Professional Documents

Culture Documents

Muhammad Bilal PDF

Muhammad Bilal PDF

Uploaded by

MuftiKhurramHussainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Muhammad Bilal PDF

Muhammad Bilal PDF

Uploaded by

MuftiKhurramHussainCopyright:

Available Formats

Dawood Family Takaful Limited / ٔ

Illustration of Benefits for Sukoon Plan / ٔ

Prepared for Muhammad Bilal / Muhammad Bilal ٔ ٔ

Basic Details /

Name / : Muhammad Bilal Date of Birth / ٔ :19-May-1979 Gender / :Male Age / : 41

Commencement Date / ٓ :26-Mar-2020 CNIC / : 3720314966317 Medical / :Non Medical ID / :558691 / 071

Coverage Details /

Half Yearly Contribution / ِ : Pak Rupees / 61,632 Compound Indexation of Basic Annual Contribution / ِ : 0%

Name of Plan or Rider / Sum Covered / ِ Payment/Coverage Term - ٔ / Annual Contribution / ِ

Basic Plan / 1,200,000 10 / 19 120,000

Accidental Death & Disability Benefit (ADDB) / 1,200,000 10 / 19 3,264

Total Annual Contribution / ِ 123,264

Illustrative Values / ٔ

Assumed Investment Returns / ٔ

Cumulative Basic

Basic Annual

Plan Contribution 8% rate of return / 10% rate of return / 12% rate of return /

Plan Year / Contribution /

Paid /

Death Benefit / Death Benefit / Death Benefit /

Cash Value / Cash Value / Cash Value /

ِ ٔ ٔ ٔ

ِ

1 120,000 120,000 1,201,455 0 1,201,475 0 1,201,496 0

2 120,000 240,000 1,215,523 0 1,215,769 0 1,216,015 0

3 120,000 360,000 1,232,307 32,307 1,233,100 33,100 1,233,901 33,901

4 120,000 480,000 1,251,970 51,970 1,253,711 53,711 1,255,492 55,492

5 120,000 600,000 1,346,364 446,187 1,363,369 463,193 1,380,936 480,759

6 120,000 720,000 1,410,494 584,091 1,437,462 611,059 1,465,615 639,212

7 120,000 840,000 1,479,644 729,834 1,519,546 769,735 1,561,654 811,844

8 120,000 960,000 1,554,232 883,978 1,610,434 940,179 1,670,403 1,000,149

9 120,000 1,080,000 1,634,716 1,047,156 1,711,032 1,123,472 1,793,382 1,205,822

10 120,000 1,200,000 1,782,786 1,412,219 1,898,761 1,528,194 2,025,291 1,654,724

15 0 1,200,000 2,079,934 1,867,418 2,404,292 2,191,775 2,783,399 2,570,883

19 0 1,200,000 2,477,499 2,477,499 3,118,551 3,118,551 3,913,950 3,913,950

Inflation Adjusted Cumulative Inflation Adjusted 3.00% Inflation Adjusted 4.00% Inflation Adjusted 5.00%

Plan Year / Main Plan Contribution Paid / rate of return / rate of return / rate of return /

ِ

ِ ِ ِ ِ

19 931,404 1,006,629 1,006,629 1,074,299 1,074,299 1,148,337 1,148,337

Notes for Participant's information / ٔ ء

Contribution Allocation Percentages / ِ :

Year 1 / *: 15% Year 2 / *: 80% Year 3 / : 90% Year 4-10 / : 100% Year 11 onwards / ٔ : 105% (100% Basic Allocation +

5% reward every year from 11th year and onwards) / ( ٔ 5% 100% )

Available Cash Value / ( / ) ٔ ِ :

Year 1 and Year 2 = 0. The ownership of the units will rest with the Takaful Operator in first two policy years and will be transferred to the PIA in the third year.

۔ ٔ (PIA) ٔ ٓ ۔0 =

Plan Benefits / ٔ :

1. Death Benefit = (a) Sum Covered from Waqf + (b) Distributable Surplus from Waqf + (c ) Net balance available in PIA at death.

۔ ُ ء ( )+( ٔ ) ِ ( )+ ٔ ِ ( )= ٔ ۔1

2. Cash Value before maturity = (a) Actuarial Distributable Reserve in Waqf + (b) Distributable Surplus from Waqf, if any+ (c) Net balance availabe in PIA .

۔ ُ ء ( )+ ( ٔ ) ِ ( )+ ( )= ِ ۔2

3. Maturity Benefit (Cash Value at Maturity) = (a) Sum Covered from Waqf + (b) Distributable Surplus from Waqf, if any+ (c) Net balance availabe in PIA.

۔ ُ ء ( )+( ٔ ) ِ ( )+ ٔ ِ ( )=( ) ٔ ۔3

The values provided in the table above are for illustrative purpose only. In case of contribution enhancement, the illustrative values are based on enhanced

contributions. The Company will charge Wakala as per first year gross Wakala % less 5% on additional amount of enhanced contribution. From the year following the

first contribution enhancement year; PIA allocation as per regular plan term will be applicable.

ٓ ِ . (5٪) ِ ۔ ء ِ ِ ۔ ، ٔ

۔ ٔ ٔ

Takaful Operator's Representative: / : Client / :

Signature / : Signature / :

Name & Code / : Name / :

Date / : Date / :

Version: 5.0 Page 1 of 3 Thursday, March 19, 2020 8:09:25 PM

You might also like

- Accounting Cycle of A Merchandising BusinessDocument54 pagesAccounting Cycle of A Merchandising BusinessKim Flores100% (1)

- Aphyd12822220000010350 2019Document1 pageAphyd12822220000010350 2019eyes_ashishNo ratings yet

- Passbook 19 20Document3 pagesPassbook 19 20SiddharthNo ratings yet

- Pybom00469130000000399 2020Document1 pagePybom00469130000000399 2020mohit thapliyalNo ratings yet

- THVSH01161660000010288 2022Document2 pagesTHVSH01161660000010288 2022Pradeep PrabhuNo ratings yet

- Claimspaid 2021Document72 pagesClaimspaid 2021sNo ratings yet

- Pidilite PFDocument6 pagesPidilite PFchandra sekharNo ratings yet

- PYKRP00522730000010817 NewDocument3 pagesPYKRP00522730000010817 NewRanganathan KNo ratings yet

- PUPUN19490870000010031 NewDocument3 pagesPUPUN19490870000010031 NewAbasahebNo ratings yet

- Hardik Epfo PassbookDocument3 pagesHardik Epfo PassbookPurohit HiteshNo ratings yet

- MDMDU10065070000010058 NewDocument2 pagesMDMDU10065070000010058 Newvignesh seenirajNo ratings yet

- KDMAL00237990000014051 NewDocument3 pagesKDMAL00237990000014051 NewSintu DasNo ratings yet

- KDMAL00237990000014051 NewDocument3 pagesKDMAL00237990000014051 NewSintu DasNo ratings yet

- LNL Iklcqd /: Page 1 of 3Document3 pagesLNL Iklcqd /: Page 1 of 3Chintala YesukiranNo ratings yet

- GNGGN00339710000011147 NewDocument2 pagesGNGGN00339710000011147 NewsumeetNo ratings yet

- Cbcbe00875250000000132 2020Document1 pageCbcbe00875250000000132 2020Chithralekha AnanthNo ratings yet

- Tnmas00313090001861778 2022Document2 pagesTnmas00313090001861778 2022Mohan RajNo ratings yet

- Ak Epfo PassbookDocument2 pagesAk Epfo PassbookPranat BajajNo ratings yet

- Cbcbe00562120000014363 2022Document2 pagesCbcbe00562120000014363 2022Anonymous DQGLUZxHNo ratings yet

- LNL Iklcqd /: Page 1 of 3Document3 pagesLNL Iklcqd /: Page 1 of 3Sanjeev KumarNo ratings yet

- JKJMU20358730000010031 NewDocument3 pagesJKJMU20358730000010031 Newnehagupta2930No ratings yet

- DSNHP09433390000966402 NewDocument4 pagesDSNHP09433390000966402 NewPramod KumarNo ratings yet

- MHBAN18726660000011066 NewDocument5 pagesMHBAN18726660000011066 NewPrajyot DeshmukhNo ratings yet

- KDMAL10186510000124029 NewDocument3 pagesKDMAL10186510000124029 NewDharmiNo ratings yet

- KDMAL10186510000124029 NewDocument3 pagesKDMAL10186510000124029 NewDharmiNo ratings yet

- LNL Iklcqd /: Page 1 of 3Document3 pagesLNL Iklcqd /: Page 1 of 3AMAN SHARMANo ratings yet

- GNGGN00290520000013324 NewDocument4 pagesGNGGN00290520000013324 NewSANJIT BAKSHINo ratings yet

- Dividend Zakat & Tax Deduction ReportsDocument4 pagesDividend Zakat & Tax Deduction ReportsfahadullahNo ratings yet

- LNL Iklcqd /: Page 1 of 3Document3 pagesLNL Iklcqd /: Page 1 of 3Ravi ShuklaNo ratings yet

- GJAHD00511080000011101 New PDFDocument2 pagesGJAHD00511080000011101 New PDFQx LtdNo ratings yet

- GRGNT24015980000010013 2022Document2 pagesGRGNT24015980000010013 2022durga prasadNo ratings yet

- LNL Iklcqd /: Page 1 of 3Document3 pagesLNL Iklcqd /: Page 1 of 3Loan LoanNo ratings yet

- MHBAN02112730000650555 NewDocument2 pagesMHBAN02112730000650555 Newanaparthi naveenNo ratings yet

- PUPUN03005390000012400 NewDocument2 pagesPUPUN03005390000012400 Newamol nagraleNo ratings yet

- MHBAN00496110000230098 NewDocument2 pagesMHBAN00496110000230098 NewSâñjây BîñdNo ratings yet

- BP 201 A PSDocument2 pagesBP 201 A PSCharlesNo ratings yet

- MHBAN00496110000230098 NewDocument2 pagesMHBAN00496110000230098 NewSâñjây BîñdNo ratings yet

- MHBAN00496110000203363 NewDocument2 pagesMHBAN00496110000203363 NewAshish SinghNo ratings yet

- TBVLR00308510000022701 2024Document2 pagesTBVLR00308510000022701 2024maazmohammed199636No ratings yet

- CBTRY002772000A0010411 NewDocument3 pagesCBTRY002772000A0010411 Newjency arokiamaryNo ratings yet

- GNGGN19547160000013391 NewDocument4 pagesGNGGN19547160000013391 NewSanjeev KumarNo ratings yet

- TBVLR14392440000010052 NewDocument2 pagesTBVLR14392440000010052 NewAshok Kumar AKNo ratings yet

- Zindagi Premier Takaful Savings Plan Illustration Software - V3 2022 (Valid Till Feb 1, 2023)Document14 pagesZindagi Premier Takaful Savings Plan Illustration Software - V3 2022 (Valid Till Feb 1, 2023)Adil FaruqiNo ratings yet

- MHBAN00354150000432828 New PDFDocument4 pagesMHBAN00354150000432828 New PDF231976No ratings yet

- LNL Iklcqd /: Page 1 of 2Document2 pagesLNL Iklcqd /: Page 1 of 2DharmiNo ratings yet

- MHBAN00456650001296406 New PDFDocument6 pagesMHBAN00456650001296406 New PDFJayant SisodiyaNo ratings yet

- KDMAL10186510000124029 NewDocument2 pagesKDMAL10186510000124029 NewDharmiNo ratings yet

- UPVNS00254400000010096 NewDocument3 pagesUPVNS00254400000010096 Newdeependrakumar946No ratings yet

- TBTAM00614220000011884 NewDocument3 pagesTBTAM00614220000011884 NewSri Abhimanyu SystemsNo ratings yet

- Tbtam00625520000013635 2022Document2 pagesTbtam00625520000013635 2022Jessy JoyNo ratings yet

- ICCL CustomersDocument2 pagesICCL CustomersJoseph KimNo ratings yet

- BP 100B - TracDocument1 pageBP 100B - TracAnton GoNo ratings yet

- PDFDocument1 pagePDFravi sonwaneNo ratings yet

- MRNOI14979840000107562 NewDocument2 pagesMRNOI14979840000107562 NewYouv YadavNo ratings yet

- Organizational Chart of JK BNKDocument1 pageOrganizational Chart of JK BNKUbaid DarNo ratings yet

- Orbbs00069050000021148 2023Document2 pagesOrbbs00069050000021148 2023swatichakra908No ratings yet

- PYKRP00356350000014517 NewDocument3 pagesPYKRP00356350000014517 NewVenu MadhuriNo ratings yet

- Tbtam17712280000013355 2023Document2 pagesTbtam17712280000013355 2023swathirehkar4895No ratings yet

- Accumulator CatalogueDocument4 pagesAccumulator CatalogueDomingos BarrosNo ratings yet

- Nec 4106 Module 1Document28 pagesNec 4106 Module 1Jessie Rey MembreveNo ratings yet

- State of The Art of MicromachiningDocument16 pagesState of The Art of MicromachiningMarcionilo NeriNo ratings yet

- Accounting AssessmentDocument8 pagesAccounting AssessmentPhenixChuanNo ratings yet

- 1 s2.0 S0360319923048711 MainDocument13 pages1 s2.0 S0360319923048711 MainFlames ShoppingNo ratings yet

- DPC-1 Part-1Document17 pagesDPC-1 Part-1kiranNo ratings yet

- Cse M1Document4 pagesCse M1GPNNo ratings yet

- QUARTER 2: MELC #16 (Week 1) W: Fabm 2 Learner'S Packet #10Document2 pagesQUARTER 2: MELC #16 (Week 1) W: Fabm 2 Learner'S Packet #10Crize ScofieldNo ratings yet

- The Retrospective Handbook - A Guide For Agile Teams (PDFDrive)Document141 pagesThe Retrospective Handbook - A Guide For Agile Teams (PDFDrive)VaaniNo ratings yet

- Ad Hoc Rules UCIDocument3 pagesAd Hoc Rules UCISean Felix BaylonNo ratings yet

- DTC P0106, P0107, P0108 4.13: GeneralDocument32 pagesDTC P0106, P0107, P0108 4.13: GeneralKeith ChoiNo ratings yet

- Aakash Gupta - The Ultimate Guide To Getting A PM Job - A No-BS Guide To Getting Your First, or Your Next, Product Management JobDocument300 pagesAakash Gupta - The Ultimate Guide To Getting A PM Job - A No-BS Guide To Getting Your First, or Your Next, Product Management JobTarun SukhijaNo ratings yet

- Goal Setting Canvas Zig PDFDocument2 pagesGoal Setting Canvas Zig PDFPuneet GuptaNo ratings yet

- Assignment AgricultureDocument5 pagesAssignment AgricultureSiLLa ÀntoNyNo ratings yet

- Wilkinson V DowntonDocument2 pagesWilkinson V DowntonShivanie RagoonananNo ratings yet

- Shongololos-Shoes English Bookdash-FKBDocument19 pagesShongololos-Shoes English Bookdash-FKBlaurie fabbriNo ratings yet

- EPM Manual DensityPRODocument196 pagesEPM Manual DensityPRODiego ReyesNo ratings yet

- Is Ethical Hacking Ethical?: Danish JamilDocument6 pagesIs Ethical Hacking Ethical?: Danish JamilFrancisco Paglia0% (1)

- HPCL Super Saver Credit Card TNCDocument8 pagesHPCL Super Saver Credit Card TNCNagaraj VukkadapuNo ratings yet

- Internal Analysis of FedEx VDocument3 pagesInternal Analysis of FedEx Vjasmine8099100% (1)

- Chews A Puppy in Ocoee, Florida Has Announced Their Partnership With Chews AdoptionDocument2 pagesChews A Puppy in Ocoee, Florida Has Announced Their Partnership With Chews AdoptionPR.comNo ratings yet

- Session PlanDocument9 pagesSession PlanAkim SabanganNo ratings yet

- Proceso Armado Diferencial 938 GDocument11 pagesProceso Armado Diferencial 938 GhebertNo ratings yet

- Japanese Candlestick ChartingDocument15 pagesJapanese Candlestick ChartingAlex WongNo ratings yet

- Port of Tallinn: IntroductionDocument21 pagesPort of Tallinn: IntroductionPort of TallinnNo ratings yet

- Lecture 2 - Marketing Ethics and Corporate Social Responsibility With AudioDocument42 pagesLecture 2 - Marketing Ethics and Corporate Social Responsibility With AudioMecheal ThomasNo ratings yet

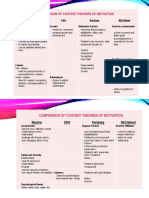

- Comparison of Content THeoriesDocument2 pagesComparison of Content THeoriesMelNo ratings yet

- Registration: How To Register Your Account?Document9 pagesRegistration: How To Register Your Account?Johnson ChristopherNo ratings yet

- UUCMS - Unified University College Management SystemDocument1 pageUUCMS - Unified University College Management Systemanusha.19cs808No ratings yet