Professional Documents

Culture Documents

TVM Buy and Rent Decision

Uploaded by

Zahid UsmanOriginal Title

Copyright

Available Formats

Share this document

Read this document in other languages

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TVM Buy and Rent Decision

Uploaded by

Zahid UsmanCopyright:

Available Formats

Case Study 1 - Group 2

Time Value of Money: The Buy Versus Rent Decision

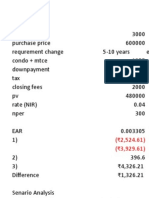

Input:

Asking Sales Price: $620,000

Final Sales Price: $600,000

Down Payment (20%): $120,000

Actual Mortgage: $480,000

Taxes due today: $18,000

Closing fees due today: $2,000

1) Monthly payment for mortgage:

The number of payments that will occur can be calculated by:

n = 25 years*12months = 300

Effective monthly rate:

In order to get the effective monthly rate, we have to use the formula for the effective annual rate (EAR), which for our case looks at follows:

0.04

( 1+r )6=1+ =¿ r=0.00330589

2

As the actual mortgage is $480,000 and will be re-paid over a period of 300 payments.

Using the Excel formula =pmt(rate,nper,pv,fv), we get the monthly payment of : $2,524.90.

2) Monthly opportunity cost of funds invested

Future value of investment:140,000 ×(1+ 0.00330589)300 =376,822.30

Taking this result gives us the opportunity cost over 25 years by subtracting $140,000 from $376,822.30, which equals $236,822.30.

To calculate the monthly opportunity cost we use the following excel formula: =pmt(rate,nper,pv,fv), Resulting in $462.82

Refer excel sheet for further working.

Case Study 1 - Group 2

3) Monthly payment Buy vs. rent

Rent:

Monthly rent: -$3,000

+

Monthly opportunity cost $462.82

=

Monthly expenditures: -$2,537.18

Buy:

Monthly mortgage payment: -$2,524.90

+

Monthly condo fee: -$1,050

+

Monthly property tax: -$300

+

Monthly Maintenance: -$50

=

Monthly expenditures: -$3,929.90

Facing the buy vs. rent decision the monthly difference is -$1392.72.

4) Outstanding Principal

Calculating the FV in Excel:

=FV(rate,nper,pmt,pv)

a) After two years

Rate= .00330589

nper (number f periods)= 24

Pmt= 2,524.90

PV= -480.000

Resulting in a outstanding principal of $456,609.29

b) After five years

Rate= .00330589

nper (number f periods)= 60

Pmt= 2,524.90

PV= -480.000

Refer excel sheet for further working.

Resulting in a outstanding principal of $417,858.79

Case Study 1 - Group 2

c) After ten years

Rate= .00330589

nper (number f periods)= 120

Pmt= 2,524.90

PV= -480.000

Resulting in a outstanding principal of $342,109.0

5) Determine the “net” future gain or loss

Table 5.1

These values indicates the difference between the loss in

Case Study 1 - Group 2

Q6 As Rebecca Young, what decision would you make? Describe any qualitative considerations that could factor into your decision.

Looking at the above projections Rebecca’s best option would be to rent. As seen above the net loss for buying is greater than that of renting. Other qualitative factors that contribute to this decision are;

Buy

Satisfaction of owning something

Do not have to worry about landlord

Asset that holds value with time

Rent

Less Stress since property damages don’t affect the renter

Can move location with little hassle

less financial burden

Despite the qualitative factors addressed above Rebecca’s best decision would be to choose renting over buying simply because of the clear advantage of both the qualitative and quantitative benefits of renting.

../Desktop/BA518 Buy Vs Rent .xlsx

You might also like

- Tme Value of MoneyDocument14 pagesTme Value of MoneyRichaBhartiya100% (2)

- Buy Vs Rent Decision Assignment Given DataDocument4 pagesBuy Vs Rent Decision Assignment Given DataMOVIES SHOPNo ratings yet

- Time Value of Money: The Buy Versus Rent Decision: InputDocument5 pagesTime Value of Money: The Buy Versus Rent Decision: InputAbdel Kader ChebliNo ratings yet

- TVM Buy DecisionDocument5 pagesTVM Buy DecisionGulfam Murtaza100% (2)

- Teaching Note - TIME VALUE OF MONEY - THE BUY VERSUS RENT DECISIONDocument9 pagesTeaching Note - TIME VALUE OF MONEY - THE BUY VERSUS RENT DECISIONANKIT AGARWAL100% (14)

- Time Value of Money The Buy Versus Rent Decision - SolutionDocument5 pagesTime Value of Money The Buy Versus Rent Decision - Solutioncpsoni62% (13)

- Time Value of Money - The Buy Versus Rent Decision - StudentDocument1 pageTime Value of Money - The Buy Versus Rent Decision - StudentUmer Tahir17% (12)

- Case Study SpreadsheetDocument17 pagesCase Study SpreadsheetExpert Answers100% (1)

- Time Value of Money The Buy Versus Rent Decision SolutionDocument5 pagesTime Value of Money The Buy Versus Rent Decision SolutionNida KhanNo ratings yet

- Time Value of Money The Buy Versus Rent Decision Solution PDFDocument5 pagesTime Value of Money The Buy Versus Rent Decision Solution PDFMuhammad Ibtehash100% (1)

- Buy Vs Rent Decision - Case ExerciseDocument6 pagesBuy Vs Rent Decision - Case ExerciseLife saver100% (2)

- Buy VS Rent ExcelDocument2 pagesBuy VS Rent ExcelGautam GulatiNo ratings yet

- Time Value of Money The Buy Versus Rent Decision Student 1Document1 pageTime Value of Money The Buy Versus Rent Decision Student 1Cristhian Javier0% (1)

- Time Value of Money The Buy Versus Rent Decision Solution PDFDocument5 pagesTime Value of Money The Buy Versus Rent Decision Solution PDFMuhammad Ibtehash100% (1)

- Working Capital Collection Period 30 DaysDocument12 pagesWorking Capital Collection Period 30 DaysLinda Putri AsmaniaNo ratings yet

- Monmouth Inc SolutionDocument9 pagesMonmouth Inc SolutionPedro José ZapataNo ratings yet

- FMV Magic Timber CaseDocument6 pagesFMV Magic Timber CaseEdward Berbari100% (1)

- Harvard Case: Sterling Household CompanyDocument10 pagesHarvard Case: Sterling Household Companymadeleine ReaNo ratings yet

- Hola Kola Case StudyDocument7 pagesHola Kola Case StudyRivki MeitriyantoNo ratings yet

- Hola Cola 111Document261 pagesHola Cola 111Neupane IshaNo ratings yet

- hOLA - kOLADocument3 pageshOLA - kOLAOm Prakash100% (1)

- Hola Kola Case - Capital Budgeting - MP15030Document4 pagesHola Kola Case - Capital Budgeting - MP15030raghav89% (19)

- Hola Kola Case SolutionDocument8 pagesHola Kola Case Solutionsathya50% (8)

- Hola KolaDocument24 pagesHola KolaNidhi Agarwal92% (12)

- Hola Kola Case StudyDocument8 pagesHola Kola Case StudyAbhinandan Singh100% (1)

- Hola KolaDocument3 pagesHola Kola17crushNo ratings yet

- Answers - Cost of Capital Wallmart Inc.Document11 pagesAnswers - Cost of Capital Wallmart Inc.Arslan HafeezNo ratings yet

- Case1 SolutionDocument15 pagesCase1 SolutionRoy Sarkis100% (1)

- North Mountain NurseryDocument3 pagesNorth Mountain NurseryMohan Ram100% (2)

- MW Petroleum Corporation (A)Document6 pagesMW Petroleum Corporation (A)AnandNo ratings yet

- Case Nike Cost of Capital - FinalDocument7 pagesCase Nike Cost of Capital - FinalNick ChongsanguanNo ratings yet

- Hola Kola Case Capital Budgeting MP15030Document4 pagesHola Kola Case Capital Budgeting MP15030Francisco RomanoNo ratings yet

- Excel File Exhibits For Marriott CaseDocument18 pagesExcel File Exhibits For Marriott Caset3ddyme123No ratings yet

- Hola Kola CaseDocument4 pagesHola Kola CaseSwaraj Dhar25% (4)

- Hola Kola Case Excel - Backup Copy - Do Not UseDocument6 pagesHola Kola Case Excel - Backup Copy - Do Not UseVishakha Chopra100% (3)

- Sally JamesonDocument3 pagesSally JamesonMithun Sridharan100% (2)

- Sec-2 - Subgroup-9 (FM-Hola Kola)Document9 pagesSec-2 - Subgroup-9 (FM-Hola Kola)Ankit VisputeNo ratings yet

- AirThread ValuationDocument6 pagesAirThread ValuationShilpi Jain0% (6)

- Case 7 - An Introduction To Debt Policy and ValueDocument5 pagesCase 7 - An Introduction To Debt Policy and ValueAnthony Kwo100% (2)

- Hola Kola CaseDocument5 pagesHola Kola CaseAisha Almazrouee92No ratings yet

- NegotiationDocument4 pagesNegotiationinesNo ratings yet

- Nike Case Final Group 4Document15 pagesNike Case Final Group 4Monika Maheshwari100% (1)

- MW SolutionDocument15 pagesMW SolutionDebasmita Nandy100% (3)

- Case 48 Sun MicrosystemsDocument25 pagesCase 48 Sun MicrosystemsChittisa Charoenpanich40% (5)

- Hola Kola Case Study SolutionsDocument8 pagesHola Kola Case Study SolutionsAnushka0% (2)

- Solution To QB QuestionsDocument3 pagesSolution To QB QuestionsSurabhi Suman100% (1)

- Credit Management ExerciseDocument5 pagesCredit Management ExerciseSavana AndiraNo ratings yet

- Enter Your Campus LocationDocument28 pagesEnter Your Campus LocationRidwaan JaffooNo ratings yet

- Cae05-Chapter 4 Notes Receivables & Payable Problem DiscussionDocument12 pagesCae05-Chapter 4 Notes Receivables & Payable Problem DiscussionSteffany RoqueNo ratings yet

- TODAY at BULLET Chapter 2 TVM ContinuedDocument8 pagesTODAY at BULLET Chapter 2 TVM ContinuedThùy LêNo ratings yet

- TODAY at BULLET Chapter 2 TVM ContinuedDocument8 pagesTODAY at BULLET Chapter 2 TVM ContinuedSiêng Năng NèNo ratings yet

- T5 - Qs and SolutionDocument15 pagesT5 - Qs and SolutionCalvin MaNo ratings yet

- Intermediate Accounting 2Document27 pagesIntermediate Accounting 2cpacpacpaNo ratings yet

- Residential Real Estate Introduction Slides - Student Version-1Document120 pagesResidential Real Estate Introduction Slides - Student Version-1Aaron HoardNo ratings yet

- Online Corporate Finance I Practice Exam 1 SolutionDocument14 pagesOnline Corporate Finance I Practice Exam 1 SolutionTien DuongNo ratings yet

- Accounting MCQ UpdatedDocument10 pagesAccounting MCQ UpdatedEttore De CarloNo ratings yet

- Quiz 3solutionDocument5 pagesQuiz 3solutionAhsan IqbalNo ratings yet

- Ch. 4 LoansandannuitiesDocument40 pagesCh. 4 LoansandannuitiesayaanNo ratings yet

- Chapter 05 Sol StudentsDocument207 pagesChapter 05 Sol Studentsedgargallego6260% (1)

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsFrom EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsNo ratings yet

- C 2 T V M: Hapter IME Alue of OneyDocument32 pagesC 2 T V M: Hapter IME Alue of OneyZahid UsmanNo ratings yet

- Corporate Governance: Suggested Answers and Examiner's CommentsDocument19 pagesCorporate Governance: Suggested Answers and Examiner's CommentsZahid UsmanNo ratings yet

- Presentation1 of Public Sector ManagementDocument25 pagesPresentation1 of Public Sector ManagementZahid UsmanNo ratings yet

- C 2 T V M: Hapter IME Alue of OneyDocument32 pagesC 2 T V M: Hapter IME Alue of OneyZahid UsmanNo ratings yet

- Mini Case of Strategic Finance - Time Value of MoneyDocument1 pageMini Case of Strategic Finance - Time Value of MoneyZahid UsmanNo ratings yet

- Corporate-Governance - Report and Tim and A, B and Canswer Are Available in This DocumentDocument26 pagesCorporate-Governance - Report and Tim and A, B and Canswer Are Available in This DocumentZahid UsmanNo ratings yet

- Corporate Governance Assignment 2 .......... q2 Ans Iss Mein HaiDocument21 pagesCorporate Governance Assignment 2 .......... q2 Ans Iss Mein HaiZahid UsmanNo ratings yet

- Confirmation Bias, Overconfidence, and Investment PerformanceP Evidence From Stock Message BoardsDocument33 pagesConfirmation Bias, Overconfidence, and Investment PerformanceP Evidence From Stock Message BoardsRenuka SharmaNo ratings yet

- Boardroom-Dynamics-Sample-Paper Corporate GovernanceDocument5 pagesBoardroom-Dynamics-Sample-Paper Corporate GovernanceZahid UsmanNo ratings yet

- Chairman and CEO - Respective Roles and Responsibilities Q 1 ... (PART 1)Document5 pagesChairman and CEO - Respective Roles and Responsibilities Q 1 ... (PART 1)Zahid UsmanNo ratings yet

- Cement Sector Review For 8M (Equity Research Report)Document3 pagesCement Sector Review For 8M (Equity Research Report)Zahid UsmanNo ratings yet

- My Presentation of Summary by DR Zulifiqar AliDocument7 pagesMy Presentation of Summary by DR Zulifiqar AliZahid UsmanNo ratings yet

- Corporate Governance - Sample PaperDocument8 pagesCorporate Governance - Sample PaperPadyala SriramNo ratings yet

- Minutes of 289th Meeting of Registration Board PDFDocument1,525 pagesMinutes of 289th Meeting of Registration Board PDFZahid UsmanNo ratings yet

- Key Financial Indicators: Statement of Financial PositionDocument2 pagesKey Financial Indicators: Statement of Financial PositionZahid UsmanNo ratings yet

- The Impact of Organizational Justice On Employee Performance in Public Sector Organization of PakistanDocument6 pagesThe Impact of Organizational Justice On Employee Performance in Public Sector Organization of PakistanZahid UsmanNo ratings yet

- Faran Sugar Mills Limited.2 PAGESDocument4 pagesFaran Sugar Mills Limited.2 PAGESZahid UsmanNo ratings yet

- Background of The CompanyDocument3 pagesBackground of The CompanyZahid UsmanNo ratings yet

- Equity Research Report (1) BY INAMULLAH (FINAL)Document8 pagesEquity Research Report (1) BY INAMULLAH (FINAL)Zahid UsmanNo ratings yet

- Equity Research Report (First 3 Pages) (Solution) ,... Zahid Usman, CMS # 28127Document4 pagesEquity Research Report (First 3 Pages) (Solution) ,... Zahid Usman, CMS # 28127Zahid UsmanNo ratings yet

- Background of The CompanyDocument3 pagesBackground of The CompanyZahid UsmanNo ratings yet

- Corporate Governance Class Activity Annual Report (Solution), Zahid Usman, SAP ID 7513, (MSAF)Document5 pagesCorporate Governance Class Activity Annual Report (Solution), Zahid Usman, SAP ID 7513, (MSAF)Zahid UsmanNo ratings yet

- EViews 9 Object Ref PDFDocument999 pagesEViews 9 Object Ref PDFZahid UsmanNo ratings yet

- FIN611 GDB No 1 (Marks 5)Document1 pageFIN611 GDB No 1 (Marks 5)Zahid Usman0% (1)

- Fin611 GDB by Zeb........ (Idea)Document1 pageFin611 GDB by Zeb........ (Idea)Zahid UsmanNo ratings yet

- Advance Financial Accounting (GDB) SolutionDocument2 pagesAdvance Financial Accounting (GDB) SolutionZahid UsmanNo ratings yet

- Chapter 05Document33 pagesChapter 05FATIMANICOLL13No ratings yet

- EViews 9 Command RefDocument775 pagesEViews 9 Command RefElvira Duran MartinezNo ratings yet

- EViews 9 Getting StartedDocument59 pagesEViews 9 Getting StartedElvira Duran MartinezNo ratings yet

- Time Value of MoneyDocument20 pagesTime Value of Moneymdsabbir100% (1)

- Accounting 21 Financial Accounting and Reporting Part 1Document5 pagesAccounting 21 Financial Accounting and Reporting Part 1Faith BariasNo ratings yet

- Chapter 3 ReceivablesDocument22 pagesChapter 3 ReceivablesCale Robert RascoNo ratings yet

- Time Value of Money: Key PointsDocument5 pagesTime Value of Money: Key PointsUday BansalNo ratings yet

- Unit 6: Financial Applications of Exponential Functions (8 Days + 1 Jazz Day + 1 Summative Evaluation Day) BIG IdeasDocument23 pagesUnit 6: Financial Applications of Exponential Functions (8 Days + 1 Jazz Day + 1 Summative Evaluation Day) BIG IdeasFatimah Rahima JingonaNo ratings yet

- GESB2000Document43 pagesGESB2000JIALU LIANG (Carrot)No ratings yet

- Assignment 2Document2 pagesAssignment 2Anil RaiNo ratings yet

- Microsoft Excel As A Financial Calculator Part IIDocument8 pagesMicrosoft Excel As A Financial Calculator Part IIbenjah2No ratings yet

- Time Value of Money FormulasDocument8 pagesTime Value of Money FormulasrovosoloNo ratings yet

- Question and Answer Set of System Analysis andDocument169 pagesQuestion and Answer Set of System Analysis andAnthony Salangsang100% (1)

- Kengskool 1e Ch2Document26 pagesKengskool 1e Ch2Khuram MaqsoodNo ratings yet

- Time Value of MoneyDocument59 pagesTime Value of MoneyjagrenuNo ratings yet

- EE Chapter 2Document24 pagesEE Chapter 2Dian Ratri CNo ratings yet

- Chapter 3 Time Value of MoneyDocument17 pagesChapter 3 Time Value of MoneywubeNo ratings yet

- ACTL2111 Module - 1Document101 pagesACTL2111 Module - 1Alex WuNo ratings yet

- Future Value of An Ordinary Annuity: Illustration 6-17Document9 pagesFuture Value of An Ordinary Annuity: Illustration 6-17Goworio Nikuah GuloNo ratings yet

- Chapter 6 Time Value of MoneyDocument39 pagesChapter 6 Time Value of Moneyjhogonnath.saha.65No ratings yet

- FinaMan Final TermDocument15 pagesFinaMan Final TermHANNAH ROSS BAELNo ratings yet

- FIN2704 Week 3 Zoom Lecture SlidesDocument23 pagesFIN2704 Week 3 Zoom Lecture SlidesZenyuiNo ratings yet

- Capital Budgeting With AnswersDocument9 pagesCapital Budgeting With AnswersishikiconsultancyNo ratings yet

- Financial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualDocument7 pagesFinancial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions Manuallaylasaintbq83pu100% (29)

- Mathematics: Interest Rates and FinanceDocument55 pagesMathematics: Interest Rates and FinanceAmr Tarek100% (1)

- BBA Banking and Finance PDFDocument65 pagesBBA Banking and Finance PDFMèhàŕ MàŕiàNo ratings yet

- PW, FW, Aw: Shreyam PokharelDocument14 pagesPW, FW, Aw: Shreyam PokharelLuna Insorita100% (1)

- Brief Contents: Preface Introduction To Financial ManagementDocument12 pagesBrief Contents: Preface Introduction To Financial ManagementDarlynple MenorNo ratings yet

- Appendix ADocument15 pagesAppendix AKang JoonNo ratings yet

- LN04Brooks671956 02 LN04Document57 pagesLN04Brooks671956 02 LN04nightdazeNo ratings yet

- Pfin3 3rd Edition Gitman Solutions ManualDocument26 pagesPfin3 3rd Edition Gitman Solutions ManualCarolineAvilakgjq100% (50)

- 4.1 The Timeline: Chapter 4 The Time Value of MoneyDocument37 pages4.1 The Timeline: Chapter 4 The Time Value of MoneySawsan Al-jamalNo ratings yet

- Chapter 1Document213 pagesChapter 1Annur SofeaNo ratings yet

- Mpb-404 Financial ManagementDocument6 pagesMpb-404 Financial ManagementMohammad Zahirul IslamNo ratings yet