Professional Documents

Culture Documents

Institute of Management Technology: Centre For Distance Learning

Uploaded by

abhimani5472Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Institute of Management Technology: Centre For Distance Learning

Uploaded by

abhimani5472Copyright:

Available Formats

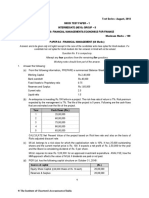

INSTITUTE OF MANAGEMENT TECHNOLOGY

CENTRE FOR DISTANCE LEARNING

GHAZIABAD

End-Term Examinations – December 2010

Subject Code : IMT-07 Time Allowed : 3 Hours

Subject Name: Working Capital Management Max. Marks : 70

Notes: (a) Answer any FOUR questions from SECTION-A and CASE STUDY as given in SECTION-B.

Each Question (SECTION-A) carries 14 MARKS and (SECTION-B) Case Study carries 14 MARKS.

(b) For students enrolled before January 2008, the Question Paper would be treated for 50 marks instead of 70 marks.

(c) No doubts/clarifications shall be entertained. In case of doubts/clarifications, make reasonable assumptions and proceed.

SECTION-A MARKS : 56

Q.1 Current assets are financed through a mix of short term and long term funds. Discuss the statement and

explain the various approaches in this context.

Q2 Write short notes on the following:

a. Gross Operating cycle

b. Certificate of Deposit

c. Forfaiting

Q3 Raina Paint Company uses 60,000 gallons of pigment per year. The cost of ordering is Rs400 per order, and

the cost of carrying the pigment in inventory is Rs 2 per gallon per year. The firm uses pigment at a constant

rate every day throughout the year.

a) Calculate the EOQ

b) Calculate the total cost of the plan suggested by the EOQ

c) Determine the total number of orders suggested by this plan.

d) Assuming that it takes 20 days to receive an order once it has been placed, determine the reorder point

in terms of gallons of pigment by using 360 day in a year.

Q4 Sadhan Nitro Company currently maintains a centralized billing system to handle average daily collections of

Rs 4,50,000. The total time for mailing , processing, and clearing has been estimated at 4 days.

a) If the companys opportunity cost on short term funds is 15%, how much this time lag of 4 days costing

the company?

b) If management has designed a system of lock boxes with regional banks that would have reduced the

float by 1.5 days & centralized billing system expense by Rs52000 annually, what is the largest total

amount of required compensating balance that the firm would be willing to accept with the lock box

management?

Q5 A firm is considering changing its credit policy from net 20 to 2/10 net 30. Its sales should increase from Rs 5

lakh to Rs 7 lakh, its cost of goods sold will go from 55% to 50% of sales. Miscellaneous administrative cost

will remain steady at Rs 40000, but collection cost will increase from Rs 20,000 to Rs30000 and bad debt

losses will go from 5 to 10% of its average accounts receivables, 40% of the customers are expected to take

the discount. This firm currently has debt of Rs 2 lakh at 6%, which include the financing costs for the funds

currently tied up in receivable. If the balance in receivables increases or decreases with the new policy, the

extra costs of funds tied up will be calculated at the 10% estimated cost of the firm’s new debt.

a) What is the likely receivable balance with each policy?

b) What will be the forecasted net income after taxes with each policy?

Q6 What is money market? Explain why there is a critical need for money market instruments.

Q7 What is conservative approach to financing firm’s funds requirement? What kind of profitability-risk-tradeoff is

involved?

ETE-Dec. 2010 Page 1 of 2 IMT-07

SECTION-B (Case Study) MARKS : 14

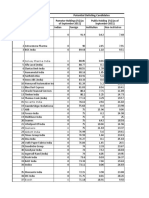

A Performa cost sheet provides the following particulars:

Particulars Amount per unit (Rs)

Elements of cost

Raw material 80

Direct Labour 30

Overhead 60

Total Cost 170

Profit 30

Selling Price 200

The following further particulars are available:

Raw Material in stock, on average, one month; Material in process (completion stage 50%), on average, half a

month; Finished goods in stock, on average, one month.

Credit allowed by suppliers is one month; credit allowed to debtors is two months; average time lag in payment of

wages is 1.5 weeks and one month in overhead expenses; one fourth of the output is sold against cash; cash in

hand & cash at bank to be maintained at Rs 3,65,000.

You are required to prepare a statement showing the working capital needed to finance a level of activity of

1,04,000 units of production. You may assume that production is carried on evenly through out the year, and wages

and overheads accrue similarly. For calculation purpose, 4 weeks may be taken as equivalent to a month.

ETE-Dec. 2010 Page 2 of 2 IMT-07

You might also like

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItFrom EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNo ratings yet

- Ininstitute of Management Technology: Centre For Distance LearningDocument2 pagesIninstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Leveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteFrom EverandLeveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteNo ratings yet

- Financial Management Exam QuestionsDocument2 pagesFinancial Management Exam QuestionstdewanjeeNo ratings yet

- 8) FM EcoDocument19 pages8) FM EcoKrushna MateNo ratings yet

- BComDocument3 pagesBComChristy jamesNo ratings yet

- AFM - IMM 110 (II) April 20, 2021Document3 pagesAFM - IMM 110 (II) April 20, 2021Aashish RanjanNo ratings yet

- GTU Exam - Financial Management QuestionsDocument3 pagesGTU Exam - Financial Management QuestionsMRRYNIMAVATNo ratings yet

- IMT-59 FinDocument1 pageIMT-59 Finrranjan64No ratings yet

- IMT 07 Working Capital Management M2Document7 pagesIMT 07 Working Capital Management M2solvedcareNo ratings yet

- 820003Document2 pages820003komalbhadani77No ratings yet

- MS-4 (2007)Document6 pagesMS-4 (2007)singhbaneetNo ratings yet

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Corporate_Finance___I_mA6Q2VgQxb.pdfDocument4 pagesCorporate_Finance___I_mA6Q2VgQxb.pdfvikas4433No ratings yet

- CAP II Group II June 2022Document97 pagesCAP II Group II June 2022aneupane465No ratings yet

- FM 02Document3 pagesFM 02Sudhan RNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall 2012 ExamsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall 2012 Examsmagnetbox8No ratings yet

- P1 Question June 2019Document6 pagesP1 Question June 2019S.M.A AwalNo ratings yet

- MBA 2nd-4th Sem Internal TestDocument3 pagesMBA 2nd-4th Sem Internal TestNritya khoundNo ratings yet

- IMT-59 Financial Management M2Document6 pagesIMT-59 Financial Management M2solvedcareNo ratings yet

- 301 FMDocument3 pages301 FMSamrudhi ZodgeNo ratings yet

- PACE1907KD FIN4124 AssgnmtDocument5 pagesPACE1907KD FIN4124 AssgnmtCarine SowNo ratings yet

- Corporate Finance Exam QuestionsDocument2 pagesCorporate Finance Exam QuestionsIsha KhannaNo ratings yet

- ADL 03 Accounting For Managers V3Document20 pagesADL 03 Accounting For Managers V3solvedcareNo ratings yet

- (2008 Pattern) PDFDocument231 pages(2008 Pattern) PDFKundan DeoreNo ratings yet

- 820003Document3 pages820003Minaz VhoraNo ratings yet

- MML 5202Document6 pagesMML 5202MAKUENI PIGSNo ratings yet

- 2820003Document5 pages2820003hetvi bhutNo ratings yet

- HW3MGT517Document3 pagesHW3MGT517Jaya PaudwalNo ratings yet

- Sem IV (Internal 2010)Document15 pagesSem IV (Internal 2010)anandpatel2991No ratings yet

- Financial Management (MBOF 912 D) 1Document5 pagesFinancial Management (MBOF 912 D) 1Siva KumarNo ratings yet

- Costing FM Model Paper - PrimeDocument17 pagesCosting FM Model Paper - Primeshanky631No ratings yet

- FM - Assignment Batch 19 - 21 IMS IndoreDocument3 pagesFM - Assignment Batch 19 - 21 IMS IndoreaskjdfaNo ratings yet

- Pravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperDocument9 pagesPravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperPravinn_MahajanNo ratings yet

- F9 RM QuestionsDocument14 pagesF9 RM QuestionsImranRazaBozdar0% (1)

- Module Code FIN 7001 Module Title: Financial ManagementDocument9 pagesModule Code FIN 7001 Module Title: Financial ManagementTitinaBangawaNo ratings yet

- 01 s303 CmapaDocument3 pages01 s303 Cmapaimranelahi3430No ratings yet

- Finance Question Papers Pune UniversityDocument12 pagesFinance Question Papers Pune UniversityJincy GeevargheseNo ratings yet

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- Intro to Financial Management final exam questionsDocument3 pagesIntro to Financial Management final exam questionsHammad Bin ajmalNo ratings yet

- Shree Guru Kripa's Institute of Management: Cost Accounting and Financial ManagementDocument6 pagesShree Guru Kripa's Institute of Management: Cost Accounting and Financial ManagementVeerraju RyaliNo ratings yet

- GTU MBA Semester 2 Financial Management Exam QuestionsDocument3 pagesGTU MBA Semester 2 Financial Management Exam QuestionsAmul PatelNo ratings yet

- Instructions To CandidatesDocument3 pagesInstructions To CandidatesSchoTestNo ratings yet

- FM MTP MergedDocument330 pagesFM MTP MergedAritra BanerjeeNo ratings yet

- Paper 8 Financial Management & Economics For Finance PDFDocument5 pagesPaper 8 Financial Management & Economics For Finance PDFShivam MittalNo ratings yet

- UntitledDocument5 pagesUntitledbetty KemNo ratings yet

- GTU MBA Financial Management Exam QuestionsDocument3 pagesGTU MBA Financial Management Exam QuestionssanketchauhanNo ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningmahendernayal007No ratings yet

- Final Examination (Final Exam Weightage:25%) Principle of Finance (Finn 100)Document3 pagesFinal Examination (Final Exam Weightage:25%) Principle of Finance (Finn 100)Taimoor ShahidNo ratings yet

- IMT-61 (Corporate Finance) Need Solution - Ur Call Away - 9582940966Document5 pagesIMT-61 (Corporate Finance) Need Solution - Ur Call Away - 9582940966Ambrish (gYpr.in)No ratings yet

- Financial Management Assg-1Document6 pagesFinancial Management Assg-1Udhay ShankarNo ratings yet

- Ca Inter May 2023 ImpDocument23 pagesCa Inter May 2023 ImpAlok TiwariNo ratings yet

- MBA Ii Semester Financial Management: Section-ADocument3 pagesMBA Ii Semester Financial Management: Section-AVundi RohitNo ratings yet

- Financial Management Exam QuestionsDocument4 pagesFinancial Management Exam QuestionsAkash raiNo ratings yet

- Financial Management 201Document4 pagesFinancial Management 201Avijit DindaNo ratings yet

- FM Revision Q BankDocument10 pagesFM Revision Q BankOmkar VaigankarNo ratings yet

- November 2018 Professional Examinations Management Accounting (Paper 2.2) Chief Examiner'S Report, Questions and Marking SchemeDocument20 pagesNovember 2018 Professional Examinations Management Accounting (Paper 2.2) Chief Examiner'S Report, Questions and Marking SchemeJoseph PhaustineNo ratings yet

- Sample Exam Paper With Answers PDFDocument6 pagesSample Exam Paper With Answers PDFabhimani5472No ratings yet

- Delisting Candidates111Document6 pagesDelisting Candidates111abhimani5472No ratings yet

- Derivative AnalysisDocument22 pagesDerivative Analysisabhimani5472No ratings yet

- We Create Stock Market ProfessionalsDocument12 pagesWe Create Stock Market Professionalsabhimani5472No ratings yet

- Bhel Case - CalculationDocument2 pagesBhel Case - Calculationabhimani5472No ratings yet

- Topic: Finance For Non Finance Executives FACULTY: Mr. J N MamtoraDocument3 pagesTopic: Finance For Non Finance Executives FACULTY: Mr. J N Mamtoraabhimani5472No ratings yet

- Sample 168 PDFDocument26 pagesSample 168 PDFabhimani5472No ratings yet

- Strategic Financial ManagementDocument20 pagesStrategic Financial ManagementNavang V. GandhiNo ratings yet

- Finance and Accounting For Non-Financial ManagersDocument36 pagesFinance and Accounting For Non-Financial Managershenry720% (1)

- Finance For Non-Finance Managers: SCDL: Obj Ect IveDocument5 pagesFinance For Non-Finance Managers: SCDL: Obj Ect Iveabhimani5472No ratings yet

- Accredited Finance For Non-Financial Managers: Chartered Management Institute'S SyllabusDocument2 pagesAccredited Finance For Non-Financial Managers: Chartered Management Institute'S Syllabusabhimani5472No ratings yet

- Finance for Non-Finance Executives SeminarDocument4 pagesFinance for Non-Finance Executives Seminarabhimani5472No ratings yet

- Finance For Non-Finance PDFDocument4 pagesFinance For Non-Finance PDFabhimani5472No ratings yet

- Finance For Non-Finance PDFDocument4 pagesFinance For Non-Finance PDFabhimani5472No ratings yet

- Finance For Non-Finance Personnel 2011Document4 pagesFinance For Non-Finance Personnel 2011abhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Working Capital Management Exam QuestionsDocument2 pagesWorking Capital Management Exam Questionsabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Working Capital Management Exam QuestionsDocument2 pagesWorking Capital Management Exam Questionsabhimani5472No ratings yet

- International Finance - Dec 09Document1 pageInternational Finance - Dec 09abhimani5472No ratings yet

- Working Capital Management Exam QuestionsDocument2 pagesWorking Capital Management Exam Questionsabhimani5472No ratings yet

- IMT-110 Basics of Personal Financial Planning End-Term ExamDocument2 pagesIMT-110 Basics of Personal Financial Planning End-Term Examabhimani5472No ratings yet

- International Finance - Dec 09Document1 pageInternational Finance - Dec 09abhimani5472No ratings yet

- IMT-110 Basics of Personal Financial Planning End-Term ExamDocument2 pagesIMT-110 Basics of Personal Financial Planning End-Term Examabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Dalmia Bharat Sugar and Industries Ltd.Document19 pagesDalmia Bharat Sugar and Industries Ltd.Shweta GargNo ratings yet

- SIDE HUSTLE PDF BOOK 1 r4 PDFDocument13 pagesSIDE HUSTLE PDF BOOK 1 r4 PDFJuan Tañamor100% (1)

- Test 2Document6 pagesTest 2Saadat Bin SiddiqueNo ratings yet

- 3.3.1 Functions That Are Integral To Business: Financial Reporting SolutionDocument15 pages3.3.1 Functions That Are Integral To Business: Financial Reporting SolutionRITZ BROWNNo ratings yet

- Hocmai TOEIC 450 Word Formation PracticeDocument5 pagesHocmai TOEIC 450 Word Formation PracticeDụ ThụNo ratings yet

- Board of Editors List of Contact Details For Internships (In Alphabetical Order)Document4 pagesBoard of Editors List of Contact Details For Internships (In Alphabetical Order)Navneet BhatiaNo ratings yet

- Chapter-6 - Importing, Exporting and Trade Relations-1Document12 pagesChapter-6 - Importing, Exporting and Trade Relations-1Lysss EpssssNo ratings yet

- Jasper and Anneka Rehnquist Case Study SolutionDocument5 pagesJasper and Anneka Rehnquist Case Study SolutionChintu WatwaniNo ratings yet

- Human Resources Performance Measurement Approaches Compared To Measures Used in Master's Theses in ASUDocument7 pagesHuman Resources Performance Measurement Approaches Compared To Measures Used in Master's Theses in ASUHugo Enrique Oblitas SalinasNo ratings yet

- Strategi Digital Branding Pada Startup Social Crowdfunding: Syahrul Hidayanto & Ishadi Soetopo KartosapoetroDocument15 pagesStrategi Digital Branding Pada Startup Social Crowdfunding: Syahrul Hidayanto & Ishadi Soetopo Kartosapoetrofour TeenNo ratings yet

- Assignment Ishan SharmaDocument8 pagesAssignment Ishan SharmaIshan SharmaNo ratings yet

- The Social Irresponsibility of Corporate Tax AvoidDocument9 pagesThe Social Irresponsibility of Corporate Tax Avoiddinda ardiyaniNo ratings yet

- Lecture03 SlidesDocument50 pagesLecture03 Slidesaditya jainNo ratings yet

- Tenke Mining Corp Annual Report Highlights Exploration SuccessDocument33 pagesTenke Mining Corp Annual Report Highlights Exploration Successdely susantoNo ratings yet

- Walmart's Supply Chain SuccessDocument4 pagesWalmart's Supply Chain Successmaximillan njagiNo ratings yet

- Different Organization Structures 11111Document3 pagesDifferent Organization Structures 11111Đức LợiNo ratings yet

- Enbridge - ENB - Stock Price - Live Quote - Historical Chart 2022Document6 pagesEnbridge - ENB - Stock Price - Live Quote - Historical Chart 2022helloNo ratings yet

- Utilita BillDocument4 pagesUtilita BillCommerce Corner LtdNo ratings yet

- 2 Discussion: This GradedDocument85 pages2 Discussion: This GradedkirinNo ratings yet

- Air Algerie - ReservationDocument7 pagesAir Algerie - Reservationlinux satNo ratings yet

- Maintaining Operations and ControlDocument46 pagesMaintaining Operations and ControlKhalid WaleedNo ratings yet

- LAP App Form IDFC Bank Bucket 3 R3Document13 pagesLAP App Form IDFC Bank Bucket 3 R3jyotigunu817No ratings yet

- Tax Invoice DetailsDocument1 pageTax Invoice DetailsHitesh BhatiNo ratings yet

- Syn 7 - Introduction To Debt Policy and ValueDocument11 pagesSyn 7 - Introduction To Debt Policy and Valuerudy antoNo ratings yet

- The Money Masters - NodrmDocument324 pagesThe Money Masters - Nodrmbenjaminfranklincz100% (1)

- Unit - I - Corporate Accounting Ii - Sba1401: School of Management StudiesDocument99 pagesUnit - I - Corporate Accounting Ii - Sba1401: School of Management StudiesPalani Udhayakumar100% (1)

- Cost Benefit AnalysisDocument3 pagesCost Benefit AnalysisAnnaNo ratings yet

- Ridhi Gupta: Course Code: IBO-03Document13 pagesRidhi Gupta: Course Code: IBO-03ManuNo ratings yet

- Six Sigma Ford Motor Company Case StudyDocument17 pagesSix Sigma Ford Motor Company Case StudyVenkata Mani Babu Karri100% (1)

- Lec 1Document53 pagesLec 1Samar NarayananNo ratings yet

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (85)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- Without a Doubt: How to Go from Underrated to UnbeatableFrom EverandWithout a Doubt: How to Go from Underrated to UnbeatableRating: 4 out of 5 stars4/5 (23)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (19)

- Think BIG and Kick Ass in Business and LifeFrom EverandThink BIG and Kick Ass in Business and LifeRating: 4.5 out of 5 stars4.5/5 (236)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeFrom EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeRating: 4.5 out of 5 stars4.5/5 (30)

- Invention: A Life of Learning Through FailureFrom EverandInvention: A Life of Learning Through FailureRating: 4.5 out of 5 stars4.5/5 (28)

- Expert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceFrom EverandExpert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceRating: 5 out of 5 stars5/5 (363)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursFrom EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursRating: 4.5 out of 5 stars4.5/5 (23)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisFrom EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisRating: 4.5 out of 5 stars4.5/5 (3)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (795)

- The Corporate Startup: How established companies can develop successful innovation ecosystemsFrom EverandThe Corporate Startup: How established companies can develop successful innovation ecosystemsRating: 4 out of 5 stars4/5 (6)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- Get Scalable: The Operating System Your Business Needs To Run and Scale Without YouFrom EverandGet Scalable: The Operating System Your Business Needs To Run and Scale Without YouRating: 5 out of 5 stars5/5 (1)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (24)

- Summary of The 33 Strategies of War by Robert GreeneFrom EverandSummary of The 33 Strategies of War by Robert GreeneRating: 3.5 out of 5 stars3.5/5 (20)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (708)