Professional Documents

Culture Documents

Key: - Cons Constant Coefficient, Hhsize Household Size, Coeff Coefficient

Uploaded by

Patrick Luanda0 ratings0% found this document useful (0 votes)

67 views1 pageOriginal Title

REVIEW QNS MSC. FI_4

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

67 views1 pageKey: - Cons Constant Coefficient, Hhsize Household Size, Coeff Coefficient

Uploaded by

Patrick LuandaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

14.

The following regression was run using quarterly data, amounting to

70 observations:

Bt 0.78 0.89 Pt 0.35St

(0.56) (0.78) (0.12)

R 0.76, DW 1.57White(5) 27.2

2

Where B is the demand for brokerage services, P is the price of the

services and S is the total number of brokers and all variables are in

logarithms (standard errors in parentheses). DW is the Durbin-

Watson statistic. White is White’s Test.

i) Comment on the specification of the above model

ii) Compute the t-ratios

iii) Does the above regression suffer from first order autocorrelation?

If so how might this have arisen?

iv) Does the model suffer from heteroscedasticity? Explain

v) Explain how you would test for normality assumption using

Jaque-Bera(JB) statistic

15. A student wanted to assess the effect of households’ income and

household size on food consumption expenditure. He obtained survey

data on weekly households’ food consumption expenditure, weekly

households’ income (both in USD) and household size based on a sample

of ten (10) households. Using STATA he estimated a multiple linear

regression with food consumption expenditure as a dependent variable,

and obtained the following results:

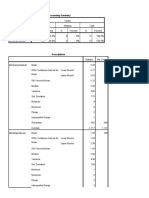

Source SS df MS Number of obs = 10

F( 2, 7) = 273.91

Model 8777.83767 2 4388.91884 Prob > F = 0.0000

Residual 112.162327 7 16.0231896 R-squared = 0.9874

Adj R-squared = 0.9838

Total 8890 9 987.777778 Root MSE = 4.0029

consumption Coef. Std. Err. t P>|t| [95% Conf. Interval]

income .4819976 .0231905 20.78 0.000 .4271607 .5368344

hhsize 3.887307 1.037112 3.75 0.007 1.434927 6.339686

_cons 15.45484 4.626001 3.34 0.012 4.516086 26.3936

Key: _cons = constant coefficient, hhsize = household size, coeff = coefficient

estimate, Std. Err. = Standard errors, df = degrees of freedom.

i. Provide a report on these results. Make sure that your report

includes interpretation and explanation on coefficient estimates and

their magnitude, t-statistic, p-values, standard errors and R-

squared.

You might also like

- Working Capital QuestionsDocument10 pagesWorking Capital QuestionsVaishnavi VenkatesanNo ratings yet

- PDF To DocsDocument72 pagesPDF To Docs777priyankaNo ratings yet

- BA 1040 Seminar 2 2014 - 2015Document10 pagesBA 1040 Seminar 2 2014 - 2015S.L.L.CNo ratings yet

- Microsoft Word - Math Ia - Final FinalDocument28 pagesMicrosoft Word - Math Ia - Final FinalAlisha Narula100% (2)

- Leverage: Prepared By:-Priyanka GohilDocument23 pagesLeverage: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- Likert Scale: Itemized Rating Scale - in The Itemized Rating Scale, The Respondents Are Provided WithDocument1 pageLikert Scale: Itemized Rating Scale - in The Itemized Rating Scale, The Respondents Are Provided WithDisha groverNo ratings yet

- Dividend Policy Gorden, Walter & MM Model Practice QuestionsDocument1 pageDividend Policy Gorden, Walter & MM Model Practice QuestionsAmjad AliNo ratings yet

- Unit - V Budget and Budgetary Control ProblemsDocument2 pagesUnit - V Budget and Budgetary Control ProblemsalexanderNo ratings yet

- Cost Volume Profit Analysis (Decision Making) - TaskDocument9 pagesCost Volume Profit Analysis (Decision Making) - TaskAshwin KarthikNo ratings yet

- Calculating operating, financial and combined leverageDocument4 pagesCalculating operating, financial and combined leveragek,hbibk,n0% (1)

- Ratio AnalysisDocument42 pagesRatio AnalysiskanavNo ratings yet

- Analysis of VariancesDocument40 pagesAnalysis of VariancesSameer MalhotraNo ratings yet

- Graded Illustrations on Capital Budgeting TechniquesDocument57 pagesGraded Illustrations on Capital Budgeting TechniquesVishesh GuptaNo ratings yet

- Linear Programming NotesDocument9 pagesLinear Programming NotesMohit aswalNo ratings yet

- Blades Hedge Thai Baht, British PoundDocument7 pagesBlades Hedge Thai Baht, British PoundAl-Imran Bin KhodadadNo ratings yet

- Analysis of Variance (ANOVA) One Way and Two WayDocument24 pagesAnalysis of Variance (ANOVA) One Way and Two WayPanma PatelNo ratings yet

- 14 - Dividend Policy SumsDocument17 pages14 - Dividend Policy SumsRISHA SHETTYNo ratings yet

- E WasteDocument20 pagesE WasteSuvankar SinghaNo ratings yet

- Gordon ModelDocument5 pagesGordon ModelRamesh Thangavel TNo ratings yet

- Capital StructureDocument6 pagesCapital StructureHasan Zahoor100% (1)

- Ipcc Cost Accounting RTP Nov2011Document209 pagesIpcc Cost Accounting RTP Nov2011Rakesh VermaNo ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- Correlation and Regression Questions - AnswersDocument19 pagesCorrelation and Regression Questions - Answerssai raoNo ratings yet

- Financial Evaluation of LEASINGDocument7 pagesFinancial Evaluation of LEASINGmba departmentNo ratings yet

- Strengths in The SWOT Analysis of ICICI BankDocument2 pagesStrengths in The SWOT Analysis of ICICI BankSudipa RouthNo ratings yet

- 878 Ch08ARQDocument5 pages878 Ch08ARQMaydawati Fidellia GunawanNo ratings yet

- Break Even AnalysisDocument6 pagesBreak Even AnalysisNafi AhmedNo ratings yet

- PVF, PVAF, CVF, CVAF Tables For Financial ManagementDocument10 pagesPVF, PVAF, CVF, CVAF Tables For Financial ManagementhamzaNo ratings yet

- 333FF2 - Bond Pricing & Bond Pricing Theorems 1Document23 pages333FF2 - Bond Pricing & Bond Pricing Theorems 1Sai PavanNo ratings yet

- Applied Corporate Finance TVM Calculations and AnalysisDocument3 pagesApplied Corporate Finance TVM Calculations and AnalysisMuxammil IqbalNo ratings yet

- Limitations of Break Even AnalysisDocument4 pagesLimitations of Break Even AnalysissowmyaNo ratings yet

- Class Discussion Questions For Capital Gains ChapterDocument3 pagesClass Discussion Questions For Capital Gains ChapterHdkakaksjsbNo ratings yet

- 18415compsuggans PCC FM Chapter7Document13 pages18415compsuggans PCC FM Chapter7Mukunthan RBNo ratings yet

- Macro & Micro Indicators of Business EnvironmentDocument25 pagesMacro & Micro Indicators of Business EnvironmentRavi Mishra75% (4)

- Sip Handbook OF IBSDocument40 pagesSip Handbook OF IBSPriyanka AgarwalNo ratings yet

- BCG ApproachDocument2 pagesBCG ApproachAdhityaNo ratings yet

- Capital Budgeting MathDocument4 pagesCapital Budgeting MathMuhammad Akmal HossainNo ratings yet

- MPhil Statistics Course Outline Fall 2018Document4 pagesMPhil Statistics Course Outline Fall 2018whatever152207No ratings yet

- CVP AnalysisDocument11 pagesCVP AnalysisPratiksha GaikwadNo ratings yet

- Marginal CostingDocument13 pagesMarginal CostingKUNAL GOSAVINo ratings yet

- WCM QuizDocument33 pagesWCM QuizbalaNo ratings yet

- Point of IndifferenceDocument3 pagesPoint of IndifferenceSandhyaNo ratings yet

- Machine Hour Rate Ormat of Computation of Machine Hour RateDocument4 pagesMachine Hour Rate Ormat of Computation of Machine Hour RatekchahalNo ratings yet

- Mount Kenya University Business Statistics IIDocument9 pagesMount Kenya University Business Statistics IICy RusNo ratings yet

- Hire PurchaseDocument16 pagesHire PurchasebrekhaaNo ratings yet

- Dax CorporationsDocument1 pageDax CorporationsNazri YusofNo ratings yet

- Marginal Costing and Cost-Volume-Profit Analysis (CVP)Document65 pagesMarginal Costing and Cost-Volume-Profit Analysis (CVP)Puneesh VikramNo ratings yet

- Cost EstimationDocument5 pagesCost EstimationSenelwa AnayaNo ratings yet

- Amendment Mat BookDocument99 pagesAmendment Mat BookSomsindhu NagNo ratings yet

- Financial Management 2E: Rajiv Srivastava - Dr. Anil MisraDocument5 pagesFinancial Management 2E: Rajiv Srivastava - Dr. Anil MisraAnkit AgarwalNo ratings yet

- Hire Purchase AccountingDocument123 pagesHire Purchase AccountingLallan Sharma50% (2)

- FRSA Practice Questions For AssignmentDocument8 pagesFRSA Practice Questions For AssignmentSrikar WuppalaNo ratings yet

- Partnership Problems With Solutions2 PDFDocument36 pagesPartnership Problems With Solutions2 PDFjeevithaNo ratings yet

- Oaf 624 Course OutlineDocument8 pagesOaf 624 Course OutlinecmgimwaNo ratings yet

- CONFIDENTIAL Corporate Finance ExamDocument3 pagesCONFIDENTIAL Corporate Finance ExamAssignment HelperNo ratings yet

- ValuationDocument23 pagesValuationishaNo ratings yet

- Marginal Costing and Profit PlanningDocument22 pagesMarginal Costing and Profit Planningdevika125790% (1)

- Problems and SolutionsDocument7 pagesProblems and SolutionsMohitAhujaNo ratings yet

- Valuation of GoodwillDocument6 pagesValuation of GoodwillPrasad NaikNo ratings yet

- Analysis Pre FinalDocument64 pagesAnalysis Pre FinalAbhishek ModiNo ratings yet

- MGS3100: Exercises - ForecastingDocument8 pagesMGS3100: Exercises - ForecastingJabir ArifNo ratings yet

- • Linear Regression with length predicted by dose-1Document7 pages• Linear Regression with length predicted by dose-1f.ember02No ratings yet

- CostDocument3 pagesCostPatrick LuandaNo ratings yet

- Comparing risk of two securities using CV and standard deviationDocument1 pageComparing risk of two securities using CV and standard deviationPatrick LuandaNo ratings yet

- Review QNS Msc. Fi - 5Document1 pageReview QNS Msc. Fi - 5Patrick LuandaNo ratings yet

- Review QNS Msc. Fi - 6 PDFDocument1 pageReview QNS Msc. Fi - 6 PDFPatrick LuandaNo ratings yet

- MSc FI Student Performance ModelDocument1 pageMSc FI Student Performance ModelPatrick LuandaNo ratings yet

- Sample Problems From Chapter 10.1: Variables What They MeanDocument12 pagesSample Problems From Chapter 10.1: Variables What They MeanFernando100% (1)

- Ratios PDFDocument1 pageRatios PDFPatrick LuandaNo ratings yet

- Annuity Problems 2Document2 pagesAnnuity Problems 2Ali Salim Ali El-BusaidiNo ratings yet

- Cyberloafing Activities and Behaviors ExploredDocument118 pagesCyberloafing Activities and Behaviors Exploredship_2106No ratings yet

- Introduction To Data AnalysisDocument21 pagesIntroduction To Data AnalysisVaneet SodhiNo ratings yet

- PSUnit I Lesson 4 Computing The Variance of A Discrete Probability DistributionDocument24 pagesPSUnit I Lesson 4 Computing The Variance of A Discrete Probability DistributionJaneth Marcelino50% (2)

- Assignment Six 20 PointsDocument8 pagesAssignment Six 20 PointsSubhash KorumilliNo ratings yet

- EstimationDocument6 pagesEstimationmohit_namanNo ratings yet

- MR AssignmentDocument111 pagesMR AssignmentPrakash RoyNo ratings yet

- Normal Curve PowerpointDocument18 pagesNormal Curve PowerpointKatherine PanganibanNo ratings yet

- Understanding Measures of Central TendencyDocument26 pagesUnderstanding Measures of Central TendencyAliNurRahmanNo ratings yet

- Cardio Analysis Using RDocument25 pagesCardio Analysis Using RPavithra ManjakuppamNo ratings yet

- 2012 Spring MKTG 3143.10 AshleyDocument12 pages2012 Spring MKTG 3143.10 AshleyVirendra MahechaNo ratings yet

- Descriptive Statistics and InterpretationDocument9 pagesDescriptive Statistics and InterpretationramNo ratings yet

- Regression With Dummy Variables Econ420 1Document47 pagesRegression With Dummy Variables Econ420 1shaharhr1No ratings yet

- 421 Mthex 2017Document3 pages421 Mthex 2017Gloria Ngeri Dan-OrawariNo ratings yet

- Tabu Ran NormalDocument14 pagesTabu Ran NormalSylvia100% (1)

- Case Processing SummaryDocument5 pagesCase Processing SummarySiti NuradhawiyahNo ratings yet

- Mosobalaje2019 Article DescriptiveStatisticsAndProbabDocument17 pagesMosobalaje2019 Article DescriptiveStatisticsAndProbabحسوني المارنزNo ratings yet

- Module 3 Sampling and Sampling Distributions PDFDocument11 pagesModule 3 Sampling and Sampling Distributions PDFVarun LalwaniNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's UniversityDocument59 pagesSlides Prepared by John S. Loucks St. Edward's UniversityVũ NguyễnNo ratings yet

- A Level Maths Edexcel S1 BOOK PDFDocument244 pagesA Level Maths Edexcel S1 BOOK PDFSarahJavaid100% (3)

- Continuous Continuous Continuous Continuous Continuous: Discrete DiscreteDocument13 pagesContinuous Continuous Continuous Continuous Continuous: Discrete DiscreteCHAKRADHAR PALAVALASANo ratings yet

- Dwnload Full Statistics Data Analysis and Decision Modeling 5th Edition Evans Solutions Manual PDFDocument36 pagesDwnload Full Statistics Data Analysis and Decision Modeling 5th Edition Evans Solutions Manual PDFgiaocleopatra192y100% (11)

- Descriptive Statistics ModifiedDocument36 pagesDescriptive Statistics ModifiedMohammad Bony IsrailNo ratings yet

- AMGMHM Mean and DeviationDocument4 pagesAMGMHM Mean and Deviationrashid aliNo ratings yet

- Statistical Analysis Measures of VariationDocument28 pagesStatistical Analysis Measures of VariationJerald Jay CatacutanNo ratings yet

- Raja Daniyal (0000242740) 8614 - Assignment 1Document30 pagesRaja Daniyal (0000242740) 8614 - Assignment 1Raja DaniyalNo ratings yet

- Statistical MethodDocument3 pagesStatistical MethodAlia buttNo ratings yet

- F.Y.B.sc. Statistics-Statistical TechniquesDocument18 pagesF.Y.B.sc. Statistics-Statistical TechniquesM Sabber NooriNo ratings yet

- PowerPoint Presentation On StatisticsDocument66 pagesPowerPoint Presentation On StatisticsMeghna N MenonNo ratings yet