Professional Documents

Culture Documents

Homework ch3-3

Uploaded by

Qasim MansiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Homework ch3-3

Uploaded by

Qasim MansiCopyright:

Available Formats

Qasim almansi / 201820414

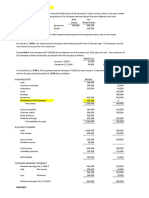

3) Park Corporation paid $180,000 for a 75% interest in Stem Co.'s

outstanding Capital Stock on January 1, 2014, when Stem's stockholders'

equity consisted of $150,000 of Capital Stock and $50,000 of Retained

Earnings. Book values of Stem's net assets were equal to their fair values on

this date. The adjusted trial balances of Park and Stem on December 31,

2014 were as follows:

Park Stem

Cash $8,250 $35,000

Dividends receivable 7,500

Other current assets 40,000 50,000

Land 50,000 30,000

Plant assets-net 100,000 150,000

Investment in Stem 195,000

Cost of sales 225,000 125,000

Other expenses 45,000 25,000

Dividends 25,000 20,000

$695,750 $435,000

Accounts payable $40,750 $35,000

Dividends payable 10,000

Capital stock 150,000 150,000

Retained earnings 75,000 50,000

Sales revenue 400,000 190,000

Income from Stem 30,000

$695,750 $435,000

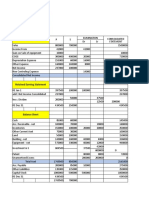

Required: Complete the partially prepared consolidated balance sheet working papers that

appear below.

Answer:

Preliminary computations

Fair value (purchase price) of 75% interest acquired $180,000

Implied fair value of Stem ($180,000 / 75%) $240,000

Book value of Stem's net assets $ (200,000)

Excess fair value over book value acquired $40,000

Initial investment cost $180,000

Income from Stem: (75%)($40,000)= $ 30,000

Dividends ($20,000)(75%) = -15,000

Balance in Investment in Stem at December 31,2014 $195,000

Consolidate

d

Eliminations

Park Stem Balance

sheet

DR CR

Cash $ 8500 35000 43,250

Dividends Recevable 7500 B 7,500 0

Other cureent asset 40000 50000 90000

Land 50000 30000 80000

Plant assets 100000 150000 250000

Investment in stem 195000 a 195000

Good will 40000 40000

Total asset 400750 265000 503250

Account payable 40750 35000 75750

Dividends payable 10000 B 7500 2500

Capital stock 150000 150000 a 150000 1500000

Retained earnings 210000 70000 A 70000 210000

Noncontrolimg interest 65000 65000

Total equity 400750 265000 503250

267500 267500

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Park Corporation and Stem Co. Consolidated Balance SheetDocument3 pagesPark Corporation and Stem Co. Consolidated Balance SheetQasim MansiNo ratings yet

- CH 9 ExamplesDocument2 pagesCH 9 ExamplesAisha PatelNo ratings yet

- Cash Flow Pr. 16-1ADocument1 pageCash Flow Pr. 16-1AKearrion BryantNo ratings yet

- Consolidation PartBDocument29 pagesConsolidation PartBHuzaifa AhmedNo ratings yet

- Extra session 2 (30 Sept 2022) spreadsheet (Ch 3)Document2 pagesExtra session 2 (30 Sept 2022) spreadsheet (Ch 3)georgius gabrielNo ratings yet

- SoalDocument4 pagesSoalRizqi Amrilah WidodoNo ratings yet

- WEEK 6-7 ULO A, B, C Answer KeyDocument4 pagesWEEK 6-7 ULO A, B, C Answer Keyzee abadilla100% (1)

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Assignment 1Document4 pagesAssignment 1Mae RocelleNo ratings yet

- AFAR2 CH. 3 - Problem Quiz 1Document19 pagesAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaNo ratings yet

- CONSO FS LESSONDocument54 pagesCONSO FS LESSONdbpcastro8No ratings yet

- Business Combination - EM Sample ProblemDocument32 pagesBusiness Combination - EM Sample ProblemJohn Stephen PendonNo ratings yet

- Consolidated Financial Statements Worked ExampleDocument5 pagesConsolidated Financial Statements Worked ExampleEnalem OtsuepmeNo ratings yet

- Advance AccountingDocument6 pagesAdvance AccountingRatna SariNo ratings yet

- CHAPTER 3 (Accounting Equation)Document5 pagesCHAPTER 3 (Accounting Equation)lcNo ratings yet

- Advanced Accounting 4Document2 pagesAdvanced Accounting 4Tax TrainingNo ratings yet

- chp3 Practice Problem 1Document1 pagechp3 Practice Problem 1api-557861169No ratings yet

- Exercises On DividendsDocument16 pagesExercises On DividendsGrace RoqueNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Wan Aidi Pra Uts Adv. AccDocument10 pagesWan Aidi Pra Uts Adv. AccWan Aidi AbdurrahmanNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Answer To ExercisesDocument40 pagesAnswer To ExercisesmarieieiemNo ratings yet

- Pam Corporation Paid $170,000 For An 80 Percent Interest in Sun CorporationDocument3 pagesPam Corporation Paid $170,000 For An 80 Percent Interest in Sun CorporationJalaj GuptaNo ratings yet

- Assignment 2Document43 pagesAssignment 2Judy ZhangNo ratings yet

- Exercise For Financial Statement Analysis and RatiosDocument15 pagesExercise For Financial Statement Analysis and RatiosViren JoshiNo ratings yet

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDocument14 pagesPurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyNo ratings yet

- CASH FLOW AND INCOME STATEMENT PROBLEMSDocument17 pagesCASH FLOW AND INCOME STATEMENT PROBLEMSIris MnemosyneNo ratings yet

- TUGAS PRIBADI AKUNTANSI KEUANGAN LANJUTAN 1Document9 pagesTUGAS PRIBADI AKUNTANSI KEUANGAN LANJUTAN 1Maulana AmriNo ratings yet

- Tugas Chapter 5: Persentase Kepemilikan Pay Corporation 75%Document6 pagesTugas Chapter 5: Persentase Kepemilikan Pay Corporation 75%Iche IcheNo ratings yet

- Buscom - Subsequent-To-The-Date-Of-Acquisition - Cost MethodDocument46 pagesBuscom - Subsequent-To-The-Date-Of-Acquisition - Cost MethodJohn Stephen PendonNo ratings yet

- Accounting AssignmentDocument5 pagesAccounting AssignmentVivek SinghNo ratings yet

- CH 4 Comprehensive ProblemDocument5 pagesCH 4 Comprehensive ProblemLNo ratings yet

- Tut 3Document5 pagesTut 3Đào Huyền Trang 4KT-20ACNNo ratings yet

- Tugas 5 - InventoryDocument11 pagesTugas 5 - InventoryMuhammad RochimNo ratings yet

- Contingent Consideration AccountingDocument25 pagesContingent Consideration AccountingAEDRIAN LEE DERECHONo ratings yet

- Problem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Document6 pagesProblem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Vincent FrancoNo ratings yet

- Cost Model ConsolidationDocument41 pagesCost Model ConsolidationJohn Stephen PendonNo ratings yet

- Answer Key - Unit TestDocument7 pagesAnswer Key - Unit TestJeanne Timoteo RaguroNo ratings yet

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Akl - Agung Prabowo - 02 - 5-3Document3 pagesAkl - Agung Prabowo - 02 - 5-3Agung PrabowoNo ratings yet

- Questions For Unit 4 RevisionDocument3 pagesQuestions For Unit 4 RevisionDimple PatelNo ratings yet

- Costing CaseDocument6 pagesCosting CasenguyenthingocmaimkNo ratings yet

- PROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)Document2 pagesPROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)zsaw zsawNo ratings yet

- 5110WA7 FinancialsDocument1 page5110WA7 FinancialsAhmed EzzNo ratings yet

- B. Record The Entries in Python's Books To Reflect Its Transactions With Shark in 2013, Assuming The Cost MethodDocument5 pagesB. Record The Entries in Python's Books To Reflect Its Transactions With Shark in 2013, Assuming The Cost MethodAndera FitriaNo ratings yet

- Exchange Gain On DonationDocument11 pagesExchange Gain On DonationDinindu SahanNo ratings yet

- CHAPTER 14 PROB 1-3 - GOZUNKAYE - XLSX - Sheet1Document28 pagesCHAPTER 14 PROB 1-3 - GOZUNKAYE - XLSX - Sheet1kaye gozunNo ratings yet

- Answers To Reviewer in Acctg 2Document3 pagesAnswers To Reviewer in Acctg 2Fatima AsprerNo ratings yet

- The Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000Document5 pagesThe Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000RomerNo ratings yet

- Chow2019 SIM AC2091 MockExamA StudentDocument23 pagesChow2019 SIM AC2091 MockExamA StudentPadamchand PokharnaNo ratings yet

- Loan Yearly Revenue Operating Profit Return On Assets Distribute Al As Dividends Other Invest ReturnDocument3 pagesLoan Yearly Revenue Operating Profit Return On Assets Distribute Al As Dividends Other Invest ReturnPath GargNo ratings yet

- Mbination 0 Consolidated FSDocument28 pagesMbination 0 Consolidated FSShe Rae Palma100% (2)

- IAS 38 and PSAK 19 on Intangible AssetsDocument42 pagesIAS 38 and PSAK 19 on Intangible AssetsAlvin FranataNo ratings yet

- Business Combination 2Document3 pagesBusiness Combination 2Jamie RamosNo ratings yet

- Session 7 and 7a SupplemenDocument10 pagesSession 7 and 7a Supplemenkhadija arifNo ratings yet

- SKD 4Document6 pagesSKD 4DiryanNo ratings yet

- Analyzing Consolidated Financial StatementsDocument3 pagesAnalyzing Consolidated Financial StatementsBryle Jay LapeNo ratings yet

- Dividend and BondsDocument3 pagesDividend and BondsJanuary Ann Bete100% (1)

- Transactions Analysis Example Current-6Document11 pagesTransactions Analysis Example Current-6Zion WilliamsNo ratings yet

- Homework Multiple Choice Questions ch2Document6 pagesHomework Multiple Choice Questions ch2Qasim MansiNo ratings yet

- Homework ch4 11-4-2020Document5 pagesHomework ch4 11-4-2020Qasim MansiNo ratings yet

- Homework Multiple Choice Questions ch2Document6 pagesHomework Multiple Choice Questions ch2Qasim MansiNo ratings yet

- Pilot acquires 90% of SandDocument2 pagesPilot acquires 90% of SandQasim MansiNo ratings yet

- Homework Multiple Choice Questions ch2Document6 pagesHomework Multiple Choice Questions ch2Qasim MansiNo ratings yet

- Beams10e Ch02 Stock Investments Investor Accounting and ReportingDocument37 pagesBeams10e Ch02 Stock Investments Investor Accounting and ReportingMareta Vina ChristineNo ratings yet

- 157 37725 EY427 2013 1 2 1 Beams10e Ch04Document48 pages157 37725 EY427 2013 1 2 1 Beams10e Ch04Amy SpencerNo ratings yet

- ch4 Consolidated Financial Statements After AcquisitionDocument57 pagesch4 Consolidated Financial Statements After AcquisitionQasim MansiNo ratings yet

- 157 37725 EY427 2013 1 2 1 Beams10e Ch03Document44 pages157 37725 EY427 2013 1 2 1 Beams10e Ch03zurinNo ratings yet

- Beams10e Ch01 Business CombinationsDocument40 pagesBeams10e Ch01 Business CombinationsFaisal RezaNo ratings yet

- 3.roshan Kumar-Payslip - Jul-2022Document1 page3.roshan Kumar-Payslip - Jul-2022Burning to ShineNo ratings yet

- Deductions From Gross EstateDocument16 pagesDeductions From Gross EstateJebeth RiveraNo ratings yet

- Visa OpenRiskManagementDocument111 pagesVisa OpenRiskManagementIsyanul RiwaldiNo ratings yet

- ISO Green and Sustainable FinanceDocument9 pagesISO Green and Sustainable FinanceWilliams wamboNo ratings yet

- Brilliant Charts User ManualDocument27 pagesBrilliant Charts User ManualKuru Govind0% (1)

- X Macey Slonaker Crystal L Slonaker 292-84-7018: U.S. Individual Income Tax ReturnDocument12 pagesX Macey Slonaker Crystal L Slonaker 292-84-7018: U.S. Individual Income Tax ReturnjonathanNo ratings yet

- Companies Act Borrowing PowersDocument11 pagesCompanies Act Borrowing PowersSaptak RoyNo ratings yet

- EBA Report On Statutory Prudential BackstopsDocument86 pagesEBA Report On Statutory Prudential BackstopsDidi BaciuNo ratings yet

- Final Project 16 March-1Document38 pagesFinal Project 16 March-1jupiter stationeryNo ratings yet

- Chapter 3 - Financial AnalysisDocument39 pagesChapter 3 - Financial AnalysisHeatstroke0% (1)

- Contoh 9 Data PanelDocument22 pagesContoh 9 Data Panelnoel_manroeNo ratings yet

- IBA Karachi Course Outlines PDFDocument38 pagesIBA Karachi Course Outlines PDFDr. Abdullah0% (1)

- Bill Gates Profile and Milestone AchievementsDocument72 pagesBill Gates Profile and Milestone AchievementsvaibhavNo ratings yet

- The Impact of Bank Loans On Small and Medium Scale Enterprises in Nigeria-1Document96 pagesThe Impact of Bank Loans On Small and Medium Scale Enterprises in Nigeria-1FawazNo ratings yet

- APT Literature Review: Arbitrage Pricing TheoryDocument11 pagesAPT Literature Review: Arbitrage Pricing Theorydiala_khNo ratings yet

- Investing in China Offers Low Costs and Huge MarketDocument10 pagesInvesting in China Offers Low Costs and Huge MarketUroOj SaleEmNo ratings yet

- Pitch Book Sample Template PDFDocument25 pagesPitch Book Sample Template PDFbijilahNo ratings yet

- FABM 1.module 5 PDFDocument34 pagesFABM 1.module 5 PDFSHIERY MAE FALCONITINNo ratings yet

- Thesis-1 13Document29 pagesThesis-1 13Beige TanNo ratings yet

- What Is Crypto-Currency ?Document13 pagesWhat Is Crypto-Currency ?charlied017No ratings yet

- De Minimis Benifit AssignmentDocument9 pagesDe Minimis Benifit AssignmentJoneric RamosNo ratings yet

- Balance SheetDocument25 pagesBalance SheetDHANUSHA BALAKRISHNANNo ratings yet

- Dse 2009 SolutionsDocument3 pagesDse 2009 Solutionss05xoNo ratings yet

- Bank Reconciliation Book to Bank MethodDocument5 pagesBank Reconciliation Book to Bank MethodNika BautistaNo ratings yet

- TS Grewal Solutions for Class 12 Accountancy Chapter 7 - Calculating Goodwill and Partner's Gains/SacrificesDocument34 pagesTS Grewal Solutions for Class 12 Accountancy Chapter 7 - Calculating Goodwill and Partner's Gains/SacrificesblessycaNo ratings yet

- Cashflow Forecasting Using Montecarlo SimulationDocument111 pagesCashflow Forecasting Using Montecarlo SimulationDavid Esteban Meneses RendicNo ratings yet

- Satyam CaseDocument9 pagesSatyam CaseGaurav Agarwal0% (1)

- Small Finance and Payment BanksDocument12 pagesSmall Finance and Payment BanksBimal MeherNo ratings yet

- Marketing FunctionsDocument25 pagesMarketing FunctionsSuny JubayerNo ratings yet

- Summar Training ReportDocument35 pagesSummar Training ReportSuruli Ganesh100% (1)