Professional Documents

Culture Documents

Institute: Xecutive Ummary Eries

Uploaded by

DIVYA SHREEOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Institute: Xecutive Ummary Eries

Uploaded by

DIVYA SHREECopyright:

Available Formats

ASIAN DEVELOPMENT BANK

A

D

EXECUTIVE INSTITUTE

B SUMMARY Kasumigaseki Bldg. 8F 3-2-5 Kasumigaseki

Chiyoda-ku, Tokyo 100-6008 Japan

I SERIES No. S10/00

Tel: 81 3 3593 5500, Fax: 81 3 3593 5571

Email: info@adbi.org http://www.adbi.org

Tokyo Executive Seminar on

Insurance Regulation and Supervision

27-28 September 1999, Tokyo

Executive Summary of Proceedings

The establishment of an integrated financial supervisory

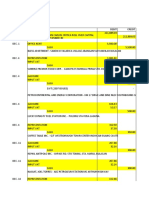

CONTENTS body that covers different financial sectors, including insur-

Macroview page 1 ance, has recently emerged as a global trend in such countries

INTRODUCTION 4 as the United Kingdom, Canada, Australia, Sweden, Norway,

ORGANIZATION OF INSURANCE Denmark, Korea, and Singapore. In Japan, the Financial Su-

SUPERVISORY AUTHORITIES 4 pervisory Agency (FSA) was formed in 1998, as part of the

Part A: Organizational Structures 4 Japanese financial “Big Bang” that intends to integrate the

Part B: Operational Arrangements 5 banking, securities, and insurance sectors. [¶ 5]

CONCURRENT WORKSHOP MEETINGS 5 The Australian Prudential Regulation Authority (APRA)

Workshop A: Prudential Regulation 5 was established in July 1998 as that country’s sole prudential

Workshop B: Supervision of Financial regulator of banks, insurance companies, pension funds, and

Conglomerates 7 other credit institutions, and in the process merged 11 sepa-

Workshop C: Exchange of Information 8 rate supervisory entities. In August 1999, the APRA’s inter-

Workshop D: Regulatory Issues on Financial nal structure was reorganized to be more consistent with the

Sector Convergence 9 trend towards convergence in the marketplace, and with the

CRISIS MANAGEMENT: SUPERVISION OF government’s objective of regulating similar risks in a simi-

INSURANCE COMPANIES IN DIFFICULTIES 10 lar manner, irrespective of institutional boundaries. [¶ 6]

CONCLUSION 11

The challenges for creating integrated supervisors are :

● merging cultures

● training staff

Macroview

● integrating systems

[ ¶ ] References are to paragraphs

● cost cutting

The environment surrounding insurance regulators and ● harmonizing prudential regimes

supervisors is changing rapidly. As the business and markets ● establishing credibility in the marketplace

evolve, regulation has to follow quickly in order to avoid be- ● minimizing disruption

coming obsolete and irrelevant. [¶ 22] ● maintaining operations [¶ 6]

Regulators now need to realize that the insurance sector

is becoming a part of a broader industry, though it may retain Regulatory reform is being implemented in the direc-

some special aspects. This general trend should not necessar- tion of removing administrative regulation that causes unnec-

ily end up with global financial conglomerates everywhere. essary costs to industry and limits managerial freedom, while

Ultimately, corporate strategies on whether to be a conglom- at the same time strengthening solvency regulation to protect

erate or instead focus on core business will be tested and policyholder interests. Ruling bodies of supervisory authori-

judged by the market. When an institution does more than ties are increasingly constituted by both regulatory and pri-

one line of business, cross-subsidy between the business lines vate representatives from the financial sector. [¶ 7]

should be an issue for financial supervisors. [¶ 46] In order to have effective and efficient supervision, it is

important that a supervisory authority has professional, com-

ADBI Executive Summary Series No. S10/00 1

petent, and dedicated staff. Selective recruitment has to be Worldwide harmonization of accounting principles for

followed by appropriate training to ensure the staff is equipped insurance companies will facilitate internationally comparable

with up-to-date knowledge and skills to supervise the fast financial information to the benefit of not only supervisors

evolving industry. In order to motivate and retain quality staff but also consumers and investors. The increasing number of

it is necessary to offer attractive remuneration packages, com- internationally-operating insurers would also welcome a single

parable to those in the financial sector, and flexible job rota- basis for their accounting. [¶ 20]

tion schemes. [¶ 9] Similarly, disclosure requirements can be an important

Only government institutions independent from the in- supervisory tool for the insurance sector as it encourages dis-

dustry can inspire the public confidence on which insurance cipline, honesty, and efficiency in management, which also

businesses rely. Adequate financing and attendant quality leads to more stability in the market as a whole. The informa-

could be achieved by separating insurance supervision from tion disclosed must be both verifiable and actually verified.

the organization of the traditional administration, and by trans- The current process of demutualization of insurance compa-

ferring it to an autonomous institution having an independent nies would lead as a matter of course to more stringent dis-

organization and budget. [¶ 10] closure requirements for publicly-traded insurance companies.

In order to avoid a situation in which the payer dictates [¶ 21]

the regulator’s actions, various alternatives including a license Discussions are also underway at the international and

charge, a levy based on annual gross premia and fines could intersectoral level concerning supervision of financial con-

be imposed so that the varied interests of different parties could glomerates. For instance, the International Association of In-

be balanced. [¶ 11] surance Supervisors (IAIS) has been working with other

The solvency position of an insurance company depends international financial standard-setting bodies for the Joint

at least on: Forum on Financial Conglomerates. [¶ 24]

● sufficient technical provisions The Joint Forum was established in 1996 as a formal

● sound investment assets corresponding to the technical provisions group to discuss conglomerate supervision, consisting of regu-

● a satisfactory solvency margin [¶ 13] lators of the three sectors in 13 countries. Its mandate covers:

Adequate regulation of solvency capital is always nec- ● exploring practical ways to share information,

essary, because no matter how sophisticated, the technical ● identifying the impediments to information sharing,

provisions or investment regulations cannot eliminate the risk ● establishing criteria for the lead supervisor and its role and

that the insurer becomes unable to meet its obligations. A va- responsibilities, and

riety of approaches are applied for stipulating statutory sol- ● developing supervisory principles. [¶ 25]

vency requirements, including fixed ratio model, risk-based While conglomeration may reduce the overall degree of

capital model, and the models based on risk or ruin theoretic vulnerability through risk diversification, it poses potential

considerations. [¶ 14] threats from a supervisor’s viewpoint, such as capital inad-

The risk-based capital formula intends to establish a equacy, contagion, intragroup exposures and transactions,

minimum capital level for each insurer, taking into consider- large exposures at a group level, and especially where insti-

ation the actual risks it assumes, such as asset risk, insurance tutions supplying non-financial services also participate in the

risk, interest rate risk, underwriting risk, and administrative cooperation. At the institution level, the supervisors should

risk. Four thresholds are established to trigger particular regu- pay attention to five aspects: ownership arrangements, com-

latory interventions, from requiring the insurer to submit a positions of management, credit relationships, distribution and

comprehensive financial plan to seizing control of the insurer outsourcing. [¶ 29, 30]

by the authority. [¶ 15]

A single regulator has many advantages such as:

Pessimistic scenario testing also has various advantages, in

● a good overview of all financial businesses

that:

● a common supervisory framework and methodology

● it is forward-looking

● it can account for many adverse factors occurring concurrently

structure

● easy communication

● it can be tailored to the risk profile inherent in each company’s

● a coordinated supervisory approach with supervision of

business mix [¶ 16, 17]

Market liberalization improves efficiency, quality, and individual companies and group supervision [¶ 27]

diversity in the market through competition and innovation,

and thereby enhances benefits for consumers and the economy Integration is now also crossing borders more frequently.

as a whole. Greater efforts could, therefore, be made to elimi- For example, in the Nordic countries, Finansinspektionen will

nate limitations to market access and national treatment, and take lead responsibility for the overall supervision of a newly-

to review domestic regulations that effectively restrict the merged transnational insurer, based on memoranda of under-

supply of services. A worthwhile strategy might be to place standing (MOU) to be negotiated among the supervisors in

the initial emphasis on liberalization of commercial presence, all three countries. [¶ 28]

followed by that of cross-border transactions and other modes

of supplying insurance services. [¶ 19]

2 ADBI Executive Summary Series No. S10/00

lowering the price of insurance products, as well as contrib-

G7 Ten Key Principles and the IAIS Model MOU envis-

uting to simplification and moralization in their supply. [¶ 41]

age a greater level of freedom of information exchange.

Commissioners of Insurance will continue to supervise

They include:

the activity related to insurance products, but given the gen-

1 authorization to share and gather information eral trend towards financial sector convergence, deeper co-

2 cross-sector information sharing operation, especially exchange of confidential information,

3 information about systems and controls with banking supervisors is becoming necessary. [¶ 42]

4 information about individuals Bancassurance arrangements are of two general forms:

5 information sharing between exchanges (not applicable strategic alliances in which banks merely market insurance

in the insurance context) products using their customer bases, and full integration

6 confidentiality through merger and acquisition between banks and insurance

7 formal agreements and written requests companies in the post-Glass-Steagall world. [¶ 43]

8 reciprocity requirements Both pension fund administrators and insurance compa-

9 cases which further supervisory purposes nies, who are active in the service of providing annuities after

retirement, are subject to very similar investment regulation,

10 removal of laws preventing supervisory information

exchange [¶ 32] though the latter have a greater degree of flexibility in invest-

ment. For example, insurance companies may invest, up to

Domestically, the U.S. National Association of Insurance certain limits, in mortgages, mutual funds, and real estate

Commissioners (NAIC) has developed a number of effective abroad, which is not allowed for more conservative pension

and innovative information systems and arrangements for in- fund administrators. [¶ 44]

formation exchange among their 55 jurisdictions. [¶ 34] Due to their long-term nature, small changes in the real

Many insurers do business across borders in Europe in rate of return make a huge difference in pension funds. In

the form of cross-border transactions or via branches and sub- order to help alleviate the future tax burden in the pension

sidiaries. As a result of EC directives, confidentiality rules system, it is vitally important to invest the funds productively.

have been harmonized and certain “rules of the game” in a Investment in the stock market should be preferable to that in

protocol on collaboration have been agreed upon among the government bonds as stocks are more profitable and less vola-

European insurance supervisors. [¶ 35] tile over the long run. [¶ 45]

The protection of policyholders is essentially provided

International insurance fraud could be significantly pre-

through financial supervision of insurance companies, first

vented by actions such as:

as prevention and subsequently as a cure if necessary and

● coordinating international regulation

possible. The implementation of a recovery plan may be en-

● giving more responsibilities to independents, auditors, ac-

sured by safeguard measures, such as restriction on asset dis-

tuaries and managers

posals, to be taken if the company fails to achieve such

● regulating reinsurers

implementation. The supervisor may further ask the company

● educating insurance consumers

to seek external support in such forms as mergers and trans-

● building effective systems for information exchanges [¶ 37]

fer of the portfolios of contracts. But generally, a guarantee

fund usually does not command sufficient resources for cop-

Exchange of information in a winding-up situation is

ing with a systemic crisis. [¶ 48]

becoming increasingly important. Establishing relationships

Winding-up or managing companies in crisis situations

with other supervisors, whether formally through a memo-

is an important issue for policyholders and claimants. Inter-

randum of understanding, or informally, is essential to hav-

vention by supervisors should be treated with respect and cir-

ing an efficient flow of information when a crisis situation

cumspection, because insurance is based on trust between the

occurs. In such a situation, one needs to select key regulators

policyholder and insurance company. [¶ 49]

with which to work. The selection could be based not only on

Prudent and effective crisis management starts with the

the influence of the demise over a given jurisdiction but also

setting up of an early warning system. Protection should also

on the relationship of trust developed through cooperation in

be provided to policyholders in winding-up through the pref-

the past. [¶ 38]

erential treatment of insurance claimants and assistance un-

Financial convergence includes many different forms,

der insolvency funds. [¶ 50]

ranging from simple cross-selling to integrated services, and

from a sector-based structure to a functional, client-oriented Protection fund scheme’s key principles include:

organization. The current sectoral regulation and supervision, ● the design of the scheme must consider moral hazard, eq-

however, face difficulties in creating a level playing field to uity and administrative cost

avoid hindering the innovation and expansion of the finan- ● the scheme must come into operation not only when liqui-

cial sector. [¶ 40] dation has taken place, but must allow for earlier action

The development of bancassurance seems to be driven ● it should only benefit policyholders and third parties

by the various synergy effects raised from combining bank ● there will be a need for greater coordination between insur-

and insurance businesses (especially, life assurance). The de- ance protection schemes and protection schemes for the

velopment of bancassurance is beneficial for consumers by banking and securities industries [¶ 51]

ADBI Executive Summary Series No. S10/00 3

INTRODUCTION “integrated” financial supervisory body that covers different

financial sectors, including insurance, has emerged as a glo-

bal trend in recent years. To date, an integrated supervisory

1. The Tokyo Executive Seminar on Insurance Regulation

body has been created in such countries as the United King-

and Supervision was held at the Asian Development Bank

dom, Canada, Australia, Sweden, Norway, Denmark, Korea,

Institute (ADBI) in Tokyo on 27-28 September 1999. It was

Singapore, and Japan. Representatives of these countries at-

hosted by the Financial Supervisory Agency (FSA) of Japan

tended the meeting of Integrated Regulators hosted by the

and ADB Institute in collaboration with the Organization for

Australian authority in May 1999. The Japanese integrated

Economic Co-operation and Development (OECD), the In-

supervisory body, the Financial Supervisory Agency (FSA),

ternational Association of Insurance Supervisors (IAIS), and

was formed in 1998, as part of the Japanese financial “Big

the Ministry of Finance of Japan. Approximately 90 high-

Bang” that intends to lower the walls between the banking,

level officials and experts attended the seminar from the in-

securities, and insurance sectors. More financial conglomer-

surance authorities of 51 jurisdictions, as well as

ates are expected to be active in the Japanese markets in the

representatives of four international organizations (European

near future. How to cope with such conglomerates is an issue

Commission, OECD, IAIS and Joint Forum). The seminar

for the FSA, as its organization is structured on a mixed func-

provided a timely opportunity for these officials and experts

tional and institutional basis.

to exchange views, and develop a better understanding of key

issues on insurance regulation and supervision. Specifically,

this seminar focused on: 6. Mr. Darryl Roberts, General Manager, Policy Devel-

opment, Australian Prudential Regulation Authority then ex-

plained the Organization of Insurance Supervision in

● organization of insurance supervisory authorities

Australia. The Australian Prudential Regulation Authority

● prudential regulation

(APRA) was established in July 1998 as that country’s sole

● supervision of financial conglomerates

prudential regulator of banks, insurance companies, pension

● exchange of information among supervisors

funds, and other credit institutions, merging 11 separate su-

● financial sector convergence

pervisory entities. In its first year, it had a “silo” structure in

● supervision of insurance companies in difficulties

which supervisory functions from different organizations sim-

ply sat side-by-side under the APRA banner. However, by

2. The seminar started with a welcome address by Mr.

August 1999, the APRA’s internal structure was reorganized

Masaharu Hino, Commissioner, FSA of Japan. The opening

to be more consistent with the trend towards convergence in

remarks were delivered by Mr. Hanley Clark, Chairman, Ex-

the marketplace, and with the government’s objective of regu-

ecutive Committee, IAIS; Mr. Everette James, Vice Chair-

lating similar risks in a similar manner, irrespective of insti-

man, Insurance Committee, OECD; Mr. Makoto Fukuda,

tutional boundaries. Mr. Roberts pointed out that the

Director-General, Financial System Planning Bureau, Minis-

challenges for creating integrated supervisors are:

try of Finance, Japan; and Mr. S.B. Chua, Director, Capacity

Building and Training, ADBI.

● merging cultures

● training staff

ORGANIZATION OF INSURANCE

● integrating systems

SUPERVISORY AUTHORITIES

● cost cutting

● harmonizing prudential regimes

3. This session was designed to explore issues related to

● establishing credibility in the marketplace

the organizational arrangements of an insurance supervisory

● minimizing disruption

body, which vary considerably among jurisdictions. The ses-

● maintaining operations

sion was divided into two parts: Part A dealt with the aspect

of organizational structure, and Part B focused on operational

7. Mr. Manuel Aguilera, President of the National Insur-

arrangements such as recruitment and funding. Mr. Andre

ance and Surety Commission, Mexico, presented the Organi-

Swanepoel of South Africa moderated this session.

zation Structure of an Insurance Supervisory Body: the

Mexican Case. The opening of the Mexican insurance indus-

Part A: Organizational Structures try to foreign competition in the early 1990s has brought about

major changes in the market structure and consequently sig-

4. An overview presentation on the recent international phe- nificant adjustments in the regulation and supervision of the

nomenon to establish an “integrated” financial supervisory insurance sector. Regulatory reform has been implemented

body was followed by two country presentations. in the direction of removing “administrative” regulation that

causes unnecessary costs to the industry and limits its man-

5. Mr. Sakura Shiga, Counsellor of the Commissioner’s agement freedom, while strengthening solvency regulation

Secretariat, Financial Supervisory Agency, Japan made a pre- to protect policyholder interests. Since 1995, the CNSF, the

sentation on an Overview of Organization Structure of an In- Mexican insurance commission, has implemented a program

surance Supervisory Body. The establishment of an to develop a new supervisory scheme. The new scheme fo-

4 ADBI Executive Summary Series No. S10/00

cuses on three key aspects: financial, actuarial, and reinsur- 11. Mr. Nambi Rangachary from the Insurance Regulatory

ance supervisions. The ruling body of the CNSF is the Board Authority, Ministry of Finance, India discussed their experi-

of Governors, which is constituted by both regulatory and ence in Funding and Independence of an Insurance Supervi-

private representatives from the financial sector. The design sor. In line with a move to deregulate the Indian insurance

of the organization of the CNSF is based on these key aspects industry, moving away from the monopoly of the state com-

of supervision, and is therefore structured on a functional basis. panies, the creation of a new regulatory body, the Insurance

Regulatory and Development Authority is planned. This regu-

Part B: Operational Arrangements latory body is designed to be autonomous and independent in

its functioning. It would consist of professional members who

8. Part B dealt with issues related to professionalism and could make their decisions transparently and independently

independence of an Insurance Supervisor. Among many is- from political interference, though being appointed by the

sues, the key ones in this respect are recruitment and funding. government. The funding of the authority would be provided

Three presenters provided their respective experience with by the industry. In order to avoid a situation in which the payer

these difficult questions. dictates the regulator’s actions, various alternatives includ-

ing the license charge, a levy based on annual gross premium

9. Ms. Lim Shu Chiau, Executive Director, Monetary Au- and fines would be imposed so that the varied interests of

thority of Singapore (MAS) described MAS’s policies on staff different parties could be balanced. In the ultimate analysis,

recruitment and training. In order to have effective and effi- one could say that the independence of an insurance supervi-

cient supervision, it is important that a supervisory authority sor depends primarily on its credibility and commitment to

has professional, competent, and dedicated staff. Recruitment professional competence.

of the right people is the first determinant in ensuring compe-

tent staff. Selective recruitment has to be followed by appro- CONCURRENT WORKSHOP MEETINGS

priate training to ensure the staff is equipped with up-to-date

knowledge and skills to supervise the industry. Apart from

recruitment and training, the MAS must also do its best to Workshop A: Prudential Regulation

motivate and retain quality staff. This can be done, for ex-

ample, by offering attractive remuneration packages, compa- 12. This workshop covered a variety of classic regulatory

rable to those in the financial sector, and flexible job rotation issues, ranging from solvency regulation to liberalization of

schemes. Human-resource assets are important for the super- insurance services. During the first half of the workshop, three

visory authorities, and the MAS is committed to providing presenters spoke about the issues related to solvency regula-

well-rounded career development plans, and building a solid tion and its techniques. Three follow-up presenters discussed

work environment and culture with which staff members can liberalization, disclosure, and accounting, respectively. Mr.

identity. Rinaldo Pecchioli of the OECD Secretariat moderated this

workshop.

10. Dr. Helmut Muller from Germany discussed his view

on the Funding and Independence of an Insurance Supervi- 13. Mr. Per Simonsen, Assistant Director General, Kredit

sor. He proposed five theses: Tilsynet, Norway provided an Overview of Solvency Regula-

tions and Early Warning Systems. The solvency position of

1 insurance supervision has to distinguish itself by high an insurance company depends at least on:

professional quality: effective supervision requires well-

trained and experienced staff and technical equipment ● sufficient technical provisions

comparable to that of the industry. ● sound investment assets corresponding to technical provisions

2 insurance supervision has to be independent from the ● a satisfactory solvency margin

insurance industry: only government institutions inde-

pendent from the industry can inspire the public confi- 14. These elements are considerably intertwined. The sol-

dence on which insurance businesses rely. vency margin requirement could therefore be relaxed if the

3 adequate financing is the basis for professional quality. other two are well satisfied. It should be noted, however, that

4 adequate financing encounters difficulties in the struc- adequate regulation of solvency capital is always necessary,

ture of traditional administration, in which the insurance because, no matter how sophisticated, the technical provisions

supervisor suffers from limitations in staff, equipment, or investment regulations cannot eliminate the risk that the

and budget in the same way as ministerial bureaucracy. insurer becomes unable to meet its obligations. There are a

5 adequate financing and consequently the attendant quality variety of approaches applied for stipulating statutory solvency

could be achieved by separating the insurance supervision requirements, including fixed ratio model, risk-based capital

from the organization of the traditional administration and model, and the models based on risk or ruin theoretic consid-

by transferring it to an autonomous institution having an erations. In many jurisdictions, one or more control levels of

independent organization and budget. solvency margin are set, which trigger certain supervisory

interventions.

ADBI Executive Summary Series No. S10/00 5

15. Mr. Alfred Gross, Commissioner, State Corporation review the domestic regulations that effectively restrict the

Commission, Bureau of Insurance Commonwealth of Virginia, supply of services. This general proposition can apply to the

United States explained the Risk-Based Capital method. In insurance market. It should be noted, however, that for the

the United States, the capital requirement for insurance com- insurance market, the economic gains of liberalization must

panies is calculated according to the risk-based capital for- be underpinned by adequate prudential regulation to protect

mula. This method has been introduced in response to a policyholders and to ensure the integrity and stability of the

number of insolvency cases in the United States in the 1980s market. The millennium round of negotiations at the World

and 1990s, which highlighted the limitations of fixed mini- Trade Organization should include liberalization of insurance

mum capital standards. The risk-based capital formula intends services on its agenda. Indeed, many countries have already

to establish a minimum capital level for each insurer, taking made encouraging commitments on insurance. Mr. Kono sug-

into consideration the actual risks it assumes, such as asset gested a strategy in which the initial emphasis can be placed

risk, insurance risk, interest rate risk, underwriting risk, and on liberalization of commercial presence, followed by that of

administrative risk. There are separate formulas for life, non- cross-border transactions and other modes of supplying in-

life, and health insurers. The risk-based capital ratio is not an surance services.

indicator of the financial strength of an insurer, but a measure

for granting insurance supervisors to take specific actions. 20. Ms. Florence Lustman, Commissaire Controleur, Com-

Four levels are established to trigger particular regulatory in- mission de Controle des Assurances, France explained Inter-

terventions, from requiring the insurer to submit a compre- national Accounting Rules for Insurance Companies. There

hensive financial plan to seizing the control of the insurer by are many reasons to be in favor of movement towards world-

the authority. wide harmonization of accounting principles for insurance

companies. Internationally comparable financial informa-

16. Mr. Darryl Roberts from the Australian Prudential tion on insurance companies is beneficial not only for su-

Regulation Authority presented the Pessimistic Scenario Test- pervisors but also for consumers and investors. The

ing in Australia. The Australian supervisory regime for life increasing number of internationally operating insurers

insurers has a two-tier capital requirement: would also welcome a single basis for their accounting. From

Tier 1 the solvency standard to ensure the ability of a com- a practical point of view, however, harmonization is not at

pany to meet its current obligations. all an easy task, as special accounting practices and con-

Tier 2 the capital adequacy standard to contemplate suffi- ventions are actually very close to the heart of the insurance

cient capital as a going concern to accept new busi- business. Moreover, various factors related to insurance, such

ness. as pension and tax systems, are far from being harmonized.

Since 1997, IASC has been running a project for develop-

17. Each capital requirement needs to be determined, taking ing international standards of insurance accounting, although

into account the scenarios of adverse market movements that this understandably will take time. Ms. Lustman therefore

may affect the value of the liabilities or assets, so as to secure sees a need for an interim, practical solution catering to the

a certain level of capital even under adverse conditions. The immediate concerns of international insurance and reinsur-

scenario testing has various advantages: ance groups.

● it is forward-looking 21. Finally, Ms. Jane Lamb, Senior Analyst, Office of the

● it can account for many adverse factors occurring concurrently Superintendent of Financial Institutions, Capital Division,

● it can be tailored to the risk profile inherent in each company’s Canada discussed Disclosure: The Good, The Bad and The

business mix Ugly. Disclosure requirements can be an important supervi-

sory tool for the insurance sector as it encourages discipline,

18. Currently, only life insurers are required to undertake honesty, and efficiency in management, which also leads to

this pessimistic scenario testing that is prescribed by the stan- more stability in the market as a whole. In order to ensure

dards, but Mr. Roberts sees that Australian regulatory regimes effective disclosure, the quality of information is important.

for insurers evolving in the direction from the blunt ratio model The information disclosed must be both verifiable and actu-

to stress testing and from the prescriptive approach to the in- ally verified. Moreover, in Canada, it must also be approved

ternal model one. by the board or “signed off” by a senior official of the com-

pany. Almost all information collected on the regulatory re-

19. Mr. Masamichi Kono, Director, Planning and Legal Af- turns is now made public in Canada, with limited exceptions,

fairs Division, Financial Supervisory Agency, Japan made a such as details on particular investments or client transac-

presentation on Liberalization of Insurance Services. Market tions, proprietary information, and the evaluation of the com-

liberalization improves efficiency, quality, and diversity in pany by the supervisor. The current process of demutualization

the market through competition and innovation, and thereby of insurance companies would lead to the application of more

enhances benefits for the consumers and the economy as a stringent disclosure requirements for publicly-traded compa-

whole. Efforts should be made, therefore, to eliminate limita- nies. Furthermore, Ms. Lamb regards it as important to im-

tions to market access and ensure national treatment and to prove the comparability of the disclosed information within a

6 ADBI Executive Summary Series No. S10/00

sector and, given the evolution of financial sector convergence, nancial sectors, i.e. banking, securities, and insurance. This

with other financial sectors. variation creates complications for a group-wide approach in

conglomerate supervision. The Joint Forum was established

22. Participants shared the sentiment that the environment in 1996 as a formal group to discuss conglomerate supervi-

surrounding insurance regulators and supervisors is chang- sion, consisting of regulators of the three sectors in 13 coun-

ing rapidly. As businesses and markets evolve, regulation has tries. Its mandate covers:

to follow quickly in order to avoid becoming obsolete and ● exploring practical ways to share information

irrelevant. Some regulators from emerging markets wonder ● identifying the impediments to information sharing

whether the sophisticated regulatory tools presented, such as ● establishing criteria for the lead supervisor and its role and

pessimistic scenario testing and the risk-based capital method responsibilities

may not be wholly relevant to regulating their markets. It may ● developing supervisory principles

be true today, but probably will not be tomorrow. One of the

general trends among the changes in the insurance markets is 26. In February 1999, the Forum issued a set of papers on

internationalization. Whether regulators like it or not, this trend capital adequacy principles, fit and proper principles, prin-

will continue in line with advancing telecommunication tech- ciples for supervisory information sharing, as well as a su-

nologies. In response, international coordination becomes pervisory questionnaire. The intragroup transactions and

increasingly important for insurance regulation and supervi- exposures principles and the risk concentration principles are

sion. In this context, regulators should pay greater attention now under consultation. It will work on the issue of transpar-

to the current efforts in harmonizing insurance accounting ency of structures under the current mandate. Its new man-

and disclosure as well as to those of market liberalization. date is under consideration, which includes issues common

to all three sectors.

Workshop B: Supervision of Financial 27. Mr. Jarl Symreng, Head of Insurance Division, Insur-

Conglomerates ance Market Department, the Swedish Financial Supervisory

Authority made a presentation on Supervision of Finan-

cial Conglomerates. Finansinspektionen is the single fi-

23. Workshop B focused on the supervisory issues related

to financial conglomerates, with which more than one finan- nancial supervisory authority that covers all Swedish

financial sectors. In countries like Sweden, which have an

cial supervisor is concerned. The first three presentations were

integrated financial environment, a single regulator has

intended to share the salient aspects of the discussions under-

way at the international and intersectoral level concerning many advantages:

● a good overview of all financial businesses

supervision of financial conglomerates. They were followed

● a common supervisory framework and methodology structure

by two speakers on supervisory challenges facing financial

● easy communication

conglomerates from their country’s experiences. Mr. Arend

● a coordinated supervisory approach with supervision of indi-

Vermaat from the Netherlands was the moderator of this work-

vidual companies and group supervision

shop.

28. Integration is in progress not only between the financial

24. Mr. Knut Hohlfeld from the IAIS Secretariat made a market segments but also across borders. In the Nordic coun-

presentation on Global Cooperation among Supervisors of tries, for example, a recent large merger has resulted in a

Different Financial Sectors. The IAIS has been working with Swedish insurer controlling half of the Norwegian and a third

other international financial standard-setting bodies for the of Finnish insurance markets. Finansinspektionen will, there-

Joint Forum on Financial Conglomerates. The IAIS has also fore, be responsible for the overall supervision of the com-

been actively involved in other international cooperation ef- pany, based on memoranda of understanding to be negotiated

forts such as the Coordination Group, the Joint Year 2000 among the supervisors in all three countries.

Council, the Multidisciplinary Working Group on Enhanced

Disclosure, the Financial Stability Forum (FSF), and the 29. Mr. Arend Vermaat, President, Verzekeringskamer,

Working Group on Offshore Financial Centres. Moreover, co- Netherlands discussed some core issues for The Supervision

operation has been achieved with other international organi- of International Financial Conglomerates. International fi-

zations, such as the IMF on the Code of Good Practice, as nancial conglomerates are becoming more important for in-

well as the World Bank, the OECD and UNCTAD. In gen- ternational financial markets. While conglomeration may

eral, close cooperation between countries around the world is reduce the overall degree of vulnerability through risk diver-

an indispensable foundation for international stability and sification, it poses potential threats from a supervisor’s view-

prosperity. The IAIS plays an important role in global coop- point, such as capital inadequacy, contagion, intra-group

eration. exposures and transactions, and large exposures at a group

level. Financial supervisors have to cope with these challenges

25. Ms. Johanna Prevost from the Secretariat to the Joint across borders. Effective coordination arrangements among

Forum explained the work program of the Joint Forum. Su- supervisors are essential for the supervision of international

pervisory objectives and approaches vary among different fi- financial conglomerates. A list of such arrangements includes:

ADBI Executive Summary Series No. S10/00 7

● realizing a level of familiarity between the supervisors involved 9 cases which further supervisory purposes

● agreeing on information exchange procedures 10 removal of laws preventing supervisory information ex-

● attaining sufficient transparency of the reviewed group change

● carrying out fit and proper tests for the relevant management

levels 33. Even before these principles were published, the IAIS

● defining basic financial parameters for a quick scan opinions had been seeking to encourage the exchange of information

● applying tests to prevent multiple gearing between its members. The IAIS model Memorandum of Un-

derstanding on exchange of information has been developed

30. Finally, Mr. László Asztalos, President, State Supervis- for this purpose.

ing Authority of Insurance in Hungary presented The Key Is-

sues of Bank-Insurance’s Regulation. Bank-insurance is a 34. Mr. Alessandro Iuppa, Superintendent, Department of

fashionable expression nowadays, without any clear defini- Professional and Financial Regulation, Maine Bureau of In-

tions available. In the narrowest interpretation, it means any surance, United States talked about the Exchange of Informa-

form of cooperation between licensed insurers and banks. The tion among United States Insurance Regulators and briefly

“financial holdings” interpretation, which Mr. Asztalos rec- described the arrangements for information exchange between

ommends, generalizes it to indicate the cooperation between the 55 U.S. jurisdictions. The National Association of Insur-

the institutions licensed to offer financial services. A broader ance Commissioners (NAIC) has developed a number of ef-

definition can include the cases in which the institutions sup- fective and innovative information systems. For example, it

plying non-financial services participate in the cooperation. has created a financial information database containing de-

Cooperation in bank-insurance may be classified at the prod- tails of the annual financial statements of insurance compa-

uct and institution levels. At the product level, the coopera- nies. The companies are required to file this information

tion can be either combined or integrated, depending on through their states to the NAIC, using a common electronic

whether the banking and insurance products preserve their format. The Special Activities Database (SAD) contains lim-

independence or not. At the institution level, the supervisors ited information on the individuals and companies that have

should pay attention to five aspects: ownership arrangements, caught the attention of regulators for potentially illegal ac-

compositions of management, credit relationships, distribu- tion. It includes a contact person from whom further details

tion and outsourcing. can be obtained. The Regulatory Information Retrieval Sys-

tem (RIRS) holds information on all the individuals and com-

Workshop C: Exchange of Information panies that have been subject to enforcement action by any of

among Supervisors the states. These U.S. schemes may not be appropriate for all

jurisdictions, but they do illustrate the need for a multi-fac-

31. This workshop examined issues of information exchange eted approach to information sharing making full use of tech-

among insurance supervisors. The first three speakers pre- nology.

sented models for information exchange arrangements among

supervisors. They were followed by two presenters who dis- 35. Mr. Henke Bjerre-Nielsen, Director General, Danish

cussed exchange of information among supervisors in spe- Financial Supervisory Authority presented the Exchange of

cific situations. This workshop was moderated by Mr. Edward Information Among Supervisors in EU Countries. Many in-

Forshaw from the United Kingdom. surers do business across borders in Europe in the form of

cross-border transactions or via branches and subsidiaries.

32. Mr. Edward Forshaw, Manager, International Relations, Therefore, the exchange of information among the supervi-

Insurance and Friendly Societies Division, Financial Services sors and the coordination of their supervisory actions are of

Authority, United Kingdom started the workshop by his pre- necessity in Europe. Formal impediments to cooperation and

sentation on the G7 Ten Key Principles and the IAIS Model exchange of information have been removed, as, thanks to

MOU. In May 1998, the Finance Ministers of the G7 coun- European directives, confidentiality rules have been harmo-

tries endorsed their Ten Key Principles on information ex- nized and certain “rules of the game” in a protocol on the

change and agreed to promote these internationally. The Ten collaboration have been agreed upon among the European

Key Principles envisage a greater level of freedom for ex- insurance supervisors. In fact, Danish supervisors, for ex-

change of information than currently exists. They include: ample, meet with other European supervisors on a regular

1 authorization to share and gather information basis and exchange information both formally and informally.

2 cross-sector information sharing Some European supervisors make on-site inspections in for-

3 information about systems and controls eign branches of their national insurers, which usually includes

4 information about individuals a visit to the host supervisor. The exchange of information is

5 information sharing between exchanges (not applicable in also important outside the EU, but the lack of a formal frame-

the insurance context) work is a challenge.

6 confidentiality

7 formal agreements and written requests 36. Mr. Steve Butterworth from the English Channel Isle

8 reciprocity requirements of Guernsey discussed Insurance Fraud and Exchange of In-

8 ADBI Executive Summary Series No. S10/00

formation. The origins of the IAIS are rooted in a desire among sometimes managed by insurance companies. The moderator

certain insurance regulators to increase the exchange of in- of this workshop was Mr. Rinaldo Pecchioli.

formation on fraud. Insurance fraud can be categorized into

claims fraud, insurer fraud, money laundering, and fit-and- 40. Prof. Lutgart Van Den Berghe, Vlerick Lewen Gent

proper issues. Nowdays, it tends to be even more complicated Management School, Belgium presented an overview of Con-

and internationalized. In general, insurance fraud results from vergence in the Financial Service Industry. Looking at the

uncontrolled agents, unregulated reinsurers, bad management, market scene today, one can witness one or another form of

poor insurance regulation and gullible customers. In this con- financial convergence in many, if not all, developed markets.

nection, the Insurance Fraud Subcommittee of the IAIS has Financial convergence is a broader concept than the emer-

made the following recommendations: gence of financial conglomerates. It includes many different

● monitor reinsurers and intermediaries, and intervene when forms, ranging from simple cross-selling to integrated ser-

necessary vices, and from a sector-based structure to a functional, cli-

● publish a list of reinsurers ent-oriented organization. Supervisors cannot prevent this

● create an accessible database of established insurers, reinsurers convergence movement, as it is embedded in a much wider

and insurance brokers trend towards integrated, financial services in an effort to of-

● establish a standard for enforcement procedures fer convenience, switching from mass production to

● establish fit and proper standards customization and individualization. The current sectoral regu-

● develop controls on web-sites lation and supervision, however, face difficulties in creating

a level playing field to avoid hindering the innovation and

37. International insurance fraud could be significantly pre- expansion of the financial sector. Professor Van Den Berghe

vented by actions such as: argues that the solo-plus supervision, which is currently dis-

● coordinating international regulation cussed in relation to financial conglomerates, will probably

● giving more responsibilities to independents, auditors, actuar- be only a temporary solution in the broader convergence

ies and managers movement in which the distinction between “lead” and “plus”

● regulating reinsurers parts becomes more difficult to maintain. Further discussion

● educating insurance consumers is necessary as regards a need for a matrix approach, combin-

● building effective systems for information exchanges ing institutional and service/product typologies, and a need

to go beyond the focus on legal entities in the financial sec-

38. Ms. Jane Lamb of Canada made a presentation on Ex- tor.

change of Information in a Winding-Up Situation. Establish-

ing relationships with other supervisors, whether formally 41. Mr. Bruno Bézard, Head of Insurance Department,

through a memorandum of understanding, or informally, is French Treasury outlined the development of bancassurance

essential to having an efficient flow of information in a crisis in France. The influence of banks in the insurance markets

situation. This is because in crisis situations the regulator must has grown remarkably in the last few decades. Especially in

act quickly and therefore has no time to learn about another the life assurance market, the share of bancassurance has

supervisory system or to find out whom to contact. When the reached more than 60 percent today, while it remains not more

OSFI faced the case of the collapse of a major Canadian in- than 6 percent in the non-life sector. The development of

surance-led conglomerate, it cooperated particularly with bancassurance seems to be driven by the various synergy ef-

regulators in the United Kingdom and the State of Michigan. fects raised from combining bank and insurance (especially,

In a crisis situation, one needs to select the key and relevant life) businesses and also the strategy of the banks against

regulators to work with, because the information should be disintermediation in the French financial market of the 1980s.

kept secret and there is little time to contact many other coun- Mr. Bezard sees the development of bancassurance as benefi-

terparts. The selection was based not only on the effects of cial for consumers by lowering the price of insurance prod-

the collapse over a given jurisdiction but also on the relation- ucts, as well as contributing to simplification and moralization

ship of trust developed through cooperation in the past. As a in their supply. However, regulators also need to be aware of

result of such coordination, the OSFI was able to act timely the risks associated with bancassurance. These include:

and quickly and work the case out smoothly.

● risk concentration at the group level

Workshop D: Regulatory Issues on ● intra-group transactions and crisis contagion

Financial Sector Convergence ● double use of capital, the opacity of group structure

● involvement of several supervisory authorities

39. Workshop D discussed the regulatory issues on finan-

cial sector convergence. After an overview presentation, three He stressed that more work to address these risks should be

speakers provided the experience in their respective coun- done at both the national and international levels.

tries as to the penetration of banks in the insurance market, or

so-called “bancassurance.” The following two speakers then 42. Mr. George Reider, President, National Association of

addressed the regulation of private pension funds that are Insurance Commissioners described the situation in the United

ADBI Executive Summary Series No. S10/00 9

States concerning the activities of banks in the insurance sec- ● to allow discounts on commissions and creation of multiple

tor. After the repeal of the Glass-Steagall Act, convergence funds by a pension fund administrator

and cross-ownership between the banking and insurance sec- ● the extension of the measurement period for “minimum yield”

tors can be expected to proceed apace. The selling of insur- required to pension funds administrators

ance products by banks had already been permitted by court ● “early retirement discounts” so as to reduce high commissions

decisions. The major merger of Travelers Insurance and charged by insurance brokers

Citicorp suggests the continued emergence of financial con-

glomerates as well. The Commissioners of Insurance will 45. Mr. Matthew King, Administrator, European Commis-

continue to supervise the activity related to insurance products, sion made a presentation on Supplementary Pensions in the

but given the general trend towards financial sector convergence, European Union: Funding Retirement through Private Sav-

deeper cooperation, especially exchange of confidential infor- ings. Pensions attract considerable attention in Europe, as the

mation, with banking supervisors is necessary. society is aging rapidly: the number of workers per pensioner

is expected to decrease sharply from the current four to two

43. Mr. Chee Siew Eng, Senior Manager, Insurance Regu- in 2020. Among the three pillars of pension structure, the EU

lation Department, Central Bank of Malaysia discussed the debate focuses upon pillar two: pension funds linked to firms.

Regulatory and Supervisory Challenges for Bancassurance The Commission intends to make these funds, where they are

in Malaysia. While the insurance industry has grown rapidly set up, more efficient through increased returns and security

over the last decade in Malaysia, the market penetration of and through increased competition. Due to their long-term

insurance products remains at a low level. This is partly be- nature, small changes in the real rate of return make a huge

cause the industry, especially the life sector, is almost totally difference in pension funds. In order to help alleviate the fu-

reliant on the agency channel for distribution, which involves ture tax burden in the pension system, it is vitally important

a vast sales force with low productivity and quality. In re- to invest the funds productively. In this context, investment

sponse, Bank Negara Malaysia, which supervises both the in the real economy, new technologies, and start-ups with great

banking and insurance sectors, is in favor of bancassurance. diversity including those in emerging market countries, is rec-

In Malaysia, bancassurance arrangements are of two forms: ommended. Mr. King also asserted that investment in the stock

strategic alliance with which banks merely market insurance market should be preferable to that in government bonds as

products using their customer bases, and full integration stocks are more profitable and less volatile over the long run.

through merger and acquisition between banks and insurance

companies. So far, the former model has been more popular 46. In open discussion, participants reconfirmed that there

but less successful. From Malaysia’s experience, the main is a general trend towards more convergence in the financial

regulatory issues in the development of bancassurance include: sector. Regulators now need to realize that the insurance sec-

● financial and administrative responsibilities of the insurers tor is becoming a part of a broader industry, though it may

● appropriate passing-on of lower distribution costs to benefit retain some special aspects. A participant argued, however,

customers that this general trend should not necessarily end up with glo-

● training of the sales force bal financial conglomerates everywhere. There was a case

● protection against personal information abuses and pressure that the decision by management of a bank to acquire an in-

selling surance company was put in question by investors. Ultimately,

● commitment by the management in promoting insurance products corporate strategy on whether to be a conglomerate or instead

focus on core business will be tested and judged by the mar-

44. Ms. Mónica Cáceres Ubilla of Intendente de Seguros ket. Another participant pointed out that when an institution

of Chile explained the Regulation of Insurance Companies does more than one line of business, cross-subsidy between

and Pension Funds Administrators in Chile. This decade, the the business lines could be an issue for financial supervisors.

social security sector has been strongly incorporated into the The institution may distort competition in a financial market,

financial sector in Latin America, especially in Chile where using the profits gained from its operations in other sectors.

the private pension system emerged in the early 1980s. Both

pension fund administrators and insurance companies are ac- CRISIS MANAGEMENT: SUPERVISION

tive in the service of providing annuities after retirement. OF INSURANCE COMPANIES IN

Being the major institutional investors in Chile, pension fund DIFFICULTIES

administrators and insurance companies are subject to very

similar investment regulation, though the latter have a greater

47. This session centered on the issue of how supervisors

degree of flexibility in investment. For example, insurance

should prepare and handle an insurance company in distress.

companies may invest, up to certain limits, in mortgages, Three speakers made presentations based on the respective

mutual funds, and real estate abroad, which is not allowed for

experience in their countries, which was followed by a the-

pension fund administrators. Eighteen years after the intro-

matic presentation on policyholder protection schemes. The

duction of the private pension system, efforts are continuing moderator of this session was Mr. Andre Swanepoel from

to improve its regulation. The legal changes currently pro-

South Africa.

posed are:

10 ADBI Executive Summary Series No. S10/00

48. Mr. Jean-Louis Bellando, Chef du Service du Controle ate regulatory actions. In Hong Kong, China protection would

des Assurances, Commission de Controle des Assurances of also be provided to policyholders in winding-up through the

France presented The Control of Insurance Companies in preferential treatment of insurance claimants and assistance

Difficulties. The protection of policyholders is essentially pro- under insolvency funds. In a financial crisis, insurers face vari-

vided through financial supervision of insurance companies, ous problems. The regulator should be prepared against such a

first as prevention and subsequently as a cure if necessary situation by an effective early warning system and preventive

and possible. When the supervisor finds an ailing company, it measures and adequate powers to handle crisis situations, as

asks the company to submit a recovery plan. The implemen- well as by greater market transparency and a reasonable bal-

tation of the plan may be ensured by safeguard measures, such ance between the market mechanism and regulation.

as restriction on asset disposals, to be taken if the company

fails the implementation. The supervisor may further ask the 51. Finally, Prof. Gerry Dickinson, City University of Lon-

company to seek external support in such forms as mergers don gave a presentation on Policyholder Protection Funds

and transfer of the portfolios of contracts. If the company keeps and Guarantee Schemes: Some Theoretical and Practical Is-

deteriorating after all these efforts, the supervisor must put sues. The protection fund/scheme concept was first developed

an end to its business, either by the compulsory transfer of its for banking and then extended to other financial sectors. While

portfolio or by the withdrawal of its license. The latter should there are pros and cons for the protection fund/scheme, it has

be the last resort, as in France it automatically leads to the been introduced in most of the advanced market countries.

liquidation of the company. A guarantee fund was introduced Professor Dickinson presented six key principles for devel-

in France in 1999. In general, however, such a fund does not oping protection schemes in insurance:

have sufficient resources for coping with a systemic crisis. ● the scheme must contain incentives to supervisory authorities

to actively explore other solutions

49. Mr. Andre Swanepoel, Deputy Executive Officer, Fi- ● the design of the scheme must consider moral hazard, equity

nancial Services Board of South Africa explained the Experi- and administrative cost

ence of South Africa in Supervising Insurance Companies in ● the scheme must not come into operation only when liquida-

Difficulties. Over the past fifteen years, eight insurance com- tion has taken place, but it must allow for earlier action

panies could be classified as those in crisis in the South Afri- ● the scheme should only benefit policyholders and third par-

can market. Out of them, two were managed back to financial ties: it should not benefit managers, owners or other creditors

soundness, three were wound up, and the remaining three were of a failing insurance company

liquidated after transfer of their businesses to other insurers. ● the design of the scheme must carefully consider the interna-

In all cases, policyholders were well protected, though in those tional dimension

years the Insurance Registrar, South Africa’s insurance su- ● within a country, there will be a need for greater coordination

pervisor, had very limited powers to rectify the situation. The between insurance protection schemes and protection schemes

new life and non-life insurance acts, promulgated in January for the banking and securities industries

1999, give more options and powers to the Registrar, such as

the authority to ask an insurer for a plan of action. Mr.

Swanepoel concluded his presentation by mentioning: CONCLUSION

● winding-up or managing companies in crisis situations is an

important issue for policyholders and claimants, since there 52. The moderators summed up their respective workshops.

are no protection or guarantee funds in South Africa, and Mr. Roberts also provided a summary for Session I and Mr.

● intervention of supervisors should be treated with respect and Wong for Session IV. The seminar was successfully concluded

circumspection, because insurance is based on trust between and participants expressed their appreciation to the ADB In-

the policyholder and insurance company. stitute, FSA of Japan and to the other organizers. The success

of the seminar was also confirmed by the evaluation ques-

50. Mr. Alan Wong, Commissioner of Insurance, Office of tionnaire in which most participants answered that the semi-

the Commissioner of Insurance, the Government of the Hong nar was useful and well organized.

Kong Special Administrative Region shared his experience

in Crisis Management of Insurance Companies. Crisis man- 53. In the concluding session, several attendants expressed

agement starts with the setting up of an early warning sys- their desire that this kind of seminar should continue to be

tem. The supervisor should find the early warning signals and organized in the future. A variety of topics were suggested in

assess the seriousness of situations through its supervisory the questionnaire for follow-up meetings, which include,

work. Concurrently, the supervisor needs to ensure the imple- among others, reinsurance, outsourcing of supervisory func-

mentation of preventive measures by companies, which in- tions, crisis management, supervision of financial conglom-

clude fit and proper management and adequate reinsurance erates, risk-based capital, emerging market issues. It was

arrangements. When necessary to safeguard the interests of generally agreed that the continuation of this kind of effort in

policyholders, the supervisor should intervene by appropri- the future would be of the utmost importance.

ADBI Executive Summary Series No. S10/00 11

1999 Executive Summary Series

All are now available online at http://www.adbi.org/forum.htm

● High-Level Regional Workshop on Asian Financial Crisis, Dissemination Conference

25-26 March 1999, Tokyo, ESS No. 01/99

● Public Administration and Civil Service Management

29 March - 2 April 1999, Tokyo, ESS No. 02/99

● Round Table on Securities Market Reforms in the Face of Asian Financial Crisis

8-9 April 1999, Tokyo, ESS No. 03/99

● Second Tokyo Seminar on Securities Market Regulation

5-12 April 1999, Tokyo, ESS No. 04/99

● Asian Mayors’ Forum: Colombo Session

28-30 June 1999, Colombo, Sri Lanka, ESS No. S05/99

● Beyond the Asian Turmoil: Capital Account Crisis and Family-Based Corporate Governance

29 April 1999, Manila, ESS No. S06/99

● Public-Private Partnerships in the Social Sector

5-9 July 1999, Tokyo, ESS No. S07/99 (includes index)

● Creating a New Architecture for Learning and Development

9-18 August 1999, Tokyo, ESS No. S08/99

● Exchange Rate Regimes in Emerging Market Economies

17-18 December 1999, Tokyo, ESS No. S09/00 (includes further references)

● Tokyo Executive Seminar on Insurance Regulation and Supervision

27-28 September 1999, Tokyo, ESS No. S10/00

● Pension Fund Reforms for Asia

9-13 November 1999, Singapore, ESS No. S11/00

● Emerging Issues in International Finance

26-29 October 1999, Bangkok, ESS No. S12/00

● International Tax Seminar

7-15 October 1999, Tokyo, ESS No. S13/00

● Banking Supervision and Competition Policy

29 November - 3 December 1999, Tokyo, ESS No. S14/00

● Corporate Governance in Asia

18-19 November 1999, Manila, ESS No. S15/00

● Policy Issues on Privatization

22-26 November, Tokyo, ESS No. S16/00

© 2000 Asian Development Bank Institute. Further proceedings online at http://www.adbi.org/forum.htm

ADBI Publishing 2/00

12 ADBI Executive Summary Series No. S10/00

You might also like

- JKIMSU, Vol. 5, No. 2, April-June 2016 Page 95-100Document6 pagesJKIMSU, Vol. 5, No. 2, April-June 2016 Page 95-100DIVYA SHREENo ratings yet

- AuthorDocument3 pagesAuthorDIVYA SHREENo ratings yet

- QuestionnaireDocument3 pagesQuestionnaireDIVYA SHREENo ratings yet

- AuthorDocument3 pagesAuthorDIVYA SHREENo ratings yet

- 4277915Document194 pages4277915DIVYA SHREENo ratings yet

- Factors influencing job satisfaction among librariansDocument43 pagesFactors influencing job satisfaction among librariansUrmila Mukundan67% (12)

- JKIMSU, Vol. 5, No. 2, April-June 2016 Page 95-100Document6 pagesJKIMSU, Vol. 5, No. 2, April-June 2016 Page 95-100DIVYA SHREENo ratings yet

- Factors influencing job satisfaction among librariansDocument43 pagesFactors influencing job satisfaction among librariansUrmila Mukundan67% (12)

- 1 PB PDFDocument5 pages1 PB PDFDIVYA SHREENo ratings yet

- Job Satisfaction of Apparel Industry Employees in Jaipur: The Iis University, JaipurDocument17 pagesJob Satisfaction of Apparel Industry Employees in Jaipur: The Iis University, JaipurKamal DeepNo ratings yet

- File81639. Buljubasic PDFDocument34 pagesFile81639. Buljubasic PDFDIVYA SHREENo ratings yet

- A Comprehensive Literature Review On Employee Job SatisfactionDocument8 pagesA Comprehensive Literature Review On Employee Job SatisfactionselbalNo ratings yet

- 1823Document9 pages1823DIVYA SHREENo ratings yet

- Employee Satisfaction Factors and Organizational OutcomesDocument10 pagesEmployee Satisfaction Factors and Organizational OutcomesAvilash PaulNo ratings yet

- File81639. Buljubasic PDFDocument34 pagesFile81639. Buljubasic PDFDIVYA SHREENo ratings yet

- PDF Megha PDFDocument75 pagesPDF Megha PDFDIVYA SHREENo ratings yet

- 0 - Divya e CommerceDocument12 pages0 - Divya e CommerceDIVYA SHREENo ratings yet

- 11 Chapter 2Document50 pages11 Chapter 2ananthakumarNo ratings yet

- 1 SMDocument11 pages1 SMDIVYA SHREENo ratings yet

- 0 - Divya e CommerceDocument12 pages0 - Divya e CommerceDIVYA SHREENo ratings yet

- PDF Megha PDFDocument75 pagesPDF Megha PDFDIVYA SHREENo ratings yet

- 1 PB PDFDocument5 pages1 PB PDFDIVYA SHREENo ratings yet

- 0 - Divya e CommerceDocument12 pages0 - Divya e CommerceDIVYA SHREENo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- An Experienced View On Markets and Investing: PerspectivesDocument5 pagesAn Experienced View On Markets and Investing: PerspectivesjcarlosdNo ratings yet

- URA Payment Slip TitleDocument1 pageURA Payment Slip TitleDaniel Kyeyune MuwangaNo ratings yet

- Banking and Finance Project Topics and MaterialsDocument3 pagesBanking and Finance Project Topics and MaterialsAlo Peter taiwoNo ratings yet

- Usbprinter 6.4 Demo: Rs. (In Words) :zero OnlyDocument2 pagesUsbprinter 6.4 Demo: Rs. (In Words) :zero OnlyCA Amit MehtaNo ratings yet

- Chap 15, 16, 17 AssignmentDocument12 pagesChap 15, 16, 17 AssignmentSamantha Charlize VizcondeNo ratings yet

- Fundamentals of Accounting Lesson 1 2 Acctng Equation DONEDocument13 pagesFundamentals of Accounting Lesson 1 2 Acctng Equation DONEkim fernandoNo ratings yet

- Basic Accounting - Prelim Exam (Preparation) - 2021 VersionDocument2 pagesBasic Accounting - Prelim Exam (Preparation) - 2021 VersionJulienne SulivasNo ratings yet

- Glen 2001097 KPNK4CDocument3 pagesGlen 2001097 KPNK4CGlen ParadiseNo ratings yet

- Customer Due Diligence For BanksDocument25 pagesCustomer Due Diligence For BanksWong Hoang100% (2)

- Contemporary Financial Management 13th Edition Moyer Test BankDocument31 pagesContemporary Financial Management 13th Edition Moyer Test Bankaneroidoutsoar6i5z100% (24)

- 12linsteel Book of Account DecemberDocument54 pages12linsteel Book of Account DecemberCarlos_CriticaNo ratings yet

- Fsa 3000Document1 pageFsa 3000Ngọc NguyễnNo ratings yet

- Questionnaire CADocument5 pagesQuestionnaire CAFerasHamdanNo ratings yet

- Credit Digests START TO FINALSDocument80 pagesCredit Digests START TO FINALSDavid YapNo ratings yet

- Emerging Technologies Disrupting The Financial Sector PDFDocument56 pagesEmerging Technologies Disrupting The Financial Sector PDFvaragg24No ratings yet

- Upper Tamakoshi Hydropower ProjectDocument5 pagesUpper Tamakoshi Hydropower ProjectShreya ChitrakarNo ratings yet

- CANARA BANK Educationl LoanDocument1 pageCANARA BANK Educationl LoanRahulJotwaniNo ratings yet

- New Health Insurance Scheme 2018 Application Form PDFDocument4 pagesNew Health Insurance Scheme 2018 Application Form PDFMannyNo ratings yet

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument55 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownRagini SharmaNo ratings yet

- Bank of The Philippine Islands-CisDocument9 pagesBank of The Philippine Islands-CisKershey SalacNo ratings yet

- MACRO 12 Money+and+BankingDocument21 pagesMACRO 12 Money+and+BankingАліса ВолочайNo ratings yet

- New Central Bank Act - Usec YebraDocument9 pagesNew Central Bank Act - Usec YebragieeNo ratings yet

- Ray Dalio Consistently Deliver ReturnsDocument2 pagesRay Dalio Consistently Deliver ReturnsnabsNo ratings yet

- Consolidated SOFP - Kaplan Questions.Document33 pagesConsolidated SOFP - Kaplan Questions.husseinNo ratings yet

- Prac ReviewDocument3 pagesPrac ReviewYannah RebogioNo ratings yet

- PLI Ready Reckoner New 18052020-1Document9 pagesPLI Ready Reckoner New 18052020-1NarayanaNo ratings yet

- CSEC POA June 2006 P1 solutionsDocument10 pagesCSEC POA June 2006 P1 solutionsDianna Lawrence100% (1)

- Targeted Inflation Rate, NIR, RIRDocument8 pagesTargeted Inflation Rate, NIR, RIRwakemeup143No ratings yet

- "A" Level Accounting: Questions BookletDocument93 pages"A" Level Accounting: Questions Bookletdrea liamNo ratings yet

- HADM 2250 Prelim Review QuestionsDocument52 pagesHADM 2250 Prelim Review QuestionsPrithvi BhushanNo ratings yet