Professional Documents

Culture Documents

BITA Crypto 10 Index

Uploaded by

Liba VisbalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BITA Crypto 10 Index

Uploaded by

Liba VisbalCopyright:

Available Formats

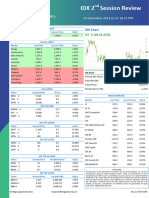

B10 Fact Sheet 1/3

CRYPTO INDEX ISIN: DE000A2YZH14

BITA Crypto 10 Index

B10

As of August 31th, 2020

Index Description

The BITA Crypto 10 Index aims to provide a transparent and objective measure of the Price Return

Performance of a basket of leading cryptocurrencies, measured against the US dollar, trading at

well-established digital asset exchanges. Index values are disseminated in real-time.

Historica Per or ance

l f m

15,000

10,000

5,000

2016-06-17 2017-04-10 2018-02-01 2018-11-28 2019-09-24 2020-07-17

B10 Quick Facts

Weighting FF Market Cap

Calculation Currency Price Return

(based on circulating supply) /

Cap Factor 25% Inception Date 15/0 /201

6 8

# of Constituents 10 Base alue

V 5,000

Rebalancing Frequency Monthly Bac tested Start alue

k V 100

Calculation Hours 00:00 - 23:00 UTC Bac testing Base Date

k 1 /0 /201

7 6 6

THE INDEX TECHNOLOGY COMPANY

www.bitadata.com

B10BJPYSI

Fact Sheet 2/3

Fact Sheet 1/3

CRYPTO INDEX

ISIN: DE000A2YZH14

BITA Crypto 10 Index

As

Asof

ofSeptember

September4th,

4th,2019

2019

B10

As of August 31th, 2020

Performance Data

B10 BTC

Index Return YTD 1 Year ITD YTD 1 Year ITD

Cumulati ve Returns 97.08% 45.50% 3821.48% 72.81% 24.03% 1522.13%

Annualized Return 177.06% 45.50% 139.96% 127.44% 24.03% 94.39%

Index Volatility YTD 1 Year ITD YTD 1 Year ITD

Annualized Volatility 85.01% 77.90% 93.01% 73.60% 68.50% 86.94%

Return / Risk Ratio 2.08 0.58 1.50 1.73 0.35 1.09

Descriptive Statistics

Top 10 Constituents Name Ticker Weight

ETH ETH 26.70%

BTC BTC 24.99%

XRP XRP 16.84%

BCH BCH 6.74%

LTC LTC 5.18%

BSV BSV 4.86%

BNB BNB 4.22%

EOS EOS 4.20%

XTZ XTZ 3.47%

XLM XLM 2.78%

MARKET CAPITALIZATION

Market Capitalization (USD Bn) Constituents Weighting Profile (%)

Total 301.90 Median 5.02

Weighted 70.50 Max 26.70

Mean 30.19 Min 2.78

Median 3.82

Largest 216.95

Smallest 1.99

THE INDEX TECHNOLOGY COMPANY

www.bitadata.com

B10BJPYSI

Fact Sheet 3/3

Fact Sheet 1/3

CRYPTO INDEX

ISIN: DE000A2YZH14

BITA Crypto 10 Index

As of September 4th, 2019

B10

As of August 31th, 2020

INDEX METHODOLOGY

The BITA Crypto 10 Index represents the performance of the largest 10 tokens,

measured against the US

dollar, trading at well-established digital asset exchanges. Composition buffers are used to achieve the fixed

number of components and to maintain stability of

the index by reducing index composition changes.

The weighting is done on the basis of market capitalization, capping the largest positions to 25%.

For more specific details about the methodology, please refer to our BITA Crypto 10 Index Methodology.

ABOUT BITA

BITA is a Germany-based Fintech that provides enterprise-grade indexes, data, and infrastructure to

institutions operating in the passive and quantitative investment space. Thanks to BITA’s innovative index

software, designed to outperform other existing solutions in terms of flexibility and speed, BITA is able to

provide independent, methodologically-sound indexes that both are investable and replicable by customers

and stakeholders. All of BITA’s methodologies and processes are completely transparent and available

publicly.

The German Federal Financial Supervisory Authority (BaFin) has registered BITA as a benchmark

administrator under the BMR. BITA appears on the ESMA register of index administrators.

DISCLAIMER

Please note that the indices published in this factsheet are for demonstration purposes only and cannot be traded directly as shown. BITA’s services are

limited to technology provision, calculation agent services, and when applicable index administration.

BITA GmbH and their licensors, research partners or data providers do not make any warranties or representations, express or implied, with respect to

the timeliness, sequence, accuracy, completeness, currentness, merchantability, quality or fitness for any particular purpose of its index data and exclude

any liability in connection therewith. BITA and their licensors, research partners or data providers are not providing investment advice through the

publication of indices or in connection therewith. In particular, the inclusion of an asset in an index, its weighting, or the exclusion of an asset from an

index, does not in any way reflect an opinion of BITA, their licensors, research partners or data providers on the merits of that company. Financial

instruments based on the BITA indices are in no way sponsored, endorsed, sold or promoted by BITA or their licensors, research partners or data

providers.

BACKTESTED PERFORMANCE

This document contains index performance data based on backtesting, i.e. calculations of how the index might have performed prior to launch if it had

existed using the same index methodology and based on historical constituents. Backtested performance information is purely hypothetical and is

provided in this document solely for information purposes. Backtested performance does not represent actual performance and should not be

interpreted as an indication of actual performance.

You might also like

- BITA Crypto 10 IndexDocument3 pagesBITA Crypto 10 Indexjaen ordonezNo ratings yet

- Fin Model - FinalDocument8 pagesFin Model - FinalMuskan ValbaniNo ratings yet

- The Warren Buffett Spreadsheet - PreviewDocument350 pagesThe Warren Buffett Spreadsheet - PreviewbysqqqdxNo ratings yet

- Exide IndustriesDocument55 pagesExide IndustriesSALONI JaiswalNo ratings yet

- Bond Fund (: Sfin - ULIF002100105BONDULPFND111)Document1 pageBond Fund (: Sfin - ULIF002100105BONDULPFND111)Pawan SinghjiNo ratings yet

- DCF ModelDocument58 pagesDCF Modelishaan0311No ratings yet

- Free Cash Flow Estimate (In INR CRS)Document2 pagesFree Cash Flow Estimate (In INR CRS)SaiVamsiNo ratings yet

- Quantamental Research - ITC LTDDocument1 pageQuantamental Research - ITC LTDsadaf hashmiNo ratings yet

- Learn2Invest Session 10 - Asian Paints ValuationsDocument8 pagesLearn2Invest Session 10 - Asian Paints ValuationsMadhur BathejaNo ratings yet

- Target ExerciseDocument18 pagesTarget ExerciseJORGE PUENTESNo ratings yet

- 1675564388bharti InfratelDocument2 pages1675564388bharti Infratelkishore13No ratings yet

- Date of Analysis 8/29/2020: Dicount Rate 10y Fed Note %Document61 pagesDate of Analysis 8/29/2020: Dicount Rate 10y Fed Note %bysqqqdxNo ratings yet

- Indian Commodities Market: March 14, 2007Document40 pagesIndian Commodities Market: March 14, 2007parishkaaNo ratings yet

- 0812 Daniel Camacho Capital Markets FinalDocument20 pages0812 Daniel Camacho Capital Markets FinalJonathan AguilarNo ratings yet

- Market Update 14th November 2017Document1 pageMarket Update 14th November 2017Anonymous iFZbkNwNo ratings yet

- UNIONBANK - Investor Presentation - 13-May-22 - TickertapeDocument69 pagesUNIONBANK - Investor Presentation - 13-May-22 - Tickertapesukash sNo ratings yet

- LBO - UncompletedDocument10 pagesLBO - UncompletedRachel TangNo ratings yet

- Date Account Size Side PNL % ReturnDocument12 pagesDate Account Size Side PNL % ReturnMarvin DimaguilaNo ratings yet

- Vaneck Vectors Video Gaming and Esports Ucits Etf: Fund Details Fund DescriptionDocument2 pagesVaneck Vectors Video Gaming and Esports Ucits Etf: Fund Details Fund DescriptionsigurddemizarNo ratings yet

- CasesDocument74 pagesCasesPollsNo ratings yet

- Inc.Document136 pagesInc.Jose AntonioNo ratings yet

- IDEA One PagerDocument6 pagesIDEA One PagerdidwaniasNo ratings yet

- #DiwaliPicks SBI Capital SecuritiesDocument15 pages#DiwaliPicks SBI Capital SecuritiesVenkatpradeepManyamNo ratings yet

- IoTeX Price Today, IOTX To USD Live, Marketcap and Chart CoinMarketCapDocument1 pageIoTeX Price Today, IOTX To USD Live, Marketcap and Chart CoinMarketCapAhmad Husein SyamNo ratings yet

- Investing in Indonesia's Bond MarketDocument22 pagesInvesting in Indonesia's Bond MarketHandy HarisNo ratings yet

- "Spring" Performance Report (VIP) : Buy Price Proof MAX Gain % Signal DateDocument2 pages"Spring" Performance Report (VIP) : Buy Price Proof MAX Gain % Signal DateMohammad Reza NajafiNo ratings yet

- MCP0673456-19091000814000000 2Document8 pagesMCP0673456-19091000814000000 2d-a.politisNo ratings yet

- The Warren Buffett Spreadsheet Final-Version - PreviewDocument335 pagesThe Warren Buffett Spreadsheet Final-Version - PreviewHari ganesh RNo ratings yet

- Eadr Project On Infosys CompanyDocument5 pagesEadr Project On Infosys CompanyDivyavadan MateNo ratings yet

- Infosys Financial Analysis: Nizamuddin Shaikh Pritesh ShahDocument10 pagesInfosys Financial Analysis: Nizamuddin Shaikh Pritesh Shahnizzu_shaikhNo ratings yet

- Union Bank - MP: Result TableDocument4 pagesUnion Bank - MP: Result TableManjunath ManjuNo ratings yet

- IDX 2nd Session Review 151223Document2 pagesIDX 2nd Session Review 151223Fb BandingNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For Today: Digitally Signed by Deepak Redekar Date: 2020.10.27 14:31:13 UTCDocument3 pagesCash Segment - Trade Summary Cum Bill Report For Today: Digitally Signed by Deepak Redekar Date: 2020.10.27 14:31:13 UTCSANDEEP GAWANDENo ratings yet

- Pi Price Today, PI To USD Live Price, Marketcap and Chart CoinMarketCapDocument1 pagePi Price Today, PI To USD Live Price, Marketcap and Chart CoinMarketCapfertinioxNo ratings yet

- Module 3 Chapter 15 DCF ModelDocument5 pagesModule 3 Chapter 15 DCF ModelAvinash GanesanNo ratings yet

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNo ratings yet

- Problem 15 Problem 16: Investments, by Bodie, Kane, and Marcus, 9th Edition Spreadsheet Templates MAIN MENU - Chapter 18Document4 pagesProblem 15 Problem 16: Investments, by Bodie, Kane, and Marcus, 9th Edition Spreadsheet Templates MAIN MENU - Chapter 18Bona Christanto SiahaanNo ratings yet

- L&T India Value FundDocument1 pageL&T India Value Fundjaspreet AnandNo ratings yet

- Bus 526Document4 pagesBus 526redwanulrahat1No ratings yet

- Most Market Outlook Most Market Outlook Most Market Outlook: Morning UpdateDocument7 pagesMost Market Outlook Most Market Outlook Most Market Outlook: Morning Updatevikalp123123No ratings yet

- Stock Selection Guide: Symbol: TXNDocument2 pagesStock Selection Guide: Symbol: TXNMayank PatelNo ratings yet

- Mvis Cryptocompare Digital Assets 10 Index: Key FeaturesDocument1 pageMvis Cryptocompare Digital Assets 10 Index: Key Featuresjaen ordonezNo ratings yet

- Maple BrownAbbott Australian Geared Equity Fund Factsheet RetailDocument2 pagesMaple BrownAbbott Australian Geared Equity Fund Factsheet RetailpetrioravainenNo ratings yet

- Pakistan Weekly Update: Market Remains StagnantDocument9 pagesPakistan Weekly Update: Market Remains StagnantShujaat AhmadNo ratings yet

- Market Update 24th November 2017Document1 pageMarket Update 24th November 2017Anonymous iFZbkNwNo ratings yet

- Balance Sheet: PBIT-EPS ChartDocument4 pagesBalance Sheet: PBIT-EPS ChartMukul KadyanNo ratings yet

- Etf Facts February 2, 2018 BMO S&P/TSX Capped Composite Index ETF ZCNDocument4 pagesEtf Facts February 2, 2018 BMO S&P/TSX Capped Composite Index ETF ZCNChrisNo ratings yet

- Airtel AnalysisDocument15 pagesAirtel AnalysisPriyanshi JainNo ratings yet

- Daily Market AnalysisDocument9 pagesDaily Market AnalysisAlin BadiuNo ratings yet

- About Kotak Nifty ETF Scheme FactsDocument3 pagesAbout Kotak Nifty ETF Scheme FactsImanNo ratings yet

- Notes: Market IndicesDocument2 pagesNotes: Market IndicesMUHAMMAD UMAR GURCHANINo ratings yet

- Market Update 16th August 2017Document1 pageMarket Update 16th August 2017Anonymous iFZbkNwNo ratings yet

- Class 9 SolutionsDocument14 pagesClass 9 SolutionsvroommNo ratings yet

- Kayhian: Thailand DailyDocument5 pagesKayhian: Thailand Dailyapi-28341169No ratings yet

- Economic Model of IMT TokenDocument1 pageEconomic Model of IMT TokenPradeep Kumar PattepuramNo ratings yet

- Dados - de - Mercado - 20210315Document5 pagesDados - de - Mercado - 20210315Market offNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsLisle Daverin BlythNo ratings yet

- Bval 01.25Document1 pageBval 01.25Althea Johnna Alvar AldojesaNo ratings yet

- Financial Digitalization and Its Implications for ASEAN+3 Regional Financial StabilityFrom EverandFinancial Digitalization and Its Implications for ASEAN+3 Regional Financial StabilityNo ratings yet

- 0478.12.M.J.2019 Paper 1 PracticeDocument11 pages0478.12.M.J.2019 Paper 1 PracticeBigBoiNo ratings yet

- WinFACT 96 - ELWE-Lehrsysteme GMBHDocument8 pagesWinFACT 96 - ELWE-Lehrsysteme GMBHLuis Diego Saravia ChoqueNo ratings yet

- Monthly Grocery List Maligai Provision ListDocument9 pagesMonthly Grocery List Maligai Provision ListmayalogamNo ratings yet

- Irg7ph42udpbf Igbt To-220Document11 pagesIrg7ph42udpbf Igbt To-220Sergio MuriloNo ratings yet

- Clarity Lims PDFDocument18 pagesClarity Lims PDFCesar Arturo Marino SaavedraNo ratings yet

- Suladan Point of Sall Managment SystemDocument75 pagesSuladan Point of Sall Managment SystemMohamed Ahmed AbdiNo ratings yet

- About Jordan's PolicyDocument20 pagesAbout Jordan's PolicySaeed Al-SaeedNo ratings yet

- SAP CO-PC Material Cost Estimate - EUGDocument38 pagesSAP CO-PC Material Cost Estimate - EUGLantNo ratings yet

- NSR-3652 Series of Synchronizer User's Manual -V1.10 - 20180510【M2018004】 - BelarusDocument54 pagesNSR-3652 Series of Synchronizer User's Manual -V1.10 - 20180510【M2018004】 - BelarusАлександр КозловNo ratings yet

- Jfet Spice StandardjftDocument18 pagesJfet Spice StandardjftAna Luisa Torres ParedesNo ratings yet

- Protocompiler WPDocument13 pagesProtocompiler WPajaysimha_vlsiNo ratings yet

- UMC 100 ManualDocument162 pagesUMC 100 ManualJunioCaetanoNo ratings yet

- IsfileexistsDocument25 pagesIsfileexistsRAMESHNo ratings yet

- Fastboot-Transfer Files From PCDocument8 pagesFastboot-Transfer Files From PCBong PasawayNo ratings yet

- BLDC MotorDocument4 pagesBLDC MotorMrudulaNo ratings yet

- Hotel Property Management System: Software Requirements SpecificationDocument17 pagesHotel Property Management System: Software Requirements SpecificationUmair HassanNo ratings yet

- NEOM-NPR-GFR-Management Manual Rev 01Document24 pagesNEOM-NPR-GFR-Management Manual Rev 01MOHD ZEESHAN100% (3)

- NM8 (S) DatasheetDocument53 pagesNM8 (S) Datasheetcalvin gninguiNo ratings yet

- D0117 RB XEO Service ManualDocument217 pagesD0117 RB XEO Service ManualYuriko MartinezNo ratings yet

- Nadaraya-Watson Teoria PDFDocument9 pagesNadaraya-Watson Teoria PDFLUIS FABIAN URREGO SANCHEZNo ratings yet

- Miniature Advanced Communication Engine (Mini-Ace) and Mini-Ace PlusDocument13 pagesMiniature Advanced Communication Engine (Mini-Ace) and Mini-Ace Plusgotcha75No ratings yet

- User Interaction Design: Information Technology and Information Systems DepartmentDocument23 pagesUser Interaction Design: Information Technology and Information Systems DepartmentArnold Adriel TarregaNo ratings yet

- Document From Sfere Electric23 AbcDocument29 pagesDocument From Sfere Electric23 AbcMuhammad SaleemNo ratings yet

- 02 NetNumen U31 Software Installation - 54PDocument54 pages02 NetNumen U31 Software Installation - 54PAppolenaire Alexis86% (7)

- Technology and Society Unit 3Document21 pagesTechnology and Society Unit 3me niksyNo ratings yet

- 001 Hydraulics IntroDocument22 pages001 Hydraulics IntroShereen SweissNo ratings yet

- LR Mate 100 Ibm ManualDocument144 pagesLR Mate 100 Ibm ManualManuel GutierrezNo ratings yet

- Onboarding Checklist PDFDocument1 pageOnboarding Checklist PDFL1 Support Team - BWANo ratings yet

- Topic 1 Assignment: Navigating GCU Resources & Writing ExpectationsDocument7 pagesTopic 1 Assignment: Navigating GCU Resources & Writing ExpectationsBlake ChambersNo ratings yet

- Business Letter ExampleDocument5 pagesBusiness Letter ExampleAhl BkdNo ratings yet