Professional Documents

Culture Documents

FM Kelompok 5 - Tugas Sesi 2

Uploaded by

hestiyaaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM Kelompok 5 - Tugas Sesi 2

Uploaded by

hestiyaaCopyright:

Available Formats

FINANCIAL MANAGEMENT

TUGAS SESI 2: BAB 4-5

Kelompok 5

Nama : Dewi Amelia

Mirza Zulkarnain

Rieza Sidafril Febianti

Unggul Satriya Anugrah

Kelas : Eksekutif B 39 E

CHAPTER 4: Time Value of Money

4-5 0 1 2 N–2 N–1 N

12%

| | | ••• | | |

PV = 42,180.53 5,000 5,000 5,000 5,000 FV = 250,000

I/YR = 12; PV = -42180.53; PMT = -5000; FV = 250000; N = ?

Solve for N with financial calculator = 11. It will take 11 years to accumulate $250,000.

4-19 a. Universal Bank: Effective rate = 7%.

Regional Bank:

4

0.06

Effective rate = 1 + - 1.0 = (1.015)4 – 1.0

4

= 1.0614 – 1.0 = 0.0614 = 6.14%.

Deposit money in Universal Bank is the best option.

b. Choose a Regional account is the right choice if funds must be left on deposit during an

entire compounding period in order for to receive any interest (1 year for Universal and 1

quarter for Regional). Assuming that it is high possibility to make a withdrawal during the

year. For example, if the withdrawal is made after 10 months, it would earn nothing on

the Universal account but (1,015) 3 - 1.0 = 4.57% on the Regional account.

4-20 a. N = 5, I/YR = 10, PV = -25000, and FV = 0,

PMT = $6,594.94.

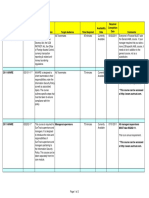

Payment Repayment Remaining of Balance

Year Interest Principal

$ $ $ $

1 6,594.94 2,500.00 4,094.94 20,905.06

2 6,594.94 2,090.51 4,504.43 16,400.63

3 6,594.94 1,640.06 4,954.88 11,445.75

4 6,594.94 1,144.58 5,450.36 5,995.39

5 *6,594.93 599.54 5,995.39 0

32,974.69 7,974.69 25,000.00

*The last payment must be smaller to force the ending balance to zero.

b. The loan size is doubled $50,000

N = 5, I/YR = 10, PV = -50000, and FV = 0

PMT = $13,189.87.

c. N = 10, I/YR = 10, PV = -50000, and FV = 0

PMT = $8,137.27

Since the payments are spread out over a longer time period, more interest must be paid

on the loan, which raises the amount of each payment.

10-year loan 5-year loan

10($8,137.27) - $50,000 5($6,594.94) - $50,000

= $31,372.70 = $15,949.37

CHAPTER 5: Bonds, Bond Valuation, and Interest Rates

5-12 a. N = 20, PV = -1100, PMT = 60, FV = 1000

I/YR = 5.185%.

Since this is a periodic rate so the nominal annual rate = 5.185%(2) = 10.37%.

b. The current yield = $120/$1,100 = 10.91%.

c. YTM = Current Yield + Capital Gains (Loss) Yield

10.37% = 10.91% + Capital Loss Yield

-0.54% = Capital Loss Yield.

d. N = 8, PV = -1100, PMT = 60, FV = 1060

I/YR = 5.075%.

Since this is a periodic rate so the nominal annual rate = 5.075%(2) = 10.15%.

5-16

Price at 8% Price at 7%

% change

$ $

10-year, 10% annual coupon 1,134.20 1,210.71 6.75%

10-year zero 463.19 508.35 9.75%

5-year zero 680.58 712.99 4.76%

30-year zero 99.38 131.37 32.19%

$100 perpetuity 1,250.00 1,428.57 14.29%

You might also like

- Sumber Label: Sumber: Theoritical Review Teori Perbedaan Generasi Oleh Yanuar Surya Putra (2016)Document3 pagesSumber Label: Sumber: Theoritical Review Teori Perbedaan Generasi Oleh Yanuar Surya Putra (2016)hestiyaaNo ratings yet

- Larry Puglia and The T Rowe Price Blue Chip Growth Fund Vrine Analysis Case Study HelpDocument5 pagesLarry Puglia and The T Rowe Price Blue Chip Growth Fund Vrine Analysis Case Study Helphestiyaa100% (1)

- Group 1 - Case 6 - Thomas Green Power Office Poiltics and A Career in CrisisDocument22 pagesGroup 1 - Case 6 - Thomas Green Power Office Poiltics and A Career in CrisishestiyaaNo ratings yet

- Mini Case MM - InstagramDocument1 pageMini Case MM - InstagramhestiyaaNo ratings yet

- In A World of Social Media: A Case Study Analysis of InstagramDocument8 pagesIn A World of Social Media: A Case Study Analysis of InstagramhestiyaaNo ratings yet

- Larry Puglia, Portfolio Manager, Blue Chip Growth FundDocument3 pagesLarry Puglia, Portfolio Manager, Blue Chip Growth FundhestiyaaNo ratings yet

- FINANCIAL MANAGEMENT - Sesi 6 PDFDocument1 pageFINANCIAL MANAGEMENT - Sesi 6 PDFhestiyaaNo ratings yet

- FINANCIAL MANAGEMENT - Sesi 6 PDFDocument1 pageFINANCIAL MANAGEMENT - Sesi 6 PDFhestiyaaNo ratings yet

- FM Kelompok 5 - Tugas Sesi 4Document2 pagesFM Kelompok 5 - Tugas Sesi 4hestiyaaNo ratings yet

- FM Kelompok 5 - Tugas Sesi 3Document2 pagesFM Kelompok 5 - Tugas Sesi 3hestiyaaNo ratings yet

- FINANCIAL MANAGEMENT Sesi 5Document4 pagesFINANCIAL MANAGEMENT Sesi 5hestiyaaNo ratings yet

- FM Kelompok 5 - Tugas Sesi 2Document2 pagesFM Kelompok 5 - Tugas Sesi 2hestiyaaNo ratings yet

- FINANCIAL MANAGEMENT Sesi 5Document4 pagesFINANCIAL MANAGEMENT Sesi 5hestiyaaNo ratings yet

- FM Kelompok 5 - Tugas Sesi 4Document2 pagesFM Kelompok 5 - Tugas Sesi 4hestiyaaNo ratings yet

- FM Kelompok 5 - Tugas Sesi 3Document2 pagesFM Kelompok 5 - Tugas Sesi 3hestiyaaNo ratings yet

- Key Answer of Exercises Chapter 12 - Managerial EconomicsDocument1 pageKey Answer of Exercises Chapter 12 - Managerial EconomicshestiyaaNo ratings yet

- Why T. Rowe Price Blue Chip Is Among The Best PDFDocument3 pagesWhy T. Rowe Price Blue Chip Is Among The Best PDFhestiyaaNo ratings yet

- How Top Manager Larry Puglia Stays Fit Mentally and PhysicallyDocument1 pageHow Top Manager Larry Puglia Stays Fit Mentally and PhysicallyhestiyaaNo ratings yet

- FM Kelompok 5 - Tugas Sesi 1Document3 pagesFM Kelompok 5 - Tugas Sesi 1hestiyaaNo ratings yet

- Investing It, Investing With Larry PugliaDocument5 pagesInvesting It, Investing With Larry PugliahestiyaaNo ratings yet

- Larry Puglia and The T Rowe Price Blue Chip Growth Fund Financial Analysis Case Study HelpDocument5 pagesLarry Puglia and The T Rowe Price Blue Chip Growth Fund Financial Analysis Case Study Helphestiyaa100% (1)

- Key Answer of Exercises Chapter 11 - Managerials EconomicsDocument1 pageKey Answer of Exercises Chapter 11 - Managerials EconomicshestiyaaNo ratings yet

- Kunci Jawaban Bab 8 PDFDocument1 pageKunci Jawaban Bab 8 PDFCalysta MerinaNo ratings yet

- Key Answer of Exercises Chapter 10 - Managerial EconomicsDocument1 pageKey Answer of Exercises Chapter 10 - Managerial Economicshestiyaa100% (1)

- Jawaban MeDocument1 pageJawaban MeCalysta MerinaNo ratings yet

- Key Answer of Exercises Chapter 7 - Managerial EconomicsDocument1 pageKey Answer of Exercises Chapter 7 - Managerial EconomicshestiyaaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- India Before IndependenceDocument3 pagesIndia Before IndependenceadiiiNo ratings yet

- Retail Management: Internal Assignment (20 MKS)Document4 pagesRetail Management: Internal Assignment (20 MKS)aarty24No ratings yet

- Logistical Challenges of Warehousing and TransportingDocument5 pagesLogistical Challenges of Warehousing and Transportingiamcheryl2098No ratings yet

- Central Action Plan 2021-22Document73 pagesCentral Action Plan 2021-22raj27385No ratings yet

- Finance Compliance Training Calendar - Current v1Document2 pagesFinance Compliance Training Calendar - Current v1shilpan9166No ratings yet

- William L. Jiler - How Charts Can Help You in The Stock Market-McGraw-Hill Education (1962)Document212 pagesWilliam L. Jiler - How Charts Can Help You in The Stock Market-McGraw-Hill Education (1962)George100% (5)

- Module 7 - Managing InventoryDocument28 pagesModule 7 - Managing InventoryMuhammad FaisalNo ratings yet

- Assignment #2 FABMDocument5 pagesAssignment #2 FABMIce Voltaire B. Guiang100% (1)

- Statement 19-JUN-23 AC 13014843 21041749Document7 pagesStatement 19-JUN-23 AC 13014843 21041749Laurentiu MilitaruNo ratings yet

- Declarations-: (Signature & Stamp of The Buyer)Document3 pagesDeclarations-: (Signature & Stamp of The Buyer)akakakshanNo ratings yet

- Adam SmithDocument18 pagesAdam SmithNesma HusseinNo ratings yet

- The Rise of Digital in Business BankingDocument7 pagesThe Rise of Digital in Business BankingShachin ShibiNo ratings yet

- Macro Econ FormulasDocument4 pagesMacro Econ FormulasChristina LeeNo ratings yet

- Chapter 11 322-330Document9 pagesChapter 11 322-330Anthon AqNo ratings yet

- ECONOMIC-DEVELOPMENTDocument20 pagesECONOMIC-DEVELOPMENTAra Mae WañaNo ratings yet

- 13 Mbfi - at - 191104 PDFDocument2 pages13 Mbfi - at - 191104 PDFAkshayNo ratings yet

- E StatementDocument6 pagesE Statementfislam1631No ratings yet

- Chapter 4Document2 pagesChapter 4Dai Huu0% (1)

- Shanaka FcoDocument6 pagesShanaka FcoKILIMANI METALS0% (1)

- Jundit Meroz Zilfa-ASSIGNMENT-Financial-Planning-and-BudgetDocument4 pagesJundit Meroz Zilfa-ASSIGNMENT-Financial-Planning-and-BudgetMeroz JunditNo ratings yet

- Appraisal ReportDocument4 pagesAppraisal Reporteric cathcartNo ratings yet

- Shape - Cutting - Game Scissors One Person TeamDocument3 pagesShape - Cutting - Game Scissors One Person TeamIshita FudduNo ratings yet

- Invoice - 2021-01-05T150251.353Document1 pageInvoice - 2021-01-05T150251.353mib_santoshNo ratings yet

- Gamuda AR2016Document356 pagesGamuda AR2016UstazFaizalAriffinOriginalNo ratings yet

- Business CommunicationDocument56 pagesBusiness CommunicationDipayan_luNo ratings yet

- CH 13-Market Economic SystemDocument3 pagesCH 13-Market Economic SystemDivya SinghNo ratings yet

- Tax3703 2Document61 pagesTax3703 2mariechen13koopmanNo ratings yet

- All SonsDocument14 pagesAll SonsMay BalangNo ratings yet

- SOIC-My JourneyDocument24 pagesSOIC-My JourneyPrateekNo ratings yet

- Marketing Cost Etc. ConceptsDocument27 pagesMarketing Cost Etc. ConceptsMOHIT CHAUDHARYNo ratings yet