Professional Documents

Culture Documents

Bonds 2 Questions Uwe

Uploaded by

Ashok ShresthaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bonds 2 Questions Uwe

Uploaded by

Ashok ShresthaCopyright:

Available Formats

INVESTMENT MANAGEMENT UMAD5X

Bonds 2 Workshop

1. The yield curve is upward sloping. Can you conclude that investors expect short-

term interest rates to rise? Why or why not?

2. The yield to maturity on one year zero coupon bonds is 7.5%. The yield to

maturity on two year zero coupon bonds is 8.5%.

a. What is the forward rate of interest for the second year?

b. If you believe in the expectations hypothesis, what is your best guess as to the

expected value of the short-term interest rate next year?

c. If you believe in the liquidity preference theory, is your best guess as to next

year’s short-term interest rate higher or lower than in (b)?

2012 June Exam Question 6

a) The graph below depicts the yields on 3 month LIBOR and T-bills. Explain why is

one always on top of the other? What happen to the spread around 2008? (5 marks)

7

6

09/08/2007

5

4

3

15/09/2008

2

1

0

01/02/02

01/08/02

01/02/04

01/08/04

01/02/06

01/08/06

01/02/08

01/08/08

01/08/09

01/08/01

01/02/03

01/08/03

01/02/05

01/08/05

01/02/07

01/08/07

01/02/09

b) Given the information provided in the table below, what is the spread between

the 10 year bond yields between that of Germany and Greece? (13 marks)

Coupon rate Current Price Par Value

Greece 6.00% 24.00 100.00

Germany 2.00% 100.00 100.00

You might also like

- Toyota Maintanence Schedule PDFDocument10 pagesToyota Maintanence Schedule PDFcod22050% (2)

- Netball Whole Sport PlanDocument2 pagesNetball Whole Sport PlanLiamAlfordNo ratings yet

- Thorntons PLC: Corporate and Business Strategy: Case Teaching NotesDocument11 pagesThorntons PLC: Corporate and Business Strategy: Case Teaching NotesGopikrishna MurugaianNo ratings yet

- Subramanyam FSA Chapter 01 - ETJDocument44 pagesSubramanyam FSA Chapter 01 - ETJMaya AngrianiNo ratings yet

- Bond Pricing: 3. A) The Yield To Maturity On One-Year Zero-Coupon Bonds Is 9%. The Yield ToDocument3 pagesBond Pricing: 3. A) The Yield To Maturity On One-Year Zero-Coupon Bonds Is 9%. The Yield ToQuỳnh Linh NgôNo ratings yet

- Base Metals Q2 2010 - OutlookDocument14 pagesBase Metals Q2 2010 - Outlookkoderi100% (1)

- MCA Trend Assistant 32171300a-EnDocument5 pagesMCA Trend Assistant 32171300a-EnFábio LeiteNo ratings yet

- HA MonoEstación Andamarca TempMaxMensual 1hidroañoDocument6 pagesHA MonoEstación Andamarca TempMaxMensual 1hidroañoHeidy E. MendozaNo ratings yet

- Optimal Group, Inc.: Company BackgroundDocument10 pagesOptimal Group, Inc.: Company BackgroundMeester KewpieNo ratings yet

- VR16 URG-I CQB GBB Parts ListDocument1 pageVR16 URG-I CQB GBB Parts Listthrow away100% (1)

- SQI and Drops Improvement of Silchar City Airtel ASSAM BY Muddasar NPI AssamDocument9 pagesSQI and Drops Improvement of Silchar City Airtel ASSAM BY Muddasar NPI AssamgauravmakhlogaNo ratings yet

- The Stock Market in MarchDocument2 pagesThe Stock Market in MarchJohn Paul GroomNo ratings yet

- Myths About The Financial Crisis of 2008Document18 pagesMyths About The Financial Crisis of 2008Jeff PrattNo ratings yet

- Trading Journal Template 34Document2 pagesTrading Journal Template 34Dery AnggaraNo ratings yet

- Introduction To The Fifth Power Plan: Figure 1-1 - Daily Average Firm Prices at Mid ColumbiaDocument11 pagesIntroduction To The Fifth Power Plan: Figure 1-1 - Daily Average Firm Prices at Mid Columbiawildan irfansyahNo ratings yet

- The Stock Market in MayDocument2 pagesThe Stock Market in MayJohn Paul GroomNo ratings yet

- Sheepskin Bubble: A Cost/benefit Analysis of EducationDocument11 pagesSheepskin Bubble: A Cost/benefit Analysis of EducationIan GrantNo ratings yet

- Hex 2Document128 pagesHex 2CatastrioNo ratings yet

- Local Situation Covid19 enDocument10 pagesLocal Situation Covid19 enHally TillsNo ratings yet

- SUCHINDRAM - LOP - 17.3.23 (3) - ModelDocument1 pageSUCHINDRAM - LOP - 17.3.23 (3) - ModelHemanth KumarNo ratings yet

- Local Situation Covid19 enDocument10 pagesLocal Situation Covid19 enDEFNo ratings yet

- Local Situation Covid19 enDocument10 pagesLocal Situation Covid19 engggAaaaNo ratings yet

- High Probability Trading Slide - Kathy Lien (Part 1)Document57 pagesHigh Probability Trading Slide - Kathy Lien (Part 1)IsabelNogales100% (2)

- Absen Kelas Xi Mipa 2 (MG Ke-3 Agustus 2021)Document8 pagesAbsen Kelas Xi Mipa 2 (MG Ke-3 Agustus 2021)Galih TegarNo ratings yet

- Where Are We in The Global Crisis?Document14 pagesWhere Are We in The Global Crisis?charudhall164217No ratings yet

- Political Economy in Shambles Some Additions To The Marxist-Leninist Crisis TheoryDocument52 pagesPolitical Economy in Shambles Some Additions To The Marxist-Leninist Crisis TheorypweispfenningNo ratings yet

- The Oil Market Through The Lens of The Latest Oil Price CycleDocument22 pagesThe Oil Market Through The Lens of The Latest Oil Price CycleAnkit BirharuaNo ratings yet

- Hex 3Document123 pagesHex 3CatastrioNo ratings yet

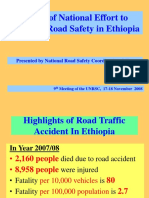

- Status of National Effort To Enhance Road Safety in EthiopiaDocument19 pagesStatus of National Effort To Enhance Road Safety in EthiopiaPulkitSainiDbspNo ratings yet

- Min SRDocument1 pageMin SRTourist GuideNo ratings yet

- HA MonoEstación Andamarca PrecipMensual EnerDic 1Document6 pagesHA MonoEstación Andamarca PrecipMensual EnerDic 1Heidy E. MendozaNo ratings yet

- Aug 2020Document1 pageAug 2020Jeremy TurnageNo ratings yet

- HEINEKEN NV (Beverages) : Earnings & Estimates Market DataDocument3 pagesHEINEKEN NV (Beverages) : Earnings & Estimates Market DataDrag MadielNo ratings yet

- Milestone Report: Late Milestones Milestones Up Next Completed MilestonesDocument1 pageMilestone Report: Late Milestones Milestones Up Next Completed MilestonesAlexandru BaciuNo ratings yet

- HCMC Market Presentation Q3 2010 - enDocument42 pagesHCMC Market Presentation Q3 2010 - enmaykidNo ratings yet

- Laporan Penerimaan Dan Pemakaian Gas Medik Blud Rsud I La Galigo Wotu Kabupaten Luwu Timur Bulan Januari Tahun 2021Document1 pageLaporan Penerimaan Dan Pemakaian Gas Medik Blud Rsud I La Galigo Wotu Kabupaten Luwu Timur Bulan Januari Tahun 2021ritaNo ratings yet

- TKB Hoc Ky Ii-ProDocument1 pageTKB Hoc Ky Ii-Prodzungnova2No ratings yet

- Lmo Io 390 A1a6Document407 pagesLmo Io 390 A1a6Daniel MkandawireNo ratings yet

- TheArgentineEconomy IAE - Marzo 2011Document43 pagesTheArgentineEconomy IAE - Marzo 2011norbertoNo ratings yet

- Pirates of The ComexDocument10 pagesPirates of The Comexgaoup100% (1)

- The Trendpointers Report: Advance Signals For Economic Expectations and ConsumptionDocument19 pagesThe Trendpointers Report: Advance Signals For Economic Expectations and ConsumptionmarcycapronNo ratings yet

- H I S A Keterangan No. Absen Kelas Nama Siswa TanggalDocument1 pageH I S A Keterangan No. Absen Kelas Nama Siswa TanggalAditya VisualNo ratings yet

- Pratt & Whitney Standard Practices Manual List of Effective PagesDocument4 pagesPratt & Whitney Standard Practices Manual List of Effective PagesRobin JacketNo ratings yet

- Local Situation Covid19 enDocument8 pagesLocal Situation Covid19 enErik ChanNo ratings yet

- 7 16 10TheWrongDebateDocument3 pages7 16 10TheWrongDebaterichardck30No ratings yet

- Defiance Cap - The Week That Just Passed Mar 19, 2010Document6 pagesDefiance Cap - The Week That Just Passed Mar 19, 2010WallstreetableNo ratings yet

- 5K Process PerformanceDocument1 page5K Process PerformanceDian RosyidNo ratings yet

- Credit Card Purchases as a Short-Term Economic IndicatorDocument20 pagesCredit Card Purchases as a Short-Term Economic IndicatorRomeoHPNo ratings yet

- The Non-Deliverable Forward (NDF) Market For The Indian RupeeDocument9 pagesThe Non-Deliverable Forward (NDF) Market For The Indian RupeeandrewpereiraNo ratings yet

- NLC Students Attendance SheetDocument2 pagesNLC Students Attendance Sheetpablo atacador67% (3)

- Sustainability 12 08142 v2Document12 pagesSustainability 12 08142 v2Bahiru BelachewNo ratings yet

- Cross Asset Technical VistaDocument20 pagesCross Asset Technical VistaanisdangasNo ratings yet

- Spreadsheet WACC Model August 2020Document118 pagesSpreadsheet WACC Model August 2020Jhonatan Steven Sotelo RodriguezNo ratings yet

- The Stock Market FallsDocument2 pagesThe Stock Market FallsJohn Paul GroomNo ratings yet

- Darren Weekly Report 47Document6 pagesDarren Weekly Report 47DarrenNo ratings yet

- Comparativo Volumenes de AguaDocument6 pagesComparativo Volumenes de AguaArthuro TrNo ratings yet

- Cross Asset Technical Vista AnalysisDocument19 pagesCross Asset Technical Vista AnalysisanisdangasNo ratings yet

- Basic Electrical & Electronics Engineering - Blue Print: Sub. Code: (FEC 105) For Revised Syllabus 2012Document2 pagesBasic Electrical & Electronics Engineering - Blue Print: Sub. Code: (FEC 105) For Revised Syllabus 2012AbhishekNo ratings yet

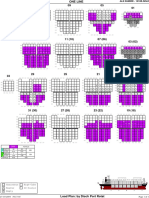

- Als Sumire 1018e Load Scan Plan (Colour)Document1 pageAls Sumire 1018e Load Scan Plan (Colour)Anonymous WnxskULNo ratings yet

- Holiday Request Form 21 22 England and Wales1.7Document11 pagesHoliday Request Form 21 22 England and Wales1.7drakeNo ratings yet

- Hex WorldDocument117 pagesHex WorldCatastrioNo ratings yet

- Pack 6 Books in 1 - Flash Cards Pictures and Words English Spanish: 400 Cards - Spanish vocabulary learning flash cards with pictures for beginnersFrom EverandPack 6 Books in 1 - Flash Cards Pictures and Words English Spanish: 400 Cards - Spanish vocabulary learning flash cards with pictures for beginnersNo ratings yet

- Pack 3 Books in 1 - Flash Cards Pictures and Words English Spanish: 200 Cards - Spanish vocabulary learning flash cards with pictures for beginnersFrom EverandPack 3 Books in 1 - Flash Cards Pictures and Words English Spanish: 200 Cards - Spanish vocabulary learning flash cards with pictures for beginnersNo ratings yet

- BKM Chapter14Document5 pagesBKM Chapter14Ashok ShresthaNo ratings yet

- Does Hedging Increase Firm Value Evidence From French Firms PDFDocument5 pagesDoes Hedging Increase Firm Value Evidence From French Firms PDFAshok ShresthaNo ratings yet

- Assessment BriefDocument9 pagesAssessment BriefAshok ShresthaNo ratings yet

- Assessment BriefDocument9 pagesAssessment BriefAshok ShresthaNo ratings yet

- Mergers and Acquisitions Types and Value CreationDocument10 pagesMergers and Acquisitions Types and Value CreationSoorajKrishnanNo ratings yet

- Priyanshu BbaDocument66 pagesPriyanshu Bbasoban moriwalaNo ratings yet

- Cons 7820 PBM Reading TwoDocument14 pagesCons 7820 PBM Reading Twoრაქსშ საჰაNo ratings yet

- REvision Pack 08-Questions and AnswersDocument45 pagesREvision Pack 08-Questions and Answerssunshine9016No ratings yet

- Developing The Indian Debt Capital Markets: Small Investor PerspectivesDocument31 pagesDeveloping The Indian Debt Capital Markets: Small Investor PerspectivesMAX PAYNENo ratings yet

- A Project Report BY Sanjana Gupta PGDM 2014-16Document22 pagesA Project Report BY Sanjana Gupta PGDM 2014-16Sanjana GuptaNo ratings yet

- Unexpected Changes in Gross Profit MarginsDocument22 pagesUnexpected Changes in Gross Profit MarginsMaher Samar Amin LurkaNo ratings yet

- List of International Financial Reporting Standards - WikipediaDocument17 pagesList of International Financial Reporting Standards - WikipediaHiyas ng SilanganNo ratings yet

- Unit 7 Finance and BankingDocument100 pagesUnit 7 Finance and BankingAlen Pestek100% (1)

- Chapter - IDocument65 pagesChapter - Iarjunmba119624No ratings yet

- 07.31.2014.new .York .July .2014.BitLicense - ProposalDocument43 pages07.31.2014.new .York .July .2014.BitLicense - ProposaljohnsmitheringNo ratings yet

- TESCODocument19 pagesTESCOEmmanuel OkemeNo ratings yet

- Sist Mba Mini Project Report 42410388 Riyas AhamedDocument81 pagesSist Mba Mini Project Report 42410388 Riyas Ahamedriyas Ahme.14No ratings yet

- NLC Investor Presentation Aug18Document35 pagesNLC Investor Presentation Aug18Gomateashwar Yesodharan SugumaarNo ratings yet

- CH 01Document14 pagesCH 01Dave Magarian100% (3)

- Samsung ThailandDocument25 pagesSamsung Thailandlipzgalz9080No ratings yet

- Cost of CapitalDocument93 pagesCost of CapitalMubeenNo ratings yet

- Business Case For Outsourcing Product TestingDocument8 pagesBusiness Case For Outsourcing Product TestingSomenath NagNo ratings yet

- FemaDocument34 pagesFemaAnirudh AroraNo ratings yet

- Insurance Sector Career Guide - Opportunities, Courses, SkillsDocument45 pagesInsurance Sector Career Guide - Opportunities, Courses, SkillsPranav ViraNo ratings yet

- Financial Inclusion Study of PMJDY in IndoreDocument55 pagesFinancial Inclusion Study of PMJDY in IndoreKuanlNo ratings yet

- Vietnam Central Bank: Roles and FunctionsDocument54 pagesVietnam Central Bank: Roles and FunctionsLinh LeNo ratings yet

- Report On The Forum On Business Permits and Licensing System (BPLS) and Inspection ReformsDocument68 pagesReport On The Forum On Business Permits and Licensing System (BPLS) and Inspection ReformsRaidenAiNo ratings yet

- Bata IndiaDocument13 pagesBata IndiaNeel ModyNo ratings yet

- Deloitte Maverick: A Study and Analysis of The US Telco CaseDocument11 pagesDeloitte Maverick: A Study and Analysis of The US Telco CaseNikhil SharmaNo ratings yet

- Ghana Tax Facts and Figures 2019 PDFDocument32 pagesGhana Tax Facts and Figures 2019 PDFVan BoyoNo ratings yet

- ECON 130 Lecture 19Document11 pagesECON 130 Lecture 19Phuong HoNo ratings yet