Professional Documents

Culture Documents

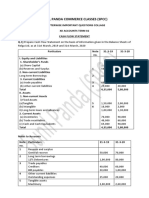

First Model Test Paper Part - B Time: 40 Minutes Accountancy M.M. 20

Uploaded by

surbhi singhal0 ratings0% found this document useful (0 votes)

8 views2 pagesOriginal Title

First Model Test Paper Part

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesFirst Model Test Paper Part - B Time: 40 Minutes Accountancy M.M. 20

Uploaded by

surbhi singhalCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

First Model Test Paper Part – B

Time: 40 Minutes Accountancy M.M. 20

1. State whether ‘Conversion of debentures into Equity Shares by a Financing Company will result into inflow,

outflow or no flow of cash?

2. State how ‘Window Dressing’ is the limitation of Financial Statement Analysis.

3. Assuming that the Current Ratio is 2:1, state giving reason whether the ratio will improve, decline or will have no

change in case a Bill Receivable is dishonored.

4. Give major heads and sub heads under which following items will be disclosed in the Balance Sheet as per

Revised Schedule VI of the Companies Act, 1956:

(a) Proposed Dividend (d) Live Stock

(b) Premium on Redemption of Debentures (e) Bank Overdraft

(c) Licenses and Franchise (f) Outstanding Expenses

5. From the following information, prepare Comparative Statement of Profit & Loss:

Particulars 2014 2013

Revenue from Operations 500% of other income 500% of other income

Other income 40,000 50,000

Cost of Material Consumed 60% of Revenue from operations 50% of Revenue from operations

Other Expenses 2 ½ % of Cost of Material Consumed 2 ½ % of Cost of Material Consumed

Tax 30% 30%

6. Following are the details regarding Inventory Turnover Ratio of ABC ltd.

Particulars Opening Closing

Raw Materials 60,000 80,000

WIP 20,000 25,000

Finished Goods 40,000 65,000

Purchases during the year were 6,50,000

What would happen to the Inventory Turnover Ratio in the following cases?

(a) Goods worth Rs. 40,000 were sold for Rs. 50,000

(b) Goods purchased worth Rs. 50,000

(c) Goods were distributed for charity purposes Rs. 20,000

(d) Goods withdrawn by proprietor Rs. 15,000

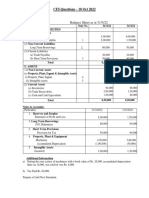

7. From the following information prepare Cash Flow Statement: (6)

Particulars Note No. 2013 2014

I. Equity and Liabilities

1. Shareholders’ Funds

(a) Share Capital 9,00,000 9,00,000

(b) Reserves and Surplus

General Reserve 6,00,000 6,20,000

Statement of Profit & Loss 1,12,000 1,36,000

2. Non-current Liabilities

Long-term Borrowings :

Mortgage Loan --- 5,40,000

3. Current Liabilities

(a) Trade Payables (Creditors) 3,36,000 2,68,000

(b) Short Term Provision : 1,50,000 20,000

Tax Provision 20,98,000 24,84,000

Total

II Assets

1. Non-current Assets

(a) Fixed Assets: 8,00,000

(i) Tangible Assets : Machinery 6,40,000

(b) Non-current Investments 1,00,000 1,20,000

2. Current Assets

(a) Inventories 4,80,000 4,20,000

(b) Trade Receivables (Debtors) 4,20,000 9,10,000

(c) Cash and Cash Equivalents 2,98,000 3,94,000

Total 20,98,000 24,84,000

Additional Information:

(a) Investments costing Rs.16,000 were sold during the year 2013-14 for Rs.17,000.

(b) Provision for Tax made during the year Rs.18,000.

(c) Dividend paid during the year Rs.80,000.

(d) During the year a part of fixed assets costing Rs.20,000 sold for Rs.24,000. The profit was included in the

Statement of Profit & Loss.

You might also like

- Generator System Fault Calculation Design GuideDocument22 pagesGenerator System Fault Calculation Design Guidedheerajdorlikar100% (2)

- E - Efma Rbi Insp Interval Assess Projector - PP SimtechDocument10 pagesE - Efma Rbi Insp Interval Assess Projector - PP SimtechAbhimanyu SharmaNo ratings yet

- Types of Air Conditioning UnitsDocument10 pagesTypes of Air Conditioning Unitssnowgalvez44No ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- BearingsDocument26 pagesBearingstmscorreiaNo ratings yet

- Project-Report-Cps-Report-At-Insplore (1) - 053856Document46 pagesProject-Report-Cps-Report-At-Insplore (1) - 053856Navdeep Singh0% (2)

- PART-B Analysis Test YtDocument8 pagesPART-B Analysis Test YtRiddhi GuptaNo ratings yet

- Cash Flow Statement Collage SPCC Term 2 PDFDocument11 pagesCash Flow Statement Collage SPCC Term 2 PDFTaaran ReddyNo ratings yet

- IPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDocument6 pagesIPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDrShailesh Singh ThakurNo ratings yet

- Accountancy Board Practical Paper - 2020-2021 Class - Xii Time: 1 Hour Max. Marks: 12Document3 pagesAccountancy Board Practical Paper - 2020-2021 Class - Xii Time: 1 Hour Max. Marks: 12Kairav KhuranaNo ratings yet

- Management Accouting Assignment4 Manish Chauhan (09-1128) .Document17 pagesManagement Accouting Assignment4 Manish Chauhan (09-1128) .manishNo ratings yet

- Proposed DividebdDocument34 pagesProposed DividebdPiyush SrivastavaNo ratings yet

- Accounting concepts and statutory auditDocument4 pagesAccounting concepts and statutory auditNamrata RamgadeNo ratings yet

- Financial Reporting & Financial Statement Analysis Paper - Dse 6.1A FM - 80 Group - A (5x3 15)Document5 pagesFinancial Reporting & Financial Statement Analysis Paper - Dse 6.1A FM - 80 Group - A (5x3 15)tanmoy sardarNo ratings yet

- EXERCISE Cashflow of The CompanyDocument41 pagesEXERCISE Cashflow of The CompanyDev lakhaniNo ratings yet

- Master Questions, Advance Level Questions and Additional Questions-Chapter 4Document18 pagesMaster Questions, Advance Level Questions and Additional Questions-Chapter 4manmeet0001No ratings yet

- Accounts AIP FINALDocument14 pagesAccounts AIP FINALManthanNo ratings yet

- CFS Questions - 18 - OCT - 2022Document5 pagesCFS Questions - 18 - OCT - 2022Kartik SujanNo ratings yet

- Important QuestionsDocument3 pagesImportant QuestionsNayan JainNo ratings yet

- Prepare Common Size Balance Sheet from Financial StatementsDocument1 pagePrepare Common Size Balance Sheet from Financial StatementsBinoy TrevadiaNo ratings yet

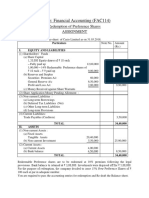

- FAC114 Financial Accounting Redemption of Preference SharesDocument4 pagesFAC114 Financial Accounting Redemption of Preference SharesDhairya ShahNo ratings yet

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyNo ratings yet

- 12 DRT AccDocument2 pages12 DRT AccDeeran DhayanithiRPNo ratings yet

- Adobe Scan 19 Mar 2024Document5 pagesAdobe Scan 19 Mar 2024anilarsha18No ratings yet

- Solution:: Equity and LiabilitiesDocument4 pagesSolution:: Equity and LiabilitiesNIMROD MOCHAHARINo ratings yet

- Isc Mock 2Document14 pagesIsc Mock 2anshikajain3474No ratings yet

- Particulars Note No. 31 Mar, 2020 31 Mar, 2019: ST STDocument5 pagesParticulars Note No. 31 Mar, 2020 31 Mar, 2019: ST STAmit sinhaNo ratings yet

- DocumentDocument4 pagesDocumentTûshar ThakúrNo ratings yet

- Cash Flow Statement for John & Joe LtdDocument4 pagesCash Flow Statement for John & Joe LtdSanjayNo ratings yet

- Problems Set On Ratio AnalysisDocument7 pagesProblems Set On Ratio AnalysispriyankaNo ratings yet

- Accounts DDocument13 pagesAccounts DRahit MitraNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- AFM Assignment 2021Document7 pagesAFM Assignment 2021NARENDRA PATTELANo ratings yet

- 232 FM AssignmentDocument17 pages232 FM Assignmentbhupesh joshiNo ratings yet

- Revision Questions XiiDocument11 pagesRevision Questions XiiSahej Kaur AroraNo ratings yet

- Cash Flow Statement - 2Document9 pagesCash Flow Statement - 2Midhun PerozhiNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- Additional Questions 5Document13 pagesAdditional Questions 5Sanjay SiddharthNo ratings yet

- Financial Management - 1 PDFDocument85 pagesFinancial Management - 1 PDFKingNo ratings yet

- Cash Flow Statement Activity Wise 05-02-24Document7 pagesCash Flow Statement Activity Wise 05-02-24navyabindra28No ratings yet

- Age No 5Document126 pagesAge No 5Deeran DhayanithiRPNo ratings yet

- 202-Financial ManagementDocument5 pages202-Financial ManagementRAHUL GHOSALENo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- Ratio Analysis ProblemsDocument4 pagesRatio Analysis ProblemsNavya SreeNo ratings yet

- Additional Illustrations-5Document19 pagesAdditional Illustrations-5goyalmanasvi06No ratings yet

- Preparation of Financial Statements - QBDocument26 pagesPreparation of Financial Statements - QBHindutav arya100% (1)

- Analysis of Financial StatementDocument23 pagesAnalysis of Financial StatementMohammad Tariq AnsariNo ratings yet

- Dabur Segment Revenue and Profit AnalysisDocument29 pagesDabur Segment Revenue and Profit AnalysisazeemNo ratings yet

- 05 Corporate LiquidationDocument4 pages05 Corporate LiquidationEric CauilanNo ratings yet

- Adobe Scan 05 Mar 2022Document5 pagesAdobe Scan 05 Mar 2022Titiksha Joshi100% (1)

- The Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Ratio & Goodwill (AC - 07)Document15 pagesThe Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Ratio & Goodwill (AC - 07)Shreyas PremiumNo ratings yet

- Acc Practical QuestionsDocument6 pagesAcc Practical QuestionsyogochkeNo ratings yet

- Class 12 Accountancy CBSE Cash Flow StatementDocument7 pagesClass 12 Accountancy CBSE Cash Flow StatementSarvesh SreedharNo ratings yet

- Cash Flow Statement Numerical ProblemsDocument4 pagesCash Flow Statement Numerical ProblemsRaja kumarNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- MAS 3: Financial Analysis Ratios for 40,000 Sales CompanyDocument2 pagesMAS 3: Financial Analysis Ratios for 40,000 Sales CompanyCristine Joy BenitezNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Screenshot 2023-09-20 at 11.30.51 AMDocument1 pageScreenshot 2023-09-20 at 11.30.51 AMprince bhatiaNo ratings yet

- Problem Set of Cash Flow StatementDocument1 pageProblem Set of Cash Flow StatementpriyankaNo ratings yet

- UntitledDocument1 pageUntitledBinoy TrevadiaNo ratings yet

- Quiz 2Document11 pagesQuiz 2Sophia Anne MonillasNo ratings yet

- Financial Management - II CA QPDocument4 pagesFinancial Management - II CA QPSivaramkrishna KasilingamNo ratings yet

- 3054 Faca-V L 8Document8 pages3054 Faca-V L 8ab6154951No ratings yet

- Laptops and Desktop-MAY PRICE 2011Document8 pagesLaptops and Desktop-MAY PRICE 2011Innocent StrangerNo ratings yet

- Tecnolatinas en PDF 170116Document45 pagesTecnolatinas en PDF 170116AaronUrdanetaNo ratings yet

- Ideas For Income Generating Projects PDFDocument29 pagesIdeas For Income Generating Projects PDFheart AquinoNo ratings yet

- Chap 7Document35 pagesChap 7Nizar TayemNo ratings yet

- Tracing Chronic Fatigue Syndrome Tsfunction Is Key To ME - CFS - B Day PDFDocument91 pagesTracing Chronic Fatigue Syndrome Tsfunction Is Key To ME - CFS - B Day PDFsanthigiNo ratings yet

- Thermodynamics 1 Initial Draft 1Document230 pagesThermodynamics 1 Initial Draft 1john pakinganNo ratings yet

- ENGG378 - 948 HydroPower-Lecture - 1 - 2019 PDFDocument34 pagesENGG378 - 948 HydroPower-Lecture - 1 - 2019 PDFJ CNo ratings yet

- Fundamentals WindDocument67 pagesFundamentals WindwlyskrdiNo ratings yet

- Dynamic Programming Algorithm Explained in ECE 551 LectureDocument11 pagesDynamic Programming Algorithm Explained in ECE 551 Lectureadambose1990No ratings yet

- Solution:: Ex 3.3 Consider The Following Parallelograms. Find The Values of The Unknowns X, Y, ZDocument9 pagesSolution:: Ex 3.3 Consider The Following Parallelograms. Find The Values of The Unknowns X, Y, ZpadmaNo ratings yet

- The American School of Classical Studies at AthensDocument23 pagesThe American School of Classical Studies at AthensDanilo Andrade TaboneNo ratings yet

- LAC Intraregional IRF GuideDocument81 pagesLAC Intraregional IRF GuideMario Cortez EscárateNo ratings yet

- School Canteen Satisfaction Survey ResultsDocument2 pagesSchool Canteen Satisfaction Survey ResultsElla PastorinNo ratings yet

- Photoshop Cheat SheetDocument11 pagesPhotoshop Cheat SheetGiova RossiNo ratings yet

- Summer Training Report Lean Process OptimisationDocument19 pagesSummer Training Report Lean Process OptimisationKrishna RaoNo ratings yet

- School Annual Data For Financial YearDocument3 pagesSchool Annual Data For Financial YearRamesh Singh100% (1)

- Circuit Breaker Analyzer & Timer CAT126D: DescriptionDocument7 pagesCircuit Breaker Analyzer & Timer CAT126D: Descriptionkenlavie2No ratings yet

- Gas Turbine Flow MeterDocument33 pagesGas Turbine Flow MeterKhabbab Hussain K-hNo ratings yet

- CPO Science Foundations of Physics: Unit 7, Chapter 24Document47 pagesCPO Science Foundations of Physics: Unit 7, Chapter 24dheerajbhagwatNo ratings yet

- Overcoming The Service Paradox in Manufacturing CompaniesDocument13 pagesOvercoming The Service Paradox in Manufacturing CompaniesErfanNo ratings yet

- The Metacentric Height EX3Document3 pagesThe Metacentric Height EX3Edrees JamalNo ratings yet

- Knowledge (2) Comprehension (3) Application (4) Analysis (5) Synthesis (6) EvaluationDocument5 pagesKnowledge (2) Comprehension (3) Application (4) Analysis (5) Synthesis (6) EvaluationxtinNo ratings yet

- Unit 1Document32 pagesUnit 1Viyat RupaparaNo ratings yet

- CCPDocument2 pagesCCPsanojmk2004No ratings yet

- Benefits of sponge cities in managing urban stormwater and floodingDocument3 pagesBenefits of sponge cities in managing urban stormwater and floodingShivamNo ratings yet