Professional Documents

Culture Documents

Final Tax

Uploaded by

Zham JavierOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Tax

Uploaded by

Zham JavierCopyright:

Available Formats

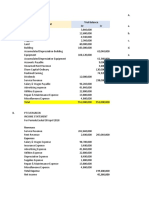

SUMMARY OF FINAL TAXES Z A M A N T H A R.

J A V I E R

TRAIN

INDIVIDUAL CORPORATION

INCOME CATEGORY Citizen Alien

Domestic

Foreign

Resident NR Resident NR-ETB NR-NETB Resident NR

INTEREST INCOME

1. Short term interest or yield 20% 20% 20% 20% 25% 20% 20% 30%

2. Long term deposit E E E E 25% 20% 20% 30%

Pre-temination rate

Less than 3 years 20% 20% 20% 20% 25% 20% 20% 30%

3 years to less than 4 years 12% 12% 12% 12% 25% 20% 20% 30%

4 years to less than 5 years 5% 5% 5% 5% 25% 20% 20% 30%

3. Foreign Currency Deposit (FCDU's) 15% E 15% E E 15% 15% E

DIVIDEND INCOME E - if there's reciprocity

4. Dividend from Domestic Corporation 10% 10% 10% 20% 25% E E 30% / E

5. Dividend from Foreign Corporation NT NT NT NT 25% NT NT 30%

6. Dividend Income from Real Estate Investment Trust 10% E 10% 10% 10% E E 10%

ROYALTIES

7. Passive Royalties from books, MC and other Lit Works 10% 10% 10% 10% 25% 20% 20% 30%

8. Passive Royalties from Cinematographic Films 20% 20% 20% 25% 25% 20% 20% 30%

9. Passive Royalties other than above 20% 20% 20% 20% 25% 20% 20% 30%

PRIZES

10. Taxable Prices less than P10000 NT NT NT NT 25% NT NT 30%

11. Taxable Prices P10,000 - above 20% 20% 20% 20% 25% NT NT 30%

WINNINGS

12. PCSO and Lotto Winning Less than P10000 E E E E E E E E

13. PCSO and Lotto Winning P10,000 - above 20% 20% 20% 20% 25% NT NT 30%

14. Winnings in general 20% 20% 20% 20% 25% NT NT 30%

INFORMERS' TAX REWARDS 10% AMOUNT RECORDED OR P1,000,000 (Whichever is Lower)

* NT - NOMAL TAX

* E - EXEMPT

You might also like

- 3.2. Finance 1 Quiz On Horizontal VerticalDocument3 pages3.2. Finance 1 Quiz On Horizontal VerticalZham JavierNo ratings yet

- Forward ContractDocument8 pagesForward ContractZham JavierNo ratings yet

- 01 Quiz Bee - P1 and TOA (Easy) PDFDocument4 pages01 Quiz Bee - P1 and TOA (Easy) PDFSamNo ratings yet

- 3.2. Finance 1 Quiz On Horizontal VerticalDocument3 pages3.2. Finance 1 Quiz On Horizontal VerticalZham JavierNo ratings yet

- 3.2. Finance 1 Quiz On Horizontal VerticalDocument3 pages3.2. Finance 1 Quiz On Horizontal VerticalZham JavierNo ratings yet

- Chapter13.Investment Centers and Transfer PricingDocument37 pagesChapter13.Investment Centers and Transfer PricingIam Laine100% (15)

- AFFIDAVIT OF WITNESS SampleDocument1 pageAFFIDAVIT OF WITNESS SampleZham JavierNo ratings yet

- AcknowledgementDocument2 pagesAcknowledgementZham JavierNo ratings yet

- AFFIDAVIT OF WITNESS SampleDocument1 pageAFFIDAVIT OF WITNESS SampleZham JavierNo ratings yet

- Business Law Testbanks / ReviewersDocument32 pagesBusiness Law Testbanks / ReviewersPutoy Itoy100% (1)

- Agamata Chapter 6Document18 pagesAgamata Chapter 6Abigail Faye Roxas100% (1)

- Government Accounting 1Document49 pagesGovernment Accounting 1mcannielNo ratings yet

- Auditing Theory Test BankDocument32 pagesAuditing Theory Test BankJane Estrada100% (2)

- Outstanding Check PolicyDocument1 pageOutstanding Check PolicyZham JavierNo ratings yet

- Ra 9178 - BmbeDocument5 pagesRa 9178 - BmbeZham JavierNo ratings yet

- PEZA Act (RA 7916) PDFDocument23 pagesPEZA Act (RA 7916) PDFDelOmisolNo ratings yet

- Psa 120 PDFDocument9 pagesPsa 120 PDFMichael Vincent Buan SuicoNo ratings yet

- TRAINDocument18 pagesTRAINAimee DiazNo ratings yet

- EXECUTIVE ORDER NO. 226 July 16, 1987Document37 pagesEXECUTIVE ORDER NO. 226 July 16, 1987eskhimhoneNo ratings yet

- Basic Concepts (Cost Accounting)Document9 pagesBasic Concepts (Cost Accounting)alexandro_novora6396No ratings yet

- Bmbe LawDocument6 pagesBmbe LawmansikiaboNo ratings yet

- Outstanding Check PolicyDocument1 pageOutstanding Check PolicyZham JavierNo ratings yet

- Entrepreneurship: Ronald C. NuiteDocument136 pagesEntrepreneurship: Ronald C. NuiteZham JavierNo ratings yet

- Joint Affidavit: - at Manila, PhilippinesDocument1 pageJoint Affidavit: - at Manila, PhilippinesZham JavierNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- (D) Capital of The Surviving SpouseDocument3 pages(D) Capital of The Surviving SpouseAnthony Angel TejaresNo ratings yet

- Deduction 80gga by Anmol Gulati 2013360 Mcom PDFDocument18 pagesDeduction 80gga by Anmol Gulati 2013360 Mcom PDFAnmol GulatiNo ratings yet

- PWC Current Issues in Income Tax Accounting Us Gaap and Ifrs PT 1Document85 pagesPWC Current Issues in Income Tax Accounting Us Gaap and Ifrs PT 1AMITNo ratings yet

- Income Tax Act 1961Document55 pagesIncome Tax Act 1961geeta100% (1)

- Joshua James R. Cabinas Assignment #1 Tax 2 (3178) : WithoutDocument2 pagesJoshua James R. Cabinas Assignment #1 Tax 2 (3178) : WithoutJoshua CabinasNo ratings yet

- CS Executive Old Paper 4 Tax Laws and Practice SA V0.3Document33 pagesCS Executive Old Paper 4 Tax Laws and Practice SA V0.3Raunak AgarwalNo ratings yet

- MODULE FinalTerm FAR 3 Operating Segment Interim Reporting Events After Reporting Period 1Document19 pagesMODULE FinalTerm FAR 3 Operating Segment Interim Reporting Events After Reporting Period 1Hazel Jane EsclamadaNo ratings yet

- Calculation FormatDocument13 pagesCalculation FormatSahil Swaynshree SahooNo ratings yet

- CE Interim ReportingDocument2 pagesCE Interim ReportingalyssaNo ratings yet

- O2C Manage Receivable System OptionsDocument2 pagesO2C Manage Receivable System OptionsAnusha ReddyNo ratings yet

- Chapter 4Document28 pagesChapter 4Nhi Phan TúNo ratings yet

- Cash Receipts Cash DisbursementDocument5 pagesCash Receipts Cash DisbursementLala BubNo ratings yet

- BIR Ruling NoDocument1 pageBIR Ruling NoPau Line EscosioNo ratings yet

- Form Vat - 2: District PeriodDocument2 pagesForm Vat - 2: District Periodjaipal sharmaNo ratings yet

- Assignment No. 4Document3 pagesAssignment No. 4Paula VillarubiaNo ratings yet

- AHM Chapter 1 - SolutionsDocument26 pagesAHM Chapter 1 - SolutionsNitin KhareNo ratings yet

- VAT On Sales To GovernmentDocument3 pagesVAT On Sales To GovernmentAnonymous OzIYtbjZ60% (5)

- 02 TISAX Participant Price ListDocument2 pages02 TISAX Participant Price ListKolhapur ANANo ratings yet

- Aanpf8204e 2011 12 PDFDocument4 pagesAanpf8204e 2011 12 PDFRAJENDRA PACHPANDENo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Melo - Quiz#6Document4 pagesMelo - Quiz#6tricia meloNo ratings yet

- Learning Module - Accounts ReceivableDocument2 pagesLearning Module - Accounts ReceivableAngelica SamonteNo ratings yet

- Individual Taxpayers (Tabag2021)Document14 pagesIndividual Taxpayers (Tabag2021)Veel Creed100% (1)

- CH 4 Income From House PropertyDocument89 pagesCH 4 Income From House PropertyPratyashNo ratings yet

- Bab 4 Soal 4Document4 pagesBab 4 Soal 4Abel AbdallahNo ratings yet

- Rmo 29-2014 Annex ADocument1 pageRmo 29-2014 Annex AteekeiseeNo ratings yet

- Abm Fabm2 Module 8 Lesson 2 Income and Business TaxationDocument24 pagesAbm Fabm2 Module 8 Lesson 2 Income and Business TaxationMelody Fabreag76% (25)

- PPE - Part - 1. CHAPTER 15Document22 pagesPPE - Part - 1. CHAPTER 15Ms VampireNo ratings yet

- PGBPDocument9 pagesPGBPYandex PrithuNo ratings yet

- Singh, Jashanpreet Tax PDF 2020 SignedDocument20 pagesSingh, Jashanpreet Tax PDF 2020 SignedJashan Dere AalaNo ratings yet