Professional Documents

Culture Documents

Sri Bharathi Women'S Arts and Science College Kunnathur - Arni

Uploaded by

Elumalai0 ratings0% found this document useful (0 votes)

15 views3 pagesThis document contains a model examination for Income Tax Law and Practice 2. It includes three sections: Section A with 10 short answer questions worth 2 marks each, Section B with 5 long answer questions worth 5 marks each, and Section C with 3 long answer questions worth 10 marks each. The questions cover topics like capital gains, income tax slabs, tax deductions, aggregation of income, set-off and carry forward of losses. For example, question 11(b) asks to calculate capital gain from sale of a residential house, and question 19 asks to determine how losses shall be set-off and carried forward from various sources of income for a given individual.

Original Description:

Original Title

income tax

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a model examination for Income Tax Law and Practice 2. It includes three sections: Section A with 10 short answer questions worth 2 marks each, Section B with 5 long answer questions worth 5 marks each, and Section C with 3 long answer questions worth 10 marks each. The questions cover topics like capital gains, income tax slabs, tax deductions, aggregation of income, set-off and carry forward of losses. For example, question 11(b) asks to calculate capital gain from sale of a residential house, and question 19 asks to determine how losses shall be set-off and carried forward from various sources of income for a given individual.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views3 pagesSri Bharathi Women'S Arts and Science College Kunnathur - Arni

Uploaded by

ElumalaiThis document contains a model examination for Income Tax Law and Practice 2. It includes three sections: Section A with 10 short answer questions worth 2 marks each, Section B with 5 long answer questions worth 5 marks each, and Section C with 3 long answer questions worth 10 marks each. The questions cover topics like capital gains, income tax slabs, tax deductions, aggregation of income, set-off and carry forward of losses. For example, question 11(b) asks to calculate capital gain from sale of a residential house, and question 19 asks to determine how losses shall be set-off and carried forward from various sources of income for a given individual.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

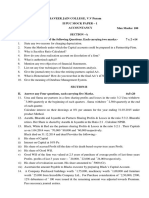

SRI BHARATHI WOMEN’S ARTS AND SCIENCE COLLEGE

KUNNATHUR – ARNI

MODEL EXAMINATION

Class : III B.Com Marks : 75

Subject : Income Tax Law and Practice 2 Date :

Sub. Code : BCM63 Time : 3 Hrs

SECTION – A

Answer all questions 10 × 2 = 20

1.What is long term capital gain?

2.Write a short note on casual income.

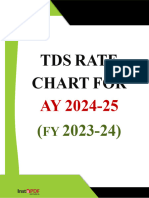

3.What do you mean by a TDS?

4.Define carry forward losses?

5.What is clubbing income?

6.What is deemed income?

7. Define assessment.

8.What is tax liability?

9.Write a short note on 80C.

10.Expand PAN.

SECTION – B

Answer any Five questions 5 × 5 = 25

11. (a) What do you mean by exempted capital gain? (Or)

(b) Mr. Ram had bought a resident house on 01.01.2009 for Rs. 40,000, she spent

Rs.75,000 for is registration on 08.11.2009. He sold the someone 15.12.2018

for Rs.1,50,000 for which he had paid a brokerage for Rs.20000 compute capital gain.

12. (a) From the following details calculate capital gain. (Or)

i) Sales consideration of urban agri-land Rs.400000 on 26.12.18[CII:280]

ii) Cost of acquisition of the land 01.08.2001 is Rs.50,000

iii) New agri land acquisition 2 nd feb-2018 is Rs.6,00,000

(b)Explain the following terms:

i)Short term capital assets

ii)Long term capital assets

13. (a)Explain the various items of income from other sources. (Or)

(b) From the following particulars given by Mr. X member of parliament calculate his

income from the other sources.

i)Salary as MP Rs. 16,000 p. m

ii)Winning from cross word puzzles Rs.20,000(gross)

iii)Winning from lottery net Rs.1,40,000

iv)Royalty on book 15,000

v)Interest on post office 10,000

14. (a)Explain the terms “clubbing of incomes” (Or)

(b)From the following information of a trader, compute the gross total income.

i)Income from house property computed 1,50,000

ii)Business loss – 60,000

iii)Current year depreciation 1,00,000

iv)Business loss preceding year 50,000

v)Unabsorbed depreciation at preceding year 30,000

vi)Short term capital loss 40,000

vii)Long -term capital gain 50,000

15. (a)Bring out the slab rates of taxability of individual below 60 years. (Or)

(b)Mr. Ram ages 50-years submit the following information.

Taxable salary 12,00,000

Interest on Bank deposits 20,000

Long term capital gain 40,800

Taxable house property income 1,80,000

Deposit in PPF 60,000

Compute the tax liability of Mrs. Ram

SECTION – C

Answer any Three questions 3 × 10 =30

16. One building (which was purchased in 2009) of X Ltd, and Industrial undertaking is

compulsory acquired by the govt of U.P Its WDV on 01.04.2018 was Rs.4,50,000. the U.P

govt. paid Rs 8,00,000 on 25 th may 2018 as compensation? The company purchased

another building for Rs.3,00,000 on 20 th march 2018 determines the amount exempted under

see? Compute the capital gain for A.Y

17. Discuss about the aggregation of income.

18. Mr.R and resident in India earned the following income during the P.Y 2018 19

Director fees 20,000

Income from agri land in Africa 50,000

Ground rent for land in patna 10,000

Interest on deposits with IFCI 5,000

Dividend from Indian company 1,000

Rent from subletting a house 20,000

Winning from lottery(net) 70,000

Interest on govt. securities 4,000

Calculate income from other sources.

19. From the following income of Mr . P how the losses shall be set-off and carry forward for

the year ending 31.3.2018

a)Salary income 24,0000

b)Income from H.P

House A 10,000

House B 20,000(loss)

House C(self) 18,000(loss)

c)Income from business:

Cloth business(Profit) 10,000

Textile business (Loss) 8,000

Speculation (profit) 8,000

Speculation(Loss) 10,000

d)Capital Gain:

a. Short term (gain) 8,000

b.Short term (loss) 16,000

c.Long term (loss) 2,000

e)Other sources 29,000

20. Explain the U/s 80 C to 80 U

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Tax H Question 2021Document3 pagesTax H Question 2021Aporupa BarNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- Paper 16Document5 pagesPaper 16VijayaNo ratings yet

- 18u3cm06 CC06Document8 pages18u3cm06 CC06Manoj MJNo ratings yet

- TaxationDocument3 pagesTaxationIshika PansariNo ratings yet

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- Css Accountancy2 2018 PDFDocument2 pagesCss Accountancy2 2018 PDFMaria NazNo ratings yet

- MF0003 Taxation ManagementDocument3 pagesMF0003 Taxation Managementuandme77No ratings yet

- Financial Management - II CA QPDocument4 pagesFinancial Management - II CA QPSivaramkrishna KasilingamNo ratings yet

- IPCC Mock Test Taxation - Only Question - 25.09.2018Document5 pagesIPCC Mock Test Taxation - Only Question - 25.09.2018KaustubhNo ratings yet

- Income Tax Law and PracticeDocument3 pagesIncome Tax Law and PracticeAbinash VeeraragavanNo ratings yet

- Instant Paper Commerce Paper - IiDocument3 pagesInstant Paper Commerce Paper - IiM JEEVARATHNAM NAIDUNo ratings yet

- (April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document3 pages(April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Corporate Accounting Ii-1Document4 pagesCorporate Accounting Ii-1ARAVIND V KNo ratings yet

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNo ratings yet

- Xi Accounting Set 3Document6 pagesXi Accounting Set 3aashirwad2076No ratings yet

- Section "A" Very Short Answer Questions) (Attempt All Questions)Document5 pagesSection "A" Very Short Answer Questions) (Attempt All Questions)Ayusha TimalsinaNo ratings yet

- Taxation Law PDFDocument3 pagesTaxation Law PDFSmag SmagNo ratings yet

- Taxation Law PDFDocument3 pagesTaxation Law PDFSmag SmagNo ratings yet

- 120 Income Tax - IIDocument21 pages120 Income Tax - IIPriya Dharshini PdNo ratings yet

- Jorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Document3 pagesJorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Abin DhakalNo ratings yet

- Income Tax Assessment and Procedure - 1Document3 pagesIncome Tax Assessment and Procedure - 1amaljacobjogilinkedinNo ratings yet

- Tax 1st Drills Answer KeyDocument18 pagesTax 1st Drills Answer KeyJerma Dela Cruz100% (1)

- Taxation - Gross Income - Quizzer - 2018 - MayDocument5 pagesTaxation - Gross Income - Quizzer - 2018 - MayKenneth Bryan Tegerero TegioNo ratings yet

- Proceeds of Property Insurance (BV 4,000,000)Document11 pagesProceeds of Property Insurance (BV 4,000,000)zeref dragneelNo ratings yet

- Bcom 402Document220 pagesBcom 402Prabhu SahuNo ratings yet

- IncomeTax-2Document6 pagesIncomeTax-2Aditya .cNo ratings yet

- Class 12 Account Set 2 Grade Increment Examination Question PaperDocument10 pagesClass 12 Account Set 2 Grade Increment Examination Question PaperPrem RajwanshiNo ratings yet

- AFA IP.l II QuestionDec 2019Document4 pagesAFA IP.l II QuestionDec 2019HossainNo ratings yet

- Financial Accounting 2022 NovemberDocument4 pagesFinancial Accounting 2022 NovemberNasiha PCNo ratings yet

- Practice Final PB PartialDocument25 pagesPractice Final PB PartialBenedict BoacNo ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Pe III Taxation II May Jun 2010Document3 pagesPe III Taxation II May Jun 2010swarna dasNo ratings yet

- Xi Accounting Set 4Document8 pagesXi Accounting Set 4aashirwad2076No ratings yet

- Taxation-Ii: (A) What Do You Mean by "Arm's Length Price" and What Are The Methods To Be Used For TheDocument4 pagesTaxation-Ii: (A) What Do You Mean by "Arm's Length Price" and What Are The Methods To Be Used For Theswarna dasNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- Tax 1 Bsais Quiz4 Theories W AnsDocument6 pagesTax 1 Bsais Quiz4 Theories W AnsCyrss BaldemosNo ratings yet

- Q7 Dealings in PropertiesDocument5 pagesQ7 Dealings in PropertiesNhajNo ratings yet

- Reg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)Document10 pagesReg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)AK GAMINGNo ratings yet

- 1e710c6f-4b3e-4b03-943f-11430d867f0e-Document30 pages1e710c6f-4b3e-4b03-943f-11430d867f0e-angela antoniaNo ratings yet

- Bsa Quiz 2.0 - Pure ProbsDocument4 pagesBsa Quiz 2.0 - Pure ProbsCyrss BaldemosNo ratings yet

- IT QuestionDocument3 pagesIT QuestionSathish SmartNo ratings yet

- Income TaxDocument2 pagesIncome TaxDr.Pratixa JoshiNo ratings yet

- 8104 MbaexDocument3 pages8104 Mbaexgaurav jainNo ratings yet

- XI AccoutingDocument8 pagesXI AccoutingJaiswal BrotherNo ratings yet

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Acc. For D.M. MQP April 2021Document4 pagesAcc. For D.M. MQP April 2021Rohith RNo ratings yet

- M.B.A (2016 Pattern)Document39 pagesM.B.A (2016 Pattern)Radha ChoudhariNo ratings yet

- 12TH Acc QPDocument9 pages12TH Acc QPLOHITHNo ratings yet

- Gross Income Quiz With Answer KeyDocument10 pagesGross Income Quiz With Answer KeyMylene AlfantaNo ratings yet

- 18CR1007 December 2020 Iii Semester Branch:Corporate Secretaryship Corporate Accounting-I CUCOR-7 (2008-09 TO 2018-19) Time: 3 Hrs Max Marks: 75Document5 pages18CR1007 December 2020 Iii Semester Branch:Corporate Secretaryship Corporate Accounting-I CUCOR-7 (2008-09 TO 2018-19) Time: 3 Hrs Max Marks: 75Athira VelayudhanNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Taxation - MAR 2021Document2 pagesTaxation - MAR 2021hemanNo ratings yet

- Screening Test Batch 2Document4 pagesScreening Test Batch 2Smiletrust NeerajNo ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- Corporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMDocument3 pagesCorporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMChirag JainNo ratings yet

- 12 Ut 1,2Document7 pages12 Ut 1,2Soni soniyaNo ratings yet

- Lecture Notes: Carbohydrates: Topics CoveredDocument26 pagesLecture Notes: Carbohydrates: Topics CoveredElumalaiNo ratings yet

- Sri Bharathi Women'S Arts and Science College Kunnathur - ArniDocument1 pageSri Bharathi Women'S Arts and Science College Kunnathur - ArniElumalaiNo ratings yet

- 3 Year QuestionDocument2 pages3 Year QuestionElumalaiNo ratings yet

- Physics Important PointsDocument1 pagePhysics Important PointsElumalaiNo ratings yet

- (A) Shall Increase Along The Positive X-Axis (B) Shall Decrease Along The Positive X-AxisDocument5 pages(A) Shall Increase Along The Positive X-Axis (B) Shall Decrease Along The Positive X-AxisElumalaiNo ratings yet

- What Is A Gradient?: 0 S S e e 0Document3 pagesWhat Is A Gradient?: 0 S S e e 0ElumalaiNo ratings yet

- Euler PDFDocument13 pagesEuler PDFElumalaiNo ratings yet

- Carnot Cycle ZHDocument6 pagesCarnot Cycle ZHElumalaiNo ratings yet

- PGTRB Physics Unit - 10Document12 pagesPGTRB Physics Unit - 10ElumalaiNo ratings yet

- K.S ACADEMY, SALEM-QUESTION PAPER PG TRB, POLYTECHNIC TRB & TNSET. COACHING CENTRE FOR PHYSICS Quantum & Statistical Mechanics Model Question Paper - PDFDocument7 pagesK.S ACADEMY, SALEM-QUESTION PAPER PG TRB, POLYTECHNIC TRB & TNSET. COACHING CENTRE FOR PHYSICS Quantum & Statistical Mechanics Model Question Paper - PDFElumalai100% (1)

- What Is NMRDocument7 pagesWhat Is NMRElumalaiNo ratings yet

- Value of Planck's Constant - Definition, Units, FormulaDocument7 pagesValue of Planck's Constant - Definition, Units, FormulaElumalaiNo ratings yet

- Mössbauer Spectroscopy and Its ApplicationsDocument7 pagesMössbauer Spectroscopy and Its ApplicationsElumalaiNo ratings yet

- Lecture 26: The Principle of Least Action (Hamilton's Principle)Document6 pagesLecture 26: The Principle of Least Action (Hamilton's Principle)ElumalaiNo ratings yet

- MP Notes PDFDocument160 pagesMP Notes PDFElumalaiNo ratings yet

- Solid State Theory Physics 545: The Lattice Specific HeatDocument56 pagesSolid State Theory Physics 545: The Lattice Specific HeatElumalaiNo ratings yet

- Weizsacker Proposed A Nuclear ModelDocument5 pagesWeizsacker Proposed A Nuclear ModelElumalaiNo ratings yet

- Bose-Einstein, Fermi-Dirac and Maxwell-Boltzman DistributionDocument5 pagesBose-Einstein, Fermi-Dirac and Maxwell-Boltzman DistributionElumalaiNo ratings yet

- M Ssbauer - Spectroscopy.and - Its.applicationsDocument62 pagesM Ssbauer - Spectroscopy.and - Its.applicationsElumalaiNo ratings yet

- Photo Electron PDFDocument3 pagesPhoto Electron PDFElumalaiNo ratings yet

- Sci PDF 1710857465640Document65 pagesSci PDF 1710857465640kasarmama7No ratings yet

- Assignment ACT 427Document8 pagesAssignment ACT 427Imtiaz AhmedNo ratings yet

- Case Study - Industrial LawDocument4 pagesCase Study - Industrial LawNurul Ain Mohd FauziNo ratings yet

- JNE Hybrid - PACKING LIST BANG DEDE 13-OKTOBERDocument2 pagesJNE Hybrid - PACKING LIST BANG DEDE 13-OKTOBERFarhan SawieNo ratings yet

- 2nd RMA For 30 RADIOsDocument4 pages2nd RMA For 30 RADIOsmohamedNo ratings yet

- Chapter 5 CGTMSEDocument17 pagesChapter 5 CGTMSEMikeNo ratings yet

- SR - No. Security - Name Isin Scrip - ID Intraday Stock ListDocument10 pagesSR - No. Security - Name Isin Scrip - ID Intraday Stock ListSashang S VNo ratings yet

- Welfare ProvisionsDocument28 pagesWelfare ProvisionsMalik Khuram ShazadNo ratings yet

- Instapdf - in Tds Rate Chart Fy 2023 24 Ay 2024 25 355Document7 pagesInstapdf - in Tds Rate Chart Fy 2023 24 Ay 2024 25 355skassociatetaxconsultantNo ratings yet

- Confederation of All India Traders Confederation of All India Traders Confederation of All India TradersDocument2 pagesConfederation of All India Traders Confederation of All India Traders Confederation of All India TradersSatya Prakash SinghNo ratings yet

- Pengendalian Keselamatan Dan Kesehatan Kerja Pada Proyek Pembangunan HotelDocument21 pagesPengendalian Keselamatan Dan Kesehatan Kerja Pada Proyek Pembangunan HotelIren DamimaNo ratings yet

- DTC95B GTSGMBH 12 23Document19 pagesDTC95B GTSGMBH 12 23Esteban Enrique Posan BalcazarNo ratings yet

- Guidelines On PD and LGD Estimation (EBA-GL-2017-16) - Chapters 1,2,3 (Only PD Estimation Part) PDFDocument200 pagesGuidelines On PD and LGD Estimation (EBA-GL-2017-16) - Chapters 1,2,3 (Only PD Estimation Part) PDFShankar RavichandranNo ratings yet

- Issues of Sustainability of Indian Rural PDFDocument15 pagesIssues of Sustainability of Indian Rural PDFJose MathaiNo ratings yet

- Glossary: A/B TestDocument10 pagesGlossary: A/B TestfnskllsdknfslkdnNo ratings yet

- Third Party Ownership and Multi-Club OwnershipDocument36 pagesThird Party Ownership and Multi-Club OwnershipBruno ToniniNo ratings yet

- Case Analysis AvonDocument4 pagesCase Analysis AvonRaj Paroha83% (6)

- MCOM420 Project OutlineDocument4 pagesMCOM420 Project OutlinemNo ratings yet

- ProblemsDocument20 pagesProblemsJoaquin DiazNo ratings yet

- IOH Sales Pitch Data CenterDocument32 pagesIOH Sales Pitch Data CenterJati RoyatNo ratings yet

- Tata Technologies IPO PDF 201123Document1 pageTata Technologies IPO PDF 201123Hitesh PhulwaniNo ratings yet

- Break-Even Level of Output BUSINESS STUDIES IGCSEDocument3 pagesBreak-Even Level of Output BUSINESS STUDIES IGCSEHriday KotechaNo ratings yet

- Entrep Module 1 Q1Document14 pagesEntrep Module 1 Q1MacyNo ratings yet

- BennyDocument3 pagesBennyDee Fue deeNo ratings yet

- Loan LetterDocument1 pageLoan LetterMuhd HisyamuddinNo ratings yet

- Statement of PurposeDocument2 pagesStatement of PurposeSandra ThomasNo ratings yet

- MGT-513 Corporate Law Course ContentDocument4 pagesMGT-513 Corporate Law Course Contentsheraz akramNo ratings yet

- Operational Data StoreDocument0 pagesOperational Data StorerajsalgyanNo ratings yet

- Denodo Job RoleDocument2 pagesDenodo Job Role059 Monisha BaskarNo ratings yet

- HRM151 - Tou052 Sas Day19Document7 pagesHRM151 - Tou052 Sas Day19Francis ConsolacionNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceFrom EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceRating: 4 out of 5 stars4/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistFrom EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistRating: 4 out of 5 stars4/5 (32)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (8)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- The Value of a Whale: On the Illusions of Green CapitalismFrom EverandThe Value of a Whale: On the Illusions of Green CapitalismRating: 5 out of 5 stars5/5 (2)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Risk Management: Concepts and Guidance, Fifth EditionFrom EverandRisk Management: Concepts and Guidance, Fifth EditionRating: 4.5 out of 5 stars4.5/5 (10)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursFrom EverandBuilt, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursRating: 5 out of 5 stars5/5 (13)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthFrom EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo ratings yet

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamFrom EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo ratings yet