Professional Documents

Culture Documents

0452 s17 Ms 22 PDF

0452 s17 Ms 22 PDF

Uploaded by

kazamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

0452 s17 Ms 22 PDF

0452 s17 Ms 22 PDF

Uploaded by

kazamCopyright:

Available Formats

Cambridge International Examinations

Cambridge International General Certificate of Secondary Education

ACCOUNTING 0452/22

Paper 2 May/June 2017

MARK SCHEME

Maximum Mark: 120

Published

This mark scheme is published as an aid to teachers and candidates, to indicate the requirements of the

examination. It shows the basis on which Examiners were instructed to award marks. It does not indicate the

details of the discussions that took place at an Examiners’ meeting before marking began, which would have

considered the acceptability of alternative answers.

Mark schemes should be read in conjunction with the question paper and the Principal Examiner Report for

Teachers.

Cambridge will not enter into discussions about these mark schemes.

Cambridge is publishing the mark schemes for the May/June 2017 series for most Cambridge IGCSE®,

Cambridge International A and AS Level and Cambridge Pre-U components, and some Cambridge O Level

components.

® IGCSE is a registered trademark.

This document consists of 12 printed pages.

© UCLES 2017 [Turn over

0452/22 Cambridge IGCSE – Mark Scheme May/June 2017

PUBLISHED

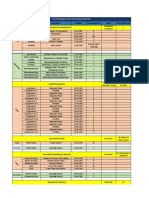

Question Answer Marks

1(a) Shiromi 13

General Ledger

Rent and Account

2017 $

April 4 Bank 495 (1)

Motor Vehicle Account

2017 $

April 10 Bank 5 500 (1)

Sales Account

2017 $

April 21 Cash 600 }(1)

Bank 6 000 }

Drawings Account

2017 $

April 26 Cash 150 (1)

Purchases Account

2017 $

April 30 Total for Month 7 460 (1)

Purchases Returns Account

2017 $

April 30 Total for month 560 (1)

Discount received Account

2017 $

April 30 Total for month 156 (1)

© UCLES 2017 Page 2 of 12

0452/22 Cambridge IGCSE – Mark Scheme May/June 2017

PUBLISHED

Question Answer Marks

Purchases Ledger

Lincy account

2017 $ 2017 $

April 7 Returns 560 (1) April 5 Purchases 3 860 (1)

April 18 Bank 3 234 }(1)

Discount 66 }

Gail Account

2017 $ 2017 $

April 24 Bank 3 510 }(1) April 16 Purchases 3 600 (1)

Discount 90 }

+ (1) dates

1(b) Decrease in inventory 2

Decrease in bank/cash balance or increase in overdraft

Increase in trade payables

Increase in short term loans

Increase in other payables

Decrease in other receivables

Purchase of non-current assets

Increase in drawings

Repayment of long term liabilities

Note: Not decrease in trade receivables as sells for cash only

Any two reasons (1) each

1(c) May not be able to pay debts when they fall due 2

May not be able to take advantage of cash discounts

May not be able to take advantage of business opportunities as they arise

May have difficulty in obtaining further supplies

May not be able to take drawings

May not have sufficient funds to pay for day to day expenses

Any two points (1) each

© UCLES 2017 Page 3 of 12

0452/22 Cambridge IGCSE – Mark Scheme May/June 2017

PUBLISHED

Question Answer Marks

1(d) increase decrease no effect 4

Take out a short-term bank loan 9(1)

Repay a long-term bank loan 9(1)

Sell goods on credit terms instead of for cash 9(1)

Obtain a higher rate of cash discount 9(1)

1(e) These are goods for re-sale/These goods are purchased for re-sale not for business use/The inventory would increase/ 1

These are short-term assets

1(f) Lower profit for the year 2

Higher capital employed/Higher owner's capital(Equity)/Higher long term loans

Any 2 reasons (1) each

© UCLES 2017 Page 4 of 12

0452/22 Cambridge IGCSE – Mark Scheme May/June 2017

PUBLISHED

Question Answer Marks

2(a) Book of prime (original) entry 4

Discount allowed Cash book (1)

Bad debts General journal (1)

Contra General journal (1)

Returns Sales returns journal (1)

2(b) Meaning 2

A contra entry is one which appears on the debit side of the purchases ledger control account and the credit side of the sales

ledger control account. (1)

Reason

The entry is made when a sales ledger account is set off against a purchases ledger account of the same person/business. (1)

2(c) Waheed 10

Sales ledger control account

2017 $ 2017 $

March 1 Balance b/d 2 346 March 1 Balance b/d 140

March 31 Bank (dis.chq) 350 (1) March 31 Bank 2 145 (1)

Sales 2 748 (2)CF/(1)OF Discount 55 (1)

Balance c/d 86 Returns 276 (1)

Contra 182 (1)

Bad debts 62 (1)

Balance c/d 2 670 (1)

5530 5 530

2017 $ 2017 $

April 1 Balance b/d 2 670 (1) April 1 Balance b/d 86 (1)

2(d) Overpayment by customer

Payment made by customer without deducting cash discount 2

Goods returned by customer after payment of balance due

Payment made in advance by customer

Any two points (1) each

© UCLES 2017 Page 5 of 12

0452/22 Cambridge IGCSE – Mark Scheme May/June 2017

PUBLISHED

Question Answer Marks

2(e) Satisfied (1) 2

Credit customers are now paying earlier/within credit period allowed/other valid answer (1)

2(f) Do not have to allow Waheed cash discount 1

May charge interest on overdue account

2(g) Have to wait longer for payment/Adversely affects liquidity position 1

Increase risk of bad debt

Any 1 point (1)

2(h) Waheed has the use of the funds for other purposes for 17 days 2

Waheed does not need to use his existing liquid funds to pay suppliers

Improved liquidity position

Or other suitable comment

Any 2 comments (1) each

© UCLES 2017 Page 6 of 12

0452/22 Cambridge IGCSE – Mark Scheme May/June 2017

PUBLISHED

Question Answer Marks

3(a) A1 Sports Club 12

Receipts and Payments Account for the year ended 30 April 2017

2017 $ 2016 $

April 30 Subscriptions 7 140 (1) March 1 3 180

Sales of 430 (1) 2017

equipment

Café sales 5 280 } (2)CF April 30 Café suppliers 3 796 (1)

} (1)OF Rates 960 (1)

Balance c/d 2 626 General expenses 910 (1)

Café wages 1 040 (1)

Loan Repaid 1 500 (1)

Loan interest 90 (1)

Equipment 4 000 (1)

15 476 15 476 (1)

2017

May 1 Balance b/d 2626 (1)

3(b) A1 Sports Club 8

Café Income Statement for the year ended 30 April 2017

$ $

Revenue 5 280 (1) OF

Cost of Sales

Opening Inventory 298 (1)

Purchases (3796 (1) – 311 (1) + 393 (1)) 3 878

4 176

Closing inventory 216 (1)

3 960

Café wages 1 040 (1) 5 000

Café profit 280 (1) OF

3(c) $7000 (1) 2

This is the amount of subscriptions which relates to this financial year (1)

© UCLES 2017 Page 7 of 12

0452/22 Cambridge IGCSE – Mark Scheme May/June 2017

PUBLISHED

Question Answer Marks

3(d) Opening bank balance/closing bank balance 5

Purchase of equipment

Proceeds of sale of equipment

Repayment of loan

Café sales

Payments to café suppliers

Café wages

Subscriptions accrued at the start of the year

Any five items (1) each

Question Answer Marks

4(a) 1

$ $

Premises 58 500

Fixtures and fittings 9 400

Inventory 9 700

Trade receivables 8 120 85 720

Trade payables 7 100

Loan 15 000

Bank overdraft 5 300 27 400

Capital 58 320 (1)

© UCLES 2017 Page 8 of 12

0452/22 Cambridge IGCSE – Mark Scheme May/June 2017

PUBLISHED

Question Answer Marks

4(b) Virat - Statement of Affairs at 31 January 2017 14

Assets $ $ $

Non-current assets Cost Accumulated Book

depreciation value

Premises 58 500 58 500

Fixtures and Fittings 9 400 1 880 (1) 7 520 (1)OF

Motor Vehicle 15 200 3 800 (1) 11 400 (1)OF

83 100 5 680 77 420 (1)OF

Current Assets 10 750 (1)

Inventory (12 900 × 100/120) 11 430

Trade receivables (8120 + 3310) 130

Less Bad debts written off 11 300 (1)

Less Provision for doubtful debts 226 (1) 11 074 (1) OF

Cash 100 (1)

Total Assets 21 924

Capital and Liabilities 99 344

Capital

Balance 73 418 (1)OF

Non-current liabilities

Loan – A Singh (repayable 2019) 10 000 (1)

Current Liabilities 7 526 (1)

Trade Payables (7100 + 6%) 8 400 (1)

Bank overdraft (5300 + 3100) 15 926

Total Liabilities 99 344

© UCLES 2017 Page 9 of 12

0452/22 Cambridge IGCSE – Mark Scheme May/June 2017

PUBLISHED

Question Answer Marks

4(c) Virat 5

Capital account

2017 $ 2016 $

Jan 31 Drawings 11 320 (1) Feb 1 Balance b/d 58 320 (1)OF

Balance c/d 73 418 (1) OF 2017

Jan 31 Motor Vehicle 15 200 (1)

Profit 11 218 (1)OF

84 738 84 738

2017

Feb 1 Balance b/d

4(d) Should compare with a business in the same trade 4

Should compare with a business of approximately the same size

Should compare with a business of the same type (sole trader)

The financial statements may be for one year which will not show trends

The financial statements may be for one year which is not a typical year

The financial year may end on different dates (when inventories are high/low)

The businesses may operate different accounting policies

The statements do not show non-monetary factors

It may not be possible to obtain all the information needed to make comparisons

Or other suitable points

Any 2 points (1) for basic statement and (1) for development

© UCLES 2017 Page 10 of 12

0452/22 Cambridge IGCSE – Mark Scheme May/June 2017

PUBLISHED

Question Answer Marks

5(a) Duality (1) 1

5(b) To ensure that the totals of the trial balance agree 2

To allow draft financial statements to be prepared

To facilitate the correction of errors

To make sure that all the errors are discovered

Any 2 reasons (1) each

5(c) Heng 6

Suspense account

2016 $ 2016 $

Dec 31 Balance 430 (1) Dec 31 Petty Cash 150 (1)

General exp 90 (1) Discount alld 1 024 (1)

Purchases Returns 454 (1)

Balance c/d 200 (1)OF

1 174 1 174

2017

Jan 1 Balance b/d 200

5(d) Either 2

All the errors have not been found (1)

There is still a balance on the suspense account (1)

Or – if the suspense account in (c) is closed –

All the errors have been discovered (1)

There is no balance remaining on the suspense account (1)

© UCLES 2017 Page 11 of 12

0452/22 Cambridge IGCSE – Mark Scheme May/June 2017

PUBLISHED

Question Answer Marks

5(e) Error Profit for the year Non-current assets Current assets Current liabilities 10

$ $ $ $

1 281 overstated 281 overstated No effect No effect

2 100 overstated (1) No effect 100 overstated (1) No effect

3 No effect No effect 150 understated (1) No effect

4 90 understated (1) No effect No effect No effect

5 1024 overstated (1) No effect No effect No effect

6 No effect No effect 4 120 overstated (2) 4 120 overstated (2)

Or Or

2 060 overstated (1) 2 060 overstated (1)

7 454 understated (1) No effect No effect No effect

© UCLES 2017 Page 12 of 12

You might also like

- Hoyle 14e Ch001 AccessibleDocument58 pagesHoyle 14e Ch001 Accessiblenawaf almatrukNo ratings yet

- Year To 31 Dec Bad Debts Written Off Debtors at 31 Dec % Provision For Doubtful DebtsDocument4 pagesYear To 31 Dec Bad Debts Written Off Debtors at 31 Dec % Provision For Doubtful DebtsHopeNo ratings yet

- Activiity 2 Investment in AssociateDocument3 pagesActiviity 2 Investment in AssociateAldrin Cabangbang67% (3)

- Paper 1 Financial AccountingDocument10 pagesPaper 1 Financial AccountingTuryamureeba JuliusNo ratings yet

- Cambridge Assessment International Education: Accounting 0452/21 October/November 2017Document9 pagesCambridge Assessment International Education: Accounting 0452/21 October/November 20171234No ratings yet

- 0452 m17 Ms 22Document13 pages0452 m17 Ms 22Mohammed MaGdyNo ratings yet

- Cambridge International Examinations: Accounting 0452/22 March 2017Document13 pagesCambridge International Examinations: Accounting 0452/22 March 2017Mike ChindaNo ratings yet

- Cambridge International Examinations: Principles of Accounts 7110/21 May/June 2017Document9 pagesCambridge International Examinations: Principles of Accounts 7110/21 May/June 2017Taha AhmedNo ratings yet

- Cambridge International Examinations: Principles of Accounts 7110/22 May/June 2017Document13 pagesCambridge International Examinations: Principles of Accounts 7110/22 May/June 2017Phiri AgnesNo ratings yet

- Cambridge Assessment International Education: Accounting 0452/22 October/November 2017Document12 pagesCambridge Assessment International Education: Accounting 0452/22 October/November 2017pyaaraasingh716No ratings yet

- Cambridge Assessment International Education: Principles of Accounts 7110/22 October/November 2017Document13 pagesCambridge Assessment International Education: Principles of Accounts 7110/22 October/November 2017Makanaka MutandariNo ratings yet

- May 2018 Professional Examinations Financial Accounting (Paper 1.1) Chief Examiner'S Report, Questions and Marking SchemeDocument28 pagesMay 2018 Professional Examinations Financial Accounting (Paper 1.1) Chief Examiner'S Report, Questions and Marking SchemeJoseph PhaustineNo ratings yet

- Cambridge Assessment International Education: Accounting 9706/23 October/November 2017Document8 pagesCambridge Assessment International Education: Accounting 9706/23 October/November 2017ASHITA AGARWAL-01841No ratings yet

- 2017 BGSS 4E5N Prelim P2Document10 pages2017 BGSS 4E5N Prelim P2Damien SeowNo ratings yet

- 9706 m17 Ms 32Document16 pages9706 m17 Ms 32FarrukhsgNo ratings yet

- 0452 Specimen Paper Answers Paper 2 (For Examination From 2020)Document26 pages0452 Specimen Paper Answers Paper 2 (For Examination From 2020)Divya SinghNo ratings yet

- Exam 2017 CFSDocument4 pagesExam 2017 CFSEpic Gaming MomentsNo ratings yet

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationDocument11 pagesCambridge International Examinations Cambridge International General Certificate of Secondary EducationputtytrishNo ratings yet

- ACBP5111T1a PDFDocument8 pagesACBP5111T1a PDFabdoabdoNo ratings yet

- F&O Event Tracker: Retail ResearchDocument2 pagesF&O Event Tracker: Retail ResearchjaimaaganNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced Levelayesha zafarNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument20 pagesCambridge International Advanced Subsidiary and Advanced LevelRay DoughNo ratings yet

- Adjusting The Records: Bookkeeping Nciii Training CourseDocument46 pagesAdjusting The Records: Bookkeeping Nciii Training CourseKim Audrey JalalainNo ratings yet

- Cambridge Assessment International Education: This Document Consists of 19 Printed PagesDocument19 pagesCambridge Assessment International Education: This Document Consists of 19 Printed Pagestecho2345No ratings yet

- CPA Ireland-Financial-Accounting-April-2018Document19 pagesCPA Ireland-Financial-Accounting-April-2018Mwenda MongweNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelTatenda NdlovuNo ratings yet

- Accounting Nov 2017 AddendumDocument16 pagesAccounting Nov 2017 Addendumkwanele andiswaNo ratings yet

- Chapter 10 - Adjusting The RecordsDocument24 pagesChapter 10 - Adjusting The RecordsJesseca JosafatNo ratings yet

- Unofficial Transcript 03-26-19Document3 pagesUnofficial Transcript 03-26-19api-455664883No ratings yet

- Cambridge Assessment International Education: Accounting 9706/32 May/June 2018Document17 pagesCambridge Assessment International Education: Accounting 9706/32 May/June 2018Tesa RudangtaNo ratings yet

- UntitledDocument26 pagesUntitledTanvi RAMSEWAKNo ratings yet

- Cambridge Assessment International Education: Accounting 9706/31 October/November 2017Document14 pagesCambridge Assessment International Education: Accounting 9706/31 October/November 2017Phiri Arah RachelNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelZaid NaveedNo ratings yet

- Cambridge Assessment International Education: Accounting 9706/32 October/November 2017Document11 pagesCambridge Assessment International Education: Accounting 9706/32 October/November 2017Phiri Arah RachelNo ratings yet

- IGCSE Accounting All Mark Scheme 2002 Summer 2018Document1,453 pagesIGCSE Accounting All Mark Scheme 2002 Summer 2018Muhammad Arif100% (3)

- C3 - Matching and Adjusting ProcessDocument12 pagesC3 - Matching and Adjusting ProcessIvy Jean Ybera-PapasinNo ratings yet

- Question No 06 Chapter No 12 - D.K Goal 11 ClassDocument1 pageQuestion No 06 Chapter No 12 - D.K Goal 11 ClassNafe MNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument13 pagesCambridge International Advanced Subsidiary and Advanced LevelAR RafiNo ratings yet

- Task Breakdown List1Document2 pagesTask Breakdown List1api-302717259No ratings yet

- Paper 2 AccountsDocument20 pagesPaper 2 AccountsRukudzo Prince MugabeNo ratings yet

- 9706 w18 QP 12Document12 pages9706 w18 QP 12Jul 480weshNo ratings yet

- Cambridge Assessment International Education: Accounting 0452/21 October/November 2018Document17 pagesCambridge Assessment International Education: Accounting 0452/21 October/November 2018Iron OneNo ratings yet

- Pulp Friction Smoothie Bar - Final Accounts 2017Document11 pagesPulp Friction Smoothie Bar - Final Accounts 2017JaydenNo ratings yet

- BAFS Mock Paper 2A Set 8 Ans EngDocument9 pagesBAFS Mock Paper 2A Set 8 Ans Enghannahho0723No ratings yet

- 2020 Financial LiteracyDocument51 pages2020 Financial LiteracyLeah AbenerNo ratings yet

- Transaction HistoryDocument2 pagesTransaction HistoryChankingyeungNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelMalik AliNo ratings yet

- 7707 Y20 SP 2Document20 pages7707 Y20 SP 2Ahmed NaserNo ratings yet

- Accounitng 2017Document20 pagesAccounitng 2017muhammad waqasNo ratings yet

- BAFS - Mock Paper 2A - Set 10 - EngDocument9 pagesBAFS - Mock Paper 2A - Set 10 - Enghannahho0723No ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument20 pagesCambridge International Advanced Subsidiary and Advanced LevelTatenda NdlovuNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument24 pagesCambridge International General Certificate of Secondary EducationMike ChindaNo ratings yet

- Fin Man 1BDocument12 pagesFin Man 1BMelissa KleinNo ratings yet

- Statement of Account - Branch - PDFDocument11 pagesStatement of Account - Branch - PDFz3overseas cleartripNo ratings yet

- Financial Highlights - 2017Document9 pagesFinancial Highlights - 2017Vikash SonNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument20 pagesCambridge International Advanced Subsidiary and Advanced LevelPhiri Arah RachelNo ratings yet

- At The Beginning of 2017 Miyazaki Company S Accounts Receivable BalanceDocument1 pageAt The Beginning of 2017 Miyazaki Company S Accounts Receivable BalanceMiroslav GegoskiNo ratings yet

- Summary of TotalsDocument2 pagesSummary of TotalsDom Minix del RosarioNo ratings yet

- Zodeq Vision - Accounting LedgersDocument24 pagesZodeq Vision - Accounting LedgerskeemorodriquezNo ratings yet

- Other Payables and Other ReceivablesDocument42 pagesOther Payables and Other ReceivablesHussain AhmedNo ratings yet

- District Insurance Office:EAST GODAVARI: Financial Year: 2017-2018Document1 pageDistrict Insurance Office:EAST GODAVARI: Financial Year: 2017-2018KasiSivaAnkamreddiNo ratings yet

- CBLO, Repo and Fixed Deposit Trades Are Not ConsideredDocument4 pagesCBLO, Repo and Fixed Deposit Trades Are Not ConsideredReedos LucknowNo ratings yet

- Alert: Developments in Preparation, Compilation, and Review Engagements, 2017/18From EverandAlert: Developments in Preparation, Compilation, and Review Engagements, 2017/18No ratings yet

- Format of AccrualsDocument1 pageFormat of AccrualsVyakt MehtaNo ratings yet

- Sources of Finance and Its CostsDocument34 pagesSources of Finance and Its CostsVyakt MehtaNo ratings yet

- Project On MergerDocument34 pagesProject On MergerVyakt MehtaNo ratings yet

- Ig MCQ MSDocument51 pagesIg MCQ MSVyakt MehtaNo ratings yet

- AS Level IndexDocument1 pageAS Level IndexVyakt MehtaNo ratings yet

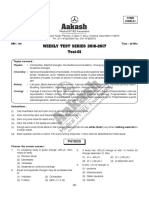

- Weekly Test Series 2016-2017 Test-01: Regd. Office: Aakash Tower, Plot No.-4, Sec-11, MLU, Dwarka, New Delhi-110075Document5 pagesWeekly Test Series 2016-2017 Test-01: Regd. Office: Aakash Tower, Plot No.-4, Sec-11, MLU, Dwarka, New Delhi-110075Vyakt MehtaNo ratings yet

- Chapter 4: Insurance Companies: Insurance: The Agreement Between Two Parties Where One Party Agrees To Take TheDocument25 pagesChapter 4: Insurance Companies: Insurance: The Agreement Between Two Parties Where One Party Agrees To Take TheJahangir AlamNo ratings yet

- Bees WaxDocument17 pagesBees WaxsamsonNo ratings yet

- MS 3605 Variable and Absorption CostingDocument5 pagesMS 3605 Variable and Absorption Costingrichshielanghag627No ratings yet

- Chapter 3 - Evaluating A Firm's Financial Performance: 2005, Pearson Prentice HallDocument48 pagesChapter 3 - Evaluating A Firm's Financial Performance: 2005, Pearson Prentice HallAura MaghfiraNo ratings yet

- Description PT Casio (Induk) PT Kenko (Anak)Document4 pagesDescription PT Casio (Induk) PT Kenko (Anak)OLIVIA CHRISTINANo ratings yet

- Based On Most Essential Learning Competencies (MELC) : Republic of The PhilippinesDocument2 pagesBased On Most Essential Learning Competencies (MELC) : Republic of The PhilippinesLeafar Etraton Serodar II100% (1)

- Nazara Technologies LimitedDocument35 pagesNazara Technologies LimitedMadhan RajNo ratings yet

- Viva Questions W AnswersDocument12 pagesViva Questions W Answersshaleen bansalNo ratings yet

- Differences Between Chapters 7, 11, 12, & 13Document3 pagesDifferences Between Chapters 7, 11, 12, & 13prubiouk100% (1)

- Duties of An AuditorDocument3 pagesDuties of An AuditorAtul GuptaNo ratings yet

- R12 Financials New FeaturesDocument19 pagesR12 Financials New FeaturesjobyjosephinNo ratings yet

- Exposing Mammon: Devotion To Money in A Market Society (Philip Goodchild)Document11 pagesExposing Mammon: Devotion To Money in A Market Society (Philip Goodchild)mrwonkishNo ratings yet

- SMGR Ugrade - 4M17 Sales FinalDocument4 pagesSMGR Ugrade - 4M17 Sales FinalInna Rahmania d'RstNo ratings yet

- Research Paper On Corporate Debt RestructuringDocument5 pagesResearch Paper On Corporate Debt Restructuringefj02jba100% (1)

- Ch.7 Hire Purchase - Instalment SystemDocument14 pagesCh.7 Hire Purchase - Instalment SystemDeepthi R Tejur100% (1)

- Topic 5 Notes-EntrepreneurshipDocument12 pagesTopic 5 Notes-EntrepreneurshipCainan Ojwang100% (1)

- User Manual of Ai Scalper Ea V2.5 - V3: SettingsDocument17 pagesUser Manual of Ai Scalper Ea V2.5 - V3: SettingsuuuNo ratings yet

- 2008 Annual Report-From ILAEDocument113 pages2008 Annual Report-From ILAEarmythunder100% (2)

- How To Use?: View The Video From The Follwing Link To Learn This Mehod Http://Youtu - Be/V2M8Avu1Q9CDocument6 pagesHow To Use?: View The Video From The Follwing Link To Learn This Mehod Http://Youtu - Be/V2M8Avu1Q9CNadeem KhanNo ratings yet

- Analysis On Financial Health of HDFC Bank and Icici BankDocument11 pagesAnalysis On Financial Health of HDFC Bank and Icici Banksaket agarwalNo ratings yet

- Asynchronous 3Document35 pagesAsynchronous 3Mark Anthony CondaNo ratings yet

- Basic AccountingDocument16 pagesBasic AccountingronnelNo ratings yet

- Proof of Concept (POC) Compilation KitDocument39 pagesProof of Concept (POC) Compilation KitVarun MittalNo ratings yet

- ACCTG 25 Negotiable Instruments Law: Lyceum-Northwestern UniversityDocument4 pagesACCTG 25 Negotiable Instruments Law: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- THE AIR CORPORATIONS (Transfer of Undertakings & Repeal) ACT, 13 of 1994.Document6 pagesTHE AIR CORPORATIONS (Transfer of Undertakings & Repeal) ACT, 13 of 1994.Neha BhatiaNo ratings yet

- Chapter 14Document17 pagesChapter 14greenapl01No ratings yet

- Record-to-Report Risk Control MatrixDocument30 pagesRecord-to-Report Risk Control MatrixAswath SNo ratings yet