Professional Documents

Culture Documents

Financial Audit Manual Veranda, Malaybalay City, Bukidnon November 06-07,2019

Uploaded by

Lail PDOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Audit Manual Veranda, Malaybalay City, Bukidnon November 06-07,2019

Uploaded by

Lail PDCopyright:

Available Formats

Financial Audit Manual

Veranda, Malaybalay City, Bukidnon

November 06-07,2019

DAY 1

Prayer Ms. Cassie Adriene Tagupa

Lupang Hinirang Ms. Fritzi Capacio ,

Opening Remarks Ms. Josephine Murillo

FAM lecturer Mr. Albert Lungay

Session 1 Explaning the general requirements and application of the Materiality Guidelines

Discussing the General Guidelines

Reviewing the General Guideleine

Materialiaty

It relates to misstatements, inclding omissions, that reasonably be expected

to influence the economic decisions of users taken on the basis of the finacial

statements

Users of FS: Public, Regulators (DILG), SP , Media

4 concepts:

Overall Planning Materiality consolidated FS basis of audit opinion

Specific Planning Materriality rules and regulations Specific like PRDP

Overall Performance Materiality lower- subset of overall planning

Specific Performance Materiality account or assertion level

Overall- FS as a whole

Specific- particular accounts, class of transactions

Other materiality thresholds:

Testing threshold

Threshold for clearly trivial matters

When to determine Planning Phase or after the UTA in the Planning Phase

What data to use Estimates (Previous Yr, Interim Balances, Annualized Balances)

What thresholds to use Stand Alone - Planning Execution and Reporting

Groups with Components- Planning and Execution Phases only

Annualized Balances only for nominal accounts (Revenues/Expenses)

Sept 90M

Divide /9

10M per month

Annualized Balances = 10M *12 Months = 120M Annualized Balance Estimate

The aditor's determination of materiality is infleced by law, regulation or other authority and by the financial information

needs of legislators and the public in relation to publicsector porgrams

Based on professional judgment (ISSAI 1320.4)

Session 2

Materilaity

Magnitude of misstatement.

Benchmark

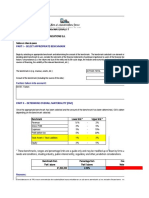

Example Total Expenditures Damulog City of Malaybalay

Current Operating Expenses 97,971,888.03 1,006,910,832.84

Transfers, Assistance and Subsidy 5,497,504.55 42,118,616.47

0.50% 0.50%

Materiality 517,346.96 5,245,147.25

2.00% 2.00%

Materiality 2,069,387.85 20,980,588.99

Performance Materiality

Extent of misstatements Performance Materiality Extent of mistatements Total Monetary of Misstatement in PY (Corrected and Uncorrected)x100

in previous year (% of planning materiality) in prior year % Monetary amount of the overall planning materiality of CY

0-40% 80%

40.04-100% 60%

Above- 100% 50% AOM 1 18,794,224.94

AOM 2 1,555,000.00

AOM 3 22,140,000.00

42,489,224.94 Total Misstatement

42,489,224.94 Total Misstatement

5,245,147.25 Overall Planning Materiality

810.067343065484 >100%

so 50% of Overall Planning Materiality

So 5,245,147.25 Overall Planning Materiality

2,622,573.62 Performance Materiality

Material Significant

Cash Yes High Prioritize

AR No Instruction 2nd Prioritize

Other Income Yes - OMAs (Other Material Accounts) Analytical

Session 3 Execution

Testing Threshold

Risk of Material Misstatement (RMM)

The risk that the auditor may express an inappropriate opinion on the FS is known as audit risk. Although audit risks and agency risks

are dissimilar in nature, it is often the case that identification of significant agency risks lead to the detection of audit risks.

Inherent risk is the susceptibility of an assertion, about a class of transaction, account balance or

disclosure to a misstatement that could be material, either individually or when aggregated with

other misstatements, before consideration of any related controls

Control risk is the risk that a misstatement that could occur in an assertion about a class of

transaction, account balance or disclosure and that could be material, either individually or when

aggregated with other misstatements will not be prevented, or detected and corrected, on a

timely manner by the entity’s internal control.

Detection risk is the risk that the auditor’s procedures will not detect a misstatement that exists

in an assertion that could be material, individually or when aggregated with misstatements.

Low Moderate High

For Asset/Income 51%-100% 26%-50% 10%-25%

For Liability/Expense/Equity 16%-25% 11%-15% 5%-10%

Accounts 2,622,573.62 Testing Threshold

CIB 10% 262,257.36 Yes

Inter Agency Rec 10% 262,257.36 Yes

Inventory 26% 681,869.14 Yes

CIP 26% 681,869.14 Yes

Loans Payable 16% 419,611.78 Yes

Trust Liability 5% 131,128.68 Yes

Other Income 51% 1,337,512.55 Yes

Travel Expense 5% 131,128.68 Yes

Other MOOE 5% 131,128.68 Yes

Clearly Trivial Matters are clearly inconsequential

Material

Not Material

(0.25-.50)% * Clearly Trivial No need to monitor Can issue AOM but no impact in Opinion

Overall Planning

Materiality

Session 4 Using Materiality in Reporting Phase

Reversion

>Change in circumstances that occurred during the audit

>New information

>A change in the auditor's understanding of the entity and its operations, as a result of performing further audit procedures

We cannot change Overal Planning Materiality but we can revise the Performance Materiality

Misstatements:

Factual Misstatements Unbooked Amount, Arithmetical Error, Reclassification Error

Judgemental Misstatementals Dereciation, Provision

Projected Misstatements Based on Sampling

Size misstatement- Quatitative Materiality

Natre and Circustances- Qualitative Materiality

Effect of uncorrecred misstatement

DAY 2

Prayer Catherine Reynoso

Financial Audit Manual

Risk is the probability of an act or event occurring that would have an adverse effect in the achievement of an agency’s objectives.

Understanding the Agency

The resident auditors assigned in their respective agencies perform, among others, financial and compliance audits.

The UTA template may include the following:

a. A general overview of the entity’s organization and operations;

b. The agency’s main activities and critical processes;

c. Projects/Programs/Activities;

d. Results of previous audit;

e. Auditor’s notes on any component that may be significant to the conduct of financial audit.

To enhance Auditor’s understanding of the audit entity, the following steps shall be undertaken:

a. Updating information base for financial audit and conducting preliminary risk assessment;

b. Assessing other matters for consideration; and,

c. Assessing Related Parties transactions

A significant risk is where the assessed risk of material misstatement is so high that in the auditor’s judgment, it will require special audit consideration as in these cases:

a. large non-routine transactions;

b. matters requiring judgment or management intervention such as changes in accounting impairment policies;

c. error or fraud is high;

d. non-compliance with laws and regulations; or,

e. unreliable internal control.

SRPIR Summary Report on Preliminary Identification of Risks

Becomes the initial basis for conducting further risk assessment and updating the overall audit strategy.

Appendix 2.6

Agency-Level Control Checklist

The preliminary assessment of the Internal Control System of the agency is based on the five components of the internal control:

Control Environment – sets the tone of an organization, influencing the control consciousness of its staff. It is the foundation for all other components of internal

control, providing discipline and structure.

Risk Assessment – process of identifying and analyzing relevant risks to the achievement of the agency’s objectives and determining the appropriate response.

Control Activities – The policies and procedures established to address risks and to achieve the agency’s objectives. The procedures that an organization puts in place to treat risk.

Information & Communication – effective processes and systems that identify, capture and report operational, financial and compliance-related information in a form and

timeframe that enable people to carry out their responsibilities.

Monitoring – the process that assesses the quality of the internal control system’s performance over time.

In COA

Quality Management

Quality Assurance

Quality Control

The following are examples of circumstances that may indicate the possibility that the FS may contain a material misstatement resulting from fraud.

Discrepancies in the accounting records, including:

i. Transactions that are not recorded in a complete or timely manner or are improperly recorded as to amount, accounting period, classification or entity policy;

ii. Unsupported or unauthorized balances or transactions;

iii. Last-minute adjustments that significantly affect financial results;

iv. Evidence of employees’ access to systems and records inconsistent with that necessary to perform their authorized duties; and,

v. Tips or complaints to the auditor about alleged fraud.

Conflicting or missing evidence, including:

i. Missing documents;

ii. Documents that appear to have been altered;

iii. Unavailability of documents other than photocopied or electronically transmitted documents when documents in original form are expected to exist;

iv. Significant unexplained items or reconciliations;

v. Unusual balance sheet changes, or changes in trends or important FS ratios or relationships – for example, receivables growing faster than revenues;

vi. Inconsistent, vague, or implausible responses from management or employees arising from inquiries or analytical procedures;

vii. Unusual discrepancies between the entity’s records and confirmation replies;

viii. Large number of credit entries and other adjustments made to accounts receivable records.

ix. Unexplained or inadequately explained differences between the accounts receivable sub-ledger and the control account, or between the customer statements and the accounts

receivable sub-ledger; and,

x. Missing or non-existent cancelled checks in circumstances where cancelled checks are ordinarily returned to the entity with the bank statement.

You might also like

- Buck-Morss Susan The Dialectics of Seeing Walter Benjamin and The Arcades ProjectDocument254 pagesBuck-Morss Susan The Dialectics of Seeing Walter Benjamin and The Arcades ProjectIg AgNo ratings yet

- BA Boeing Stock SummaryDocument1 pageBA Boeing Stock SummaryOld School ValueNo ratings yet

- Mini - Case - AnalyticsDocument5 pagesMini - Case - AnalyticsAlex Ngai100% (1)

- Overview If Railway AccountsDocument40 pagesOverview If Railway AccountsKannan ChakrapaniNo ratings yet

- SK FormsDocument116 pagesSK FormsDyëng RäccâNo ratings yet

- ACE Personal Trainer Manual Chapter 17Document54 pagesACE Personal Trainer Manual Chapter 17Đạt NguyễnNo ratings yet

- Financial Performance Measures and Value Creation: the State of the ArtFrom EverandFinancial Performance Measures and Value Creation: the State of the ArtNo ratings yet

- DBM Form 706Document4 pagesDBM Form 706Joyce Ann Caigas - BarcelonNo ratings yet

- RA 9225 Citizenship Retention and Reacquisition Act of 2003Document3 pagesRA 9225 Citizenship Retention and Reacquisition Act of 2003Adrianne BenignoNo ratings yet

- Blue Rider Decal Monograph 1 Aviation in Post WW1 AustriaDocument26 pagesBlue Rider Decal Monograph 1 Aviation in Post WW1 AustriaLaurentiu Ionescu100% (3)

- Module 010 Financial Statements and The Ratio AnalysisDocument9 pagesModule 010 Financial Statements and The Ratio AnalysisHo Ming LamNo ratings yet

- 2021 Annual ReportDocument64 pages2021 Annual ReportBBNo ratings yet

- Chapter 6 For CUP Financial AccountingDocument15 pagesChapter 6 For CUP Financial Accountingratanak_kong1-9No ratings yet

- Balanced ScorecardDocument18 pagesBalanced ScorecardOnder YardasNo ratings yet

- UnionBankofthePhilippinesPSEUBP PublicCompanyDocument1 pageUnionBankofthePhilippinesPSEUBP PublicCompanyLester FarewellNo ratings yet

- MaterialityDocument9 pagesMaterialityBenedict KaruruNo ratings yet

- IT Audit CH 3Document5 pagesIT Audit CH 3JC MoralesNo ratings yet

- Vaibhav BFDocument9 pagesVaibhav BFVaibhav GuptaNo ratings yet

- EMISSION Feasibility AnalysisDocument28 pagesEMISSION Feasibility AnalysisJay ArNo ratings yet

- MSA 1 Winter 2021Document12 pagesMSA 1 Winter 2021gohar azizNo ratings yet

- Market Operation-8811Document2 pagesMarket Operation-8811Charles D. FloresNo ratings yet

- Financial Ratio AnalyisisDocument16 pagesFinancial Ratio AnalyisisNeil Jasper CorozaNo ratings yet

- Slides Part 1Document60 pagesSlides Part 1nichtnancyNo ratings yet

- IN Financial Management 1: Leyte CollegesDocument20 pagesIN Financial Management 1: Leyte CollegesJeric LepasanaNo ratings yet

- Assessment-3b-2 (1) (AutoRecovered)Document6 pagesAssessment-3b-2 (1) (AutoRecovered)Trúc NguyễnNo ratings yet

- 600 - Materiality AvayaDocument19 pages600 - Materiality AvayaBrayan Nicolás Martínez RomeroNo ratings yet

- MANACC2 - Responsibility Accounting, Segment Reporting and Balanced ScorecardDocument7 pagesMANACC2 - Responsibility Accounting, Segment Reporting and Balanced ScorecardSean SanchezNo ratings yet

- Genting Malaysia Berhad 110220Document51 pagesGenting Malaysia Berhad 110220BT GOHNo ratings yet

- Assignment Brief APDocument4 pagesAssignment Brief APmudassar saeed100% (1)

- Client: PT Jambi Prima Coal Closing Date: 31 Desember 2018Document7 pagesClient: PT Jambi Prima Coal Closing Date: 31 Desember 2018Umar MukhtarNo ratings yet

- Unit 1 GleimDocument19 pagesUnit 1 GleimAlina ZainabNo ratings yet

- Determination of MaterialityDocument4 pagesDetermination of Materialitynataliecheung324No ratings yet

- Readymade Chappathi Project ReportDocument13 pagesReadymade Chappathi Project ReportJose PiusNo ratings yet

- Financial Statement Analysis: Prof. Vivek BhatiaDocument48 pagesFinancial Statement Analysis: Prof. Vivek BhatiaManan GuptaNo ratings yet

- Vibgyor CV 2020Document4 pagesVibgyor CV 2020nr994724No ratings yet

- NIB Financial ModelDocument229 pagesNIB Financial ModelMilin RaijadaNo ratings yet

- AFM Sample Model - 2 (Horizontal)Document18 pagesAFM Sample Model - 2 (Horizontal)munaftNo ratings yet

- C18Y1101 Sadhurshan Sathyawelu BAIBF10020Document14 pagesC18Y1101 Sadhurshan Sathyawelu BAIBF10020saran.woowNo ratings yet

- Significance of Financial Management Planning For Small and Medium EnterpriseDocument8 pagesSignificance of Financial Management Planning For Small and Medium EnterpriseSyed MuneemNo ratings yet

- CHAPTER II - Financial Analysis and PlanningDocument84 pagesCHAPTER II - Financial Analysis and PlanningTamiratNo ratings yet

- Terrier Security Services (India) Private LimitedDocument7 pagesTerrier Security Services (India) Private Limitedgcgary87No ratings yet

- Analyst Presentation March 23Document23 pagesAnalyst Presentation March 23RakeshNo ratings yet

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetNo ratings yet

- Executive SummaryDocument5 pagesExecutive SummaryJen LCNo ratings yet

- Financial Performance and ReviewDocument2 pagesFinancial Performance and Reviewsunaina jojoNo ratings yet

- A.) Horizontal and Vertical Analysis (Omnibus Bio-Medical Systems Inc)Document7 pagesA.) Horizontal and Vertical Analysis (Omnibus Bio-Medical Systems Inc)Levi Lazareno EugenioNo ratings yet

- Executive Summary: Outcome Indicators 1. No. and Percentage Increase of Lgus With 484 (10%) 1,729 357%Document6 pagesExecutive Summary: Outcome Indicators 1. No. and Percentage Increase of Lgus With 484 (10%) 1,729 357%Jen LCNo ratings yet

- 2 Ratio Analysis Financial Statement Analysis 1652097843303Document8 pages2 Ratio Analysis Financial Statement Analysis 1652097843303vroommNo ratings yet

- AlphaCapital ReportDocument58 pagesAlphaCapital ReportBBNo ratings yet

- Financial Results 2014/15 2014╱15年度財務狀況Document36 pagesFinancial Results 2014/15 2014╱15年度財務狀況余日中No ratings yet

- Operation Profile: Basic DataDocument13 pagesOperation Profile: Basic DataAlan GarcíaNo ratings yet

- 3.1-3.4 Financial Planning (Mar 31)Document151 pages3.1-3.4 Financial Planning (Mar 31)Lisette MarizNo ratings yet

- Garima Bank 1st Quarter2077Document1 pageGarima Bank 1st Quarter2077Aman AgrawalNo ratings yet

- Busi 331 Project 1 Marking Guide: HandbookDocument28 pagesBusi 331 Project 1 Marking Guide: HandbookDilrajSinghNo ratings yet

- F5 Part I Becker 2017Document246 pagesF5 Part I Becker 2017cabienoNo ratings yet

- Unit 5. Financial Statement Analysis IIDocument32 pagesUnit 5. Financial Statement Analysis IIsikute kamongwaNo ratings yet

- Annual Report 2020Document248 pagesAnnual Report 2020Trina NaskarNo ratings yet

- 489 1373284812858Document64 pages489 1373284812858MadushanNo ratings yet

- Safari - 26-Feb-2018 at 3:42 PM-1Document1 pageSafari - 26-Feb-2018 at 3:42 PM-1Hesamuddin KhanNo ratings yet

- CHAPTER II - Financial Analysis and PlanningDocument84 pagesCHAPTER II - Financial Analysis and PlanningMan TKNo ratings yet

- Tos Far Final Quali 2018, LEVEL I and IIDocument6 pagesTos Far Final Quali 2018, LEVEL I and IIMarriz Bustaliño TanNo ratings yet

- 05 Ratios and Trend AnalysisDocument11 pages05 Ratios and Trend AnalysisHaris IshaqNo ratings yet

- Financial Steering: Valuation, KPI Management and the Interaction with IFRSFrom EverandFinancial Steering: Valuation, KPI Management and the Interaction with IFRSNo ratings yet

- STPR Gaurav Singh NegiDocument17 pagesSTPR Gaurav Singh NegiGaurav Singh NegiNo ratings yet

- Bautista v. SabinianoDocument3 pagesBautista v. SabinianoBeltran KathNo ratings yet

- 7 Private Car Package Policy WordingsDocument18 pages7 Private Car Package Policy WordingsShashikant ThakreNo ratings yet

- Competency Based QuestionsDocument3 pagesCompetency Based QuestionsAvni JainNo ratings yet

- CLC and Fund Convention: ObjectivesDocument2 pagesCLC and Fund Convention: ObjectivesRiteshNo ratings yet

- OLDHAM MBC SCHEDULE of PERSONS NOMINATEDDocument20 pagesOLDHAM MBC SCHEDULE of PERSONS NOMINATEDPoliceCorruptionNo ratings yet

- Relevance of Dayanand in ModernDocument2 pagesRelevance of Dayanand in ModernVikas PrajapatiNo ratings yet

- Load LineDocument2 pagesLoad LineAamir SirohiNo ratings yet

- UCPB General Insurance vs. Aboitiz Shipping Corporation, Et - AlDocument2 pagesUCPB General Insurance vs. Aboitiz Shipping Corporation, Et - AlZazaNo ratings yet

- Valdez vs. Lucero and Jimenez 76 Phil. 356, March 27, 1946Document8 pagesValdez vs. Lucero and Jimenez 76 Phil. 356, March 27, 1946Kathleen Joy GarciaNo ratings yet

- Poplack 2004Document10 pagesPoplack 2004Rodion KsnNo ratings yet

- Data Sharing ChecklistsDocument2 pagesData Sharing ChecklistsKarl OcNo ratings yet

- Amy WeirchDocument4 pagesAmy WeirchAmy Weirich FilesNo ratings yet

- Burbe V MagultaDocument2 pagesBurbe V MagultaCedrickNo ratings yet

- Opening SpeechDocument2 pagesOpening Speechapi-276904992No ratings yet

- Bibliography 5Document5 pagesBibliography 5api-598960068No ratings yet

- WAPDA Budget Manual BookDocument24 pagesWAPDA Budget Manual BookWaheed Ahmad67% (3)

- Case Study Chapter 14Document2 pagesCase Study Chapter 14Zaid Al-rakhesNo ratings yet

- Haryana Police Act 2008Document26 pagesHaryana Police Act 2008amit0861No ratings yet

- Persuasive Writing PromptsDocument8 pagesPersuasive Writing PromptsvivNo ratings yet

- Traceability Dashboard - NesteDocument7 pagesTraceability Dashboard - NestejunemrsNo ratings yet

- Cash and Liquidity Management - Topic 3Document47 pagesCash and Liquidity Management - Topic 3kodeNo ratings yet

- Case Comment On Rajiv Raturi v. Union of India The Dawn of Disability Rights in IndiaDocument6 pagesCase Comment On Rajiv Raturi v. Union of India The Dawn of Disability Rights in IndiaInquisitive MindNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument18 pagesInstructions / Checklist For Filling KYC FormTushar Prakash ChaudhariNo ratings yet

- ObliconDocument2 pagesObliconmedic102No ratings yet

- Reflective Journal 1Document4 pagesReflective Journal 1api-489438833No ratings yet