Professional Documents

Culture Documents

Business Line - Sept 2013 - 4

Uploaded by

Himadri SOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Line - Sept 2013 - 4

Uploaded by

Himadri SCopyright:

Available Formats

The looming banking crisis | Business Line Page 1 of 3

The looming banking crisis

C. P. CHANDRASEKHAR

JAYATI GHOSH

The crisis that engulfs the Indian economy is expected to spread. This will immediately hit corporates and infrastructure

projects burdened with large debts that are now far more expensive to service. In the process, India’s banks will be affected.

September 2, 2013:

With the collapse of the rupee and the stock market capturing attention, and corporate and media anger directed at the

Food Security and Land Acquisition Bills, attention is diverted from much else that is wrong with the Indian economy.

Except for occasional and startling reminders.

One such came from Credit Suisse that pointed to the debt overload among leading Indian corporates. Another came

from Reserve Bank of India Deputy Governor K.C. Chakrabarty on the losses building up in India’s infrastructural

sector, including in its privately operated component.

These are problems in themselves. But they are also problems that spill over into other sectors, especially banking.

Consider, for example, the Credit Suisse India report tracking borrowing by 10 leading Indian business groups that are

among the biggest corporate borrowers.

The groups covered are Adani, Essar, GMR, GVK, Jaypee, JSW, Lanco, Reliance ADA, Vedanta and Videocon. These

groups have been on a borrowing spree with their liabilities rising six-fold over the six years ending March 2013 to

touch Rs 6.31 trillion (Chart 1).

This amounts to close to 35 per cent of the gross bank credit outstanding from scheduled commercial banks to large

industry (Chart 2), and 28 and 11 per cent, respectively, of bank lending to industry and all sectors. Bank exposure here

is large enough to trouble the banks if the firms concerned are in trouble.

High interest burden

There are wide variations across these groups with Reliance ADA, Vedanta, Essar and Adani leading the pack.

But it is not the level of gross debt that matters most but its relation to the net worth of the company or group

concerned.

The difficulty is that leverage in many cases has been high and rising. There is only one among these groups that has a

debt equity ratio of less than one, two have ratios between 1 and 1.5, three have ratios between 2 and 4, another three

between 4 and 5 and one with a ratio of 9.4 (Chart 3).

As compared with this the average debt equity ratio of the RBI’s sample of 3,041 non-government non-financial public

limited companies for the financial year 2011-12 stood at just 0.71 per cent. Leverage is clearly high. The result is some

of these groups (such as Essar, GMR, GVK and Lanco) are carrying an interest burden that exceeds their earnings

before interest and taxes.

This vulnerability is now being significantly aggravated by the sharp depreciation of the rupee, since in the case of at

least half these groups, between 30 and 70 per cent of their debt is foreign currency debt.

With the rupee having depreciated by more than 15 per cent in recent months, the impact this would have on interest

and repayment commitments on forex loans would be substantial. The possibility of default or major restructuring is

indeed substantial.

Either way, banks exposed to these and other such groups are likely to take a hit that would affect their bottom line and

their capital adequacy.

http://www.thehindubusinessline.com/opinion/columns/c-p-chandrasekhar/the-loomin... 30-10-2013

You might also like

- Company Valuation MethodsDocument20 pagesCompany Valuation MethodsKlaus LaurNo ratings yet

- Foreign Exchange ManagementDocument21 pagesForeign Exchange ManagementSreekanth GhilliNo ratings yet

- Ex10 - Working Capital Management With SolutionDocument9 pagesEx10 - Working Capital Management With SolutionJonas Mondala80% (5)

- Retail BankingDocument49 pagesRetail Bankingrajunegi88No ratings yet

- SHARES - EXERCISES - KopiaDocument6 pagesSHARES - EXERCISES - KopiaOla KrupaNo ratings yet

- NEGO 103 Case DigestsDocument34 pagesNEGO 103 Case DigestskbongcoNo ratings yet

- How India Lends Fy2023Document68 pagesHow India Lends Fy2023prajwaln876No ratings yet

- Business Line - Sept 2013 - 3Document1 pageBusiness Line - Sept 2013 - 3Himadri SNo ratings yet

- Business Line - Sept 2013 - 2Document1 pageBusiness Line - Sept 2013 - 2Himadri SNo ratings yet

- Business Line - Sept 2013Document3 pagesBusiness Line - Sept 2013Himadri SNo ratings yet

- Banking System in India Non Performing AssetsDocument12 pagesBanking System in India Non Performing AssetssrikarNo ratings yet

- Banking SectorDocument7 pagesBanking SectorHarsha Vardhan KambamNo ratings yet

- Financial Sector and Economic Growth in IndiaDocument5 pagesFinancial Sector and Economic Growth in IndiaAnshuman DasNo ratings yet

- Topic: The Management of Commercial Banks of BangladeshDocument7 pagesTopic: The Management of Commercial Banks of BangladeshNahid H AshikNo ratings yet

- NPA Levels Highest in 2011-12 During Last 5 Years: RBI: Non-Performing Assets in Indian BanksDocument2 pagesNPA Levels Highest in 2011-12 During Last 5 Years: RBI: Non-Performing Assets in Indian Banksglo6riaNo ratings yet

- Determinants of Non-Performing Loan in Nepalese Commercial BanksDocument17 pagesDeterminants of Non-Performing Loan in Nepalese Commercial Bankskripa poudelNo ratings yet

- AMNirupama Anatomy NBFCDocument38 pagesAMNirupama Anatomy NBFCRutuja SNo ratings yet

- What Ails The NBFCsDocument8 pagesWhat Ails The NBFCsVimarsh PadhaNo ratings yet

- Where Then Does The Problem Lie? The Problems: Economic Survey 2014-15Document1 pageWhere Then Does The Problem Lie? The Problems: Economic Survey 2014-15Sagargn SagarNo ratings yet

- Bhopal Branch of CIRC of ICAI: This Ediition SpecialDocument26 pagesBhopal Branch of CIRC of ICAI: This Ediition SpecialShrikrishna DwivediNo ratings yet

- 3.1 Assessment of The Position of Credit Inclusion in India and Benchmarking Vis-À-Vis The Global PositionDocument1 page3.1 Assessment of The Position of Credit Inclusion in India and Benchmarking Vis-À-Vis The Global PositionRajat ChawlaNo ratings yet

- Integrate Credit Markets To Tame InflationDocument9 pagesIntegrate Credit Markets To Tame Inflationrvaidya2000No ratings yet

- Wilful Defaulters of Indian Banks A First Cut AnalDocument40 pagesWilful Defaulters of Indian Banks A First Cut AnaladvaitNo ratings yet

- Vol 1 Iss 3 Paradise Infocreative Project Developing CenterDocument21 pagesVol 1 Iss 3 Paradise Infocreative Project Developing CenterParadise InfocreativeNo ratings yet

- Causes of NPADocument7 pagesCauses of NPAsggovardhan0% (1)

- New Banking LicenseesDocument11 pagesNew Banking LicenseesDhananjay SharmaNo ratings yet

- Credit SpreadsDocument6 pagesCredit Spreadsspps140899No ratings yet

- Loan Moratorium 2020-Its Impact On Indian Banks: Assistant Professor, Dept. of CommerceDocument14 pagesLoan Moratorium 2020-Its Impact On Indian Banks: Assistant Professor, Dept. of CommerceNeethu VipinNo ratings yet

- Nicholas Borst CLM Issue 75Document21 pagesNicholas Borst CLM Issue 75Ghanashyam MuthukumarNo ratings yet

- (Microsoft Word - NBFCsDocument4 pages(Microsoft Word - NBFCsrvaidya2000No ratings yet

- FINM3006 Notes On Past Exams: 2016 Test 1Document77 pagesFINM3006 Notes On Past Exams: 2016 Test 1Navya VinnyNo ratings yet

- CM Project of Mehak Juneja (18BSP1729)Document5 pagesCM Project of Mehak Juneja (18BSP1729)mehak junejaNo ratings yet

- Financing Micro Finance in IndiaDocument7 pagesFinancing Micro Finance in IndiaSourav MaityNo ratings yet

- Non Bank LendersDocument15 pagesNon Bank LendersdavidNo ratings yet

- A Crisis of Banking SectorDocument3 pagesA Crisis of Banking SectorMithesh PhadtareNo ratings yet

- A Framework For Debt Relief Cum Adjustment Packages 010523Document19 pagesA Framework For Debt Relief Cum Adjustment Packages 010523MANI SNo ratings yet

- Source: World Bank. Notes: Years of Takeoff-Brazil, Japan and Korea: 1961, China: 1978, India: 1979Document1 pageSource: World Bank. Notes: Years of Takeoff-Brazil, Japan and Korea: 1961, China: 1978, India: 1979Sagargn SagarNo ratings yet

- A STUDY ON ReviewDocument28 pagesA STUDY ON Reviewaurorashiva1No ratings yet

- Plagiarism Checker X - Report: Originality AssessmentDocument30 pagesPlagiarism Checker X - Report: Originality Assessmentaurorashiva1No ratings yet

- Economic Environment of Business: Batch 2019-20Document4 pagesEconomic Environment of Business: Batch 2019-20priyanka valechhaNo ratings yet

- 18.sachin KhandareDocument4 pages18.sachin KhandareRam KumarNo ratings yet

- Name: Jay Ketanbhai Changela Enrollment No.: 20fomba11508 For The Submission Of: SeeDocument26 pagesName: Jay Ketanbhai Changela Enrollment No.: 20fomba11508 For The Submission Of: SeeMAANNo ratings yet

- How Private Are Public Banks?: Opinion Columns ChandrasekharDocument8 pagesHow Private Are Public Banks?: Opinion Columns Chandrasekharzenflesh21No ratings yet

- How MF REgulation Shall Be Diff From Fin Regulation - Susan REnuka - 2012Document31 pagesHow MF REgulation Shall Be Diff From Fin Regulation - Susan REnuka - 2012Vishal DhekaleNo ratings yet

- Crisis in Banking SectorDocument7 pagesCrisis in Banking SectorShrujan SinhaNo ratings yet

- BankingSector PDFDocument2 pagesBankingSector PDFRono JamesNo ratings yet

- ASSIGNMENT Management of Banks & Financial InstitutionsDocument4 pagesASSIGNMENT Management of Banks & Financial InstitutionsnimmyNo ratings yet

- CII BWR ReportDocument27 pagesCII BWR ReportBalakrishna DammatiNo ratings yet

- Micro Finance - Policy InitiativesDocument12 pagesMicro Finance - Policy Initiativesshashankr_1No ratings yet

- The Public-Sector Banking Crisis in IndiaDocument4 pagesThe Public-Sector Banking Crisis in IndiaAbhijeet JaiswalNo ratings yet

- Credit Inclusion in India and Benchmarking Vis-À-Vis The Global PositionDocument1 pageCredit Inclusion in India and Benchmarking Vis-À-Vis The Global PositionRajat ChawlaNo ratings yet

- Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?Document31 pagesMonetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?Putin V.VNo ratings yet

- 2019 07 14 09 20 44 AmDocument21 pages2019 07 14 09 20 44 AmmeronNo ratings yet

- DEMONETISATIONDocument26 pagesDEMONETISATIONMoazza Qureshi50% (2)

- Possibility of Recession, Spike in Risky Borrowing Threaten Canada's Financial SystemDocument4 pagesPossibility of Recession, Spike in Risky Borrowing Threaten Canada's Financial SystemOdo NthagaNo ratings yet

- LOW RATE OF SBI Moody'sDocument3 pagesLOW RATE OF SBI Moody'sVs RanaNo ratings yet

- Posted: Sat Feb 03, 2007 1:58 PM Post Subject: Causes For Non-Performing Assets in Public Sector BanksDocument13 pagesPosted: Sat Feb 03, 2007 1:58 PM Post Subject: Causes For Non-Performing Assets in Public Sector BanksSimer KaurNo ratings yet

- Risk Management of Banking SystemDocument12 pagesRisk Management of Banking Systemabhinav choudhuryNo ratings yet

- Dissertation Project IqbalDocument85 pagesDissertation Project Iqbalsunnychauhan89No ratings yet

- Credit Flows To Businesses During The Great Recession: Conomic OmmentaryDocument6 pagesCredit Flows To Businesses During The Great Recession: Conomic Ommentarykharal785No ratings yet

- Newsletter March 2015 FinalDocument9 pagesNewsletter March 2015 FinalavishathakkarNo ratings yet

- Subprime Crisis Effect On Indian Markets: A Deeper Look at The Contagion ChannelDocument14 pagesSubprime Crisis Effect On Indian Markets: A Deeper Look at The Contagion ChannelMangesh GulkotwarNo ratings yet

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesFrom EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesNo ratings yet

- Guidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsFrom EverandGuidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsNo ratings yet

- Marketing ReportDocument83 pagesMarketing ReportHimadri SNo ratings yet

- 2B NTPC Muzaffarpur CHP CommercialDocument729 pages2B NTPC Muzaffarpur CHP CommercialHimadri SNo ratings yet

- 1F Facilities To Be Provided by Owner PDFDocument1 page1F Facilities To Be Provided by Owner PDFHimadri SNo ratings yet

- Price Format 'A' For - Supply of Main Equipment - Muzaffarpur Thermal Power Project (2X195 MW)Document1 pagePrice Format 'A' For - Supply of Main Equipment - Muzaffarpur Thermal Power Project (2X195 MW)Himadri SNo ratings yet

- Muzaffarpur Thermal Power Project (2 X 195 MW) : Sr. Description by by No Vendor BHEL A MechanicalDocument3 pagesMuzaffarpur Thermal Power Project (2 X 195 MW) : Sr. Description by by No Vendor BHEL A MechanicalHimadri SNo ratings yet

- Muzaffarpur Thermal Power Project (2 X 195 MW) : Detail To Be Provided Along With Techno Commercial Price OfferDocument1 pageMuzaffarpur Thermal Power Project (2 X 195 MW) : Detail To Be Provided Along With Techno Commercial Price OfferHimadri SNo ratings yet

- Muzaffarpur Thermal Power Project (2 X 195 MW) : Insurance and CompensationDocument1 pageMuzaffarpur Thermal Power Project (2 X 195 MW) : Insurance and CompensationHimadri SNo ratings yet

- Muzaffarpur Thermal Power Project (2 X 195 MW) : Pre Qualification Criteria For VendorsDocument1 pageMuzaffarpur Thermal Power Project (2 X 195 MW) : Pre Qualification Criteria For VendorsHimadri SNo ratings yet

- 1D Input Documents PDFDocument1 page1D Input Documents PDFHimadri SNo ratings yet

- Sector Briefing - Steel Industry Overview: Fig.2 Major Steel-Producing CountriesDocument2 pagesSector Briefing - Steel Industry Overview: Fig.2 Major Steel-Producing CountriesHimadri SNo ratings yet

- Global and Domestic Steel: Pressing Issues and Way AheadDocument40 pagesGlobal and Domestic Steel: Pressing Issues and Way AheadHimadri SNo ratings yet

- Proveness CriteriaDocument366 pagesProveness CriteriaHimadri SNo ratings yet

- Is Power Sector Too Risky For Indian Banks?: OutlookDocument2 pagesIs Power Sector Too Risky For Indian Banks?: OutlookHimadri SNo ratings yet

- Ecb - Op307 C85ee17bc5.enDocument46 pagesEcb - Op307 C85ee17bc5.enSarang PokhareNo ratings yet

- Pertemuan 6 - Disposisi Properti, Pabrik Dan PeralatanDocument20 pagesPertemuan 6 - Disposisi Properti, Pabrik Dan PeralatanTawang Deni WijayaNo ratings yet

- Chapter 7Document9 pagesChapter 7Hezekiah Babor LopeNo ratings yet

- Formal Report-CompressedDocument12 pagesFormal Report-Compressedapi-457467141No ratings yet

- Question 1Document6 pagesQuestion 1Ibrahim SameerNo ratings yet

- Eco401 Final Term NotesDocument5 pagesEco401 Final Term NotesLALANo ratings yet

- RatiosDocument6 pagesRatiosWindee CarriesNo ratings yet

- Taran Christoper S. m5 t8 ReflectionDocument4 pagesTaran Christoper S. m5 t8 ReflectionChristoper TaranNo ratings yet

- Mutual Funds - IntroductionDocument9 pagesMutual Funds - IntroductionMd Zainuddin IbrahimNo ratings yet

- Xi Akl 3 - Lembar Kerja Memproses Entry JurnalDocument25 pagesXi Akl 3 - Lembar Kerja Memproses Entry JurnalKeshya MantovanniNo ratings yet

- 354158IRSA Institutional Presentation FY22Document26 pages354158IRSA Institutional Presentation FY22Edu DanósNo ratings yet

- Impact of Financial Performance On Stock Price of Non Bank Financial Institutions Nbfi in Bangladesh Dynamic Panel ApproachDocument4 pagesImpact of Financial Performance On Stock Price of Non Bank Financial Institutions Nbfi in Bangladesh Dynamic Panel Approachucok rakaNo ratings yet

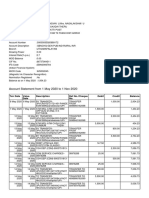

- Account Statement From 1 May 2020 To 1 Nov 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument9 pagesAccount Statement From 1 May 2020 To 1 Nov 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceChellapandiNo ratings yet

- 3) From - SF - To - VaRDocument48 pages3) From - SF - To - VaRDunsScotoNo ratings yet

- Lecture 7Document68 pagesLecture 7Hassan NadeemNo ratings yet

- Financial MarketDocument4 pagesFinancial MarketজহিরুলইসলামশোভনNo ratings yet

- Coral - Commitment LetterDocument283 pagesCoral - Commitment LetterMarius AngaraNo ratings yet

- Currency Hedging: Currency Hedging Is The Use of Financial Instruments, Called Derivative Contracts, ToDocument3 pagesCurrency Hedging: Currency Hedging Is The Use of Financial Instruments, Called Derivative Contracts, Tovivekananda RoyNo ratings yet

- 604 ch3Document72 pages604 ch3Hazel Grace SantosNo ratings yet

- Chapter 2 Capital MarketsDocument9 pagesChapter 2 Capital MarketsFarah Nader Gooda100% (1)

- Business InfographicDocument1 pageBusiness InfographicLuck BananaNo ratings yet

- Thesis - Progress Report. For Advisor OnlyDocument3 pagesThesis - Progress Report. For Advisor OnlyamogneNo ratings yet

- ALM Presentation 02-12-2013Document27 pagesALM Presentation 02-12-2013Cvijet IslamaNo ratings yet

- Congress ExhibitionCatalogue 15-05-2017Document17 pagesCongress ExhibitionCatalogue 15-05-2017ALNo ratings yet

- The Bank of KhyberDocument76 pagesThe Bank of KhyberWaqas KhanNo ratings yet