Professional Documents

Culture Documents

Solution - Q27

Solution - Q27

Uploaded by

anand kumar0 ratings0% found this document useful (0 votes)

18 views3 pagesThis document contains information about 4 assets in a portfolio including their cost, beta, yearly income, current value, and expected returns. It then calculates the portfolio's overall beta, returns based on each asset, expected returns using CAPM, and compares the actual versus expected returns based on beta. The portfolio has a beta of 1.13, an expected return of 10.375% based on the individual asset weights and returns, and the actual returns are generally in line with or higher than the expected returns calculated from each asset's beta.

Original Description:

q7

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains information about 4 assets in a portfolio including their cost, beta, yearly income, current value, and expected returns. It then calculates the portfolio's overall beta, returns based on each asset, expected returns using CAPM, and compares the actual versus expected returns based on beta. The portfolio has a beta of 1.13, an expected return of 10.375% based on the individual asset weights and returns, and the actual returns are generally in line with or higher than the expected returns calculated from each asset's beta.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views3 pagesSolution - Q27

Solution - Q27

Uploaded by

anand kumarThis document contains information about 4 assets in a portfolio including their cost, beta, yearly income, current value, and expected returns. It then calculates the portfolio's overall beta, returns based on each asset, expected returns using CAPM, and compares the actual versus expected returns based on beta. The portfolio has a beta of 1.13, an expected return of 10.375% based on the individual asset weights and returns, and the actual returns are generally in line with or higher than the expected returns calculated from each asset's beta.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

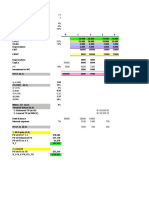

Asset Cost Beta Yearly Income Value Today

A 20000 0.80 1600 20000

B 35000 0.95 1400 36000

C 30000 1.50 0 34500

D 15000 1.25 375 16500

A) Portfolio Beta

Asset Weight = Cost Beta Weighted Value

A 20000 0.80 16000

B 35000 0.95 33250

C 30000 1.50 45000

D 15000 1.25 18750

TOTAL 100000 113000

Portfolio Beta = Weighted Value/Total of Wei 1.13

B) Percentage Return on each asset

Asset Cost Yearly Income Value Today Return on Asset

A 20000 1600 20000 1600

B 35000 1400 36000 2400

C 30000 0 34500 4500

D 15000 375 16500 1875

C) Portfolio Return

Asset Percentage Return

Weight = Cost Weighted Value

A 8.00% 20000 1600

B 6.86% 35000 2400

C 15.00% 30000 4500

D 12.50% 15000 1875

TOTAL 100000 10375

Portfolio Beta = Weighted Value/Total of Wei 10.375%

D) Expected Return - CAPM Risk Free 4%

Market Return 10%

Asset Beta Expected Return

A 0.80 8.80%

B 0.95 9.70%

C 1.50 13.00%

D 1.25 11.50%

D) Expected Return - CAPM v/s Actual Return

Beta based on

Asset Beta Expected ReturnActual Return Actual Return

A 0.80 8.80% 8.00% 0.67

B 0.95 9.70% 6.86% 0.48

C 1.50 13.00% 15.00% 1.83

D 1.25 11.50% 12.50% 1.42

Percentage Return

8.00%

6.86%

15.00%

12.50%

You might also like

- PracticeDocument5 pagesPracticearif khanNo ratings yet

- Problem 4: Multiple Choice - ComputationalDocument5 pagesProblem 4: Multiple Choice - ComputationalKATHRYN CLAUDETTE RESENTENo ratings yet

- Session 16 Inventory Management ABC Analysis OM 2019 Practice ProblemsDocument13 pagesSession 16 Inventory Management ABC Analysis OM 2019 Practice Problemsswaroop shettyNo ratings yet

- ABC Exercise and Case StudyDocument5 pagesABC Exercise and Case StudyCésar Vázquez ArzateNo ratings yet

- Chapter 13 - Partnership Dissolution (Problem 3-Journal Entries)Document11 pagesChapter 13 - Partnership Dissolution (Problem 3-Journal Entries)Penelope Palcon75% (4)

- CH 9 Capital Budgeting PayongayongDocument5 pagesCH 9 Capital Budgeting PayongayongNadi Hood100% (1)

- Geraldine E. Martinez, Bsa-Iii Chapter 8 - Problem 7Document6 pagesGeraldine E. Martinez, Bsa-Iii Chapter 8 - Problem 7Geraldine Martinez DonaireNo ratings yet

- Chapter 13 Prob 1,3,4Document6 pagesChapter 13 Prob 1,3,4geyb awayNo ratings yet

- Chapter 45 - Teacher's ManualDocument5 pagesChapter 45 - Teacher's ManualHohohoNo ratings yet

- Joint CostsDocument9 pagesJoint CostsChiragNo ratings yet

- Partnership Dissolution - AssignmentDocument3 pagesPartnership Dissolution - AssignmentCathleen TenaNo ratings yet

- Buget ExcelDocument9 pagesBuget ExcelKhushbu PandeyNo ratings yet

- FM PracticalDocument12 pagesFM PracticalManya RanaNo ratings yet

- Foodtree LBO Deleverage: FinancialsDocument12 pagesFoodtree LBO Deleverage: FinancialsmartinsiklNo ratings yet

- Solutions Manual Instructors Physics by Resnick Halliday Krane 5th Ed Vol 2Document6 pagesSolutions Manual Instructors Physics by Resnick Halliday Krane 5th Ed Vol 2onyejekwe100% (1)

- Notes Part 2 Operating SegmentsDocument5 pagesNotes Part 2 Operating SegmentsRey Joyce AbuelNo ratings yet

- TUGAS 7Document11 pagesTUGAS 7Rayhan AnandaNo ratings yet

- All Normal All Crash Cycle 1 Cycle 2 Cycle 3 Cycle 4 Project Duration 18 9 15 12 10 9 Total Cost: 10999.99994 11900 10500 10000 10000 11900Document10 pagesAll Normal All Crash Cycle 1 Cycle 2 Cycle 3 Cycle 4 Project Duration 18 9 15 12 10 9 Total Cost: 10999.99994 11900 10500 10000 10000 11900Sanjay TiwariNo ratings yet

- UY. ProjMgtExer3Document2 pagesUY. ProjMgtExer3Young BloodNo ratings yet

- Complete Design For Storm Water Drainage System For PGI, ChandigarhDocument1 pageComplete Design For Storm Water Drainage System For PGI, Chandigarhwapcos pmidcNo ratings yet

- β - U (VS) 1.5 β - U (HE) 2 Risk-free 4% Risk Premium 8% tax 50%Document1 pageβ - U (VS) 1.5 β - U (HE) 2 Risk-free 4% Risk Premium 8% tax 50%Young-Hun KimNo ratings yet

- Total 5 Marks: Question 1 BDocument8 pagesTotal 5 Marks: Question 1 Bshaneice_lewisNo ratings yet

- B, Capital After Admission 480,000: Problem 1 #1Document6 pagesB, Capital After Admission 480,000: Problem 1 #1Alizah BucotNo ratings yet

- Activity Management ScienceDocument3 pagesActivity Management ScienceNicole MalinaoNo ratings yet

- Cpa Review School of The Philippines.2Document6 pagesCpa Review School of The Philippines.2Snow TurnerNo ratings yet

- L5 ABC Classification ExerciseDocument3 pagesL5 ABC Classification ExerciseRohit WadhwaniNo ratings yet

- SOL. MAN. - CHAPTER 8 - NOTES (Part 2)Document7 pagesSOL. MAN. - CHAPTER 8 - NOTES (Part 2)Fhrauline Manaois RamosNo ratings yet

- Assignment IiDocument5 pagesAssignment IiusmanjalaliNo ratings yet

- IA 1 Valix 2020 Ver. Problem 27-3 - Problem 27-4Document4 pagesIA 1 Valix 2020 Ver. Problem 27-3 - Problem 27-4Ariean Joy Dequiña100% (1)

- Tugas Kuliah 8 MO2 - Mega Oktaviani (20059148)Document15 pagesTugas Kuliah 8 MO2 - Mega Oktaviani (20059148)Mega OktavianiNo ratings yet

- Costing CaseDocument6 pagesCosting CasenguyenthingocmaimkNo ratings yet

- Tugas Data ExcelDocument13 pagesTugas Data ExcelMega OktavianiNo ratings yet

- Joint Product & By-ProductDocument14 pagesJoint Product & By-ProductMuhammad azeem100% (1)

- Chapter 1Document5 pagesChapter 1Anh Thu VuNo ratings yet

- Accounting For Special Transactions and Business CombinationsDocument3 pagesAccounting For Special Transactions and Business CombinationsJustine Reine CornicoNo ratings yet

- 95-AFAR-Final-Preboard-SolutionsDocument10 pages95-AFAR-Final-Preboard-Solutions20100723No ratings yet

- Debt LevelDocument3 pagesDebt Levelsultan altamashNo ratings yet

- C B FC 20% A: Debt RatioDocument4 pagesC B FC 20% A: Debt Ratiojohn condesNo ratings yet

- Accounts - FIFO and WA For FinalDocument11 pagesAccounts - FIFO and WA For FinalRohan SinghNo ratings yet

- geogebra-export (3e)-mescladoDocument3 pagesgeogebra-export (3e)-mescladodadynho112No ratings yet

- C9 12 ActivityDocument5 pagesC9 12 ActivityJANNA GRACE DELA CRUZNo ratings yet

- Extra Material On CFDocument127 pagesExtra Material On CFPanosMavrNo ratings yet

- Merk Synthetic Rating Table (DSCR) : Greater Than Less Than Spread RatingDocument1 pageMerk Synthetic Rating Table (DSCR) : Greater Than Less Than Spread RatingAdriBCCNo ratings yet

- Quiz 8 (Operating Segment) - Sheet1Document1 pageQuiz 8 (Operating Segment) - Sheet1Shane TorrieNo ratings yet

- Business Risk:: Invesdted Capital Is Difference Between Total Assets and Working CapitalDocument5 pagesBusiness Risk:: Invesdted Capital Is Difference Between Total Assets and Working Capitaldua tanveerNo ratings yet

- Cost of Machine Cash Add Sales Tax Add Shipping Cost Add Insurance in Transit Add Installation Cost Total Cost of The MachineDocument22 pagesCost of Machine Cash Add Sales Tax Add Shipping Cost Add Insurance in Transit Add Installation Cost Total Cost of The MachineMohsin HassanNo ratings yet

- Francisco, Nicole Anne O. 4 Yr - BSA Sir SimbilloDocument4 pagesFrancisco, Nicole Anne O. 4 Yr - BSA Sir SimbilloNicole FranciscoNo ratings yet

- Materi Untuk Tugas Topik 2Document11 pagesMateri Untuk Tugas Topik 2Violen AmeliaNo ratings yet

- Cost Volume Profit Analysis (CVP) / Break Even AnalysisDocument10 pagesCost Volume Profit Analysis (CVP) / Break Even AnalysisTaymoor AliNo ratings yet

- Exercises - Operating SegmentsDocument6 pagesExercises - Operating SegmentsJamaica SaquilabonNo ratings yet

- Solutions To Problems: BasicDocument22 pagesSolutions To Problems: BasicSyed AshikNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Loan Yearly Revenue Operating Profit Return On Assets Distribute Al As Dividends Other Invest ReturnDocument3 pagesLoan Yearly Revenue Operating Profit Return On Assets Distribute Al As Dividends Other Invest ReturnPath GargNo ratings yet

- Accounting - Week 2 - Syndicate 3 - CVP Excel DemoDocument3 pagesAccounting - Week 2 - Syndicate 3 - CVP Excel DemoKrishna Rai0% (1)

- FC - Session 1 (BEP)Document3 pagesFC - Session 1 (BEP)ARYAMAN TELANGNo ratings yet

- September 08 - Chapter 6-Capital Gains Taxation (Assignment)Document3 pagesSeptember 08 - Chapter 6-Capital Gains Taxation (Assignment)anitaNo ratings yet

- FM 2019 SolutionsDocument6 pagesFM 2019 Solutionsaditikotere92No ratings yet

- Marr Calculation and ExamplesDocument4 pagesMarr Calculation and ExamplesAi manNo ratings yet

- Module - II (Session 6,7,8)Document12 pagesModule - II (Session 6,7,8)test twotestNo ratings yet

- Flaming Pickles, Andhra Pradesh: Unitsalesprices UnitcostsDocument4 pagesFlaming Pickles, Andhra Pradesh: Unitsalesprices Unitcostsanand kumarNo ratings yet

- Appraisal Problem Pg. No. 141Document3 pagesAppraisal Problem Pg. No. 141anand kumarNo ratings yet

- Next Maintanance Problem 40 PG No. 116Document1 pageNext Maintanance Problem 40 PG No. 116anand kumarNo ratings yet

- AtlantaOlmpcs - RawDataDocument6 pagesAtlantaOlmpcs - RawDataanand kumarNo ratings yet

- AIIM - Trimester IV - PSM - Session5Document6 pagesAIIM - Trimester IV - PSM - Session5anand kumarNo ratings yet

- Rating: Brand and Model Price RatingDocument4 pagesRating: Brand and Model Price Ratinganand kumarNo ratings yet

- PG. NO. 149 Problem On MultiplexDocument2 pagesPG. NO. 149 Problem On Multiplexanand kumarNo ratings yet

- Method-1. Elaborate Method: Number of RetirementsDocument4 pagesMethod-1. Elaborate Method: Number of Retirementsanand kumarNo ratings yet

- Technical + Financial PPPDocument2 pagesTechnical + Financial PPPanand kumarNo ratings yet

- B.R.M. Project Proposal: by Group: 4 - AIIM - PGDM (IM) - 2019-21Document5 pagesB.R.M. Project Proposal: by Group: 4 - AIIM - PGDM (IM) - 2019-21anand kumarNo ratings yet

- Group4 MIS FacebookPrivacyCaseDocument13 pagesGroup4 MIS FacebookPrivacyCaseanand kumarNo ratings yet

- The Mundra Power PlantDocument1 pageThe Mundra Power Plantanand kumarNo ratings yet

- Consumer Preference Analysis For New Toothpaste Launch: Group 4Document13 pagesConsumer Preference Analysis For New Toothpaste Launch: Group 4anand kumarNo ratings yet

- Pmiaa Fedpmcop Case Study PDFDocument8 pagesPmiaa Fedpmcop Case Study PDFanand kumarNo ratings yet

- Social Media Analytics in Indian Politics: Group 4Document8 pagesSocial Media Analytics in Indian Politics: Group 4anand kumarNo ratings yet

- 2015 - Ahmedabad PDFDocument501 pages2015 - Ahmedabad PDFanand kumarNo ratings yet