Professional Documents

Culture Documents

Groenke Construction Co, Adjustments December 31, 20X7: Adjust # Account Names Debit Credit

Uploaded by

farhann Jatt0 ratings0% found this document useful (0 votes)

32 views5 pagescase study analysis

Original Title

Final.2

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcase study analysis

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views5 pagesGroenke Construction Co, Adjustments December 31, 20X7: Adjust # Account Names Debit Credit

Uploaded by

farhann Jattcase study analysis

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 5

ACT300 Principles of Accounting I

Module 8: Portfolio Project Template Option #1, Part 2

Groenke Construction Company

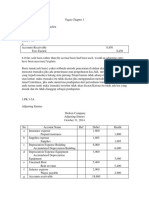

Groenke Construction Co, Adjustments December 31, 20X7

Adjust # Account Names Debit Credit

1 Supplies Expense 2,800

Supplies 2,800

2 Wage expense 3,500

Wages payable 3,500

3 Insurance Expense 8,600

Prepaid insurance 8,600

4 Rent expense 2,250

Rent payable 2,250

5 Depreciation expense 8,000

Accumulated depreciation 8,000

6 Interest expense 450

Accrued interest 450

7 Property tax expense 625

Property tax payable 625

8 Utilities expense 425

Utilities payable 425

Groenke Construction Co, Adjustments December 31, 20X7

Unadjusted Trial Balance Adjustments Adjusted Trial Balance

Acct # Account Names Debit Credit Debit Credit Debit Credit

101 Cash $15,000 $15,000

126 Supplies $8,500 $2,800 $5,700

128 Prepaid insurance $11,200 $8,600 $2,600

167 Equipment $175,000 $175,000

168 Accumulated depreciation - equipment $19,000 $8,000 $27,000

201 Accounts payable $9,250 $9,250

251 Long-term notes payable $45,000 $45,000

301 Stockholders' equity $106,900 $106,900

302 Dividends $15,750 $15,750

401 Demolition fees earned $153,000 $153,000

623 Wage expense $61,800 $3,500 $65,300

633 Interest expense $6,250 $450 $6,700

640 Rent expense $15,750 $2,250 $18,000

683 Property tax expense $12,500 $625 $13,125

684 Repair expense $6,100 6100

690 Utilities expense $5,300 $425 $5,725

Supplies Expense $2,800 $2,800

Wages payable $3,500 $3,500

Insurance Expense $8,600 $8,600

Rent payable $2,250 $2,250

Depreciation expense $8,000 $8,000

Interest payable $450 $450

Property tax payable $625 $625

Utilities payable $425 $425

TOTALS $333,150 $333,150 $26,650 $26,650 $348,400 $348,400

BE SURE TO CREATE A FINANCIAL STATEMENTS FROM THE ADJUSTED TRIAL BALANCE

Groenke Construction Co.

Income Statement

For the year ending December 31, 2007

Revenues:

Demolition fees earned $ 153,000

Expenses:

Wages 65,300

Interest 6,700

Rent 18,000

Property Tax 13,125

Repairs 6,100

Utilities 5,725

Supplies Expense 2,800

Insurance 8,600

Depreciation 8,000

Total expenses $ 134,350

Net income $18,650

Groenke Construction Co.

Statement of Stockholders' Equity

As at Decemeber 31, 2007

Stockholders' Equity, [31-Dec-2007] $ 61,900

Plus: Additional shareholder investment ###

Net income ###

Less: Dividends $ 15,750

Stockholders' Equity, [31-Dec-2007] $ 109,800

Groenke Construction Co.

Balance Sheet

for the year ended Decemeber 31, 2007

Assets Liabilities & Stockholders' Equity

Cash $ 15,000 Accounts Payable $ 9,250

Supplies 5,700 Wages Payable 3,500

Prepaid Insurance 2,600 Rent Payable 2,250

Equipment 175,000 Interest Payable 450

Accumulated Depreciation (27,000) Property Tax Payable 625

Utilities Payable 425

Long-term Notes 45,000

61,500

Total stockholders' equity $ 109,800

Total Assets $ 171,300 Total liabilities and stockholders' equity $171,300

You might also like

- 592198Document11 pages592198mohitgaba19No ratings yet

- Worksheet: Lazlo Service Co. Trial Balance December 31, 2006 Debit CreditDocument2 pagesWorksheet: Lazlo Service Co. Trial Balance December 31, 2006 Debit CreditRoby RamdhanNo ratings yet

- ACC CUỐI KÌDocument5 pagesACC CUỐI KÌNguyen Thi Thu Phuong (K16HL)No ratings yet

- Answer Key - Chapter 6 - ACCOUNTINGDocument92 pagesAnswer Key - Chapter 6 - ACCOUNTINGIL MareNo ratings yet

- Jawaban Latihan SoalDocument31 pagesJawaban Latihan SoalRizalMawardiNo ratings yet

- Adjusting Entries ConstantinoDocument5 pagesAdjusting Entries ConstantinoKyla Lyn OclaritNo ratings yet

- Item (A) Type of Adjustment (B) Accounts Before AdjustmentDocument11 pagesItem (A) Type of Adjustment (B) Accounts Before Adjustmentsuci monalia putriNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTING1Document19 pagesAnswer Key - Chapter 6 - ACCOUNTING1IL MareNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- Accounting Chapter 6Document2 pagesAccounting Chapter 6Kelvin Rex SumayaoNo ratings yet

- Unadjusted Trial BalanceDocument10 pagesUnadjusted Trial BalanceMingxNo ratings yet

- Chapter 5Document27 pagesChapter 5nadima behzadNo ratings yet

- MM Company Unadjusted Trial Balance December 31, 2020Document22 pagesMM Company Unadjusted Trial Balance December 31, 2020KianJohnCentenoTurico100% (2)

- Jawaban Soal UTS Akuntansi Keu - MenengahDocument4 pagesJawaban Soal UTS Akuntansi Keu - MenengahJessinthaNo ratings yet

- Test 2 Jan2023 - Tapah Q2 FS SSDocument4 pagesTest 2 Jan2023 - Tapah Q2 FS SSNajmuddin AzuddinNo ratings yet

- Kidusan Amha Mbao-6074-15A FMA Assignment-11111Document13 pagesKidusan Amha Mbao-6074-15A FMA Assignment-11111Kidusan AmhaNo ratings yet

- Accounting Compeleting The CycleDocument14 pagesAccounting Compeleting The CyclecamilleNo ratings yet

- Corrected TB CH 2Document1 pageCorrected TB CH 2Birhanu DesalegnNo ratings yet

- BSBFIN401 Assessment 3Document6 pagesBSBFIN401 Assessment 3Kitpipoj PornnongsaenNo ratings yet

- Chapter 3 Practice QuestionsDocument3 pagesChapter 3 Practice QuestionsFamily PicturesNo ratings yet

- Accounting 10 ColumnsDocument2 pagesAccounting 10 ColumnsTRIXIEJOY INIONNo ratings yet

- #Chapter 4 Asignación (Recovered)Document22 pages#Chapter 4 Asignación (Recovered)adrianasofiagomez14No ratings yet

- Financial Accounting - Assignment #1#Document5 pagesFinancial Accounting - Assignment #1#Hasan NajiNo ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- Practice Questions For Closing EntriesDocument2 pagesPractice Questions For Closing EntriesZainullah KhanNo ratings yet

- Budget Car Rentals QuestionDocument1 pageBudget Car Rentals QuestionMd Jahid HossainNo ratings yet

- P3 2A AnswerDocument2 pagesP3 2A AnswerMinh NhậtNo ratings yet

- Nguyen Thu HuyenDocument8 pagesNguyen Thu Huyenhuyền nguyễnNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- Bali Company Worksheet For The Year Ended December 31, 2020: InstructionsDocument4 pagesBali Company Worksheet For The Year Ended December 31, 2020: Instructionsshera haniNo ratings yet

- Incomplete Records MTQDocument5 pagesIncomplete Records MTQqas4476pubNo ratings yet

- Dnda Putri Nurhaliza - Tugas Chapter 3Document2 pagesDnda Putri Nurhaliza - Tugas Chapter 3dindawatanabe54No ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- ACCT 2105 Tutorial Exercises - Topic 4 - Income StatementDocument8 pagesACCT 2105 Tutorial Exercises - Topic 4 - Income StatementHoàng Trọng HiếuNo ratings yet

- HMGT2280 Chapter 4 HomeworkDocument7 pagesHMGT2280 Chapter 4 HomeworkAdrizal MatorangNo ratings yet

- Worksheet Complete Exercise ns3Document8 pagesWorksheet Complete Exercise ns3Steven consueloNo ratings yet

- Amanda D - Excel 2Document3 pagesAmanda D - Excel 2api-643373008No ratings yet

- Financial Accounting-Assignment-4Document4 pagesFinancial Accounting-Assignment-4Margaux JohannaNo ratings yet

- 01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022Document6 pages01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022hermitpassiNo ratings yet

- Review Accounting 1Document9 pagesReview Accounting 1jhouvanNo ratings yet

- PA-1 Adjusments and Worksheet (Problems)Document5 pagesPA-1 Adjusments and Worksheet (Problems)Safira ChairunnisaNo ratings yet

- Accumulated Depreciation of BuildingDocument12 pagesAccumulated Depreciation of BuildingLukastheofilus oNo ratings yet

- Lab Komputer Akuntansi KeuanganDocument8 pagesLab Komputer Akuntansi KeuanganlistianiNo ratings yet

- Handout 1 Adjusting Entries Adjusted Trial Balance Financial Statements Answer KeyDocument3 pagesHandout 1 Adjusting Entries Adjusted Trial Balance Financial Statements Answer KeyKris Dela CruzNo ratings yet

- Financial Statement HandoutDocument5 pagesFinancial Statement Handoutmuzamilarshad31No ratings yet

- Asm ACCOUNTINGDocument16 pagesAsm ACCOUNTINGVũ Khánh HuyềnNo ratings yet

- Accounting Cycle Requirement 1: Journal Entries T-AccountsDocument5 pagesAccounting Cycle Requirement 1: Journal Entries T-Accountsnerissa belloNo ratings yet

- Protecto Company Purchaesed 75 Percent of StrandDocument4 pagesProtecto Company Purchaesed 75 Percent of Strandlaale dijaanNo ratings yet

- Principles of Accounting (A B E)Document3 pagesPrinciples of Accounting (A B E)r kNo ratings yet

- Sure IpadalaDocument1 pageSure IpadalaChristine LogdatNo ratings yet

- Cash CA NCA CLDocument8 pagesCash CA NCA CL15vinayNo ratings yet

- Ex 2Document13 pagesEx 2Phuong Vu HongNo ratings yet

- Group Assignment Account SEM1Document7 pagesGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeNo ratings yet

- Aldrich Magnaye BSA 1 B Problem 8 ActivityDocument5 pagesAldrich Magnaye BSA 1 B Problem 8 ActivityAnonnNo ratings yet

- Sports HavenDocument3 pagesSports HavenKailash Kumar100% (1)

- Retained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Document21 pagesRetained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Umar Razi QasimNo ratings yet

- Problem and Chart of AccountsDocument2 pagesProblem and Chart of AccountsRey Joyce AbuelNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Why WACC Is Important To Consider For CompaniesDocument8 pagesWhy WACC Is Important To Consider For Companiesfarhann JattNo ratings yet

- MOD8Document2 pagesMOD8farhann JattNo ratings yet

- Payback Period Year Cash Flows Cumulative Cash FlowsDocument8 pagesPayback Period Year Cash Flows Cumulative Cash Flowsfarhann JattNo ratings yet

- Bank Statement Balance $15,875 Add: Deposit in Transit $52,000 Erroneous Withdrawl $5,000 Deduct: Outstanding Checks $2,075 Erroneous Deposit $3,000Document4 pagesBank Statement Balance $15,875 Add: Deposit in Transit $52,000 Erroneous Withdrawl $5,000 Deduct: Outstanding Checks $2,075 Erroneous Deposit $3,000farhann JattNo ratings yet

- Journal Entries: ACT300 Principles of Accounting Module 2: Critical Thinking Template Option #1Document4 pagesJournal Entries: ACT300 Principles of Accounting Module 2: Critical Thinking Template Option #1farhann JattNo ratings yet

- Shares: A - Preferred and Common ShareDocument3 pagesShares: A - Preferred and Common Sharefarhann JattNo ratings yet

- Answer: Supporting Documents Serve As A Great Tool To Help Accountants To KeepDocument1 pageAnswer: Supporting Documents Serve As A Great Tool To Help Accountants To Keepfarhann JattNo ratings yet

- Apple IncDocument13 pagesApple Incfarhann JattNo ratings yet

- Date Account Names Debit CreditDocument2 pagesDate Account Names Debit Creditfarhann JattNo ratings yet

- The Correlation Between Poverty and Reading SuccessDocument18 pagesThe Correlation Between Poverty and Reading SuccessocledachingchingNo ratings yet

- Motivation, Budgets and Responsibility AccountingDocument5 pagesMotivation, Budgets and Responsibility AccountingDesak Putu Kenanga PutriNo ratings yet

- Investor / Analyst Presentation (Company Update)Document48 pagesInvestor / Analyst Presentation (Company Update)Shyam SunderNo ratings yet

- Army Institute of Law, MohaliDocument11 pagesArmy Institute of Law, Mohaliakash tiwariNo ratings yet

- Become A Partner Boosteroid Cloud Gaming PDFDocument1 pageBecome A Partner Boosteroid Cloud Gaming PDFNicholas GowlandNo ratings yet

- Cyborg Urbanization - Matthew GandyDocument24 pagesCyborg Urbanization - Matthew GandyAngeles Maqueira YamasakiNo ratings yet

- SH INDUSTRIAL 1 2023.02.03 Contract of Service vs. Contract For Service ENGDocument5 pagesSH INDUSTRIAL 1 2023.02.03 Contract of Service vs. Contract For Service ENGthe advantis lkNo ratings yet

- Abaga Loiweza C. BEED 3A Activity 4.ADocument4 pagesAbaga Loiweza C. BEED 3A Activity 4.ALoiweza AbagaNo ratings yet

- Tadao Ando: List of Building ProjectsDocument15 pagesTadao Ando: List of Building ProjectsDivya JandhyalaNo ratings yet

- Secret Trust EssayDocument3 pagesSecret Trust Essayshahmiran99No ratings yet

- Louis BegleyDocument8 pagesLouis BegleyPatsy StoneNo ratings yet

- GM DS-3 End Term Submission - RMKVDocument15 pagesGM DS-3 End Term Submission - RMKVShrutiNo ratings yet

- Engleza Intensiv Subiectul II Variante 001 100 An 2008ututyuutrDocument101 pagesEngleza Intensiv Subiectul II Variante 001 100 An 2008ututyuutrTeo CoddinNo ratings yet

- Speed Up Your BSNL BroadBand (Guide)Document13 pagesSpeed Up Your BSNL BroadBand (Guide)Hemant AroraNo ratings yet

- (Asian Connections) Prasenjit Duara - The Crisis of Global Modernity - Asian Traditions and A Sustainable Future-Cambridge University Press (2015)Document339 pages(Asian Connections) Prasenjit Duara - The Crisis of Global Modernity - Asian Traditions and A Sustainable Future-Cambridge University Press (2015)MichaelCarloVillasNo ratings yet

- 2018 Management Accounting Ibm2 PrepDocument9 pages2018 Management Accounting Ibm2 PrepВероника КулякNo ratings yet

- Grade 1 Booklet Part 1Document33 pagesGrade 1 Booklet Part 1SOBWAJUNNo ratings yet

- Biofuel Production From Citrus Wastes IranDocument13 pagesBiofuel Production From Citrus Wastes IranRoberto Moreno MuñozNo ratings yet

- Annex 2. 4. 1-Water Storage Final ReportDocument46 pagesAnnex 2. 4. 1-Water Storage Final ReportMonday Gahima DeoNo ratings yet

- Culture Lect 2Document4 pagesCulture Lect 2api-3696879No ratings yet

- Multiple Choice Questions: Compiled by CA Bhanwar BoranaDocument45 pagesMultiple Choice Questions: Compiled by CA Bhanwar BoranaGirishNo ratings yet

- Kerala Tour Package 1Document6 pagesKerala Tour Package 1mountsNo ratings yet

- 21 Century Literature From The Philippines and The WorldDocument15 pages21 Century Literature From The Philippines and The WorldJill MaguddayaoNo ratings yet

- Dutch Lady NK Present Isnin 1 C PDFDocument43 pagesDutch Lady NK Present Isnin 1 C PDFAbdulaziz Farhan50% (2)

- Tamilnadu Places of Public Resort ActDocument18 pagesTamilnadu Places of Public Resort ActGobichettipalayam Municipality GMCNo ratings yet

- ICT - Rice Farmers - KujeDocument12 pagesICT - Rice Farmers - KujeOlateju OmoleNo ratings yet

- The Life God Has Called Me To LiveDocument3 pagesThe Life God Has Called Me To LiveOluwafunsho RaiyemoNo ratings yet

- Browerville Blade - 08/08/2013Document12 pagesBrowerville Blade - 08/08/2013bladepublishingNo ratings yet

- HandoutDocument2 pagesHandoutDino ZepcanNo ratings yet

- Battery Storage Solution: With Fronius GEN24 Plus and BYD Battery-Box Premium HVS/HVMDocument4 pagesBattery Storage Solution: With Fronius GEN24 Plus and BYD Battery-Box Premium HVS/HVMcipri1981No ratings yet