Professional Documents

Culture Documents

Project Report On Harshad Mehta Scam

Uploaded by

Aman SrivastavaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Report On Harshad Mehta Scam

Uploaded by

Aman SrivastavaCopyright:

Available Formats

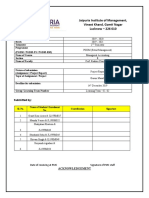

Jaipuria Institute of Management,

Vineet Khand, Gomti Nagar

Lucknow – 226 010

Academic Year 2019 – 2020

Batch 2019 – 2021

Trimester 3rd Trimester

Programme

(PGDM / PGDM-FS / PGDM-RM) PGDM (Retail Management)

Name of Course Professtional Ethics

Section E

Name of Faculty Prof. Maneesh Yadav

Nature of submission

(Assignment / Project Report) Project Report

The topic of Assignment / Project

Harshad Mehta Scam

Deadline for submission 04th March 2020

Group/ Learning Team Number Learning Team E – 07

Maximum allotted marks 20

Contribution of group/LT members in the assignment/project

Sl.

Name &Enrolment Number of Student Contribution Signature

No.

1 Aman Srivastava & JL19RM007

2 Kritika Chauhan& JL19RM020

3 Manish Sinha& JL19RM021

Shivanand Chaudhary&

4

JL19RM050

5 Vignesh Gupta & JL19RM058

6 Yuvika Singh& JL19RM063

Date of receiving at PMC Signature of PMC staff

Penalty (marks to be deducted):

ACKNOWLEDGEMENT

Jaipuria Institute of Management, Lucknow Page 1

We wish to express our sincere gratitude to Prof. Maneesh Yadav, faculty of Professtional Ethics of

Jaipuria Institute of Management, Lucknow for providing us with an opportunity to do our project

work on “HARSHAD MEHTA SCAM”. This project bears an imprint of support of many peoples.

I sincerely thank our project guide Prof. Maneesh Yadav for his guidance and encouragement in

carrying out this project work.

I also wish to express my gratitude to the officials and other staff members of Jaipuria Institute of

Management, Lucknow who rendered their help during the period of our project work. Last but not

the least, we wish to avail ourselves of this opportunity, express a sense of gratitude and love to our

friends and our beloved parents for their manual support, strength, help and for everything.

1. Aman Srivastava [JL19RM007]

2. Kritika Chauhan [JL19RM020]

3. Manish Sinha [JL19RM021]

4. Shivanand Chaudhary [JL19RM050]

5. Vignesh Gupta [JL19RM058]

6. Yuvika Singh [JL19RM063]

TABLE OF CONTENTS

Jaipuria Institute of Management, Lucknow Page 2

CHAPTER TITLE PAGE NO.

Acknowledgement

Table of Contents

1 Facts, Observation and Judgement of (Aman Srivastava) 4

2 Facts, Observation and Judgement of (Kritika Chauhan) 5

3 Facts, Observation and Judgement of (Manish Sinha) 6

4 Facts, Observation and Judgement of (Shivanand Chaudhary) 7

5 Facts, Observation and Judgement of (Vignesh Gupta) 8

6 Facts, Observation and Judgement of (Yuvika Singh) 9

Facts, Observations and Judgement on Harshad Mehta Scam

( By:- Aman Srivastava [JL19RM007] [LT-07])

Facts & Observations:

Jaipuria Institute of Management, Lucknow Page 3

1. The fraud done by Harshad Mehta was around Rs 3500 crores which was a huge and biggest amount

fraud in year 1992.

2. In early stage by the scam share market sensex indices increased by 4500 points. In which ACC share

prices increases from Rs 200 to Rs 9000

3. Case was performed or a tool used was “Ready Forward Deal”.

4. Ready forward deal is the deals that are signed between the banks in short term loans which are

given for 15 days.

5. Loans are given on the government securities

6. Harshad Mehta acts as Agent between the banks.

7. Harshad Mehta search for the bank who needs loan and bank who can provide the loans.

8. Harshad Mehta get the money from bank which needs to buy bank securities and invest that into

the stock market to manipulate the share price. And when as their money he arranges securities

from other banks.

9. Sucheta Dalal senior journlist, The Times of India expose the scam done by the Harshad Mehta.

10. 72 criminal cases and 600 civil suits are filled against Harshad Mehta and family.

11. Harshad Mehta had share worth Rs 453 crores of 131 companies in unknown account.

(Observation)

12. Harshad Mehta called as big bull of stock market. Harshad Mehta did not do the fraud instead he

exploited the loopholes of the system. (Observation)

13. Bank’s authority provide cheque on the name of Harshad Mehta but bank have to give the cheque

on the other bank’s name which means bank authority was also not careful and serious about their

work and Harshad took the advantage of this. (Observation)

14. Bank’s authority played unethically in their work by providing fake receipts without any mortage

(Bank involve are Bank of Karad and Metropolitan Co-operative Bank). (Observation)

15. The diverted money leads to pump in the share market by which share held by Harshad start

increasing. (Observation)

16. The scam was so big of his time that there is indulgence of PM P.V. Narshima Rao. (Observation)

17. In my view there is breaking of Right Based Ethics and Conduct Based Ethics (specifically egosim of

Telelogical Ethics). (Observation)

18. In my view Breaking of code of conducts is done.(Observation)

Judgement

1. According to me the judgement given by Bombay court is right i.e. life time imprisionment.

2. Harshad Mehta properties and companies should be sold out for the repayment.

3. Bank employees how are involved should be fined heavily and sentenced for the

imprisonment.

4. Mehta and his brothers were arrested by CBI on Nov 9 1992 for misappropriating more than 27

lakhs shares of about 90 companies

5. He was later charged for 72 criminal cases and more than 600 civil actions suits were filed against

him.

6. On , September 1999, Bombay High Court convicted and sentenced him to 5

years imprisonment and a fine of Rs 25,000.

7. On 14 January 2003, Supreme court of india confirmed High Court's judgement. It was a 2:1

majority judgement.

8. In 2018 ,Mumbai court has accused 9 people ,including Ashwin Mehta, brother of Harshad Mehta, in

a case of duping the SBI for RS.105 Crores.

Jaipuria Institute of Management, Lucknow Page 4

9. In 2019 , Jyoti Mehta wife of Harshad Mehta won a case against a local broker for a claim of Rs. 6

crores .

10. In 2019 , Family free of Rs.2000 crore of tax demand after 27 years .

( By:- Kritika Chauhan [JL19RM020] [LT-07])

CASE OVERVIEW

Harshad Mehta done his business well in stock market and having great knowledge he smartly swap the

money of banks. Banks trusted Harshad Mehta for finding banks to give their security to another banks and

other banks trusted him to find banks who could take money in exchange of security.

During the exchange of securities between two banks, he take time and for a short period of time with those

money he apply them in stock market to earn extra profit.

He swaps money between diffrent banks as banks sign the cheque in name of Harshad Mehta because banks

never know with whom they were making contracts with.

Harshad had done money exchange deals with many other banks and earn more profit. Harshad always used

ReadyForwardDeal process to earn profit.

He used these money to manipulate stock prices in market.

For making more profit, he took further steps and with help of bank he drafted fake receipts for himself and

stared using them. He gave those receipts to bank who want to purchase government securities and as

earlier mentioned banks trusted Harshad Mehta so they belive that they were actual receipts.

With help of those money, he manipulated many stocks in market and rose the price.

In few months, the stocks of ACC went from 200Rs to 9000Rs.

His scam was exposed when bear market came and Harshad faced a huge loss where he was unable to

retrun the money of bank.

Banks faced loss of 3000-4000 cr. As they lend money on basis of fake receipts.

The chairman of vijya bank took his life after he heard the scam as he himself provided cheques to

Harshadmehta.

On 9 Nov 1992, CBI arrested Harshad Mehta. There were 600 civil action suits and 70 criminal charges.

SEBI banned Harshad Mehta to invest further in stock markets.

MY POINT OF VIEW

Banks should not trust any broker to provide securities or for lending money also

There were time, when banks give fake receipts to Harshad Mehta, which was totally a part of crime.

Jaipuria Institute of Management, Lucknow Page 5

On basis of those fake receipts, bank had lose of 3-4000 cr.

And most important, because of this scam, the chairperson of vijya bank commited suicide who

provided cheques to Harshad Mehta on matter of trust.

Although in the end, Harshad Mehta himself died with remaining 27 criminal charges in his list.

( By:- Manish Sinha [JL19RM021] [LT-07])

OBSERVATION

Harshad Mehta was one of the greatest registered broker in India.

Mr. Mehta used the ready forward (RF) deal to insert money into the market.

With the help of Bank’s employee Mr. Mehta get fake bank receipts issued.

Mr. Mehta utilized these BRs to get different banks to loan him cash under the bogus impression

that they were loaning against government protections.

He was killed in light of the fact that numerous powerful individuals were included and they can be

discovered engaged with this trick.

JUDGEMENT

Harshad Mehta and his brother were arrested by investigation agencies in November 1992.

He was charged with over 70 criminal cases (mostly relating to bribery, cheating, forgery, criminal

conspiracy and falsification of accounts) and over 600 civil action suits.

In 1993, Mehta worked up a tempest when he openly reported that he had paid Rs 1 crore to Prime

Minister PV Narasimha Rao.

On 31- December 2001, at the age of 48, Mehta died with 27 cases still pending against him in Tihar

Jail.

In 2008, Mumbai court has denounced 9 individuals, including Ashwin Mehta, brother of harshad

Mehta, if there should arise an occurrence of hoodwinking the SBI for Rs.105 crores

In 2019, family liberated from Rs. 2000 crore of tax demand after 27 years.

( By:- Shivanand Chaudhary [JL19RM050] [LT-07])

Jaipuria Institute of Management, Lucknow Page 6

Harshad Mehta Scam worth Rs 3500 crore

Harshad Mehta was born in 1954 into a very poor family. He completed his high school from Raipur

but he was a very average kind of student. Who didn’t show any kind of promiseAfter completing his

schooling he came to Mumbai where he did his b.com from Lala Lajpat Rai college.

He struggled to sell garments and appliances etc, His luck turned around when he joined New India

Assurance Company as a salesperson and got interested in the stock market. After that, he quit the

job and joined a brokerage firm and learned the ins & out of the stock market also made connection

with the influential brokers and within 3 years he became a broker at BSE(Bombay stock exchange).

In 1990 he also established his firm called GROW MORE RESEARCH AND ASSET MANAGEMENT, but

he had great ambition to more money. Where he started finding a loophole in the banking system,

as the RBI has made a mandate of keeping a certain amount of government bonds with the banks.

He was dealing with almost every bank, whenever the stock price would rise he would liquidate his

position from the stock market and take care of any deficits as he was reading the money with the

bank and the stock market. He conspired with two banks(Bank of Karad and Metropolitan

cooperative bank) to issue fake bank receipts that had no legal holding, just a piece of paper.

An Investigating journalist named Sucheta Dalal got went of modus operandi and published an

article in Times of India newspaper. As this shock, the stock market and the Indian banks became

aware of the money also it did not take much time for CBI to get into the matter they filed 70 cases

of fraud.

WARNING

Harshad Mehta's story and more recently Nirav Modi scandal are such fraud which makes us getting

the thought of our banking system and stock market are at risk the general public money being

exploited with some of the banking officials helping to lead such fraud. A general reminder as to

whenever a company starts to grow rapidly with greater valuation the investor must be very aware

of the working of the company is under the legal norms and abide by law considering the general

public investment.

( By:- Vignesh Gupta [JL19RM058] [LT-07])

FACTS

Jaipuria Institute of Management, Lucknow Page 7

The scam was of diversion of bank funds worth Rs 3500 crore.

Ready Forward deal was used for the scam.

Journalist SuchetaDalal exposed Mehta’s scam

He took advantages of loopholes in banking system

He triggered SENSEX in 1992 .

He accused Prime Minister P.V. Narsimha Rao for taking Rs.1crore for removing all the cases against

him.

The chairman of Vijaya bank committed suicide.

He died in Tihar prison, some believe that he was murdered .

Special court was set up to facilitate speedy trial.

His total liabilities was of around Rs.16,044 crore .

His wife filed a case against a local broker and won the case in 2019 for Rs.6 crores.

OBSERVATIONS

According to me his motive is to trigger SENSEX and he did it.

He was murdered because many influential people were involved and they can be even found

involved in this scam.

He was one of the greatest stockbroker in india .

He has exploited several loopholes in the Indian banking system

JUDGEMENTS

Mehta and his brothers were arrested by CBI on Nov 9 1992 for misappropriating more than 27

lakhs shares of about 90 companies

He was later charged for 72 criminal cases and more than 600 civil actions suits were filed against

him

On , September 1999, Bombay High Court convicted and sentenced him to 5

years imprisonment and a fine of ₹25,000.

On 14 January 2003, Supreme court of india confirmed High Court's judgement. It was a 2:1

majority judgement.

In 2003 , when he died in Tihar jail he was convicted for only one case .

In 2018 ,Mumbai court has accused 9 people ,including Ashwin Mehta, brother of Harshad Mehta, in

a case of duping the SBI for RS.105 Crores.

In 2019 , Jyoti Mehta wife of Harshad Mehta won a case against a local broker for a claim of Rs. 6

crores

In 2019 , Family free of Rs.2000 crore of tax demand after 27 years

( By:- Yuvika Singh [JL19RM063] [LT-07])

OBSERVATION

Jaipuria Institute of Management, Lucknow Page 8

Harshad Mehta was an Indian stock broker and he was known as a big bull of stock exchange. He completed

his graduation from Lala Lajpat Rai College, Mumbai. After this he worked in different companies for 2 years

after that he developed the interest in share market and joined the stock broker B.Ambalal in 1980s. In 1981

he joined J.L Shah and Nandalal Sheth as a sub broker. After gaining knowledge about stock market he and

his brother started his own firm named as Grow More Research and Asset Management. Later he became an

active member in Bombay Stock Exchange as a broker.

For scam Harshad Mehta used two instruments the first one was Ready Forward Deal and second one was

Bank Receipt.

Ready Forward deal was the short term loan instruments for bank. There was some loopholes in the RF deals

and Harshad Mehta know the loopholes and by using that he made biggest scam and earn ample of illegal

money. He also make fake bank receipt for earning money. When any bank wants to sell their government

securities then as a collateral bank use to give a receipt not the actual securities and that receipt was called

Bank receipt. He makes fake receipts and took money from bank against those fake receipts.

He used this money to invest in stock market due to which the share price of ACC increases to Rs 9000 from

Rs 200 in few months. Due to drastic change in price people started investing in it and prices of stock went

to peak and he started earning profit, by that profit he used to return the money to the bank and collect the

fake bank receipt. After sometime when the prices started decreasing Harshad suffered huge losses and was

unable to pay money to the bank.

On 23rdapril 1992, the scam was exposed by journalist Sucheta Dalal in TOI. Due to Harshad Mehta’s scam

banking sector suffered the loss of almost Rs 4000 crores.

JUDGEMENTS

Harshad Mehta was arrested by investigation agencies in 1992.

The investigation agencies charged with over 70 criminal cases and over 600 civil action suits.

In 1993, he announced that he paid 1 crore to Prime Minister PV Narasimha Rao.

In 2001, he died at the age of 48 with 27 cases still pending against him.

In 2019, Jyoti Mehta wife of Harshad Mehta won a case against local broker for claim of Rs. 6 crores.

In 2019, Mehta family free from Rs 2000 crores of tax after 27 years.

Jaipuria Institute of Management, Lucknow Page 9

You might also like

- Harshad Mehta Scam 2Document6 pagesHarshad Mehta Scam 2TejashriNo ratings yet

- Harshad Mehta ScamDocument9 pagesHarshad Mehta ScamMashboob R.MNo ratings yet

- Harshad Mehta Case StudyDocument11 pagesHarshad Mehta Case StudyRahul75% (4)

- Financial Scams in India: Harshad Mehta, Ketan Parekh, SatyamDocument12 pagesFinancial Scams in India: Harshad Mehta, Ketan Parekh, SatyamApoorv SrivastavaNo ratings yet

- Harshad Mehta CaseDocument16 pagesHarshad Mehta Casegunjan67% (3)

- Harshad Mehta ScamDocument4 pagesHarshad Mehta Scamvanitathakur91No ratings yet

- Rotomac Bank Scam: by Sumit 20mba035Document15 pagesRotomac Bank Scam: by Sumit 20mba035Preksha KatariaNo ratings yet

- Ketan Praekh ScamDocument15 pagesKetan Praekh ScamNikhil KediaNo ratings yet

- PMC Bank Scam: How Depositors Were CheatedDocument9 pagesPMC Bank Scam: How Depositors Were CheatedAshutosh SharmaNo ratings yet

- Harshad Mehta ScamDocument17 pagesHarshad Mehta ScamPrerna Bhadani100% (1)

- Harshad Mehta Scam and LICDocument20 pagesHarshad Mehta Scam and LICYUVRAJ RAJBHARNo ratings yet

- ABG Shipyard LTD PERADocument12 pagesABG Shipyard LTD PERASabrina Supti100% (1)

- Ketan ParekhDocument13 pagesKetan ParekhDiptiJaiswalNo ratings yet

- Credit Control Policy of RbiDocument6 pagesCredit Control Policy of RbiSoumya DhirNo ratings yet

- A Case Study On Ketan Parekh ScamDocument5 pagesA Case Study On Ketan Parekh ScamManish Singh100% (1)

- The Bank and The Mundhra AffairDocument14 pagesThe Bank and The Mundhra AffairAmbika MehrotraNo ratings yet

- Ketan Parekh Scam CaseDocument10 pagesKetan Parekh Scam CaseGavin Lobo100% (1)

- Ketan Parekh Scam Impact on Financial SectorDocument5 pagesKetan Parekh Scam Impact on Financial SectorJinal Shah100% (1)

- Saradha Group Financial ScandalDocument8 pagesSaradha Group Financial ScandalDhrubajyoti Datta100% (1)

- Submitted By-Apurva Jain ROLL NO. - 1710Document11 pagesSubmitted By-Apurva Jain ROLL NO. - 1710apurva JainNo ratings yet

- Case Study On CRB ScamDocument26 pagesCase Study On CRB ScamMandish AjmeriNo ratings yet

- PMC BankDocument5 pagesPMC BankRabindra DasNo ratings yet

- Case Study On: CRB ScamDocument26 pagesCase Study On: CRB Scamsangeethaiyer100% (1)

- Group8 SaradhaChitFundScam ReportDocument14 pagesGroup8 SaradhaChitFundScam Reportavinash singhNo ratings yet

- Presentation On Topic Punjab National Bank Scam (Nirav Modi)Document25 pagesPresentation On Topic Punjab National Bank Scam (Nirav Modi)Anoop MohantyNo ratings yet

- Merger and Acquisition in Bank Sector in IndiaDocument63 pagesMerger and Acquisition in Bank Sector in IndiaOmkar Chavan0% (1)

- NSEL Scam: India's Biggest Commodity ScamDocument40 pagesNSEL Scam: India's Biggest Commodity ScamVardaan Bajaj100% (1)

- PMC Bank fraud titleDocument9 pagesPMC Bank fraud titleSneha100% (1)

- Scam 1992 - A Web Series On Harshad Mehta ScamDocument2 pagesScam 1992 - A Web Series On Harshad Mehta ScamAavish GuptaNo ratings yet

- Case Study Vijay Mallya - Another Big NaDocument10 pagesCase Study Vijay Mallya - Another Big Najai sri ram groupNo ratings yet

- Sebi detects IPO scam involving manipulation of primary marketDocument4 pagesSebi detects IPO scam involving manipulation of primary marketMonika SharmaNo ratings yet

- Sahara ScamDocument6 pagesSahara ScamdarshitakamaniNo ratings yet

- The Merger of Associate Banks With State Bank of India A Pre and Post Merger AnalysisDocument13 pagesThe Merger of Associate Banks With State Bank of India A Pre and Post Merger AnalysisRachit GoyalNo ratings yet

- Sahara ScamDocument14 pagesSahara Scamsagar srivastava100% (1)

- Business Law Demutualisation Corporatisation SEBI RegulationsDocument8 pagesBusiness Law Demutualisation Corporatisation SEBI RegulationsShashank JoganiNo ratings yet

- The 176-point Sensex crash that exposed a major stock market scamDocument16 pagesThe 176-point Sensex crash that exposed a major stock market scamNandan SapaleNo ratings yet

- Problems of The Depository System in IndiaDocument4 pagesProblems of The Depository System in IndiaAkash Gupta100% (1)

- Ketan Parekh: Prepared by - Mohit Bothra PGDM-07 Globsyn Business School KolkataDocument13 pagesKetan Parekh: Prepared by - Mohit Bothra PGDM-07 Globsyn Business School Kolkatamohitbothra50% (4)

- Funding of Mergers & TakeoversDocument31 pagesFunding of Mergers & TakeoversMohit MohanNo ratings yet

- Report On Ketan Parekh ScamDocument16 pagesReport On Ketan Parekh ScamRabiul Khan100% (2)

- Role of RBI in Indian Financial MarketsDocument5 pagesRole of RBI in Indian Financial MarketsBiswajit Paul100% (2)

- DHFL Bank ScamDocument7 pagesDHFL Bank ScamPrasannaNo ratings yet

- White Collar Crimes in Indian Education SectorDocument11 pagesWhite Collar Crimes in Indian Education SectorAnjana AgarwalNo ratings yet

- The Satyam CaseDocument40 pagesThe Satyam CaseManinder SinghNo ratings yet

- Liability For Dishonor of Cheques - ProjectDocument53 pagesLiability For Dishonor of Cheques - Projectparullawyer89% (18)

- Nitin - Harshad Mehta Scam PDFDocument12 pagesNitin - Harshad Mehta Scam PDFAnkit SangwanNo ratings yet

- Harshad Mehta PDFDocument17 pagesHarshad Mehta PDFaniket deshpandeNo ratings yet

- Final Research Report On Financial-Scams-In-IndiaDocument59 pagesFinal Research Report On Financial-Scams-In-IndiaMohammed Shaiq75% (4)

- Legal Aspects of Business: A Case Analysis Report On Commonwealth Games ScamDocument11 pagesLegal Aspects of Business: A Case Analysis Report On Commonwealth Games ScamLovey OberoiNo ratings yet

- Role of Sebi in Capital Market IssuesDocument6 pagesRole of Sebi in Capital Market Issuescoolfaiz2No ratings yet

- Rotomac Bank FraudDocument8 pagesRotomac Bank FraudAnand Christudas100% (3)

- Ketan Parekh ScamDocument32 pagesKetan Parekh Scamolkpq0% (1)

- Case StudyDocument8 pagesCase StudyAnkur RajputNo ratings yet

- Harshad Mehta ScamDocument16 pagesHarshad Mehta ScamAshu JainNo ratings yet

- ABG Shipyard ScamDocument5 pagesABG Shipyard ScamTejas PotdarNo ratings yet

- KETAN PAREKH - The Mystery Man !!Document30 pagesKETAN PAREKH - The Mystery Man !!sangamch123No ratings yet

- Assignment of Killamsetty Rasmita Scam 1992Document8 pagesAssignment of Killamsetty Rasmita Scam 1992rkillamsettyNo ratings yet

- Event Report GREEN CODEDocument9 pagesEvent Report GREEN CODEaditi anandNo ratings yet

- PPM Research PaperDocument14 pagesPPM Research PaperPragyan BhadoriyaNo ratings yet

- Automobile Workshop Process Mapping and Quality AnalysisDocument16 pagesAutomobile Workshop Process Mapping and Quality AnalysisAman SrivastavaNo ratings yet

- Garam Masala Project ReportDocument14 pagesGaram Masala Project ReportAman SrivastavaNo ratings yet

- Novartis vs Cipla Project ReportDocument9 pagesNovartis vs Cipla Project ReportAman Srivastava100% (1)

- Assignment OMDocument7 pagesAssignment OMAman SrivastavaNo ratings yet

- Garam Masala Project ReportDocument14 pagesGaram Masala Project ReportAman SrivastavaNo ratings yet

- Assignment OMDocument7 pagesAssignment OMAman SrivastavaNo ratings yet

- Garam Masala Project ReportDocument14 pagesGaram Masala Project ReportAman SrivastavaNo ratings yet

- Novartis vs Cipla Project ReportDocument9 pagesNovartis vs Cipla Project ReportAman Srivastava100% (1)

- Assignment OMDocument7 pagesAssignment OMAman SrivastavaNo ratings yet

- Project Report On Reliance DigitalDocument23 pagesProject Report On Reliance DigitalAman SrivastavaNo ratings yet

- Novartis vs Cipla Project ReportDocument9 pagesNovartis vs Cipla Project ReportAman Srivastava100% (1)

- Garam Masala Project ReportDocument14 pagesGaram Masala Project ReportAman SrivastavaNo ratings yet

- New Project Report On Reliance DigitalDocument21 pagesNew Project Report On Reliance DigitalAman SrivastavaNo ratings yet

- Assignment OMDocument7 pagesAssignment OMAman SrivastavaNo ratings yet

- Assignment Report On Reliance DigitalDocument19 pagesAssignment Report On Reliance DigitalAman Srivastava100% (1)

- Project Report On Reliance DigitalDocument20 pagesProject Report On Reliance DigitalAman Srivastava67% (6)

- Sonali Bank Foreign ExchangeDocument59 pagesSonali Bank Foreign Exchangeসৃজনশীলশুভ100% (1)

- FM CH 3Document18 pagesFM CH 3samuel kebedeNo ratings yet

- Case Study - Hill Country Snack Foods Co.Document4 pagesCase Study - Hill Country Snack Foods Co.Saurabh Agarwal0% (1)

- 9 - 10. Corporate CRTLDocument37 pages9 - 10. Corporate CRTLRaimond DuflotNo ratings yet

- Chapter 8. Reversal Trading StrategiesDocument38 pagesChapter 8. Reversal Trading StrategiesЕкатерина ВладиславовнаNo ratings yet

- DocxDocument28 pagesDocxSunil KumarNo ratings yet

- Resume Ed TechDocument2 pagesResume Ed Techapi-369827779No ratings yet

- Jharkhand Industrial and Investment Promotion Policy 2016Document78 pagesJharkhand Industrial and Investment Promotion Policy 2016anon_794527129No ratings yet

- IFRS 17 IntroductionDocument25 pagesIFRS 17 IntroductionIoanna ZlatevaNo ratings yet

- MACFOS LIMITED announces anchor investor allocation of 330,000 shares to Maven India FundDocument1 pageMACFOS LIMITED announces anchor investor allocation of 330,000 shares to Maven India Fundavinash sharmaNo ratings yet

- FactsheetDocument1 pageFactsheetAdam MuhammadNo ratings yet

- FINANCIAL REPORTING ANALYSIS OF NISHAT AND CRESCENT TEXTILEDocument44 pagesFINANCIAL REPORTING ANALYSIS OF NISHAT AND CRESCENT TEXTILEAbdul KhaliqNo ratings yet

- Investment in Equity Securities Journal EntriesDocument1 pageInvestment in Equity Securities Journal EntriesMelvin MendozaNo ratings yet

- Chapter 9 Long Term Financing CalculationDocument13 pagesChapter 9 Long Term Financing Calculationsofea yusoffNo ratings yet

- Answer Key ABM2Document6 pagesAnswer Key ABM2Elle Alorra RubenfieldNo ratings yet

- FM16 Ch26 Tool KitDocument21 pagesFM16 Ch26 Tool KitAdamNo ratings yet

- Braking China Without Breaking The World: Blackrock Investment InstituteDocument32 pagesBraking China Without Breaking The World: Blackrock Investment InstitutetaewoonNo ratings yet

- The Effect of Profitability, Firm Size, Financial Leverage and Firm Growth On Dividend Policy: A Study On PSX Listed Non-Financial FirmsDocument28 pagesThe Effect of Profitability, Firm Size, Financial Leverage and Firm Growth On Dividend Policy: A Study On PSX Listed Non-Financial FirmsHinaNo ratings yet

- Updated Questions NotesDocument10 pagesUpdated Questions NotesBijesh SahNo ratings yet

- Tutorial Letter 4/0/2017 Financial Strategy MAC4865: Define TomorrowDocument12 pagesTutorial Letter 4/0/2017 Financial Strategy MAC4865: Define TomorrowdevashneeNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word Documentshubhangiw17No ratings yet

- Elevated Complete Bus Plan 1.2Document15 pagesElevated Complete Bus Plan 1.2ee sNo ratings yet

- Topic 6 COMMON STOCKDocument34 pagesTopic 6 COMMON STOCKnurul shafifah bt ismailNo ratings yet

- FSD7Document2 pagesFSD7Leo the BulldogNo ratings yet

- Performance Manager PDFDocument146 pagesPerformance Manager PDFparivijjiNo ratings yet

- Bus 5110 Managerial Accounting Written Assignment Unit 62 PDFDocument14 pagesBus 5110 Managerial Accounting Written Assignment Unit 62 PDFEmmanuel Gift BernardNo ratings yet

- Detecting Creative Accounting and Fraud (June 6, 2020 - 9am)Document2 pagesDetecting Creative Accounting and Fraud (June 6, 2020 - 9am)Via Commerce Sdn BhdNo ratings yet

- Case Nike Cost of Capital - FinalDocument7 pagesCase Nike Cost of Capital - FinalNick ChongsanguanNo ratings yet

- Financial System Concepts ExplainedDocument59 pagesFinancial System Concepts ExplainedBao Huynh0% (1)

- Regal Bank placed under statutory managementDocument30 pagesRegal Bank placed under statutory managementANDREA RODRIGUEZ DUARTENo ratings yet