Professional Documents

Culture Documents

Ownership Structure Impacts on Malaysian Trading and Services Firms

Uploaded by

some_one372Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ownership Structure Impacts on Malaysian Trading and Services Firms

Uploaded by

some_one372Copyright:

Available Formats

European Journal of Business and Social Sciences, Vol. 3, No.2 , pp 32-43, May 2014. P.P.

32 - 43

URL: http://www.ejbss.com/recent.aspx

ISSN: 2235 -767X

OWNERSHIP STRUCTURE AND FIRM PERFORMANCE:

EVIDENCE FROM MALAYSIAN TRADING AND SERVICES SECTOR.

Zuriawati Zakaria Noorfaiz Purhanudin,

(Corresponding Author)

Department of Finance, Department of Finance,

Faculty of Business and Finance, Faculty of Business and Finance,

Universiti Tunku Abdul Rahman, Universiti Tunku Abdul Rahman,

31900, Kampar, Malaysia 31900, Kampar, Malaysia

E-mail: zuriawatiz@utar.edu.my E-mail: noorfaiz@utar.edu.my

Yamuna Rani Palanimally

Department of Accounting,

Faculty of Business and Finance,

Universiti Tunku Abdul Rahman,

31900, Kampar, Malaysia

E-mail: yamunarp@utar.edu.my

ABSTRACT

The objective of this study is to examine the impact of ownership

structure i.e. concentrated, managerial, government and foreign

on firm performance of the Malaysian listed Trading and

Services firms. This study was conducted for a period of six years

(2005 to 2010). The study revealed that when firm are

concentrated or managerial ownership, it can enhance the firm

performance, while inversely occurs in government ownership

firms. The Trading and Services firms are not affected by

ownership structure under pre crisis period. The significant

effect only can be seen in concentrated firm under during crisis

and post crisis periods and for foreign ownership firms in post

crisis period.

Keywords: Ownership structure, firm performance, crisis

period.

EUROPEAN JOURNAL OF BUSINESS AND SOCIAL SCIENCES 32

European Journal of Business and Social Sciences, Vol. 3, No.2 , pp 32-43, May 2014. P.P. 32 - 43

URL: http://www.ejbss.com/recent.aspx

ISSN: 2235 -767X

1.0 Introduction

Ownership structure is relatively varied across countries (Chen & Yu, 2012). Corporate ownership in

Malaysia is typically characterized as concentrated shareholding compared with the ownership structure in

Western countries (Claessens et al., 2002). In Malaysian companies, families hold around 44.7% of their

shares (Carney & Child, 2013). Examples of Malaysian companies with family ownership are Tan Chong

Motor Holdings Bhd., YTL Group, IOI Group, and some others. With a high level of concentration, there

will be a strong monitoring power over company managerial decisions. This is because the block holders

wish to safeguard their investments. In Indonesia, Korea, Malaysia, Singapore, Philippines, and Taiwan

(China), 15% to 80% of companies have managers who are family members as the controlling owners

(Claessens et al., 2000). When large shareholders act as managers, the possibility of conflict between

shareholders and managers would be reduced. This will help the managers make decisions that can benefit

and increase their firms’ value. Ownership concentration and firm performance has a significant

relationship. The equity owned by corporation, government, nominee and individual eventually influenced

overall firm performance (Mat Nor, Shariff and Ibrahim, 2010). According to Sulong and Mat Nor (2008),

large shareholders’ ownership provides the incentive for the controlling shareholders to use their influence

to maximize value, to exert control, and to protect their interests in the company.

Beside concentration of ownership and managerial ownership, government-controlled institutions also hold

significant shares in the Malaysian listed companies. However, instead of placing more emphasis on their

social objective, government-controlled companies in Malaysia appeared to be more closely politically

connected (Mohd Ghazali & Weetman, 2006). They do not need to attract potential investor and worry about

funding since they can easily obtain it from local banks at lower cost. In addition, Mohd Ghazali and

Weetman (2006) found that government ownership companies may be less open in disclosing information

pertaining to their performance to the public to protect the real or beneficial owners.

Since ownership in Malaysia varies with concentration, managerial, government, and foreign ownership,

result is expected to show different effect on firm performance. Yet, there are not many empirical studies on

ownership structure and firm performance in Malaysia Trading and Services Sectors. Thus, based on the

context of Malaysia, this research contributes to the growing literature on ownership structure and firm

performance.

1.1 Trading and Services Sector in Malaysia

In Malaysia, services sector is perceives as the engine of growth of the Malaysia’s economy. As in 2012, it

has recorded a significant performance where 54.6% of the country’s GDP is represented by services trade

which is valued of RM408.9 billion. The services sectors that generated the revenues for the economy are

distributive trade (26.1%), government services (14.7%), finance (13.1%), real estate and business services

(10.1%), information and communication (7.0%), transportation and storage (6.7%), utilities (4.6%),

accommodations and restaurants (4.5%), insurance (4.1%) and other services (9.1%) (Department of

Statistics Malaysia, 2013). Besides, Foreign Direct Investment (FDI) inflows in the services sector have also

risen, particularly in financial services, shared services and outsourcing, as well as communications.

EUROPEAN JOURNAL OF BUSINESS AND SOCIAL SCIENCES 33

European Journal of Business and Social Sciences, Vol. 3, No.2 , pp 32-43, May 2014. P.P. 32 - 43

URL: http://www.ejbss.com/recent.aspx

ISSN: 2235 -767X

In view of the past and continuous outstanding performance of the services environment, the government

has included the services sector as one of the main driving force under the 10th Malaysian Plan to sustain its

long term economic growth. It is expected to remain the primary source of growth, motivated mainly by the

expansion in finance and business services, wholesale and retail trade, accommodation and restaurants as

well as the transport and communications subsectors. In line with the aspiration to become a developed

nation by 2020, the services sector is expected to grow at 7.2% annually until 2015, raising its contribution

to GDP to 65% by the end of the Plan period (Tenth Malaysia Plan, 2011). This growth will depend largely

on improving the sector’s productivity and attracting of RM44.6 billion in new investment for the services

sector to reach the targeted GDP contribution. During the Plan period, the services sector will be liberalized

under the ASEAN Framework Agreement on Services (AFAS), World Trade Organization (WTO) and free

trade arrangements (FTAs). In keeping with the AFAS, further liberalization will be undertaken for all 128

subsectors, allowing at least 70% ASEAN equity ownership by 2015. In this regard, the Government will

expand on its commitments made to the WTO in 1995 to liberalize 65 services subsectors. Malaysia will

make further improvements to its offers including areas such as healthcare, professional services,

environment, transport, education and telecommunications, as well as tourism and information and

communications technology (ICT) services. Malaysia will also continue to negotiate free trade arrangements

in the services sector with its major trading partners (Tenth Malaysia Plan, 2011).

2.0 Literature Review

2.1 Concentrated Ownership

Hill and Snell (1988) found that, there is positive relationship between ownership structure and firm

performance, as measured by profitability. This resulted from firm strategic choice. Concentrated firms

encourage innovation as strategy linked to increasing the value of the firms. Meanwhile, they discourage

diversification strategy due to this strategy would tied manager and interest objective together. However,

Arosa et al. (2010) showed that concentrated in non-listed Spanish firms either family or non-family not

related to firm performance. But, the author do finds the relationship towards performance in family firms is

based on which generation manages the firms. The positive relationship can be seen in first generation at

low level of control right due to monitoring hypothesis and negatively related at high level of ownership as

result of expropriation hypothesis. When the subsequent generation has joined, the ownership disperses.

Family ownership creates value for all the firm’s shareholders only when the founder is still active in the

firm either as the CEO or as a Chairperson with a hired CEO (Villalonga & Amit, 2006). When family firms

are run by descendent-CEO, minority shareholders, those firms would be worse off than they would be in

nonfamily firms in which they would be exposed to the classic agency conflict with managers. There is

negative impact on company performance when the control is passed to the next generation of the family

(Cucculelli & Micucci, 2008; Arosa et al., 2010).

According to Alimehmeti and Paletta (2012), an Italian listed firm shows the positive relationship between

ownership concentration and firm value for the year 2006 to 2009 except 2008. In year 2008, the result

indicate a non-linear relationship exist prove to that the financial crisis has enhanced the expropriation

effects divergent the monitoring effects. Other researchers such as Barclay and Holderness (1989),

McConnell and Servaes (1990), and Omran (2009) also found positive relationship between ownership

concentration and firm performance.

EUROPEAN JOURNAL OF BUSINESS AND SOCIAL SCIENCES 34

European Journal of Business and Social Sciences, Vol. 3, No.2 , pp 32-43, May 2014. P.P. 32 - 43

URL: http://www.ejbss.com/recent.aspx

ISSN: 2235 -767X

H1 There is a positive relationship between ownership concentration and firm performance.

2.2 Managerial ownership

The good news with CEO or top management stock ownership is the potential to reduce agency conflict

(Jensen & Meckling, 1976) since it could reduce excessive consumption by the CEO or top management and

increase the firm’s value. However, the bad thing with CEO stock ownership is that with higher holding

stock, it lags them from internal and external company discipline; thus reducing firm value (Jensen &

Ruback, 1983). Since 1980, larger companies have used stock and stock options as a way to compensate top

management. Thus, with larger stock ownership, the CEOs are more likely to be entrenched to their position

(Hall & Liebman, 1998).

Managers with low level of ownership are unable to do this since a variety of market discipline measures

can be enforced upon them, so that they would work towards increasing shareholder wealth (Griffith, 1999).

Based on simultaneous equations, Loderer and Martin (1997) revealed that firm performance will not higher

with increases in managerial ownership. But, better performance firm can enlarge the managerial

shareholding. However, Belghitar, Clark and Kassimatis (2011) indicate that the effect of managerial

ownership on firm performance varies with the degree of ownership. At low and high level of ownership,

firm performance hinder, whereas performance is enhance at intermediate level. It’s due to managers’

personal costs during low ownership and managerial entrenchment at high level of ownership.

H2 There is a negative relationship between managerial ownership and firm performance.

2.3 Government ownership

State ownership and firms’ performance have a convex relationship (Wei and Varela, 2003; Wei et al., 2005;

Ng et al., 2009). Ng et al. (2009) stated that strong privatization and state control give benefits to Chinese

firm during 1996 to 2003. It because both concentrated firm and the balance of power jointly contributed to

firm performance. However, firm with mixed control experience poor performance due to ambiguity of

ownership control, property rights, agency issues, profits and welfare objectives. Moreover, the result also

shows inverse relationship between SOEs firm size and performance. The larger the size of SOEs firm, the

poorer the firm would perform. It happen since it involved more government bureaucracy, high agency

costs, and difficult to manage if any changes in economic and political environment.

Other than that, Leuz and Oberholzer-Gee (2006) reported Indonesian companies enjoy low cost of capital

provided by state-owned local bank since they are politically connected to the former President Suharto. In

Malaysia, Najid and Abdul Rahman, (2011) reported that with government involvement, the GLC

(government linked companies) shows a positive relationship to firm performance. Investors do believe that

companies backed by the government can face any difficulties and put effort to enhance the company as

basis of equality and stability of the economy. It supports the previous finding by Eng and Mak, (2003).

Firm with government involvement have benefit it term obtaining information and easier to get financing

from different channels than non-state firms.

EUROPEAN JOURNAL OF BUSINESS AND SOCIAL SCIENCES 35

European Journal of Business and Social Sciences, Vol. 3, No.2 , pp 32-43, May 2014. P.P. 32 - 43

URL: http://www.ejbss.com/recent.aspx

ISSN: 2235 -767X

H3 There is a positive relationship between government ownership and firm performance.

2.4 Foreign ownership

By using return on assets (ROA) and Tobin’s Q to measure firm performance, Douma et al. (2006) reported

that foreign firms in India perform better than domestic firms. Foreign ownership firms are positively and

significant to influence firm performance. The result contradicted with previous study by Barbosa and Louri

(2005). The authors find that after controlling for firm industry specific effect, the performance of Portugal

firms is not affected by foreign ownership. The result based on 523 firms in Portugal in year 1992.

However, positive relationship between foreign ownership and firm performance reported in Greece as

measured by upper quantiles of gross return on assets based 2561 firms in year 1997. Firms in Russia with

foreign ownership have higher productivity than domestic firms (Yudaeva et al., 2003). Similarly,

Srithanpong (2012) indicated that foreign ownership positively effect on performance of Thai construction

industry. Foreign firms are more productive, high construction capability and pay higher average wages than

domestic firms. Additionally, it also may provide financial support, transfer of technology, and experience

(Huang & Shiu 2009; Gurbuz & Aybars 2010; Romalis 2011).

H4 There is a positive relationship between foreign ownership and firm performance.

3.0 Methodology

This study used the annual report of Bursa Malaysia Public Listed firms for the period of 2005 to 2010 to

obtained data for ownership. This period of study was chosen to see the effect of ownership structure during

subprime crisis which occurred in 2007 and 2008. Therefore, this study will be more significant since it

would capture three stages of economic condition: before crisis (2005-2006), during crisis (2007-2008), and

after crisis (2009-2010). Erkens et al. (2012) examined the influence of corporate governance on firms’

performance during the 2007-2008 financial crisis. They suggested that firms with high institutional

ownership faced high risk prior to crisis resulting in more losses incurred during crisis.

Other than that, data for return on assets and control variables collected from Datastrem. This study mainly

focuses on listed Trading and Services Firms. Firm which do not have complete data during the period of

study will be excluded from the sample. Hence, a balance panel data of 73 firms examined from the total of

177 firms.

The empirical model used in this study can be described as follows:

ROAi β 0 β1CO β 2 MO β 3GO β 4 MO β 4 MTBV β 5 LEV β 6 FZ ε it

Where; β0 = constant term; ROA = Return on Assets for firm I; CO = Concentrated Ownership; MO =

Managerial Ownership; GO = Government Ownership; FO = Foreign Ownership; MTBV = Market-to-Book

Equity Ratio; LEV = Leverage; and FZ = Firm Size.

EUROPEAN JOURNAL OF BUSINESS AND SOCIAL SCIENCES 36

European Journal of Business and Social Sciences, Vol. 3, No.2 , pp 32-43, May 2014. P.P. 32 - 43

URL: http://www.ejbss.com/recent.aspx

ISSN: 2235 -767X

Return on Assets (ROA) is used as a proxy for firm performance. It regresses against the ownership

structure (concentrated, managerial, government and foreign) and other control variables (investment

opportunities, leverage and firm size). ROA has been used by many studies to measure for firm performance

including Demsetz and Villalonga (2001), Douma et al. (2006) and Phung and Hoang (2013).

To examine the effect of concentrated ownership, this study employed Herfindahl index. It based on total

shares owned by the largest five shareholders (Cespedes et al., 2010 and Fazlzadeh et al., 2011).

Government ownership is defined as when company shares are held by federal/states institutions, agencies,

and government-linked companies (GLCs) through the 30 top shareholders in the list (Mat Nor and Sulong,

2007). Similarly, for foreign ownership measured by the sum of all shares in the hand of foreign

shareholders who are in the list of 30 largest held though either nominee companies or other corporate

foreign share holdings. Managerial ownership is measured as the percentage of shares held by executive

directors to total number of shares issued. This method is similar to Abdullah (2006).

As for control variables, market-to-book value of equity ratio is a measure of investment opportunities

(Adjaoud and Ben-Amar, 2010). Leverage is measured based on debt to equity ratio as suggested by

previous researches such as Lev and Kunitzky (1974) and Gaver, and Gaver, (1993). Firm size is one of the

control variables measured by using log of total assets (Chae et al., 2009).

4.0 Findings

4.1 Descriptive Statistics

Table 4.1 presents the descriptive statistics for variables used in the study for the period of 2005 to 2010.

The average (median) of ROA (proxy for firm performance) in Malaysia listed Trading and Services firms

was 5.00% (4.51%) and the maximum was 37.38%. Ownership concentration based on Herfindahl index,

HI5, showed that concentration ranges from 3.81% to 97.92%. The mean percentage of the five largest

shareholders was 51.74% implying that more than 50% of the share ownership was held by top five

Malaysian companies’ shareholders. The average (median) of managerial ownership in Malaysia listed

companies was 4.81% (0.11%) and the maximum was 62%. Besides, the average government ownership

was 6.89% and the highest being 79.18%. On other hand, the result showed that the average (median)

15.58% (7.03%) of Malaysia Trading and Services firms’ shares were held by foreigners with the maximum

of 77.45%. In terms of firm size, average (median) was 8.97 (8.81) and ranged from 6.18 to 12.46.

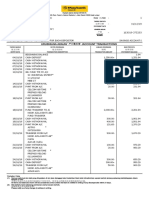

Table 4.1: Descriptive Statistics

Standard

Variables Mean Median Maximum Minimum Deviation

ROA (%) 5.00 4.51 37.38 -14.13 6.49

CO (%) 51.74 48.15 97.92 3.81 18.57

MO (%) 4.81 0.11 62.00 0.00 10.83

GO (%) 6.89 0.64 79.18 0.00 12.58

FO (%) 15.58 7.03 77.45 0.00 19.17

MTBV 1.08 0.95 13.36 -49.09 4.14

LEV (%) 57.14 40.39 336.11 0.00 62.49

FZ (%) 8.97 8.81 12.46 6.18 0.75

Notes. ROA = return on assets ; Ownership structure: HI5 = Concentrated based on Herfindahl Index; MO = Managerial

Ownership; GO = Government Ownership; and FO = Foreign Ownership; control variables consists of MTBV = Market to book

value; LEV = Leverage; FZ = Firm Size.

EUROPEAN JOURNAL OF BUSINESS AND SOCIAL SCIENCES 37

European Journal of Business and Social Sciences, Vol. 3, No.2 , pp 32-43, May 2014. P.P. 32 - 43

URL: http://www.ejbss.com/recent.aspx

ISSN: 2235 -767X

4.2 Empirical Result.

Table 4.2: The relationship between ownership structure and

firm performance (ROA).

Variables Coeff S.E

Constant 69.29*** (15.02)

CO 0.10** (0.05)

MO 0.91*** (0.15)

GO -0.14* (0.07)

FO 0.09 (0.08)

MTBV -0.25* (0.14)

LEV -0.01 (0.01)

SZ -8.23*** (1.63)

R-squared 0.47

Adjusted R-squared 0.36

F-statistic 4.05***

Durbin-Watson 2.32

***, **, * indicate significance at the 1%, 5 % and 10% levels

Table 4.2 present the regression result based n panel fixed effect model. There are five variables

significantly influence Trading and Services firm performance. This study found that there is a positive

relationship between ownership concentration and firm performance at 5% significant level. Thus, the

hypothesis (H1) was accepted. The result is consistent with earlier study by Barclay and Holderness (1989),

McConnell and Servaes (1990), Omran (2009) Alimehmeti and Paletta (2012). The controlling shareholders

often act as the manager too. Since they know the nature of the company business very well, most of the

time their main focus is on investment and on increasing the firms’ performance instead of increasing

dividends to shareholders (Ali et al., 2007).

Contrary to expectation, the result in Table 4.2 also showed that managerial ownership positively and

significant at 1% influence the firm performance. This indicates that increase manager holding share in

Trading and Services firms able to influence firms enhance the performance. The hypothesis (H2) that there

is negative relationship between managerial ownership and firm performance was rejected. As for

government ownership, it shows a negative relationship toward firm performance at 10% significant level,

hence H3 was rejected. When firm has mixed control between corporate and government, it would lead to

poor firm performance due to ambiguity of ownership control, property rights, agency issues, profits and

welfare objectives (Ng et al., 2009). The positive and insignificant result shows for foreign ownership,

therefore H4 was rejected. The performance of Trading and Services firms in Malaysia is not affected by

foreign shareholding consistent with previous research by Barbosa and Louri (2005). Looking on control

variable, firm investment opportunities and size of the firm negatively influence firm performance at 10%

and 1% significant level, respectively. There is a tendency that the firm overinvestment in negative NPV

projects and the agency problem is higher in large firm.

EUROPEAN JOURNAL OF BUSINESS AND SOCIAL SCIENCES 38

European Journal of Business and Social Sciences, Vol. 3, No.2 , pp 32-43, May 2014. P.P. 32 - 43

URL: http://www.ejbss.com/recent.aspx

ISSN: 2235 -767X

Table 4.3: The affect of ownership structure and firm performance (ROA) under three stage

crisis periods.

Variables Pre crisis During Crisis Post Crisis

Constant 13.6 9.95 39.88***

(8.87) (7.74) (14.83)

CO 0.00 0.07** 0.18***

(0.04) (0.03) (0.06)

MO -0.10 -0.04 0.03

(0.06) (0.05) (0.13)

GO 0.00 0.03 0.17

(0.04) (0.05) (0.12)

FO 0.02 0.03 0.13**

(0.04) (0.03) (0.06)

MTBV 1.18*** -0.38*** -0.53**

(0.34) (0.12) (0.22)

LEV -0.02** -0.03*** 0.00

(0.01) (0.01) (0.02)

SZ -1.05 -0.66 -5.27***

(0.97) (0.85) (1.65)

R-squared 0.16 0.2 0.13

Adjusted R-squared 0.11 0.16 0.08

F-statistic 3.23*** 5.04*** 0.13***

Durbin-Watson 2.04 2.09 2.38

***, **, * indicate significance at the 1%, 5 % and 10% levels

Table 4.3 present the result during the three stage crisis periods based on panel random effect model. The

results showed that ownership structure (concentrated, managerial, government and foreign) does not

influence firm performance before the crisis in year 2005 to 2006. However, during the crisis period 2007 to

2008, only concentrated ownership reported positive and significant at 5% in influencing Trading and

Services firms’ performance. Continuously, after the crisis (2009-2010), it strongly affected the firm

performance at 1% significant level. It showed that the firm with high ownership concentration would focus

more to secure and maintain the company performance facing the crisis and unstable economic condition

rather than focussing on the shareholder’s interest.

Foreign ownership also positively influences the firm performance for the post crisis period. Firm with high

foreign ownership could help solving issue due to crisis especially in term of financial support, transfer of

technology, and experience (Huang & Shiu 2009; Gurbuz & Aybars 2010; Romalis 2011). As for control

variables, firm investments opportunities help improve the firm performance under the pre crisis period. The

result contradicted under the crisis and post crisis period. The higher the firm facing leverage, the poorer the

performance showed under the pre crisis and during crisis periods. Likewise, the size of the firm influences

the performance for the post crisis period at 1% significant level.

EUROPEAN JOURNAL OF BUSINESS AND SOCIAL SCIENCES 39

European Journal of Business and Social Sciences, Vol. 3, No.2 , pp 32-43, May 2014. P.P. 32 - 43

URL: http://www.ejbss.com/recent.aspx

ISSN: 2235 -767X

5.0 Conclusion

Based on 73 listed Trading and Services firms in Malaysia, this study examined the relationship between

ownership structure (concentrated, managerial, government and foreign) and firm performance. The period

of study was conducted from year 2005 to 2010. During the period of study, the subprime crisis happened

around 2007 and 2008. Hence, this research further capture the impact of ownership structure on firm

performance under three different stage namely pre crisis, during crisis and post crisis. The empirical result

showed that concentrated firm positively influences firm performance. However, the influence is not

significant for pre crisis period. The higher the managerial ownership, firm reported high performance.

Whereas, poor firm performance can be see with increases of government ownership. Foreign ownership

firm only gain benefit after the crisis period. The higher the firm foreign ownership, the better it performs

during the post crisis period.

EUROPEAN JOURNAL OF BUSINESS AND SOCIAL SCIENCES 40

European Journal of Business and Social Sciences, Vol. 3, No.2 , pp 32-43, May 2014. P.P. 32 - 43

URL: http://www.ejbss.com/recent.aspx

ISSN: 2235 -767X

References

1. Abdullah, S. N. (2006). Board structure and ownership in Malaysia: The case of distressed listed

companies. Corporate Governance, 6(5), 582-594.

2. Adjaoud, F., & Ben-Amar, W. (2010). Corporate governance and dividend policy: Shareholders’

protection or expropriation? Journal of Business Finance & Accounting, 35(5), 648-667.

3. Ali, A., Chen, T., and Radhakrishnan, S. (2007). Corporate disclosures by family firms. Journal of

Accounting and Economics, 44, 238–286.

4. Alimehmeti, G. & Paletta, A. (2012). Ownership concentration and effects over firm performance:

Evidence from Italy. European Scientific Journal October edition vol. 8, (22).

5. Arosa, B., Iturralde, T., & Maseda, A. (2010). Ownership structure and firm performance in non-

listed firms: Evidence from Spain. Journal of Family Business Strategy, 1, 88–96.

6. Barbosa, N. & Louri, H. (2005). Corporate performance: Does ownership matter? A Comparison of

foreign-and-domestic-owned firms in Greece and Portugal. Review of Industrial Organization, 27,

73-102.

7. Belghitar, Y, Clark, E. & Kassimatis, K. (2011). Managerial ownership and firm performance: A re-

examination using marginal conditional stochastic dominance. European Financial Management

Association.

8. Barclay, M., & Holderness, C. (1989). Private benefits from control of public corporation. Journal of

Financial Economics, 25(2), 371–395.

9. Carney, R. W. & Child, T. B. (2013). Changes to the Ownership and Control of East Asian

Corporations between 1996 and 2008: The primacy of Politics. Journal of Financial Economics, 107,

494–513.

10. Céspedes, J., González, M., & Molina, C. A. (2010). Ownership and capital structure in Latin

America. Journal of Business Research, 63(3), 248-254.

11. Chae, J., Kim, S., & Lee, E. J. (2009). How corporate governance affects payout policy under agency

problems and external financing constraints. Journal of Banking & Finance, 33, 2093–2101.

12. Chen, C. J., & Yu, C. M. J. (2012). Managerial ownership, diversification, and firm performance:

Evidence from an emerging market. International Business Review, 21(3), 518-534.

13. Claessens, S., Djankov, S., & Lang, L. H. P. (2000). The separation of ownership and control in East

Asian corporations. Journal of Financial Economics, 58, 81–112.

14. Claessens, S., Djankov, S., Fan, J.P. H., & Lang, L. H. P. (2002). Disentangling the incentive and

entrenchment effects of large shareholdings. The Journal of Finance, 57(6), 2741-2772.

15. Cucculelli, M., & Micucci, G. (2008). Family succession and firm performance: Evidence from

Italian family firms. Journal of Corporate Finance, 14(1), 17-31.

16. Demsetz, H. & Villalonga, B. (2001). Ownership Structure and Corporate Performance. Journal of

Corporate Finance, 7, 209−233

17. Douma, S, George, R & Kabir, R (2006). Foreign and Domestic Ownership, Business Groups, and

Firm Performance: Evidence from a Large Emerging Market. Strategic Management Journal, 27(7),

637-57.

18. Eng, L.L and Mak, Y.T. (2003). Corporate Governance and Voluntary Disclosure. Journal of

Accounting and Public Policy 22, 325–345.

19. Erkens, D. H., Hung, M., & Matos, P. (2012). Corporate governance in the 2007-2008 financial

crisis: Evidence from financial institutions worldwide. SSRN working paper.

20. Fazlzadeh, A., Hendi, A. T., & Mahboubi, K. (2011). The examination of the effect of ownership

structure on firm performance in listed firms of Tehran Stock Exchange based on the type of the

industry. International Journal of Business and Management, 6(3), 249-266.

EUROPEAN JOURNAL OF BUSINESS AND SOCIAL SCIENCES 41

European Journal of Business and Social Sciences, Vol. 3, No.2 , pp 32-43, May 2014. P.P. 32 - 43

URL: http://www.ejbss.com/recent.aspx

ISSN: 2235 -767X

21. Gaver, J. J., & Gaver, K. M. (1993).Additional evidence on the association between the investment

opportunity set and corporate financing, dividend, and compensation policies. Journal of Accounting

and Economics, 16(1-3), 125-160.

22. Griffith, J. M. (1999). CEO ownership and firm value. Managerial and Decision Economics, 20(1),

1-8.

23. Gurbuz, A. O. & Aybars, A. (2010). The Impact of Foreign Ownership on Firm Performance,

Evidence from an Emerging Market: Turkey. American Journal of Economics & Business

Administration, 2(4).350-9.

24. Hall, B., & Liebman, J. (1998). Are CEOs really paid like bureaucrats? Quarterly Journal of

Economics, 113, 653–691.

25. Hill, C. W., & Snell, S. A. (1988). External control, corporate strategy, and firm performance in

research-intensive industries. Strategic Management Journal, 9(6), 577-590.

26. Huang, R.D & Shiu, C-Y (2009). Local effects of foreign ownership in an emerging financial

market: evidence from qualified foreign institutional investors in Taiwan. Financial Management,

38(3).567.

27. Jensen, M., & Ruback, R. (1983). The market for corporate control: The scientific evidence. Journal

of Financial Economics, 11, 5–50.

28. Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behaviour, Agency cost and

ownership structure. Journal of Financial Economics, 3, 305-360.

29. Loderer, C. and Martin, K. (1997). Executive Stock Ownership and Performance: Tracking Faint

Traces. Journal of Financial Economics 45, 223−255.

30. Lev, B., & Kunitzky, S. (1974). On the association between smoothing measures and the risk of

common. The Accounting Review, 49(2), 259-270.

31. Leuz, C., & Oberholzer-Gee, F. (2006). Political relationships, global financing, and corporate

transparency: Evidence from Indonesia. Journal of Financial Economics, 81(2), 411-439.

32. Mat Nor, F., & Sulong, Z. (2007). The interaction effect of ownership structure and board

governance on dividends: Evidence from Malaysian listed firms listed firms. Capital Market Review,

15(1/2), 73-101.

33. Mat Nor, F. M., Shariff, F. M., & Ibrahim, I. (2010). The effect of concentrated ownership on the

performance of the firm: do external shareholding and board structure matter? Journal of

Management, 30, 93-102.

34. McConnell, J., & Servaes, H. (1990). Additional evidence on equity ownership and corporate value.

Journal of Financial Economics, 27(2), 595–612.

35. Mohd Ghazali, N. A., & Weetman, P. (2006). Perpetuating traditional influences: Voluntary

disclosure in Malaysia following the economic crisis. Journal of International Accounting, Auditing

and Taxation, 15, 226-248.

36. Najid, N. A & Abdul Rahman, R. (2011)). Government Ownership and Performance of Malaysian.

Government-Linked Companies. International Research Journal of Finance and Economics.

37. Ng, A., Yuce, A. & Chen, E. (2009). Determinants of state equity ownership, and its effect on

value/performance: China’s privatized firms. Pacific-Basin Finance Journal, 17 (4), 413–443.

38. Omran, M. (2009). Post-privatization corporate governance and firm performance: the role of private

ownership concentration, identity and board composition. Journal of Comparative Economics 37 (4),

658-673.

39. Phung, D. N & Le, T. P. V (2013). Foreign Ownership, Capital Structure and Firm Performance:

Empirical Evidence from Vietnamese Listed Firms. The IUP Journal of Corporate Governance,

12(2), 40.

EUROPEAN JOURNAL OF BUSINESS AND SOCIAL SCIENCES 42

European Journal of Business and Social Sciences, Vol. 3, No.2 , pp 32-43, May 2014. P.P. 32 - 43

URL: http://www.ejbss.com/recent.aspx

ISSN: 2235 -767X

40. Romalis, J. (2011). The value of foreign ownership. Economic and Business Review for Central and

South - Eastern Europe, 13(1/2), 107-18.

41. Srithanpong, T. (2013). Foreign Ownership and Firm Performance in the Thai Construction Industry.

International Proceedings of Economics Development & Research, 55, 72.

42. Sulong, Z., & Mat Nor, F. (2008). Dividend, ownership structure and board governance on firm

value: Empirical evidence from Malaysia listed firms. Malaysia Accounting Review, 7(2).

43. Tenth Malaysia Plan (2011-2015). Available from:

http://www.pmo.gov.my/dokumenattached/RMK/RMK10_Eds.pdf.

44. Villalongaa, B. & Amit, R. (2006). How do family ownership, control and management affect firm

value? Journal of Financial Economics, 80, 385–417.

45. Wei, Z. B. & Varela, O. (2003). State equity ownership and firm market performance: evidence from

China’s newly privatized firms. Global Finance Journal, 14(1), 65–82.

46. Wei, Z. B ., Xie, F. X. & Zhang, S. R. (2005). Ownership structure and firm value in China’s

privatized firms: 1991–2001. Journal of Financial and Quantitative Analysis, 40(1), 87–108.

47. Yudaeva, K., Kozlov, K., Melentieva, N. & Ponomareva, N. (2003). Does foreign ownership

matter? Economics of Transition, 11(3), 383-409.

EUROPEAN JOURNAL OF BUSINESS AND SOCIAL SCIENCES 43

You might also like

- Positioning Malaysia in the International Arena: Perdana Discourse Series 5From EverandPositioning Malaysia in the International Arena: Perdana Discourse Series 5No ratings yet

- HR Management Guide for Zeon ComputerDocument14 pagesHR Management Guide for Zeon ComputerShar KhanNo ratings yet

- Assignment/ TugasanDocument4 pagesAssignment/ Tugasanapplelind weeNo ratings yet

- BBSH4103 Hazard ManagementDocument9 pagesBBSH4103 Hazard ManagementSweethy Chong Yee MayNo ratings yet

- UmwDocument4 pagesUmwFarrel JaarNo ratings yet

- Bbim 4103Document16 pagesBbim 4103Sharifah Md IbrahimNo ratings yet

- OUMM3203Document11 pagesOUMM3203Zaari MohamadNo ratings yet

- Bachelor of Human Resource Management: Matriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentreDocument17 pagesBachelor of Human Resource Management: Matriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentreThenmalar SubramaniamNo ratings yet

- Financial MGMTDocument13 pagesFinancial MGMTBen AzarelNo ratings yet

- An Investigation Into The Challenges Facing The Planning of ManpowerDocument11 pagesAn Investigation Into The Challenges Facing The Planning of ManpowerresearchparksNo ratings yet

- FIDMDocument23 pagesFIDMAiyoo JessyNo ratings yet

- BBPB 2103Document24 pagesBBPB 2103Shack JennyNo ratings yet

- Assigment HUMAN RESOURCE DEVELOPMENT BBDH4103Document10 pagesAssigment HUMAN RESOURCE DEVELOPMENT BBDH4103Loyai BaimNo ratings yet

- Ownership Structure and Company Performance - Research and Literature ReviewDocument5 pagesOwnership Structure and Company Performance - Research and Literature ReviewGwendolyn PansoyNo ratings yet

- BBPS4103 Assignment Jan2008Document9 pagesBBPS4103 Assignment Jan2008pprpd_bdetgraNo ratings yet

- Assignment/ Tugasan - Industrial RelationsDocument5 pagesAssignment/ Tugasan - Industrial RelationsFauziah MustafaNo ratings yet

- Final Drafting Proposal (Woman Online Shopping Behaviour)Document24 pagesFinal Drafting Proposal (Woman Online Shopping Behaviour)Jiana NasirNo ratings yet

- BBSB4103 - Liew Leong YeeDocument13 pagesBBSB4103 - Liew Leong YeeRyan JeeNo ratings yet

- 2019-A Review Study of The Human Resource Management Practices On Job Satisfaction of Hotel Industry Employees of MalaysiaDocument10 pages2019-A Review Study of The Human Resource Management Practices On Job Satisfaction of Hotel Industry Employees of MalaysiaArif ArhieNo ratings yet

- 2.strategic Management 1Document15 pages2.strategic Management 1stepmal0% (1)

- Determining Employer-Employee RelationshipsDocument12 pagesDetermining Employer-Employee RelationshipsRyan JeeNo ratings yet

- Faculty of Science & Technology: Matriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentreDocument13 pagesFaculty of Science & Technology: Matriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentreMuhamad Muzakkir0% (1)

- Strategic Management Assignment: Name: Mani SelvanDocument22 pagesStrategic Management Assignment: Name: Mani SelvanMani SelvanNo ratings yet

- BBMC4103 Pengurusan PerubahanDocument6 pagesBBMC4103 Pengurusan PerubahanzabedahibrahimNo ratings yet

- Assignment 1 FinalDocument17 pagesAssignment 1 FinalGary AngNo ratings yet

- 42886Document5 pages42886afif1207No ratings yet

- ABCR2103Document8 pagesABCR2103michaelsim2020No ratings yet

- Financial Structure Analysis of Two Malaysian Public Listed CompaniesDocument8 pagesFinancial Structure Analysis of Two Malaysian Public Listed CompanieskaybeezuhdiNo ratings yet

- BBEK4203 Government Budget SurplusDocument4 pagesBBEK4203 Government Budget SurplusMarlissa Nur OthmanNo ratings yet

- BBPB2103 AssignmentDocument2 pagesBBPB2103 AssignmentPhewit TymeNo ratings yet

- MARKETING MANAGEMENT 1 Assignment OUMDocument13 pagesMARKETING MANAGEMENT 1 Assignment OUMYogeswari SubramaniamNo ratings yet

- QuestionDocument4 pagesQuestionHaziq ZulkeflyNo ratings yet

- AirAsia ZitaDocument15 pagesAirAsia ZitaLavarn PillaiNo ratings yet

- Logistics Management of Milk Powder PackingDocument15 pagesLogistics Management of Milk Powder PackingCatherine Ooi100% (1)

- Assignment Submission and AssessmentDocument6 pagesAssignment Submission and AssessmentfmdeenNo ratings yet

- Assigment FINANCIAL MANAGEMENT IIDocument14 pagesAssigment FINANCIAL MANAGEMENT IILoyai BaimNo ratings yet

- BBUI3103Document8 pagesBBUI3103sthiyaguNo ratings yet

- HRM656 (PAIR WORK - 5A) Managing Diversity 2Document2 pagesHRM656 (PAIR WORK - 5A) Managing Diversity 2Siti UmairahNo ratings yet

- BHRM Honours Degree in Human Resource ManagementDocument11 pagesBHRM Honours Degree in Human Resource Managementsthiyagu0% (1)

- Faculty of Information Technology & Multimedia CommunicationDocument12 pagesFaculty of Information Technology & Multimedia CommunicationDiLip SinghNo ratings yet

- Oumm3203 Professional EthicsDocument10 pagesOumm3203 Professional EthicsSimon RajNo ratings yet

- Bbng3103 International BusinessDocument13 pagesBbng3103 International Businessdicky chongNo ratings yet

- Tugasan BBPS4103 Mei 2013Document17 pagesTugasan BBPS4103 Mei 2013azri100% (1)

- Matriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentreDocument13 pagesMatriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentrekerttanaNo ratings yet

- Industrial Relations AssignmentsDocument10 pagesIndustrial Relations AssignmentsDevi KannanNo ratings yet

- HRM Roles and Challenges at CadburyDocument22 pagesHRM Roles and Challenges at CadburyJamuna RaniNo ratings yet

- Fakulti Sains Sukan Dan Rekreasi: Group AssignmentDocument11 pagesFakulti Sains Sukan Dan Rekreasi: Group Assignmentsaidatul aliahNo ratings yet

- CKS Supermarket Cost Leadership Strategy AnalysisDocument17 pagesCKS Supermarket Cost Leadership Strategy AnalysisstepmalNo ratings yet

- BBHI4103 Industrial Relation AssignmentsDocument8 pagesBBHI4103 Industrial Relation AssignmentsLing Ching Yap0% (2)

- Civil Engineering Entrepreneur Profile: Maznah HamidDocument6 pagesCivil Engineering Entrepreneur Profile: Maznah HamidMohd Amirul NajmieNo ratings yet

- Education and Social Sciences Bachelor of Teaching (Primary Education) With HonoursDocument13 pagesEducation and Social Sciences Bachelor of Teaching (Primary Education) With Honoursvickycool7686No ratings yet

- FIN420 Individual Assignment 20214Document3 pagesFIN420 Individual Assignment 20214Admin & Accounts AssistantNo ratings yet

- Final Drafting Proposal On CorruptionDocument24 pagesFinal Drafting Proposal On CorruptionJiana NasirNo ratings yet

- Islamic Ethical Business Practices Among Muslim Entrepreneurs: A Case Study in Syarikat FAIZA Sdn. Bhd. (SFSB)Document7 pagesIslamic Ethical Business Practices Among Muslim Entrepreneurs: A Case Study in Syarikat FAIZA Sdn. Bhd. (SFSB)inventionjournalsNo ratings yet

- OUMH1203Document4 pagesOUMH1203Izwani SalfinasNo ratings yet

- Report Sime DarbyDocument6 pagesReport Sime DarbyNor Azura0% (1)

- Carrer Planning AssignmentDocument7 pagesCarrer Planning AssignmentDevi KannanNo ratings yet

- Aia Bhd. Malaysia: Institute of Mathematical Sciences Faculty of Science University of MalayaDocument31 pagesAia Bhd. Malaysia: Institute of Mathematical Sciences Faculty of Science University of MalayaTAKUNDANo ratings yet

- Malindo Air's Communication and Group DynamicsDocument3 pagesMalindo Air's Communication and Group Dynamicsnurul hashimaNo ratings yet

- Fakulti Bisnes & Pengurusan Semester Januari / 2019: CBCT2203Document14 pagesFakulti Bisnes & Pengurusan Semester Januari / 2019: CBCT2203hantu malamNo ratings yet

- Corporate Ownership Structure and Firm PerformanceDocument11 pagesCorporate Ownership Structure and Firm Performancesome_one372No ratings yet

- Faisal Spinning Mills Annual Report Highlights Record ProfitsDocument57 pagesFaisal Spinning Mills Annual Report Highlights Record Profitssome_one372No ratings yet

- FASM - 2014 (Faisal Sinning Mill 2014Document60 pagesFASM - 2014 (Faisal Sinning Mill 2014some_one372No ratings yet

- Faisal Spinning Mills 2013 Annual Report and AGM NoticeDocument57 pagesFaisal Spinning Mills 2013 Annual Report and AGM Noticesome_one372No ratings yet

- List of IndustriesDocument12 pagesList of Industriessome_one372No ratings yet

- 1 PB PDFDocument8 pages1 PB PDFsome_one372No ratings yet

- Model Five Page PDFDocument36 pagesModel Five Page PDFsome_one372No ratings yet

- The Impact of Ownership Structure and Capital Structure On Financial Performance of Vietnamese FirmsDocument8 pagesThe Impact of Ownership Structure and Capital Structure On Financial Performance of Vietnamese Firmssome_one372No ratings yet

- Developing Financial Products AssignmentDocument1 pageDeveloping Financial Products Assignmentsome_one372No ratings yet

- Sustainability 09 00867 PDFDocument15 pagesSustainability 09 00867 PDFsome_one372No ratings yet

- Relationship between Capital Structure and Ownership in Sri LankaDocument19 pagesRelationship between Capital Structure and Ownership in Sri Lankasome_one372No ratings yet

- Questions Literature ObjectiveDocument10 pagesQuestions Literature Objectivesome_one372No ratings yet

- Reduction of Interest Rate ImpactDocument7 pagesReduction of Interest Rate Impactsome_one372No ratings yet

- Effect of Corporate Governance Structure On The Financial Performance of Johannesburg Stock Exchange (JSE) - Listed Mining FirmsDocument15 pagesEffect of Corporate Governance Structure On The Financial Performance of Johannesburg Stock Exchange (JSE) - Listed Mining Firmssome_one372No ratings yet

- Reduction of Interest Rate ImpactDocument7 pagesReduction of Interest Rate Impactsome_one372No ratings yet

- Notes of Internal Audit Part 15Document2 pagesNotes of Internal Audit Part 15some_one372No ratings yet

- Notes of Internal Audit Part 8Document2 pagesNotes of Internal Audit Part 8some_one372No ratings yet

- Macro Environment of Indian Life Insurance Business: A PESTLE AnalysisDocument18 pagesMacro Environment of Indian Life Insurance Business: A PESTLE AnalysisAkansha GoyalNo ratings yet

- Notes of Internal Audit Part 14Document2 pagesNotes of Internal Audit Part 14some_one372No ratings yet

- Notes of Internal Audit Part 13Document2 pagesNotes of Internal Audit Part 13some_one372No ratings yet

- SOlution To AnsDocument12 pagesSOlution To Anssome_one372No ratings yet

- Notes of Internal Audit Part 7Document2 pagesNotes of Internal Audit Part 7some_one372No ratings yet

- Notes of Internal Audit Part 10Document2 pagesNotes of Internal Audit Part 10some_one372No ratings yet

- Notes of Internal Audit Part 9Document2 pagesNotes of Internal Audit Part 9some_one372No ratings yet

- Notes of Internal Audit Part 4Document3 pagesNotes of Internal Audit Part 4some_one372No ratings yet

- Notes of Internal Audit Part 6Document3 pagesNotes of Internal Audit Part 6some_one372No ratings yet

- Notes of Internal Audit Part 11Document2 pagesNotes of Internal Audit Part 11some_one372No ratings yet

- Notes of Internal Audit Part 5Document2 pagesNotes of Internal Audit Part 5some_one372No ratings yet

- Notes of Internal Audit Part 3Document4 pagesNotes of Internal Audit Part 3some_one372No ratings yet

- Gap AnalysisDocument5 pagesGap AnalysisRavi BavariaNo ratings yet

- Usa Eb-5 Investor Visa Program: Usfc Webinar SeriesDocument17 pagesUsa Eb-5 Investor Visa Program: Usfc Webinar SeriesPushaan SinghNo ratings yet

- Work Sheet Computation of Income Under The Head "Capital Gains"Document4 pagesWork Sheet Computation of Income Under The Head "Capital Gains"Vishal SarkarNo ratings yet

- Homework on Share-Based PaymentsDocument4 pagesHomework on Share-Based PaymentsCharles TuazonNo ratings yet

- Black BookDocument41 pagesBlack BookMoazza QureshiNo ratings yet

- Philippine tax obligations calculation resident citizenDocument3 pagesPhilippine tax obligations calculation resident citizenKatrina Dela CruzNo ratings yet

- Maruti Suzuki Annual Report 2020-21-107-108Document2 pagesMaruti Suzuki Annual Report 2020-21-107-108Atul PandeyNo ratings yet

- What Is NCFM Exam? What Is Nism Exam? NCFM, Nism Mock Test at WWW - Modelexam.in.Document15 pagesWhat Is NCFM Exam? What Is Nism Exam? NCFM, Nism Mock Test at WWW - Modelexam.in.SRINIVASAN100% (4)

- Valuation of GoodwillDocument34 pagesValuation of GoodwillGamming Evolves100% (1)

- Islamic Finance and BankingDocument10 pagesIslamic Finance and BankingMaruf AhmedNo ratings yet

- Introduction of India's Liberalised Exchange Rate Management System (LERMSDocument4 pagesIntroduction of India's Liberalised Exchange Rate Management System (LERMSOjasvee Khanna0% (1)

- Commercial Footprint Plots in Yeida CityDocument24 pagesCommercial Footprint Plots in Yeida Cityvaibhavrai2255No ratings yet

- LKAS 37 - StudentsDocument7 pagesLKAS 37 - StudentskawindraNo ratings yet

- Dse 2009 SolutionsDocument3 pagesDse 2009 Solutionss05xoNo ratings yet

- 163019-375293 20191231 PDFDocument6 pages163019-375293 20191231 PDFAmran KeloNo ratings yet

- Revenue Requirements and RAB WebinarDocument26 pagesRevenue Requirements and RAB WebinarDallas Dragon100% (1)

- Tutorial 4 - QuestionsDocument2 pagesTutorial 4 - QuestionsHuang ZhanyiNo ratings yet

- Chapter 01 Globalization AnDocument55 pagesChapter 01 Globalization AnLiaNo ratings yet

- Module 11-Inventory Cost FlowDocument8 pagesModule 11-Inventory Cost FlowCreative BeautyNo ratings yet

- Name of student: Lại Thị Huyền Trà Class: BAK9 ID: DTQ1953401010107Document3 pagesName of student: Lại Thị Huyền Trà Class: BAK9 ID: DTQ1953401010107Huyền TràNo ratings yet

- Description: S&P/BMV Total Mexico Esg Index (MXN)Document7 pagesDescription: S&P/BMV Total Mexico Esg Index (MXN)tmayur21No ratings yet

- IBA Karachi Course Outlines PDFDocument38 pagesIBA Karachi Course Outlines PDFDr. Abdullah0% (1)

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document9 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- 1.1 Conceptual FrameworkDocument9 pages1.1 Conceptual FrameworkMhaye Arabit GaylicanNo ratings yet

- Afm ProjectDocument11 pagesAfm ProjectAnshul MishraNo ratings yet

- Test Bank For Principles of Risk Management and Insurance 12th Edition by RejdaDocument10 pagesTest Bank For Principles of Risk Management and Insurance 12th Edition by Rejdajames90% (10)

- Government Accounting: (Unified Account Code Structure)Document13 pagesGovernment Accounting: (Unified Account Code Structure)Mariella AngobNo ratings yet

- Divisional PerformanceDocument22 pagesDivisional PerformanceAmir HamzaNo ratings yet

- D) Click Next at Account List Window E) Enter The Amount NextDocument3 pagesD) Click Next at Account List Window E) Enter The Amount NextNoor Salehah100% (6)

- 26ASDocument4 pages26ASSatyam MaramNo ratings yet