Professional Documents

Culture Documents

Tax Calculator (Salary Format)

Tax Calculator (Salary Format)

Uploaded by

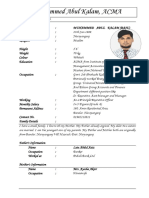

Muhammed Abul Kalam AcmaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Calculator (Salary Format)

Tax Calculator (Salary Format)

Uploaded by

Muhammed Abul Kalam AcmaCopyright:

Available Formats

Name

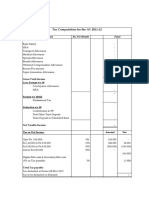

Computation of Taxable Income & Tax Liability

Assessment Year: 2016-2017 (IY: 2015-2016)

ETIN:

Components

Income Amount Exemption Taxable Income

Income from Salary U/S-21

Basic Salary - -

House Rent - -

Medical Allowance - -

Conveyance Allowance - -

House Maintenance - -

Entertainment Allowance - -

Utilities Allowance -

PF Employer's Contribution - -

Interest Income from PF - -

Bonus - -

Leave Fare Assistance - -

Employer Provided car (select "Yes" if yes) No - -

Other - -

Total Taxable income from Salary - - -

Income from Other Sources U/S-33

Interest on Savings Deposit - -

Interset on DPS - -

Other - -

Total income from Other Sources - - -

Total Taxable Income - - -

Allowable Investment

PF both Contribution -

DPS

Benevolent fund

Schanchaypatra

Life Insurance Premium

Laptop/Computer -

Others (if any)

Actual Investment -

Allowable Limit/Elegible amount -

Tax Rebate on Allowable Investment

Total Income does not exceed Tk. 10 lac so 15% of allowable limit -

Amount of Tax Payable (Tk.)

Please Select your Category >>>>>>> Male

Income Tax Rate Tax

Up to First - Nil -

Next - 10% -

Next - 15% -

Next - 20% -

Next - 25% -

Remaining - 30% -

Maximum you can Invest for rebate - Gross Tax Liability -

- Less: Investment Rebate -

Limit Available Tax Liability -

- Minimum Tax -

Please Select where you reside Net Tax Liability -

Add: Surcharge - -

Dhaka/Chittagong

Total Tax Liability -

Write Down your Net Worth Tk. Less: TDS on Salary

Less: TDS against car

Less: TDS on Interest -

Md. Shakhawat Hossain, ITP (01733629666, 04470019336)

TDS Per month (Salaried Employee) Less: Tax Refund due up to I/Y-14-15 -

- Tax Payable -

Md. Shakhawat Hossain, ITP (01733629666, 04470019336)

You might also like

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFfpenalozalNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFArifNo ratings yet

- Profit and Loss Statement Multi StepDocument1 pageProfit and Loss Statement Multi StepDevyani SharmaNo ratings yet

- Precedent Transaction Template - NewDocument5 pagesPrecedent Transaction Template - NewAmay SinghNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Business-Budget 12monthsDocument5 pagesBusiness-Budget 12monthsEyob SNo ratings yet

- Budgeting and Forecasting: and The Impact On ProfitabilityDocument33 pagesBudgeting and Forecasting: and The Impact On ProfitabilityHassan AzizNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementKakz KarthikNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementUtiyyalaNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementCarl SoriaNo ratings yet

- Business-Budget 12monthsDocument6 pagesBusiness-Budget 12monthsReza KurniaNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFCarl SoriaNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementKNNo ratings yet

- Household Budget PlannerDocument8 pagesHousehold Budget PlannersumithNo ratings yet

- Profit and Loss ProjectionDocument3 pagesProfit and Loss ProjectionDokumen SayaNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementGejehNo ratings yet

- Word Blank CV Template Example 15Document2 pagesWord Blank CV Template Example 15mantika09No ratings yet

- Computation Details: Ali Hassan M. Lucman Jr. Hermeno A. PalamineDocument1 pageComputation Details: Ali Hassan M. Lucman Jr. Hermeno A. PalamineKobi SaibenNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFfpenalozal100% (1)

- City Bank StatementDocument1 pageCity Bank StatementMuhammed Abul Kalam Acma63% (8)

- Nigerian PAYE Calculator 4.0Document2 pagesNigerian PAYE Calculator 4.0obumuyaemesi100% (1)

- Income Tax Calculator FY 2023 24Document1 pageIncome Tax Calculator FY 2023 24Balamurali KirankumarNo ratings yet

- Untitled SpreadsheetDocument8 pagesUntitled SpreadsheetAretha DawesNo ratings yet

- Template Budget and Cash FlowDocument6 pagesTemplate Budget and Cash FlowlliombajnrNo ratings yet

- Business Budget 12monthsDocument4 pagesBusiness Budget 12monthsArie KristionoNo ratings yet

- Business-Budget 12monthsDocument5 pagesBusiness-Budget 12monthsSRININo ratings yet

- Personal Monthly Budget1Document3 pagesPersonal Monthly Budget1Olivia OctoficeNo ratings yet

- 3-Year Profit and Loss Projection: Merca OnlineDocument3 pages3-Year Profit and Loss Projection: Merca OnlineOrlandoAvendañoNo ratings yet

- Expense Budget Sheet 8669ndpdg 05 23 2Document2 pagesExpense Budget Sheet 8669ndpdg 05 23 2Ode Kustriani AtmajaNo ratings yet

- Bussines BudgetDocument2 pagesBussines BudgetMUHAMMAD RABBIL ALBADRINo ratings yet

- 2021 April Budget: Minilec India Pvt. LTDDocument4 pages2021 April Budget: Minilec India Pvt. LTDShantanu ParanjapeNo ratings yet

- Images/ 1profit and Loss Statement Single StepDocument1 pageImages/ 1profit and Loss Statement Single Steplexiakennedy746No ratings yet

- Template BudgetDocument2 pagesTemplate Budgetene_andreyNo ratings yet

- Business-Budget & OverheadDocument6 pagesBusiness-Budget & OverheadALAF SINERGI SDN BHDNo ratings yet

- Anggaran BisnisDocument4 pagesAnggaran BisnisAlfiani FadillahNo ratings yet

- Annual Business Budget TemplateDocument5 pagesAnnual Business Budget TemplateTJ 17 ChannelNo ratings yet

- EFY Bussiness BudgetDocument4 pagesEFY Bussiness BudgetFinance Dental JayaNo ratings yet

- Business BudgetDocument5 pagesBusiness Budgetbasel abduNo ratings yet

- New Tax Calculator - AY 17-18Document11 pagesNew Tax Calculator - AY 17-18Rohankumar KshirsagarNo ratings yet

- Balance Sheet TemplateDocument4 pagesBalance Sheet TemplateSolomon Ahimbisibwe100% (1)

- 2022 Budget: (Company Name)Document6 pages2022 Budget: (Company Name)Raffy Pax Galang RafaelNo ratings yet

- Before Going To The Next (T C) Sheet, First Read The Following InstructionsDocument16 pagesBefore Going To The Next (T C) Sheet, First Read The Following InstructionsGopal KasatNo ratings yet

- Business Budget 12monthsDocument4 pagesBusiness Budget 12monthsSadia RahmanNo ratings yet

- Score Financial Spreadsheet TemplateDocument29 pagesScore Financial Spreadsheet TemplateMohamed Shaffaf Ali RasheedNo ratings yet

- Pro-Forma Income Statement: RevenueDocument6 pagesPro-Forma Income Statement: Revenuemas kapcaiNo ratings yet

- 2022 Tax ComputationDocument7 pages2022 Tax ComputationGeo Mosaic Diaz (Jiyu)No ratings yet

- Indian Tax ComputationDocument1 pageIndian Tax ComputationrahuuulsharmaNo ratings yet

- Difference - Monthly Income: Housing EntertainmentDocument4 pagesDifference - Monthly Income: Housing EntertainmentKhay KhayNo ratings yet

- Tax Summary 2019 Ver.1Document163 pagesTax Summary 2019 Ver.1Aiko Cherrie NakamuraNo ratings yet

- CASHFLOW JuegoDocument1 pageCASHFLOW JuegoRebeca Valverde DelgadoNo ratings yet

- Audit Finance ReportingDocument5 pagesAudit Finance ReportingIbtissam BelkaydNo ratings yet

- Cash FlowDocument1 pageCash FlowadsakljfnmdsklNo ratings yet

- Financial StatementsDocument5 pagesFinancial Statementskl2304013112No ratings yet

- Breakeven and Profit-Volume-Cost AnalysisDocument4 pagesBreakeven and Profit-Volume-Cost AnalysisNu SNo ratings yet

- Full & Final Payment Statement: (A) PaymentsDocument2 pagesFull & Final Payment Statement: (A) PaymentsAkash KumarNo ratings yet

- It 23-24Document5 pagesIt 23-24Alok G ShindeNo ratings yet

- Azurea Spa - Bohol Yearly Budget TemplateDocument2 pagesAzurea Spa - Bohol Yearly Budget TemplateAzurea SpaNo ratings yet

- Incomes and Expenditures Account FormatDocument2 pagesIncomes and Expenditures Account FormatAmitShankarNo ratings yet

- 5 May PS 2022Document4 pages5 May PS 2022Almira CaranogNo ratings yet

- Income Statement - MonthlyDocument11 pagesIncome Statement - MonthlyRickyNo ratings yet

- CH 1 - Determination of National IncomeDocument13 pagesCH 1 - Determination of National IncomePrathmesh BhansaliNo ratings yet

- RMC No. 73-2019 - 1604C Alphalist Format Jan 2018 Final2Document2 pagesRMC No. 73-2019 - 1604C Alphalist Format Jan 2018 Final2Leo R.No ratings yet

- Certify: To Whom It May ConcernDocument1 pageCertify: To Whom It May ConcernMuhammed Abul Kalam AcmaNo ratings yet

- Salary CertificateDocument1 pageSalary CertificateMuhammed Abul Kalam AcmaNo ratings yet

- Foreign Exchange Risk Management Guidelines: Social Islami Bank LimitedDocument4 pagesForeign Exchange Risk Management Guidelines: Social Islami Bank LimitedMuhammed Abul Kalam AcmaNo ratings yet

- TIN Certificate KalamDocument1 pageTIN Certificate KalamMuhammed Abul Kalam Acma100% (1)

- Some Important Abbreviation For ITP ExamDocument3 pagesSome Important Abbreviation For ITP ExamMuhammed Abul Kalam AcmaNo ratings yet

- Kalam Matrimonial CV UpdatedDocument2 pagesKalam Matrimonial CV UpdatedMuhammed Abul Kalam AcmaNo ratings yet

- Kalam Matrimonial CVDocument2 pagesKalam Matrimonial CVMuhammed Abul Kalam AcmaNo ratings yet

- Muhammed Abul Kalam Cover LetterDocument1 pageMuhammed Abul Kalam Cover LetterMuhammed Abul Kalam AcmaNo ratings yet

- Coa Sistem ElvisDocument10 pagesCoa Sistem ElvisAli ErlanggaNo ratings yet

- Accounting For Government Grant - HandoutDocument2 pagesAccounting For Government Grant - HandoutFrankie Asido0% (1)

- University of Dhaka Department of Statistics Syllabus For 4-Year B.S. (Honors) Starting Sessions: 2017-2018Document45 pagesUniversity of Dhaka Department of Statistics Syllabus For 4-Year B.S. (Honors) Starting Sessions: 2017-2018Janus MalikNo ratings yet

- T&A C.2 History of Income Tax of NepalDocument10 pagesT&A C.2 History of Income Tax of NepalSabina Aryal RegmiNo ratings yet

- Appendix 7C - RROR-IGDocument3 pagesAppendix 7C - RROR-IGTesa GDNo ratings yet

- Common Sense EconomicsDocument4 pagesCommon Sense EconomicsMichael CotterNo ratings yet

- Chapter-7 Asset Held For Sale and Discontinued OperationDocument17 pagesChapter-7 Asset Held For Sale and Discontinued OperationbikilahussenNo ratings yet

- COMPUTATION ReadingDocument4 pagesCOMPUTATION ReadingSankalp BhardwajNo ratings yet

- XXXXDocument1 pageXXXXravinakhanhifiNo ratings yet

- Tata Motors: PrintDocument2 pagesTata Motors: Printprathamesh tawareNo ratings yet

- Eco Chap5 Teach PointDocument35 pagesEco Chap5 Teach Pointbrook zelekeNo ratings yet

- The Basic Income Illusion: Alex Gourevitch Lucas StanczykDocument22 pagesThe Basic Income Illusion: Alex Gourevitch Lucas StanczykVladimir Cristache100% (1)

- IAS 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument5 pagesIAS 20 Accounting For Government Grants and Disclosure of Government AssistanceShiza ArifNo ratings yet

- Venus Manuscript CVV EditedDocument45 pagesVenus Manuscript CVV EditedFrancis Dave Peralta BitongNo ratings yet

- Computation of Income: Nazneen Mohammed Javed ShaikhDocument3 pagesComputation of Income: Nazneen Mohammed Javed ShaikhRahul RampalNo ratings yet

- Strat CostDocument6 pagesStrat CostrylNo ratings yet

- CH 19Document8 pagesCH 19Saleh RaoufNo ratings yet

- Sudhir Anand and Amartya SenDocument34 pagesSudhir Anand and Amartya SenAnkur SinghNo ratings yet

- Top Glove 2020, 2021Document3 pagesTop Glove 2020, 2021nabil izzatNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPAchut GoreNo ratings yet

- Bcom Comp IV Apr2019 Income Tax Law and Practice-IDocument4 pagesBcom Comp IV Apr2019 Income Tax Law and Practice-IKunal NandaNo ratings yet

- Excel RevenueDocument44 pagesExcel RevenueromaricheNo ratings yet

- 4 - Taxation LawDocument10 pages4 - Taxation LawNikkiAndradeNo ratings yet

- Eventi 2020 - 8 Rules of Private Investor - OnlineDocument24 pagesEventi 2020 - 8 Rules of Private Investor - OnlineVăn Nam TrươngNo ratings yet

- FAR Assignment - 2Document7 pagesFAR Assignment - 2Melvin ShajiNo ratings yet

- Profit and Loss WiproDocument2 pagesProfit and Loss WiproSai SunilNo ratings yet

- BIR Ruling 101-18 wPEDocument8 pagesBIR Ruling 101-18 wPEKathyrn Ang-ZarateNo ratings yet

- Responsibility Acctg Transfer Pricing GP AnalysisDocument33 pagesResponsibility Acctg Transfer Pricing GP AnalysisMoonNo ratings yet

- Assignment 1 Acc406 (Group)Document16 pagesAssignment 1 Acc406 (Group)syamimi zuhailiNo ratings yet

- Junior Philippine Institute of Accountants Income Statement For The Academic Year Ended May 31, 2021Document5 pagesJunior Philippine Institute of Accountants Income Statement For The Academic Year Ended May 31, 2021Julliena BakersNo ratings yet