paymentselvaramesh nadar100% (1)

- A Study of Marketing Benefits and Challenges of E-Commerce An Emerging Economy (With Special Reference of Myntra)Document72 pagesA Study of Marketing Benefits and Challenges of E-Commerce An Emerging Economy (With Special Reference of Myntra)opsteam.turnaround2No ratings yet

- Sample Synopsis For MBA DissertationDocument15 pagesSample Synopsis For MBA DissertationReshma Cp0% (1)

- A Study On Consumer Perception Towards e CommerceDocument8 pagesA Study On Consumer Perception Towards e CommerceRaheema Abdul Gafoor100% (1)

- Impact of Digital Wallets On Consumer Behavior in IndiaDocument17 pagesImpact of Digital Wallets On Consumer Behavior in IndiaIJAR JOURNALNo ratings yet

- PaytmDocument66 pagesPaytmSomya Shree RoutNo ratings yet

- Cryptocurrency in India - Its Effect and Future On Economy With Special Reference To BitcoinDocument12 pagesCryptocurrency in India - Its Effect and Future On Economy With Special Reference To BitcoinnyenookeNo ratings yet

- Passenger SatisfactionDocument9 pagesPassenger SatisfactionRosemary babuNo ratings yet

- Meesho App R BDocument34 pagesMeesho App R BMahesh KharatNo ratings yet

- A Project Report On Icici Online BankingDocument18 pagesA Project Report On Icici Online BankingAmit SinghNo ratings yet

- Study of Consumer Perception of Digital Payment ModeDocument14 pagesStudy of Consumer Perception of Digital Payment Modekarthick50% (2)

- Study of Consumer Perception of Digital Payment ModeDocument18 pagesStudy of Consumer Perception of Digital Payment ModeGayatri MhalsekarNo ratings yet

- (2018) An Assessment of Digital Payment Method After Demonitisation in India (Lexipedia)Document8 pages(2018) An Assessment of Digital Payment Method After Demonitisation in India (Lexipedia)s.husain.bhuNo ratings yet

- 546 PDFDocument10 pages546 PDFIron ManNo ratings yet

- Credit Card Statement (10) - UnlockedDocument2 pagesCredit Card Statement (10) - UnlockedAnand DNo ratings yet

- Application of Online Payment Method ProposalDocument3 pagesApplication of Online Payment Method ProposalTrang Vu Ha QTKD-3KT-17No ratings yet

- 231018143119USS0TCOWPLVEWDocument1 page231018143119USS0TCOWPLVEWMohammad Imran NewazNo ratings yet

- Payment & Settlement SystemsDocument17 pagesPayment & Settlement SystemsAnshu GuptaNo ratings yet

- Report 20230604125900Document8 pagesReport 20230604125900AbhimanyuNo ratings yet

- Https Retail - Onlinesbi.com Retail MobilenoupdateguidelinesDocument1 pageHttps Retail - Onlinesbi.com Retail MobilenoupdateguidelinesEr Biswajit Biswas100% (1)

- The History of MasterCard Credit CardsDocument3 pagesThe History of MasterCard Credit CardsKapil Nainiwal100% (1)

- Email LogDocument23 pagesEmail LogIlham RamdhaniNo ratings yet

- Product Dissection For PAYTMDocument7 pagesProduct Dissection For PAYTMashikal70No ratings yet

- Supplier Bank DetailsDocument2 pagesSupplier Bank DetailsJoaquina BeloNo ratings yet

- Inc42's State of Indian Fintech Report Q1 2022Document54 pagesInc42's State of Indian Fintech Report Q1 2022Ritik MehtaNo ratings yet

- E-Commerce - : Sudarshan Jawale & Pankaj Itm - Xmba, HydDocument38 pagesE-Commerce - : Sudarshan Jawale & Pankaj Itm - Xmba, HydSudarshan JawaleNo ratings yet

- Gmail - Booking Confirmation On IRCTC, Train - 12424, 10-Jul-2022, 2A, NDLS - GHY (1) - 2Document1 pageGmail - Booking Confirmation On IRCTC, Train - 12424, 10-Jul-2022, 2A, NDLS - GHY (1) - 2Girwar SinghNo ratings yet

- Caceis Template Clients mt101Document9 pagesCaceis Template Clients mt101Fitiavana Joel AndriantsehenoNo ratings yet

- Group 2A: Catanduanes State University Calatagan Virac, CatanduanesDocument9 pagesGroup 2A: Catanduanes State University Calatagan Virac, CatanduanesLaila Mae PiloneoNo ratings yet

- Salary Account Benefits Workings TNCDocument4 pagesSalary Account Benefits Workings TNCHarish S MNo ratings yet

- StatementDocument1 pageStatementVishakha RawatNo ratings yet

- Dubai Islamic Bank January June 2021 SOCDocument26 pagesDubai Islamic Bank January June 2021 SOCAD ADNo ratings yet

- Cooch Behar Panchanan Barma University: NotificationDocument1 pageCooch Behar Panchanan Barma University: NotificationShubhadip AichNo ratings yet

- Transaction History Reportfareastmaritices86211112021111034Document5 pagesTransaction History Reportfareastmaritices86211112021111034Ces RiveraNo ratings yet

- (2008) Smart Cards in Transportation Systems Lead The WayDocument1 page(2008) Smart Cards in Transportation Systems Lead The WayAtestate LiceuNo ratings yet

- UPI - Unified Payment InterfaceDocument9 pagesUPI - Unified Payment Interfacemohit0744No ratings yet

- NETS Prepaid Card Vs NETS FlashPay Comparison - v3.4Document1 pageNETS Prepaid Card Vs NETS FlashPay Comparison - v3.4TestNo ratings yet

- 8.truong Huong Giang - Global Financial ServicesDocument16 pages8.truong Huong Giang - Global Financial ServicesHương GiangNo ratings yet

- Statement 1698578808753Document26 pagesStatement 1698578808753abhay singhNo ratings yet

- 59025Document6 pages5902519epci022 Prem Kumaar RNo ratings yet

- Course Director: Lynda Hazelwood Certed B Phil Tefl: Intesol Worldwide Limited Company No. 5697958Document1 pageCourse Director: Lynda Hazelwood Certed B Phil Tefl: Intesol Worldwide Limited Company No. 5697958glamoc1987No ratings yet