Professional Documents

Culture Documents

Table 1.1. Overview of The World Economic Outlook Projections (Percent Change, Unless Noted Otherwise)

Uploaded by

sy yusufOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Table 1.1. Overview of The World Economic Outlook Projections (Percent Change, Unless Noted Otherwise)

Uploaded by

sy yusufCopyright:

Available Formats

EXECUTIVE SUMMARY

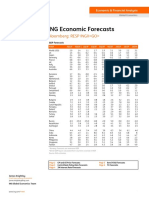

Table 1.1. Overview of the World Economic Outlook Projections

(Percent change, unless noted otherwise)

Difference from January Difference from October

Projections 2020 WEO Update1 2019 WEO1

2019 2020 2021 2020 2021 2020 2021

World Output 2.9 –3.0 5.8 –6.3 2.4 –6.4 2.2

Advanced Economies 1.7 –6.1 4.5 –7.7 2.9 –7.8 2.9

United States 2.3 –5.9 4.7 –7.9 3.0 –8.0 3.0

Euro Area 1.2 –7.5 4.7 –8.8 3.3 –8.9 3.3

Germany 0.6 –7.0 5.2 –8.1 3.8 –8.2 3.8

France 1.3 –7.2 4.5 –8.5 3.2 –8.5 3.2

Italy 0.3 –9.1 4.8 –9.6 4.1 –9.6 4.0

Spain 2.0 –8.0 4.3 –9.6 2.7 –9.8 2.6

Japan 0.7 –5.2 3.0 –5.9 2.5 –5.7 2.5

United Kingdom 1.4 –6.5 4.0 –7.9 2.5 –7.9 2.5

Canada 1.6 –6.2 4.2 –8.0 2.4 –8.0 2.4

Other Advanced Economies2 1.7 –4.6 4.5 –6.5 2.1 –6.6 2.2

Emerging Market and Developing Economies 3.7 –1.0 6.6 –5.4 2.0 –5.6 1.8

Emerging and Developing Asia 5.5 1.0 8.5 –4.8 2.6 –5.0 2.3

China 6.1 1.2 9.2 –4.8 3.4 –4.6 3.3

India3 4.2 1.9 7.4 –3.9 0.9 –5.1 0.0

ASEAN-54 4.8 –0.6 7.8 –5.4 2.7 –5.5 2.6

Emerging and Developing Europe 2.1 –5.2 4.2 –7.8 1.7 –7.7 1.7

Russia 1.3 –5.5 3.5 –7.4 1.5 –7.4 1.5

Latin America and the Caribbean 0.1 –5.2 3.4 –6.8 1.1 –7.0 1.0

Brazil 1.1 –5.3 2.9 –7.5 0.6 –7.3 0.5

Mexico –0.1 –6.6 3.0 –7.6 1.4 –7.9 1.1

Middle East and Central Asia 1.2 –2.8 4.0 –5.6 0.8 –5.7 0.8

Saudi Arabia 0.3 –2.3 2.9 –4.2 0.7 –4.5 0.7

Sub-Saharan Africa 3.1 –1.6 4.1 –5.1 0.6 –5.2 0.4

Nigeria 2.2 –3.4 2.4 –5.9 –0.1 –5.9 –0.1

South Africa 0.2 –5.8 4.0 –6.6 3.0 –6.9 2.6

Memorandum

European Union5 1.7 –7.1 4.8 –8.7 3.1 –8.8 3.1

Low-Income Developing Countries 5.1 0.4 5.6 –4.7 0.5 –4.7 0.4

Middle East and North Africa 0.3 –3.3 4.2 –5.9 1.2 –6.0 1.2

World Growth Based on Market Exchange Rates 2.4 –4.2 5.4 –6.9 2.6 –6.9 2.6

World Trade Volume (goods and services) 0.9 –11.0 8.4 –13.9 4.7 –14.2 4.6

Imports

Advanced Economies 1.5 –11.5 7.5 –13.8 4.3 –14.2 4.2

Emerging Market and Developing Economies –0.8 –8.2 9.1 –12.5 4.0 –12.5 4.0

Exports

Advanced Economies 1.2 –12.8 7.4 –14.9 4.4 –15.3 4.3

Emerging Market and Developing Economies 0.8 –9.6 11.0 –13.7 6.8 –13.7 6.6

Commodity Prices (US dollars)

Oil6 –10.2 –42.0 6.3 –37.7 11.0 –35.8 10.9

Nonfuel (average based on world commodity import weights) 0.8 –1.1 –0.6 –2.8 –1.2 –2.8 –1.9

Consumer Prices

Advanced Economies 1.4 0.5 1.5 –1.2 –0.4 –1.3 –0.3

Emerging Market and Developing Economies7 5.0 4.6 4.5 0.0 0.0 –0.2 0.0

London Interbank Offered Rate (percent)

On US Dollar Deposits (six month) 2.3 0.7 0.6 –1.2 –1.3 –1.3 –1.5

On Euro Deposits (three month) –0.4 –0.4 –0.4 0.0 0.0 0.2 0.2

On Japanese Yen Deposits (six month) 0.0 –0.1 –0.1 0.0 –0.1 0.0 0.1

Source: IMF staff.

Note: Real effective exchange rates are assumed to remain constant at the levels prevailing during February 17–March 16, 2020. Economies are

listed on the basis of economic size. The aggregated quarterly data are seasonally adjusted. WEO = World Economic Outlook.

1Difference based on rounded figures for the current, January 2020 WEO Update, and October 2019 WEO forecasts.

2Excludes the Group of Seven (Canada, France, Germany, Italy, Japan, United Kingdom, United States) and euro area countries.

3For India, data and forecasts are presented on a fiscal year basis, and GDP from 2011 onward is based on GDP at market prices with fiscal year

2011/12 as a base year.

International Monetary Fund | April 2020 ix

WORLD ECONOMIC OUTLOOK: THE GRE AT LOCKDOWN

Table 1.1 (continued)

(Percent change, unless noted otherwise)

Year over Year Q4 over Q48

Projections Projections

2018 2019 2020 2021 2018 2019 2020 2021

World Output 3.6 2.9 –3.0 5.8 3.3 2.7 –1.4 4.9

Advanced Economies 2.2 1.7 –6.1 4.5 1.8 1.5 –5.2 4.4

United States 2.9 2.3 –5.9 4.7 2.5 2.3 –5.4 4.9

Euro Area 1.9 1.2 –7.5 4.7 1.2 1.0 –5.9 3.6

Germany 1.5 0.6 –7.0 5.2 0.6 0.5 –5.2 3.6

France 1.7 1.3 –7.2 4.5 1.2 0.9 –5.0 2.7

Italy 0.8 0.3 –9.1 4.8 0.0 0.1 –7.2 3.9

Spain 2.4 2.0 –8.0 4.3 2.1 1.8 –7.0 3.7

Japan 0.3 0.7 –5.2 3.0 –0.2 –0.7 –3.2 3.4

United Kingdom 1.3 1.4 –6.5 4.0 1.4 1.1 –5.3 3.8

Canada 2.0 1.6 –6.2 4.2 1.8 1.5 –5.4 4.0

Other Advanced Economies2 2.6 1.7 –4.6 4.5 2.3 2.0 –4.6 5.5

Emerging Market and Developing Economies 4.5 3.7 –1.0 6.6 4.5 3.7 1.6 5.2

Emerging and Developing Asia 6.3 5.5 1.0 8.5 6.1 4.7 4.8 5.0

China 6.7 6.1 1.2 9.2 6.6 6.0 4.9 5.1

India3 6.1 4.2 1.9 7.4 5.8 2.0 7.4 4.0

ASEAN-54 5.3 4.8 –0.6 7.8 5.1 4.5 1.1 6.0

Emerging and Developing Europe 3.2 2.1 –5.2 4.2 ... ... ... ...

Russia 2.5 1.3 –5.5 3.5 2.9 2.3 –6.5 5.4

Latin America and the Caribbean 1.1 0.1 –5.2 3.4 0.2 –0.1 –5.6 4.8

Brazil 1.3 1.1 –5.3 2.9 1.3 1.7 –5.8 3.6

Mexico 2.1 –0.1 –6.6 3.0 1.5 –0.4 –7.4 5.7

Middle East and Central Asia 1.8 1.2 –2.8 4.0 ... ... ... ...

Saudi Arabia 2.4 0.3 –2.3 2.9 4.3 –0.3 –0.5 1.3

Sub-Saharan Africa 3.3 3.1 –1.6 4.1 ... ... ... ...

Nigeria 1.9 2.2 –3.4 2.4 ... ... ... ...

South Africa 0.8 0.2 –5.8 4.0 0.2 –0.6 –7.2 9.6

Memorandum

European Union5 2.3 1.7 –7.1 4.8 1.7 1.4 –5.9 4.2

Low-Income Developing Countries 5.1 5.1 0.4 5.6 ... ... ... ...

Middle East and North Africa 1.0 0.3 –3.3 4.2 ... ... ... ...

World Growth Based on Market Exchange Rates 3.1 2.4 –4.2 5.4 2.7 2.3 –2.9 4.7

World Trade Volume (goods and services) 3.8 0.9 –11.0 8.4 ... ... ... ...

Imports ...

Advanced Economies 3.3 1.5 –11.5 7.5 ... ... ... ...

Emerging Market and Developing Economies 5.1 –0.8 –8.2 9.1 ... ... ... ...

Exports

Advanced Economies 3.3 1.2 –12.8 7.4 ... ... ... ...

Emerging Market and Developing Economies 4.1 0.8 –9.6 11.0 ... ... ... ...

Commodity Prices (US dollars)

Oil6 29.4 –10.2 –42.0 6.3 9.5 –6.1 –42.2 12.4

Nonfuel (average based on world commodity import weights) 1.3 0.8 –1.1 –0.6 –2.3 4.9 –3.1 0.9

Consumer Prices

Advanced Economies 2.0 1.4 0.5 1.5 1.9 1.4 0.3 1.8

Emerging Market and Developing Economies7 4.8 5.0 4.6 4.5 4.2 4.9 3.1 4.0

London Interbank Offered Rate (percent)

On US Dollar Deposits (six month) 2.5 2.3 0.7 0.6 ... ... ... ...

On Euro Deposits (three month) –0.3 –0.4 –0.4 –0.4 ... ... ... ...

On Japanese Yen Deposits (six month) 0.0 0.0 –0.1 –0.1 ... ... ... ...

4Indonesia, Malaysia, Philippines, Thailand, Vietnam.

5Beginning with the April 2020 WEO, the United Kingdom is excluded from the European Union group. Difference based on European Union excluding

the United Kingdom.

6Simple average of prices of UK Brent, Dubai Fateh, and West Texas Intermediate crude oil. The average price of oil in US dollars a barrel was $61.39

in 2019; the assumed price, based on futures markets, is $35.61 in 2020 and $37.87 in 2021.

7Excludes Venezuela. See country-specific note for Venezuela in the “Country Notes” section of the Statistical Appendix.

8For World Output, the quarterly estimates and projections account for approximately 90 percent of annual world output at purchasing-power-parity

weights. For Emerging Market and Developing Economies, the quarterly estimates and projections account for approximately 80 percent of annual

emerging market and developing economies’ output at purchasing-power-parity weights.

You might also like

- Hercules Poirpt PDFDocument4 pagesHercules Poirpt PDFsy yusuf73% (11)

- Hercules Poirpt PDFDocument4 pagesHercules Poirpt PDFsy yusuf73% (11)

- Issues in Global MarketingDocument30 pagesIssues in Global Marketingsy yusufNo ratings yet

- How To Fill Up Product Replacement FormDocument7 pagesHow To Fill Up Product Replacement FormDoraaina100% (1)

- Real GDP: World Advanced EconomiesDocument27 pagesReal GDP: World Advanced Economiesmichel mboueNo ratings yet

- Real GDP: World Advanced EconomiesDocument27 pagesReal GDP: World Advanced EconomiesPaul TambunanNo ratings yet

- World Economy OutlookDocument24 pagesWorld Economy OutlookFaiz BurhaniNo ratings yet

- World Advanced Economies: (Percent Change From Previous Year)Document33 pagesWorld Advanced Economies: (Percent Change From Previous Year)Saira BalochNo ratings yet

- GEP June 2023 GDP Growth DataDocument27 pagesGEP June 2023 GDP Growth DataKong CreedNo ratings yet

- World Advanced Economies: (Percent Change From Previous Year)Document33 pagesWorld Advanced Economies: (Percent Change From Previous Year)harshad bhirudNo ratings yet

- Real GDP: World 3.0 2.3 - 4.3 4.0 3.8 0.9 - 0.2 Advanced Economies 2.2 1.6 - 5.4 3.3 3.5 1.6 - 0.6Document19 pagesReal GDP: World 3.0 2.3 - 4.3 4.0 3.8 0.9 - 0.2 Advanced Economies 2.2 1.6 - 5.4 3.3 3.5 1.6 - 0.6Suhe EndraNo ratings yet

- World Advanced Economies: (Percent Change From Previous Year)Document32 pagesWorld Advanced Economies: (Percent Change From Previous Year)Edwin SoetirtoNo ratings yet

- We o Jan 2021 UpdateDocument14 pagesWe o Jan 2021 UpdateNavendu TripathiNo ratings yet

- IMF forecasts steady global growth amid high uncertaintyDocument57 pagesIMF forecasts steady global growth amid high uncertaintyBILLY 102013286No ratings yet

- WORLD ECONOMIC OUTLOOK STATISTICAL APPENDIXDocument30 pagesWORLD ECONOMIC OUTLOOK STATISTICAL APPENDIXEimy NavasNo ratings yet

- Global Growth Weakening As Some Risks Materialise OECD Interim Economic Outlook Handout March 2019Document13 pagesGlobal Growth Weakening As Some Risks Materialise OECD Interim Economic Outlook Handout March 2019Valter SilveiraNo ratings yet

- Ae8c39ec enDocument22 pagesAe8c39ec enStathis MetsovitisNo ratings yet

- CREDIT SUISSE ECONOMICS - Global Economics Quarterly - The Worst Is Yet To Come (28sep2022)Document45 pagesCREDIT SUISSE ECONOMICS - Global Economics Quarterly - The Worst Is Yet To Come (28sep2022)ikaNo ratings yet

- IMF - WEO - 202004 - Statistical Appendix - Tables A PDFDocument15 pagesIMF - WEO - 202004 - Statistical Appendix - Tables A PDFAnna VassilovskiNo ratings yet

- We o July 2023 UpdateDocument13 pagesWe o July 2023 UpdateStella GárnicaNo ratings yet

- World Output Grouth Since 1991Document1 pageWorld Output Grouth Since 1991hellbustNo ratings yet

- Laju Pertumbuhan Produk Domestik Bruto Per Kapita Beberapa Negara Menurut Harga Konstan (Persen), 2000-2015Document4 pagesLaju Pertumbuhan Produk Domestik Bruto Per Kapita Beberapa Negara Menurut Harga Konstan (Persen), 2000-2015Rahayu SetianingsihNo ratings yet

- Short Range Outlook Table by Region 2016-2017-13april2016Document1 pageShort Range Outlook Table by Region 2016-2017-13april2016mohammedredameNo ratings yet

- IEO106 Handout FinalDocument16 pagesIEO106 Handout FinalValter SilveiraNo ratings yet

- Informe Bianual de l'OCDE 2019-2020Document16 pagesInforme Bianual de l'OCDE 2019-2020naciodigitalNo ratings yet

- Statapp Tables A1 A15Document30 pagesStatapp Tables A1 A15Steven OomsNo ratings yet

- EO PresentationDocument23 pagesEO PresentationjrmiztliNo ratings yet

- (Percent Change, Unless Otherwise Noted) : Table 1.1. Overview of The World Economic Outlook ProjectionsDocument3 pages(Percent Change, Unless Otherwise Noted) : Table 1.1. Overview of The World Economic Outlook ProjectionsSathish KumarNo ratings yet

- Ip183 - en - Statistical AnnexDocument3 pagesIp183 - en - Statistical AnnexPeter DerdakNo ratings yet

- FocusEconomics Consensus Forecast Middle East & North Africa - June 2016Document83 pagesFocusEconomics Consensus Forecast Middle East & North Africa - June 2016Ali HosnyNo ratings yet

- October 2022 INGF 3Document7 pagesOctober 2022 INGF 3Daniel SbizzaroNo ratings yet

- OECD Interim Economic Outlook September 2019Document19 pagesOECD Interim Economic Outlook September 2019Valter SilveiraNo ratings yet

- Statistical Tables: Table 1. Growth Rate of GDPDocument8 pagesStatistical Tables: Table 1. Growth Rate of GDPazile_071386No ratings yet

- Global Economy - Website - Aug 9 2022Document3 pagesGlobal Economy - Website - Aug 9 2022vinay jodNo ratings yet

- Economic Out Look 190603Document14 pagesEconomic Out Look 190603sirdquantsNo ratings yet

- Economic Survey 2002-03Document240 pagesEconomic Survey 2002-03raza9871No ratings yet

- Steel Demand Forecasts and Top 10 Steel-Using Countries in 2019Document1 pageSteel Demand Forecasts and Top 10 Steel-Using Countries in 2019Arie HendriyanaNo ratings yet

- Annual Percent Change, Unless Noted OtherwiseDocument1 pageAnnual Percent Change, Unless Noted OtherwiseFz DNo ratings yet

- Copia de Maddison-Fases de Crecimiento Por RegionesDocument14 pagesCopia de Maddison-Fases de Crecimiento Por RegionesJosh VeigaNo ratings yet

- Lobal Usiness CenarioDocument38 pagesLobal Usiness CenariozunaaliNo ratings yet

- Economic Update and Outlook: Key Issues For 2011Document21 pagesEconomic Update and Outlook: Key Issues For 2011TrevorCrouchNo ratings yet

- Forecast Tables EN PDFDocument2 pagesForecast Tables EN PDFSyed Maratab AliNo ratings yet

- Inflation Rates of Selected EconomiesDocument2 pagesInflation Rates of Selected EconomieshesfacultyNo ratings yet

- Chap 58Document1 pageChap 58Tarit MondalNo ratings yet

- EBRDDocument1 pageEBRDDennik SME100% (1)

- FocusEconomics Consensus Forecast Central America and Caribbean - November 2015Document65 pagesFocusEconomics Consensus Forecast Central America and Caribbean - November 2015John SnowNo ratings yet

- Current State of India's Political EconomyDocument23 pagesCurrent State of India's Political EconomyrahulnationaliteNo ratings yet

- Steel Demand Forecast Table Shows Growth in Developing EconomiesDocument1 pageSteel Demand Forecast Table Shows Growth in Developing EconomiesSrikanth SrikantiNo ratings yet

- 6fc55141 enDocument2 pages6fc55141 enTalila SidaNo ratings yet

- GDP ProjectDocument2 pagesGDP Projectnghiah5No ratings yet

- FocusEconomics Consensus Forecast Central America and Caribbean - December 2016Document63 pagesFocusEconomics Consensus Forecast Central America and Caribbean - December 2016John SnowNo ratings yet

- 2020 Poverty LADocument269 pages2020 Poverty LAgonza sotoNo ratings yet

- GDP Up by 0.6% in Both The Euro Area and The EU28: Flash Estimate For The Second Quarter of 2017Document3 pagesGDP Up by 0.6% in Both The Euro Area and The EU28: Flash Estimate For The Second Quarter of 2017loginxscribdNo ratings yet

- GDP Growth ProjectionsDocument27 pagesGDP Growth ProjectionsSimon SamNo ratings yet

- OECD Keeps Recovery on TrackDocument22 pagesOECD Keeps Recovery on TrackSoniaNo ratings yet

- OECD Economic Outlook Presentation Data May 2021Document75 pagesOECD Economic Outlook Presentation Data May 2021fedpelaNo ratings yet

- FocusEconomics Consensus Forecast Central America and Caribbean - April 2015Document63 pagesFocusEconomics Consensus Forecast Central America and Caribbean - April 2015John SnowNo ratings yet

- 1 InflationDocument1 page1 Inflationramshah tajammalNo ratings yet

- Stronger Growth But Risks Loom Large, OECD Economic Outlook May 2018Document27 pagesStronger Growth But Risks Loom Large, OECD Economic Outlook May 2018The BubbleNo ratings yet

- ADO 2021 Statistical Table GDP Growth RatesDocument1 pageADO 2021 Statistical Table GDP Growth RatesKarl LabagalaNo ratings yet

- Izvještaj EBRD-a Za Svibanj 2020.Document23 pagesIzvještaj EBRD-a Za Svibanj 2020.Index.hrNo ratings yet

- 2021 06 22 Merelli Macro ScenarioDocument66 pages2021 06 22 Merelli Macro ScenarioVito GiacovelliNo ratings yet

- 2024global Economic Report by World BankDocument50 pages2024global Economic Report by World Bankkellymeinhold327No ratings yet

- Beyond the Enclave: Towards a Pro-Poor and Inclusive Development Strategy for ZimbabweFrom EverandBeyond the Enclave: Towards a Pro-Poor and Inclusive Development Strategy for ZimbabweNo ratings yet

- Vision & Mission WorksheetsDocument6 pagesVision & Mission Worksheetssy yusufNo ratings yet

- Vision & Mission WorksheetsDocument6 pagesVision & Mission Worksheetssy yusufNo ratings yet

- How German Media Companies Defined Their Digital Transformation StrategiesDocument23 pagesHow German Media Companies Defined Their Digital Transformation Strategiessy yusufNo ratings yet

- Russia Travel Advisory PDFDocument3 pagesRussia Travel Advisory PDFsy yusufNo ratings yet

- Prof Fiz AnomalyDocument2 pagesProf Fiz Anomalysy yusufNo ratings yet

- Star ModelDocument6 pagesStar Modelnomimaster100% (2)

- Russia Travel Advisory PDFDocument3 pagesRussia Travel Advisory PDFsy yusufNo ratings yet

- 10 Life Lessons from Basic SEAL TrainingDocument3 pages10 Life Lessons from Basic SEAL Trainingsy yusuf100% (1)

- Ob On HBRDocument17 pagesOb On HBRsy yusufNo ratings yet

- Test Bank Ch1Document44 pagesTest Bank Ch1sy yusufNo ratings yet

- 2 Anoverview12Document12 pages2 Anoverview12sy yusufNo ratings yet

- Global Market Integration Module 3Document3 pagesGlobal Market Integration Module 3Erika Joyce RunasNo ratings yet

- Draft Minutes of The 17th NSSSC Meeting - 12 October 2022 EditedDocument13 pagesDraft Minutes of The 17th NSSSC Meeting - 12 October 2022 EditedwathuNo ratings yet

- Introduction To OPDocument35 pagesIntroduction To OPCharisa SamsonNo ratings yet

- Assignment On Brand Management: NokiaDocument6 pagesAssignment On Brand Management: NokiaashuniftkolkataNo ratings yet

- Trade Theory Practice Questions ExplainedDocument39 pagesTrade Theory Practice Questions ExplainedRosa MoleaNo ratings yet

- RDO No. 27 - Caloocan CityDocument1,015 pagesRDO No. 27 - Caloocan Citykathleenalberto22No ratings yet

- Characteristics of Underdevelopment and Approaches to Measuring Poverty in PakistanDocument54 pagesCharacteristics of Underdevelopment and Approaches to Measuring Poverty in PakistanHamid UsmanNo ratings yet

- Microeconomics Course: BY Emery Emerimana MBA-Project Management and Finance Email: Tel: 71 578 069/75 658 470Document103 pagesMicroeconomics Course: BY Emery Emerimana MBA-Project Management and Finance Email: Tel: 71 578 069/75 658 470dan dylan terimbereNo ratings yet

- Cambridge International AS & A Level: EconomicsDocument15 pagesCambridge International AS & A Level: EconomicsDivya SinghNo ratings yet

- Đề Đánh Giá Năng Lực Thpt Qg 2024Document8 pagesĐề Đánh Giá Năng Lực Thpt Qg 2024Võ Trương Gia NgọcNo ratings yet

- Nass ModuleDocument195 pagesNass ModuleNdumiso MoyoNo ratings yet

- Submission: Block B5 - Typical Storey Framing Plan Smiliar: Block B6 (Handed) (3Rd To 5Th Storey)Document1 pageSubmission: Block B5 - Typical Storey Framing Plan Smiliar: Block B6 (Handed) (3Rd To 5Th Storey)fade2black11No ratings yet

- 134 - Realubit V JasoDocument2 pages134 - Realubit V JasoJai HoNo ratings yet

- Chapter 13 Intermediate AccountingDocument18 pagesChapter 13 Intermediate AccountingDanica Mae GenaviaNo ratings yet

- Janome Sewing Machine RE1712Document34 pagesJanome Sewing Machine RE1712lanaNo ratings yet

- Adec 511 - 500 Pre-Installation ManualDocument22 pagesAdec 511 - 500 Pre-Installation ManualAbdo SerboutiNo ratings yet

- NYC Spent $9M Sending Out $5 Bills With Mental Health SurveyDocument1 pageNYC Spent $9M Sending Out $5 Bills With Mental Health SurveyRamonita GarciaNo ratings yet

- Hombres y BestiasDocument223 pagesHombres y BestiasPaul GuillenNo ratings yet

- Accounting FinalDocument12 pagesAccounting FinalChithra NellametlaNo ratings yet

- Motor VehicleDocument6 pagesMotor Vehiclekailasasundaram100% (6)

- St. Thomas More College Chapter 03 Tobacco Excise TaxesDocument6 pagesSt. Thomas More College Chapter 03 Tobacco Excise TaxesAlbano MeaNo ratings yet

- Unitaid Proposal Cover Page: If More Than One Partner, List On Separate LinesDocument38 pagesUnitaid Proposal Cover Page: If More Than One Partner, List On Separate LinesMayom MabuongNo ratings yet

- Master Thesis Uzh EconomicsDocument4 pagesMaster Thesis Uzh Economicsfjgjdhzd100% (1)

- Unit 3 GSTDocument51 pagesUnit 3 GSTMichael WellsNo ratings yet

- Electricity Reform in Romania: Restructuring Plans and Key IssuesDocument29 pagesElectricity Reform in Romania: Restructuring Plans and Key IssuesgotcanNo ratings yet

- Accounting & Marketing Students ListDocument9 pagesAccounting & Marketing Students ListJustine Brylle DomantayNo ratings yet

- MKWD LWUA ADB Package 3 Technical Details and DrawingsDocument195 pagesMKWD LWUA ADB Package 3 Technical Details and DrawingsRoland AnaumNo ratings yet

- Steven Johnson - Reef, City, WebDocument12 pagesSteven Johnson - Reef, City, WebNishanth MuralidharNo ratings yet

- Full Cone Spiraljet NozzlesDocument3 pagesFull Cone Spiraljet NozzlesCláudio DálioNo ratings yet