Professional Documents

Culture Documents

Morgan McKinley - 2020 Accounting and Finance - Financial Services Salary Guide Salary Guide

Uploaded by

Kıvanç SekizkardeşCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Morgan McKinley - 2020 Accounting and Finance - Financial Services Salary Guide Salary Guide

Uploaded by

Kıvanç SekizkardeşCopyright:

Available Formats

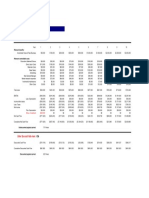

SINGAPORE - 2020 ACCOUNTING AND FINANCE - FINANCIAL SERVICES SALARY GUIDE

The Morgan McKinley 2020 Salary Guide for expected salaries for professional roles in Singapore.

Accounting & Finance Permanent Salaries ($ Per Annum)

Job Title Low Average High

Product Controller $65,000 $120,000 $150,000+

Financial Reporting $70,000 $108,000 $140,000+

Regulatory Reporting $70,000 $108,000 $140,000+

Valuation Control $75,000 $120,000 $150,000+

FP&A $80,000 $120,000 $150,000+

Internal Audit $70,000 $90,000 $130,000

Performance Analyst (Asset Management) $80,000 $120,000 $150,000+

Pricing Analyst $54,000 $78,000 $120000

Tax (Fund/Asset Management) $84,000 $130,000 $200,000

Treasury (Fund Management) $60,000 $80,000 $150,000

Financial Accountant/Manager (Fund Management) $48,000 $76,000 $120,000

Financial Accountant / Manager (Family Office) $42,000 $60,000 $84000+

Fund Accountant (Junior / Senior) $36,000 $54,000 $72,000+

Fund Accounting (Manager / Senior Manager) $72,000 $100,000 $160,000

Legal Entity Controller $65,000 $108,000 $140,000+

Finance Manager $85,000 $120,000 $140,000+

Financial Controller $120,000 $150,000 $180,000+

Finance Director $180,000 $220,000 $250,000+

CFO (Fund Mangement) $220,000 $350,000 $550,000

Accounting & Finance Contract Salaries ($ Per Annum)

© Morgan McKinley 2020

Job Title Low Average High

Product Controller $66,000 $80,000 $150,000+

Financial Reporting $72,000 $100,000 $140,000+

Regulatory Reporting $48,000 $84,000 $120,000+

Valuation Control $84,000 $120,000 $150,000+

FP&A $80,000 $120,000 $150,000+

Internal Audit $70,000 $90,000 $130,000

Performance Analyst (Asset Management) $80,000 $120,000 $150,000+

Pricing Analyst $54,000 $78,000 $100,000+

Tax (Fund/Asset Management) $84,000 $130,000 $120,000+

Treasury / Senior Associate/Director (Fund Management) $60,000 $80,000 $150,000+

Financial Accountant/Manager (Fund Management) $48,000 $76,000 $120000+

Financial Accountant / Manager (Family Office) $42,000 $60,000 $84000+

Fund Accountant (Junior / Senior) $36,000 $54,000 $72000+

Fund Accounting (Manager / Senior Manager) $72,000 $100,000 $160,000+

Legal Entity Controller $80,000 $108,000 $140,000+

Finance Manager $85,000 $120,000 $140,000+

Financial Controller $120,000 $150,000 $180,000+

Finance Director $180,000 $200,000 $220,000+

CFO (Fund Mangement) $200,000 $350,000 $500,000+

Accounting & Finance (Banking & Financial Services)

In recent times there have been fewer applicants in the Q1 and Q3 because many companies pay bonuses

in Feb/Mar. The employees would rather wait to receive their bonuses after working for about three

months into the New Year and then resign before Q3.

Consequently, this has caused an increase in the headcount movement in the industry. Candidates apply

directly to firms or secure jobs through referrals.

© Morgan McKinley 2020

Overview of the 2019 industry trends

Many of the foreign companies in Singapore oversee business affairs from their headquarters while

establishing branch offices in Singapore.

There has been an increase in the number of Chinese and Indian firms interested in expanding their

business to foreign countries. Singapore is one of the best investment destinations because of its

transparency in governance and thriving economy.

Singapore has maintained a good relationship with neighbouring countries and the major stakeholders in

APAC.

Companies that need to hire applicants to fill financial service positions are in search of experienced

workers who can function as reviewers, advisors, and business partners;the goal is to form strategic

relationships to establish production centres at a minimal cost.

Three highly demanded skills in the accounting and finance sector are as follows:

1) Regulatory Reporting

2) Financial Reporting

3) Financial Planning & Analytics

Why is there a demand for these roles?

Companies regard regulatory reporting as an essential responsibility and establishing business

partnerships makes it easy to communicate effectively with the industry stakeholders.

With the implementation of the new MAS 610, there is a demand for candidates who can handle regulatory

reporting efficiently. The new industry trends have revealed that banks now combine financial reporting &

regulatory reporting as one role. What this means is that better-skilled candidates are needed to handle

the more complex roles.

Banks interested in expanding their brand in Singapore and are in the process of establishing innovative

finance teams to support the employees at the front office. There is more demand for FP & A managers

now, more than ever before. These are the professionals who will be in charge of analytics, budgeting,

forecasting the market, and ensuring that the organisation’s business is financially sustainable.

Recruitment strategies used by investors in Singapore

Hiring the best Fund Accountants

The advancement in the area of Fund Services can be attributed to the action taken by fund management

firms to introduce new funds services in Singapore. This is a significant trend that has boosted the Private

Equity and Real Estate sector.

Leveraging favourable tax policies

The on-going 13x income tax scheme has encouraged companies with branches in Singapore to demand

competent applicants who can properly oversee asset management functions.

Hiring financial controllers/finance managers

The employers acknowledge the importance of having a team that can align management reporting and

© Morgan McKinley 2020

budgeting with the business.

Creating better working conditions

Regarding the funding sector, bigger companies offer their employees additional work-free days when

employees have worked at the firm for a particular number of years. This is commonly called a long-

service leave/award. The companies are more interested in retaining their best employees for many more

years.

To achieve this, the banks and companies in the financial sector have implemented different strategies to

attract the best candidates to occupy vacant positions. These companies offer leadership training

programs, relationship building coaching, and attractive bonuses.

Qualifications required for securing better jobs

Applicants who have acquired chartered accountancy qualifications such as CA/CPA/ACCA, stand a high

chance of securing good jobs. Experience is also considered as a recruitment factor.

Remuneration trends in the industry

In banks, employee salary increments are at 15%; consequently, the variable bonuses are higher, which

makes it difficult to account for the overall compensation.

Gender and diversity ratios and existing policies have had an influence on the financial and accounting

sector in the area of financial services.

The MAS 610 makes it mandatory to hire applicants who can perform regulatory reporting in banks. here

have, however, been advancements in the financial sector due to the VCC scheme that was implemented

recently. The current political issues in Hong Kong have left companies with no choice but to search and

hire talent in Singapore.

Have remote working opportunities been impactful?

There has been no significant impact on the financial sector. However, depending on the firm, some level

of flexibility is permitted. For example, some companies require their employees to work in offices, while

others such as small and medium-sized banks allow their staff to work for shorter hours, to help them

achieve a better work/life balance. Also, bigger foreign banks offer employees more flexibility and remote

working opportunities.

The impact of technology changes in the industry

More firms have started automation projects to remain competitive. However, there is a consistent

demand for trained employees who can help to achieve the transition.

It is expected that the demand for employees in the financial sector will remain consistent because more

finance and funds management companies are expanding into Singapore.

With the advancement of technology, there will be an increase in the demand for candidates who have IT

skills.

© Morgan McKinley 2020

The decline in the number of trained candidates available to take jobs in Singapore will compel clients to

be more liberal about the academic background of candidates in Singapore.

Merging roles in the workplace has also become a trend now.Bigger banks have started merging the

regulatory reporting functions with the financial reporting functions.

Also, in smaller firms, accounting responsibilities are combined with KYC/AML functions. This trend creates

opportunities for job seekers who can gain work experience and exposure in other fields.

© Morgan McKinley 2020

You might also like

- Australia Salary Guide 2022Document31 pagesAustralia Salary Guide 2022RajeevGuptaNo ratings yet

- Salary Guide: Accounting & Finance in Hong KongDocument40 pagesSalary Guide: Accounting & Finance in Hong Kongchl100hkNo ratings yet

- 2019 Finance & Accounting Salary Report: Roles from $40K to $300KDocument2 pages2019 Finance & Accounting Salary Report: Roles from $40K to $300KUdayraj SinghNo ratings yet

- Singapore Salary BankingDocument5 pagesSingapore Salary BankingMartin JpNo ratings yet

- Banking & Financial Services Salary GuideDocument16 pagesBanking & Financial Services Salary GuidestevecoppessNo ratings yet

- Accountancy Career MapDocument1 pageAccountancy Career MapAlexchandar AnbalaganNo ratings yet

- Betts Comp Guide 2018Document2 pagesBetts Comp Guide 2018MadiNo ratings yet

- Restaurant Business Proposal-1Document13 pagesRestaurant Business Proposal-1aimarylorenzoizquierdoNo ratings yet

- Accountancy / Finance Technical Services Professional ServicesDocument24 pagesAccountancy / Finance Technical Services Professional ServicesSam_1_No ratings yet

- Section-A: Consolidated Statement of Profit and LossDocument5 pagesSection-A: Consolidated Statement of Profit and LossFarman ShaikhNo ratings yet

- Ginther Fashion PR PlanDocument7 pagesGinther Fashion PR PlanTrang NguyễnNo ratings yet

- Security Agency Business Plan ExampleDocument39 pagesSecurity Agency Business Plan ExampleedjamesenduranceNo ratings yet

- FOOT LOCKER Financial AnalysisDocument4 pagesFOOT LOCKER Financial AnalysisreyesNo ratings yet

- Financial PlanDocument28 pagesFinancial PlannabeelaraoNo ratings yet

- SG MP 2022 Salary ReportDocument97 pagesSG MP 2022 Salary ReportDfffNo ratings yet

- NVDA F3Q23 Investor Presentation FINALDocument62 pagesNVDA F3Q23 Investor Presentation FINALandre.torresNo ratings yet

- Business BudgetDocument5 pagesBusiness BudgetCarolNo ratings yet

- Tutoring Business Plan ExampleDocument23 pagesTutoring Business Plan Example24 Alvarez, Daniela Joy G.No ratings yet

- Cases in Finance 3rd Edition Demello Solutions ManualDocument11 pagesCases in Finance 3rd Edition Demello Solutions ManualJanice Kahalehoe100% (36)

- Highland Malt Accounting Project PDFDocument12 pagesHighland Malt Accounting Project PDFEng Chee Liang100% (1)

- Business Valuations PDFDocument5 pagesBusiness Valuations PDFAyan NoorNo ratings yet

- 2020 Canadian Venture Capital Compensation ReportDocument34 pages2020 Canadian Venture Capital Compensation ReportLeon P.No ratings yet

- About IAB Canada: ResearchDocument8 pagesAbout IAB Canada: ResearchdomudemNo ratings yet

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- Don Mariano Marcos Memorial State University College of Graduate StudiesDocument5 pagesDon Mariano Marcos Memorial State University College of Graduate StudiesJezibel MendozaNo ratings yet

- Salary Guide 2019 HungaryDocument29 pagesSalary Guide 2019 HungaryTNo ratings yet

- Plan-Do-Check-Adjust (PDCA) Cycle: W. Edwards Deming Toyota Production System Lean ManufacturingDocument29 pagesPlan-Do-Check-Adjust (PDCA) Cycle: W. Edwards Deming Toyota Production System Lean ManufacturingnozediNo ratings yet

- Ratio Analysis of Honda Motors Co., LtdDocument13 pagesRatio Analysis of Honda Motors Co., LtdHuzaifa RajputNo ratings yet

- Construction Company Business Plan ExampleDocument19 pagesConstruction Company Business Plan ExamplemiintlyricsNo ratings yet

- RV Park Business Plan ExampleDocument27 pagesRV Park Business Plan Examplejackson jimNo ratings yet

- Average Starting Salary For AccountantsDocument4 pagesAverage Starting Salary For AccountantsDevon JohnsonNo ratings yet

- Variance Analysis: Assignment Line ItemDocument18 pagesVariance Analysis: Assignment Line Itemfatima khurramNo ratings yet

- A. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Document6 pagesA. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Phạm Thu HuyềnNo ratings yet

- Jaxworks PaybackAnalysis1Document1 pageJaxworks PaybackAnalysis1Jo Ann RangelNo ratings yet

- Bold Thinking: Robert H. Hacker Cincinnati, Oh OCTOBER 24-25, 2009Document42 pagesBold Thinking: Robert H. Hacker Cincinnati, Oh OCTOBER 24-25, 2009api-25978665No ratings yet

- Rotman Full Time Employment and Salary Report WebDocument15 pagesRotman Full Time Employment and Salary Report WebVishnu RoyNo ratings yet

- Accounting and Finance Tugas Kelompok #3 Chapter 6 Financial Planning and ForecastingDocument10 pagesAccounting and Finance Tugas Kelompok #3 Chapter 6 Financial Planning and Forecastingbudiman100% (1)

- That S Cut Business Proposal PPT OnlyDocument22 pagesThat S Cut Business Proposal PPT OnlyDeveshwar BansalNo ratings yet

- MY Market Trends Report 2014 1HDocument12 pagesMY Market Trends Report 2014 1HSeng KitNo ratings yet

- CFO Finance VP in Chicago IL Resume Peter StazzoneDocument2 pagesCFO Finance VP in Chicago IL Resume Peter StazzonePeterStazzoneNo ratings yet

- Tugas AKM III - Week 3Document6 pagesTugas AKM III - Week 3Rifda AmaliaNo ratings yet

- Strategic Management Analysis of Procter & Gamble (P&GDocument24 pagesStrategic Management Analysis of Procter & Gamble (P&Gradhika chaudhary50% (2)

- BSBFIM501 - Task 3 - FeliciaDocument5 pagesBSBFIM501 - Task 3 - FeliciasharingdaastradingNo ratings yet

- PPP Key Ratio Analysis I Cba June 122019Document33 pagesPPP Key Ratio Analysis I Cba June 122019Kelvin Namaona NgondoNo ratings yet

- Tugas Minggu Ke 5Document4 pagesTugas Minggu Ke 5Devenda Kartika RoffandiNo ratings yet

- Bab-Mk Afn1Document6 pagesBab-Mk Afn1CalistaNo ratings yet

- 2024 UK Candidate Salary Guide MPDocument74 pages2024 UK Candidate Salary Guide MPErwinNo ratings yet

- Ultimate Business Plan TemplateDocument31 pagesUltimate Business Plan TemplateCandice BoodooNo ratings yet

- Nvda f4q23 Investor Presentation FinalDocument57 pagesNvda f4q23 Investor Presentation FinalDebarros MartinsNo ratings yet

- Strategic planning budget and financial projectionsDocument14 pagesStrategic planning budget and financial projectionsDamaris MoralesNo ratings yet

- ENGR 3322 Written Report 3Document3 pagesENGR 3322 Written Report 3Darwin LomibaoNo ratings yet

- Course Work SyliviaDocument9 pagesCourse Work Syliviaelvis page kamunanwireNo ratings yet

- Exercise 3. Cash Flows Statements and WorkingDocument8 pagesExercise 3. Cash Flows Statements and WorkingQuang Dũng NguyễnNo ratings yet

- Company Benefits GuideDocument12 pagesCompany Benefits GuideKc Reyes IiNo ratings yet

- McDowell Industries Receivables AnalysisDocument8 pagesMcDowell Industries Receivables AnalysisTABUADA, Jenny Rose V.No ratings yet

- Course Code: Fn-550Document25 pagesCourse Code: Fn-550shoaibraza110No ratings yet

- Financial PlanDocument18 pagesFinancial Planashura08No ratings yet

- Ireland Salary Guide 2022Document457 pagesIreland Salary Guide 2022abhy_aramawatNo ratings yet

- Financial Literacy for Managers: Finance and Accounting for Better Decision-MakingFrom EverandFinancial Literacy for Managers: Finance and Accounting for Better Decision-MakingRating: 5 out of 5 stars5/5 (1)

- Icaew Briefing The Future of Audit April 2011Document2 pagesIcaew Briefing The Future of Audit April 2011jafferyasimNo ratings yet

- Turkiye de Yoksulluk Olgusu Nun Yapisal PDFDocument22 pagesTurkiye de Yoksulluk Olgusu Nun Yapisal PDFKıvanç SekizkardeşNo ratings yet

- Morgan McKinley - 2020 Accounting and Finance - Commercial Businesses Salary Guide Salary GuideDocument5 pagesMorgan McKinley - 2020 Accounting and Finance - Commercial Businesses Salary Guide Salary GuideKıvanç SekizkardeşNo ratings yet

- Wheat 2010 FinalDocument2 pagesWheat 2010 FinalKıvanç SekizkardeşNo ratings yet

- Top-Ranked Business Management Systems 2009: The Accounting LibraryDocument5 pagesTop-Ranked Business Management Systems 2009: The Accounting LibraryKıvanç SekizkardeşNo ratings yet

- Teams Part 1 - Purpose of A Team CompleteDocument11 pagesTeams Part 1 - Purpose of A Team CompleteJeremiah GillNo ratings yet

- A STUDY On Industrial RelationsDocument53 pagesA STUDY On Industrial RelationsVenkat66% (29)

- Shell Graduate Programme e Brochure 3Document26 pagesShell Graduate Programme e Brochure 3Davide BoreanezeNo ratings yet

- Assignment On Change in HR Policies Pre and Post COVID-19 SituationDocument9 pagesAssignment On Change in HR Policies Pre and Post COVID-19 SituationNAMAN PRAKASHNo ratings yet

- G.R. No. 203115 Island Overseas Transport Corp. v. BejaDocument8 pagesG.R. No. 203115 Island Overseas Transport Corp. v. BejaJosephine Redulla LogroñoNo ratings yet

- Building Permit Requirements GuideDocument28 pagesBuilding Permit Requirements GuidemrelfeNo ratings yet

- BS Accountancy graduates' employment surveyDocument6 pagesBS Accountancy graduates' employment surveyJhazzette MirasNo ratings yet

- Food Processing Industry of Pakistan PDFDocument73 pagesFood Processing Industry of Pakistan PDFMary Tango Melon67% (6)

- Municipal Corporation of Delhi Vs SonuDocument7 pagesMunicipal Corporation of Delhi Vs Sonuaseemtyagi1155No ratings yet

- Week 2Document20 pagesWeek 2Muhammad Naveed100% (1)

- Application For Admission To The Middle TempleDocument14 pagesApplication For Admission To The Middle TemplemjanjNo ratings yet

- Management Implications of TheoryDocument9 pagesManagement Implications of TheoryShahrukh AliNo ratings yet

- LNL Iklcqd /: Page 1 of 7Document7 pagesLNL Iklcqd /: Page 1 of 7UTTAL RAYNo ratings yet

- Zulfiqar Ali AlviDocument5 pagesZulfiqar Ali AlviRauf AlamNo ratings yet

- Pakistan Agricultural Research Council Revised Clearance/No Demand CertificateDocument2 pagesPakistan Agricultural Research Council Revised Clearance/No Demand CertificateMuhammad NawazNo ratings yet

- A Study On Career Development With Special Reference To IbmDocument20 pagesA Study On Career Development With Special Reference To IbmSomiyaNo ratings yet

- AssignmentDocument34 pagesAssignmentAnshika SharmaNo ratings yet

- Labor Standards - Case Digests Atty. MagsinoDocument16 pagesLabor Standards - Case Digests Atty. MagsinoAnsfav PontigaNo ratings yet

- "Effectiveness of Epms in Rdcis (Sail) ": Research TopicDocument53 pages"Effectiveness of Epms in Rdcis (Sail) ": Research Topicj4jhnyNo ratings yet

- Road # 3, Banjara Hills, Hyderabad 500 034: For IBS Use Only Class of 2009Document20 pagesRoad # 3, Banjara Hills, Hyderabad 500 034: For IBS Use Only Class of 2009abcdownload1No ratings yet

- Labor Law Guide on Recruitment, Placement and Illegal RecruitmentDocument14 pagesLabor Law Guide on Recruitment, Placement and Illegal RecruitmentMan2x SalomonNo ratings yet

- Liberal PartyDocument8 pagesLiberal Partyapi-338662908No ratings yet

- Popular Vote Bill Clears Hurdle: Google SurpriseDocument31 pagesPopular Vote Bill Clears Hurdle: Google SurpriseSan Mateo Daily JournalNo ratings yet

- Business Team ResponsibilitiesDocument3 pagesBusiness Team ResponsibilitiesKz AwangNo ratings yet

- Position Paper Labor CaseDocument9 pagesPosition Paper Labor CaseMaharshi Cru50% (2)

- Lantion Vs NLRCDocument6 pagesLantion Vs NLRCPaulo Miguel GernaleNo ratings yet

- Standard SOP Recruitment ProcedureDocument3 pagesStandard SOP Recruitment ProcedurePerwez21No ratings yet

- Legal Register - Federal Law No. 32Document7 pagesLegal Register - Federal Law No. 32Priyanka JNo ratings yet

- Territory Development and Time ManagementDocument54 pagesTerritory Development and Time Managementtheanuuradha1993gmai100% (1)

- Full ProjectDocument103 pagesFull Projectவெங்கடேஷ் ராமசாமி83% (6)