Professional Documents

Culture Documents

Foschini Ar 2010 Financials Company Financials

Uploaded by

AlekcsandraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Foschini Ar 2010 Financials Company Financials

Uploaded by

AlekcsandraCopyright:

Available Formats

FOSCHINI GROUP ANNUAL REPORT 2010 - Page 224

Foschini Limited

as at 31 March

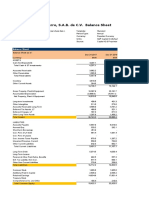

STATEMENT OF FINANCIAL POSITION

2010 2009

Note Rm Rm

ASSETS

Non-current assets

FOSCHINI LIMITED

Investment in preference shares 4 200,0 200,0

Interest in subsidiaries Appendix 1 950,0 1 246,5

Deferred taxation

1 150,0 1 446,5

Current assets

Interest in subsidiaries Appendix 1 682,5 749,3

Other receivables 3,9 5,4

Cash 1,7 1,3

688,1 756,0

Total assets 1 838,1 2 202,5

EQUITY AND LIABILITIES

Capital and reserves

Share capital 13.2 3,4 3,4

Share premium 498,7 498,7

Dividend reserve 15.1 408,8 408,8

Distributable reserve 916,3 1 278,3

1 827,2 2 189,2

Current liabilities

Other payables 5,7 6,2

Taxation payable 5,2 7,1

10,9 13,3

Total equity and liabilities 1 838,1 2 202,5

Guarantee: The company has guaranteed the overdraft facilities of subsidiary companies.

The amounts utilised amounted to 1 041,0 1 271,0

T4IB02815-Foschini AR Fin.indd 224 2010/07/23 1:21 PM

FOSCHINI GROUP ANNUAL REPORT 2010 - Page 225

Foschini Limited continued

for the years ended 31 March

INCOME STATEMENT

2010 2009

Rm Rm

Profit before taxation* 421,5 359,4

Taxation – current year (90,9) (114,8)

Profit attributable to ordinary shareholders 330,6 244,6

* after taking account of:

Dividends received – subsidiary companies 237,4 136,1

– preference shares 13,8 19,1

STATEMENT OF COMPREHENSIVE INCOME

2010 2009

Rm Rm

Profit attributable to ordinary shareholders 330,6 244,6

Total comprehensive income for the year 330,6 244,6

STATEMENT OF CHANGES IN EQUITY

2010 2009

Rm Rm

Equity at the beginning of the year 2 189,2 2 637,2

Total comprehensive income for the year 330,6 244,6

Dividends paid (692,6) (692,6)

Equity at the end of the year 1 827,2 2 189,2

T4IB02815-Foschini AR Fin.indd 225 2010/07/23 1:21 PM

FOSCHINI GROUP ANNUAL REPORT 2010 - Page 226

Foschini Limited continued

for the years ended 31 March

APPENDIX 1: SUBSIDIARY COMPANIES

Issued 2010 2009

share 2010 2009 Indebted- Indebted-

capital Cost Cost ness ness

Name of subsidiary Note R Rm Rm Rm Rm

FOSCHINI LIMITED CONTINUED

Trading subsidiaries

Foschini Retail Group (Proprietary) Limited 2, 3, 7 2 102,5 102,5 727,0 1 142,6

Retail Credit Solutions (Proprietary) Limited 2 18 200 – – – –

What U Want To Wear (Proprietary) Limited 2 66 200 0,1 0,1 – –

Markhams (Proprietary) Limited 2 1 – – – –

Fashion Retailers (Proprietary) Limited 4 250 006 0,2 0,2 – –

Foschini Finance (Proprietary) Limited 2, 7 6 – – 153,0 219,9

Foschini Services (Proprietary) Limited 2 10 – – – –

Foschini Stores (Proprietary) Limited 2, 6 1 – – 528,6 528,6

Foschini Swaziland (Proprietary) Limited 5 2 – – – –

Foschini Investments (Proprietary) Limited 2 10 – – – –

Pienaar Sithole and Associates (Proprietary) Limited 2, 7 100 – – 1,8 1,8

TFG Apparel Supply Company (Proprietary) Limited 2, 7 2 – – 119,1 –

Total trading subsidiaries 102,8 102,8 1 529,5 1 892,9

Other* 1,1 1,1 (0,9) (0,9)

Total 103,9 103,9 1 528,6 1 892,0

2010 2009

Summary Rm Rm

Investment in shares at cost 103,9 103,9

Amounts owing by subsidiaries – non-current portion 846,1 1 142,6

Total non-current portion 950,0 1 246,5

Amounts owing by subsidiaries – current portion 682,5 749,3

Total interest in subsidiaries 1 632,5 1 995,8

Notes

1. The company owns, directly or indirectly, all the ordinary shares in the subsidiaries listed above.

2. Incorporated in South Africa.

3. Included is an amount of R102,5 (2009: R102,5 ) million representing the fair value of 102 500 R1 preference shares issued on

28 February 2002. The directors’ valuation thereof at 31 March 2010 is R102,5 (2009: R102,5) million.

4. Incorporated in Namibia.

5. Incorporated in Swaziland.

6. The loan to subsidiary is unsecured, interest free and no fixed date for repayment has been determined.

7. The loan to subsidiary is unsecured, bears interest at rates determined from time to time and no fixed date for repayment has been

determined. By mutual agreement the loan will not be repayable within the next 12 months.

* A schedule of these details is available on request

T4IB02815-Foschini AR Fin.indd 226 2010/07/23 1:21 PM

FOSCHINI GROUP ANNUAL REPORT 2010 - Page 227

Foschini Limited continued

for the years ended 31 March

APPENDIX 2: RELATED PARTY INFORMATION

2010 2009

Rm Rm

Loans to and from related parties are disclosed in appendix 1.

Interest was received from the following related parties:

Foschini Retail Group (Proprietary) Limited 111,5 210,5

Pienaar Sithole and Associates (Proprietary) Limited 0,2 –

TFG Apparel Supply Company (Proprietary) Limited 1,7 –

Foschini Finance (Proprietary) Limited 22,8 –

136,2 210,5

Dividends were received from the following related parties:

Retail Credit Solutions (Proprietary) Limited 100,5 2,6

Foschini Retail Group (Proprietary) Limited 81,7 40,5

Foschini Services (Proprietary) Limited 5,7 –

Foschini Finance (Proprietary) Limited 12,2 13,7

Markhams (Proprietary) Limited 0,9 –

What U Want to Wear (Proprietary) Limited – 10,0

Foschini Stores (Proprietary) Limited 28,4 69,3

229,4 136,1

Preference dividends were received from the following related party:

Foschini Retail Group (Proprietary) Limited 8,0 8,9

Dividends were paid to the following related parties:

Foschini Stores (Proprietary) Limited 69,3 69,3

The Foschini Share Incentive Trust 24,3 34,2

93,6 103,5

Also refer to note 36 for related party disclosure.

T4IB02815-Foschini AR Fin.indd 227 2010/07/23 1:21 PM

You might also like

- Foschini Ar 2010 Financials Group FinancialsDocument47 pagesFoschini Ar 2010 Financials Group FinancialsAlekcsandraNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- VedantaDocument2 pagesVedantaOnkar ShindeNo ratings yet

- Burberry AR 2016-17 CleanDocument10 pagesBurberry AR 2016-17 Cleanqiaocheng2023No ratings yet

- Infosys Annual Report 2015-16Document1 pageInfosys Annual Report 2015-16Gayathree NandigamNo ratings yet

- Kohls Balance Sheet 2015Document2 pagesKohls Balance Sheet 2015Mathew VisarraNo ratings yet

- Statement of Financial Position: Samba Bank Annual Report 2021Document2 pagesStatement of Financial Position: Samba Bank Annual Report 2021Ahmad KhalidNo ratings yet

- Infosys Balance SheetDocument37 pagesInfosys Balance SheetSakshi BathlaNo ratings yet

- Honda Balance SheetDocument2 pagesHonda Balance Sheetmeri4uNo ratings yet

- Separate Statement of Financial PositionDocument1 pageSeparate Statement of Financial PositionJorge VeraNo ratings yet

- Annual Financial Statements of Volkswagen AG As of December 31, 2022Document307 pagesAnnual Financial Statements of Volkswagen AG As of December 31, 2022Karen NinaNo ratings yet

- Interim Report For The Quarter Ended 30 September 2010Document9 pagesInterim Report For The Quarter Ended 30 September 2010Cadmus ChuahNo ratings yet

- Singtel 18 Financial Statements ExcerptsDocument4 pagesSingtel 18 Financial Statements ExcerptsAayush PrakashNo ratings yet

- Consolidated Statement of Comprehensive Income: For The Year Ended 31 DecemberDocument5 pagesConsolidated Statement of Comprehensive Income: For The Year Ended 31 DecemberVajri Varun GuturuNo ratings yet

- Mindtree SA IndAS 1Q21Document41 pagesMindtree SA IndAS 1Q21sh_chandraNo ratings yet

- FS GIAA 31 Maret 2020Document120 pagesFS GIAA 31 Maret 2020agung wardhanaNo ratings yet

- 1 30062010 StatementDocument1 page1 30062010 StatementChee Heng KingNo ratings yet

- Financial Statement 1q 2020Document20 pagesFinancial Statement 1q 2020Milena DańczyszynNo ratings yet

- PAIR Accounts - December 2018 - Formatted 14 Feb 2019 UpdatedDocument60 pagesPAIR Accounts - December 2018 - Formatted 14 Feb 2019 UpdatedMuhammad SamiNo ratings yet

- Private Company Financials Balance Sheet: Xchanging Software Europe LimitedDocument1 pagePrivate Company Financials Balance Sheet: Xchanging Software Europe Limitedprabhav2050No ratings yet

- Case Study Part 1 Financial AnalysisDocument4 pagesCase Study Part 1 Financial AnalysisNikola PavlovskaNo ratings yet

- PT Serasi AutorayaDocument61 pagesPT Serasi AutorayaGood Year Surya NuswantaraNo ratings yet

- FS GIAA 30 September 2021 - FinalDocument116 pagesFS GIAA 30 September 2021 - Finalagung wardhanaNo ratings yet

- Financial Supplement: January - MarchDocument9 pagesFinancial Supplement: January - MarchSanjeev ThadaniNo ratings yet

- Actividad 3.1Document27 pagesActividad 3.1David RiosNo ratings yet

- Extracted Pages From PVR Ltd. - 19Document1 pageExtracted Pages From PVR Ltd. - 19jadgugNo ratings yet

- Wipro Limited and SubsidiariesDocument34 pagesWipro Limited and SubsidiariesLyca SorianoNo ratings yet

- Financial Report 30 09 2019 ENDocument38 pagesFinancial Report 30 09 2019 ENVenture ConsultancyNo ratings yet

- Ifrs Consolidated Financials q4 Fy22Document35 pagesIfrs Consolidated Financials q4 Fy22Midhun ManoharNo ratings yet

- CCAA Consolidadas LOGISTA 30.09.22 InglésDocument6 pagesCCAA Consolidadas LOGISTA 30.09.22 InglésadasdasdasdaNo ratings yet

- DCF Model: Consolidated Balance Sheet Consolidated Statement of Profit & Loss Consolidated Statement of Cash FlowsDocument1 pageDCF Model: Consolidated Balance Sheet Consolidated Statement of Profit & Loss Consolidated Statement of Cash FlowsGolamMostafaNo ratings yet

- Berger Paints Bangladesh Limited Statement of Financial PositionDocument8 pagesBerger Paints Bangladesh Limited Statement of Financial PositionrrashadattNo ratings yet

- PT Masi - 31 Dec 2020Document67 pagesPT Masi - 31 Dec 2020jf testNo ratings yet

- Jet Airways Financial Report-2008Document2 pagesJet Airways Financial Report-2008RKMNo ratings yet

- Assignment Financial Analysis Chapter 2.Document2 pagesAssignment Financial Analysis Chapter 2.Shaimaa MuradNo ratings yet

- Annual-Report-FML-30-June-2020-23 Vol 2Document1 pageAnnual-Report-FML-30-June-2020-23 Vol 2Bluish FlameNo ratings yet

- PT Diamond Food Indonesia Tbk. Dan Entitas AnakDocument45 pagesPT Diamond Food Indonesia Tbk. Dan Entitas AnakIrsyad KamalNo ratings yet

- Interim Consolidated Condensed Financial Statements For The Six Months 633c1a0975d75Document23 pagesInterim Consolidated Condensed Financial Statements For The Six Months 633c1a0975d75Сергей АнуфриевNo ratings yet

- Balance Sheet 08 09Document1 pageBalance Sheet 08 09Kunal SharmaNo ratings yet

- Hade PDFDocument2 pagesHade PDFMaradewiNo ratings yet

- IMperial Mines 2018.Q2 FSDocument30 pagesIMperial Mines 2018.Q2 FSKevin GullufsenNo ratings yet

- Financial Statements of BMW AgDocument52 pagesFinancial Statements of BMW AgSimranNo ratings yet

- Bal SheetDocument1 pageBal Sheetfakeking1412No ratings yet

- Ind As Financials Consol q4 Fy 21Document42 pagesInd As Financials Consol q4 Fy 21asdasdNo ratings yet

- Extract of Balance SheetDocument2 pagesExtract of Balance SheetBIPIN KUMAR SAHOONo ratings yet

- Unless Otherwise Specified, All Financials Are in INR LakhsDocument8 pagesUnless Otherwise Specified, All Financials Are in INR LakhsShirish BaisaneNo ratings yet

- Adidas AG Consolidated Statement of Financial Position (IFRS)Document6 pagesAdidas AG Consolidated Statement of Financial Position (IFRS)Sanjeev ThadaniNo ratings yet

- The Bank of Punjab: Interim Condensed Balance Sheet As at September 30, 2008Document13 pagesThe Bank of Punjab: Interim Condensed Balance Sheet As at September 30, 2008Javed MuhammadNo ratings yet

- Shell Pakistan Limited Financial Statements For The Year Ended December 31, 2010Document60 pagesShell Pakistan Limited Financial Statements For The Year Ended December 31, 2010popatiaNo ratings yet

- Analisis Laporan Keuangan PT. Unilever Harwendah Sri Rengganis - 19802244009Document10 pagesAnalisis Laporan Keuangan PT. Unilever Harwendah Sri Rengganis - 19802244009Harwendah RengganisNo ratings yet

- 15 Balance Sheet - 2Document1 page15 Balance Sheet - 2amer_mrd87No ratings yet

- ACC ProjectDocument2 pagesACC ProjectShrey DardaNo ratings yet

- Mercedes Benz Group Ag Annual Financial Statements Entity Ag 2021Document70 pagesMercedes Benz Group Ag Annual Financial Statements Entity Ag 2021S.J GAMINGNo ratings yet

- BDODocument6 pagesBDOVince Raphael MirandaNo ratings yet

- New IAR Key Audit MattersDocument4 pagesNew IAR Key Audit Mattersjulie anne mae mendozaNo ratings yet

- T Systems (Report)Document219 pagesT Systems (Report)Prachi SaklaniNo ratings yet

- Balance SheetDocument1 pageBalance SheetJack DawsonNo ratings yet

- Packages Annualreport2002Document66 pagesPackages Annualreport2002omairNo ratings yet

- Sample Working Capital Per Dollar of Sales Calculation: Total Sales Income StatementDocument7 pagesSample Working Capital Per Dollar of Sales Calculation: Total Sales Income StatementsanjusarkarNo ratings yet

- Transformation And: Corporate Social InvestmentDocument22 pagesTransformation And: Corporate Social InvestmentAlekcsandraNo ratings yet

- Foschini Ar 2010 Financials ApprovalsDocument4 pagesFoschini Ar 2010 Financials ApprovalsAlekcsandraNo ratings yet

- Audit Commitee Report: Financial ResultsDocument11 pagesAudit Commitee Report: Financial ResultsAlekcsandraNo ratings yet

- Foschini Ar 2010 Review of Operations and Services Financial ServicesDocument13 pagesFoschini Ar 2010 Review of Operations and Services Financial ServicesAlekcsandraNo ratings yet

- Foschini Ar 2010 Review of Operations and Services OperationsDocument42 pagesFoschini Ar 2010 Review of Operations and Services OperationsAlekcsandraNo ratings yet

- Foschini Ar 2010 Executive ReportsDocument26 pagesFoschini Ar 2010 Executive ReportsAlekcsandraNo ratings yet

- Foschini Ar 2010 Corporate GovernanceDocument14 pagesFoschini Ar 2010 Corporate GovernanceAlekcsandraNo ratings yet

- Foschini Ar 2010 Review of Operations and Services ServicesDocument27 pagesFoschini Ar 2010 Review of Operations and Services ServicesAlekcsandraNo ratings yet

- Foschini Ar 2010 Business OverviewDocument9 pagesFoschini Ar 2010 Business OverviewAlekcsandraNo ratings yet

- Strengths Insight Guide: Father of Strengths Psychology and Inventor of CliftonstrengthsDocument7 pagesStrengths Insight Guide: Father of Strengths Psychology and Inventor of CliftonstrengthsAlekcsandraNo ratings yet

- Full Competency Model 11 2 - 10 1 2014Document39 pagesFull Competency Model 11 2 - 10 1 2014Arees UlanNo ratings yet

- The Examiner's Answers For Financial Strategy: Section ADocument18 pagesThe Examiner's Answers For Financial Strategy: Section Amagnetbox8No ratings yet

- ACC501 Solved Current Papers McqsDocument36 pagesACC501 Solved Current Papers Mcqssania.mahar100% (2)

- Ratio Analysis MASDocument8 pagesRatio Analysis MAShanna0690No ratings yet

- Accounting:Text and Cases 2-1 & 2-3Document3 pagesAccounting:Text and Cases 2-1 & 2-3Mon Louie Ferrer100% (5)

- FAR04-13.2 - SBPT BVPS EPS - RevisedDocument12 pagesFAR04-13.2 - SBPT BVPS EPS - RevisedAi NatangcopNo ratings yet

- Company Law LecturesDocument48 pagesCompany Law Lecturesimdad1986No ratings yet

- Insurance Financial Soundness Indicator-Caramel ModelDocument9 pagesInsurance Financial Soundness Indicator-Caramel ModelSemere AtakiltNo ratings yet

- Technopreneurship WK13Document96 pagesTechnopreneurship WK13Juvill VillaroyaNo ratings yet

- Business Unit 3 NotesDocument45 pagesBusiness Unit 3 Notesamir dargahiNo ratings yet

- Leases, Debt and ValueDocument57 pagesLeases, Debt and ValueGaurav ThakurNo ratings yet

- Ratio AnalysisDocument8 pagesRatio AnalysisRenz Abad0% (1)

- 1-Introduction To Financial StatementsDocument95 pages1-Introduction To Financial Statementstibip12345100% (3)

- Acc11 Accounting For Government and Not-For-profit EntitiesDocument5 pagesAcc11 Accounting For Government and Not-For-profit EntitiesKaren UmaliNo ratings yet

- Hashu Met Iom Sip ReportDocument43 pagesHashu Met Iom Sip Reportpritam giri100% (1)

- Burshane LPG Ratio AnalysisDocument25 pagesBurshane LPG Ratio AnalysisCorolla GrandeNo ratings yet

- FY - 2013 - PRAS - Prima Alloy Steel Universal TBKDocument48 pagesFY - 2013 - PRAS - Prima Alloy Steel Universal TBKnanaNo ratings yet

- Mahusay, Bsa 315, Module 1-CaseletsDocument9 pagesMahusay, Bsa 315, Module 1-CaseletsJeth MahusayNo ratings yet

- Chapter Two Master BudgetDocument15 pagesChapter Two Master BudgetNigussie BerhanuNo ratings yet

- Project Cost Fixed AssetsDocument51 pagesProject Cost Fixed AssetsRuffa Mae MatiasNo ratings yet

- Prospectus Axway English Version FinalDocument187 pagesProspectus Axway English Version FinalhpatnerNo ratings yet

- Topic 1Document59 pagesTopic 1SarannyaRajendraNo ratings yet

- Annual Report & Accounts 2014-15 Deluxe Version in English 03102015 PDFDocument324 pagesAnnual Report & Accounts 2014-15 Deluxe Version in English 03102015 PDFSantosh SinghNo ratings yet

- Solved Trevor Corporation Had 2 900 000 in Total Liabilities and 4 300 000 inDocument1 pageSolved Trevor Corporation Had 2 900 000 in Total Liabilities and 4 300 000 inAnbu jaromiaNo ratings yet

- AFSA Cash Flow AnalysisDocument19 pagesAFSA Cash Flow AnalysisRikhabh DasNo ratings yet

- Mirae Asset Monthly Full Portfolio August 2019Document61 pagesMirae Asset Monthly Full Portfolio August 2019sunnyramidiNo ratings yet

- Internship Report On MCB BankDocument80 pagesInternship Report On MCB Bankfaezaiqbal100% (10)

- 2017 AFR GCs Volume I PDFDocument897 pages2017 AFR GCs Volume I PDFJessica Aldea100% (1)

- Reliance Petroleum's Triple Option Convertible Debentures (A) (FINC06)Document4 pagesReliance Petroleum's Triple Option Convertible Debentures (A) (FINC06)Lakshmi Narasimha Moorthy100% (2)

- Company Law Aug 21Document126 pagesCompany Law Aug 21dipti somaiyaNo ratings yet

- WEEK 1 ReviewerDocument33 pagesWEEK 1 ReviewerFebemay LindaNo ratings yet