Professional Documents

Culture Documents

P60, OO0 RM: Pto - Ooo

Uploaded by

Lovely Mae LariosaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P60, OO0 RM: Pto - Ooo

Uploaded by

Lovely Mae LariosaCopyright:

Available Formats

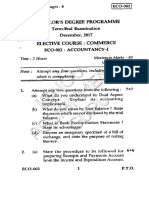

RgSA: The Rryia Sdrol of Accountancy Page 10 of 25

43. What is the correct carrying value of raw-materials inventories?

a.725,AAA b. 708,000 c.728,OOO d. 698,000

44" Assuming direct write-off method is used to account for inventory write-down,.how much

should be recognized in the profit/loss as a result of the lower of cost or net realizable value

valuation of inventories?

a. 201,0o0 b. 206,000 c. 210,000 d. 216,000

45. Assuming allowance method and the following allowance for inventory write-down existed at

the beginning of the year (FG - P60,OO0; WIP - PTO.OOO; RM - O), how much should be '

recognized in the profit/loss as a result of the lower of cost or net realizable value valuation of

inventories?

a. 107,000 b. 86,000 c. 138,000 d. L45,o0o

PIRQ.ELEM 15:

You observed the inventory count of the Solsons Company as of December 31, 2AL4. The client

prepared the summary presented below and gave it to you for verification.

Quantity Cost NRV Amount

A 360 units P3.60/dozen P3.64/dozen P1,31O.40

B 24 units 4.70 each 4.80 each 112.80

C 28 units 16.50 each 16.50 each 1,353.00

D 43 units 5.15 each 5.20 each 176.80

e 4OO units 9.10 each 8.10 each 3,640.00

F 7O dozens 2.00 each 2.00 each 140.00

G 95 grosses t44.OO per gross 132.00 per gross . 13,780.00

46. How much should the inventory be presented in the 2014 balance sheet?

a. 18,364.25. c. 20,513.20.

b. 19,604.25. d. 20,315.00.

PR,OBLEII 15:

In the couree of your audit of DKf{Y Company3'Receivables- acount as of December 31, 2014, you

found out that the account cornprised the following itemsl

Trade accounts receivable P1,550,000

Trade accounts receivable, assigned (proceeds from assignment

amounted to P650,000) - 75O,OO0

Trade accounts receivable, factored (proceeds from factoring done on

a without-recourse basis anrounted to P250,000 30o,0oo

l2o/o Trade notes receivable 200,000

2Aa/o Trade notes receivable, discounted at 4oo/o upon receipt

of the 180-day note on a without recourse basis 300,o00

Trade receivables rendered worthless 50,000

Installments receivable, normally due 1 year to two years 600,000

Customers' accounts reporting credit balances

arising from sales rdturns 60,000

Advance payments for purchase of merchandise 300,000

Customers' accounts reporting credit balances arising

from advance payments 40,000

Cash advances to subsidiary 8O0,0oo

Claim from insurance company 30,000

Sr"rbscription receivable due in 60 days, 600,000

Accrued interest receivable 20,000

Deposit on contract bids 500,000

Advances to stockholders (collectibte in 2AU) 2,000.000

Requirements:

47. How much is the total trade receivables?

a. 3,650,000 c. 3,000,000

b. 3,100,000 d. 2,950,000

''18, How much is the amount to be presented as "trade and other receivables" under current

assets?

a.

7,350,000 c. 4,850,000

b.

5,350,000 d. 4,050,000

4t9. How much loss from receivable financing should be recognized in the income statements?

a.36,000 c. 86,OOO

You might also like

- Financial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreDocument16 pagesFinancial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreShane TorrieNo ratings yet

- Financial Accounting and Reporting: ConceptualDocument9 pagesFinancial Accounting and Reporting: Conceptualben yiNo ratings yet

- 1.statement of Cash Flows - MIDTERMDocument27 pages1.statement of Cash Flows - MIDTERMMaeNo ratings yet

- Quiz - 4B UpdatesDocument7 pagesQuiz - 4B UpdatesAngelo HilomaNo ratings yet

- Financial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreDocument18 pagesFinancial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreAnirban Roy ChowdhuryNo ratings yet

- Ratio Analysis ProblemsDocument4 pagesRatio Analysis ProblemsNavya SreeNo ratings yet

- Reviewer FAR3Document17 pagesReviewer FAR3AnonymousWriter34870% (10)

- Caf 5 Far1 Spring 2019xsxDocument5 pagesCaf 5 Far1 Spring 2019xsxMustafa ZaheerNo ratings yet

- Questionnaire-Practical Accounting 1 Test I: Answer The FollowingDocument10 pagesQuestionnaire-Practical Accounting 1 Test I: Answer The FollowingKristee PlanesNo ratings yet

- Learning Unit 7 - Elimination of Intragroup TransactionsDocument61 pagesLearning Unit 7 - Elimination of Intragroup TransactionsThulani NdlovuNo ratings yet

- LEVEL 2 Online Quiz - Questions SET ADocument8 pagesLEVEL 2 Online Quiz - Questions SET AVincent Larrie MoldezNo ratings yet

- Part 1: Reviewer#5: Midterm Quiz 9fundamentals of Accounting 1 & 2)Document5 pagesPart 1: Reviewer#5: Midterm Quiz 9fundamentals of Accounting 1 & 2)annedanyle acabadoNo ratings yet

- Quiz 2 Cashflows Final PDFDocument4 pagesQuiz 2 Cashflows Final PDFChito MirandaNo ratings yet

- Fin Mang 2020Document3 pagesFin Mang 2020vinayakraj jamreNo ratings yet

- Practical Accounting 1Document11 pagesPractical Accounting 1Jomar VillenaNo ratings yet

- ReviewerDocument9 pagesReviewerMarielle JoyceNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- B.B.A., Sem.-IV CC-213: Corporate Financial StatementsDocument4 pagesB.B.A., Sem.-IV CC-213: Corporate Financial StatementsJJ NayakNo ratings yet

- ECO-2 ENG CompressedDocument4 pagesECO-2 ENG CompressedAmit AdhikariNo ratings yet

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- Additional Cash Flow ProblemsDocument3 pagesAdditional Cash Flow ProblemsChelle HullezaNo ratings yet

- Mock TestDocument7 pagesMock TestShivaji hariNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- 1stLecture-Partnership LiquidationDocument25 pages1stLecture-Partnership LiquidationRechelle Dalusung100% (1)

- Problem 1: Finals - ReceivablesDocument4 pagesProblem 1: Finals - ReceivablesLeslie Beltran ChiangNo ratings yet

- FARAP-4518Document3 pagesFARAP-4518Accounting StuffNo ratings yet

- Chapter 46 Cash Flow ComprehensiveDocument8 pagesChapter 46 Cash Flow ComprehensiveCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- ACC10007 Sample Exam 2Document9 pagesACC10007 Sample Exam 2dannielNo ratings yet

- First Model Test Paper Part - B Time: 40 Minutes Accountancy M.M. 20Document2 pagesFirst Model Test Paper Part - B Time: 40 Minutes Accountancy M.M. 20surbhi singhalNo ratings yet

- Chapter 1 - Statement of Financial Position - UnlockedDocument2 pagesChapter 1 - Statement of Financial Position - UnlockedJerome_JadeNo ratings yet

- IA3 Chapter 22 29Document5 pagesIA3 Chapter 22 29ZicoNo ratings yet

- Advanced Accounting 2DDocument5 pagesAdvanced Accounting 2DHarusiNo ratings yet

- Revised Accounting 16Document20 pagesRevised Accounting 16Jennifer GarnetteNo ratings yet

- FAR Material-2Document8 pagesFAR Material-2Blessy Zedlav LacbainNo ratings yet

- Activity 1Document2 pagesActivity 1Cristine Joy BenitezNo ratings yet

- Review Handouts and Materials: Semester Auditing Problems INTEGR 2-004 Agriculture and LiabilitiesDocument8 pagesReview Handouts and Materials: Semester Auditing Problems INTEGR 2-004 Agriculture and LiabilitiesKarlayaanNo ratings yet

- Section A - CASE QUESTIONS (Total: 50 Marks) : Module A (December 2010 Session)Document13 pagesSection A - CASE QUESTIONS (Total: 50 Marks) : Module A (December 2010 Session)Vong Yu Kwan EdwinNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- AFM-CFS ProblemsDocument10 pagesAFM-CFS ProblemskanikaNo ratings yet

- Answer Key Fa RemDocument4 pagesAnswer Key Fa RemMac b IBANEZNo ratings yet

- University of Rizal System - Binangonan Campus College of Accountancy 2 Year Iac 3 Quiz #2Document3 pagesUniversity of Rizal System - Binangonan Campus College of Accountancy 2 Year Iac 3 Quiz #2Justine JaymaNo ratings yet

- KALBARYONISHERLY2Document8 pagesKALBARYONISHERLY2De MarcusNo ratings yet

- Paper - 1: Advanced Accounting: Answer All QuestionsDocument22 pagesPaper - 1: Advanced Accounting: Answer All Questionsmakarand8july78100% (1)

- Management Programme: MS-04: Accounting and Finance For ManagersDocument5 pagesManagement Programme: MS-04: Accounting and Finance For Managersanon_323108No ratings yet

- Tugas Kelompok Pengantar Akuntansi 1: Dosen: Basuki, S.E.,M.Pd.,M.AkDocument11 pagesTugas Kelompok Pengantar Akuntansi 1: Dosen: Basuki, S.E.,M.Pd.,M.AkMas AbiNo ratings yet

- AACONAPPS2 A433 - Audit of ReceivablesDocument23 pagesAACONAPPS2 A433 - Audit of ReceivablesDawson Dela CruzNo ratings yet

- IA Activity 2 Chapter 4&5Document9 pagesIA Activity 2 Chapter 4&5Sunghoon SsiNo ratings yet

- SOFP-mcq ProblemsDocument4 pagesSOFP-mcq Problemschey dabest100% (1)

- Palmones, Jayhan Grace M. QuizDocument6 pagesPalmones, Jayhan Grace M. QuizjayhandarwinNo ratings yet

- FAR Diagnostic Exam PDFDocument9 pagesFAR Diagnostic Exam PDFReach Moon DaddyNo ratings yet

- Accounting For Decision Making or Management AU Question Paper'sDocument41 pagesAccounting For Decision Making or Management AU Question Paper'sAdhithiya dhanasekarNo ratings yet

- Accounts AIP FINALDocument14 pagesAccounts AIP FINALManthanNo ratings yet

- 17769cash Flow Practice QuestionsDocument8 pages17769cash Flow Practice QuestionsirmaNo ratings yet

- Afar 02: Corporate Liquidation: I. True or False - Theory of AccountsDocument5 pagesAfar 02: Corporate Liquidation: I. True or False - Theory of AccountsRoxell CaibogNo ratings yet

- 291122fnbccd DecryptedDocument5 pages291122fnbccd DecryptedAMRITHANo ratings yet

- DocxDocument35 pagesDocxjikee11No ratings yet

- Aud315 - Quizzes Solution PaperDocument6 pagesAud315 - Quizzes Solution PaperLorraineMartinNo ratings yet

- Wiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsNo ratings yet

- Wiley Practitioner's Guide to GAAS 2023: Covering All SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2023: Covering All SASs, SSAEs, SSARSs, and InterpretationsNo ratings yet

- The Review School No.: That orDocument1 pageThe Review School No.: That orLovely Mae LariosaNo ratings yet

- Itsaccountsreceivablestobplasof It: R Etrr/ F L (Document1 pageItsaccountsreceivablestobplasof It: R Etrr/ F L (Lovely Mae LariosaNo ratings yet

- Sales: P1-,27A, OAO - 1LZB, O00 - )Document1 pageSales: P1-,27A, OAO - 1LZB, O00 - )Lovely Mae LariosaNo ratings yet

- Loo/O 37.: Profit ToDocument1 pageLoo/O 37.: Profit ToLovely Mae LariosaNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Review School No.: That orDocument1 pageThe Review School No.: That orLovely Mae LariosaNo ratings yet

- Acknowledgement 2Document3 pagesAcknowledgement 2Lovely Mae LariosaNo ratings yet

- Factory Overhead VarianceDocument8 pagesFactory Overhead VarianceLovely Mae LariosaNo ratings yet

- Risk Assessment 1Document93 pagesRisk Assessment 1Kristyl CernaNo ratings yet

- Rental Property Business PlanDocument27 pagesRental Property Business PlanSharif Abd Rahman100% (10)

- #Test Bank - Law 2-DiazDocument35 pages#Test Bank - Law 2-DiazKryscel Manansala81% (59)

- PSQC 1Document34 pagesPSQC 1Lovely Mae LariosaNo ratings yet

- Taxes TransferDocument52 pagesTaxes TransferGrayl TalaidNo ratings yet

- Philippines TaxDocument3 pagesPhilippines TaxerickjaoNo ratings yet

- Name: - : of Agricultural Food Product in Its Original State From ADocument4 pagesName: - : of Agricultural Food Product in Its Original State From AKarla Andrea OñasNo ratings yet

- Standard Costing and Variance AnalysisDocument17 pagesStandard Costing and Variance AnalysisLovely Mae Lariosa0% (1)

- MAS 2 - Standard CostingDocument13 pagesMAS 2 - Standard CostingLovely Mae Lariosa100% (1)

- HO3 Pre Test 1Document3 pagesHO3 Pre Test 1Lovely Mae LariosaNo ratings yet

- Standard Costing and Variance AnalysisDocument17 pagesStandard Costing and Variance AnalysisLovely Mae LariosaNo ratings yet

- HO3 Pre Test 1Document3 pagesHO3 Pre Test 1Lovely Mae LariosaNo ratings yet

- LAW NegoDocument5 pagesLAW NegogeminailnaNo ratings yet

- Law Nego Pretest and Post TestDocument4 pagesLaw Nego Pretest and Post TestLovely Mae LariosaNo ratings yet

- H04 NiDocument11 pagesH04 NiLovely Mae LariosaNo ratings yet

- Ap Receivables Quizzer507Document20 pagesAp Receivables Quizzer507Jean Tan100% (1)

- SvciDocument70 pagesSvciRej VillamorNo ratings yet

- Conversion CycleDocument44 pagesConversion CycleLovely Mae LariosaNo ratings yet

- CPAR TAX7411 Estate Tax With Answer 1 PDFDocument6 pagesCPAR TAX7411 Estate Tax With Answer 1 PDFstillwinmsNo ratings yet

- Boarding House Guide Book 2013 SmallDocument60 pagesBoarding House Guide Book 2013 SmallLovely Mae LariosaNo ratings yet

- MAS ReviewerDocument22 pagesMAS ReviewerBeverly HeliNo ratings yet

- Glasanay BF Q3W3Document4 pagesGlasanay BF Q3W3Whyljyne Mary GlasanayNo ratings yet

- Gail India Ltd. ReportDocument8 pagesGail India Ltd. Reportsakshi gulatiNo ratings yet

- Chapter 6 Quiz andDocument71 pagesChapter 6 Quiz andME Valleser100% (1)

- Brochure Money Mantra LatestDocument14 pagesBrochure Money Mantra LatestA SNo ratings yet

- I. Overheads Recap From Session 3: Exercise: D&W Handout Template For Session 4Document9 pagesI. Overheads Recap From Session 3: Exercise: D&W Handout Template For Session 4Jules VautrinNo ratings yet

- NSBZDocument6 pagesNSBZKenncy100% (4)

- Vice President Security Lending in NYC NY NJ Resume Fernando RiveraDocument3 pagesVice President Security Lending in NYC NY NJ Resume Fernando Riverafernandorivera1No ratings yet

- Booklet Exercises 2Document7 pagesBooklet Exercises 2Talhaa MaqsoodNo ratings yet

- DebenturesDocument16 pagesDebenturesJenice Victoria CrastoNo ratings yet

- Syllabus 7 Weeks ABMF2013 Fundamental of FinanceDocument6 pagesSyllabus 7 Weeks ABMF2013 Fundamental of FinanceKanchelskiTehNo ratings yet

- Bank Windhoek Investment Fund Fact Sheet Nov 2014Document1 pageBank Windhoek Investment Fund Fact Sheet Nov 2014poiqweNo ratings yet

- Multiple Choice Questions General ConceptsDocument10 pagesMultiple Choice Questions General ConceptsAzureBlazeNo ratings yet

- AC216 Unit 4 Assignment 5 - Amortization MorganDocument2 pagesAC216 Unit 4 Assignment 5 - Amortization MorganEliana Morgan100% (1)

- Ch05 P24 Build A ModelDocument5 pagesCh05 P24 Build A ModelCristianoF7No ratings yet

- Indas 11511 16 RammohanDocument72 pagesIndas 11511 16 RammohanGhanShyam ParmarNo ratings yet

- Ross Corporate 13e PPT CH21 AccessibleDocument37 pagesRoss Corporate 13e PPT CH21 AccessibleVy Dang PhuongNo ratings yet

- Problems Audit of Shareholdersx27 Equitydocx PDFDocument23 pagesProblems Audit of Shareholdersx27 Equitydocx PDFRaisa GeleraNo ratings yet

- Oswaal 25 Years - DIDocument116 pagesOswaal 25 Years - DIiamtarunkr11No ratings yet

- Richard Dennis Sonterra Capital Vs Cba Nab Anz Macquarie Gov - Uscourts.nysd.461685.1.0-1Document87 pagesRichard Dennis Sonterra Capital Vs Cba Nab Anz Macquarie Gov - Uscourts.nysd.461685.1.0-1Maverick MinitriesNo ratings yet

- KCP Capital BudgetingDocument98 pagesKCP Capital BudgetingVamsi SakhamuriNo ratings yet

- MBA FSA SyllabusDocument4 pagesMBA FSA SyllabusJian HuanNo ratings yet

- Intermediate Accouting Sample ProblemsDocument24 pagesIntermediate Accouting Sample ProblemstrishaNo ratings yet

- Lecture - 5 - Hedging Risks. The Use of Financial Derivatives and InsuranceDocument25 pagesLecture - 5 - Hedging Risks. The Use of Financial Derivatives and InsuranceJaylan A ElwailyNo ratings yet

- MCQS On Financial ManagementDocument3 pagesMCQS On Financial ManagementAnonymous kwi5IqtWJNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document9 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)muhammad tahirNo ratings yet

- Behavioural Corporate Finance Power PointDocument12 pagesBehavioural Corporate Finance Power PointLawrence NgariNo ratings yet

- BITA Crypto 10 IndexDocument3 pagesBITA Crypto 10 IndexLiba VisbalNo ratings yet

- Markowitz in Tactical Asset AllocationDocument12 pagesMarkowitz in Tactical Asset AllocationsoumensahilNo ratings yet

- Itctp 2022Document4 pagesItctp 2022Muskaan ShawNo ratings yet

- Problems (p.112) : Derek Abbott WK 2 HomeworkDocument4 pagesProblems (p.112) : Derek Abbott WK 2 HomeworkDerek Abbott100% (4)