Professional Documents

Culture Documents

Partnership Dissolution

Uploaded by

Cjhay MarcosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Dissolution

Uploaded by

Cjhay MarcosCopyright:

Available Formats

QUIZ #3

Partnership Dissolution

Name: __________________________________ Date: _____________________ Score: ________

I. PROBLEM SOLVING. Solve the following independent problems. Show solutions in good form and

write your final answer in the space provided. (No solution, no point)

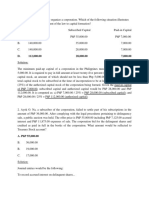

1. The capital balances in the FSH are F’s capital- 600,000, S’ capital – 500,000 and H’s capital –

400,000 and the income ratios are 5:3:2, respectively. The FISH partnership is formed after

admitting I to the firm with a cash investment of 600,000 for a 25% capital interest. The bonus

to be debited to H’s capital in admitting I is? ____________________

2. G purchases 50% of J’s capital interest in the JS partnership for 220,000. If the capital

balances of J and S are 300,000 and 400,000 respectively, G’s capital balances following the

purchase is? _____________________

3-5

The existing balances of old partners prior to the admission of D are as follows:

Partners

A - 100,000

B - 200,000

C - 300,000

D is to admitted to the partnership by direct purchase of 20% each of the existing partner’s

capital for 100,000.

3. The net asset of the partnership, right after the admission of D would be? ______________

4. The capital balance of A after admission of D is? ____________________

5. Assuming that D was admitted by investing 150,000 for 20% interest in the firm, D’s agreed

capital would be? _____________________

6. Jaja, Diana, and Revi are partners of JDR Partnership who share profit and losses in a ratio of

1:2:3, respectively and have the following capital balances on July 1, 2014. Jaja Capital –

500,000, Diana Capital – 350,125, Revi Capital – 250,650. On July 1, 2014, Peter admitted to

the partnership by buying ¼ of Jaja’s interest for 150,000. How much will be the total capital of

the partnership immediately after the admission of Peter? _____________

7. Partners Micheal, Ge, and Feb have total combines capital of 985,020. Harold is to be

admitted as a new partner with 25% interest in capital and earnings for a cash investment.

Bonus is not to be recorded. How much cash should Harold invest? ___________

8. Mela, Sheena and Patricia have equities in a partnership of 325,000, 225,000 and 100,550

respectively, and share profit and losses in a ratio of 2:1:2 respectively. Dianne is to be

admitted to the partnership by investing 200,000 for 20% interest and bonus method is used in

her admission. How much will be the capital balance of Dianne after admission?

________________

You might also like

- Statement of Realization and LiquidationDocument2 pagesStatement of Realization and LiquidationSherilyn Bunag0% (1)

- Mutual Fund Insight Nov 2022Document214 pagesMutual Fund Insight Nov 2022Sonic LabelsNo ratings yet

- Formation of PartnershipDocument18 pagesFormation of PartnershipschafieqahNo ratings yet

- Partnership Formation and OperationsDocument6 pagesPartnership Formation and Operationsrodel100% (2)

- Partnership Operations Part 2Document14 pagesPartnership Operations Part 2Nerish PlazaNo ratings yet

- Handout Chapter 2Document3 pagesHandout Chapter 2Cjhay MarcosNo ratings yet

- Acctg 2 QuizDocument4 pagesAcctg 2 QuizAshNor RandyNo ratings yet

- Partnership Accounting IntroductionDocument5 pagesPartnership Accounting IntroductionAbigail MendozaNo ratings yet

- AFAR-02 (Partnership Dissolution & Liquidation)Document13 pagesAFAR-02 (Partnership Dissolution & Liquidation)Maricris AlilinNo ratings yet

- 4 - Lecture Notes - Partnership DissolutionDocument18 pages4 - Lecture Notes - Partnership DissolutionNikko Bowie PascualNo ratings yet

- Partnership Dissolution - Lecture and Sample ProblemsDocument6 pagesPartnership Dissolution - Lecture and Sample ProblemsJenina CrisologoNo ratings yet

- Midterm Exam StatconDocument4 pagesMidterm Exam Statconlhemnaval100% (4)

- Partnership Liquidation - SeatworkDocument1 pagePartnership Liquidation - SeatworkReymilyn SanchezNo ratings yet

- Pharmaceutical Microbiology NewsletterDocument12 pagesPharmaceutical Microbiology NewsletterTim SandleNo ratings yet

- ASM INTERNATIONAL Carburizing Microstructures and Properties by Geoffrey ParrishDocument222 pagesASM INTERNATIONAL Carburizing Microstructures and Properties by Geoffrey ParrishAdheith South NgalamNo ratings yet

- Valuation of ContributionDocument2 pagesValuation of ContributionsunshineNo ratings yet

- Chapter 14 Partnerships Formation and OperationDocument24 pagesChapter 14 Partnerships Formation and OperationJudith100% (5)

- AFAR 01 Partnership FormationDocument9 pagesAFAR 01 Partnership FormationJohn Rey BallesterosNo ratings yet

- Spa ClaimsDocument1 pageSpa ClaimsJosephine Berces100% (1)

- Partnership LiquidationDocument1 pagePartnership LiquidationJo Vee VillanuevaNo ratings yet

- Partnership and CorporationDocument6 pagesPartnership and CorporationShaira Nicole Vasquez50% (2)

- Partnership HCC CttoDocument7 pagesPartnership HCC CttoKenncy100% (1)

- Mock Aqe 1Document15 pagesMock Aqe 1AshNor RandyNo ratings yet

- Tajima TME, TMEF User ManualDocument5 pagesTajima TME, TMEF User Manualgeorge000023No ratings yet

- Wala LangDocument8 pagesWala LangMax Dela TorreNo ratings yet

- LiquidationDocument2 pagesLiquidationMaria LopezNo ratings yet

- AFAR - Partnership OperationDocument21 pagesAFAR - Partnership OperationReginald ValenciaNo ratings yet

- Chapter 1: PartnershipDocument121 pagesChapter 1: PartnershipGab IgnacioNo ratings yet

- X 3Document8 pagesX 3Max Dela Torre0% (1)

- Solution in Partnership Liquidation InstallmentDocument20 pagesSolution in Partnership Liquidation InstallmentNikki GarciaNo ratings yet

- Partnership 2021 - Long ProblemsDocument5 pagesPartnership 2021 - Long ProblemsMichael MagdaogNo ratings yet

- Corporation - Transactions Subsequent To FormationDocument7 pagesCorporation - Transactions Subsequent To FormationJohncel Tawat100% (1)

- Top 25 Problems On Dissolution of A Partnership Firm PDFDocument1 pageTop 25 Problems On Dissolution of A Partnership Firm PDFDaniza Rose AltoNo ratings yet

- Chapter 1 PartnershipsDocument46 pagesChapter 1 PartnershipsAkkamaNo ratings yet

- Partnership AcctgDocument3 pagesPartnership AcctgcessbrightNo ratings yet

- Compiled Corporation QuestionsDocument20 pagesCompiled Corporation QuestionsKatNo ratings yet

- Partnership FormationDocument3 pagesPartnership Formationmiss independent100% (1)

- Midterm Exercises 1 ProblemsDocument2 pagesMidterm Exercises 1 Problemslinkin soyNo ratings yet

- AE 112 Finals Summative AssessmentDocument12 pagesAE 112 Finals Summative AssessmentmercyvienhoNo ratings yet

- Chapter 4 DissolutionDocument24 pagesChapter 4 DissolutionJenny BernardinoNo ratings yet

- AC-42-Lec-Midterm-test-bank - Answer KeyDocument9 pagesAC-42-Lec-Midterm-test-bank - Answer KeyEunice CatubayNo ratings yet

- Handouts PartnershipDocument9 pagesHandouts PartnershipCPANo ratings yet

- Quiz - PartnershipDocument2 pagesQuiz - PartnershipLeisleiRagoNo ratings yet

- PROBLEMsDocument3 pagesPROBLEMsHancel NageraNo ratings yet

- LiquidationDocument2 pagesLiquidationMikelle Justin RaizNo ratings yet

- Credit Memo Ok Debit Memo Ok Debit MemoDocument22 pagesCredit Memo Ok Debit Memo Ok Debit MemoVea Canlas CabertoNo ratings yet

- Midterm Exam ACTG22Document2 pagesMidterm Exam ACTG22Jj Abad BoieNo ratings yet

- SATURDAYDocument20 pagesSATURDAYkristine bandaviaNo ratings yet

- Activity 1.2.2Document1 pageActivity 1.2.2De Nev Oel0% (1)

- Partnership OperationsDocument2 pagesPartnership OperationsKristel SumabatNo ratings yet

- Partnership Liquidation QuizDocument5 pagesPartnership Liquidation QuizAlexis TRADIO100% (1)

- Corporation QuizDocument13 pagesCorporation Quizjano_art21No ratings yet

- Partnership Formation: Office Furniture Will Be Debited For P3200Document1 pagePartnership Formation: Office Furniture Will Be Debited For P3200Von Andrei MedinaNo ratings yet

- De PartnershipDocument23 pagesDe PartnershipcamillaNo ratings yet

- 2nd Quiz Midterm Acctg12Document3 pages2nd Quiz Midterm Acctg12Erma Caseñas50% (2)

- Chapter 5 CorporationDocument14 pagesChapter 5 CorporationMathewos Woldemariam BirruNo ratings yet

- 2021 Act130 Prelim ExaminationDocument13 pages2021 Act130 Prelim ExaminationMica R.No ratings yet

- Partnership Operations: QuizDocument8 pagesPartnership Operations: QuizLee SuarezNo ratings yet

- Afar I. Partnership FormationDocument4 pagesAfar I. Partnership FormationIrish SantiagoNo ratings yet

- Retirement of A Partner 1Document1 pageRetirement of A Partner 1Vonna TerribleNo ratings yet

- BS4Document4 pagesBS4Von Andrei MedinaNo ratings yet

- Chapter One TDocument39 pagesChapter One TtemedebereNo ratings yet

- Partnership HandoutsDocument4 pagesPartnership Handoutsrose anne0% (1)

- Practical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionDocument46 pagesPractical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionKeith Anthony AmorNo ratings yet

- ParCor QuizDocument4 pagesParCor QuizJinx Cyrus Rodillo0% (1)

- Semifinal BSA Partnership CorporationDocument5 pagesSemifinal BSA Partnership Corporationycalinaj.cbaNo ratings yet

- Partnership Mock ExamDocument4 pagesPartnership Mock ExamCleo Meguel AbogadoNo ratings yet

- Module #3 - Obligations of Employees and BusinessDocument4 pagesModule #3 - Obligations of Employees and BusinessCjhay MarcosNo ratings yet

- Week 1, Module #1 - MotivationDocument7 pagesWeek 1, Module #1 - MotivationCjhay MarcosNo ratings yet

- Week 2, Module #3, Work Teams and GroupDocument4 pagesWeek 2, Module #3, Work Teams and GroupCjhay MarcosNo ratings yet

- Week 3, Module #4 - LeadershipDocument4 pagesWeek 3, Module #4 - LeadershipCjhay MarcosNo ratings yet

- Week 1, Module #2 - CommunicationDocument9 pagesWeek 1, Module #2 - CommunicationCjhay MarcosNo ratings yet

- Week 4, Module #5 - Foundation of Organizational StructureDocument4 pagesWeek 4, Module #5 - Foundation of Organizational StructureCjhay MarcosNo ratings yet

- Week 3, Module #5 - Conlict ManagementDocument5 pagesWeek 3, Module #5 - Conlict ManagementCjhay MarcosNo ratings yet

- Remember The Cartoon You Used To Watch As A ChildDocument2 pagesRemember The Cartoon You Used To Watch As A ChildCjhay MarcosNo ratings yet

- Globalisasyon TESTDocument11 pagesGlobalisasyon TESTCjhay MarcosNo ratings yet

- Week 2, Module #3 - Group Dynamics and Team BuildingDocument6 pagesWeek 2, Module #3 - Group Dynamics and Team BuildingCjhay Marcos100% (1)

- Week 1, Module #2 - Leadership StylesDocument4 pagesWeek 1, Module #2 - Leadership StylesCjhay MarcosNo ratings yet

- NSTPDocument2 pagesNSTPCjhay MarcosNo ratings yet

- Provincial Youth Business Convention 2018Document4 pagesProvincial Youth Business Convention 2018Cjhay MarcosNo ratings yet

- I Corinthians 14:40-Let All Things Be Done Decently in OrderDocument1 pageI Corinthians 14:40-Let All Things Be Done Decently in OrderCjhay MarcosNo ratings yet

- Financial ManagerDocument7 pagesFinancial ManagerCjhay MarcosNo ratings yet

- Week 1, Module #1 - LeadershipDocument6 pagesWeek 1, Module #1 - LeadershipCjhay MarcosNo ratings yet

- Nature of Financial ManagementDocument6 pagesNature of Financial ManagementCjhay MarcosNo ratings yet

- FM Quiz #1Document2 pagesFM Quiz #1Cjhay MarcosNo ratings yet

- FM Quiz #3 SET 1Document2 pagesFM Quiz #3 SET 1Cjhay MarcosNo ratings yet

- The Principles of Art (1938) That What An Artist Does To An Emotion Is Not To Induce It, But Express ItDocument2 pagesThe Principles of Art (1938) That What An Artist Does To An Emotion Is Not To Induce It, But Express ItCjhay MarcosNo ratings yet

- Data Center College of The PhilippinesDocument1 pageData Center College of The PhilippinesCjhay MarcosNo ratings yet

- ResignationDocument1 pageResignationCjhay MarcosNo ratings yet

- Financial MNGT Chapter IDocument33 pagesFinancial MNGT Chapter ICjhay MarcosNo ratings yet

- EconDocument1 pageEconCjhay MarcosNo ratings yet

- Memorandum of Agreement2Document2 pagesMemorandum of Agreement2Cjhay MarcosNo ratings yet

- Laoag City: DATA Center College of The PhilippinesDocument1 pageLaoag City: DATA Center College of The PhilippinesCjhay MarcosNo ratings yet

- Different Parts of A Business PlanDocument2 pagesDifferent Parts of A Business PlanCjhay MarcosNo ratings yet

- Data Center College of The PhilippinesDocument1 pageData Center College of The PhilippinesCjhay MarcosNo ratings yet

- Presentation, Analysis and Interpretaion of DataDocument6 pagesPresentation, Analysis and Interpretaion of DataCjhay MarcosNo ratings yet

- Catalogue of The Herbert Allen Collection of English PorcelainDocument298 pagesCatalogue of The Herbert Allen Collection of English PorcelainPuiu Vasile ChiojdoiuNo ratings yet

- Perhitungan Manual Metode Correlated Naïve Bayes Classifier: December 2020Document6 pagesPerhitungan Manual Metode Correlated Naïve Bayes Classifier: December 2020andreas evanNo ratings yet

- Frito Lay AssignmentDocument14 pagesFrito Lay AssignmentSamarth Anand100% (1)

- Mayor Breanna Lungo-Koehn StatementDocument2 pagesMayor Breanna Lungo-Koehn StatementNell CoakleyNo ratings yet

- Sigma Valve 2-WayDocument2 pagesSigma Valve 2-WayRahimNo ratings yet

- Change Language DynamicallyDocument3 pagesChange Language DynamicallySinan YıldızNo ratings yet

- AdvertisingDocument2 pagesAdvertisingJelena ŽužaNo ratings yet

- Stainless Steel 1.4404 316lDocument3 pagesStainless Steel 1.4404 316lDilipSinghNo ratings yet

- Fin 3 - Exam1Document12 pagesFin 3 - Exam1DONNA MAE FUENTESNo ratings yet

- Options Trading For Beginners Aug15 v1Document187 pagesOptions Trading For Beginners Aug15 v1Glo BerriNo ratings yet

- Land Use Paln in La Trinidad BenguetDocument19 pagesLand Use Paln in La Trinidad BenguetErin FontanillaNo ratings yet

- Introduction To Radar Warning ReceiverDocument23 pagesIntroduction To Radar Warning ReceiverPobitra Chele100% (1)

- Database Management System and SQL CommandsDocument3 pagesDatabase Management System and SQL Commandsdev guptaNo ratings yet

- Seminar Report of Automatic Street Light: Presented byDocument14 pagesSeminar Report of Automatic Street Light: Presented byTeri Maa Ki100% (2)

- To Syed Ubed - For UpdationDocument1 pageTo Syed Ubed - For Updationshrikanth5singhNo ratings yet

- Modal Case Data Form: GeneralDocument4 pagesModal Case Data Form: GeneralsovannchhoemNo ratings yet

- Permit To Work Audit Checklist OctoberDocument3 pagesPermit To Work Audit Checklist OctoberefeNo ratings yet

- Shares and Share CapitalDocument50 pagesShares and Share CapitalSteve Nteful100% (1)

- Crivit IAN 89192 FlashlightDocument2 pagesCrivit IAN 89192 FlashlightmNo ratings yet

- 16 Easy Steps To Start PCB Circuit DesignDocument10 pages16 Easy Steps To Start PCB Circuit DesignjackNo ratings yet

- 1.2 The Main Components of Computer SystemsDocument11 pages1.2 The Main Components of Computer SystemsAdithya ShettyNo ratings yet

- MNO Manuale Centrifughe IngleseDocument52 pagesMNO Manuale Centrifughe IngleseChrist Rodney MAKANANo ratings yet

- CC Anbcc FD 002 Enr0Document5 pagesCC Anbcc FD 002 Enr0ssierroNo ratings yet

- VRIODocument3 pagesVRIOJane Apple BulanadiNo ratings yet