Professional Documents

Culture Documents

Tools in The Implementation Stage PDF

Uploaded by

sheldoncooper0 ratings0% found this document useful (0 votes)

7 views2 pagesOriginal Title

Tools-in-the-Implementation-Stage.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesTools in The Implementation Stage PDF

Uploaded by

sheldoncooperCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Tools in the Implementation Stage

1. Synergistic Strategy Synergistic Strategy - Horizontal Integration may

2. Intensive Strategies only be effective based on the ff. conditions:

3. Diversified Strategy 1. The organization competes in a growing

4. Defensive Strategies industry

5. Generic Competitive Strategies 2. Competitors have deficiency in some

capabilities, competencies, or resources.

Synergistic Strategy 3. Economies of scale would have a

It is a directional strategy where two significant impact on the production and

independent firms agree to combine their operation.

resources to establish a greater than the 4. Integration would lead to a monopoly

value of the two firms prior to acquisition permitted by the gov’t.

due to economies of scale ü Vertical Integration

1+1=3 Is a synergistic strategic action where a firm

Synergy denotes that the firm seeks a usually expands to strengthen the company’s

better market position greater than the sum position in the industry by way of acquisition,

of its parts, which can be attributed to the merger, or takeover of another company along the

multiplier effect of the firms combined industry value chain.

resources.

ü Horizontal Integration Two Kinds

Is a synergistic strategic action to strengthen the 1. Forward Integration

company’s position in the industry by way of 2. Backward Integration

acquisition, merger, or takeover of a competitor in

the same industry value chain. Forward Integration Backward Integration

Examples:

The manufacturing company The manufacturing

Disney taking over Pixar acquires the wholesaler/retailer company acquires the

Kraft Foods merged with Cadbury for the purpose of achieving supplier company to

Jollibee acquiring Mang Inasal, Chowking, higher economies of scale and streamline the supply chain

larger market share. process.

Red Ribbon

Smart and Sun Cellular Considerations for Effective The manufacturing

Forward Integration company acquires its

1. Few quality distributors/ supplier for the

Synergistic Strategy - Horizontal Integration retailers are available in improvement in efficiency

Several companies are motivated to engage in the industry and have high and cost savings.

profit margins.

horizontal Integration due to the following: 2. Distributors are very

1. Lower Costs expensive, unreliable or

High Production Low Costs which leads to unable to meet the firms

objectives

greater economies of scale and higher 3. Industry is expected to

efficiency. grow significantly where

2. Increased Level of Differentiation there are benefits of stable

productions and

As a result of combined resources, the firm distribution

can offer a distinct product/ features. 4. The acquiring company

3. Increased Bargaining Power gain more power has enough resources and

capabilities to manage the

over suppliers and distributors, promote new business

economic stability

4. Reduced Competition

Illustration: Lamoiyan Company was the major

Less market players = less intense competition

supplier of aluminum collapsible toothpaste tubes

5. Increased Diversification

to Colgate-Palmolive Co. (CPC) sometime in 1970

access new markets and distribution

Forward Integration Backward Integration

channels

The manufacturing company The manufacturing

On the other hand, companies would NOT engage acquires the company acquires the

wholesaler/retailer for the supplier company to

due to the following: purpose of achieving higher streamline the supply chain

1. Damaged Value economies of scale and larger process.

Expected benefits and value did not market share.

materialize. Oftentimes, the partnership fails

The Lamoiyan company CPC takes over Lamoiyan

and destroy the value primarily due to acquired CPC for the company for the toothpaste

difference in org culture. toothpaste products and tube, in order to cut

2. Legal Repercussion perform tasks of a distributor/ transportation costs, better

wholesaler. economies of scale,

Gov’t discourages a monopolistic market improve profit margins and

structure due to lack of competition and so the make CPC more

gov’t facilitates the approval process of such competitive

merger.

3. Reduced Flexibility Intensive Strategy

Large orgs are harder to manage and less Classified as corporate/ business strategies that

flexible in introducing innovations. offer courses of action by way of providing

intensive efforts to improve a firm’s competitive Important points to consider prior to diversification:

position with existing products. 1. Is the industry to be entered more attractive

• Market Penetration than the firm’s existing business?

• Market Development 2. Can the firm establish a competitive

• Product Development advantage within the industry to be

v Market Penetration entered?

is a strategy that seeks to increase market

share for existing products/services in existing Diversified Strategy can be done in two ways:

markets through intensified marketing efforts such 1. Horizontal/ Related Diversification

promotion and advertising. 2. Unrelated Diversification

includes increasing the number of

salespeople, increasing advertising expenditures, Horizontal/ Related Diversification

offering extensive sales promo items or increasing a strategy of offering new products to

publicity efforts. related products/ services. These new

Effective to pursue ff. the four conditions: products/services add to the existing core

1. Current markets are not saturated business, either through acquisition of competitors

2. Usage rate of present customers can be or through internal development of new

increased significantly products/services.

3. Market shares of competitors low Industry Example:

sales high Jollibee Group which has been expanding

4. Increased economies of scale provide its food and restaurant brands for three decades

major competitive advantages through acquisition of its domestic competitors

v Market Development and expansion to overseas markets. (Chowking,

is a strategy that seeks to increase market Greenwich, Mang Inasal and Red Ribbon)

share by introducing existing products/ services

into new market(s) or geographical area(s). Unrelated Diversification

Effective to pursue ff. the six conditions: a strategy of offering new products not

1. New channels of distribution that are related to existing products/ services.

reliable, inexpensive, and of good quality Example:

2. Firm is very successful at what it does Aboitiz Group that has the ff. businesses:

3. Untapped or unsaturated markets 1. Power generation and distribution (Davao

4. Capital and human resources necessary to Light and Power)

manage expanded operations 2. Banking and Insurance (Union bank and

5. Excess production capacity City Savings Bank)

6. Basic Industry rapidly becoming global 3. Food Manufacturing (Pilmico Foods)

v Product Development 4. Real Estate (AboitizLand, Cebu Industrial

is a portfolio strategy that seeks to increase Park Developers)

market share and sales by innovating/improving 5. Construction and shipbuilding (Aboitiz

existing products/ services in existing markets. Construction Group)

developing new products/services which

entails large research and development

expenditures.

Effective to pursue ff. the five conditions:

1. Products are in maturity stage of life cycle

2. Competes in industry characterized by

rapid technological developments

3. Major competitors offer better-quality

products at comparable prices

4. Compete in high-growth industry

5. Strong research and development

capabilities

Diversified Strategy

It is a corporate strategic action applied for a firm

to expand business operation that offers new

products to new markets whether related or not

related in products/services. Answer the question

“What motivates firms to diversify?”

To grow

To fully utilize existing resources and

capabilities

To spread the risks

To make use of surplus cash flows

Diversified Strategy

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Due Process, Equal Protection CasesDocument12 pagesDue Process, Equal Protection CasessheldoncooperNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Creating Long-Term Loyalty RelationshipsDocument18 pagesCreating Long-Term Loyalty RelationshipsHudha100% (1)

- New Code of Judicial Conduct AnnotatedDocument74 pagesNew Code of Judicial Conduct Annotatedramuj2094% (16)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)zaki ansariNo ratings yet

- Ebay and AlibabaDocument49 pagesEbay and AlibabaYeung Yeu Kwen100% (2)

- Tumey Vs Ohio DigestDocument2 pagesTumey Vs Ohio DigestManuel Bertulfo DerainNo ratings yet

- The New Product Development ProcessDocument4 pagesThe New Product Development ProcessDileepNo ratings yet

- Nmims Solved Assignment Solution June 2020Document80 pagesNmims Solved Assignment Solution June 2020Palaniappan NNo ratings yet

- Esguerra Vs VillanuevaDocument1 pageEsguerra Vs VillanuevasheldoncooperNo ratings yet

- Reciprocal Obligations DigestDocument21 pagesReciprocal Obligations DigestsheldoncooperNo ratings yet

- Nego Cases 2nd Set (6-7)Document21 pagesNego Cases 2nd Set (6-7)sheldoncooperNo ratings yet

- Crim Pro Full Text Motion To QuashDocument69 pagesCrim Pro Full Text Motion To QuashsheldoncooperNo ratings yet

- Criminal Law 1 JurisprudenceDocument21 pagesCriminal Law 1 JurisprudencesheldoncooperNo ratings yet

- Legal Ethics Digest CasesDocument36 pagesLegal Ethics Digest CasessheldoncooperNo ratings yet

- Nego Cases 1st Set (11-15)Document26 pagesNego Cases 1st Set (11-15)sheldoncooperNo ratings yet

- Nego Cases 2nd Set (1-5)Document32 pagesNego Cases 2nd Set (1-5)sheldoncooperNo ratings yet

- Nego Cases 1st Set (1-5)Document23 pagesNego Cases 1st Set (1-5)sheldoncooperNo ratings yet

- Principles The 1987 Constitution The Constitution of The Republic of The Philippines PreambleDocument10 pagesPrinciples The 1987 Constitution The Constitution of The Republic of The Philippines PreamblesheldoncooperNo ratings yet

- Nego Cases 1st Set (6-10)Document28 pagesNego Cases 1st Set (6-10)sheldoncooperNo ratings yet

- Republic Act No 9175Document3 pagesRepublic Act No 9175Joseph Santos GacayanNo ratings yet

- Solid Waste ManagementDocument18 pagesSolid Waste ManagementsheldoncooperNo ratings yet

- Natural Caves and Resources Protection ActDocument4 pagesNatural Caves and Resources Protection Actjunayrah galmanNo ratings yet

- Water Code 1 JurisdictionDocument40 pagesWater Code 1 JurisdictionsheldoncooperNo ratings yet

- Water Code 2 ProsecutionDocument8 pagesWater Code 2 ProsecutionsheldoncooperNo ratings yet

- NIPAS ActDocument15 pagesNIPAS ActSusan MalubagNo ratings yet

- Water Code 3 Writ of Continuing MandamusDocument16 pagesWater Code 3 Writ of Continuing MandamussheldoncooperNo ratings yet

- Mining Act 1Document114 pagesMining Act 1sheldoncooperNo ratings yet

- Joint - Solidary CasesDocument691 pagesJoint - Solidary CasessheldoncooperNo ratings yet

- Digest of Mendoza V Arrieta G R No 32599Document2 pagesDigest of Mendoza V Arrieta G R No 32599Clyde TanNo ratings yet

- Property Ownership CasesDocument88 pagesProperty Ownership CasessheldoncooperNo ratings yet

- Oblicon Cases Part IV PDFDocument76 pagesOblicon Cases Part IV PDFsheldoncooperNo ratings yet

- Article II DigestDocument27 pagesArticle II DigestsheldoncooperNo ratings yet

- Searches and Seizures CasesDocument15 pagesSearches and Seizures CasessheldoncooperNo ratings yet

- Concept of State Digested CasesDocument14 pagesConcept of State Digested CasessheldoncooperNo ratings yet

- Business CaseDocument2 pagesBusiness CaseHeravasov ShamilNo ratings yet

- Information MemorandumDocument6 pagesInformation MemorandumChristine Joy EstropiaNo ratings yet

- 4 The Sale of Goods Act, 1930Document8 pages4 The Sale of Goods Act, 1930Sudheer VishwakarmaNo ratings yet

- Eco XI Sample Paper 2 For Term 2Document2 pagesEco XI Sample Paper 2 For Term 2Prisha GuptaNo ratings yet

- Total Quality Management Maruti SuzukiDocument11 pagesTotal Quality Management Maruti SuzukiAadil KakarNo ratings yet

- MG220 - Marketing Management - Sess 11-16Document82 pagesMG220 - Marketing Management - Sess 11-16Muhammad Umair Shabbir FastNUNo ratings yet

- Double Entry Bookkeeping - T-AccountsDocument4 pagesDouble Entry Bookkeeping - T-AccountsAbdulla Maseeh100% (1)

- Behavior-Over-Time Graphs (Botgs) : ExerciseDocument13 pagesBehavior-Over-Time Graphs (Botgs) : ExerciseTaufan PutraNo ratings yet

- CBD Section ManagerDocument3 pagesCBD Section ManagerYatendra VarmaNo ratings yet

- Foundations of PricingDocument8 pagesFoundations of PricingUnsolved MistryNo ratings yet

- Chapter 1 - Intro To Marketing 201Document4 pagesChapter 1 - Intro To Marketing 201GriinNo ratings yet

- Business MathDocument7 pagesBusiness Mathlun3l1ght18No ratings yet

- Quality Recliner Chairs Completed The Following Selected Transactions 2016 Jul 1 Sold PDFDocument1 pageQuality Recliner Chairs Completed The Following Selected Transactions 2016 Jul 1 Sold PDFTaimour HassanNo ratings yet

- TI Cycles New Product Strategy 16th Aug V1.3Document5 pagesTI Cycles New Product Strategy 16th Aug V1.3darshan kabraNo ratings yet

- BS Chapter 17 Marketing Strategy 1Document13 pagesBS Chapter 17 Marketing Strategy 1Crystal KalyanaratneNo ratings yet

- DMart CaseDocument8 pagesDMart CaseSINAL PANCHOLINo ratings yet

- Application and Analysis Exercises 28.1 and 28.2Document8 pagesApplication and Analysis Exercises 28.1 and 28.2Peper12345No ratings yet

- Case Study 2 Week 6 Keeping Stock BMC's Failed Expansion in AustraliaDocument6 pagesCase Study 2 Week 6 Keeping Stock BMC's Failed Expansion in AustraliaSuraj ChoursiaNo ratings yet

- Cost AccountingDocument53 pagesCost Accountingpritika mishraNo ratings yet

- Marketing MixDocument4 pagesMarketing MixSavita NeetuNo ratings yet

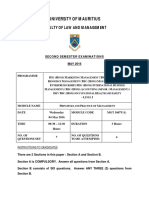

- University of Mauritius: Faculty of Law and ManagementDocument5 pagesUniversity of Mauritius: Faculty of Law and ManagementFadil RushNo ratings yet

- Unit 2: Sale of Goods On Approval or Return Basis: Learning OutcomesDocument17 pagesUnit 2: Sale of Goods On Approval or Return Basis: Learning OutcomessajedulNo ratings yet

- Topic 11: Audit of Inventory CycleDocument38 pagesTopic 11: Audit of Inventory CycleViolet KohNo ratings yet

- Mountain Dew Mountain DewDocument3 pagesMountain Dew Mountain DewRanjan GuptaNo ratings yet

- Group 9 - Snapdeal CaseDocument3 pagesGroup 9 - Snapdeal CaseMohd Yousuf MasoodNo ratings yet