Professional Documents

Culture Documents

VODAFONE IDEA LTD (Telecom Carriers) : Earnings & Estimates Market Data

Uploaded by

Rachit WadhwaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VODAFONE IDEA LTD (Telecom Carriers) : Earnings & Estimates Market Data

Uploaded by

Rachit WadhwaCopyright:

Available Formats

This document is being provided for the exclusive use of PULKIT KHANDELWAL at [FIRM]. Not for redistribution.

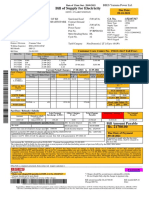

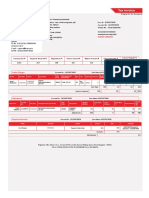

IDEA IN Equity

VODAFONE IDEA LTD (Telecom Carriers)

Vodafone Idea Limited operates as a telecom service provider. The Company offers 2G, 3G, and 4G mobile services, as well as mobile payments, advanced enterprise

offerings, and entertainment. Vodafone Idea serves customers in India. [FIGI BBG000FR5515]

Earnings & Estimates Market Data

27.00

Next Announcement Date 02/06/20

P/E INR N.A. 22.00

Est P/E 03/20 N.A. 17.00

T12M EPS -32.38

12.00

Est EPS -6.51

7.00

2.00

12 12 1/ 3/ 3/ 4/ 5/ 6/ 7/ 8/ 9/ 10

/1 /3 30 1/ 31 30 30 29 29 28 27 /2

/2 1/ /2 20 /2 /2 /2 /2 /2 /2 /2 7/

01 20 01 19 01 01 01 01 01 01 01 20

8 18 9 9 9 9 9 9 9 9 19

Corporate Info

Px/Chg 1D (INR) 6.79/-3.69%

52 Wk H (11/21/18) 27.51

Suman Tower, Plot No 18, Sector 11 www.vodafoneidea.com

52 Wk L (11/15/19) 2.4

Gandhinagar, Gujarat 382011 T: 91-79-6671-4000

YTD Change/% -16.011/-70.22%

IN Employees 13,520 (03/31/19)

Mkt Cap INR 195,113.3M

Managing Director/CEO Ravinder Takkar

Shrs Out/Float 28,735.4M/18,688.2M

Deputy Managing Director Ambrish P Jain

Chief Financial Officer Akshaya Moondra

Revenue Earnings Per Share

500B 10

400B 5

300B

-5

200B

-10

100B -15

B -20

2015 2016 2017 2018 2019 2020 2015 2016 2017 2018 2019 2020

FY 315.27B 359.35B 355.53B 282.47B 370.06B 438.32B FY 5.45 5.17 -0.74 -6.86 -17.40 -6.51

Q1 75.55B 87.95B 94.87B 81.57B 58.89B 112.65B Q1 1.30 1.56 0.37 -1.38 3.51 -1.70

Q2 75.66B 86.77B 93.00B 74.61B 76.64B 108.44B Q2 1.27 1.36 0.15 -1.87 -5.16 -17.72

Q3 80.09B 90.01B 86.61B 68.06B 117.36B 111.80B Q3 1.29 1.28 -0.64 -2.15 -3.07 -1.43

Q4 83.97B 94.63B 81.09B 61.22B 117.41B 102.94B Q4 1.58 0.97 -0.56 -1.48 -4.67 -1.36

Ratios

Fiscal Year End * Last Quarter End ~ Current/T12M

03/2019 09/20 Q2 INR

Issue Data Per Share Data Cash Flow Analysis

~ Last Px INR/6.79 ~ EPS -21.12 ~ CF/NI N.A.

~ P/E N.A. ~ EPS T12M -32.38 ~ Dvd P/O N.A.

~ Dvd Ind Yld N.A. ~ DPS 0.00 ~ Cash Gen/Cash Reqd 0.1

~ P/B 0.81 ~ Bk Val Per Sh 8.38 ~ Csh Dvd Cov N.A.

~ P/S 0.2 ~ Rev/Bas Sh 53.53 ~ CFO/Sales 1.6%

~ P/CF N.A. ~ Csh Earn / Sh -9.84 ~ Eff IR 9.8%

~ Mkt Cap 195,113.3M ~ Curr Shares Out 28.7B

~ Curr P/FCF N.A. ~ FCF/Basic Sh -10.19

Growth Potential Profitability Structure

~ EPS - 1 Yr Gr -209.8% ~ OPM -28.4% ~ Curr Ratio 0.3

~ Cap 1Y Gr 117.7% ~ Prtx Mrgn -49.1% ~ Quick Ratio 0.2

~ BPS 1Y Gr 80.7% ~ ROA -27.1% ~ Debt/Assets 54.8%

~ Retntn Rt N.A. ~ ROE -140.3% ~ Debt/Com Eq 211.2%

~ Rev - 1 Yr Gr 31.0% ~ ROC -36.0% ~ A/R Trnovr 12.8

~ Ast 1Y Gr 133.0% ~ Ast TO 0.2 ~ Inv Turnover 7.5

~ Empl 1Y Gr N.A. ~ Finl Lev 3.8 ~ GM N.A.

~ Eff Tx Rate N.A. ~ EBIT/Tot Int Exp -1.2

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries

in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing

and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates do not provide investment advice,

and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 11/21/2019 00:53:00 1

This document is being provided for the exclusive use of PULKIT KHANDELWAL at [FIRM]. Not for redistribution.

IDEA IN Equity

Geographic Segmentation

2018 Rev 3Yr Gr

India 282.79B -3.60%

Product Segmentation

2018 Rev 3Yr Gr

Cellular Mobile Telephony Services (CMTS) 273.71B -4.23%

National Long Distance (NLD) 4.75B -6.49%

Passive Infrastructure 4.33B -45.33%

Top Holders | HDS »

Issue Information | RELS » GRASIM INDUSTRIES LTD 11.55%

EURO PACIFIC SECURITIES LT 11.13%

Sec Type Common Stock PRIME METALS LTD 7.61%

Pri Exch Natl India ORIANA INVESTMENTS PTE LTD 7.47%

PAR INR 10 MOBILVEST 5.83%

Pri MIC XNSE VODAFONE TELECOMMUNICATION 5.65%

Incorp INDIA TRANS CRYSTAL LTD 5.08%

FIGI BBG000FR5515

ISIN INE669E01016

SEDOL1 B1MP4H4 IN

WPK # A0MLJE

Equity Weights

S&P BSE 500 IDX N.A.

Nifty 500 N.A.

S&P BSE 200 IDX N.A.

Nifty Next 50 N.A.

Nifty 200 N.A.

Nifty 100 N.A.

Bloomberg ESG Data N.A.

FTSE EmMarkAllCapChinA 0.012%

FTSE EmMktAlCapChinAInTR 0.009%

S&P Global BMI USD N.A.

Dividend | DVD »

INR

Ind Gross Yield N.A.

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries

in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing

and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates do not provide investment advice,

and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 11/21/2019 00:53:00 2

This document is being provided for the exclusive use of PULKIT KHANDELWAL at [FIRM]. Not for redistribution.

IDEA IN Equity

Bloomberg Intelligence: Telecom Carriers, Asia-Pacific

Critical Themes: Squeezing Huawei Remaps 5G, Hinders China Industry Indicators: APAC Total Wireless Revenue

Huawei Ostracism Slows Asia, Europe 5G Rollout, 385,555

Restrains China 330,868

Analyst Coverage Anthea Lai & Charles Shum

May 30, 2019 276,181

The U.S. ban on Huawei could delay Asian and European 5G 221,494

rollouts and exclude China from influencing the next generation 166,807

of global communications technology. Chinese telcos will likely

112,120

keep Huawei as their main telecom equipment provider, but 20 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2

00 000 001 002 003 004 005 006 007 008 009 010 011 012 013 014 015 016 017 018

others may switch to alternatives such as Ericsson, Nokia and

Samsung, incurring extra cost. The South Korean company,

along with Taiwan's Mediatek, may also supply chips to Huawei, Source: Ovum, Currency: , Unit: N/A, Periodicity: Annually

which will probably struggle to upgrade its own chips without

access to ARM's intellectual property. Huawei is central to

China's goal of reaching the commanding heights of telecoms,

after its home-grown 3G and 4G efforts failed to gain global Industry Indicators: APAC Mobile Data Traffic (TB per month)

traction.

Critical Themes: China's Mobile User Fight, 5G Lead 7,879,422

China Mobile Subscriber Fight May Drag on Before 5G 5,987,165

Pays Off 4,094,908

Analyst Anthea Lai

2,202,651

Apr 16, 2019

Chinese telecom operators will likely face more price pressure, 310,394

20 20 20 20 20 20 20 20 20 20

12 12 13 14 15 16 17 18 19 20

even after the government loosened its service charge

reduction target this year. An aggressive subscriber war may

persist, even as the impact of last July's nationwide mobile data

roaming-fee removal starts to wear off in 2H. China Mobile is Source: Cisco Systems, Currency: , Unit: N/A, Periodicity: Annually

at risk of losing the most high-spending customers, since churn

rates may rise along with the nation's rising implementation of

mobile number portability (MNP). Chinese telcos stand to bear

the cost of attaining large-scale 5G deployment in 2020, despite

a lack of monetization opportunities. China Mobile retains its

subscriber lead with nearly 930 million mobile customers. A

possible merger of its two smaller rivals, China Telecom and

China Unicom, may lead to significant savings on their 5G

spending.

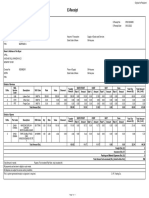

Industry Revenue (CCB) Operating Statistics of Industry Comparables (RV)

Company FY Revenue Total Revenue Comps

Metric Company Comps Low Comps High

VODAFONE IDEA LT 283B 100.00% Median

CHINA TELECOM-H 3.03e+03B 77.86% Sales Growth Yoy (%) 31 -22.7 5.56 122

CHINA UNITED-A 2.58e+03B 85.78% EBITDA Margin (%) 12.4 8.48 32.6 60.2

KT CORP 1.31e+03B 89.66% Capex/Sales 20.7 1.62 23.2 32.3

SK HOLDINGS CO L 1.04e+03B 16.54% EBITDA Growth (%) -24 -50.9 4.47 150

SK TELECOM 951B 90.74%

Equity Valuation of Industry Comparables (RV)

Company Revenue Breakdown (CCB) Comps

Metric Company Comps Low Comps High

Industry Percentage Median

Telecom Carriers 100.00% Est P/E Current Yr N.A. 9.63 22.3 60.6

EV/TTM EBITDA 10.4 3.28 7.61 32.4

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries

in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing

and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates do not provide investment advice,

and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 11/21/2019 00:53:00 3

You might also like

- Russia BAML March 2022Document12 pagesRussia BAML March 2022elizabethrasskazovaNo ratings yet

- List of Names and Dates from DocumentDocument820 pagesList of Names and Dates from DocumentFrnanda OvNo ratings yet

- 6905 Ruthette Court - NRHDocument3 pages6905 Ruthette Court - NRHTanner LeggettNo ratings yet

- AIDTauditDocument74 pagesAIDTauditCaleb TaylorNo ratings yet

- Feb 1-3613311284991 - BM2233I010340187Document7 pagesFeb 1-3613311284991 - BM2233I010340187Jihoon BongNo ratings yet

- #15 Investment in AssociatesDocument3 pages#15 Investment in AssociatesZaaavnn VannnnnNo ratings yet

- What is a SPAC? Understanding the Alternative to a Traditional IPODocument22 pagesWhat is a SPAC? Understanding the Alternative to a Traditional IPOPolina ChtchelockNo ratings yet

- Base Carbon: Initiating Coverage With An Outperform (Speculative) RatingDocument23 pagesBase Carbon: Initiating Coverage With An Outperform (Speculative) RatingJim McIntyreNo ratings yet

- Shop Electricity Bill PDFDocument1 pageShop Electricity Bill PDFR DNo ratings yet

- Your Electricity Bill For: Loknath Developers PVTDocument2 pagesYour Electricity Bill For: Loknath Developers PVTRahul NaagNo ratings yet

- MA and Equity Offerings Market Report 2022Document21 pagesMA and Equity Offerings Market Report 2022thinh thaiNo ratings yet

- About BlankDocument2 pagesAbout Blankसंग्रामसिंह जाखलेकर पाटीलNo ratings yet

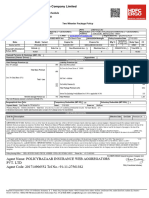

- Private Car Comprehensive Policy: Certificate of Insurance Cum Policy ScheduleDocument4 pagesPrivate Car Comprehensive Policy: Certificate of Insurance Cum Policy ScheduleSiddhartha MittalNo ratings yet

- Ola Ride Receipt 19 Jan 2023Document3 pagesOla Ride Receipt 19 Jan 2023Anonymous Clm40C1No ratings yet

- CITI Company ListDocument716 pagesCITI Company ListtomanojsachdevaNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2312 1001 0405 1200 000Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2312 1001 0405 1200 000gggggjoshi.gaurav1991No ratings yet

- Software - IT Companies List in Hyderabad With Contact DetailsDocument12 pagesSoftware - IT Companies List in Hyderabad With Contact DetailsHemanth KumarNo ratings yet

- Stockholders' Equity Calculations for Multiple CompaniesDocument20 pagesStockholders' Equity Calculations for Multiple CompaniesKarlovy DalinNo ratings yet

- Hardship: Blake A Brewer 1904 West 75Th Place Davenport Ia 52806Document4 pagesHardship: Blake A Brewer 1904 West 75Th Place Davenport Ia 52806Blake BrewerNo ratings yet

- Advancing Indonesia's Export Through Financing, Guarantee and Consultancy ServicesDocument486 pagesAdvancing Indonesia's Export Through Financing, Guarantee and Consultancy ServicesLaurens BuloNo ratings yet

- BBS maloprodajni cjenik 28/17MDocument17 pagesBBS maloprodajni cjenik 28/17MEdwin MehinagicNo ratings yet

- Brazil Small Caps PortfolioDocument8 pagesBrazil Small Caps PortfolioElidiel BarrosoNo ratings yet

- AAR Corp. ReportDocument15 pagesAAR Corp. Reportakr200714No ratings yet

- Egov Urban Portal-Water Tax PDFDocument2 pagesEgov Urban Portal-Water Tax PDFPadmavathi Putra LokeshNo ratings yet

- UpekshaDocument3 pagesUpekshaShashikala MadushaniNo ratings yet

- Mitchell Board of Education Agenda 6-13Document28 pagesMitchell Board of Education Agenda 6-13Erik KaufmanNo ratings yet

- 2021 Agency Legislative Bill Analysis:: Department of TransportationDocument10 pages2021 Agency Legislative Bill Analysis:: Department of TransportationChris VaughnNo ratings yet

- Sinqia: A Christmas Gift - Acquisition of NewconDocument4 pagesSinqia: A Christmas Gift - Acquisition of NewconRenan Dantas SantosNo ratings yet

- E-Receipt: Page 1 of 1Document1 pageE-Receipt: Page 1 of 1Vipul DahiyaNo ratings yet

- Monthly Services: Included at No Extra CostDocument1 pageMonthly Services: Included at No Extra CostRajnish VermaNo ratings yet

- Edzel AberiaDocument1 pageEdzel AberiaEdz carl AberiaNo ratings yet

- Remote Digital Signature FDDocument2 pagesRemote Digital Signature FDSimion Georgiana-LilianaNo ratings yet

- Ogl 073721645167051043Document5 pagesOgl 073721645167051043Rajesh KumarNo ratings yet

- Invoice Act May 2022Document2 pagesInvoice Act May 2022Pavan kumarNo ratings yet

- Insurance Acknowledgment ReceiptDocument2 pagesInsurance Acknowledgment ReceiptArman PenalosaNo ratings yet

- Applied Financial Accounting AFAC02-6: Formative Assessment - AssignmentDocument7 pagesApplied Financial Accounting AFAC02-6: Formative Assessment - AssignmentDesire PiRah GriffinsNo ratings yet

- Beyond Snack Detail DeckDocument21 pagesBeyond Snack Detail Deckcchascashc100% (1)

- AutoCheck Vehicle History ReportDocument5 pagesAutoCheck Vehicle History ReportSUHIMAN SALMANNo ratings yet

- Manage Beneficiaries TIAA BankDocument2 pagesManage Beneficiaries TIAA BankAbdy Fernando SanchezNo ratings yet

- MAPFRE Insurance Terms and Conditions PDFDocument3 pagesMAPFRE Insurance Terms and Conditions PDFSarah MccoyNo ratings yet

- Tanla Shareholder Report Highlights GrowthDocument20 pagesTanla Shareholder Report Highlights GrowthSree HarshaNo ratings yet

- J'usqu'a Dia 183Document303 pagesJ'usqu'a Dia 183my nameNo ratings yet

- Invoice FebDocument2 pagesInvoice FebSadashiv RahaneNo ratings yet

- HomeCredit Loan Payment ScheduleDocument2 pagesHomeCredit Loan Payment ScheduleKylyn JynNo ratings yet

- Receipt Pay - K2PAQ5WopcBicD From Skill Nation (Paid)Document1 pageReceipt Pay - K2PAQ5WopcBicD From Skill Nation (Paid)Ravichette KumarNo ratings yet

- Cancontrol List 2022-08-19 enDocument76 pagesCancontrol List 2022-08-19 enGary NayanNo ratings yet

- In Ps Blockchain Noexp PDFDocument32 pagesIn Ps Blockchain Noexp PDFMurali DharanNo ratings yet

- 1ms - Mecon LTD (DNS) - blr-Sl22-23113Document1 page1ms - Mecon LTD (DNS) - blr-Sl22-23113Dipan DasNo ratings yet

- Technical Data Sheet Enphase Microinverter PDFDocument2 pagesTechnical Data Sheet Enphase Microinverter PDFJustin SitohangNo ratings yet

- Jeep AutocheckDocument6 pagesJeep AutocheckLindsey HudsonNo ratings yet

- GNGGN00252970000208293 NewDocument3 pagesGNGGN00252970000208293 NewHimachali VloggerNo ratings yet

- Lupin Cash Flow, Lupin Financial Statement & AccountsDocument4 pagesLupin Cash Flow, Lupin Financial Statement & Accountsatul.jha2545No ratings yet

- Final Placement Report 2021Document14 pagesFinal Placement Report 2021Siddhi KansalNo ratings yet

- BVB0033270 PDFDocument6 pagesBVB0033270 PDFMohd Fakhrul Nizam HusainNo ratings yet

- AZGOP Republican Party of Arizona POA Campaign Finance ReportDocument25 pagesAZGOP Republican Party of Arizona POA Campaign Finance ReportBarbara EspinosaNo ratings yet

- MF Yash Agrawal 31-03-2022 HoldingsDocument3 pagesMF Yash Agrawal 31-03-2022 HoldingsShreya AgrawalNo ratings yet

- India Tourism Statics (2012) PDFDocument343 pagesIndia Tourism Statics (2012) PDFJesse StoutNo ratings yet

- Agenda JPMorgan Healthcare Conference 2013Document4 pagesAgenda JPMorgan Healthcare Conference 2013behnamin_rahmaniNo ratings yet

- E Shore DR, Willis, TX 77318-6634, Montgomery County: Multiple Building Property SummaryDocument6 pagesE Shore DR, Willis, TX 77318-6634, Montgomery County: Multiple Building Property SummaryBot makerNo ratings yet

- Two Wheeler Insurance Policy SummaryDocument7 pagesTwo Wheeler Insurance Policy SummaryAswini Kumar PaloNo ratings yet

- 4-17-19 SIGNED RLNG Rescission LetterDocument10 pages4-17-19 SIGNED RLNG Rescission LetterRyan E. Emanuel, Ph.D.No ratings yet

- Aakanksha Jee 2 Result 2022Document1 pageAakanksha Jee 2 Result 2022Komet Study AbroadNo ratings yet

- Viewpoint 6 Getting StartedDocument42 pagesViewpoint 6 Getting StartedNitin ChandruNo ratings yet

- GDP Growth Q1FY19: Dipankar Mitra Somnath Mukherjee Research, ASKWA August 31, 2018Document3 pagesGDP Growth Q1FY19: Dipankar Mitra Somnath Mukherjee Research, ASKWA August 31, 2018Kunal SinhaNo ratings yet

- Agenda Item Report and Backup Information PDFDocument8 pagesAgenda Item Report and Backup Information PDFMaria MeranoNo ratings yet

- HEINEKEN NV (Beverages) : Earnings & Estimates Market DataDocument3 pagesHEINEKEN NV (Beverages) : Earnings & Estimates Market DataDrag MadielNo ratings yet

- Business Plan: Conversion of Urine Into Organic FertilizerDocument17 pagesBusiness Plan: Conversion of Urine Into Organic FertilizerRachit WadhwaNo ratings yet

- Business Plan: Conversion of Urine Into Organic FertilizerDocument17 pagesBusiness Plan: Conversion of Urine Into Organic FertilizerRachit WadhwaNo ratings yet

- Wealth ManagementDocument1 pageWealth ManagementRachit WadhwaNo ratings yet

- KanpurDocument9 pagesKanpurRachit WadhwaNo ratings yet

- DUMPINGDocument8 pagesDUMPINGRachit WadhwaNo ratings yet

- Banking Structure in India PDFDocument12 pagesBanking Structure in India PDFShantanu PorelNo ratings yet

- Coach CarterDocument16 pagesCoach CarterRachit WadhwaNo ratings yet

- Chapter 14Document42 pagesChapter 14Rachit WadhwaNo ratings yet

- DescriptionDocument1 pageDescriptionRachit WadhwaNo ratings yet

- April Bulletin 2014 PDFDocument28 pagesApril Bulletin 2014 PDFRachit WadhwaNo ratings yet

- Colgate Marketing StrategyDocument5 pagesColgate Marketing StrategyRachit WadhwaNo ratings yet

- Coach CarterDocument16 pagesCoach CarterRachit WadhwaNo ratings yet

- Sum7 Credit AnalysisDocument25 pagesSum7 Credit AnalysisRachit WadhwaNo ratings yet

- Colgate Marketing StrategyDocument5 pagesColgate Marketing StrategyRachit WadhwaNo ratings yet

- Women DevelopmentDocument15 pagesWomen DevelopmentSukanya RayNo ratings yet

- April Bulletin 2014 PDFDocument28 pagesApril Bulletin 2014 PDFRachit WadhwaNo ratings yet

- CaseDocument3 pagesCaseRachit WadhwaNo ratings yet

- Efficiency of Indian Manufacturing FirmsDocument18 pagesEfficiency of Indian Manufacturing FirmsRachit WadhwaNo ratings yet

- Sum6 Relationship ManagementDocument14 pagesSum6 Relationship ManagementRachit WadhwaNo ratings yet

- GEDocument9 pagesGEAlper AykaçNo ratings yet

- Skill Gap in Accounting Education For Prospective ManagersDocument8 pagesSkill Gap in Accounting Education For Prospective ManagersRachit WadhwaNo ratings yet

- Warrants, ADR, GDR, Innovative Financial ProductsDocument22 pagesWarrants, ADR, GDR, Innovative Financial ProductsSanjeevNo ratings yet

- Unit 4. Accounting For Partnerships: A PartnershipDocument17 pagesUnit 4. Accounting For Partnerships: A PartnershipHussen AbdulkadirNo ratings yet

- Augenbaum V RC Ventures LLC Et Al 2022-10-31 22-cv-09327Document10 pagesAugenbaum V RC Ventures LLC Et Al 2022-10-31 22-cv-09327GMEEEENo ratings yet

- Revised Corporation Code - Part IDocument50 pagesRevised Corporation Code - Part IだみNo ratings yet

- Participantes Sepa Instant Credit TransferDocument53 pagesParticipantes Sepa Instant Credit TransferVozpopuliNo ratings yet

- About Venture CapitalDocument8 pagesAbout Venture CapitalKishor YadavNo ratings yet

- 15 Minute Stock Breakouts, Technical Analysis ScannerDocument8 pages15 Minute Stock Breakouts, Technical Analysis Scannerravi.youNo ratings yet

- Entrepreneurial FinanceDocument112 pagesEntrepreneurial FinanceJohnny BravoNo ratings yet

- Daftar PustakaDocument4 pagesDaftar PustakaFitriani VeenaNo ratings yet

- Buybacks and DelistingDocument23 pagesBuybacks and DelistingKushal Adeshra100% (2)

- Comply Table EditedDocument19 pagesComply Table EditedisraqueNo ratings yet

- Special Issues in Corporate FinanceDocument6 pagesSpecial Issues in Corporate FinanceMD Hafizul Islam HafizNo ratings yet

- Corporate Governance Issues & ChallengesDocument4 pagesCorporate Governance Issues & ChallengesMuhammad AhmedNo ratings yet

- Partnership and RCCDocument24 pagesPartnership and RCCJames CantorneNo ratings yet

- A22169213 18777 22 2022 Ca1aq2010Document5 pagesA22169213 18777 22 2022 Ca1aq2010Thakur Anmol RajputNo ratings yet

- Order in The Respect of Shamken Multifab Limited and OrsDocument15 pagesOrder in The Respect of Shamken Multifab Limited and OrsShyam SunderNo ratings yet

- KYC Documents For EntitiesDocument2 pagesKYC Documents For EntitiesParikshit YadavNo ratings yet

- ParCor QuizDocument4 pagesParCor QuizJinx Cyrus Rodillo0% (1)

- Dividend Policy Insights of Kanchan BankDocument9 pagesDividend Policy Insights of Kanchan Bankbaap hu teraNo ratings yet

- BookBuilding PPTDocument23 pagesBookBuilding PPTAakashRavalNo ratings yet

- Employers Liability Insurance RecordsDocument1,781 pagesEmployers Liability Insurance RecordsAmine AïdiNo ratings yet

- Acquisition GuideDocument4 pagesAcquisition GuideNikhil KarwaNo ratings yet

- KSE - 30 IndexDocument21 pagesKSE - 30 IndexNadeem uz Zaman100% (1)

- Authorized Mobility PartnersDocument44 pagesAuthorized Mobility PartnersCarl MartensNo ratings yet