Professional Documents

Culture Documents

An Informal Learning Session With MDRT and Top of The Table Leaders

Uploaded by

Alejandro HernándezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Informal Learning Session With MDRT and Top of The Table Leaders

Uploaded by

Alejandro HernándezCopyright:

Available Formats

326 Focus Sessions: Top of the Table

An Informal Learning Session with

MDRT and Top of the Table Leaders

Adelia C. Chung, CLU, ChFC, Marvin H. Feldman, CLU, ChFC, and Moderator: Brian H. Ashe, CLU

Ashe: Two MDRT Past Presidents will discuss how they have didn’t want to be at their activities, but they seemed to be

run their practices, maintained a strong work-life balance, OK if I wasn’t there, and I always thought I would have a

and consistently qualified for Top of the Table. If you think second chance.

you can’t increase your productivity and also find time for And then Alanna dies and she’s three years old, and I

your family, you’re in the right place. realize her brother is six years old. And I had not been to a

Let’s start with a couple of questions. Adelia, do you feel single preschool excursion. I had not done any of the things

that you lead a balanced Whole Person life? that I wanted to do and always thought I would have the

time to do. I think that’s one of the gifts she gave us: To real-

Chung: I believe I do now. But it wasn’t always the case. I ize that time is precious, and very often you have only one

really had to be deliberate and make choices. As some of you chance to make a memory. I then became a room mother.

may know, we lost our three-year-old daughter to leukemia. I did all kinds of things that I never thought my work life

That was really a wake-up call for me, because my family was would allow me to do.

always important to me, but my work has always been impor- And you know what I found? When you prioritize and

tant to me as well. And I think, as women, we do this to our- you make the time, there is time for everything. And my cli-

selves. We want to be the perfect everything. And I’m here to ents now know that my work is important to me, and when

tell you, that doesn’t exist, and I don’t believe that’s possible. I’m at work I’m happy to be there. But when I’m at home, I’m

My life used to be this: I would be the first one in the also happy to be at home. And I think that it’s a choice we

office every day and the last to leave. I’d work weekends need to make, and we need to manage our time. So I truly

and I never had really clingy, needy kids. It wasn’t that I believe that work balance is possible.

Brian H. Ashe, CLU

Ashe is a 46-year MDRT member with 16 Court of the Table and four Top of the Table qualifications. An

MDRT Past President, his work is concentrated in estate conservation, retirement planning, employee

benefits, and business insurance strategies. A popular speaker, Ashe has addressed groups around the

world. He currently writes the “Back Page” column for Advisor Today, and his comments have appeared

in the Wall Street Journal, Money, the Chicago Tribune, Crain’s Chicago Business, and more—as well as

on more than 60 radio stations and 95 TV stations.

Brian Ashe & Associates Ltd

1440 Maple Ave Ste 9B, Lisle, IL 60532 USA

email: bashe29843@aol.com phone: +1 630.964.0966

View this presentation in the Resource Zone at mdrt.org or purchase from mdrtstore.org.

Adelia C. Chung, CLU, ChFC

Chung is a 35-year MDRT member with eight Court of the Table and 13 Top of the Table qualifications.

She was the first female MDRT President, serving in 2005, and has been a Chair or member of more

than 20 MDRT committees. She is an Excalibur Knight of the MDRT Foundation and served as its

President in 1999. The owner of Spectrum Wealth Management in Honolulu, Hawaii, Chung has

held many positions of leadership throughout the life insurance business, and she regularly speaks to

international audiences.

Spectrum Wealth Management LLC

3468 Waialae Avenue Suite 234, Honolulu, HI 96816 USA

email: adelia@spectrumhawaii.com phone: +1 808.469.4081

View this presentation in the Resource Zone at mdrt.org or purchase from mdrtstore.org.

Annual Meeting Proceedings | 2017 ©Million Dollar Round Table

An Informal Learning Session with MDRT and Top of the Table Leaders 327

Ashe: When that occurred, which was a tremendously dif- Feldman: You want the compliance edited version? Well,

ficult and an emotional time, you did find a way to help turn there are a couple of things. I can’t limit it to one, but there

that sacrifice into a positive that wound up benefiting other are a couple of things that most people don’t know about

people. Could you share that with us? me. When I was younger, before children, both my wife and

I used to race sports cars. We had a Corvette, and we cam-

Chung: When you’re going through a difficult time, some- paigned it all over the Midwest, and we would race on the

times it’s really hard to see the good in it. But, fortunately, I’ve weekend and spend the entire week putting it back together,

always been raised to believe that there’s good in everything. so we could race on the weekend.

Our daughter was given six weeks to live after her diagnosis, Unfortunately, just as we were having children, I was

and her only hope for survival was a bone marrow transplant. involved in a major accident where I ran off the course and

There was no family donor, so we needed to do a bone mar- had a problem and stuck and ripped the nose off, ripped the

row drive. We did 22 drives in a six-week period, and over back off. So I was sitting there in a roll cage looking around

30,000 people joined the bone marrow registry. saying, “Where’s my car?” And I quit racing. I raced once

My husband said during one of the television interviews more after that, and I said, “I’ve got to be here to raise my

where we were making our plea that if Alanna could not family.” So I made a decision not to race anymore.

find a donor, at least other people could and would. She was Unfortunately, the urge for speed never disappeared. So

very fortunate; she did find a donor from Taiwan. She did now, when I buy a car, the dealer gives me a preprinted book

have a bone marrow transplant. Unfortunately, she relapsed. of speeding tickets that he just puts in the glove box. So I still

But, today, over 150 people have matched and were given a like to drive fast cars.

second chance at life. The other thing that nobody knows about me is that I used

It’s the kind of thing you don’t wish on anyone, but if to be a competitive pistol shooter, and I campaigned around

you look for it, there’s a lot of good that has come out of it. the country in the senior’s class primarily. I’m much better at

We’ve grown personally. We’ve been made aware of medical shooting something with a pistol than I am with a rifle or a

research and the importance of it. If that didn’t happen to shotgun. So I have a whole arsenal of weapons and enough to

us, I’m not sure we would have the same kind of passion that make sure that nobody in the neighborhood is ever molested.

we do for medical research.

Ashe: Let me ask you both a question. How do you think

Ashe: Thank you for sharing that. I’ve always thought that if you your involvement with the Million Dollar Round Table has

look at someone’s resume, you really don’t have to ask too many enhanced both your personal and business experiences?

more questions because it’s on the resume. But anybody can

look at a resume and really not have an understanding of who Chung: Well, the Million Dollar Round Table exposes you to so

that person is. Marv, could you just touch on one thing that’s off much. And I am so grateful to MDRT for so many of the oppor-

the resume about you that most people don’t know? It could be tunities I’ve been given. I really think that I’m just an ordinary

an avocation; it could be a family thing or a school project that person. I had an exceptional childhood, but I never thought my

you were involved in. What’s off the resume about you? adult life would turn out to be the journey that I’ve had.

Marvin H. Feldman, CLU, ChFC

Feldman is president of the Feldman Financial Group, and president and CEO of the LIFE Foundation.

He is a 43-year MDRT member, past Top of the Table Chair and 2002 MDRT President, with 35 Top

of the Table qualifications. He received the Circle of Life award in 2004 and the John Newton Russell

award in 2011, the highest honor for an individual by the insurance industry. Feldman was also named to

Insurance Newscast’s list of the 100 Most Powerful People in the Insurance Industry, North America, and

is listed in “Who’s Who in Business and Finance” and “Who’s Who in the World.”

Feldman Financial Group

2016 Eagle Pointe, Palm Harbor, FL 34685 USA

email: marv@feldmanfinancialgroup.com phone: +1 727.723.9020

View this presentation in the Resource Zone at mdrt.org or purchase from mdrtstore.org.

©Million Dollar Round Table Annual Meeting Proceedings | 2017

328 Focus Sessions: Top of the Table

And it really started at an MDRT meeting, my very first. If you have a really good year, everybody looks at you and

What’s interesting is, as Brian mentioned, my dad was in the says that your mom or your dad gave you the business, right?

business. And so the first year I qualified he said, “You will But if you have a really bad year, everybody gives you full

be attending the Annual Meeting.” And I said, “I can read credit. Think about that for a second. That was one of the

the books. I can watch the videotapes.” And he said, “It’s not things I had to deal with when I first started in the business.

the same as being there.” So, psychologically, you have to come to grips with that and

And so the Dallas Annual Meeting was my very first understand that you have to do things on your own, but, at

meeting. I went to that meeting thinking I was going to the same time, you have to learn from the mistakes of oth-

learn the secret. I was going to meet somebody who was ers because you’re not going to live long enough to make all

going to tell me: Here’s the formula, and if you just do that, those mistakes yourself. So it’s important to listen to what

you’ll be successful. And with just two years in the busi- your parents are saying. It’s important to listen to what your

ness, it was great that I learned early on that really there is peers are telling you and learn from their mistakes and learn

no secret. At that meeting, I met so many wonderful peo- from their successes and build on that as you go forward.

ple, and I realized then that the best people in our industry I remember coming to my first MDRT. I was seven

are really people who are just trying to do a good job. And years in the business at that point. I’d spent two and a half

so much of the external world paints us as salespeople or years with New York Life as an agent and then five years

pushy. But then I came to this MDRT meeting, and I met in its management program. And, as a manager, you’re not

people and realized that the best of the best were really allowed to sell, so you can’t qualify for MDRT. So when I

good people who just wanted to do good. And they really came back into personal production, I was fortunate, and

weren’t doing anything different from what I was doing. the next year I did go to an MDRT meeting.

They were just doing a lot more of it. So that was a valuable And, of course, I grew up second generation hearing

lesson early on. about MDRT all the time. I went to my first meeting, and of

The other thing that MDRT does is it teaches you to course I knew my dad and my dad’s friends who were all his

experience discomfort, but to work through it. And this age. I didn’t know anybody my age.

organization has given me so many opportunities to grow. So I got to the first meeting—Main Platform—and I was

You have this supportive network, and you realize that you’re sitting in the very last row of the balcony in the meeting hall

in over your head. But no one here will ever let you drown. in San Francisco. I was looking down at the stage, which is

And so, as a result, you grow because you’re on the edge all about four miles away, saying, “Who the hell are all those

the time and people are pushing and encouraging you. old, white-haired people on the stage?” And then, 20 years

It was said this morning during the Main Platform that later, I was the old, white-haired person on the stage.

our industry is unique because people are willing to share I volunteered for PGA at the very first meeting because

and grow. And I think that’s what makes MDRT special. I was told that was what I had to do. And I volunteered for

something every year that I went to an MDRT meeting.

Ashe: I’ve heard that among MDRT membership about And I think, in my career, I’ve only missed two and that was

30 percent of members are related in some way to another due to family commitments, and family always comes first.

member—mother, father, brother, cousin—probably more But MDRT has become and always has been an integral part

so in this business than in other businesses. And, Marv, your of my practice. It’s where I developed my circle of friends

father, Ben Feldman, was looked at as an icon of this busi- that I could go to. So MDRT became my oversized study

ness. I would ask you, in looking at MDRT activities and group where I could look at people like you and say, “Hey,

opportunities: Did you find that there were both positives I’ve got a case and I don’t know what to do with it. Can I

and negatives associated with the fact that your father was call you and discuss it?” And we’d talk about cases, and I’d

looked at as an icon? figure out what to do. I could talk to my dad, but I didn’t

always want to hear what he wanted to tell me. So I had to

Feldman: Well, absolutely. First of all, how many people here get some positive reinforcement from someplace else. And

are second and third generation in the business? There are MDRT was that positive reinforcement.

quite a few. And I’m sure you can relate to this if you have If you’re not taking advantage of that, if you’re not mak-

parents who are in the business. ing those relationships and you’re not reaching out to other

Annual Meeting Proceedings | 2017 ©Million Dollar Round Table

An Informal Learning Session with MDRT and Top of the Table Leaders 329

people, you really, truly need to do that. Because that’s how Feldman: I hated it. I still hate it.

you will grow.

Ashe: And I think that’s probably true for most of us, isn’t

Ashe: Marv, you’ve qualified for Top of the Table 35 times. it? The one thing that we hate to do is prospect. If you find

And you lived in East Liverpool, Ohio. someone whom you can partner with who likes to prospect,

that’s a real gift. But I think it’s the toughest thing that we

Feldman: The booming metropolis. do—finding people and knowing the right questions to ask

them to try to open up cases.

Ashe: It’s not the booming metropolis, not where you had

4 million prospects out your front door. Would you say that Feldman: Some people dislike it. I hated it. There’s a differ-

you owed that to the fact that the Feldman name in East Liv- ence. But I did force myself to do it, and I can do it very, very

erpool, Ohio, just opened doors to all of those prospects? Or well. But it’s like anything else: If you’re going to be success-

were you just a person who loved to prospect on your own? ful, you have to learn to do the things that you truly don’t

like to do, and you have to push through those areas that you

Feldman: I was a masochist; I loved to prospect on my own. don’t do well. And if you can find an alternative way to do it,

Actually, the Feldman name sometimes was a hindrance be- which is what I did, then that works.

cause people would say, “He’s coming to sell me something. I hired a young lady to come in and make the telephone

I’m not going to buy it no matter what he says.” And you do calls for me for prospecting. When I picked up the tele-

get that from time to time. phone, the first thing that happened was, I saw this row of

Our little town had 10,000 people in it. When I was grow- teeth that started to develop on the telephone. And I thought

ing up, it was 25,000. I think today it’s about 8,000. But I that by the time I got it to my ear, it was going to clamp on

knew that I had to develop my own client base. I couldn’t and never let go. So I sent out pre-approach letters, and I had

depend on my father’s because they were all his age. Today, a young lady who made the phone calls. She was wonderful

they’d all be 104 years old. I don’t think they’d be good pros- on the phone. She was better than I was. And she’d make

pects for anything. So I had to concentrate on developing the appointments. And then, if I had to do follow-up, it was

my own clients, and when I moved to East Liverpool with a warm call, not a cold call. So I developed a system that

my wife, I said that this is one of the things that we really worked for me as opposed to being continually frustrated

had to key in on. What you should all know is that I hate trying to do it on my own.

to prospect with a passion. I don’t like it. But I developed a

system that worked for me even when I wasn’t working the Ashe: Both of you have consistently qualified for Top of the

system. And I was able to do what I needed to do. But all my Table. And I’ve heard it said before that the only thing that is

clients were 50 to100 miles away. They weren’t in the East certain is change. So given that the only thing that is certain

Liverpool area, although we had people who would walk in is change, where do you think the future opportunities lie,

and ask if we could do things. and are they as great as the opportunities that have existed

But what I prospected for were people who were in the in the past?

estate planning arena or in business succession. I was a per-

son with blinders on—that’s what I looked for. So I did very Chung: Well, I think the one unique thing is, it’s easy to

little disability. If I had somebody who needed that, I called sometimes think that the future doesn’t include us. But I do

another agent in. If it was a group case, I called in another believe that this is a relational business. And I do believe that

agent. Long-term care didn’t come in until long after I was as much as companies will try to push us out of the equation,

doing other things. But even with long-term care, I called there will always be the need for a good advisor. And we hear

somebody else in to do it, because I wanted to specialize in a lot about relationships and developing that skill set, and I

certain areas and that’s what I concentrated on. truly believe that that’s what differentiates us. Because even as

But it was no different from being in any other place. You we sit here, the products that we have are obtainable every-

go where the prospects are, and you make the effort. where, right? Online, people can do their own research. But

people still need someone to guide them. Because informa-

Ashe: But you didn’t like doing it? tion is not the problem, right? It’s getting people to execute it.

©Million Dollar Round Table Annual Meeting Proceedings | 2017

330 Focus Sessions: Top of the Table

It’s bringing that human element. So I really believe that there I think the opportunities for those of us sitting in this

will always be a role for the advisor. room are absolutely phenomenal at this point. And I think

It’s interesting, because one of the companies that I do a this is a tremendous opportunity to be bringing in new peo-

lot of business with does a lot of online sales. And one day ple because they’re going to be trained from the get-go with

our office got a phone call and the individual said, “If I buy all these compliance issues. They’re not going to ever know

it on the Internet or from you, is it the same price?” And I there was another way to do it. It’s the only thing they’ve

said, “Yes.” He said, “OK, I’m just going to go fill out the ever known, so it’s the norm for them. It’s going to be easy

forms on the Internet.” I said, “Wait. You can get me for free. for them to adapt. So if you have young people whom you’re

Why would you want to fill out the forms and schedule the trying to bring in, successor agents, family members, I think

medical and do it all by yourself when you can have someone right now is fantastic time for that.

guide you through the process?” And then I said, and the

one thing I still haven’t figured out is, “How do you apply Ashe: I was just thinking that one of the strange anomalies on

for a death claim online?” When it matters most we’re there. advice—and this relates to the Department of Labor regula-

tions in the United States—was the encouragement by the

Feldman: It’s hard when you’re dead to apply for the death government of the use of robot advisors because the cost of

benefit. the transaction is low. And yet we have this explosion of new

fiduciary duties, right? And I think Joe Jordan put it best

Chung: Exactly. And your family doesn’t even know what to when he said, “So isn’t it strange? They think that no advice is

do, right? And I think that’s where our real value comes into still better than your advice.”

play. I think many companies think that they can do without They put in all of these fiduciary standards that people

us, and they think that an 800 number will replace us. But I have to adhere to and then say, “But we’re encouraging you

do think that if you’re good at developing relationships and to go someplace where you get no advice.” It’s kind of a

you’re good at providing exceptional service, there will always strange circumstance we live in. It doesn’t make sense, does

be a place for you. it? Not when you think of it that way.

Feldman: I travel around the world. I speak in a lot of dif- Feldman: Well, but it’s government regulations. It’s not de-

ferent countries. And I see a lot of government regulation signed to make sense.

in every country, not just here. But government regulation

is pushing out those people who are marginal in our busi- Ashe: One of the things, too, that I would like your input

ness. The people sitting in this room are not marginal. You on—because we have older advisors in the room and we have

are the best of the best. You represent the best of the fi- younger advisors in the room—is, do you perceive differences

nancial services industry. And when everybody else is gone, in the way in which old and seasoned advisors approach their

you’re still going to be here because you will be able to business, approach industry involvement with associations,

adapt to the new regulations and the new compliance issues and have the same sense of starting with a professional or-

and whatever else is required. And that’s what happened in ganization as soon as they start their careers? Is it something

the UK. It’s got far, far fewer agents and advisors, but the you think that they will grow into? Because I see, certainly

ones who are still there are doing much better than they’ve from my vantage point, decreases in participation. And I’m

ever done in its history. And you heard that on the Main not so sure if it’s just that people don’t feel that there’s value,

Platform today. or is there a whole set of different assumptions that younger

The population base is increasing. There are more and people have versus older people have? Because, in the past,

more people—more people who are earning more money, professional associations were a very big part of our business.

more people who have problems that need to be solved.

And they need to speak with somebody. And while a robot Chung: I know, for me, when I entered the business—and

advisor might work, a robot advisor does not provide sym- certainly it’s changed over the last 30-plus years—we had a

pathy or empathy over the telephone. You do. That gives manager who said, and who happened to be my dad, but he

you the ability to develop trust and confidence, which a set the standards: “You will join me; you will participate; you

robot advisor will never do. will go to MDRT.” I didn’t even think enough to question

Annual Meeting Proceedings | 2017 ©Million Dollar Round Table

An Informal Learning Session with MDRT and Top of the Table Leaders 331

that. I think certainly young people today question every- Feldman: Well, you’ve got two situations. You’ve got what

thing. I think sometimes you just need to do it, and then we have here in the United States and then what you have

you see the value in it. And it makes me very sad that young every place else. Look at Asia where the number of agents is

people aren’t joining professional organizations, because it growing exponentially. I think somebody told me the other

can enrich your life. You think you’re contributing to your day that in mainland China there are 10 million agents. I

industry, but then you gain so much more. know Ping An has 1 million plus agents all by itself, and it

And part of it is, when you join an organization like continues to grow. And, as its middle market grows, there will

NAIFA, I think, you’re making that commitment to support be more and more need. What it needs are more permanent

your industry. And you’re no longer on the sidelines; you’re agents as opposed to temporary.

actually involved and you’re made aware of what’s going on. Part of the problem we have here in the United States is,

I think that young people take that for granted. They think if you go back 20 years ago, there were 1,900 companies.

somebody else is going to pave the road for them; they think Last year, that reduced to under 900 companies. There aren’t

that they don’t need to participate, and yet this wonderful nearly as many companies out there that are in the market

career that we have is going to remain unchanged if they to recruit. A lot of companies are now manufacturers, but

don’t invest their time and energy. So I think that the busi- they’re not distributors. It’s going through the brokerage sys-

ness has evolved, that there isn’t that same level of guidance tems. And you’ve got New York Life and Northwestern and

and the same kind of respect maybe. I used to just do things others that are recruiting, but the average age in the industry

because my elders told me to do it. And then I saw the value is almost 60 years old at this particular point. So normal

down the road. attrition is going to take about 30 percent of our agents over

I think it’s very tough for young people today, because the next eight to ten years.

there are so many options. We had very few options. If you If you work the numbers backward, and let’s assume there

want to be successful, you go down this path. But, today, are 300,000 full-time agents, we’re going to lose 120,000, or

there are so many ways to define success, and there are so 30 to 40 percent, which means that, over a 10-year period,

many ways to reach it. I think that, unless a young person you’ve got about 12,000 agents per year that are disappear-

has someone guiding them, the path is very crooked. ing. Unfortunately, retention in our industry is still only 15

percent at the end of four years. Work the numbers back-

Ashe: Let me ask a question if there are people in the audi- ward. In order to have 12,000 agents after four years, you

ence from outside of North America. Do your countries have have to start with 80,000 hires. Can anybody guess how

an increased or a decreased participation in professional as- many agents were hired in the last year or so by the few com-

sociations? panies that are still hiring? Between 30,000 and 34,000 total

agents. And that includes the State Farms, the Allstates, all

Audience Question: Big insurance companies, like New of the P&C companies—that’s the total. We need 80,000.

York Life, Mass Mutual, and Northwestern Mutual, have, We’re getting 30,000 to 34,000.

year after year, fewer and fewer and fewer and fewer agents Something has to change. Or it just represents one tre-

in the field. What’s going to happen 10, 15, 20 years from mendous opportunity for the young people coming into the

now? What does corporate have to do in order to attract more business. There are fewer and fewer of us needing to service

people and repay the business? I see, in my office, 10 people an ever larger population base that’s continuing to earn more

come in, and maybe one is going to stay at the end of the year and more money and have discretionary funds to spend.

and, five years later, maybe will not be around. What’s going That’s worldwide.

to happen? It is a problem. As I said before, this is a tremendous opportunity for all

Also, I’m the only one coming to MDRT from my gen- of us because our competition is going away. For old guys,

eral office out of 80 agents. The last meeting we had with how many more years are they going to be able to run hard

NAIFA was about six months ago. I’m preoccupied with that and do the things that they need to do? I’m in the process of

kind of thing because, as Mr. Feldman said, the need of the turning my entire practice over to my successor agent who

marketplace is there. Who’s going to serve that? Who’s going happens to be my niece—third generation in our business.

to push them? Who’s going to guide them to make the deci- And now, when a client calls me, I find out what he or she

sion and implement a financial plan? needs and I’ll say, “I’ll have Wendy call you.” And I work

©Million Dollar Round Table Annual Meeting Proceedings | 2017

332 Focus Sessions: Top of the Table

with her to do what needs to be done. But I want continuity Feldman: But you wanted to sell them something.

in the family. The opportunity is there.

Chung: No, I was really sincere. I wanted a relationship at

Ashe: My younger son is in the business as well. the time. That’s really what I was looking for—a relationship.

And so you still get rejected. I had one woman I called four

Feldman: There are issues; there are problems. Nobody has times every six months. And she kept saying no, and when

really addressed how they’re going to resolve that. They’re she finally said yes, years later, I said, “Why did you say yes?”

never going to be able to hire enough agents to replace what She said, “Because I knew if I told you to call back in six

we currently have. But I think that once everybody adjusts to months, you would, so I was trying to get it over with.”

the new world of compliance, and with the DOL and other So you still need a system, but I didn’t really make

things that are going on, people will be able to become more cold calls. What’s interesting is, my dad made it very hard

proficient and more efficient, and we’ll be able to continue to for me the first three years in the business. And the other

grow practices. agency managers used to tease because, really, he was try-

ing to push me out of his office. But when you’re 22 years

Audience Question: My question is for both of you who old and someone tells you you can’t do it, it’s motivation to

have parents in the business. I have a son who is 21 whom do it, right? I didn’t have my own office; I didn’t have my

I’m looking to bring into the business. Or let me rephrase own phone. But what I did have was that I really believed in

that—he wants to get into the business. But with both of what life insurance could do. I really believed in the prod-

your parents being in the business, did they make it harder, ucts, and I really felt like I was helping people. That was

such as, “I had to figure it out, so you’re going to have to fig- my motivation.

ure it out”? Or was there coaching and advice? But fast-forward. I have a son now who is 27 years old. He

graduated from college, and his parents say to him, “Well,

Chung: What’s interesting is, I did have a father in the busi- you have two choices. You can move home and live free

ness. And my father did not have a college education. He sac- for a year and look for a job. Or you can stay in California

rificed to make sure I had one. I went to college, and I started and find a job.” So he called me up one day, and he said, “I

law school. And it was after my first year of law school that decided I’m staying in California, and I have a job.” And I

I started selling insurance. I didn’t think it was going to be a said, “And what are you going to do?” He explained it to me,

career at the time; I thought it was a summer job. And then and I said, “Spencer, that’s not a job; that’s an opportunity.”

I decided not to go back to law school. My father was devas- Well, it turns out he is in the insurance business. I wouldn’t

tated at the time. He just kept saying to me, “I can’t believe say he’s good at it, but his manager makes him prospect.

I spent all this money educating you, and you want to do And, for some reason, he listens to her. So during the first

what?” It wasn’t that he didn’t think it was a great career, be- year in the business, he could not go home on Friday until

cause obviously it was and it serves him well. He just thought he had 12 appointments. And his record is 95 phone calls for

he wanted an easier life for me. So he kept saying, “Are you one appointment.

sure you want to do this? Because this is hard.”

Like Marvin, I hated to prospect. But my leads came Feldman: That’s persistency.

from orphan policyholders. I started with an agency that was

very established and had a huge book, but no one had been Chung: That is. And I used to say to Steve, “I think this kid

servicing many of these clients for decades. And so I didn’t has a loose screw.” Who would keep calling after that? But,

have to make cold calls because people actually had a policy. I’m happy to say, it’s been four years and he’s still in the busi-

So what basically happened was, I would call them, and I ness. For someone who has a child, I think this business is a

would say, “Your account has been transferred to me. My wonderful opportunity, and Brian can speak to it because his

name is Adelia. I’d like to meet with you to make sure the son is in the business. But I also do think it’s a tough business,

policy is still doing what you intended it to do.” and you can’t want it for your child. The child has to want it

Now, I got rejections because people would say, “Well, for himself.

you just want to sell me something.” And I said, “No, no, no,

I’m really sincere about just wanting to explain this to you.” Feldman: Absolutely.

Annual Meeting Proceedings | 2017 ©Million Dollar Round Table

An Informal Learning Session with MDRT and Top of the Table Leaders 333

Chung: This isn’t easy, but it becomes your purpose and your this person that was for $1 million. Well, like anybody else,

mission. It is nice to have someone in the family understand I’d never seen a million-dollar illustration that I was going

what you’re doing. And I think that’s what was helpful to me to go present.

as much as my dad initially didn’t support it. Once he knew And the only good thing that happened about that par-

I was serious, he understood what it took in this business and ticular appointment was that I went. That was it. I didn’t

he was able to support me in that way. make the sale, but I learned a lot. I learned to think big, and

I learned to understand from my father, and I remember him

Feldman: I’ll give you a quick story about my starting in the telling me this: The problems of the clients he worked with,

business because my dad had such a high profile in the indus- from a perspective standpoint, are the same as somebody else

try. I graduated from Ohio State on March 16. I got married who needs just a $5,000 or a $1,000 or a $15,000 or $20,000

on March 18. I started full-time with New York Life on March policy. The only difference is that their problem is bigger. It’s

27. And I started in Columbus, Ohio, which was 200 miles got more zeros on it. The solution has more zeros on it. And

away from my father’s operation, for two reasons. Number once I learned that and I understood that and I accepted it,

one, my wife was still in school. And, number two, I needed it was no longer a problem for me to go out and call on those

to prove to myself and the rest of the industry that I was either types of people. And that’s when I restructured how I was

going to fail or succeed on my own. I did well enough that prospecting.

and after two and a half years, New York Life came to me and

said, “We’d like you to come into the management program.” Audience Question: This is my 21st year in the business.

And, of course, my dad said, “That’s where people go who One thing I never did was qualify for Court of the Table.

can’t work in sales.” That was OK; I still wanted to do this. So I was wondering, is there any magic idea that I can get?

Then, I finally came back into the field, when my mother For example, my clients are all professional doctors and im-

developed cancer. Just before she died, he said, “Please come migrants. Maybe I’m not a good closer. I am a great door

back.” We moved back to our little town of East Liverpool. opener, but I don’t close. I don’t go for big numbers. I’m not

But I still remember two things. One was the very first a good salesperson.

time I went on my very first interview as a brand-new agent.

Now remember, I grew up with Ben Feldman. When we Feldman: It doesn’t matter whether you’re working on large

sat down for dinner, we talked life insurance. When we sat numbers as far as the size of the case or large numbers based

down for breakfast, we talked life insurance. When we went on the number of people you’re seeing. You just have to put

on vacation, we talked life insurance. I don’t think my dad it in perspective. If your average size case is $3,000 and you

could talk about anything without life insurance coming in want to make a goal, you divide the goal by 3,000, and that’s

somewhere. He loved to fish. I’m sure if he could have sold how many cases you have.

the fish a policy, he would have done that too. But if your average case is $30,000 and your goal is there,

But that very first interview that I went out on, I can you divide 30 into whatever that goal is. And maybe it’s a

remember telling myself, I’m not going to say what my dad lot fewer cases; they’re just much bigger. The problem with

says. I’m not going to do what my dad did. I’m going to do this bigger cases is, they’re much more complicated and harder

on my own. And I walked out, after I was all done, and said, to get through.

“Oh crap, I said it just like my dad.” But I closed the sale. If I were to do anything over again, I would concentrate

So it worked. much more on case rate than on case size.

When I returned back into my dad’s operation after seven

years, I developed enough skills that he pretty much left me Audience Question: It’s not that my face amount is small.

alone and let me do what I wanted to do. He told me there I do $1 million, $10 million, but mostly term. And then, of

was a case he had been working on, and his personality and course, the DI and retirement. I do all areas of planning. The

the individual he called on didn’t mesh. He said, “Marv, I problem is that most of my audience, for some reason, are not

think your personality will do better on this case.” Now, I’d into a permanent life insurance solution.

just come from management where I was training people on

how to sell $25,000 and $50,000 policies. Not premiums— Feldman: There’s nothing wrong with term. Term is your in-

policies. And he handed me an illustration to go present to ventory of future business. So, at some point, the term makes

©Million Dollar Round Table Annual Meeting Proceedings | 2017

334 Focus Sessions: Top of the Table

them clients. And you have to have clients before you can go have friends. So, for me, that’s really how it’s evolved. Again,

back and call on them again. So you make them clients, and I would just pick up more orphans and reach out to them.

then you go back and call on them over and over and over,

and you educate them on the importance of solving a perma- Ashe: I’d like to insert one thing here just because I happen to

nent problem with a permanent product. have this information that I was going to pass on to someone

Now, if they only have a temporary problem, term insur- else later. I’ll ask the question of the people in the room just

ance is fine. But what if they’re looking to do things for in general. Which group of people in members of the Million

estate planning purposes? What if it’s something perhaps Dollar Round Table—a regular member, Court of the Table,

on a buy-sell succession planning in a medical practice? or Top of the Table member—has the most lives? In 2015,

Those are where permanent products work. If they have a and I’ve tracked this for 16 years, a regular member of the

special needs child, they need permanent products because Million Dollar Round Table wrote on average 163 lives. An

that child is going to be around. It’s a matter of educating average for Top of the Table is 715 lives.

your clients as to how the permanent product fits in their The reason I’m saying that is, we have a perception that

particular situation. So it’s problem, solution, problem, solu- when people reach Top of the Table, they’re writing these

tion—that’s what you have to do. huge cases on 20 or 30 lives. And consistently, from the time

that I was President of the Million Dollar Round Table,

Audience Question: I want to hear each of your specific looking at this back in 2000, every single year Top of the

languages on how you prospect, because obviously the cli- Table members have more lives than any other category of

entele that you work with is much different from when we membership. And if you look even at, well, 163 to 700, is

started 25 years ago, for anybody that’s growing. To have a there a linear progression on income? No. It’s an exponential

bigger leap or those quantum leaps, what specifically are you increase on income. So they could do four times the number

articulating when you’re asking for prospects? Are you defin- of lives, but they have eight times the amount of the com-

ing them? pensation. Why? Because in the prospecting process, from

doing a lot of prospecting, they just bump into more cases

Chung: Again, I’m really no good at prospecting. My focus because of the activity.

has always been with the clients I have, trying to create mem- And there’s this perception: Don’t work harder; work

orable experiences for them. We do that by trying, and it’s the smarter. My sense has been, it’s always work smarter and

little things. When they come into the office, everyone calls harder. And then you develop the lives that generate that

them by name. It’s touching them twice a year, at least, with a type of activity.

birthday card, and I usually send Thanksgiving cards. We do

client appreciation events as well. Chung: I can validate that. Marv just said it’s a bunch more

But our referrals have come organically. If there’s one zeros. It really is true. When I attended my first Top of the

benefit of being a dinosaur in this business, it is the children, Table meeting, I think I wrote 600 lives that year. And I met

the families that we sold policies on when those children people at that meeting who did it on 20 lives. And, at that

were young. They’ve now grown up. We’ve been with the point, I had never sold a million-dollar policy. I remember

family for 20 to 30 years. Just the other day, I had a girl calling home—it was a meeting in Vegas—and I said to my

come in, and she had just graduated from med school. She dad, “I don’t belong here because I did a small group break-

said, “Adelia, I don’t know why I’m here, but my dad said I out session, and they’re talking about premium dollars, and I

need to talk to you.” That happens a lot. When I was born, hadn’t even sold face amounts that large.” I said, “I don’t be-

my parents bought me a policy, and now I have a baby, so I long here; I think I should leave.” And he said, “The concepts

want to buy my baby a policy. are the same. It’s just that they’re selling policies with more

A lot of the referrals right now just come organically. I zeros.” And it really is true: The sales process is exactly the

wish I could ask for referrals, but the few times I’ve been same. It’s just that, as Marv said, there are larger problems. I

able to and know what to say, it’s then that I can’t make the think many times we limit it. But to me, it’s more about ac-

follow-up call. So it does happen just by itself if you continue tivity than policy size. And, when I started, my goal was one

to maintain relationships. As the children grow up, you app a week, and I didn’t care how big or small it was. It was

become the life insurance agent for that family. Or if they just the activity, because the size will come with it.

Annual Meeting Proceedings | 2017 ©Million Dollar Round Table

An Informal Learning Session with MDRT and Top of the Table Leaders 335

Audience Question: I’m pretty new in the business. I’m the same case at the same time? How did you negotiate that,

less than two years. My question is, with all of your experi- or how did you work with that?

ences and all of your knowledge, if you’re going to redo

it, what would be your first three months’ or six months’ Chung: I really didn’t do any joint cases with my dad be-

business plan? cause he was a manager. But I do have a business partner.

And Brian is 14 years younger than I, so obviously our styles

Feldman: If I were to start over again, I would go back to law are very different. But the reason we’ve been together now

school, but not to be an attorney. I wouldn’t want to prac- for 10 years, the reason it’s worked, is our values are exactly

tice law. But I can tell you, if you’re dealing with somebody the same. But the way we approach the business is very dif-

who is an attorney and they’re in this business, they carry a ferent. He doesn’t use paper at all. He thinks it’s really cool

tremendous amount of weight and respect. And I thought to do his entire presentation on an iPad and then to email

about going back to law school when my daughters were in his client the disk, the fob—whatever—the file. I still use

law school just to get the degree. So if I were planning it paper. But it works.

again, I would go back and start in law school, get the degree, I still remember the first day he came into the office. He

and then I would go right into personal production. But I said, “Why do you have a pencil sharpener?” I said, “Because

would continue to prospect in the business market because that’s how you sharpen pencils.” The second day he walked

the problems are there. And they’re bigger problems. So I’d in with a mechanical pencil, and he said, “This is what we

like to write those types of cases, more of those cases, more use.” I tried it, and it doesn’t work. It’s invigorating to have

zeros on the cases, more zeros on the premiums. That’s where a young person in the office because he makes me question

I would concentrate my prospecting, and that’s how I would things. And, for our clients, I always tell them they benefit

develop my business. because they get two perspectives, but the right answer is in

the middle. So I see it as a plus not a negative.

Audience Question: You both touched on this quite a bit,

but I also joined my father in the business. And one thing I’d Ashe: And with that I would like to thank you all for your

like to hear a little bit more from you is, how did you navigate kind attention and our presenters for being so open in all the

the differences in your styles when you were both working on things that help to make them successful.

©Million Dollar Round Table Annual Meeting Proceedings | 2017

You might also like

- The Leader Who Had No Title: A Modern Fable on Real Success in Business and inFrom EverandThe Leader Who Had No Title: A Modern Fable on Real Success in Business and inRating: 4.5 out of 5 stars4.5/5 (75)

- Think Less Live MoreDocument51 pagesThink Less Live MoreWayne Chu100% (1)

- Abundance On Demand: Five Easy Steps to Master The Inner Game of MoneyFrom EverandAbundance On Demand: Five Easy Steps to Master The Inner Game of MoneyRating: 1 out of 5 stars1/5 (1)

- 10 Interview Questions and Answers - DAILY JOBS Dubai UAE - New Job OpeningsDocument27 pages10 Interview Questions and Answers - DAILY JOBS Dubai UAE - New Job OpeningsRaza ButtNo ratings yet

- A Study On Supply Chain and Logistics Managemernt For K.M.B GraniteDocument50 pagesA Study On Supply Chain and Logistics Managemernt For K.M.B GraniteRaja Thrisangu100% (1)

- Causes and Effects of The Cold WarDocument2 pagesCauses and Effects of The Cold WarkhanrrrajaNo ratings yet

- All Fired Up: Optimize Mental Wellness to Ignite Joy and Fuel Peak PerformanceFrom EverandAll Fired Up: Optimize Mental Wellness to Ignite Joy and Fuel Peak PerformanceNo ratings yet

- Mentally Fit: A Guide to Engaging the Mind, Body and Spirit: A Holistic Approach to WellnessFrom EverandMentally Fit: A Guide to Engaging the Mind, Body and Spirit: A Holistic Approach to WellnessNo ratings yet

- Tenacious Abundance: Simple Habits & Hacks for Being Happy, Healthy, Wealthy & WiseFrom EverandTenacious Abundance: Simple Habits & Hacks for Being Happy, Healthy, Wealthy & WiseNo ratings yet

- From Night to Light: My Brain Injury Journey from Despair to Hope, Faith and JoyFrom EverandFrom Night to Light: My Brain Injury Journey from Despair to Hope, Faith and JoyNo ratings yet

- Supercharge Your Life After 60: 10 Tips to Navigate a Dynamic DecadeFrom EverandSupercharge Your Life After 60: 10 Tips to Navigate a Dynamic DecadeNo ratings yet

- Imploded You-niverse: Thoughts on Fear, Failure & the Pitfalls of PerfectionFrom EverandImploded You-niverse: Thoughts on Fear, Failure & the Pitfalls of PerfectionNo ratings yet

- The Way to a Better Day: Dedicated to Those Hungry for More in LifeFrom EverandThe Way to a Better Day: Dedicated to Those Hungry for More in LifeNo ratings yet

- Unfinished: Unlock Your Superpowers, Live with Purpose, and Discover Limitless PossibilitiesFrom EverandUnfinished: Unlock Your Superpowers, Live with Purpose, and Discover Limitless PossibilitiesNo ratings yet

- Dancing with Fear and Confidence: How to liberate yourself and your career in mid-lifeFrom EverandDancing with Fear and Confidence: How to liberate yourself and your career in mid-lifeNo ratings yet

- Focus on Better: A Real Deal Guide to Becoming a Match for Sustained Happiness, Success, and Fulfillment.From EverandFocus on Better: A Real Deal Guide to Becoming a Match for Sustained Happiness, Success, and Fulfillment.No ratings yet

- Core, Communication, Leadership: Building Blocks for a Successful Leader!From EverandCore, Communication, Leadership: Building Blocks for a Successful Leader!No ratings yet

- The Simple Shift: How Useful Thinking Changes the Way You See EverythingFrom EverandThe Simple Shift: How Useful Thinking Changes the Way You See EverythingNo ratings yet

- Peace, Possibilities and Perspective: Peace, Possibilities and PerspectiveFrom EverandPeace, Possibilities and Perspective: Peace, Possibilities and PerspectiveNo ratings yet

- A Wink from a Guru: How I overcame Anxiety and reclaimed my lifeFrom EverandA Wink from a Guru: How I overcame Anxiety and reclaimed my lifeNo ratings yet

- Life Skills for Young Adults: How to Survive Each Day and the Rest of Your LifeFrom EverandLife Skills for Young Adults: How to Survive Each Day and the Rest of Your LifeNo ratings yet

- Dear Charlie: An Inspirational True Story of a Single Mother and Her Ability to Live a Productive Life with Stage Iv Cancer (Charlie).From EverandDear Charlie: An Inspirational True Story of a Single Mother and Her Ability to Live a Productive Life with Stage Iv Cancer (Charlie).No ratings yet

- Thinking Just Hurts the Team: Find Happiness and Ignite Your Full Potential by Taking the Principles of Yoga to the WorkplaceFrom EverandThinking Just Hurts the Team: Find Happiness and Ignite Your Full Potential by Taking the Principles of Yoga to the WorkplaceNo ratings yet

- Rediscover Your Greatness: A Guide to an INSPIRING and FULFILLED LifeFrom EverandRediscover Your Greatness: A Guide to an INSPIRING and FULFILLED LifeNo ratings yet

- I Want a New Career...Now What Do I Do?: The Ultimate Career Transformation Guide for Figuring Out What You Want to Do & How to Get Paid for It!From EverandI Want a New Career...Now What Do I Do?: The Ultimate Career Transformation Guide for Figuring Out What You Want to Do & How to Get Paid for It!No ratings yet

- In Her Own Words: Women’s Wisdom to Move You from Surviving to ThrivingFrom EverandIn Her Own Words: Women’s Wisdom to Move You from Surviving to ThrivingNo ratings yet

- The Theory & Practice of Well-Being: Your Comprehensive & Actionable Guide to the Good LifeFrom EverandThe Theory & Practice of Well-Being: Your Comprehensive & Actionable Guide to the Good LifeNo ratings yet

- When In Doubt, Delete It!: 36 Life Changing Edits That Will Add More Clarity, Success, and Joy to Your LifeFrom EverandWhen In Doubt, Delete It!: 36 Life Changing Edits That Will Add More Clarity, Success, and Joy to Your LifeNo ratings yet

- Hannah's Christmas Gift: A Story About Your Life And The Choices You Make!From EverandHannah's Christmas Gift: A Story About Your Life And The Choices You Make!No ratings yet

- 28 Ways of Compassion: A Guide to Transformation and Leadership for a Relationship-Centric Healthcare CultureFrom Everand28 Ways of Compassion: A Guide to Transformation and Leadership for a Relationship-Centric Healthcare CultureNo ratings yet

- LD Steve TurpieDocument4 pagesLD Steve TurpieKhurshedNo ratings yet

- Park Road Plaza: Lessons in Life, Leadership and Generational DiversityFrom EverandPark Road Plaza: Lessons in Life, Leadership and Generational DiversityNo ratings yet

- The Align Method 5 Movement Principles For A Stronger Body, SharperDocument388 pagesThe Align Method 5 Movement Principles For A Stronger Body, Sharperivano monsalveNo ratings yet

- A Beautiful Choice: How to Guide Your Child Through Life-Threatening Illness, Succeed and Connect with Your ChildFrom EverandA Beautiful Choice: How to Guide Your Child Through Life-Threatening Illness, Succeed and Connect with Your ChildNo ratings yet

- Woosah: A Survival Guide for Women of Color Working in CorporateFrom EverandWoosah: A Survival Guide for Women of Color Working in CorporateNo ratings yet

- You don't have to shout to Stand Out: Networking Conversations that Ignite Interest and Create Connections (Techniques from a quiet entrepreneur)From EverandYou don't have to shout to Stand Out: Networking Conversations that Ignite Interest and Create Connections (Techniques from a quiet entrepreneur)No ratings yet

- Turn Devastation into Motivation: The Grass Really Is Greener...From EverandTurn Devastation into Motivation: The Grass Really Is Greener...No ratings yet

- The Subconscious, The Divine, and Me: A Spiritual Guide for the Day-to-Day PilgrimFrom EverandThe Subconscious, The Divine, and Me: A Spiritual Guide for the Day-to-Day PilgrimRating: 5 out of 5 stars5/5 (2)

- August 2013Document8 pagesAugust 2013api-141776464No ratings yet

- General Sessions: Main PlatformDocument4 pagesGeneral Sessions: Main PlatformAlejandro HernándezNo ratings yet

- How To Reach The Top of The Table and Stay There: This Session Was Presented in HindiDocument3 pagesHow To Reach The Top of The Table and Stay There: This Session Was Presented in HindiAlejandro HernándezNo ratings yet

- Matter: Demographics, and I Started at The Intergenerational TransferDocument5 pagesMatter: Demographics, and I Started at The Intergenerational TransferAlejandro HernándezNo ratings yet

- Forget Willpower: How To Achieve More For Your Business: Annual Meeting ProceedingsDocument3 pagesForget Willpower: How To Achieve More For Your Business: Annual Meeting ProceedingsAlejandro HernándezNo ratings yet

- Moving To Great: General Sessions: Main PlatformDocument5 pagesMoving To Great: General Sessions: Main PlatformAlejandro HernándezNo ratings yet

- How To Make Millions Each Year and Work Just 50 Days: Annual Meeting ProceedingsDocument6 pagesHow To Make Millions Each Year and Work Just 50 Days: Annual Meeting ProceedingsAlejandro HernándezNo ratings yet

- Hanna's Letter To Santa and Other Great Conversations About Critical Illness InsuranceDocument4 pagesHanna's Letter To Santa and Other Great Conversations About Critical Illness InsuranceAlejandro HernándezNo ratings yet

- Tolani1 PDFDocument2 pagesTolani1 PDFAlejandro HernándezNo ratings yet

- Wadswrth PDFDocument6 pagesWadswrth PDFAlejandro HernándezNo ratings yet

- TITLEPAGDocument1 pageTITLEPAGAlejandro HernándezNo ratings yet

- Everybody Knows Joe: 11 Keys To Impactful Networking: Focus Sessions: MarketingDocument5 pagesEverybody Knows Joe: 11 Keys To Impactful Networking: Focus Sessions: MarketingAlejandro HernándezNo ratings yet

- Creating Exceptional Client Experiences: Special SessionsDocument3 pagesCreating Exceptional Client Experiences: Special SessionsAlejandro HernándezNo ratings yet

- Major Scale Pattern in 3rdsDocument1 pageMajor Scale Pattern in 3rdsAlejandro HernándezNo ratings yet

- The Contemporary World Lesson 2Document32 pagesThe Contemporary World Lesson 2WENDELL VERGARANo ratings yet

- ObliCon Reviewer SMDocument111 pagesObliCon Reviewer SMJessa Marie BrocoyNo ratings yet

- Fforde Economic StrategyDocument29 pagesFforde Economic StrategyDinhThuyNo ratings yet

- Milkfish Tilapia TunaDocument5 pagesMilkfish Tilapia Tunatonbar000No ratings yet

- Anatomy and Physiology Outline PDFDocument2 pagesAnatomy and Physiology Outline PDFHampson MalekanoNo ratings yet

- NCM 109 SKILLS LAB DAY 1 Laboratory and Diagnostics22Document55 pagesNCM 109 SKILLS LAB DAY 1 Laboratory and Diagnostics22Joseph DusichNo ratings yet

- Dead Poets SocietyDocument1 pageDead Poets SocietyNagy ZenteNo ratings yet

- PE-3-badminton ModuleDocument24 pagesPE-3-badminton ModuleBob Dominic DolunaNo ratings yet

- Regulations ON Academic Matters: Tezpur UniversityDocument21 pagesRegulations ON Academic Matters: Tezpur UniversitybishalNo ratings yet

- pr40 03-EngDocument275 pagespr40 03-EngLUZ CERONNo ratings yet

- HS-193070003 Exxon Oil Mobilgrease 28 CertificatesDocument3 pagesHS-193070003 Exxon Oil Mobilgrease 28 Certificatesflacuchento2013No ratings yet

- Bernardo Carpio - Mark Bryan NatontonDocument18 pagesBernardo Carpio - Mark Bryan NatontonMark Bryan NatontonNo ratings yet

- Types of Volcanoes - ShapeDocument2 pagesTypes of Volcanoes - ShapejeffersonNo ratings yet

- Humanities SculptureDocument15 pagesHumanities SculpturehungrynomadphNo ratings yet

- BearingsDocument52 pagesBearingsrahul singhNo ratings yet

- Bearing CapacityDocument4 pagesBearing CapacityahmedNo ratings yet

- 2019 Admax CataDocument30 pages2019 Admax CataEVENTIA AFRICANo ratings yet

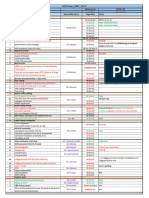

- Hach - MWP (Plan Vs Actual) Status - 22 Oct-1Document1 pageHach - MWP (Plan Vs Actual) Status - 22 Oct-1ankit singhNo ratings yet

- FRC Team 2637, Phatnom Catz, Techbinder 2023 - 2024 CrescendoDocument17 pagesFRC Team 2637, Phatnom Catz, Techbinder 2023 - 2024 CrescendoShrey Agarwal (Drago Gaming)No ratings yet

- English NotesDocument39 pagesEnglish NotesNorAini MohamadNo ratings yet

- CAF5 FAR1 QB 2017-Castar - PK PDFDocument210 pagesCAF5 FAR1 QB 2017-Castar - PK PDFYousaf JamalNo ratings yet

- Use of Digital Games in Teaching Vocabulary To Young LearnersDocument6 pagesUse of Digital Games in Teaching Vocabulary To Young LearnersRosely BastosNo ratings yet

- Prog Copywriting Exercise 10Document3 pagesProg Copywriting Exercise 10azertyNo ratings yet

- Unit 19-20Document10 pagesUnit 19-20Wulan AnggreaniNo ratings yet

- PACEDocument23 pagesPACEGonzalo SkuzaNo ratings yet

- Summer ReadingDocument1 pageSummer ReadingDonna GurleyNo ratings yet

- Business Law Syllabus (BLT)Document4 pagesBusiness Law Syllabus (BLT)Glene NallaNo ratings yet