Professional Documents

Culture Documents

HEINEKEN NV (Beverages) : Earnings & Estimates Market Data

Uploaded by

Drag MadielOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HEINEKEN NV (Beverages) : Earnings & Estimates Market Data

Uploaded by

Drag MadielCopyright:

Available Formats

This document is being provided for the exclusive use of BOHAN JIANG at [FIRM]. Not for redistribution.

HEIA NA Equity

HEINEKEN NV (Beverages)

Heineken N.V. produces and distributes beverages internationally. The Company produces beers, spirits, wines, and soft drinks under various brand names. [FIGI

BBG000BW4R84]

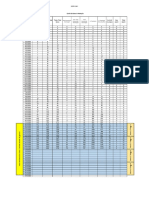

Earnings & Estimates Market Data

104.00

Next Announcement Date 10/23/19

P/E EUR 29.96 98.20

Est P/E 12/19 22.52 92.40

T12M EPS 3.31

86.60

Est EPS 4.41

80.80

75.00

9/ 10 11 12 1/ 2/ 3/ 4/ 5/ 6/ 7/ 8/ 9/

30 /3 /2 /2 28 27 29 28 28 27 27 26 25

/2 0/ 9/ 9/ /2 /2 /2 /2 /2 /2 /2 /2 /2

01 20 20 20 01 01 01 01 01 01 01 01 01

8 18 18 18 9 9 9 9 9 9 9 9 9

Corporate Info

Px/Chg 1D (EUR) 99.20/-.1%

52 Wk H (07/26/19) 104.00

PO Box 28 www.theheinekencompany.com

52 Wk L (01/18/19) 74.28

Amsterdam 1000 AA T: 31-20-523-92-39

YTD Change/% 22.00/28.5%

NL Employees 85,000 (06/30/19)

Mkt Cap EUR 57,139.5M

Chairman-Mgmt Board/CEO Jean-Francois van Boxmeer

Shrs Out/Float 576.0M/188.2M

CFO/Member-Mgmt Board Laurence Debroux

Chief Supply Chain Officer Marc Gross

Revenue Earnings Per Share

25B 5

20B 4

15B 3

10B 2

5B 1

2015 2016 2017 2018 2019 2020 2015 2016 2017 2018 2019 2020

FY 20.51B 20.79B 21.91B 22.47B 23.87B 24.92B FY 3.57 3.68 3.94 4.25 4.41 4.76

S1 9.90B 10.09B 10.48B 10.78B 11.44B -- S1 1.59 1.71 1.82 1.89 1.84 --

S2 10.62B 10.70B 11.41B 11.69B 12.54B -- S2 1.84 1.97 1.71 2.11 2.56 --

Ratios

Fiscal Year End * Last Quarter End ~ Current/T12M

12/2018 06/19 Q2 EUR

Issue Data Per Share Data Cash Flow Analysis

~ Last Px EUR/99.20 ~ EPS 3.34 ~ CF/NI 2.3

~ P/E 30.0 ~ EPS T12M 3.31 ~ Dvd P/O 47.9%

~ Dvd Ind Yld 1.7% ~ DPS 1.60 ~ Cash Gen/Cash Reqd 1.5

~ P/B 3.76 ~ Bk Val Per Sh 26.41 ~ Csh Dvd Cov 2.1

~ P/S 2.4 ~ Rev/Bas Sh 39.41 ~ CFO/Sales 19.5%

~ P/CF 14.1 ~ T12M CPS 7.05 ~ Eff IR 3.2%

~ Mkt Cap 57,139.5M ~ Curr Shares Out 576.0M

Growth Potential Profitability Structure

~ EPS - 1 Yr Gr -1.5% ~ OPM 14.0% ~ Curr Ratio 0.9

~ Cap 1Y Gr 2.1% ~ Prtx Mrgn 12.7% ~ Quick Ratio 0.5

~ BPS 1Y Gr 7.8% ~ ROA 4.3% ~ Debt/Assets 35.7%

~ Retntn Rt 52.1% ~ ROE 13.1% ~ Debt/Com Eq 104.4%

~ Rev - 1 Yr Gr 4.0% ~ ROC 7.7% ~ A/R Trnovr N.A.

~ Empl 1Y Gr 7.0% ~ Ast TO 0.5 ~ EBIT/Tot Int Exp 6.4

~ Ast 1Y Gr 2.2% ~ Finl Lev 3.0

~ Eff Tx Rate 26.5%

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries

in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing

and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates do not provide investment advice,

and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 09/29/2019 20:00:20 1

This document is being provided for the exclusive use of BOHAN JIANG at [FIRM]. Not for redistribution.

HEIA NA Equity

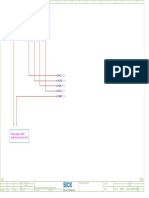

Geographic Segmentation Holdings Summary

2018 Rev 3Yr Gr Inst Holdings | OWN »

Europe 10.35B 2.85% # of Inst. Owners 633

The Americas 6.78B 9.58% Shares Owned 155.51M

Africa and Middle East, E. Europe 3.05B -2.18% Shares Out/Float 27%/56.2%

Asia Pacific 2.92B 5.58% # of Buyers/Sellers 181/174

Shares Sold 61.00M

Product Segmentation

2018 Rev 3Yr Gr

Breweries 22.47B 3.09% Insider Holdings | OWN »

% Held by Insiders 0.06%

Net change last 6M -14.04%

Top Holders | HDS »

Issue Information | RELS » HEINEKEN HOLDING NV 50.00%

CB EQUITY LLP 8.63%

Sec Type Common Stock FOMENTO ECONOMICO MEXICANO 8.63%

Pri Exch EN Amsterdam SUN LIFE FINANCIAL INC 1.90%

PAR EUR 1.6 VANGUARD GROUP INC 1.23%

Pri MIC XAMS MORGAN STANLEY 1.14%

Incorp NETHERLANDS BLACKROCK 1.07%

FIGI BBG000BW4R84

ISIN NL0000009165

SEDOL1 7792559 NL

Common 018773481

WPK # A0CA0G

Equity Weights

Sicovam 505585

Dutch # 00916 STXE 600 (EUR) Pr N.A.

ESTX (EUR) Pr N.A.

AEX-Index N.A.

BLOOMBERG EUROPEAN 500 0.594%

STXE 600 Food&Bevrg EUR N.A.

MSCI EURO 0.787%

MSCI PAN-EURO 0.409%

BBG WORLD INDEX 0.098%

ESTX Food&Bevrg (EUR) Pr N.A.

STXE Lrg 200 (EUR) Pr N.A.

Dividend | DVD »

EUR

Ind Gross Yield 1.66%

5Y Net Growth 13.14%

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries

in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing

and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates do not provide investment advice,

and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 09/29/2019 20:00:20 2

This document is being provided for the exclusive use of BOHAN JIANG at [FIRM]. Not for redistribution.

HEIA NA Equity

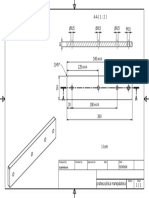

Bloomberg Intelligence: Beverages, Global

Critical Themes: Alcoholic Beverage Company Pension Funding Industry Indicators: US Non-Alcohol CPI

in Hand

Plunging Interest Rates Challenge Alcoholic-Beverage 164

Companies

155

Analyst Coverage Duncan Fox & Kenneth Shea

Sep 9, 2019 146

A 50-bp cut in discount rates would add $3.6 billion to pension 137

funding if applied to the European-quoted beverage companies

128 19 19 19 19 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20

and Molson Coors, yet that's unlikely to alter company 96 97 98 99 00 01 02 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20

strategies as pension deficits are under control. The companies

generated more than $22 billion of free cash flow and paid $12

billion in dividends in 2018. Source: Bureau of Labor Statistics, Currency: , Unit: N/A, Periodicity: Annually

Critical Themes: U.S. Beverage Group Faces Interest Rate

Pension Risks

Tumbling Interest Rates a New Challenge for U.S. Industry Indicators: US Alcohol CPI

Beverage Group

145

Analyst Coverage Kenneth Shea & Gopal Srinivasan

Aug 13, 2019 136

Plunging intermediate-term U.S. interest rates might pressure 127

leading U.S. beverage companies, in our view, if the rates 118

stay low and tepid stock returns force the likes of Coca-

109

Cola and PepsiCo to add to pension-plan funding. Such

additional investment could outweigh any potential benefit from 100 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20

00 01 02 03 04 05 06 06 07 08 09 10 11 12 13 14 15 16 17 18 19

refinancing debt.

Source: Bureau of Labor Statistics, Currency: , Unit: N/A, Periodicity: Annually

Industry Indicators: Eurozone Alcohol CPI

104

98

92

86

80

74 19 19 19 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20

97 98 99 00 01 02 03 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20

Source: Eurostat, Currency: , Unit: N/A, Periodicity: Annually

Industry Revenue (CCB) Operating Statistics of Industry Comparables (RV)

Company FY Revenue Total Revenue Comps

Metric Company Comps Low Comps High

HEINEKEN NV 22.5B 100.00% Median

ANHEUSER-BUSCH I 46.2B 100.00% Sales Growth Yoy (%) 3.99 -5.85 5.17 15.4

PEPSICO INC 38.8B 70.91% EBITDA Margin (%) 21.5 9.79 20.2 30.4

COCA-COLA CO/THE 30B 100.00% ROIC 6.76 4.36 18.8 84.7

NESTLE SA-REG 25.1B 31.75%

HEINEKEN HLDG 22.5B 100.00% Equity Valuation of Industry Comparables (RV)

Comps

Metric Company Comps Low Comps High

Company Revenue Breakdown (CCB) Median

Industry Percentage Est P/E Current Yr 22.5 13 23.7 58.7

Beverages 100.00% EV/EBITDA FY1 12.7 6.34 15.4 29.8

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries

in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing

and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates do not provide investment advice,

and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 09/29/2019 20:00:20 3

You might also like

- Republic of The Philippines: Quezon CityDocument1 pageRepublic of The Philippines: Quezon CityCharina Marie CaduaNo ratings yet

- The Corporation Code ReviewerDocument28 pagesThe Corporation Code Reviewernoorlaw100% (3)

- Financial LiteracyDocument27 pagesFinancial LiteracyLea E Hondrade100% (3)

- K2A Trading Journal FXDocument11 pagesK2A Trading Journal FXmrsk1801No ratings yet

- Solution - Cash Flow Projection - FinalDocument51 pagesSolution - Cash Flow Projection - Finalanon_355962815100% (1)

- Computerized Bookkeeping of Joseph Landscaping and Plant Store Business Case STUDENTDocument24 pagesComputerized Bookkeeping of Joseph Landscaping and Plant Store Business Case STUDENThello nasty100% (1)

- The Power of Scarcity: Leveraging Urgency and Demand to Influence Customer DecisionsFrom EverandThe Power of Scarcity: Leveraging Urgency and Demand to Influence Customer DecisionsNo ratings yet

- High Probability Trading Slide - Kathy Lien (Part 1)Document57 pagesHigh Probability Trading Slide - Kathy Lien (Part 1)IsabelNogales100% (2)

- Aravind Eye Care Case StudyDocument6 pagesAravind Eye Care Case Studycarazoss100% (1)

- VODAFONE IDEA LTD (Telecom Carriers) : Earnings & Estimates Market DataDocument3 pagesVODAFONE IDEA LTD (Telecom Carriers) : Earnings & Estimates Market DataRachit WadhwaNo ratings yet

- NETFLIX INC (Internet Media & Services) : Earnings & Estimates Market DataDocument3 pagesNETFLIX INC (Internet Media & Services) : Earnings & Estimates Market DataLorenNo ratings yet

- SUBSEA 7 SA (Oil & Gas Services & Equip) : Earnings & Estimates Market DataDocument1 pageSUBSEA 7 SA (Oil & Gas Services & Equip) : Earnings & Estimates Market DataSahil GoelNo ratings yet

- Delivery EfficiancyDocument2 pagesDelivery Efficiancyvidisha officeNo ratings yet

- The Stock Market in MarchDocument2 pagesThe Stock Market in MarchJohn Paul GroomNo ratings yet

- Actividades Del Día:: Reporte Diario de AvanceDocument2 pagesActividades Del Día:: Reporte Diario de Avancederwin huertaNo ratings yet

- Task 16 CDocument3 pagesTask 16 CstudyyyyymailNo ratings yet

- Actividades Del Día:: Reporte Diario de AvanceDocument2 pagesActividades Del Día:: Reporte Diario de Avancederwin huertaNo ratings yet

- Darren Weekly Report 47Document6 pagesDarren Weekly Report 47DarrenNo ratings yet

- Dry Weight Prediction 5Document1 pageDry Weight Prediction 5kevinhartzogNo ratings yet

- PM.11 Promoting Power Plant Construction Project ProductivityDocument8 pagesPM.11 Promoting Power Plant Construction Project ProductivitypirotteNo ratings yet

- Actividades Del Día:: Reporte Diario de AvanceDocument2 pagesActividades Del Día:: Reporte Diario de Avancederwin huertaNo ratings yet

- SPC EjemplosDocument59 pagesSPC EjemplosDaniel LópezNo ratings yet

- Chap007 Principle of Corporate FinanceDocument41 pagesChap007 Principle of Corporate FinanceMc LeeNo ratings yet

- The Outlook For Oil Prices: Bullish and Bearish PerspectivesDocument30 pagesThe Outlook For Oil Prices: Bullish and Bearish PerspectivesMSA-ACCA100% (2)

- Models of Information Security AnalysisDocument14 pagesModels of Information Security AnalysisMechantronNo ratings yet

- 2021 Kallanish Presentation Scrap & Iron Ore Webinar 13 January 21Document28 pages2021 Kallanish Presentation Scrap & Iron Ore Webinar 13 January 21Izzul AzmiNo ratings yet

- Lucrare Practica (Matematica)Document4 pagesLucrare Practica (Matematica)Mihaela CepoiNo ratings yet

- Independent Gantt Chart: SR No. Task Name Start Date Days To CompleteDocument5 pagesIndependent Gantt Chart: SR No. Task Name Start Date Days To CompleteRohit AttriNo ratings yet

- Data Kes Covid by HADocument1 pageData Kes Covid by HAHafiz AkbalNo ratings yet

- Actividades Del Día:: Reporte Diario de AvanceDocument2 pagesActividades Del Día:: Reporte Diario de Avancederwin huertaNo ratings yet

- Tiggo 8 Pro MAX Price - 25 08 2023 - WEBDocument2 pagesTiggo 8 Pro MAX Price - 25 08 2023 - WEBKoma S FazilovNo ratings yet

- Day Trade MM20Document50 pagesDay Trade MM20Jorge Alfredo Da Rosa MissaggiaNo ratings yet

- Cost Accounting MathsDocument15 pagesCost Accounting MathsShakilNo ratings yet

- Arkray HbA1c - FebruariDocument2 pagesArkray HbA1c - FebruariIndah MeylizaNo ratings yet

- Actividades Del Día:: Reporte Diario de AvanceDocument2 pagesActividades Del Día:: Reporte Diario de Avancederwin huertaNo ratings yet

- Economic Developments and Investment Environment in TurkeyDocument30 pagesEconomic Developments and Investment Environment in TurkeyPolat ArıNo ratings yet

- Nyse MS 2002Document28 pagesNyse MS 2002Gautam TandonNo ratings yet

- Advanced Data Structures QuestionsDocument2 pagesAdvanced Data Structures QuestionsShreya WarangNo ratings yet

- Chart 5: PM7 - Chloride Content in Vapor: Spectrum XD3899 Back System Feed StrategyDocument3 pagesChart 5: PM7 - Chloride Content in Vapor: Spectrum XD3899 Back System Feed Strategyjswee396No ratings yet

- ITC LTD.: Presented ByDocument12 pagesITC LTD.: Presented BypavanNo ratings yet

- Altfx Report 2020 February: 1) Win & Loss ChartDocument3 pagesAltfx Report 2020 February: 1) Win & Loss ChartAnthony ChukwujekwuNo ratings yet

- Marimekko ChartDocument5 pagesMarimekko Chartharpal84No ratings yet

- TromolDocument1 pageTromolEden HazardNo ratings yet

- Fixed Income Trading Strategies: Victor Haghani & Gerard GennotteDocument27 pagesFixed Income Trading Strategies: Victor Haghani & Gerard GennottePrateek JajooNo ratings yet

- The Stock Market FallsDocument2 pagesThe Stock Market FallsJohn Paul GroomNo ratings yet

- Ict12 BDocument3 pagesIct12 BRinoa Ianne BorcioneNo ratings yet

- Activity 2 - MorataDocument2 pagesActivity 2 - MorataJohn Nelo MorataNo ratings yet

- Diagram ADocument2 pagesDiagram ALEMUS SSNo ratings yet

- TrailWatch HKDocument1 pageTrailWatch HKlmc20190033No ratings yet

- Data Peso DIF Data Peso DIFDocument5 pagesData Peso DIF Data Peso DIFLeandro De O de LimaNo ratings yet

- RHUBSanMiguel LayoutDocument10 pagesRHUBSanMiguel Layoutantony solisNo ratings yet

- Libra Bhukti ChartDocument1 pageLibra Bhukti ChartManoj JainNo ratings yet

- Bonds 2 Questions UweDocument1 pageBonds 2 Questions UweAshok ShresthaNo ratings yet

- Philips mcm3000 SMDocument27 pagesPhilips mcm3000 SMTito PeñaNo ratings yet

- Master Spreadsheet 2 - With Charts 2024 - ShcheglovaMDocument23 pagesMaster Spreadsheet 2 - With Charts 2024 - ShcheglovaMМария ЩегловаNo ratings yet

- GMK Norilskiy Nikel Pao Adr (Nkelyq)Document2 pagesGMK Norilskiy Nikel Pao Adr (Nkelyq)Carlos FrancoNo ratings yet

- Pinhole Exposure ScaleDocument1 pagePinhole Exposure Scalestein3112100% (1)

- Demo 9267354 Wiring Diagram Safe AGV ForkliftDocument13 pagesDemo 9267354 Wiring Diagram Safe AGV ForkliftMarcelo AlbuquerqueNo ratings yet

- Pick of The Week - Birla Corporation Ltd. - 08-09-2023Document3 pagesPick of The Week - Birla Corporation Ltd. - 08-09-2023deepaksinghbishtNo ratings yet

- Prateca Ploca Manipulatora PDFDocument1 pagePrateca Ploca Manipulatora PDFjadrankostanimirovicNo ratings yet

- Pick of The Week - Steel Strip Wheels LTDDocument3 pagesPick of The Week - Steel Strip Wheels LTDshaubhikmondalNo ratings yet

- Nations Trust Bank Sri LankaDocument3 pagesNations Trust Bank Sri Lankaudita7208100% (1)

- Gantt Chart2Document3 pagesGantt Chart2midorimisoNo ratings yet

- Rebar Take Off Office and Store SubstructureDocument1 pageRebar Take Off Office and Store SubstructureNantukina TeshomeNo ratings yet

- Key To "KS" Pumps Taco Vertical In-Line Pumps: REV Date ECO AppdDocument5 pagesKey To "KS" Pumps Taco Vertical In-Line Pumps: REV Date ECO Appdcarmen hernandezNo ratings yet

- Self Erecting Cranes 2020 Cranes 2020Document2 pagesSelf Erecting Cranes 2020 Cranes 2020Untung AjiTiaNo ratings yet

- SSM Monoblock Leaflet L4 4 April2017Document1 pageSSM Monoblock Leaflet L4 4 April2017Mohammad ShahidNo ratings yet

- Supply Chain Management - Group ProjectDocument7 pagesSupply Chain Management - Group ProjectDrag MadielNo ratings yet

- Master Thesis As A MonographyDocument1 pageMaster Thesis As A MonographyDrag MadielNo ratings yet

- Stock Market Volatility and Presidential Election Uncertainty: Evidence From Political Futures MarketsDocument8 pagesStock Market Volatility and Presidential Election Uncertainty: Evidence From Political Futures MarketsDrag MadielNo ratings yet

- Tilapia Hatchery ManagementDocument2 pagesTilapia Hatchery ManagementDrag Madiel100% (1)

- Seed Rearing ManualDocument16 pagesSeed Rearing ManualDrag MadielNo ratings yet

- Ijest NG Vol3 No7 pp1 14 PDFDocument14 pagesIjest NG Vol3 No7 pp1 14 PDFRahul SethiNo ratings yet

- Veterinarian: Subject Will Not Be Treated)Document1 pageVeterinarian: Subject Will Not Be Treated)Drag MadielNo ratings yet

- 1 Sustaining Good GovernanceDocument11 pages1 Sustaining Good GovernanceDrag MadielNo ratings yet

- Greggs, in Section B Examples Must Not Be Based On The Organisation Chosen in Section ADocument4 pagesGreggs, in Section B Examples Must Not Be Based On The Organisation Chosen in Section ADrag MadielNo ratings yet

- Chicago Author-Date Citation Style GuideDocument7 pagesChicago Author-Date Citation Style GuideDrag MadielNo ratings yet

- 2-Case StudyDocument2 pages2-Case StudyDrag MadielNo ratings yet

- 2 Participation-Performance RelationshipDocument18 pages2 Participation-Performance RelationshipDrag MadielNo ratings yet

- The Effect of Dynamic Assessment On EFL Reading Comprehension in Different Proficiency LevelsDocument22 pagesThe Effect of Dynamic Assessment On EFL Reading Comprehension in Different Proficiency LevelsDrag MadielNo ratings yet

- Veterinarian: Subject Will Not Be Treated)Document1 pageVeterinarian: Subject Will Not Be Treated)Drag MadielNo ratings yet

- Present data with charts figures tablesDocument2 pagesPresent data with charts figures tablesDanny GarciaNo ratings yet

- Sequential Paper Part 1Document1 pageSequential Paper Part 1Drag MadielNo ratings yet

- Final Contact Angle ExperimentDocument4 pagesFinal Contact Angle ExperimentDrag MadielNo ratings yet

- HITS Literature Review Process PDFDocument41 pagesHITS Literature Review Process PDFDrag MadielNo ratings yet

- Molson Coors Brewing PDFDocument3 pagesMolson Coors Brewing PDFDrag MadielNo ratings yet

- The Effects of Teaching Self-Regulated Learning Strategies On EFL Students' Reading ComprehensionDocument6 pagesThe Effects of Teaching Self-Regulated Learning Strategies On EFL Students' Reading ComprehensionDrag MadielNo ratings yet

- Mandatory Outline For Case Analysis: ( (Already Answered)Document2 pagesMandatory Outline For Case Analysis: ( (Already Answered)Drag MadielNo ratings yet

- Proposal - Docx (08 - 12 - 2019, 03 - 30 PM)Document5 pagesProposal - Docx (08 - 12 - 2019, 03 - 30 PM)Drag MadielNo ratings yet

- Task Repetition inDocument3 pagesTask Repetition inDrag MadielNo ratings yet

- ZD84YADocument1 pageZD84YADrag MadielNo ratings yet

- How to Write a Literature Review GuideDocument19 pagesHow to Write a Literature Review GuideToufik AhmedNo ratings yet

- Literature Review StrategiesDocument2 pagesLiterature Review Strategiesizeldien5870No ratings yet

- Working Paper 3Document28 pagesWorking Paper 3Budi SantosoNo ratings yet

- Saudi Vision2030Document85 pagesSaudi Vision2030ryx11No ratings yet

- Critical Success Factors of Small and Medium-Sized Enterprises in Saudi Arabia: Insights From Sustainability PerspectiveDocument12 pagesCritical Success Factors of Small and Medium-Sized Enterprises in Saudi Arabia: Insights From Sustainability PerspectiveDrag MadielNo ratings yet

- Principles of Taxation: Nature, Scope, Classification, and Essential CharacteristicsDocument14 pagesPrinciples of Taxation: Nature, Scope, Classification, and Essential CharacteristicsClariña VirataNo ratings yet

- Income Tax Guide to Key Sections, Rates and RemediesDocument23 pagesIncome Tax Guide to Key Sections, Rates and RemediesAlyanna CabralNo ratings yet

- Class Exercise - Bank ReconciliationDocument5 pagesClass Exercise - Bank Reconciliationmoosanippp0% (2)

- Bosch India annual report highlights FY2018-19 financialsDocument212 pagesBosch India annual report highlights FY2018-19 financialsMuhammad SaninNo ratings yet

- Chapter 1 The Role and Environment of Managerial FinanceDocument24 pagesChapter 1 The Role and Environment of Managerial FinancePenantang Doktrin Kekristenan100% (1)

- Financial Economics Bodie Merton PresentationDocument5 pagesFinancial Economics Bodie Merton PresentationPaul Cheslaw0% (1)

- Financial AnalysisDocument87 pagesFinancial AnalysisJithin KrishnanNo ratings yet

- Birla RatioDocument22 pagesBirla RatioveeraranjithNo ratings yet

- Chapter 13 Capital Structure and Leverage PDFDocument16 pagesChapter 13 Capital Structure and Leverage PDFbasit111No ratings yet

- CH 010Document24 pagesCH 010melodie03No ratings yet

- Introduction To International TaxationDocument13 pagesIntroduction To International TaxationChantia Riva SiallaganNo ratings yet

- Sub: FIMMDA CBRICS Corporate Bond Reporting Platform Participant Application AgreementDocument4 pagesSub: FIMMDA CBRICS Corporate Bond Reporting Platform Participant Application AgreementharikrishnanmscphysicsNo ratings yet

- Budget 2019-20 Highlights and Key TakeawaysDocument24 pagesBudget 2019-20 Highlights and Key TakeawaysSumit BhanderiNo ratings yet

- Life Insurer Improves Customer RetentionDocument5 pagesLife Insurer Improves Customer RetentionmanchorusNo ratings yet

- Final Project Memo - QNT550Document7 pagesFinal Project Memo - QNT550srinath_meduriNo ratings yet

- Airtel Segment Wise AnalysisDocument6 pagesAirtel Segment Wise AnalysisRishabh KapoorNo ratings yet

- Business Plan "Brownies Matcho" Goals:: VisionDocument7 pagesBusiness Plan "Brownies Matcho" Goals:: Visionrizka amandaNo ratings yet

- Entellus Medical Investor Presentation August 2017Document26 pagesEntellus Medical Investor Presentation August 2017medtechyNo ratings yet

- Contract of Lease: Know All Men by These PresentsDocument4 pagesContract of Lease: Know All Men by These PresentsRonel FillomenaNo ratings yet

- AirAsia SlidesDocument9 pagesAirAsia SlidesjaysonchammbaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiaBKLMMDFKLFBNo ratings yet

- HR 125-016 Tax Cut Act - Karissa Kimble 1Document2 pagesHR 125-016 Tax Cut Act - Karissa Kimble 1api-385039333No ratings yet

- Cost Accounting Practices in The Service IndustryDocument4 pagesCost Accounting Practices in The Service Industryasma zainNo ratings yet