Professional Documents

Culture Documents

Competitive Advantage Resources Capabilities

Uploaded by

akeila30 ratings0% found this document useful (0 votes)

21 views10 pagesOriginal Title

chapter 4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views10 pagesCompetitive Advantage Resources Capabilities

Uploaded by

akeila3Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 10

Chapter 4

QUESTION 2: WHAT ARE THE COMPANY’S MOST IMPORTANT

RESOURCES AND CAPABILITIES, AND WILL THEY GIVE THE COMPANY

A LASTING COMPETITIVE ADVANTAGE OVER RIVAL COMPANIES?

A company’s resources and capabilities represent its competitive assets

and are determinants of its competitiveness and ability to succeed in the

marketplace.

A company’s resources and capabilities are its competitive assets and

determine whether its competitive power in the marketplace will be

impressively strong or disappointingly weak.

Resource and capability analysis provides managers with a powerful tool

for sizing up the company’s competitive assets and determining whether

they can provide the foundation necessary for competitive success in the

marketplace.

This is a two-step process:

1) The first step is to identify the company’s resources and

capabilities.

2) The second step is to examine them more closely to ascertain

which are the most competitively important and whether they

can support a sustainable competitive advantage over rival

firms. This second step involves applying the

four tests of a resource’s competitive power.

A capability is the capacity of a firm to perform some internal activity

competently. Like resources, capabilities vary in form, quality, and

competitive importance, with some being more competitively valuable than

others. Apple’s product innovation capabilities are widely recognized as

being far superior to those of its competitors; Nordstrom is known for its

superior incentive management capabilities; PepsiCo is admired for its

marketing and brand management capabilities.

Organizational capabilities are developed and enabled through the

deployment of a company’s resources.

Types of Company Resources

Broadly speaking, resources can be divided into two main categories:

tangible and intangible resources.

The Four Tests of a Resource’s Competitive Power

The competitive power of a resource or capability is measured by how many

of four specific tests it can pass. These tests are referred to as the VRIN

tests for sustainable competitive advantage — VRIN is a shorthand

reminder standing for Valuable, Rare, Inimitable, and Nonsubstitutable.

The first two tests determine whether a resource or capability can

support a competitive advantage. The last two determine whether

the competitive advantage can be sustained.

1. Is the resource or capability competitively Valuable?

To be competitively valuable, a resource or capability must be directly

relevant to the company’s strategy, making the company a more

effective competitor. Unless the resource or capability contributes to

the effectiveness of the company’s strategy, it cannot pass this first

test. An indicator of its effectiveness is whether the resource enables

the company to strengthen its business model by improving its

customer value proposition and/or profit formula. Companies have to

guard against contending that something they do well is necessarily

competitively valuable.

E.G. Apple’s operating system for its personal computers by some

accounts is superior to Microsoft’s Windows 8, but Apple has failed in

converting its resources devoted to operating system design into

anything more than moderate competitive success in the global PC

market.

2. Is the resource or capability Rare — is it something rivals lack?

Resources and capabilities that are common among firms and widely

available cannot be a source of competitive advantage. All makers of

branded cereals have valuable marketing capabilities and brands,

since the key success factors in the ready-to-eat cereal industry

demand this. They are not rare. However, the brand strength of Oreo

cookies is uncommon and has provided Kraft Foods with greater

market share as well as the opportunity to benefit from brand

extensions such as Double Stuff Oreos and Mini Oreos. A resource or

capability is considered rare if it is held by only a small number of firms

in an industry or specific competitive domain. Thus, while general

management capabilities are not rare in an absolute sense, they are

relatively rare in some of the less developed regions of the world and

in some business domains.

3. Is the resource or capability Inimitable — is it hard to copy?

The more difficult and more costly it is for competitors to imitate a

company’s resource or capability, the more likely that it can also

provide a sustainable competitive advantage. Resources and

capabilities tend to be difficult to copy when they are unique (a

fantastic real estate location, patent-protected technology, an

unusually talented and motivated labour force), when they must be

built over time in ways that are difficult to imitate (a well-known brand

name, mastery of a complex process technology, years of cumulative

experience and learning), and when they entail financial outlays or

large-scale operations that few industry members can undertake (a

global network of dealers and distributors). Imitation is also difficult for

resources and capabilities that reflect a high level of social complexity

(company culture, interpersonal relationships among the managers or

R&D teams, trustbased relations with customers or suppliers) and

causal ambiguity, a term that signifies the hard-to-disentangle nature

of the complex resources, such as a web of intricate processes

enabling new drug discovery. Hard-to-copy resources and capabilities

are important competitive assets, contributing to the longevity of a

company’s market position and offering the potential for sustained

profitability.

4. Is the resource or capability Nonsubstitutable— is it invulnerable to

the threat of substitution from different types of resources and

capabilities?

Even resources that are competitively valuable, rare, and costly to

imitate may lose much of their ability to offer competitive advantage if

rivals possess equivalent substitute resources. For example,

manufacturers relying on automation to gain a cost-based advantage

in production activities may find their technology-based advantage

nullified by rivals’ use of low-wage offshore manufacturing. Resources

can contribute to a sustainable competitive advantage only when

resource substitutes aren’t on the horizon.

A company requires a dynamically evolving portfolio of resources and

capabilities to sustain its competitiveness and help drive improvements in its

performance. A dynamic capability is an ongoing capacity of a company to

modify its existing resources and capabilities or create new ones.

TABLE 4.3 What to Look for in Identifying a Company’s Strengths,

Weaknesses, Opportunities, and Threats.

Company Value Chain

Value Chain Analysis of Rival Firms

Facilitates a comparison, activity-by-activity, of how effectively and

efficiently a company delivers value to its customers, relative to its

competitors.

The Value Chain Analysis Process:

● Segregate the firm’s operations into different types of primary and

secondary activities to identify the major components of its internal cost

structure.

● Use activity-based costing to evaluate the activities.

● Do the same for significant competitors.

Value Chain System for an Entire Industry

♦ Industry Value Chain:

● The firm’s internal value chain

● The value chains of industry suppliers

● The value chains of channel intermediaries

♦ Effects of the Industry Value Chain:

● Costs and margins of suppliers and channel partners can affect prices to

end consumers.

● Activities of channel partners can affect industry sales volumes and

customer satisfaction.

You might also like

- Topic 4 Internal Environment 1Document7 pagesTopic 4 Internal Environment 1moza salimNo ratings yet

- Chapter 3Document38 pagesChapter 3Sweet RanonNo ratings yet

- Internal AnalysisDocument12 pagesInternal AnalysisKirabo Ivy MarthaNo ratings yet

- Strategic Management Chapter 4Document9 pagesStrategic Management Chapter 4Optimus PrimeNo ratings yet

- The Internal Organization: Resources, Capabilities, Core Competencies, and Competitive AdvantagesDocument2 pagesThe Internal Organization: Resources, Capabilities, Core Competencies, and Competitive AdvantagestriagungNo ratings yet

- Resource Based Viw of The FirmDocument14 pagesResource Based Viw of The FirmOtieno AlooNo ratings yet

- Chapter 4 SMDocument7 pagesChapter 4 SMrakibulislammbstu01No ratings yet

- Internal Analysis: Resources, Capabilities, and Core CompetenciesDocument8 pagesInternal Analysis: Resources, Capabilities, and Core CompetenciesNadineNo ratings yet

- Strategic Business Analysis - Resource Based Theory Looks at Organization ResourcesDocument2 pagesStrategic Business Analysis - Resource Based Theory Looks at Organization ResourcesAMNo ratings yet

- Analyzing a Company's Resources and Competitive PositionDocument52 pagesAnalyzing a Company's Resources and Competitive Positionprabakar070No ratings yet

- S & EPM Unit 2Document30 pagesS & EPM Unit 2SaikatPatraNo ratings yet

- Chapter 4 Internal ... Competitive StregthDocument24 pagesChapter 4 Internal ... Competitive StregthchelintiNo ratings yet

- Chap 4 MCQDocument9 pagesChap 4 MCQethanvampireNo ratings yet

- The Resource Based View of The FirmDocument19 pagesThe Resource Based View of The FirmHassan Bin Shahid50% (2)

- Chapter 3Document3 pagesChapter 3Mariya BhavesNo ratings yet

- 19e Section6 LN Chapter04Document14 pages19e Section6 LN Chapter04benbenchen100% (3)

- Resource Based View - Strategic ManagementDocument17 pagesResource Based View - Strategic ManagementZordan100% (5)

- Internal Analysis - Resources and CompetencesDocument5 pagesInternal Analysis - Resources and CompetencesJoana ToméNo ratings yet

- Analyzing A Company's Resources and Competitive PositionDocument54 pagesAnalyzing A Company's Resources and Competitive PositionVarun SoodNo ratings yet

- Competing On ResourcesDocument3 pagesCompeting On ResourcesrajeshwariNo ratings yet

- Ibs - BS - Mba - S8 & 9Document34 pagesIbs - BS - Mba - S8 & 9Muskan KhanNo ratings yet

- Resources and CapabilitiesDocument12 pagesResources and CapabilitiesKeith NavalNo ratings yet

- Chapter 4 Lecture Note Evaluation A Company's Resources, Cost Position, and Competitive StrengthDocument13 pagesChapter 4 Lecture Note Evaluation A Company's Resources, Cost Position, and Competitive StrengthBuffwear IDNo ratings yet

- VRIO Framework Explained - SMIDocument7 pagesVRIO Framework Explained - SMIgraceNo ratings yet

- Internal Scanning: Organizational AnalysisDocument14 pagesInternal Scanning: Organizational AnalysisFaiz ur RehmanNo ratings yet

- Viro FameworkDocument3 pagesViro FameworkMayank GoelNo ratings yet

- Strategic Capabilities and Competitive Advantage: Question of ValueDocument6 pagesStrategic Capabilities and Competitive Advantage: Question of ValueGummadi Banu PrakashNo ratings yet

- Evaluating A Company's Resources and Competitive Position: Chapter TitleDocument65 pagesEvaluating A Company's Resources and Competitive Position: Chapter TitleArush BhatnagarNo ratings yet

- Analyzing Firm Resources with the VRIO FrameworkDocument21 pagesAnalyzing Firm Resources with the VRIO Frameworksajeet sahNo ratings yet

- Value Resources Immitate Order AnalysisDocument10 pagesValue Resources Immitate Order Analysisshivani0% (1)

- Strategy - Chapter 5: Basing Strategy On Resources and CapabilitiesDocument8 pagesStrategy - Chapter 5: Basing Strategy On Resources and CapabilitiesTang WillyNo ratings yet

- CH 03 ImDocument27 pagesCH 03 Imjacklee1918No ratings yet

- Internal AnalysisDocument52 pagesInternal AnalysisRahul Kumar JainNo ratings yet

- Chapter 4Document46 pagesChapter 4asterayemetsihet87No ratings yet

- Buildind Sustained and Competitove AdvantagesDocument24 pagesBuildind Sustained and Competitove AdvantagesROOMA SALEEMNo ratings yet

- Organisational ResourcesDocument119 pagesOrganisational ResourcesAli AghapourNo ratings yet

- Evaluating A Company's Resources and Competitive PositionDocument54 pagesEvaluating A Company's Resources and Competitive PositionSalman QureshiNo ratings yet

- Sustainable Competitive AdvantageDocument49 pagesSustainable Competitive AdvantageakashniranjaneNo ratings yet

- EVALUATING THE ROLE OF CORE COMPETENCIES IN IMPROVING PERFORMANCE OF MANUFACTURING INDUSTRIESFrom EverandEVALUATING THE ROLE OF CORE COMPETENCIES IN IMPROVING PERFORMANCE OF MANUFACTURING INDUSTRIESNo ratings yet

- Internal Analysis: Distinctive Competencies, Competitive Advantage and ProfitabilityDocument28 pagesInternal Analysis: Distinctive Competencies, Competitive Advantage and ProfitabilityArun Mathews JacobNo ratings yet

- Module3 - The Internal OrganizationDocument24 pagesModule3 - The Internal OrganizationLysss Epssss100% (3)

- Evaluating A Company's Resources and Competitive PositionDocument65 pagesEvaluating A Company's Resources and Competitive PositionArush BhatnagarNo ratings yet

- Session 4 - Evaluating A Company's Resources, Cost Position, and CompetitivenessDocument40 pagesSession 4 - Evaluating A Company's Resources, Cost Position, and CompetitivenessBealjjNo ratings yet

- Analyzing a Firm's Internal Resources Using the VRIO FrameworkDocument10 pagesAnalyzing a Firm's Internal Resources Using the VRIO FrameworkPrajakta GokhaleNo ratings yet

- VRIO Framework Explained - SMIDocument10 pagesVRIO Framework Explained - SMITanisha AgrawalNo ratings yet

- The Internal Environment: Resources, Capabilities, and Core CompetenciesDocument6 pagesThe Internal Environment: Resources, Capabilities, and Core CompetenciesSai BabaNo ratings yet

- Strategic Management Chap004Document65 pagesStrategic Management Chap004rizz_inkays100% (2)

- Analyzing Firm Resources Using the VRIO FrameworkDocument17 pagesAnalyzing Firm Resources Using the VRIO FrameworkKomal75% (4)

- What Is The Present Strategy?: I.E. Same ProductDocument3 pagesWhat Is The Present Strategy?: I.E. Same ProductRaveena SharmaNo ratings yet

- Chapter 3Document42 pagesChapter 3project manajement2013No ratings yet

- VRIODocument3 pagesVRIOPrajakta GokhaleNo ratings yet

- Resources and Capabilities DurabilityDocument16 pagesResources and Capabilities Durabilitymnsasirekha100% (1)

- Business Resources and CapabilitiesDocument29 pagesBusiness Resources and CapabilitiessushantjoshiNo ratings yet

- Analyzing A Company's Resources and Competitive PositionDocument80 pagesAnalyzing A Company's Resources and Competitive Positionmohammed fayazNo ratings yet

- Strategic Marketing Management-: The Competitive Advantage & Value CreationDocument29 pagesStrategic Marketing Management-: The Competitive Advantage & Value Creationnaveen jaffriNo ratings yet

- Analysis of Internal Environment: Chapter-5Document34 pagesAnalysis of Internal Environment: Chapter-5Farhan Israq AhmedNo ratings yet

- Analyzing the Internal EnvironmentDocument56 pagesAnalyzing the Internal EnvironmentAbel RonaldoNo ratings yet

- How Firms Can Earn Above-Average Returns According to I/O and Resource-Based ModelsDocument4 pagesHow Firms Can Earn Above-Average Returns According to I/O and Resource-Based ModelsShabbirAhmad100% (1)

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (25)

- Afa TheoryDocument5 pagesAfa Theoryakeila3No ratings yet

- Covered Interest ArbitrageDocument7 pagesCovered Interest Arbitrageakeila3No ratings yet

- Risk Management TechniquesDocument16 pagesRisk Management Techniquesakeila3No ratings yet

- Homemade Leverage - Levered To UnleveredDocument4 pagesHomemade Leverage - Levered To Unleveredakeila3No ratings yet

- International Finance TerminologyDocument3 pagesInternational Finance Terminologyakeila3No ratings yet

- Terms and MeaningDocument2 pagesTerms and Meaningakeila3No ratings yet

- Chapter 8Document3 pagesChapter 8akeila3No ratings yet

- Final Accounting Theory DocumentDocument27 pagesFinal Accounting Theory Documentakeila3No ratings yet

- Comprehensive Income Reporting (Final)Document27 pagesComprehensive Income Reporting (Final)akeila3No ratings yet

- National Flour Mills Analytical ReviewDocument17 pagesNational Flour Mills Analytical Reviewakeila3No ratings yet

- Terms and MeaningDocument2 pagesTerms and Meaningakeila3No ratings yet

- NFM Analytical Review 2017-2018Document13 pagesNFM Analytical Review 2017-2018akeila3No ratings yet

- International Finance TerminologyDocument3 pagesInternational Finance Terminologyakeila3No ratings yet

- Business LawDocument3 pagesBusiness Lawakeila3No ratings yet

- Comprehensive Exam A: Cost Accounting SolutionsDocument30 pagesComprehensive Exam A: Cost Accounting Solutionsakeila3100% (1)

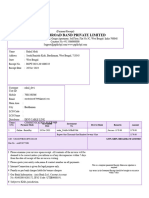

- GTPL KCBPL 26.11.2023Document1 pageGTPL KCBPL 26.11.2023rajkumarmodi9832No ratings yet

- G.R. No. 154493 December 6, 2006 REYNALDO VILLANUEVA, Petitioner, Philippine National Bank (PNB), RespondentDocument3 pagesG.R. No. 154493 December 6, 2006 REYNALDO VILLANUEVA, Petitioner, Philippine National Bank (PNB), RespondentGennard Michael Angelo AngelesNo ratings yet

- Qualifying Exam Reviewer Basic Accounting StudentDocument10 pagesQualifying Exam Reviewer Basic Accounting StudentAngelica PostreNo ratings yet

- Research Rma Format Guide 1Document110 pagesResearch Rma Format Guide 1Nicole Anne PacoNo ratings yet

- Oracle Fusion Middleware Disaster Recovery Solution Using HP EVA StorageDocument29 pagesOracle Fusion Middleware Disaster Recovery Solution Using HP EVA Storagehelmy_mis1594No ratings yet

- 67 3 3 AccountancyDocument39 pages67 3 3 AccountancyHarman Singh SachdevaNo ratings yet

- The Engineer'S Presentation Regarding Dispute # 2: Contract No. NKB/ICB-01 Presented By: KHANKI ConsultantsDocument25 pagesThe Engineer'S Presentation Regarding Dispute # 2: Contract No. NKB/ICB-01 Presented By: KHANKI ConsultantsArshad MahmoodNo ratings yet

- Coca Cola vs. IloiloDocument8 pagesCoca Cola vs. IloiloTinersNo ratings yet

- HCC P 15 17 01 Rev. 2 - Braz ProcedureDocument5 pagesHCC P 15 17 01 Rev. 2 - Braz ProcedureAnasNo ratings yet

- Case Study - Questtion Exam - Bus 5323Document5 pagesCase Study - Questtion Exam - Bus 5323Liên HạNo ratings yet

- Successful Career DevelopmentDocument7 pagesSuccessful Career DevelopmentAynurNo ratings yet

- List of Attorneys March 2018Document21 pagesList of Attorneys March 2018LOVETH KONNIANo ratings yet

- Sri Trang Gloves Company Profile and Focus on InnovationDocument20 pagesSri Trang Gloves Company Profile and Focus on InnovationRudy NASUHANo ratings yet

- Thesis Fulltext01Document81 pagesThesis Fulltext01Chandra manandharNo ratings yet

- Sensor Tower Q2 2021 Data DigestDocument71 pagesSensor Tower Q2 2021 Data Digestchoong Poh100% (1)

- Karnataka Land Grant Rules, 1969Document20 pagesKarnataka Land Grant Rules, 1969Ramanan SelvamNo ratings yet

- Affidavit of Written Initial Universal Commercial Code Financing StatementDocument8 pagesAffidavit of Written Initial Universal Commercial Code Financing StatementKamal Hakim Bey100% (1)

- Investigación Tik Tok InglesDocument5 pagesInvestigación Tik Tok InglesZEUS POSEIDONNo ratings yet

- Ralph Lauren Seeks Tax Refund Through LoopholeDocument3 pagesRalph Lauren Seeks Tax Refund Through LoopholeJeff Weiner100% (1)

- Business Strategy: An Introduction To Market Driven StrategyDocument19 pagesBusiness Strategy: An Introduction To Market Driven StrategyAkki vaidNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryKatesicawattpad OfficialNo ratings yet

- Business Models For Geographic Information: January 2018Document23 pagesBusiness Models For Geographic Information: January 2018Bala RaoNo ratings yet

- 01 NI Course Unit 6Document8 pages01 NI Course Unit 6Miguel LeybaNo ratings yet

- NATIONAL BUDGET CIRCULAR NO 590 A DATED SEPTEMBER 29 2023 Amending Item 3.3 of NBC 590 Validity of UnproDocument4 pagesNATIONAL BUDGET CIRCULAR NO 590 A DATED SEPTEMBER 29 2023 Amending Item 3.3 of NBC 590 Validity of UnproChristian RuizNo ratings yet

- Cccu Babs l5 t1 DB Assignment 202304Document14 pagesCccu Babs l5 t1 DB Assignment 202304Dinu Anna-MariaNo ratings yet

- Location Analysis and Decision Support Model for Bank Branch LocationDocument29 pagesLocation Analysis and Decision Support Model for Bank Branch LocationRecep HaneciNo ratings yet

- Internal Combustion Engines in WorkbenchDocument498 pagesInternal Combustion Engines in WorkbenchSuri Kens Michua100% (2)

- Adigrat UnversityDocument32 pagesAdigrat UnversityAmir sabirNo ratings yet

- Trading Agreement 2018 - SolidmarkDocument2 pagesTrading Agreement 2018 - SolidmarkPhillip James TabiqueNo ratings yet

- Krishna Constructions: Work Order ToDocument2 pagesKrishna Constructions: Work Order ToNasim AktarNo ratings yet