Professional Documents

Culture Documents

Rogue Trader Inc. Mauricio Montoya Journal Entries October 10, 2011

Uploaded by

mauricio03270 ratings0% found this document useful (0 votes)

9 views1 pageOriginal Title

Rogue_Trader-JE

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageRogue Trader Inc. Mauricio Montoya Journal Entries October 10, 2011

Uploaded by

mauricio0327Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

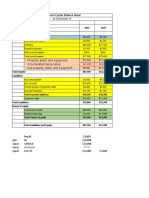

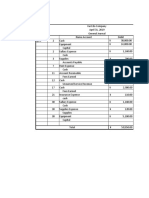

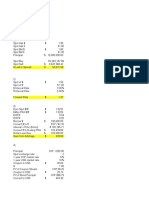

Rogue Trader inc.

Mauricio Montoya

Journal Entries October 10, 2011

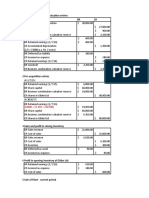

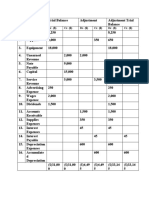

1) Equipment $120,000 16) Pre-Paid Rent $5,000

Notes Payable $100,000 Cash $5,000

Gain $20,000

17) Supply Expense $900

2) Advertising Expense $3,000 Supply $900

Cash $3,000

18) Inventory Exp. $10,000

3) Prepaid Insurance $4,800 Inventory $10,000

Cash $4,800

19) Wage Expense $14,000

4) Interest Expense $2,467 Cash $14,000

Mortgage Payable $3,533

Cash $6,000 Adjustments

a) December Mortgage Interest

5) Acct. Receivable $120,000 Interest Expense $2,374

Sales Revenue $120,000 Interest Payable $2,374

6) Cash $360,000 b) Interest on 10% Note (Oct. 1)

Common Stock $300,000 Interest Expense $2,500

Excess Par $60,000 Interest Payable $2,500

c) Equipment Depreciation

7) Wage Expenses $7,000 Depreciation Exp. $6,000

Cash $7,000 Acc. Depreciation $6,000

8) Equipment $200,000 d) Interest on 15% Note (Nov. 1)

Notes Payable $200,000 Interest Expense $5,000

Interest Payable $5,000

9) Sales Return $5,000 e) Equipment Depreciation

Acct. Receivable $5,000 Depreciation Expense $3,333

Acc. Depreciation $3,333

10) Interest Expense $2,437

Mortgage Payable $7,563 f) Interest on 6% Note

Cash $10,000 Interest Expense $150

Interest Payable $150

11) Inventory $14,000

Cash $5,000 g) Insurance Adjustment

Acct. Payable $9,000 Insurance Exp. $600

Prepaid Insurance $600

12) Cash $115,000

Acct. Recievable$115,000 h) Building Expense

Dep. Expense (Bldg.) $5,000

13) Accounts Payable $9,000 Acc. Depreciation $5,000

Cash $9,000

i) Income Taxes

14) Cash $160,000 Tax Expense $42,000

Sales Revenue $160,000 Tax Payable $42,000

15) Dividend $84,000

Dividend Payable $84,000

You might also like

- 59 Biggest Mistakes Made by Property Investors and How To Avoid Them - Helen Collier-KogtevsDocument129 pages59 Biggest Mistakes Made by Property Investors and How To Avoid Them - Helen Collier-Kogtevsmauricio0327100% (1)

- Nysc Call Up LetterDocument1 pageNysc Call Up LetterVickthor ST77% (13)

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- Analysis of NPADocument31 pagesAnalysis of NPApremlal1989No ratings yet

- Call CenterDocument25 pagesCall Centerbonika08No ratings yet

- Remedial Law Q and ADocument17 pagesRemedial Law Q and Akonvan100% (2)

- Buyer - Full Transaction ChecklistDocument15 pagesBuyer - Full Transaction Checklistmauricio0327No ratings yet

- Module 2 Ver 3.1Document81 pagesModule 2 Ver 3.1Akira Marantal Valdez100% (1)

- Sherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanDocument6 pagesSherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanSherlin KhuNo ratings yet

- Sample Buyer Presentation - 2Document13 pagesSample Buyer Presentation - 2mauricio0327No ratings yet

- Sour BeersDocument3 pagesSour Beersmauricio0327No ratings yet

- Sour BeersDocument3 pagesSour Beersmauricio0327No ratings yet

- Jennys FroyoDocument16 pagesJennys FroyoKailash Kumar100% (2)

- 25 RESA vs. MO 39Document37 pages25 RESA vs. MO 39George Poligratis Rico100% (2)

- Sept. 2021 INSET Notice and Minutes of MeetingDocument8 pagesSept. 2021 INSET Notice and Minutes of MeetingSonny MatiasNo ratings yet

- Solicitor General Vs Metropolitan Manila Authority, 204 SCRA 837 (1991) - BernardoDocument1 pageSolicitor General Vs Metropolitan Manila Authority, 204 SCRA 837 (1991) - Bernardogeni_pearlc100% (1)

- Byte Repair Service, Inc Neraca Saldo December 31, 2013: JurnalDocument5 pagesByte Repair Service, Inc Neraca Saldo December 31, 2013: Jurnaljilboobs100% (2)

- Accounting PincipleDocument12 pagesAccounting PincipleĐạt Đào78% (9)

- Rogue Trader-JEDocument1 pageRogue Trader-JEmauricio0327No ratings yet

- Sports HavenDocument3 pagesSports HavenKailash Kumar100% (1)

- CH 2 - HomeworkDocument5 pagesCH 2 - HomeworkAxel OngNo ratings yet

- 6 DesemberDocument8 pages6 DesemberKezia N. ApriliaNo ratings yet

- Waltham Oil Solution Journal EntriesDocument4 pagesWaltham Oil Solution Journal EntriesVinayak SinglaNo ratings yet

- ACC CUỐI KÌDocument5 pagesACC CUỐI KÌNguyen Thi Thu Phuong (K16HL)No ratings yet

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocument4 pagesThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarNo ratings yet

- ALACDocument18 pagesALACshruthisreehkNo ratings yet

- Lab Pengantar AkuntansiDocument6 pagesLab Pengantar Akuntansirahadatul aishyNo ratings yet

- Akm. P10Document5 pagesAkm. P10Diandra MurtiNo ratings yet

- Chapter 3 PDFDocument15 pagesChapter 3 PDFJay BrockNo ratings yet

- Financial & Managerial Accounting - JunXianDocument5 pagesFinancial & Managerial Accounting - JunXianhashtagjxNo ratings yet

- AFM AssignmentDocument7 pagesAFM AssignmentMudit BhargavaNo ratings yet

- UntitledDocument4 pagesUntitledRima WahyuNo ratings yet

- Assignment CH 6 and 8Document11 pagesAssignment CH 6 and 8Bushra IbrahimNo ratings yet

- 1943191Document5 pages1943191mohitgaba19No ratings yet

- Untitled SpreadsheetDocument7 pagesUntitled SpreadsheetJames Gliponio CamanteNo ratings yet

- BD21060 Aman Assignment2Document10 pagesBD21060 Aman Assignment2Aman KundraBD21060No ratings yet

- Pacilio Securtiy Service Accounting EquationDocument11 pagesPacilio Securtiy Service Accounting EquationKailash KumarNo ratings yet

- Tugas 10Document3 pagesTugas 10Reyhan ArioNo ratings yet

- Statement of Cash Flows ADocument7 pagesStatement of Cash Flows ABabylyn NavarroNo ratings yet

- Akuntansi Account ReceivableDocument8 pagesAkuntansi Account Receivablem habiburrahman55No ratings yet

- Nomor 1: Gain From Bargain Purchase $ - 9,000Document3 pagesNomor 1: Gain From Bargain Purchase $ - 9,000Sherlin KhuNo ratings yet

- Accounting Worksheet (WWW - crafTI.pro)Document2 pagesAccounting Worksheet (WWW - crafTI.pro)abwdigital01No ratings yet

- Modul Lab Akuntansi Lanjutan Ii - P 21.22Document34 pagesModul Lab Akuntansi Lanjutan Ii - P 21.22christin melinaNo ratings yet

- Acct 6065 Second Exam Spring 202104262021Document14 pagesAcct 6065 Second Exam Spring 202104262021Michael Pirone100% (1)

- SCM Topic 1 Blades Solution 2022Document3 pagesSCM Topic 1 Blades Solution 2022Adi KurniawanNo ratings yet

- MC Worksheet-3 (DICKY IRAWAN - C1I017051)Document5 pagesMC Worksheet-3 (DICKY IRAWAN - C1I017051)DICKY IRAWAN 1No ratings yet

- Soal Chapter 1 Hal. 46 P1 - 1 Acquisition Journal Entries (Ebook Beam)Document2 pagesSoal Chapter 1 Hal. 46 P1 - 1 Acquisition Journal Entries (Ebook Beam)SECRET MENUNo ratings yet

- Module 2Document81 pagesModule 2Arra StypayhorliksonNo ratings yet

- 22i 2763Document3 pages22i 2763i222763 Asma JavaidNo ratings yet

- UntitledDocument3 pagesUntitledi222763 Asma JavaidNo ratings yet

- ACC101 Chapter2newDocument19 pagesACC101 Chapter2newCASTOR JAVIERNo ratings yet

- True or False: Multiple ChoiceDocument10 pagesTrue or False: Multiple ChoiceダニエルNo ratings yet

- RIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningDocument4 pagesRIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningRizka OktavianiNo ratings yet

- S11171641 - Youvashni Shivali Narayan-20.7Document6 pagesS11171641 - Youvashni Shivali Narayan-20.7shivnilNo ratings yet

- IA3 Chapter 14 Problem 31Document3 pagesIA3 Chapter 14 Problem 31Bea TumulakNo ratings yet

- Trial Balance-2Document1 pageTrial Balance-2Riski Nack OutsiderNo ratings yet

- ACC101 Chapter2new EditedDocument19 pagesACC101 Chapter2new EditedCASTOR JAVIERNo ratings yet

- Dr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Document3 pagesDr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Ishrat Jahan PapiyaNo ratings yet

- FINC 721 Project 3Document6 pagesFINC 721 Project 3Sameer BhattaraiNo ratings yet

- 158 634353431366610342 New Test 2Document14 pages158 634353431366610342 New Test 2Mara Shaira SiegaNo ratings yet

- Btap Chap 2Document2 pagesBtap Chap 2Thuy DuonggNo ratings yet

- Managerial Accounting Assignment-1: Submitted by Harpreet Singh 2010PGP020Document10 pagesManagerial Accounting Assignment-1: Submitted by Harpreet Singh 2010PGP020happiest1No ratings yet

- Jawaban Latihan SoalDocument31 pagesJawaban Latihan SoalRizalMawardiNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- Seminar 1 ExerciseDocument17 pagesSeminar 1 Exercise蔡雨彤No ratings yet

- 592198Document11 pages592198mohitgaba19No ratings yet

- Reynaldo Gulane CleanersDocument3 pagesReynaldo Gulane CleanersshaneemacasiNo ratings yet

- SOLUTION MANUAL Akm 1 PDFDocument4 pagesSOLUTION MANUAL Akm 1 PDFRizka khairunnisaNo ratings yet

- Diskusi After UTS - 5I - Mutia Maulida - 2102015028 - Consolidation With Loss On Intercompany SaleDocument6 pagesDiskusi After UTS - 5I - Mutia Maulida - 2102015028 - Consolidation With Loss On Intercompany SaleNova AnggrainiNo ratings yet

- Title Commitment GuideDocument1 pageTitle Commitment Guidemauricio0327No ratings yet

- After The Sale - BuyerDocument1 pageAfter The Sale - Buyermauricio0327No ratings yet

- After The Sale - BuyerDocument1 pageAfter The Sale - Buyermauricio0327No ratings yet

- Buyer Offer Cover Letter Example 1Document1 pageBuyer Offer Cover Letter Example 1mauricio0327No ratings yet

- Home Warranty Plan OptionsDocument1 pageHome Warranty Plan Optionsmauricio0327No ratings yet

- Mineral Water Calculator v5Document7 pagesMineral Water Calculator v5mauricio0327No ratings yet

- S95 ManualDocument196 pagesS95 Manualmauricio0327No ratings yet

- Greece (Country Guide) 8th Edition - (Malestrom)Document392 pagesGreece (Country Guide) 8th Edition - (Malestrom)francerossiNo ratings yet

- Muscular Activity During Uphill Cycling PDFDocument12 pagesMuscular Activity During Uphill Cycling PDFCatalin FloreaNo ratings yet

- Beer U: Sour BeerDocument17 pagesBeer U: Sour BeerstonebrewNo ratings yet

- Test - 1 John MarinoDocument15 pagesTest - 1 John Marinomauricio0327No ratings yet

- Hefeweizen NHC PresentationDocument45 pagesHefeweizen NHC Presentationmauricio0327No ratings yet

- HefeweizensDocument4 pagesHefeweizensmauricio0327No ratings yet

- F5205 Quiz - 3 Fall 2012Document1 pageF5205 Quiz - 3 Fall 2012mauricio0327No ratings yet

- Development and Testing ProcessesDocument4 pagesDevelopment and Testing Processesmauricio0327No ratings yet

- Midterm MMDocument15 pagesMidterm MMmauricio0327No ratings yet

- BocksDocument3 pagesBocksmauricio0327No ratings yet

- Global Finance Exam - 2 Fall 2012Document6 pagesGlobal Finance Exam - 2 Fall 2012mauricio0327No ratings yet

- Executive Branch of The GovernmentDocument4 pagesExecutive Branch of The Governmentmauricio0327No ratings yet

- Global Finance Exam - 2 Fall 2012Document6 pagesGlobal Finance Exam - 2 Fall 2012mauricio0327No ratings yet

- Groupon AnalysisDocument2 pagesGroupon Analysismauricio0327No ratings yet

- John Marino - International Finance FinalDocument10 pagesJohn Marino - International Finance Finalmauricio0327No ratings yet

- Global Exam I Fall 2012Document4 pagesGlobal Exam I Fall 2012mauricio0327No ratings yet

- Chapter 6 Financial AssetsDocument6 pagesChapter 6 Financial AssetsAngelica Joy ManaoisNo ratings yet

- Review - Phippine Arch Post WarDocument34 pagesReview - Phippine Arch Post WariloilocityNo ratings yet

- Factura ComercialDocument4 pagesFactura ComercialErick Limpias Rios BridouxNo ratings yet

- Cooperative BankDocument70 pagesCooperative BankMonil MittalNo ratings yet

- Dansart Security Force v. BagoyDocument4 pagesDansart Security Force v. BagoyAyo LapidNo ratings yet

- Part List Ms 840Document32 pagesPart List Ms 840ZANDY ARIALDO VELANDIANo ratings yet

- Decongestion of PNP Lock-Up Cells DTD August 14, 2012 PDFDocument3 pagesDecongestion of PNP Lock-Up Cells DTD August 14, 2012 PDFjoriliejoyabNo ratings yet

- Portrayal of Women in Outdoor Advertising.Document33 pagesPortrayal of Women in Outdoor Advertising.Ali ChaganiNo ratings yet

- Motion To Vacate Summary Eviction OrderDocument3 pagesMotion To Vacate Summary Eviction OrderAlly MakambaNo ratings yet

- The Analysis of Foreign PolicyDocument24 pagesThe Analysis of Foreign PolicyMikael Dominik AbadNo ratings yet

- Program Registration Forms Sea-BasedDocument28 pagesProgram Registration Forms Sea-BasedCharina Marie CaduaNo ratings yet

- Presenters GuidelinesDocument9 pagesPresenters GuidelinesAl Dustur JurnalNo ratings yet

- Fam Law II - CompleteDocument103 pagesFam Law II - CompletesoumyaNo ratings yet

- Arcelor MittalDocument4 pagesArcelor Mittalnispo100% (1)

- Barangay ProfilesDocument3 pagesBarangay ProfilesMello Jane Garcia DedosinNo ratings yet

- Trip ID: 230329124846: New Delhi To Gorakhpur 11:15 GOPDocument2 pagesTrip ID: 230329124846: New Delhi To Gorakhpur 11:15 GOPRishu KumarNo ratings yet

- Applicti9n of Tcs - NQT - V1 - Bundle PackDocument17 pagesApplicti9n of Tcs - NQT - V1 - Bundle PackGopal Jee MishraNo ratings yet

- Letter From SMEIA To British PMDocument4 pagesLetter From SMEIA To British PMpandersonpllcNo ratings yet

- Case Study On Tata NanoDocument12 pagesCase Study On Tata NanoChandel Manuj100% (1)

- Control Scheme For Acb Transformer Incomer Module Type-DaetDocument86 pagesControl Scheme For Acb Transformer Incomer Module Type-DaetAVIJIT MITRANo ratings yet

- PFRS 3 Business CombinationDocument3 pagesPFRS 3 Business CombinationRay Allen UyNo ratings yet

- Privacy and InfDocument13 pagesPrivacy and InfFriedeagle OilNo ratings yet

- Cfa Blank ContractDocument4 pagesCfa Blank Contractconcepcion riveraNo ratings yet