Professional Documents

Culture Documents

Cpale Tax RFBT New Topics

Cpale Tax RFBT New Topics

Uploaded by

Nath Bongalon0 ratings0% found this document useful (0 votes)

1 views2 pagesOriginal Title

CPALE TAX RFBT NEW TOPICS.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views2 pagesCpale Tax RFBT New Topics

Cpale Tax RFBT New Topics

Uploaded by

Nath BongalonCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

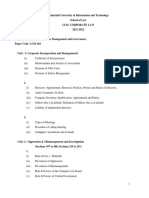

TAXATION

New topics CPA BORAD EXAM

As of October 2017

I. TAXATION UNDER THE LOCAL GOVERNMENT CODE

A. Scope and different types of local taxes (Limited to real property tax, local business tax)

B. Tax base and tax rates

C. Venue and time of filing of tax returns

D. Venue and time of payment

II. PREFERENTIAL TAXATION

A. Senior Citizens Law

(1) Exemption from income tax of qualified senior citizens

(2) Tax incentives for qualified establishments selling goods and services to senior citizens

B. Magna Carta for Disabled Persons

(1) Tax incentives for qualified establishments selling goods and services to senior citizens

C. Special Economic Zone Act

(1) Policy and the Philippine Economic Zone Authority

(2) Registration of investments

(3) Fiscal incentives to PEZA-registered economic zone enterprises

D. Omnibus Investments Code (Book 1 of Executive Order 226)

(1) Policy and the board of investment (BOI)

(2) Preferred areas of investment

(3) Investments Priority Plan

(4) Registration of investments

(5) Fiscal incentives to BOI registered enterprises

E. Barangay Micro Business Enterprises (BMBEs) Act

(1) Registration of BMBEs

(2) Fiscal incentives to BMBEs

F. Double Taxation Agreements (DTA)

(1) Nature and purpose of DTAs

(2) Manner of giving relief from double taxation

(3) Procedure for availment of tax treaty benefits

REGULATORY FRAMEWORK FOR USINESS TRANSACTIONS

(Formerly Business Law)

New topics in CPA Board Exam

as of October 2017

A. INSOLVENCY LAW (8) Merger and consolidation of cooperatives

(1) Definition of insolvency (9) Dissolution of cooperatives

(2) Suspension of payments

(3) Voluntary insolvency E. PDIC LAW

(4) Involuntary insolvency (1) Insurable deposits

(2) Maximum liability

B. CORPORATE REHABILITATION (3) Requirements for claims

(1) Definition of terms

(2) Stay order F. SECRECY OF ANK DEPOSIT AND

(3) Receiver UNCLAIMED BALANCES LAW

(4) Rehabilitation plan

(5) Contents of petition and other types of G. GENERAL BANKING LAW

Rehabilitation (1) Definition of Banks

C. BOUNCING CHECKS H. AMLA LAW

(1) Checks without insufficient funds (1) Covered transactions

(2) Evidence of knowledge of insufficient funds (2) Suspicious transactions

(3) Duty of Drawee (3) Reportorial requirement

(4) Credit construed

I. THE NEW CENTRAL BANK ACT

D. COOPERATIVES (1) Legal tender power over coins and note

(1) Organization and registration of Cooperatives (2) Conservatorship

(2) Administration (3) Receivership and Closures

(3) Responsibilities, Rights, and privileges of

cooperatives J. INTELLECTUAL PROPERTY LAW

(4) Capital, property of funds (1) The law on patents

(5) Audit, inquiry and member’s right to examine (2) The law on trademark, service marks and trade

(6) Allocation and distribution of funds names

(7) Types and categories of cooperatives (3) The law on copyright

You might also like

- Syllabus UCC Business Law and Taxation IntegrationDocument9 pagesSyllabus UCC Business Law and Taxation IntegrationArki Torni100% (1)

- Taxation Law Review SyllabusDocument14 pagesTaxation Law Review SyllabusRoxanne Peña100% (2)

- International Financial Reporting Standards (IFRS) Workbook and Guide: Practical insights, Case studies, Multiple-choice questions, IllustrationsFrom EverandInternational Financial Reporting Standards (IFRS) Workbook and Guide: Practical insights, Case studies, Multiple-choice questions, IllustrationsNo ratings yet

- Law On Sales ReviewerDocument1 pageLaw On Sales ReviewerNath BongalonNo ratings yet

- 2 Commercial and Taxation Law SyllabusDocument12 pages2 Commercial and Taxation Law Syllabusapple psciNo ratings yet

- CMBE2 Introductory Accounting For Non-Accountancy Students SyllabusDocument7 pagesCMBE2 Introductory Accounting For Non-Accountancy Students SyllabusEunice AmbrocioNo ratings yet

- Coverage Law On Taxation 2014 Bar ExaminationsDocument19 pagesCoverage Law On Taxation 2014 Bar ExaminationsAnonymous JqiHOYWmsNo ratings yet

- LLM Corporate Law SyllabusDocument10 pagesLLM Corporate Law SyllabusCorpsons MgtNo ratings yet

- Mercantile Law: 2019 Bar ExaminationsDocument3 pagesMercantile Law: 2019 Bar ExaminationsDheimEresNo ratings yet

- Mercantile LAW: I. Letters of Credit and Trust ReceiptsDocument4 pagesMercantile LAW: I. Letters of Credit and Trust ReceiptsclarizzzNo ratings yet

- Syllabus - Commercial and Taxation LawDocument13 pagesSyllabus - Commercial and Taxation LawDiane JulianNo ratings yet

- SYLLABUS Tax FOR 2023 BARDocument3 pagesSYLLABUS Tax FOR 2023 BARJournal SP DabawNo ratings yet

- Insolvency Theories and ApproachesDocument5 pagesInsolvency Theories and ApproachesRoberto GuiseppiNo ratings yet

- Syllabus For ACCLAW4Document5 pagesSyllabus For ACCLAW4Alyzza Marie BlandoNo ratings yet

- 2017 BAR Tax Law Review SyllabusDocument23 pages2017 BAR Tax Law Review SyllabusErby Jennifer Sotelo-GesellNo ratings yet

- Nationa Credit Act FormsDocument114 pagesNationa Credit Act FormsrodystjamesNo ratings yet

- Syllabus - Corporate Law 2024Document1 pageSyllabus - Corporate Law 2024AsthaNo ratings yet

- Taxation 2 Syllabus Atty SaniDocument4 pagesTaxation 2 Syllabus Atty Saniyasser lucmanNo ratings yet

- Taxation Law 2: Case DigestDocument155 pagesTaxation Law 2: Case DigestLala ManzanoNo ratings yet

- Taxation Law 2: Case DigestDocument155 pagesTaxation Law 2: Case DigestJosh Napiza100% (1)

- Integ - RFBT Syllabus 2021-2022Document8 pagesInteg - RFBT Syllabus 2021-2022Kelvin CulajaraNo ratings yet

- Araullo University Cabanatuan City Nueva EcijaDocument14 pagesAraullo University Cabanatuan City Nueva EcijacryzelNo ratings yet

- Commercial Law Bar SyllabusDocument8 pagesCommercial Law Bar SyllabusJM EnguitoNo ratings yet

- Taxrev SyllabusDocument12 pagesTaxrev SyllabusDiane JulianNo ratings yet

- Tax Law 1 Discussion Guide 2. Sept 2022Document5 pagesTax Law 1 Discussion Guide 2. Sept 2022Bestie BushNo ratings yet

- Araullo University Cabanatuan City Nueva EcijaDocument14 pagesAraullo University Cabanatuan City Nueva EcijacryzelNo ratings yet

- Chapter 2 - Taxes, Tax Laws and Tax Administration: Shanice Molina-Cabotage, CPADocument28 pagesChapter 2 - Taxes, Tax Laws and Tax Administration: Shanice Molina-Cabotage, CPAJumella TamayoNo ratings yet

- Corp & Comm - List of Topics Covered Terms 1 & 2 - 2024Document3 pagesCorp & Comm - List of Topics Covered Terms 1 & 2 - 2024Onoke John ValentineNo ratings yet

- Bar2023 SyllabusDocument51 pagesBar2023 SyllabusAnwar TucodNo ratings yet

- Chapter 2 Taxes Tax Laws and Tax AdministrationDocument29 pagesChapter 2 Taxes Tax Laws and Tax Administrationdexter padayaoNo ratings yet

- CPC Notes-Amish ShahDocument6 pagesCPC Notes-Amish ShahAshutosh Singh Parmar100% (1)

- Law Bare ActsDocument2 pagesLaw Bare ActsAnilNo ratings yet

- 1) Banking Regulation & Compliance and Legal AspectsDocument2 pages1) Banking Regulation & Compliance and Legal AspectsAnilNo ratings yet

- 202 BL Question BankDocument8 pages202 BL Question BankSamrudhi ZodgeNo ratings yet

- ATP 108 Commercial Transactions Course Outline 2023 - 2024Document5 pagesATP 108 Commercial Transactions Course Outline 2023 - 2024Topz TrendzNo ratings yet

- Larry P. Ignacio © A. Special Commercial LawsDocument13 pagesLarry P. Ignacio © A. Special Commercial LawsAudrin Agapito deasisNo ratings yet

- Mercantile LawDocument4 pagesMercantile LawRoger Montero Jr.No ratings yet

- TAXREV SANTOSsyllabusDocument7 pagesTAXREV SANTOSsyllabusJoma CoronaNo ratings yet

- B Law-MockDocument3 pagesB Law-MockMuhammad Mazhar YounusNo ratings yet

- CIR v. Bank of Commerce, G.R. No. 180529 (2013)Document20 pagesCIR v. Bank of Commerce, G.R. No. 180529 (2013)Kriszan ManiponNo ratings yet

- Ebook PDF Contemporary Social and Sociological Theory Visualizing Social Worlds 3rd Edition PDFDocument41 pagesEbook PDF Contemporary Social and Sociological Theory Visualizing Social Worlds 3rd Edition PDFjohn.fair736100% (37)

- Ebook PDF Contemporary Social and Sociological Theory Visualizing Social Worlds 3rd Edition 2 PDFDocument41 pagesEbook PDF Contemporary Social and Sociological Theory Visualizing Social Worlds 3rd Edition 2 PDFjohn.fair736100% (37)

- The Instittute of Certified Public Accountants of Paksitan (Icpap)Document3 pagesThe Instittute of Certified Public Accountants of Paksitan (Icpap)Smag SmagNo ratings yet

- Mercantile Law PDFDocument3 pagesMercantile Law PDFSmag SmagNo ratings yet

- Final Question - Bank of BLDocument5 pagesFinal Question - Bank of BLAman RaiNo ratings yet

- 2022 Syllabus For Commercial LawDocument5 pages2022 Syllabus For Commercial LawEd NaNo ratings yet

- Civil Law SyllabusDocument8 pagesCivil Law SyllabusElmo DecedaNo ratings yet

- Small Smiles Bankruptcy DocumentsDocument340 pagesSmall Smiles Bankruptcy DocumentsGlennKesslerWPNo ratings yet

- Taxation 2 Course Outline Midterms DraftDocument6 pagesTaxation 2 Course Outline Midterms DraftIra Francia AlcazarNo ratings yet

- FDI Course OutlineDocument8 pagesFDI Course OutlineLuis Miguel Garrido MarroquinNo ratings yet

- Travelport (2020) Adverse ChangeDocument61 pagesTravelport (2020) Adverse ChangeZviagin & CoNo ratings yet

- Tax 2 SyllabusDocument9 pagesTax 2 SyllabusAlvin RufinoNo ratings yet

- Chapter Title: List of Abbreviations List of Cases List of Table List of Figure PrefaceDocument13 pagesChapter Title: List of Abbreviations List of Cases List of Table List of Figure PrefaceASHU KNo ratings yet

- Syllabus. Income Tax. Mvavjanuary 15, 2018Document6 pagesSyllabus. Income Tax. Mvavjanuary 15, 2018Christine Ang CaminadeNo ratings yet

- Upreme !court: L/Epublic of Tbe T) Bilippineg FfranilaDocument11 pagesUpreme !court: L/Epublic of Tbe T) Bilippineg FfranilaPbftNo ratings yet

- BAY:01512259 VLDocument15 pagesBAY:01512259 VLChapter 11 DocketsNo ratings yet

- The Depositories Act 1996Document18 pagesThe Depositories Act 1996Mukul Kr Singh Chauhan0% (1)

- Tax Bar SyllabusDocument2 pagesTax Bar SyllabusbananayellowsharpieNo ratings yet

- T1330-Drafting, Pleading and Conveyance (Clinical Course I)Document3 pagesT1330-Drafting, Pleading and Conveyance (Clinical Course I)Shrishti VermaNo ratings yet

- Iran-United States Claims Arbitration: Debates on Commercial and Public International LawFrom EverandIran-United States Claims Arbitration: Debates on Commercial and Public International LawNo ratings yet

- TiuaonsgtdnDocument2 pagesTiuaonsgtdnNath BongalonNo ratings yet

- (Ex. Liquors) (Ex. Grape Wine) (Ex. Beer) (Ex. Chewing Tobacco)Document1 page(Ex. Liquors) (Ex. Grape Wine) (Ex. Beer) (Ex. Chewing Tobacco)Nath BongalonNo ratings yet

- Relevant Costing For Non Routine Decision Making - Managment ScienceDocument1 pageRelevant Costing For Non Routine Decision Making - Managment ScienceNath BongalonNo ratings yet

- Sample ProblemDocument5 pagesSample ProblemNath BongalonNo ratings yet

- Intangible AssetDocument2 pagesIntangible AssetNath BongalonNo ratings yet

- Recognizing Expenses When Incurred Rather Than When PaidDocument2 pagesRecognizing Expenses When Incurred Rather Than When PaidNath BongalonNo ratings yet

- Introduction To Bank ReconciliationDocument8 pagesIntroduction To Bank ReconciliationNath Bongalon100% (1)

- Learning or Not: Active and Passive ClassesDocument6 pagesLearning or Not: Active and Passive ClassesNath Bongalon60% (5)

- Dalton's Atomic TheoryDocument2 pagesDalton's Atomic TheoryNath BongalonNo ratings yet

- A Case Study On The Effects of Bullying To Teenagers With Broken FamilyDocument5 pagesA Case Study On The Effects of Bullying To Teenagers With Broken FamilyNath BongalonNo ratings yet

- The LithosphereDocument8 pagesThe LithosphereNath Bongalon100% (1)

- Classification of TrianglesDocument4 pagesClassification of TrianglesNath BongalonNo ratings yet

- 1st PPT GEO3Document17 pages1st PPT GEO3Nath BongalonNo ratings yet

- 14 Acctg Ed 1 - Receivable FinancingDocument19 pages14 Acctg Ed 1 - Receivable FinancingNath BongalonNo ratings yet

- 12 Acctg Ed 1 - Notes Receivable PDFDocument17 pages12 Acctg Ed 1 - Notes Receivable PDFNath BongalonNo ratings yet

- 13 Acctg Ed 1 - Loan ReceivableDocument17 pages13 Acctg Ed 1 - Loan ReceivableNath BongalonNo ratings yet

- 15 Acctg Ed 1 - Receivable Financing 2Document10 pages15 Acctg Ed 1 - Receivable Financing 2Nath BongalonNo ratings yet

- 08 Acctg Ed 1 - Bank Reconciliation PDFDocument3 pages08 Acctg Ed 1 - Bank Reconciliation PDFNath BongalonNo ratings yet

- 11 Acctg Ed 1 - Estimation of Doubtful Accounts PDFDocument12 pages11 Acctg Ed 1 - Estimation of Doubtful Accounts PDFNath BongalonNo ratings yet

- George Polya: December 1887 - September 1985Document1 pageGeorge Polya: December 1887 - September 1985Nath BongalonNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsNath BongalonNo ratings yet

- RECEIVABLESDocument12 pagesRECEIVABLESNath BongalonNo ratings yet

- Triangle Classification: Sides AnglesDocument2 pagesTriangle Classification: Sides AnglesNath BongalonNo ratings yet

- Auditing Theory - Day 04Document2 pagesAuditing Theory - Day 04Nath BongalonNo ratings yet

- Charles DarwinDocument4 pagesCharles DarwinNath BongalonNo ratings yet

- Whodoyousayiam? Who Said It?: Chapter/Ve RseDocument3 pagesWhodoyousayiam? Who Said It?: Chapter/Ve RseNath BongalonNo ratings yet

- Accounting FOR Partnership SDocument3 pagesAccounting FOR Partnership SNath BongalonNo ratings yet

- 03 Acctg Ed 1 - Conceptual Framework 2 PDFDocument5 pages03 Acctg Ed 1 - Conceptual Framework 2 PDFNath BongalonNo ratings yet

- 4 Rowell Ind Corp V CADocument3 pages4 Rowell Ind Corp V CAArtemisTzyNo ratings yet

- CONTRACT OF LEASE (Muntinlupa)Document6 pagesCONTRACT OF LEASE (Muntinlupa)mrsjpendletonNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument8 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledAdam SmithNo ratings yet

- MAIN MsWordDocument566 pagesMAIN MsWordatmaratiNo ratings yet

- Contractual Agreemenmt AssignmentDocument16 pagesContractual Agreemenmt AssignmentHaron HB WritersNo ratings yet

- Nervous ShockDocument18 pagesNervous ShocksfreigaNo ratings yet

- Malaysian Salvors Ltd. v. MalaysiaDocument2 pagesMalaysian Salvors Ltd. v. MalaysiaJB SuarezNo ratings yet

- PDF Remedies For Breach of ContractDocument17 pagesPDF Remedies For Breach of ContractaNo ratings yet

- CONTRACT-OF-LEASE SampleDocument6 pagesCONTRACT-OF-LEASE Samplenicanor ambronaNo ratings yet

- Module 6 - Opening Exercise - 22FD-COM321-1Document4 pagesModule 6 - Opening Exercise - 22FD-COM321-1Miranda MooreNo ratings yet

- Topic 6: Provisions Common To Pledge and MortgageDocument26 pagesTopic 6: Provisions Common To Pledge and Mortgagehyunsuk fhebieNo ratings yet

- Md. Noorul Hoda Vs Bibi Raifunnisa and Ors. On 1 December, 1995Document3 pagesMd. Noorul Hoda Vs Bibi Raifunnisa and Ors. On 1 December, 1995tejas12311No ratings yet

- Quiz On ContractsDocument4 pagesQuiz On ContractsJunaly PanagaNo ratings yet

- Delfin Tan V BenoliraoDocument2 pagesDelfin Tan V BenoliraoRoms RoldanNo ratings yet

- Spa Pagibig TemplateDocument3 pagesSpa Pagibig TemplateJerson MadronaNo ratings yet

- Revised Corporation Code MatrixDocument5 pagesRevised Corporation Code MatrixDaphne SueltoNo ratings yet

- Nuisance Meaning and Implication Under Nigerian LawDocument12 pagesNuisance Meaning and Implication Under Nigerian LawLautechPredegreeNo ratings yet

- PARAFLEX TYPE O 1x18 Drawing v17 CCDocument7 pagesPARAFLEX TYPE O 1x18 Drawing v17 CCzyayikNo ratings yet

- BUS 670 Week 2 Assignment Negligent TortDocument7 pagesBUS 670 Week 2 Assignment Negligent TortKennNo ratings yet

- Salas V CA, GR No. 76788 Jan 22, 1990Document3 pagesSalas V CA, GR No. 76788 Jan 22, 1990Marianne Shen PetillaNo ratings yet

- Biz LawDocument216 pagesBiz LawOyebisi OpeyemiNo ratings yet

- Dean Abella Notes On PartnershipDocument7 pagesDean Abella Notes On PartnershipcarmineNo ratings yet

- Chapter 5 Obligations of The VendeeDocument6 pagesChapter 5 Obligations of The VendeeMarianne Hope VillasNo ratings yet

- Lost/Stolen Cheque/Cheque Book/Cashier Order (CO) Report FormDocument2 pagesLost/Stolen Cheque/Cheque Book/Cashier Order (CO) Report FormTasneef ChowdhuryNo ratings yet

- National Law Institute University Bhopal: Contract - IDocument14 pagesNational Law Institute University Bhopal: Contract - Ivenkatesh sahuNo ratings yet

- Full Notes MBF22408T Credit Risk and Recovery ManagementDocument90 pagesFull Notes MBF22408T Credit Risk and Recovery ManagementSheetal DwevediNo ratings yet

- Businessperson's Guide To Federal Warranty Law - Federal Trade CommissionDocument21 pagesBusinessperson's Guide To Federal Warranty Law - Federal Trade Commissionpianorx2No ratings yet

- Aatish ADRDocument3 pagesAatish ADRAatishNo ratings yet

- RFBT Syllabus - Oct 2022 CPALEDocument8 pagesRFBT Syllabus - Oct 2022 CPALEGup KnwNo ratings yet

- Gmail - Poonam Nanda Sent You An Amazon Pay Gift Card!Document3 pagesGmail - Poonam Nanda Sent You An Amazon Pay Gift Card!Daniel RizviNo ratings yet