Professional Documents

Culture Documents

Institute of Management Technology: Centre For Distance Learning

Uploaded by

abhimani5472Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Institute of Management Technology: Centre For Distance Learning

Uploaded by

abhimani5472Copyright:

Available Formats

INSTITUTE OF MANAGEMENT TECHNOLOGY

CENTRE FOR DISTANCE LEARNING

GHAZIABAD

End-Term Examinations – June 2009

Subject Code : IMT-110 Time Allowed : 3 Hours

Subject Name: Basics of Personal Financial Planning Max. Marks : 50

Notes: (a) Answer any FOUR questions from SECTION-A and CASE STUDY as given in SECTION-B.

Each Question (SECTION-A) carries 9 MARKS and (SECTION-B) Case Study carries 14 MARKS.

(b) No doubts/clarifications shall be entertained. In case of doubts/clarifications, make reasonable assumptions and proceed.

(c) For students enrolled in January 2008, July 2008 and January 2009 batches, the Question Paper would be treated for

70 marks instead of 50 marks.

SECTION-A MARKS : 36

Q1. Discuss the importance of obtaining financial information relating to a client in the preparation of a financial plan. How will

you gather and assess this information?

Q2. a) Explain the concept of Time value of money and its importance in formulating personal financial goals.

b) Would you rather receive Rs 5000 today or Rs 10000 in 10 years? Assume the rate of interest to be at 9%

(assume future value of Rs 1after 10 year period = Rs 2.3674)

Q3. a) How do you estimate optimal insurance protection for an individual? What is net worth and how is it measured?

b) Discuss the concept of Human Life Value bringing out the information set that is required for its computation.

Q4. a) Discuss the objective of tax planning? What are the sources of income that are exempt from tax?

b) Mrs Veena, age 45, earns gross income of Rs 950000 in FY 2008-09. She invests in equity linked tax savings –

Rs 60000/- in the Public provident fund- Rs 20000/ and in equity linked tax savings scheme Rs 30000/-. She also has

a mediclaim policy where she pays a premium of 15000/- annually. Calculate her tax liability.

Q5. Why is a written financial plan preferable over an oral one? What are the major components of a comprehensive written

plan?

Q6. Hari (25years), a software engineer, is presently working with Infosys and is earning a gross salary of Rs 3,60,000 p.a.

Out of that, 25% is chargeable for the payment of income tax. To maintain a particular standard of living, he is required to

spend Rs 18000 p.m. out of which 80% is meant for the dependants of his family. The amount thus saved is deposited in

SBI at 8% rate of interest. Out of total savings, 80% is expected to fulfill the incremental future requirements of the

dependants and rest for the self requirements during his old age following retirement at 65 years of age. (Given, Present

value factor= 11.92)

You are required to calculate the life value of Hari through the Human Life Value method.

Q7. Write short notes on any three-

(i) Rule of 72 (ii) Annuity (iii) Estate planning

(iv) Present value and future value of money (iv) Investment Risks

SECTION-B (Case Study) MARKS : 14

Ram, a 40 year old salary earner, draws a monthly take home pay of Rs 40,000/- His family includes his wife and two school

going children-

Family composition- Wife aged- 35 years

A girl aged 12 years

A boy aged 9 years.

His annual family expenditure is Rs 3,00,000. He will retire from his job at the age of 60, without any pension benefit from his

company. As such, he decides to plan for his retirement needs. He projects his annual expenditure post retirement to be 50% of

what it is today. He also expects 5% per year future inflation. He expects to earn about 9% on his investments prior to retirement.

(Given: the 5% Inflation factor for Rs 1 in a time period of 20 years= Rs 2.65 and Expected rate of return compound interest

factor @9% for 20 years- 51.1)

Questions

1. How much retirement fund would Ram need considering the inflation factor? (5)

2. Advise Ram on how much does he need to save annually in order to accumulate the needed amount within 20 years? (5)

3. Why has retirement planning assumed more importance now, than it was forty years ago? List the factors that

affect sound retirement planning. (4)

29-6-2009 (E) Page 1 of 1 IMT-110

You might also like

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Sample Exam Paper With Answers PDFDocument6 pagesSample Exam Paper With Answers PDFabhimani5472No ratings yet

- Computer-Aided Administration of Registration Department (CARD), Hyderabad, Andhra PradeshDocument2 pagesComputer-Aided Administration of Registration Department (CARD), Hyderabad, Andhra PradeshtechiealyyNo ratings yet

- Tyrone Wilson StatementDocument2 pagesTyrone Wilson StatementDaily FreemanNo ratings yet

- George F. Nafziger, Mark W. Walton-Islam at War - A History - Praeger (2008)Document288 pagesGeorge F. Nafziger, Mark W. Walton-Islam at War - A History - Praeger (2008)موسى رجب100% (2)

- KEPITAL-POM - KEPITAL F20-03 LOF - en - RoHSDocument8 pagesKEPITAL-POM - KEPITAL F20-03 LOF - en - RoHSEnzo AscañoNo ratings yet

- Financial Planning - Dec 09Document2 pagesFinancial Planning - Dec 09abhimani5472No ratings yet

- Shanti Business School: PGDM Trimester-Iii End Term Examination JULY - 2015Document7 pagesShanti Business School: PGDM Trimester-Iii End Term Examination JULY - 2015SharmaNo ratings yet

- Spring 2009 Mgt201 3 VuabidDocument5 pagesSpring 2009 Mgt201 3 Vuabidsaeedsjaan100% (3)

- Dec 2008Document2 pagesDec 2008tdewanjeeNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityIsha KhannaNo ratings yet

- IMT-59 FinDocument1 pageIMT-59 Finrranjan64No ratings yet

- ABACUS-Intro - To Buss - FinanceDocument1 pageABACUS-Intro - To Buss - FinanceAli AkbarNo ratings yet

- Module 1 CFP Mock TestDocument6 pagesModule 1 CFP Mock Testchitra_shresthaNo ratings yet

- Project Finance Question PaperDocument3 pagesProject Finance Question PaperBhavna0% (1)

- BBS 3rd Year Foundation of Financial Systems Model QuestionDocument8 pagesBBS 3rd Year Foundation of Financial Systems Model QuestionNirajan SilwalNo ratings yet

- Final Examination (Final Exam Weightage:25%) Principle of Finance (Finn 100)Document3 pagesFinal Examination (Final Exam Weightage:25%) Principle of Finance (Finn 100)Taimoor ShahidNo ratings yet

- July 2020 BBF20103 Introduction To Financial Management Assignment 2Document5 pagesJuly 2020 BBF20103 Introduction To Financial Management Assignment 2Muhamad SaifulNo ratings yet

- BBA07Final09 Marking SchemeDocument4 pagesBBA07Final09 Marking SchemeKamal AkzNo ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- FTX2024F - 2019 Question PaperDocument15 pagesFTX2024F - 2019 Question PaperhannaNo ratings yet

- Sample Questions On Introduction To Financial PlanningDocument7 pagesSample Questions On Introduction To Financial PlanningRavi NagrajNo ratings yet

- Level III of CFA Program Mock Exam 1 - Questions (AM)Document26 pagesLevel III of CFA Program Mock Exam 1 - Questions (AM)Lê Chấn PhongNo ratings yet

- Financial Management (Online)Document1 pageFinancial Management (Online)mehmood khan kkartNo ratings yet

- Ininstitute of Management Technology: Centre For Distance LearningDocument2 pagesIninstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Investment Planning and Portfolio ManagementDocument3 pagesInvestment Planning and Portfolio ManagementTark Raj BhattNo ratings yet

- Corporate Finance, Term-II, 2021-23Document2 pagesCorporate Finance, Term-II, 2021-23keshav kumarNo ratings yet

- Financial Management Paper 2.4march 2023Document17 pagesFinancial Management Paper 2.4march 2023johny SahaNo ratings yet

- 820003Document2 pages820003komalbhadani77No ratings yet

- B1 Free Solving (May 2019) - Set 1Document5 pagesB1 Free Solving (May 2019) - Set 1paul sagudaNo ratings yet

- MMPC 014Document6 pagesMMPC 014Pawan ShokeenNo ratings yet

- An Autonomous Institution, Affiliated To Anna University, ChennaiDocument7 pagesAn Autonomous Institution, Affiliated To Anna University, Chennaisibi chandanNo ratings yet

- MBA 5109 - Financial Management (MBA 2020-2022)Document6 pagesMBA 5109 - Financial Management (MBA 2020-2022)sreekavi19970120No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningmahendernayal007No ratings yet

- Time-Bound Home Exam-2020: Purbanchal UniversityDocument2 pagesTime-Bound Home Exam-2020: Purbanchal UniversityEnysa DlNo ratings yet

- Corporate Finance I mA6Q2VgQxb PDFDocument4 pagesCorporate Finance I mA6Q2VgQxb PDFvikas4433No ratings yet

- CS Final - Financial Tresurs and Forex Management - June 2004Document4 pagesCS Final - Financial Tresurs and Forex Management - June 2004Rushikesh DeshmukhNo ratings yet

- The Figures in The Margin On The Right Side Indicate Full Marks. Please Answer All Bits of A Question at One PlaceDocument7 pagesThe Figures in The Margin On The Right Side Indicate Full Marks. Please Answer All Bits of A Question at One Placemknatoo1963No ratings yet

- Revalidation Test Paper Question GR IIIDocument9 pagesRevalidation Test Paper Question GR IIIMinhaz AlamNo ratings yet

- FNCE 10002 Sample FINAL EXAM 2 For Students - Sem 2 2019 PDFDocument3 pagesFNCE 10002 Sample FINAL EXAM 2 For Students - Sem 2 2019 PDFC A.No ratings yet

- ACC 4153 Group ProjectDocument7 pagesACC 4153 Group ProjectRisvana RizzNo ratings yet

- International Financial Management (Regular) Paper: 3.2: Time: 3 Hours Maximum Marks: 80Document3 pagesInternational Financial Management (Regular) Paper: 3.2: Time: 3 Hours Maximum Marks: 80SANAULLAH SULTANPURNo ratings yet

- 2.BMMF5103 FINAL EXAM Formated-Moderated 1-2013Document9 pages2.BMMF5103 FINAL EXAM Formated-Moderated 1-2013theatresonicNo ratings yet

- MMPMC 014Document3 pagesMMPMC 014Ashvanee Kr. PathakNo ratings yet

- Test Series: May, 2020 Mock Test Paper 1 Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument10 pagesTest Series: May, 2020 Mock Test Paper 1 Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- BSF 4230 - Advanced Portfolio Management - April 2022Document8 pagesBSF 4230 - Advanced Portfolio Management - April 2022Maryam YusufNo ratings yet

- UntitledDocument158 pagesUntitledSakshi KhandelwalNo ratings yet

- sFikv8tLO3DuTOB3I8bY 4762Document2 pagessFikv8tLO3DuTOB3I8bY 4762dipusharma4200No ratings yet

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- Sample Question CFPDocument15 pagesSample Question CFPapi-3814557100% (7)

- Corporate FinanceDocument2 pagesCorporate FinanceMuhammad Atif SheikhNo ratings yet

- MBA 2nd-4th Sem Internal TestDocument3 pagesMBA 2nd-4th Sem Internal TestNritya khoundNo ratings yet

- Corporate FinanceDocument4 pagesCorporate FinancejosemusiNo ratings yet

- Half Yearly - ST IgnatiusDocument16 pagesHalf Yearly - ST IgnatiusuhhwotNo ratings yet

- Paper ID (B0210Document3 pagesPaper ID (B0210suchjazzNo ratings yet

- Bcoc 136Document4 pagesBcoc 136Pranav KarwaNo ratings yet

- PGDM D - Corp ValDocument2 pagesPGDM D - Corp Valsanket patilNo ratings yet

- Project Appraisal Assignment2Document9 pagesProject Appraisal Assignment2Shashi Bhushan SonbhadraNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItFrom EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNo ratings yet

- The Exciting World of Indian Mutual FundsFrom EverandThe Exciting World of Indian Mutual FundsRating: 5 out of 5 stars5/5 (1)

- Strengthening India's Intergovernmental Fiscal Transfers: Learnings from the Asian ExperienceFrom EverandStrengthening India's Intergovernmental Fiscal Transfers: Learnings from the Asian ExperienceNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Delisting Candidates111Document6 pagesDelisting Candidates111abhimani5472No ratings yet

- Sample 168 PDFDocument26 pagesSample 168 PDFabhimani5472No ratings yet

- We Create Stock Market ProfessionalsDocument12 pagesWe Create Stock Market Professionalsabhimani5472No ratings yet

- Accredited Finance For Non-Financial Managers: Chartered Management Institute'S SyllabusDocument2 pagesAccredited Finance For Non-Financial Managers: Chartered Management Institute'S Syllabusabhimani5472No ratings yet

- Finance For Non-Finance Managers: SCDL: Obj Ect IveDocument5 pagesFinance For Non-Finance Managers: SCDL: Obj Ect Iveabhimani5472No ratings yet

- Topic: Finance For Non Finance Executives FACULTY: Mr. J N MamtoraDocument3 pagesTopic: Finance For Non Finance Executives FACULTY: Mr. J N Mamtoraabhimani5472No ratings yet

- Ininstitute of Management Technology: Centre For Distance LearningDocument2 pagesIninstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Finance - For Non-Finance - ExecutivesDocument4 pagesFinance - For Non-Finance - Executivesabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Finance For Non-Finance Personnel 2011Document4 pagesFinance For Non-Finance Personnel 2011abhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Finance Question PaperDocument2 pagesFinance Question Paperabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- International Finance - Dec 09Document1 pageInternational Finance - Dec 09abhimani5472No ratings yet

- Corporate Finance Practice QuestionsDocument11 pagesCorporate Finance Practice Questionsabhimani5472No ratings yet

- Icici Marketing Strategy of Icici BankDocument68 pagesIcici Marketing Strategy of Icici BankShilpi KumariNo ratings yet

- Comparative Financial Statement - Day4Document28 pagesComparative Financial Statement - Day4Rahul BindrooNo ratings yet

- Capital InsuranceDocument8 pagesCapital InsuranceLyn AvestruzNo ratings yet

- Smart Wealth Builder Policy Document Form 17Document29 pagesSmart Wealth Builder Policy Document Form 17Chetanshi Nene100% (1)

- WEST COAST PRODUCTIONS, INC 4:12-cv-00748-FRBDocument11 pagesWEST COAST PRODUCTIONS, INC 4:12-cv-00748-FRBcopyrightclerkNo ratings yet

- Export-Import Documentation Aditya Kapoor PDFDocument8 pagesExport-Import Documentation Aditya Kapoor PDFPradeepNo ratings yet

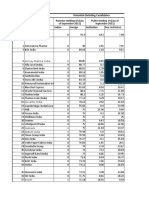

- Financial Statement of Raymond & Bombay DyingDocument18 pagesFinancial Statement of Raymond & Bombay DyingGaurav PoddarNo ratings yet

- Cases-CompDocument169 pagesCases-CompDavid John MoralesNo ratings yet

- Samyu AgreementDocument16 pagesSamyu AgreementMEENA VEERIAHNo ratings yet

- Annual Income Tax ReturnDocument2 pagesAnnual Income Tax ReturnRAS ConsultancyNo ratings yet

- Why I Love This ChurchDocument3 pagesWhy I Love This ChurchJemicah DonaNo ratings yet

- Gyms & Health Clubs - ERCDocument1 pageGyms & Health Clubs - ERCCraig Pisaris-HendersonNo ratings yet

- Midf FormDocument3 pagesMidf FormRijal Abd ShukorNo ratings yet

- Presentation: Pradhan Mantri Gram Sadak YojanaDocument25 pagesPresentation: Pradhan Mantri Gram Sadak Yojanaamitmishra50100% (1)

- US v. Esmedia G.R. No. L-5749 PDFDocument3 pagesUS v. Esmedia G.R. No. L-5749 PDFfgNo ratings yet

- Application Form Marine Hull Pleasure Craft Jet SkiDocument3 pagesApplication Form Marine Hull Pleasure Craft Jet SkiMaxedus DotaNo ratings yet

- Farm Animal Fun PackDocument12 pagesFarm Animal Fun PackDedeh KhalilahNo ratings yet

- BailmentDocument3 pagesBailmentanoos04No ratings yet

- Beta Price List Conduit 22-03-2021Document1 pageBeta Price List Conduit 22-03-2021Jugno ShahNo ratings yet

- Shah Abdul Latif University, Khairpur: ST NDDocument9 pagesShah Abdul Latif University, Khairpur: ST NDsaqib maharNo ratings yet

- FusionAccess Desktop Solution V100R006C20 System Management Guide 09 (FusionSphere V100R006C10 or Earlier)Document306 pagesFusionAccess Desktop Solution V100R006C20 System Management Guide 09 (FusionSphere V100R006C10 or Earlier)ABDEL PAGNA KARIM100% (1)

- Oracle SOA 11.1.1.5.0 Admin GuideDocument698 pagesOracle SOA 11.1.1.5.0 Admin GuideConnie WallNo ratings yet

- Thermal Physics Assignment 2013Document10 pagesThermal Physics Assignment 2013asdsadNo ratings yet

- Lesson 25 The Fruits of Manifest Destiny StudentDocument31 pagesLesson 25 The Fruits of Manifest Destiny StudentGabriel BalderramaNo ratings yet

- Sample of Notarial WillDocument3 pagesSample of Notarial WillJF Dan100% (1)

- DemocarcyDocument5 pagesDemocarcyAdil ZiaNo ratings yet