Professional Documents

Culture Documents

Bank Recolonization

Uploaded by

asma100%(1)100% found this document useful (1 vote)

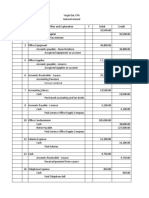

478 views1 pageXYZ Company must reconcile its bank statement that shows an ending balance of $300,000 with its ledger balance of $260,900. The reconciliation includes a $100 bank service charge, $20 interest income, $50,000 in outstanding checks, and $20,000 in undeposited funds. Errors were also made in recording a $470 check as $370 and a $9,800 collection by the bank of a note receivable. Additionally, a $520 deposit was charged back as non-sufficient funds.

Original Description:

Original Title

bank recolonization

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentXYZ Company must reconcile its bank statement that shows an ending balance of $300,000 with its ledger balance of $260,900. The reconciliation includes a $100 bank service charge, $20 interest income, $50,000 in outstanding checks, and $20,000 in undeposited funds. Errors were also made in recording a $470 check as $370 and a $9,800 collection by the bank of a note receivable. Additionally, a $520 deposit was charged back as non-sufficient funds.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

478 views1 pageBank Recolonization

Uploaded by

asmaXYZ Company must reconcile its bank statement that shows an ending balance of $300,000 with its ledger balance of $260,900. The reconciliation includes a $100 bank service charge, $20 interest income, $50,000 in outstanding checks, and $20,000 in undeposited funds. Errors were also made in recording a $470 check as $370 and a $9,800 collection by the bank of a note receivable. Additionally, a $520 deposit was charged back as non-sufficient funds.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

XYZ Company is closing its books and must prepare a bank reconciliation for

the following items:

Bank statement contains an ending balance of $300,000 on February 28,

2018, whereas the company’s ledger shows an ending balance of

$260,900

Bank statement contains a $100 service charge for operating the

account

Bank statement contains interest income of $20

XYZ issued checks of $50,000 that have not yet been cleared by the

bank

XYZ deposited $20,000 but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was

misreported in the cash payments journal as $370.

A note receivable of $9,800 was collected by the bank.

A check of $520 deposited by the company has been charged back as

NSF

Answer:

You might also like

- JOURNALIZINGDocument2 pagesJOURNALIZINGArneld SantiagoNo ratings yet

- Inancial CCTG: Adjusting The AccountsDocument28 pagesInancial CCTG: Adjusting The AccountsLj BesaNo ratings yet

- Assignment Adjusting EntriesDocument2 pagesAssignment Adjusting EntriesKim Patrick VictoriaNo ratings yet

- Journalizing (Doctora) Dr. MarasiganDocument10 pagesJournalizing (Doctora) Dr. Marasigankianna doctoraNo ratings yet

- FAR Chapt 11 Answer KeyDocument19 pagesFAR Chapt 11 Answer KeyJerickho JNo ratings yet

- General Journal: Date Account Titles and Explanation Debit Credit Posting ReferenceDocument9 pagesGeneral Journal: Date Account Titles and Explanation Debit Credit Posting ReferenceCherrie Mae BanaagNo ratings yet

- Worksheet and Financial Statement 4Document21 pagesWorksheet and Financial Statement 4Bhebz Erin MaeNo ratings yet

- Bank ReconciliationDocument60 pagesBank ReconciliationLourdes EyoNo ratings yet

- General Journal, GeveraDocument2 pagesGeneral Journal, GeveraFeiya LiuNo ratings yet

- Mr. Addams' Financial StatementDocument10 pagesMr. Addams' Financial StatementKim KoalaNo ratings yet

- Fabm2 - Se (2) Answer KeyDocument2 pagesFabm2 - Se (2) Answer Keyl m100% (1)

- Pilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksDocument16 pagesPilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksStudent Core GroupNo ratings yet

- Group Activity 1Document10 pagesGroup Activity 1Winshei Cagulada0% (1)

- FAR Chapter4 FinalDocument43 pagesFAR Chapter4 FinalPATRICIA COLINANo ratings yet

- FABM 2 MIDTERM AutoRecoveredDocument15 pagesFABM 2 MIDTERM AutoRecoveredMerdwindelle AllagonesNo ratings yet

- FSDocument44 pagesFSMaria Beatriz Aban Munda100% (2)

- Activity 7 Motivation-GomezDocument12 pagesActivity 7 Motivation-GomezANGELICA FRANSCINE GOMEZ100% (1)

- Lesson 7.4Document7 pagesLesson 7.4crisjay ramosNo ratings yet

- Trial Balance Wk17 GeneralizationDocument1 pageTrial Balance Wk17 GeneralizationYenique SalongaNo ratings yet

- Group 6Document6 pagesGroup 6Love KarenNo ratings yet

- AccountingDocument5 pagesAccountingAbe Loran PelandianaNo ratings yet

- PT .1 in AccountingDocument8 pagesPT .1 in AccountingMerdwindelle Allagones100% (1)

- Resuento - Ulob ActivitiesDocument16 pagesResuento - Ulob Activitiesemem resuentoNo ratings yet

- Midterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Document6 pagesMidterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Vaseline QtipsNo ratings yet

- Bhulero Merchandise Periodic 11 25Document10 pagesBhulero Merchandise Periodic 11 25Mary Jane PalermoNo ratings yet

- Lesson 7 - Activity FABMDocument2 pagesLesson 7 - Activity FABMZamantha MarquezNo ratings yet

- Trial Balance - Daria TolentinoDocument1 pageTrial Balance - Daria TolentinoShaira Nicole VasquezNo ratings yet

- ACTIVITY 1 MabalaDocument5 pagesACTIVITY 1 MabalaJulie mabuyoNo ratings yet

- Accounting QuestionsDocument10 pagesAccounting QuestionsJhaycob Lance Del RosarioNo ratings yet

- Accounting Problems and Exercises4 Accounting Cycle IllustrationDocument1 pageAccounting Problems and Exercises4 Accounting Cycle IllustrationMario Agoncillo50% (2)

- Performance Task No 2 - Group Work - Planning Concepts and Tools P1Document8 pagesPerformance Task No 2 - Group Work - Planning Concepts and Tools P1Corn SaladNo ratings yet

- Midterm 2nd 3rd Meeting RevisedDocument6 pagesMidterm 2nd 3rd Meeting RevisedChristopher CristobalNo ratings yet

- Trucking and StorageDocument2 pagesTrucking and StorageMichael San Luis100% (1)

- Special JournalDocument7 pagesSpecial JournalJohn Christopher Sta AnaNo ratings yet

- Book 1Document6 pagesBook 1ItsRenz YTNo ratings yet

- Journal Entries TradingDocument79 pagesJournal Entries TradingAvox EverdeenNo ratings yet

- Current Asset Current Asset Contra AssetDocument7 pagesCurrent Asset Current Asset Contra AssetAlexander QuemadaNo ratings yet

- Q4 ABM Fundamentals of ABM1 11 Week 4Document4 pagesQ4 ABM Fundamentals of ABM1 11 Week 4Celine Angela AbreaNo ratings yet

- Completing The Acctg CycleDocument14 pagesCompleting The Acctg CycleHearty Hitutua100% (1)

- Group Quiz 1Document3 pagesGroup Quiz 1Joselito Marane Jr.No ratings yet

- 10-Column Worksheet FormDocument1 page10-Column Worksheet FormJewel CabigonNo ratings yet

- Chapter 2 ActivityDocument10 pagesChapter 2 ActivityBELARMINO LOUIE A.No ratings yet

- Accounting 2Document4 pagesAccounting 2Jocelyn Delacruz50% (2)

- WorksheetDocument37 pagesWorksheetKim FloresNo ratings yet

- Accounting 101Document17 pagesAccounting 101Jenne Santiago BabantoNo ratings yet

- Question: Problem On Accrual E. Gevera Realty Co. Who Owns A BuildingDocument2 pagesQuestion: Problem On Accrual E. Gevera Realty Co. Who Owns A BuildingKen SannNo ratings yet

- Accounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Document16 pagesAccounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Fider GracianNo ratings yet

- ACCOUNTING IDENTITY-means That TheDocument23 pagesACCOUNTING IDENTITY-means That TheHel LoNo ratings yet

- ACCTG 1 Week 2-3 - Accounting in BusinessDocument13 pagesACCTG 1 Week 2-3 - Accounting in BusinessReygie FabrigaNo ratings yet

- Financial Accounting and ReportingDocument1 pageFinancial Accounting and ReportingPaula BautistaNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document19 pagesFundamentals of Accountancy, Business and Management 1Shiellai Mae Polintang0% (1)

- Practice Set 1Document1 pagePractice Set 1marissa casareno almuete100% (2)

- Castro Company ZABALLADocument11 pagesCastro Company ZABALLAHelping Five (H5)No ratings yet

- Cost of Goods Sold WorksheetDocument2 pagesCost of Goods Sold Worksheetbutch listangcoNo ratings yet

- General Ledger - Adrianne, Mendoza-BSBA-1 BLK BDocument6 pagesGeneral Ledger - Adrianne, Mendoza-BSBA-1 BLK BJaks ExplorerNo ratings yet

- Unadjusted Trial Balance Adjustments Account Titles Debit Credit DebitDocument6 pagesUnadjusted Trial Balance Adjustments Account Titles Debit Credit DebitAllen CarlNo ratings yet

- Fabm1 Completing The Accounting CycleDocument16 pagesFabm1 Completing The Accounting CycleVenice100% (1)

- Dental Clinic AnswerDocument16 pagesDental Clinic AnswerMaria Licuanan100% (1)

- John Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditDocument3 pagesJohn Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditJessie ForpublicuseNo ratings yet