Professional Documents

Culture Documents

Review QNS Msc. Fi - 3

Uploaded by

Patrick LuandaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Review QNS Msc. Fi - 3

Uploaded by

Patrick LuandaCopyright:

Available Formats

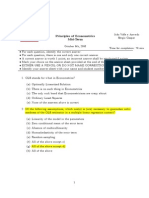

12.

The following results are for an empirical model

where percentage scores of MSc.FI student at IAA were

modeled as a function of sex (1=Female, 0=Male) and age of the students

(in years):

(1.920) (2.175) (0.033)

F = 14.14 ESS = 154,466.942 n = 123

Standard errors (S.E) are reported under the coefficient estimates. The

regression F-statistic, coefficient of determination , the error sum of

squares (ESS) and the sample size (n) are also reported.

i) Interpret the model and the coefficient of sex.

ii) Compute the t-ratios

iii) Is the intercept coefficient significantly different from zero at 5 percent

level? Why or why not?

iv) On the basis of the results, what variable(s) would you consider

deleting from the model? Give reason(s).

v) Test for the overall significance of the estimated model (i.e test the null

hypothesis ) at 5% level of significance.

13. A researcher obtained the following ordinary least squares (OLS)

estimates for a UK firm’s stock price using 120 observations from 1980

m1 to 1989m12 (All variables in logarithms):

ln st 0.87 0.54 ln pt 0.65ln yt 0.34 ln rt 0.32 ln mt

(1.06) (0.24) (0.30) (0.12) (0.24)

R 2 0.34, RSS 1.24, 4

F115 3.75

st are the log of the stock price, pt is the log of profits, yt is the log of its

output in the UK, rt is the log of expenditure on research and

development and mt is the log of expenditure on Marketing. Figures in

parentheses are standard errors and RSS is the Residual Sum of

Squares.

i) Briefly evaluate the reasons behind including the above

explanatory variables in the regression.

ii) What is the explanatory power of the regression?

iii) Individually using the t-test, test whether each coefficient equals 0,

at the 5% level of significance

iv) Using a t-test does the coefficient on the variable lnyt = 1?

v) Explain why the error term needs to be normally distributed and

how the problem of non-normality can be overcome.

You might also like

- Midterm Sem1 2013Document6 pagesMidterm Sem1 2013picklepoesieNo ratings yet

- Reading 1 Multiple Regression - AnswersDocument90 pagesReading 1 Multiple Regression - Answerstristan.riolsNo ratings yet

- Multiple Choice Sample QuestionsDocument3 pagesMultiple Choice Sample QuestionsthuyvuNo ratings yet

- Model PaperDocument4 pagesModel PaperLochana PrasadiNo ratings yet

- Q.B StatisticsDocument7 pagesQ.B StatisticsNavkar Jain SahabNo ratings yet

- Assignment No.2: Jameel Ahmed (8513) To: Sir Arsalan HashmiDocument7 pagesAssignment No.2: Jameel Ahmed (8513) To: Sir Arsalan HashmiAbdul RafayNo ratings yet

- Sample Exam 3 (Chapter 7 To 10) With HighlightDocument4 pagesSample Exam 3 (Chapter 7 To 10) With HighlightChisei MeadowNo ratings yet

- Multiple Choice Sample QuestionsDocument3 pagesMultiple Choice Sample QuestionsNguyn Lại QuengNo ratings yet

- Quiz 4 Review Questions With AnswersDocument10 pagesQuiz 4 Review Questions With AnswersSteven NguyenNo ratings yet

- Subject: E: Model Mis-Specification.: Conometric Problems RevisitedDocument4 pagesSubject: E: Model Mis-Specification.: Conometric Problems RevisitedShadman SakibNo ratings yet

- MEC-009 - ENG-D12 - CompressedDocument4 pagesMEC-009 - ENG-D12 - CompressednitikanehiNo ratings yet

- 12Document16 pages12Vishal kaushikNo ratings yet

- Tarea 10nestadisticaDocument9 pagesTarea 10nestadisticacamilomelgarejo92No ratings yet

- Seminar QuestionsDocument5 pagesSeminar Questionsabdulwahabsaid26No ratings yet

- In To 1 in Fifty In: Variable, Observation, and Data SetDocument4 pagesIn To 1 in Fifty In: Variable, Observation, and Data Setعلي الجامعيNo ratings yet

- ECONODocument19 pagesECONONoman Moin Ud DinNo ratings yet

- HI6007 Group Assignment T3.2018Document4 pagesHI6007 Group Assignment T3.2018AH MughalNo ratings yet

- Exam QuestionsDocument3 pagesExam Questionskasturi.kandalamNo ratings yet

- Sample Question EconometricsDocument11 pagesSample Question EconometricsIves LeeNo ratings yet

- Exercises Units 1,2,3Document8 pagesExercises Units 1,2,3Eduardo MuñozNo ratings yet

- Class-Xi ECONOMICS (030) ANNUAL EXAM (2020-21) : General InstructionsDocument8 pagesClass-Xi ECONOMICS (030) ANNUAL EXAM (2020-21) : General Instructionsadarsh krishnaNo ratings yet

- CT 2Document4 pagesCT 2Anisha AuladNo ratings yet

- Question Bank For Mba StudentsDocument6 pagesQuestion Bank For Mba StudentsVidhi singhNo ratings yet

- Adam Smith Business School Subject of Economics Degree of MSC Degree Exam Basic Econometrics, Econ5002Document6 pagesAdam Smith Business School Subject of Economics Degree of MSC Degree Exam Basic Econometrics, Econ5002Junjing MaoNo ratings yet

- Pre Board - 2 11 EcoDocument3 pagesPre Board - 2 11 EcoNDA AspirantNo ratings yet

- Gra 65151 - 201820 - 06.12.2018 - QPDocument6 pagesGra 65151 - 201820 - 06.12.2018 - QPHien NgoNo ratings yet

- E301sample Questions2 - 12Document3 pagesE301sample Questions2 - 12Osman GulsevenNo ratings yet

- ES50112 Exam 20Document4 pagesES50112 Exam 20LucNo ratings yet

- Lecture On Non-Parametric StatisticsDocument16 pagesLecture On Non-Parametric StatisticsRyan BondocNo ratings yet

- Analysis and Discussion: Responsibility and Do Not Have InstitutionalDocument11 pagesAnalysis and Discussion: Responsibility and Do Not Have InstitutionalHafizhHermawanNo ratings yet

- Example 2Document7 pagesExample 2Thái TranNo ratings yet

- Exam Example2+AnswersDocument5 pagesExam Example2+AnswersArthur NingNo ratings yet

- Do Change Exchange Rate of China Affect in GDPDocument2 pagesDo Change Exchange Rate of China Affect in GDPFarhan Ali ChahwanNo ratings yet

- Mid Term UmtDocument4 pagesMid Term Umtfazalulbasit9796No ratings yet

- On Bias, Inconsistency, and Efficiency of Various Estimators in Dynamic Panel Data ModelsDocument26 pagesOn Bias, Inconsistency, and Efficiency of Various Estimators in Dynamic Panel Data ModelsGilani UsmanNo ratings yet

- Session 5 ch4Document5 pagesSession 5 ch4Trung Kiên NguyễnNo ratings yet

- HUM 4057 08 Sep 2022Document5 pagesHUM 4057 08 Sep 2022Sidharth SudershanNo ratings yet

- Mention The Table Number Which You Are Referring To.: Regression MathDocument4 pagesMention The Table Number Which You Are Referring To.: Regression MathNusratJahanHeabaNo ratings yet

- BRM PDFDocument5 pagesBRM PDFanupam rahman srizonNo ratings yet

- 1 e ExercisesDocument31 pages1 e ExerciseszubairulhassanNo ratings yet

- Mid Term Test BFT 64Document3 pagesMid Term Test BFT 64Ngọc LươngNo ratings yet

- Midterm PrinciplesDocument8 pagesMidterm Principlesarshad_pmadNo ratings yet

- Review Question Econometrics - 2Document3 pagesReview Question Econometrics - 2OLIVA MACHUMUNo ratings yet

- Exercises 4,5,6,7+test CanvasDocument5 pagesExercises 4,5,6,7+test CanvasEduardo MuñozNo ratings yet

- Ex08 PDFDocument29 pagesEx08 PDFSalman FarooqNo ratings yet

- Ma3251 - SNM Unit - 1 Testing of Hypothesis Au Questions-1Document31 pagesMa3251 - SNM Unit - 1 Testing of Hypothesis Au Questions-1Abinaya SriNo ratings yet

- Introduction To Econometrics, TutorialDocument22 pagesIntroduction To Econometrics, Tutorialagonza70No ratings yet

- BSI Semester - III - 2020Document3 pagesBSI Semester - III - 2020VISHWA SAHNINo ratings yet

- MCO-3-D15 ENG CompressedDocument2 pagesMCO-3-D15 ENG CompressedKripa Shankar MishraNo ratings yet

- Diploma Programmes Main Examination: Dipl/Qts0109/May2018/MaineqpDocument17 pagesDiploma Programmes Main Examination: Dipl/Qts0109/May2018/MaineqpMay JingNo ratings yet

- Econometrics Sheet 2B MR 2024Document5 pagesEconometrics Sheet 2B MR 2024rrrrokayaaashrafNo ratings yet

- University of Engineering & Management, Jaipur: University Examination MBA, 1 Year, 2 SemesterDocument6 pagesUniversity of Engineering & Management, Jaipur: University Examination MBA, 1 Year, 2 SemesterSupriyo BiswasNo ratings yet

- SEM 4 - 10 - BA-BSc - HONS - ECONOMICS - CC-10 - INTRODUCTORYECONOMETRI C - 10957Document3 pagesSEM 4 - 10 - BA-BSc - HONS - ECONOMICS - CC-10 - INTRODUCTORYECONOMETRI C - 10957PranjalNo ratings yet

- Checklist For Final ExamDocument7 pagesChecklist For Final ExamThành LongNo ratings yet

- Heteroscedasticity IssueDocument3 pagesHeteroscedasticity IssueShadman Sakib100% (2)

- 2021, Obe, 12277502Document6 pages2021, Obe, 12277502nikhiljoshisrccNo ratings yet

- System GMM With Small SampleDocument28 pagesSystem GMM With Small SampleNur AlamNo ratings yet

- BA Sample Paper Questions2Document17 pagesBA Sample Paper Questions2kr1zhna0% (1)

- Statistical Inference for Models with Multivariate t-Distributed ErrorsFrom EverandStatistical Inference for Models with Multivariate t-Distributed ErrorsNo ratings yet