Professional Documents

Culture Documents

Syllabus AFR

Uploaded by

Harsh Kandele0 ratings0% found this document useful (0 votes)

44 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

44 views2 pagesSyllabus AFR

Uploaded by

Harsh KandeleCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Course Name: ADVANCED FINANCIAL REPORTING Course Code: 18JBS209

Number of credits: 3 Number of Hours: 35

Learning Outcomes:

a) Appreciate theory and practice of financial reporting

b) Examine the corporate voluntary disclosures

c) Outline the emerging trends in financial reporting

Module 1: Financial Reporting Framework: 5 Hours

Learning Outcomes: Explain the framework of financial reporting

Overview of Accounting Standards – Indian AS, IFRS, IFRS for SMEs, Global Reporting Initiative

(GRI), IASB and IASC, SEBI, Role of Ministry of Corporate affairs, SEC, Quarterly report filing,

annual report filing, Electronic Data Information Filing and Retrieval System (EDIFAR), the

Electronic Data-Gathering, Analysis, and Retrieval system (EDGAR), Important components of

annual report - MD&A, Auditors report, Directors report

Module 2: Cash flow Statements: 5 Hours

Learning Outcomes: Develop the skill of preparing cash flow Statements

Cash flow statements: Components of statement of cash flows – Operating activities – Investing

activities - financing activities – Preparation of statement of cash flows (Indirect method)

Module 3: Financial Statements of Banking Companies: 7 Hours

Learning Outcomes: Discover the financial statements of Banking companies

Banking company financial statements: Preparation of statement of Profit and Loss and balance

sheet of banks.

Module 4: Financial Statements of Insurance Companies: 5 Hours

Learning Outcomes: Discover the financial statements insurance companies

Insurance company financial statements: Preparation of final accounts of Life and non-life

insurance companies; Revenue account, P&L Account and Balance sheet (simple problems

only).

Module 5: Advanced issues in Financial Reporting: 8 Hours

Learning Outcomes:

5.a) Develop an effective managerial perspective of advanced issues in Financial Reporting

5.b) Examine the emerging trends in financial reporting

Earnings per share (EPS), diluted EPS, Segment Reporting, Share based payments - Employee

stock options plans (ESOP), Employee stock purchase plan (ESPP) and Stock Appreciation Rights

(SAR), Sustainability reporting, Concept of Triple Bottom Line Reporting*, Forensic accounting*,

Ethics in Accounting*, Creative accounting, Accounting Scandals Enron, Xerox, Satyam*

Human Resources Accounting – significance, methods for accounting, real world practices,

Brand valuation

(* These topics are categorized as ‘Self-learning’ topics and are subjected to testing)

Basic Text:

Narayanaswamy R, (Recent edition). Financial Accounting A Managerial Perspective. New Delhi,

India: Prentice Hall India

Reference Books:

Earl K. Stice & James Stice (2006). Financial Accounting: Reporting And Analysis. Delhi, India:

South Western/Cengage Learning India

Other reading materials:

Chartered Accountant Journal, published by The Institute of Chartered Accountants of India,

New Delhi, India

Management Accountant Journal, published by The Institute of Cost Accountants of India,

Kolkatta, India

Annual Reports of L&T, BHEL, Bajaj Finance, General Insurance companies

Evaluation Pattern:

Continuous End term

Attendance Total

Evaluation Examination

45% 50% 5% 100%

You might also like

- Financial Reporting Statements and AnalysisDocument2 pagesFinancial Reporting Statements and AnalysisMadhav RajbanshiNo ratings yet

- Accounting and Finance For ManagersDocument322 pagesAccounting and Finance For ManagersPrasanna Aravindan100% (5)

- Syllabus and Scheme of Examination For: (Draft Approved by Faculty of Commerce and Business On 26 - 6-15)Document70 pagesSyllabus and Scheme of Examination For: (Draft Approved by Faculty of Commerce and Business On 26 - 6-15)Rohan SinghNo ratings yet

- MBAF5004 Financial Accounting and ReportingDocument2 pagesMBAF5004 Financial Accounting and ReportingRahulNo ratings yet

- Commerce Hons RegularDocument48 pagesCommerce Hons RegularHimanshu palNo ratings yet

- B. Com. (Hons.) : SyllabusDocument43 pagesB. Com. (Hons.) : SyllabusAditya SharmaNo ratings yet

- 20 Page Commerce & AccountancyDocument20 pages20 Page Commerce & Accountancymikasha977No ratings yet

- Online - Accounting and Financial ManagementDocument2 pagesOnline - Accounting and Financial ManagementPranav KompallyNo ratings yet

- Semester-I: Scheme of Examination andDocument63 pagesSemester-I: Scheme of Examination andBhavna MuthyalaNo ratings yet

- MBA Syllabus for Accounting and Information Systems at Jagannath UniversityDocument18 pagesMBA Syllabus for Accounting and Information Systems at Jagannath UniversityIbrahim Arafat ZicoNo ratings yet

- Financial Accts - PG1Document47 pagesFinancial Accts - PG1Abhishek SinghNo ratings yet

- IIM Bangalore Financial Accounting course outlineDocument3 pagesIIM Bangalore Financial Accounting course outlineSmriti AggarwalNo ratings yet

- Tlaw188l Financial-Accounting TH 1.0 0 Tlaw188lDocument2 pagesTlaw188l Financial-Accounting TH 1.0 0 Tlaw188lShreyaah TSNo ratings yet

- 1.3 Accounting For Managers: 1. General InformationDocument4 pages1.3 Accounting For Managers: 1. General InformationKartik KNo ratings yet

- 28899cpt Fa SM CP InipageDocument14 pages28899cpt Fa SM CP InipageDinesh Kumar0% (1)

- Chapter 1Document90 pagesChapter 1Ankit Deshmukh100% (1)

- Detailed SyllabusDocument4 pagesDetailed Syllabussundaram MishraNo ratings yet

- Financial Reporting FR FAQ Revised FinalDocument51 pagesFinancial Reporting FR FAQ Revised FinalrdttecNo ratings yet

- FA Sem1 FADocument2 pagesFA Sem1 FApraveenpatidar209No ratings yet

- ASM SOC B. Com. (Hons.) Course Syllabus 2019-22Document99 pagesASM SOC B. Com. (Hons.) Course Syllabus 2019-22Rajdeep Kumar RautNo ratings yet

- FSA Course Outline 10-06-2016Document6 pagesFSA Course Outline 10-06-2016Supreet NarangNo ratings yet

- Financial Accounting CourseDocument1 pageFinancial Accounting Coursepritam BhowmikNo ratings yet

- CA CPT Account Book IndexDocument14 pagesCA CPT Account Book IndexNishaPatel100% (2)

- Financial Accounting and Reporting 2021Document662 pagesFinancial Accounting and Reporting 2021pronab sarker100% (3)

- 2022-23 - CFRA - IIMC Course Outline - SentDocument10 pages2022-23 - CFRA - IIMC Course Outline - SentAnanya DevNo ratings yet

- IIM Bangalore Financial Accounting course outlineDocument4 pagesIIM Bangalore Financial Accounting course outlineShabir AhmedNo ratings yet

- Financial Accounting Asia Global 2nd Edition Williams Solutions ManualDocument28 pagesFinancial Accounting Asia Global 2nd Edition Williams Solutions ManualBrianWilsonqekdn100% (15)

- Financial Accounting & Analysis - Code - BBA (G.) 105 & BBA (B & I) 103 - Sem - IDocument126 pagesFinancial Accounting & Analysis - Code - BBA (G.) 105 & BBA (B & I) 103 - Sem - Isambhav jindal100% (1)

- BBA Syllabus FinalDocument13 pagesBBA Syllabus FinalHimanshuNo ratings yet

- 6th Sem Project 1Document87 pages6th Sem Project 1GauravsNo ratings yet

- Paid CourseDocument278 pagesPaid CourseAkshay GajghateNo ratings yet

- MBA SyllabusDocument18 pagesMBA SyllabusShaheen MahmudNo ratings yet

- MGT105Document8 pagesMGT105shahnwazNo ratings yet

- Shikha - Bhatia@imi - Edu: Page 1 of 6Document6 pagesShikha - Bhatia@imi - Edu: Page 1 of 6Daksh AnejaNo ratings yet

- MBA SyllabusDocument18 pagesMBA SyllabusAdnanNo ratings yet

- Commerce Honours PDFDocument41 pagesCommerce Honours PDFchikunNo ratings yet

- Course Outline FINANCIAL AND MANAGERIAL ACC DBU 2014 - 020642Document3 pagesCourse Outline FINANCIAL AND MANAGERIAL ACC DBU 2014 - 020642Ahmed YimamNo ratings yet

- Corporate Financial ReportingDocument6 pagesCorporate Financial ReportingAsadvirkNo ratings yet

- Financial Reporting Vol. 1Document902 pagesFinancial Reporting Vol. 1Mayank Jain100% (11)

- GM5101: Accounting and Finance CourseDocument2 pagesGM5101: Accounting and Finance Courserakeshsharmarv3577No ratings yet

- Chapter 03Document54 pagesChapter 03LBL_LowkeeNo ratings yet

- Course Outline - FACGDocument9 pagesCourse Outline - FACGPuneet GargNo ratings yet

- FINANCIAL ACCOUNTING FM-501Document5 pagesFINANCIAL ACCOUNTING FM-501sehrish kayaniNo ratings yet

- Financial Reporting Volume-IDocument860 pagesFinancial Reporting Volume-IMayank Parekh100% (3)

- Fr & Fsa Sem-6 Gkj (Final File)_02!03!24 (Final)Document72 pagesFr & Fsa Sem-6 Gkj (Final File)_02!03!24 (Final)bharatipaul42No ratings yet

- Internship Report - 03 June 22Document12 pagesInternship Report - 03 June 22Alina KujurNo ratings yet

- ACC 201: Financial AccountingDocument3 pagesACC 201: Financial AccountingWave WoNo ratings yet

- Financial AccountingDocument252 pagesFinancial AccountingSonia Dhar100% (1)

- Basic Concepts in Management Accounting ReviewerDocument13 pagesBasic Concepts in Management Accounting ReviewerAB CloydNo ratings yet

- ProgramDocument54 pagesProgramManeet SinghNo ratings yet

- Financial Accounting BasicsDocument60 pagesFinancial Accounting Basicsaqsa palijoNo ratings yet

- I208 GP235 Financial ManagmentDocument3 pagesI208 GP235 Financial Managmentleo rojasNo ratings yet

- CA Final - Financial Reporting Vol. 1Document905 pagesCA Final - Financial Reporting Vol. 1Gs Shiksha100% (5)

- Financial Statement Analysis: MGT-537 Dr. Hafiz Muhammad Ishaq 32Document77 pagesFinancial Statement Analysis: MGT-537 Dr. Hafiz Muhammad Ishaq 32gazmeerNo ratings yet

- Curriculum: Masters in Business Administrat 2020-2022 Term: 1 - Semester Course: MGC1051 - Financial Accounting and AnalysisDocument16 pagesCurriculum: Masters in Business Administrat 2020-2022 Term: 1 - Semester Course: MGC1051 - Financial Accounting and AnalysisAnand BabarNo ratings yet

- The University of Burdwan: Under Semester With Choice Based Credit System W.E.F. 2017-2018 OnwardDocument24 pagesThe University of Burdwan: Under Semester With Choice Based Credit System W.E.F. 2017-2018 OnwardAbhishekNo ratings yet

- Financial Accounting AnalysisDocument4 pagesFinancial Accounting AnalysisScolaNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- XTRAs - CC & ITCDocument11 pagesXTRAs - CC & ITCHarsh KandeleNo ratings yet

- Indirect Taxes Project Based ActivityDocument13 pagesIndirect Taxes Project Based ActivityHarsh KandeleNo ratings yet

- Cms Business School: #319, 17Th Cross, 25Th Main, JP Nagar, 6Th Phase,, Bangalore-560078Document1 pageCms Business School: #319, 17Th Cross, 25Th Main, JP Nagar, 6Th Phase,, Bangalore-560078Harsh KandeleNo ratings yet

- Compass 2019 ScheduleDocument6 pagesCompass 2019 ScheduleHarsh KandeleNo ratings yet

- Excel Short Cuts Cheat Sheet by FunctionsDocument5 pagesExcel Short Cuts Cheat Sheet by Functionsanon_491881087No ratings yet

- MCQ GST Answer KeyDocument23 pagesMCQ GST Answer KeyvineethkmenonNo ratings yet

- MBA Indirect Taxes CourseDocument8 pagesMBA Indirect Taxes CourseHarsh KandeleNo ratings yet

- Harsh Kandele-19mbar0242-Cia2-ItDocument9 pagesHarsh Kandele-19mbar0242-Cia2-ItHarsh KandeleNo ratings yet

- Score Card: Harsh Kandele Male 06 Dec 1997Document2 pagesScore Card: Harsh Kandele Male 06 Dec 1997Harsh KandeleNo ratings yet

- Score Card: Harsh Kandele Male 06 Dec 1997Document2 pagesScore Card: Harsh Kandele Male 06 Dec 1997Harsh KandeleNo ratings yet

- Nmat by Gmac 2018 Official Score Card: Candidate Name Nmat by Gmac Id Gender DOB Email Id Address Category PWD StatusDocument1 pageNmat by Gmac 2018 Official Score Card: Candidate Name Nmat by Gmac Id Gender DOB Email Id Address Category PWD StatusHarsh KandeleNo ratings yet

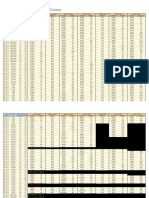

- S.No. Name of The Scrip Amt Invested No. of Shares Bought CMP Price in 2010Document8 pagesS.No. Name of The Scrip Amt Invested No. of Shares Bought CMP Price in 2010Harsh KandeleNo ratings yet

- CMAT 2019 score card for Harsh KandeleDocument1 pageCMAT 2019 score card for Harsh KandeleHarsh KandeleNo ratings yet

- S No. Return: Name of The Mutual Fund SchemeDocument4 pagesS No. Return: Name of The Mutual Fund SchemeHarsh KandeleNo ratings yet

- List of Commodities Traded in India including Agricultural and Non-Agricultural itemsDocument5 pagesList of Commodities Traded in India including Agricultural and Non-Agricultural itemsHarsh KandeleNo ratings yet

- S.No. Name of The Company MKT Cap (CRS)Document4 pagesS.No. Name of The Company MKT Cap (CRS)Harsh KandeleNo ratings yet

- S No. Return: Name of The Mutual Fund SchemeDocument4 pagesS No. Return: Name of The Mutual Fund SchemeHarsh KandeleNo ratings yet

- S.No. Name of The Company MKT Cap (CRS)Document4 pagesS.No. Name of The Company MKT Cap (CRS)Harsh KandeleNo ratings yet

- S.No. Name of The Scrip Amt Invested No. of Shares Bought CMP Price in 2010Document8 pagesS.No. Name of The Scrip Amt Invested No. of Shares Bought CMP Price in 2010Harsh KandeleNo ratings yet

- Ass IGNMENTDocument2 pagesAss IGNMENTHarsh KandeleNo ratings yet

- List of Commodities Traded in India including Agricultural and Non-Agricultural itemsDocument5 pagesList of Commodities Traded in India including Agricultural and Non-Agricultural itemsHarsh KandeleNo ratings yet

- Name of The Company: S. No. Share Price in 2010 Amt Invested No. of Shares CMPDocument2 pagesName of The Company: S. No. Share Price in 2010 Amt Invested No. of Shares CMPHarsh KandeleNo ratings yet

- Lecture 14Document19 pagesLecture 14Harsh KandeleNo ratings yet

- Stock Apr 19Document64 pagesStock Apr 19Harsh KandeleNo ratings yet

- Lecture 13Document21 pagesLecture 13Harsh KandeleNo ratings yet

- Syllabus Corp PDFDocument4 pagesSyllabus Corp PDFHarsh KandeleNo ratings yet

- EPFDocument19 pagesEPFHarsh KandeleNo ratings yet

- Marketing Management Key ConceptsDocument19 pagesMarketing Management Key Conceptsnandini88No ratings yet

- Supply Chain Management: Supply Chain Performance: Achieving Strategic Fit and ScopeDocument27 pagesSupply Chain Management: Supply Chain Performance: Achieving Strategic Fit and ScopeAsadNo ratings yet

- DIT 0205 Elementary Mathematics and Decision Making - PrintreaDocument3 pagesDIT 0205 Elementary Mathematics and Decision Making - Printreakipkoecharonz korirNo ratings yet

- Technology TransferDocument20 pagesTechnology TransferDeepankumar Athiyannan75% (8)

- Solved Use Your Answers To Problems 26a and 28 To ExplainDocument1 pageSolved Use Your Answers To Problems 26a and 28 To ExplainM Bilal SaleemNo ratings yet

- Exam 0809Document2 pagesExam 0809Karen Yung100% (1)

- Balance Sheet GodrejDocument4 pagesBalance Sheet Godrejjohn11051990100% (1)

- 2 Understanding The Business OperationsDocument24 pages2 Understanding The Business OperationsAYAME MALINAO BSA19No ratings yet

- Mandap SecorationDocument18 pagesMandap Secorationmk.dekaparaNo ratings yet

- GROUP 5 - Value Chain AnalysisDocument17 pagesGROUP 5 - Value Chain Analysisk61.2212155104No ratings yet

- Financial Accounting Fundamentals 6th Edition Wild Solutions ManualDocument6 pagesFinancial Accounting Fundamentals 6th Edition Wild Solutions ManualJeremyMitchellkgaxp100% (57)

- CA New Project.pdf 1 AprilDocument55 pagesCA New Project.pdf 1 Aprilpratikshapatil0606No ratings yet

- BI&analyticsDocument19 pagesBI&analyticssomenath tewaryNo ratings yet

- Lesson 4 - Statement of Cash Flows Ch23Document65 pagesLesson 4 - Statement of Cash Flows Ch23zhart1921No ratings yet

- Chap 8Document13 pagesChap 8MichelleLeeNo ratings yet

- Equity Research PPT Dhawal Shah-1Document16 pagesEquity Research PPT Dhawal Shah-1Dhaval ShahNo ratings yet

- Orientation To AccountingDocument18 pagesOrientation To AccountingMukund kelaNo ratings yet

- Resume Amal ZohbanDocument1 pageResume Amal ZohbanRanju RajuNo ratings yet

- Materi Transfer Antar Perusahaan Atas AsetDocument25 pagesMateri Transfer Antar Perusahaan Atas AsetBaiq Melaty Sepsa WindiNo ratings yet

- Cfas ComputationDocument4 pagesCfas ComputationSherica VirayNo ratings yet

- Accounting Equation & Accounting ClassificationDocument17 pagesAccounting Equation & Accounting ClassificationMuhammad AdibNo ratings yet

- Seminar Case Study Moncler Scraps Week 4Document5 pagesSeminar Case Study Moncler Scraps Week 4Muhammed MughniNo ratings yet

- Awareness of Mutual Fund and Its ScopeDocument64 pagesAwareness of Mutual Fund and Its ScopeLakshman Kota100% (1)

- Morning Star Fund Rating MethodologyDocument35 pagesMorning Star Fund Rating MethodologyfoliveiraNo ratings yet

- CBO ReportDocument6 pagesCBO Reportdharmesh1986No ratings yet

- Dream BeautyDocument6 pagesDream BeautyANZ100% (5)

- The in Uencing Factors On Coffee Shop Customers' Revisit IntentionDocument7 pagesThe in Uencing Factors On Coffee Shop Customers' Revisit IntentionAmabelle AbapoNo ratings yet

- Six Reasons to Admire Sephora Brand | AakerDocument4 pagesSix Reasons to Admire Sephora Brand | AakerSwarnim DobwalNo ratings yet

- Retail Assets: Product Manager: Key ResponsibilitiesDocument5 pagesRetail Assets: Product Manager: Key ResponsibilitiesNitin MandavkarNo ratings yet

- Introduction To Strategic Cost Management and Management AccountingDocument3 pagesIntroduction To Strategic Cost Management and Management AccountingnovyNo ratings yet