Professional Documents

Culture Documents

LEASING

Uploaded by

Zaenal FananiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LEASING

Uploaded by

Zaenal FananiCopyright:

Available Formats

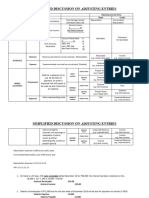

Kieso, et al (2009): Ch.

21

PSAK N0. 30

Materials

IAS No. 17

Transportation (Truck,

Aircraft, Bus)

Information Technology

Residual values. Lessee

Construction Comp

Sales-type leases (lessor). Agriculture Comp

Players

Bargain purchase options.

Banks

Initial direct costs. Special Leasing Problems Lessors Leasing Comp

Current versus noncurrent

classification. Independents

Disclosure.

100% Financing at Fixed Rates.

Classify the lease Protection Against Obsolescence.

Implicit interest rate Flexibility.

Determine the PV of asset and

Incremental lease liability Advantages Less Costly Financing.

borrowing rate Tax Advantages.

Effective-Interest Off-Balance-Sheet

Method Used to Financing

allocate each lease LEASING

payment between Make the lease

principal and interest. payment table What are the conditions?

present value of the Transfer of ownership

minimum lease Accounting by Lessee

payments Accounting option price and the

(excluding expected fair market

Asset and Liability value must be large

executory costs) or Recorded at the lower bargain-purchase

option enough

fair-market value of of:

the leased asset.

Record the Lease term is

If lease transfers journal entries generally fixed,

ownership, Lease term is for noncancelable

depreciate asset over major part of

Bargain-renewal option

the economic life of Capital/Finance Lease economic life

the asset. probability to exercise

Types of leasing for lessee of the option

Depreciation Period

the term of the lease

Minimum rental

payment

lease payments amounts to Guaranteed

substantially all of the fair residual value

value of the leased asset

Penalty for failure to

renew or extend

Bargain-purchase option

Operating Lease

LEASING (2).mmap - 15/05/2015 -

You might also like

- Accounting For Leases Accounting For LeasesDocument66 pagesAccounting For Leases Accounting For Leasessteveny floridaNo ratings yet

- Lessor Accounting (IFRS 16)Document1 pageLessor Accounting (IFRS 16)Innocent MakayaNo ratings yet

- CH 21Document53 pagesCH 21Albert Adi NugrohoNo ratings yet

- Lease IFRS 16 Summary Final FAR2Document1 pageLease IFRS 16 Summary Final FAR2zaryab6097653No ratings yet

- Kieso Inter Ch21 IFRS Leases SingaporeDocument89 pagesKieso Inter Ch21 IFRS Leases Singaporetira MeliniaNo ratings yet

- Ind As 11Document37 pagesInd As 11CA Keshav MadaanNo ratings yet

- Accounting for Leases: Capital vs Operating MethodsDocument28 pagesAccounting for Leases: Capital vs Operating MethodsCabdixakiim-Tiyari Cabdillaahi AadenNo ratings yet

- IAS17 Handouts PDFDocument9 pagesIAS17 Handouts PDFJessa BasadreNo ratings yet

- AIK - Day 3 - Accounting For LeasesDocument53 pagesAIK - Day 3 - Accounting For LeasesKurnia WindartiNo ratings yet

- Readme JumboDocument4 pagesReadme JumboJulzNo ratings yet

- Customer JourneyDocument5 pagesCustomer JourneySanam TNo ratings yet

- Commercial Arrangements For Solar Rooftop Projects - Anuj VashishthaDocument36 pagesCommercial Arrangements For Solar Rooftop Projects - Anuj VashishthaSAEL SOLARNo ratings yet

- CH 21 Accounting For LeasesDocument87 pagesCH 21 Accounting For LeasesSamiHadadNo ratings yet

- Your Next : A Car For Your Every NeedDocument8 pagesYour Next : A Car For Your Every NeedANKUR PUROHITNo ratings yet

- Ey Leases A Summary of Ifrs 16 and Its Effects May 2016Document28 pagesEy Leases A Summary of Ifrs 16 and Its Effects May 2016Sittie HijaraNo ratings yet

- Leases under PFRS 16 - Key Concepts and Accounting by LesseesDocument9 pagesLeases under PFRS 16 - Key Concepts and Accounting by LesseesTrisha Mae Mendoza MacalinoNo ratings yet

- Accounting For LeasesDocument30 pagesAccounting For LeasesChristine TejadaNo ratings yet

- MapDocument1 pageMapddi40275No ratings yet

- 5207871Document87 pages5207871sfrhNo ratings yet

- Niif 16 JSSDocument29 pagesNiif 16 JSSMiguel CarranzaNo ratings yet

- 41276645Document25 pages41276645Gehan FaroukNo ratings yet

- Ind AS 17 LeasesDocument48 pagesInd AS 17 LeasesHimanshu GaurNo ratings yet

- Indas-116: Name - Dipeeka Banka ROLL NO. - 859 Guide - Prof. Sonali SahaDocument15 pagesIndas-116: Name - Dipeeka Banka ROLL NO. - 859 Guide - Prof. Sonali SahaDipeeka BankaNo ratings yet

- MindMap PPEDocument1 pageMindMap PPEHazel Rose CabezasNo ratings yet

- FNCE 317 Formula Sheet - FinalDocument2 pagesFNCE 317 Formula Sheet - FinalDon JonesNo ratings yet

- Chapter 47Document40 pagesChapter 47alghazalianNo ratings yet

- Far 21 Notes and Loans Payable Debt RestructuringDocument7 pagesFar 21 Notes and Loans Payable Debt RestructuringJulie Mae Caling MalitNo ratings yet

- Vascon Engineers LTD Financial Results and PriceDocument1 pageVascon Engineers LTD Financial Results and PricePillu The DogNo ratings yet

- IFRS 16-Presentation 2017 Reviewed SAVRALADocument40 pagesIFRS 16-Presentation 2017 Reviewed SAVRALAShahid MahmudNo ratings yet

- Lease - Lessee's Perspective: Lecture NotesDocument9 pagesLease - Lessee's Perspective: Lecture NotesDonise Ronadel SantosNo ratings yet

- Kinds of Adjusting Entries 1Document2 pagesKinds of Adjusting Entries 1Marc Justine Gamiao GoNo ratings yet

- Where Administration Stands ResponsibleDocument3 pagesWhere Administration Stands Responsiblesainath mudaliarNo ratings yet

- Pertemuan 10 Chapter 21 KiesoDocument93 pagesPertemuan 10 Chapter 21 KiesoJordan SiahaanNo ratings yet

- வாடகை ஒப்பந்த பத்திரம் Rental Agreement Format In Tamil Font (q6ng7mdeyjnv)Document2 pagesவாடகை ஒப்பந்த பத்திரம் Rental Agreement Format In Tamil Font (q6ng7mdeyjnv)ÂaryanArun0% (1)

- IND AS 116 - P2-DraftDocument2 pagesIND AS 116 - P2-DraftSarun ChhetriNo ratings yet

- Annual Report of IOCL 90Document1 pageAnnual Report of IOCL 90Nikunj ParmarNo ratings yet

- Infrastructure Charges Notice CalculatorDocument1 pageInfrastructure Charges Notice Calculatorabdullah amanullahNo ratings yet

- Ind As 23 - Mind MapDocument2 pagesInd As 23 - Mind MapSarun ChhetriNo ratings yet

- Seminar 6 Lease Accounting III: AC2101 - Accounting Recognition and MeasurementDocument7 pagesSeminar 6 Lease Accounting III: AC2101 - Accounting Recognition and MeasurementcccqNo ratings yet

- 74899bos60524 cp6 U8Document161 pages74899bos60524 cp6 U8chandrakantchainani606No ratings yet

- Assignment IA 2 - Week 15 PDFDocument39 pagesAssignment IA 2 - Week 15 PDFViola JovitaNo ratings yet

- Disposal and depreciation of property assetsDocument4 pagesDisposal and depreciation of property assetsjhell dela cruzNo ratings yet

- AAFR Notes IFRS - 16Document27 pagesAAFR Notes IFRS - 16WaqasNo ratings yet

- Scheme of Open Book ContractDocument2 pagesScheme of Open Book ContractMaria Dewi ManurungNo ratings yet

- Bid Document - 2023-11-29T075739.193Document170 pagesBid Document - 2023-11-29T075739.193Kiran BasnetNo ratings yet

- Chapter 4Document17 pagesChapter 4arnika2No ratings yet

- Different Types of LeasesDocument3 pagesDifferent Types of LeasesSubhajit AdhikariNo ratings yet

- Changes To Key Performance Indicators Under IFRS 17: Interesting Thought Is About Which Regime Will Become LeadingDocument1 pageChanges To Key Performance Indicators Under IFRS 17: Interesting Thought Is About Which Regime Will Become LeadingMuhammad KholiqNo ratings yet

- IFRS 16 Effects Analysis PDFDocument104 pagesIFRS 16 Effects Analysis PDFKaren LiebheartNo ratings yet

- Marsh Klgates Risk Management Insurance Strategies SeminarDocument230 pagesMarsh Klgates Risk Management Insurance Strategies SeminarAhasanul RahhatNo ratings yet

- IFRS-16 New Lease Amendment PDFDocument7 pagesIFRS-16 New Lease Amendment PDFkhaymksNo ratings yet

- P2Mindmap (JoeFang)Document41 pagesP2Mindmap (JoeFang)Mubashar HussainNo ratings yet

- IFRS16 - Lease Standard SAP Solution Through Real Estate Management - SAP BlogsDocument12 pagesIFRS16 - Lease Standard SAP Solution Through Real Estate Management - SAP BlogsFranki Giassi MeurerNo ratings yet

- IFRS 15 For Banks - PWC in Depth INT2017-11Document10 pagesIFRS 15 For Banks - PWC in Depth INT2017-11Hy YgameNo ratings yet

- Tactical Financing Decisions: Lease, Hybrid, and PreferredDocument33 pagesTactical Financing Decisions: Lease, Hybrid, and PreferredMUTIARA MAKNUNNo ratings yet

- ch21 Accounting Leases PDFDocument109 pagesch21 Accounting Leases PDFTri LarasatiNo ratings yet

- Week 7 - ch21Document63 pagesWeek 7 - ch21bafsvideo4100% (1)

- CH 21Document104 pagesCH 21y4yn2jdk4jNo ratings yet

- 2022 - Ahmadroziq - Kinerja Bank SyariahDocument2 pages2022 - Ahmadroziq - Kinerja Bank SyariahZaenal FananiNo ratings yet

- Materi 2 How To Read A Scientific PaperDocument25 pagesMateri 2 How To Read A Scientific PaperZaenal FananiNo ratings yet

- Durbin Watson TablesDocument11 pagesDurbin Watson TablesgotiiiNo ratings yet

- PT ASURANSI BINA DANA ARTA Q1 2018 FINANCIALSDocument108 pagesPT ASURANSI BINA DANA ARTA Q1 2018 FINANCIALSZaenal FananiNo ratings yet

- Document1 PDFDocument1 pageDocument1 PDFZaenal FananiNo ratings yet

- LinkDocument1 pageLinkZaenal FananiNo ratings yet

- Durbin Watson TablesDocument11 pagesDurbin Watson TablesgotiiiNo ratings yet

- Economic Value AddedDocument4 pagesEconomic Value AddedZaenal FananiNo ratings yet

- Rundown JCAE 2018-UpdateddDocument17 pagesRundown JCAE 2018-UpdateddZaenal FananiNo ratings yet

- How To Incorporate Non-Randomized Studies in Cochrane Reviews of Patient SafetyDocument58 pagesHow To Incorporate Non-Randomized Studies in Cochrane Reviews of Patient SafetyZaenal FananiNo ratings yet

- Network proxy settings for UN air libraryDocument1 pageNetwork proxy settings for UN air libraryZaenal FananiNo ratings yet

- 3-2 - How To Use SmartPLS Software - Assessing Measurement Models - 3!5!14Document24 pages3-2 - How To Use SmartPLS Software - Assessing Measurement Models - 3!5!14Zaenal FananiNo ratings yet

- Thermo-Economics CalculationsDocument28 pagesThermo-Economics CalculationsedwardNo ratings yet

- Chapter 4 Problem SetDocument3 pagesChapter 4 Problem SetNasir Ali RizviNo ratings yet

- Dividend PolicyDocument3 pagesDividend PolicyJaspreet KaurNo ratings yet

- Facts:: ROMEO C. GARCIA, Petitioner, vs. DIONISIO V. LLAMAS, Respondent. G.R. No. 154127 December 8, 2003Document2 pagesFacts:: ROMEO C. GARCIA, Petitioner, vs. DIONISIO V. LLAMAS, Respondent. G.R. No. 154127 December 8, 2003Cy MichaelisNo ratings yet

- CAIIB Elective Papers LowDocument16 pagesCAIIB Elective Papers LowKumar AshuNo ratings yet

- Sept 20 2011Document9 pagesSept 20 2011eerpinarNo ratings yet

- Sample Reply To Demand Letter - Infrastructure Contract DisputeDocument2 pagesSample Reply To Demand Letter - Infrastructure Contract DisputeKhrisna Lopo100% (2)

- Options, Caps, Floors, and Collars GuideDocument24 pagesOptions, Caps, Floors, and Collars GuideKamalakar ReddyNo ratings yet

- PAH20655 Sek 24Document14 pagesPAH20655 Sek 24msar 8888No ratings yet

- How to Open a Lending Investor in the PhilippinesDocument5 pagesHow to Open a Lending Investor in the PhilippinesBelteshazzarL.CabacangNo ratings yet

- GuaranteeDocument48 pagesGuaranteeAadhitya NarayananNo ratings yet

- Chapter 3-Uses of Funds - Part 1Document6 pagesChapter 3-Uses of Funds - Part 1Pháp NguyễnNo ratings yet

- Comparative Analysis Credit RatingDocument103 pagesComparative Analysis Credit RatingRoyal Projects100% (1)

- 115 - Yam v. CA DigestDocument2 pages115 - Yam v. CA DigestStephieIgnacioNo ratings yet

- Everything You Need to Know About Promissory NotesDocument30 pagesEverything You Need to Know About Promissory NotesSabyasachi GhoshNo ratings yet

- MCQ Chapter 8 Working CapitalDocument11 pagesMCQ Chapter 8 Working CapitalNigamananda KhandualNo ratings yet

- The House On Elm StreetDocument4 pagesThe House On Elm StreetKathy Alex Yepéz EchegarayNo ratings yet

- Treasurer ReportDocument2 pagesTreasurer ReportPilo Pas Kwal100% (1)

- Galicia-Module 2 Oblicon Ba11 PDFDocument3 pagesGalicia-Module 2 Oblicon Ba11 PDFJhonard GaliciaNo ratings yet

- RBI Functions and Banking RegulatorsDocument167 pagesRBI Functions and Banking RegulatorsApurva RanjanNo ratings yet

- Changes in The Insurance Sector in The Pre & Post Liberalization ScenarioDocument11 pagesChanges in The Insurance Sector in The Pre & Post Liberalization ScenarioRamya BalanNo ratings yet

- Rusty and Dusty Slow MoversDocument1 pageRusty and Dusty Slow Moversputrii_328326870No ratings yet

- Pub Risk Accounting and Risk Management For AccountantDocument559 pagesPub Risk Accounting and Risk Management For Accountant2AD for everyoneNo ratings yet

- New Microsoft PowerPoint PresentationDocument18 pagesNew Microsoft PowerPoint Presentationmusaraza890No ratings yet

- Grand Videoke TKR-373MP SongbookDocument2 pagesGrand Videoke TKR-373MP Songbooktikki0219No ratings yet

- 14 Asseveration On Mortgage FraudDocument7 pages14 Asseveration On Mortgage FraudAngelus WatsonNo ratings yet

- Policies and Regulations that Promote Sustainable MicrofinanceDocument33 pagesPolicies and Regulations that Promote Sustainable Microfinanceiamyt100% (1)

- Land BankDocument2 pagesLand BankGee DomingoNo ratings yet

- Understanding Credit Appraisal Process for MSME Loans at State Bank of IndiaDocument49 pagesUnderstanding Credit Appraisal Process for MSME Loans at State Bank of IndiaVamshiKrishna0% (1)

- Analysis of Asian Paints Integration of Supply Chain ManagementDocument37 pagesAnalysis of Asian Paints Integration of Supply Chain ManagementNikhilKrishnanNo ratings yet