Professional Documents

Culture Documents

Tugas 1 Managementg Financial PT WIKA

Uploaded by

Mohammad IrfanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tugas 1 Managementg Financial PT WIKA

Uploaded by

Mohammad IrfanCopyright:

Available Formats

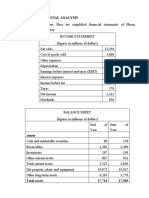

Chapter 1.

Financial Statements, Taxes and Cash Flow

PT WIKA 2018

(dalam Milyar Rupiah)

I The cash flow identify

Cash flow from assets Cash flow to creditors (bondholders) + Cash flow to

=

stockholders (owners)

II. Cash flow from assets

Cash flow from assets Operating cash flow – Net capital spending – Change

= in net working capital (NWC)

2,772,531 – 4,917,958 – (-2,681,376)

= -4,826,803

It had to raise a net Rp 4,826,803 in funds. Having a negative cash flow from assets

indicates that WIKA putting more money into the long-term success than actually

earning.

Where:

Operationg cash flow Earning before interest and taxes (EBIT) +

= Depreciation – Taxes

2,358,629 – 726,943

= 1,631,686

Net capital spending Ending net fixed assets – Beginning net fixed assets +

= Depreciation

59.230.001 - 43.555.496

= 54,874,505

Change in NWC Ending NWC – Beginning NWC

= (13.973.766 – 2.722.531) – (11.253.778–

4.917.958)

= (11,251,235) – (6,335,820)

= 4,915,415

III. Cash flow to creditors (bondholders)

Cash flow to creditors Interest paid – Net new borrowing

=

= 43,555,495– (13,762,736 + 28,251,952)

= -1,540,807

IV. Cash flow to stockholders (owners)

Cash flow to stockholders = Dividends paid – Net new equity raised

2,073,300 – 2,213,543

= -140,243

WIKA 2017

(dalam Milliar Rupiah)

I The cash flow identify

Cash flow from assets Cash flow to creditors (bondholders) + Cash flow to

=

stockholders (owners)

II. Cash flow from assets

Cash flow from assets Operating cash flow – Net capital spending – Change

= in net working capital (NWC)

1.885.252 – 2.637.548 – (-2.727.823)

= 3.480.119

The cash flow from assets can be positive or negative, since it represents whether the

firm raised funds or distributed funds on a net basis. In this problem, even though net

income and OCF are positive, the firm invested heavily in both fixed assets and net

working capital; it had to raise a net Rp 3.480.119 in funds from its stockholders and

creditors to make these investments.

Where:

Operationg cash flow Earning before interest and taxes (EBIT) +

= Depreciation – Taxes

1.462.391– 629.479

= 832.912

Net capital spending Ending net fixed assets – Beginning net fixed assets +

= Depreciation

34.910.107 – 11.253.779

= 23.656.328

Change in NWC Ending NWC – Beginning NWC

=

11.253.778– 9.270.000

= 1.983.778

III. Cash flow to creditors (bondholders)

Cash flow to creditors Interest paid – Net new borrowing

=

-6.779.737 – 5.076.334

= -11.856.071

IV. Cash flow to stockholders (owners)

Cash flow to stockholders Dividends paid – Net new equity raised

=

-3.446.536 – 14.631.825

= -18.078.361

Chapter 2. Working with Financial Statement

WIKA

(Dalam milliar rupiah)

1. Liquidity Ratio

“Nilai ideal dari rasio ini adalah 150%, semakin besar adalah semakin baik dan

perusahaan dalam kondisi sehat”

Net Working Capital = Current Assets – Current Liability

Tahun Current Asset Current Liability NWC

2018 59.230.001 42.014.686 17.215.315

31.051.950

2017 45.683.774 14.631.824

Current Ratio =

Tahun Current Assets Current Liability Current Ratio

2018 59.230.001 42.014.686 1,4x

2017 45.683.774 31.051.950 1,4x

Quick Ratio =

Tahun Current Assets Inventory Current Liability Quick Ratio

2018 59.230.001 27.225.313 42.014.686 0,7x

2017 45.683.774 18.852.531 31.051.950 0,9x

Return on Assets (ROA) = x 100%

Tahun Current Year Income Total Assets ROA

2018 2.073.299.864 58.645.244 35,3%

2017 1.356.115.489 110.148.921 12,3%

2. Assets Management Ratio atau Activity Ratio

“Semakin tinggi nilai presentase rasio ini adalah semakin baik. Dapat dibandingkan

dengan nilai rata-rata dari industri sejenis dipasar agar dapat menilai seberapa efisien

perusahaan mengelola sumber daya yang dimiliki”

Total Assets Turn Over =

Tahun Sales and Revenue Total Assets TATO

2018 31.158.193 58.645.244 0,5x

26.176.403 110.148.921 0,2x

2017

3. Du Pont System

“Alat analisis yang digunakan untuk menganalisis laba dari perusahaan atau bisnis”

Return on Investment (ROI) = Net Profit Margin x Total Assets Turn Over x 100%

Tahun Net Profit Margin TATO ROI

2018 6.7% 0,5x 3,35%

2017 5.2% 0,2x 1,04%

You might also like

- Tugas 1 Managementg Financial PT WIKADocument4 pagesTugas 1 Managementg Financial PT WIKAMohammad IrfanNo ratings yet

- Analysis of Reports and Financial Statements For The Year 2014 of Cimb Bank BerhadDocument9 pagesAnalysis of Reports and Financial Statements For The Year 2014 of Cimb Bank BerhadjagethiswariNo ratings yet

- Exercises - CorrectionDocument4 pagesExercises - Correctionmonaatallah1No ratings yet

- Practice Solution 2Document4 pagesPractice Solution 2Luigi NocitaNo ratings yet

- 5financial AnalysisDocument23 pages5financial AnalysisRonie SugarolNo ratings yet

- Cash Flow From Assets - Solution PDFDocument3 pagesCash Flow From Assets - Solution PDFSeptian Sugestyo PutroNo ratings yet

- Capital Investment Decisions: Discussion QuestionsDocument38 pagesCapital Investment Decisions: Discussion QuestionsParth GandhiNo ratings yet

- File8 Module 3A Fin Analysis ReportingDocument4 pagesFile8 Module 3A Fin Analysis ReportingDálè Jàspér CüllénNo ratings yet

- Chapter 4 - Concept Questions and Exercises StudentDocument9 pagesChapter 4 - Concept Questions and Exercises StudentVõ Lê Khánh HuyềnNo ratings yet

- Cashflow Analysis - Beta - GammaDocument14 pagesCashflow Analysis - Beta - Gammashahin selkarNo ratings yet

- Cash Flow Case StudyDocument6 pagesCash Flow Case StudyvzzrNo ratings yet

- Ratio Analysis of WiproDocument7 pagesRatio Analysis of Wiprosandeepl4720% (2)

- Session - Cash FlowsDocument42 pagesSession - Cash Flowsmohit rajputNo ratings yet

- Pert. Ke 3. Analisa Kinerja KeuanganDocument25 pagesPert. Ke 3. Analisa Kinerja KeuanganYULIANTONo ratings yet

- 2011 of Cimb BankDocument9 pages2011 of Cimb BankjagethiswariNo ratings yet

- XFINMAN - Cash Flow AnalysisDocument17 pagesXFINMAN - Cash Flow AnalysisMae Justine Joy TajoneraNo ratings yet

- Cash Flow StatementDocument19 pagesCash Flow Statementasherjoe67% (3)

- Corporate Finance - SS 11, Reading 35 - Capital BudgetingDocument45 pagesCorporate Finance - SS 11, Reading 35 - Capital Budgetingud100% (1)

- Cost Management: Hansen & MowenDocument42 pagesCost Management: Hansen & MowenAnkit ThakralNo ratings yet

- Practice Solution 1Document8 pagesPractice Solution 1Luigi NocitaNo ratings yet

- ch3 Slides PostedDocument28 pagesch3 Slides Postedakshitnagpal9119No ratings yet

- Cash FlowDocument6 pagesCash FlowRazi KamrayNo ratings yet

- Modern Appliances Corporation Has Reported Its Financial Results For The Year Ended December 31, 2011Document5 pagesModern Appliances Corporation Has Reported Its Financial Results For The Year Ended December 31, 2011rook semayNo ratings yet

- 7 11 Capital ManagementDocument6 pages7 11 Capital ManagementRonaldo ConventoNo ratings yet

- Name-Ishwor Rijal LBU I'd - 77271300 Subject - Corporate FinanceDocument10 pagesName-Ishwor Rijal LBU I'd - 77271300 Subject - Corporate FinanceIshwor RijalNo ratings yet

- ANALISIS RASIO PT Prima Cakrawala AbadiDocument15 pagesANALISIS RASIO PT Prima Cakrawala AbadiotovitasariNo ratings yet

- FIN448 DCFwWACC SolutionDocument9 pagesFIN448 DCFwWACC SolutionAndrewNo ratings yet

- Financial Ratio and Time Series AnalysisDocument8 pagesFinancial Ratio and Time Series AnalysisSantania syebaNo ratings yet

- Financial Analysis For NIKEDocument12 pagesFinancial Analysis For NIKEAnny Cloveries GabayanNo ratings yet

- PVR Inox - Accounts 1Document13 pagesPVR Inox - Accounts 1Prithwish RoyNo ratings yet

- Name ID: Md. Samit Hossain Md. Ibna Alam Refat Md. Rahmatullah Tanvir Shaike RahmanDocument19 pagesName ID: Md. Samit Hossain Md. Ibna Alam Refat Md. Rahmatullah Tanvir Shaike RahmanAnjan kunduNo ratings yet

- MBA Pre-Term - Ch5 - CFDocument38 pagesMBA Pre-Term - Ch5 - CFJoe YunNo ratings yet

- 01 Signal Cable CompanyDocument5 pages01 Signal Cable Companyodraude97100% (1)

- Copia de OPERMIN ZAMBIA LTD-MANAGEMENT ACCOUNTS-MARCH 2017Document6 pagesCopia de OPERMIN ZAMBIA LTD-MANAGEMENT ACCOUNTS-MARCH 2017Jcaldas AponteNo ratings yet

- Case 1Document5 pagesCase 1noor memekNo ratings yet

- The Scope of Financial Management and Financing Working CapitalDocument24 pagesThe Scope of Financial Management and Financing Working CapitalbluesnakerNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument43 pagesFinancial Statements, Cash Flow, and TaxesshimulNo ratings yet

- Principles of Accounting 5th Edition Smart Solutions ManualDocument9 pagesPrinciples of Accounting 5th Edition Smart Solutions Manualspaidvulcano8wlriz100% (19)

- Nabil Bank Q1 FY 2021Document28 pagesNabil Bank Q1 FY 2021Raj KarkiNo ratings yet

- Lecture: Statement of Cash Flow Ii Lecture ADocument27 pagesLecture: Statement of Cash Flow Ii Lecture ATinashe ChikwenhereNo ratings yet

- Exercises For Chapter 23 EFA2Document16 pagesExercises For Chapter 23 EFA2Thu LoanNo ratings yet

- T1 FIN MA2 Capital Budgeting DecisionsDocument120 pagesT1 FIN MA2 Capital Budgeting DecisionsMangoStarr Aibelle VegasNo ratings yet

- Financial Statements Notes On The Financial StatementsDocument95 pagesFinancial Statements Notes On The Financial StatementsEvariste GaloisNo ratings yet

- Fraser & Neave Holdings BHDDocument10 pagesFraser & Neave Holdings BHDKirthiga NathanNo ratings yet

- Lobj19 - 0000055 CR 1907 02 A PDFDocument28 pagesLobj19 - 0000055 CR 1907 02 A PDFqqqNo ratings yet

- Week 2 Treasury Management by LCLEJARDEDocument34 pagesWeek 2 Treasury Management by LCLEJARDEErica CadagoNo ratings yet

- Practice Problems 2Document10 pagesPractice Problems 2Luigi NocitaNo ratings yet

- Rasio Lancar: Nama:Intania Nim: A1C118086 Kelas: E Akuntansi Reguler Sore MK: Akt. Keuangan 1Document4 pagesRasio Lancar: Nama:Intania Nim: A1C118086 Kelas: E Akuntansi Reguler Sore MK: Akt. Keuangan 1Reza HijjulbaetNo ratings yet

- Gross Working CapitalDocument14 pagesGross Working Capitalfizza amjadNo ratings yet

- Answers: Operating Income Changes in Net Operating AssetsDocument6 pagesAnswers: Operating Income Changes in Net Operating AssetsNawarathna KumariNo ratings yet

- Handout 7 - Business FinanceDocument3 pagesHandout 7 - Business FinanceCeage SJNo ratings yet

- Cash Flows at Warf Computers - Group 5 v.28.09Document8 pagesCash Flows at Warf Computers - Group 5 v.28.09Zero MustafNo ratings yet

- Revisi Tugas Cash Flow AnalysisDocument29 pagesRevisi Tugas Cash Flow AnalysisNovilia FriskaNo ratings yet

- 115 Chapter 15 RaibornDocument24 pages115 Chapter 15 RaibornVictoria CadizNo ratings yet

- Assingment Sem 1 AccDocument6 pagesAssingment Sem 1 AccASMAA BINTI JAIDI STUDENTNo ratings yet

- Dividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksFrom EverandDividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksNo ratings yet

- J 2022 SCC OnLine SC 864 Tushardubey Symlaweduin 20221015 214803 1 23Document23 pagesJ 2022 SCC OnLine SC 864 Tushardubey Symlaweduin 20221015 214803 1 23Tushar DubeyNo ratings yet

- Social Media Engagement and Feedback CycleDocument10 pagesSocial Media Engagement and Feedback Cyclerichard martinNo ratings yet

- Maturity AssessmentDocument228 pagesMaturity AssessmentAli ZafarNo ratings yet

- Pharmacology NCLEX QuestionsDocument128 pagesPharmacology NCLEX QuestionsChristine Williams100% (2)

- STAAD Seismic AnalysisDocument5 pagesSTAAD Seismic AnalysismabuhamdNo ratings yet

- 05 - SRX NatDocument44 pages05 - SRX NatLuc TranNo ratings yet

- Hw5 MaterialsDocument2 pagesHw5 MaterialsmehdiNo ratings yet

- Instructions For Comprehensive Exams NovemberDocument2 pagesInstructions For Comprehensive Exams Novembermanoj reddyNo ratings yet

- Why Is Inventory Turnover Important?: ... It Measures How Hard Your Inventory Investment Is WorkingDocument6 pagesWhy Is Inventory Turnover Important?: ... It Measures How Hard Your Inventory Investment Is WorkingabhiNo ratings yet

- DX DiagDocument16 pagesDX DiagMihaela AndronacheNo ratings yet

- Pay Policy and Salary ScalesDocument22 pagesPay Policy and Salary ScalesGodwin MendezNo ratings yet

- Gabuyer Oct13Document72 pagesGabuyer Oct13William Rios0% (1)

- Level of Life Skills Dev 5Document59 pagesLevel of Life Skills Dev 5MJ BotorNo ratings yet

- Questions - Mechanical Engineering Principle Lecture and Tutorial - Covering Basics On Distance, Velocity, Time, Pendulum, Hydrostatic Pressure, Fluids, Solids, EtcDocument8 pagesQuestions - Mechanical Engineering Principle Lecture and Tutorial - Covering Basics On Distance, Velocity, Time, Pendulum, Hydrostatic Pressure, Fluids, Solids, EtcshanecarlNo ratings yet

- Link Belt Rec Parts LastDocument15 pagesLink Belt Rec Parts LastBishoo ShenoudaNo ratings yet

- AbDocument8 pagesAbSehar BanoNo ratings yet

- Ca50c584 MAYTAGE00011 1 2Document2 pagesCa50c584 MAYTAGE00011 1 2Michael MartinNo ratings yet

- Editing For BeginnersDocument43 pagesEditing For BeginnersFriktNo ratings yet

- ACCOUNTS Foundation Paper1Document336 pagesACCOUNTS Foundation Paper1mukni613324100% (1)

- Address All Ifrs 17 Calculations Across The Organization W Ith A Unified PlatformDocument4 pagesAddress All Ifrs 17 Calculations Across The Organization W Ith A Unified Platformthe sulistyoNo ratings yet

- IllustratorDocument27 pagesIllustratorVinti MalikNo ratings yet

- Exercises Service CostingDocument2 pagesExercises Service Costingashikin dzulNo ratings yet

- Bill FormatDocument7 pagesBill FormatJay Rupchandani100% (1)

- BACS2042 Research Methods: Chapter 1 Introduction andDocument36 pagesBACS2042 Research Methods: Chapter 1 Introduction andblood unityNo ratings yet

- Role of SpeakerDocument11 pagesRole of SpeakerSnehil AnandNo ratings yet

- Objectives in DraftingDocument1 pageObjectives in Draftingshannejanoras03No ratings yet

- Compound Wall Design (1) - Layout1Document1 pageCompound Wall Design (1) - Layout1SandeepNo ratings yet

- Manual Teclado GK - 340Document24 pagesManual Teclado GK - 340gciamissNo ratings yet

- Class Participation 9 E7-18: Last Name - First Name - IDDocument2 pagesClass Participation 9 E7-18: Last Name - First Name - IDaj singhNo ratings yet

- Microfluidic and Paper-Based Devices: Recent Advances Noninvasive Tool For Disease Detection and DiagnosisDocument45 pagesMicrofluidic and Paper-Based Devices: Recent Advances Noninvasive Tool For Disease Detection and DiagnosisPatelki SoloNo ratings yet