Professional Documents

Culture Documents

India-RE-Map Sept 2019 PDF

India-RE-Map Sept 2019 PDF

Uploaded by

vrpankajOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India-RE-Map Sept 2019 PDF

India-RE-Map Sept 2019 PDF

Uploaded by

vrpankajCopyright:

Available Formats

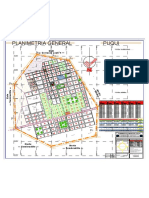

INDIA RE

Lead sponsor Associate sponsor

MAP 2019

SEPTEMBER

www.bridgetoindia.com

Total utility scale wind and solar capacity as on 30 September 20191

All figures in MW

DISCOM offtake NTPC offtake

6,738 3,777

SECI offtake

Public sector development 5,035

204

Public sector development

2,090

SECI offtake

9,540

NTPC offtake

1,950 DISCOM offtake

32

5 Solar 13,753

33

5 DISCOM offtake 18,432 Solar

698

UTTAR PRADESH

5

29,722

Comm.

840 Pipeline

1,120

Pipeline

1,170

SECI offtake 28,665

Wind

490

1

19

8,335 10,233

5

50 Commissioned Public sector

15 66,650 development

793

UTTARAKHAND Others

Commissioned NTPC offtake 4,273

225

1,200 Others

3,140 Wind SECI offtake

8

36,928 1,749

Commissioned

219 13 24

200

16

16

PUNJAB 1

5

Commissioned

850

11

JHARKHAND

Commissioned DISCOM offtake

16

HARYANA 821

126 32,039

Commissioned

57

125

30

BIHAR

250

1,200 16 17

2

3,

12

WEST BENGAL

1,

65

5

0

5

82

3,9

800 MW

RAJASTHAN

3,

Commissioned

22

270 431

Pipeline 107

4,070

Commissioned 150 310

366

10,094 105

1,6

74

00 1,3 55 72

1,8

6,172 1,9 50 98

4,2

82 2,0 65

15

2,0

33

GUJARAT

2,0

143 198

8

282

46

Pipeline

2,263

Commissioned

8,924 300 MW 22

6,878

6,453 CHHATTISGARH

Commissioned

100

105

207

20

60

80

220 1

20

182 340

20 5

Pipeline

202 5

1,17

MADHYA PRADESH

1,92

81

5

7

2,429

Commissioned

4,356

ODISHA Pipeline

101

2

41

51

23 Commissioned

304

385

290

400

129 458 58

30

5

37 128 9

21

Pipeline

30

21 15 300 MW

TELANGANA 152

815

0

866 Commissioned

05 32

17 282

1,7 1,4 6 3,649

6

74

15

2,0

1,278 MW

MAHARASHTRA 3,521

310

Pipeline

2,515

ANDHRA PRADESH

2,689

ANDAMAN &

500

2,668

Commissioned

6,257 NICOBAR ISLANDS

90

4,783

4,693 750 1,5

Total RE capacity addition

37

516 MW 57

5

from 2014 until

0

2,2

September 2019

25

18

Pipeline

400

1,325

3,488

Comm.

281

5

0 605 Commissioned

24 9

1,5 30 7,580

672

77

993 10

45

< 1 GW

1,0

Pipeline

4,0 42

3,8

KARNATAKA 25

92

7

95

Pipeline

40

3

1,233 19

1-3 GW

3,203

3,175

4,742

Commissioned

3-5 GW

00

3,78

11,242 50

743

6,5

5

91 561 758

2

1,5

5-7 GW

1,75

2,3 60

28

50

3,3

Pipeline

33

Pipeline 611 > 7 GW

TAMIL NADU

62

22

KERALA

269

729

78

Commissioned

Commissioned

136

12,934

Huawei inverters

58

7,2

9,5

capacity commissioned

54

74

12

2

14

12

in the state

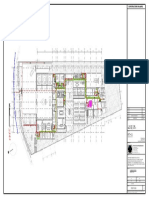

Leading players1

(projects commissioned between October 2018 - September 2019, totaling 8,972 MW)

Project developers Module suppliers Inverter suppliers Solar EPC contractors Turbine manufacturers

(estimated DC size - 8,173 MW) (AC size - 6,320 MW) (AC size - 6,164 MW) (2,236 MW)

SCHNEIDER 1.

OT

OTHERS 1.4%

INOX

SENVION 1.3%

OTHERS 0.5%

HE

REGEN 1.3%

R

WE

OTH

KEH

S&W 9.6%

RS

RA

WIND

YS

GE 1.3%

PO

/

ERS

NO

UA 3

HI

PO

CO

TA

TA

HE WE

TK

GY

N

3%

2.7%

TA

C

GE

11.4

TI

.2%

RO R I N

NER

Y

HI

NO

N

TE

G

FU NF

UU

5.9

S

ER

5.1

%

SU

W

TU RA

8.8

M

DE

NE

%

N1

A

%

EN

R 1 AC

LT DR

1.

GR E 1. .1% CIO

1%

A N

ISE

9.1

INE HI

SB

T 1% 5.7 NA

AC

ME 1.6% SH MA

%

IC

% 7.5

%R

ESS ZN

6%

% %

EL 1 % 6.6 ON

TM

INF .7% 8.5 ZL

11.4

13.

RA YI

AME

RISONGLI 0 SU

.2%

MAHI 1.8%

NDRA

SUST % N

LC L

HANW AR 0.8%

.8% .6%

24

EN 2.2 12.6 HA 1.2 29

% %

EMMVEE L&T

INOX WIND 1.3% ABB 11.1 SELF-E

PC 31.5 5.5%

2.3% TATA POWER 1.4 %

% 7.9% VIKRAM SOLAR %

GREENKO 2.3% LONGI 1.4%

%

O S OLAR 1.6 5.2% VIK

2.6% PHON % RAM S OLAR

ENGIE EE 1 .6

9.3% HT SA 8% 4%

2.7% REN NT

1. 6.6% 24.

AAD

A EW CHI % JIN

KO 19

.9% 4.2 STAS

AV %

POW 1.8 SOL % VE

ER R AR HU RE

2.8 OL

A

% AW FEX

TU

M AS 2.9 1.3

% EI

DR 4.

26.

R % N A 1 1%

FO .1 MU

L

EA

5.

SO 7%

2%

I4

8%

5%

N NE TB 0. B-

3.

7.8

NF EL 0.8 6%

E EL

DA RS

.6%

R 1. %

SU

R

R

SIE

EC

%

SOL A 1.6 4%

BH CAL 0.

LA

3.2

A

5.2

HE

NT

4.2

TR

A3

AZ

I O

3.9%

SO

4.6%

ME

SUNGROW 15.5%

OT

%

%

%

4.2% CAN

TR NC

IC

%W

2.4

EC

CSUN 4.2%

TATA POWER 4.5%

1.6%

UR

AH

O 4.5

JA

IN

1.6

2.4%

KE

%

EC LA

NS

1.6% E

H

RGY 1.6%

1.6% HARSHA ABAKUS

1.6% SIEMENS GAME

%

TR

E

TR

T 1.6

GCL

C

AAR

SPR

R

PO

OR

G

MY

A

ENC

RS

AM

JAK

W

RI

EL

IAN

EE

ER

NG

INEE

HARA

NRICH

ESA

WE

ADIA

NE

APG

SON

IER

O

HILD ENE

RI

PO

ENE

ENG

MA

EM

LLY B

N SOLAR

YS

PR

RGY

RA

PES

MCNA

SA

Domestic manufacturers

Powered by

India Solar www.indiasolarnavigator.com

Navigator

Policies Tenders Projects Leading players

Price trends News and special comment

marketing@bridgetoindia.com | +91 124 420 4003

Lead sponsor Associate sponsor

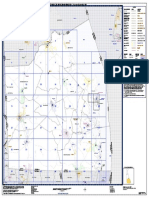

Top 10 players Top 15 project developers

(projects commissioned between October 2018 to September 2019) (solar and wind capacity as on 30 September 2019)

Commissioned solar capacity Pipeline solar capacity

Project developers Module suppliers Inverter suppliers EPC contractors Turbine manufacturers Commissioned wind capacity Pipeline wind capacity

4,000 Adani

Current Company Previous Increase/ Company Previous Increase/ Company Previous Increase/ Company Previous Increase/ Company Previous Increase/

Name rank Decrease Name rank Decrease Name rank Decrease Name rank Decrease Name rank Decrease ReNew

rank

SB Energy 6 Risen Energy 5 TMEIC 4 Sterling & 1 Suzlon 2 3,500

1

Wilson

2 NLC - ZnShine - Huawei 1 Tata Power 5 Siemens 1 3,000

Gamesa SB Energy

3 ReNew 3 Vikram Solar - Sungrow 2 Mahindra 3 Vestas 3

Susten 2,500

Acme

Total pipleline, MW

Azure Power - Jinko Solar - L&T 2 Acciona - Azure Power

4 TBEA 5

2,000

5 Sprng Energy 10 Suntech 10 ABB 3 Vikram Solar - GE -

1,500 Sprng Energy

6 Tata Power 7 Waaree - Delta 8 Refex - Inox Wind 4 Hero Future

Shapoorji

Pallonji

1,000 Mytrah Tata Power

7 APGENCO 8 Canadian 1 Hitachi 6 B-Electric 8 Senvion - Avaada NTPC

Solar

8 Mytrah - Csun - Kehua - KEC 10 Regen 8 500

International NLC Sembcorp

9 Adani 1 GCL 6 GE 10 Oriano - Pioneer 7 Greenko

0

0 1,000 2,000 3,000 4,000 5,000

10 Fortum - Trina 3 Schneider 9 Jakson - RRB Energy - Total commissioned capacity, MW

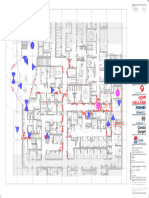

RE tariff trend2

Solar power tenders Wind power tenders Solar-wind hybrid tenders

Tender size Allocated capacity

Capacity allocation, MW

150 2,000

500 85

750 745 100

500 750 50 500 250 500 2,000 1,200 500 1,000 840 150 100 1,200

100 480 480

500

500 720 680

250 250 1,000 500 500 550 6 129 250

75 100 500

1,000 1,500 200 235 550 1,000 1,200

500 760 600 500 40 50

750 250 1,200 440

1,200

1,400

750

2,000

6.00

5.70

5.00

Tariff, INR/ kWh

4.00 4.41 3.54 4.38

3.46 3.47 3.38

3.15 3.26 3.15 3.13 3.23 3.08

2.98 2.93 2.95 2.91 2.83 3.02

3.46 3.47 2.80 2.87 2.73 2.83 2.85 2.79 2.77 2.92 2.89

2.71 2.82 2.83 2.75 2.68 2.75 2.70 2.84

3.00 2.63 2.49 2.48

2.67

2.54 2.52 2.44 2.60 2.72 2.69 2.61 2.49 2.70 2.55 2.50 2.65 2.75 2.65

3.15 2.45 2.45 3.07 2.45 3.17 3.09 3.13 2.45 3.17 3.02

2.97 2.94 2.91 2.92 2.89 2.91 3.02

2.85 2.82 2.85 2.82 2.74 2.81 2.87 2.79 2.75 2.69 2.83

2.62 2.44 2.43 2.64 2.48 2.47

2.65

2.44 2.70 2.44 2.51 2.44

2.72 2.77

2.59 2.71 2.79 2.76 2.67 2.44 2.55 2.55 2.48 2.65 2.54 2.50 2.65 2.75 2.53

2.00

1.00

TANGEDCO Tamil Nadu

UPNEDA Uttar Pradesh

UPNEDA Uttar Pradesh

UPNEDA Uttar Pradesh

SECI Pan India VIII

SECI Pan India V

MAHAGENCO Maharashtra

SECI Karnataka

GRIDCO Odisha

OREDA Odhisa

SECI Pan India

SECI Telangana

SECI Maharashtra

APGENCO Andhra Pradesh

500 MW

250 MW

750 MW

1,000 MW

50 MW

250 MW

500 MW

1,500 MW

GUVNL Gujarat

500 MW

1,000 MW

250 MW

500 MW

GUVNL Gujarat

500 MW

500 MW

300 MW

500 MW

2,000 MW

860 MW

GUVNL Gujarat

APDCL Assam

100 MW

550 MW

SECI Andhra Pradesh

750 MW

200 MW

SECI Pan India I

2,000 MW

2,000 MW

SECI Pan India II

3,000 MW

750 MW

2,000 MW

2,000 MW

650 MW

MSEDCL Maharashtra

1,000 MW

1,000 MW

200 MW

SECI Pan India V

1,200 MW

6 MW

1,200 MW

500 MW

150 MW

200 MW

500 MW

550 MW

100 MW

129 MW

SECI Pan India VI

1,200 MW

1,000 MW

GUVNL Gujarat IV

500 MW

SECI Pan India III

1,200 MW

750 MW

GUVNL Gujarat III

700 MW

GUVNL Gujarat II

1,000 MW

250 MW

SECI Pan India VII

1, 200 MW

GUVNL Gujarat V

1,000 MW

SECI Pan India II

1,200 MW

1,200 MW

SECI Rajasthan II

750 MW

500 MW

GUVNL Gujarat

200 MW

GUVNL Gujarat

750 MW

1,200 MW

1,800 MW

NTPC Andhra Pradesh

RUMS Madhya Pradesh

NHPC Tamil Nadu

SECI Rajasthan

SECI Rajasthan

SECI Rajasthan

SECI Rajasthan

NLC Tamil Nadu

NTPC Andhra Pradesh

SECI Rajasthan

SECI Pan India Wind I

SECI Pan India II

SECI Pan India III

SECI Pan India IV

SECI Pan India IV

MSEDCL Maharashtra

KREDL Karnataka

KREDL Karnataka

NTPC Pan India

NTPC Pan India

KREDL Karnataka

MSEDCL Maharashtra

KREDL Karnataka

KREDL Karnataka

KREDL Karnataka

MSEDCL Maharashtra

2017 2018 Until September 2019

RE capacity addition and allocation, MW Electricity generation in FY 2019 by source Ratio of RE power generation to total power consumption

Allocated capacity Commissioned capacity

FY 2009

3%

FY 2019 19,770 6,884 Solar 35%

3%

FY 2018 9,869 10,931 67%

Karnataka

17% 30%

Wind

5%

FY 2017 6,686 10,011

10% 2% 25%

Biomass 1% 1%

FY 2016 8,220 5,687 Small hydro Andhra Pradesh

Coal 0.6%

73% 20%

FY 2015 2,188 2,587

Tamil Nadu

FY 2014 1,520 2,180 Large hydro 15%

Rajasthan

10%

Gujarat

FY 2013 88 2,018 Telangana

10% Madhya Pradesh

Maharashtra

FY 2012 2,194

Nuclear 5% Uttar Pradesh

Punjab

Gas 4% 3%

FY 2011 1,242

Diesel Others

0.01% 0%

20,000 16,000 12,000 8,000 4,000 0 4,000 8,000 12,000 16,000 20,000

FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019

Solar power Wind power

Notes

1. Methodology data available with us. All data has been d. Pipeline includes projects that have been capacity are not shown on the map. i. In many projects, the EPC contractor role is split third party clients. b. GUVNL – Gujarat Urja Vikas Nigam Limited g. UPNEDA – Uttar Pradesh New & Renewable

a. BRIDGE TO INDIA has conducted an extensive cross-referenced, where possible. However, we allocated to developers but not yet g. We have relied on AC capacity numbers for between multiple parties. We have used several k. We have assumed completion of some projects c. MSEDCL – Maharashtra State Electricity Energy Development Agency

data collection exercise and relied on multiple do not guarantee completeness or accuracy of commissioned. It also includes projects where calculations. For module supplier market share criteria including final responsibility for by the end of September 2019 based on Distribution Corporation Limited 3. This map has been sponsored by Huawei (Lead

market sources including MNRE, CEA, state any information. the power purchase agreements may not have analysis, we have used DC numbers where commissioning and value of contracts for information provided by industry players. Sponsor) and Oriano (Associate Sponsor), but all

been signed. determining credits. d. RUMS – Rewa Ultra Mega Solar Limited

nodal agencies, project developers and b. Only grid connected projects above 1 MW (AC) available and else have increased the AC 2. Acronyms used: production responsibility, editorial rights and

equipment suppliers to provide accurate, factual have been considered in this report. e. Solar-wind hybrid tenders are accounted for number by 30%. j. Self-EPC denotes EPC services rendered e. SECI - Solar Energy Corporation of India Limited copyrights remain with BRIDGE TO INDIA.

information as far as possible. Some suppliers under solar capacity unless stated otherwise. in-house by developers or their affiliates, who a. APDCL – Assam Power Distribution Company f. TANGEDCO – Tamil Nadu Generation and

c. Market shares for all players are given on the h. Location for 9,285 MW of pipeline projects under Limited

were either unreachable or did not validate the basis of capacity commissioned in the year. f. States with less than 20 MW commissioned inter-state transmission tenders is not available. are not engaged in providing EPC services to Distribution Corporation

Lead sponsor Associate sponsor

INDIA RE

MAP2019

SEPTEMBER

Subscribe to the

deepest market insights

Subscription packages Paid reports

India RE Weekly

India RE Weekly India Solar Open Access Market

It’s raining tenders

Surge of new tenders and fall in module

INDIA SOLAR

COMPASS 2018 Q1 India Solar Compass India Solar Rooftop Market

prices bring hope to the sector

© BRIDGE TO INDIA, 2018 Page 1

India RE Policy Brief &

Solar park development in India Pipeline

Lead sponsor

India RE Market Brief

INDIA RE CEO SURVEY 2018

28,665

Customized reports Customized reports India Solar Rooftop Market Commissioned

66,650

Analytics

© BRIDGE TO INDIA Energy Private Limited P +91 124 4204003 www.facebook.com/bridgetoindia

E marketing@bridgetoindia.com www.twitter.com/bridgetoindia

C-8/5, DLF Phase 1,

W www.bridgetoindia.com

Gurugram - 122001 (HR), India

You might also like

- DD13 Engine Harness PDFDocument2 pagesDD13 Engine Harness PDFalejandro sanchezNo ratings yet

- MCM - 120-Pin Connector: All Information Subject To Change Without NoticeDocument1 pageMCM - 120-Pin Connector: All Information Subject To Change Without NoticeLuis Eduardo Corzo EnriquezNo ratings yet

- Instant Assessments for Data Tracking, Grade 2: MathFrom EverandInstant Assessments for Data Tracking, Grade 2: MathNo ratings yet

- LMI-Flexible Operation of Dadri Coal Fired UnitsDocument8 pagesLMI-Flexible Operation of Dadri Coal Fired Unitssumit kontNo ratings yet

- DD13 Engine Harness PDFDocument2 pagesDD13 Engine Harness PDFalejandro calixtoNo ratings yet

- Acrex 2023 - Hall 1 & Hall 2 Floor Plan (09.01.2023)Document1 pageAcrex 2023 - Hall 1 & Hall 2 Floor Plan (09.01.2023)Lines art StudioNo ratings yet

- India Renewable MAP: Uttar PradeshDocument2 pagesIndia Renewable MAP: Uttar PradeshChandrakant MishraNo ratings yet

- Top Beam Details1Document13 pagesTop Beam Details1AATVIK SHRIVASTAVANo ratings yet

- CGK063 BBCS Mechanical BinderDocument110 pagesCGK063 BBCS Mechanical BinderBack to SumateraNo ratings yet

- Mtip MapDocument1 pageMtip MapAlan PittmanNo ratings yet

- P4059zor 62 22 0 T1001 001 001 - DDocument1 pageP4059zor 62 22 0 T1001 001 001 - DShravan ThangallapalliNo ratings yet

- Ds Gigavue Ta Series Traffic AggregationDocument14 pagesDs Gigavue Ta Series Traffic AggregationMARCELOTRIVELATTONo ratings yet

- DudulgaonDocument1 pageDudulgaonManoj Lodha100% (1)

- Thesis BoardsDocument1 pageThesis BoardsJames ConleyNo ratings yet

- GPSNavigation Setfor Commercial AviationDocument8 pagesGPSNavigation Setfor Commercial AviationSssssjsjsjsjsNo ratings yet

- Southern Star: Aeropack Ecozone Properties IncDocument1 pageSouthern Star: Aeropack Ecozone Properties IncJason toraldeNo ratings yet

- Waterbox 900Document28 pagesWaterbox 900cem jakartaNo ratings yet

- San Marino Arcadia: (To Azusa)Document2 pagesSan Marino Arcadia: (To Azusa)VIctorNo ratings yet

- Lighting Electrical layout-EP-04Document1 pageLighting Electrical layout-EP-04Madelo, Allysa Mae, M.No ratings yet

- Urbanizacion PDFDocument1 pageUrbanizacion PDFRamiro GarcíaNo ratings yet

- District 7 Townhouse Vietnam 2019-10-07Document6 pagesDistrict 7 Townhouse Vietnam 2019-10-07Hieu TranNo ratings yet

- Equipments Foundation Layout: Geographic North 22.377° Prevaling Summer Wind S/WDocument1 pageEquipments Foundation Layout: Geographic North 22.377° Prevaling Summer Wind S/Wtitir bagchiNo ratings yet

- As App Vs Rev Foot1675404512947Document2 pagesAs App Vs Rev Foot1675404512947Fadi AlatrashNo ratings yet

- Land Use & Zoning: Line & GradeDocument1 pageLand Use & Zoning: Line & GradeJhn Cbllr BqngNo ratings yet

- FM - 3 - PC - 05002 - 0 DCG12900 KEBAYORAN B (RW05) To ContractorDocument1 pageFM - 3 - PC - 05002 - 0 DCG12900 KEBAYORAN B (RW05) To ContractorIksan GnwnNo ratings yet

- Aahar 2024 H7 - 30.01.24Document1 pageAahar 2024 H7 - 30.01.24salesa1creativedesignNo ratings yet

- @COA 2024 - LIA ALIYANIDocument54 pages@COA 2024 - LIA ALIYANISuryadi YadiNo ratings yet

- 06 Pohetakali Ff-LsectionDocument1 page06 Pohetakali Ff-Lsection4 frameNo ratings yet

- Kurnool - 30 NM - RWY 2000Document1 pageKurnool - 30 NM - RWY 2000aeeNo ratings yet

- Delaware SussexDocument1 pageDelaware SussexIgor SemenovNo ratings yet

- Electrical System C32 Generator Set With EMCP3: Harness and Wire Electrical Schematic SymbolsDocument4 pagesElectrical System C32 Generator Set With EMCP3: Harness and Wire Electrical Schematic Symbolsyasser eljabaliNo ratings yet

- Ag Ug: 330 TH Ru GR Av El at El - +2 370 0Document1 pageAg Ug: 330 TH Ru GR Av El at El - +2 370 0John SmitNo ratings yet

- Prepone AreaDocument1 pagePrepone Areasumit pandeyNo ratings yet

- Static Pump Dismantling Layout PDFDocument1 pageStatic Pump Dismantling Layout PDFVishnu MuraliNo ratings yet

- Ds Gigavue Ta Series Traffic AggregationDocument16 pagesDs Gigavue Ta Series Traffic AggregationsaagNo ratings yet

- Mill Container Yard Mill Piaper Storage BuildingDocument1 pageMill Container Yard Mill Piaper Storage BuildingN-Uhibbu UllaeNo ratings yet

- Layout PlanDocument1 pageLayout PlanJasvinder SolankiNo ratings yet

- Top Beam Slab Details1Document8 pagesTop Beam Slab Details1AATVIK SHRIVASTAVANo ratings yet

- M007 MML Arc DWG Ucstedu CL 00201 - Rev4.0Document1 pageM007 MML Arc DWG Ucstedu CL 00201 - Rev4.0whalet74No ratings yet

- Construction Drawing: Boundary Line Boundary Line Boundary LineDocument1 pageConstruction Drawing: Boundary Line Boundary Line Boundary LinerajavelNo ratings yet

- Construction Drawing: Ext'G MH (Sew) TL 100.90Document1 pageConstruction Drawing: Ext'G MH (Sew) TL 100.90rajavelNo ratings yet

- 4124 Aa DC 21710L101S01 Is01Document1 page4124 Aa DC 21710L101S01 Is01titir bagchiNo ratings yet

- SHR-HEY-ASB-DRG-SEC-101002 Level 01 Security Layout Zone 2Document1 pageSHR-HEY-ASB-DRG-SEC-101002 Level 01 Security Layout Zone 2rc.design0911No ratings yet

- City of Birmingham: Structures Ready For DemolitionDocument1 pageCity of Birmingham: Structures Ready For DemolitionErin Edgemon25% (4)

- MASTER SLD - NEW UPDATE-ModelDocument1 pageMASTER SLD - NEW UPDATE-Modeldhiansyah 92lifeNo ratings yet

- Lot-712-G Lot-712-E: Fma FelDocument1 pageLot-712-G Lot-712-E: Fma FelHassan AlaskaNo ratings yet

- Bihar: Asansol DivisionDocument1 pageBihar: Asansol DivisionMitesh KumarNo ratings yet

- APO Security - PT WCP-14 - SignDocument3 pagesAPO Security - PT WCP-14 - SignTengku Nizarul AslamiNo ratings yet

- 1Document1 page1Russell RaferNo ratings yet

- 966K and 972K Wheel Loader Electrical SystemDocument4 pages966K and 972K Wheel Loader Electrical SystemFlorencio MaximilianoNo ratings yet

- Peta Rencana LSU 2021Document1 pagePeta Rencana LSU 2021Patblas PatblasNo ratings yet

- PP03Document1 pagePP03Leyli Acevedo ReyesNo ratings yet

- RRGRGDocument1 pageRRGRGLeyli Acevedo ReyesNo ratings yet

- 06-01-2023. Juklak Sales Program Juni 2023 - OMDocument1 page06-01-2023. Juklak Sales Program Juni 2023 - OMnurul.widyamurtiNo ratings yet

- Scada-Sow For Remote Ends Pts12cn321 - Ashbailyah - 9038Document1 pageScada-Sow For Remote Ends Pts12cn321 - Ashbailyah - 9038Osama Ahmad ChaudharyNo ratings yet

- PLDM Plumbing FCD PlanDocument34 pagesPLDM Plumbing FCD PlanNon Etabas GadnatamNo ratings yet

- Be Hydrocyclone Package (Asbea-A-2702) 32294 Ponticelli - Al Shaheen PWTDocument45 pagesBe Hydrocyclone Package (Asbea-A-2702) 32294 Ponticelli - Al Shaheen PWTTĩnh Hồ TrungNo ratings yet

- Workplot: Not For ProductionDocument1 pageWorkplot: Not For ProductionOmkar TodkarNo ratings yet

- PreviewDocument4 pagesPreviewالعندليب الاسمرNo ratings yet

- PHASE-01 PHASE-02: Kep PlanDocument1 pagePHASE-01 PHASE-02: Kep PlanSenthilmurugan KumaresanNo ratings yet

- DocumentDocument452 pagesDocumentRashmi KumariNo ratings yet

- Power Sector Update 1595419253Document6 pagesPower Sector Update 1595419253Surya Teja SarmaNo ratings yet

- TOPIC OF THE CASE STUDY: NTPC - Reliance: Conflict Over Gas SupplyDocument5 pagesTOPIC OF THE CASE STUDY: NTPC - Reliance: Conflict Over Gas SupplyVaibhav AggarwalNo ratings yet

- NTPC Vindhyachal ReportDocument13 pagesNTPC Vindhyachal Reportblackswan_07No ratings yet

- SynopsisDocument3 pagesSynopsisPreeti RawatNo ratings yet

- HR Practices NTPCDocument16 pagesHR Practices NTPCRuchika SinhaNo ratings yet

- Tariff Order DNHPDCL 2021-22Document172 pagesTariff Order DNHPDCL 2021-22sunilgvoraNo ratings yet

- Your GATE'WAY To Megawatts of Success: Engineering Executive Trainees in Disciplines ofDocument4 pagesYour GATE'WAY To Megawatts of Success: Engineering Executive Trainees in Disciplines ofKaushalendra Kumar SinghNo ratings yet

- Broad StatusDocument73 pagesBroad StatusamitjustamitNo ratings yet

- The List of Public Sector Undertakings in India Details All inDocument26 pagesThe List of Public Sector Undertakings in India Details All inJoydeep SenguptaNo ratings yet

- BEM SingrauliDocument102 pagesBEM SingrauliGyandeep PradhanNo ratings yet

- Master Builder June2014 - 1Document40 pagesMaster Builder June2014 - 1lazybookwarmNo ratings yet

- 4230 405 PVI M 402 03 InstrumentationCable Technicalspecification C2Document9 pages4230 405 PVI M 402 03 InstrumentationCable Technicalspecification C2ajju1378No ratings yet

- NTPC Faridabad Summer Internship ReportDocument50 pagesNTPC Faridabad Summer Internship ReportBindal HeenaNo ratings yet

- Capital Structure of NTPCDocument49 pagesCapital Structure of NTPCArunKumar100% (1)

- Public Accounts Committee (2012-2013)Document43 pagesPublic Accounts Committee (2012-2013)Maroo GoliNo ratings yet

- A Training ReportDocument22 pagesA Training ReportSandeep Kumar0% (1)

- 01-10 Feb 2013eximDocument16 pages01-10 Feb 2013eximgopvij1No ratings yet

- Bharat Heavy Electricals Limited (BHEL) : Sector StalwartDocument23 pagesBharat Heavy Electricals Limited (BHEL) : Sector Stalwartshaifali24No ratings yet

- AGE Mployment: Module - 7 Wage Employment in BusinessDocument14 pagesAGE Mployment: Module - 7 Wage Employment in BusinessBhanu Pratap SinghNo ratings yet

- IndScan Projects Newsletter Aug I 10Document63 pagesIndScan Projects Newsletter Aug I 10Anush UnoNo ratings yet

- InfralinePlus October 2014Document84 pagesInfralinePlus October 2014SurendranathNo ratings yet

- NTPCDocument395 pagesNTPCJyothsna DeviNo ratings yet

- 03.NTPCs Renewable Energy PlanDocument42 pages03.NTPCs Renewable Energy PlanNagaraj NaikNo ratings yet

- Power Sector Financing Project ReportDocument57 pagesPower Sector Financing Project ReportAnonymous hVrzfRSmT100% (1)

- Industry Profile On PowerDocument15 pagesIndustry Profile On PowerDeepankar MitraNo ratings yet

- E - Executive SummaryDocument15 pagesE - Executive Summarynaba1577No ratings yet

- Petition No. 164/MP/2018 &ors. Page 1 of 48Document48 pagesPetition No. 164/MP/2018 &ors. Page 1 of 48Bhupendra CharanNo ratings yet

- InfralinePlus March2017Document76 pagesInfralinePlus March2017SurendranathNo ratings yet