Professional Documents

Culture Documents

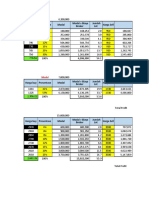

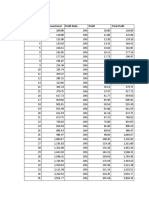

Year Fair Value Depreciation Rate Depreciation Fair Value at The Year End

Uploaded by

Shaina Aragon0 ratings0% found this document useful (0 votes)

4 views1 pageSample

Original Title

Example 4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSample

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageYear Fair Value Depreciation Rate Depreciation Fair Value at The Year End

Uploaded by

Shaina AragonSample

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

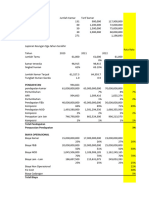

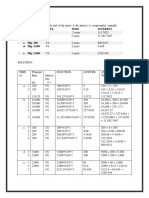

Example 4:

Fair Value = 2,500,000

Residual Value = 500,000

Useful life = 10 years Straight line depreciation rate = 1/10 = 10% per year

Depreciation for December 2020

2,500,000 x 10% x 3/12 = 62,500

Depreciation for December 2021

(2,500,000 – 62,500) x 10% x 12/12 = 243,750

Fair Value at the

Year Fair Value Depreciation Rate Depreciation

year end

1 2,500,000 10% 62,500 1,993,163

2 2,437,500 10% 243,750 1,749,413

3 2,193,750 10% 219,375 1.530,038

4 1,974,375 10% 197,438 1,332,600

5 1,776,937 10% 177,694 1,154,906

6 1,599,243 10% 159,924 994,982

7 1,439,319 10% 143,932 851,050

8 1,295,387 10% 129, 539 721,511

9 1,165,848 10% 116,585 604,926

10 1,049,263 10% 104,926 500,000

You might also like

- Sukanya Samruddhi Returns CalculatorDocument3 pagesSukanya Samruddhi Returns Calculatorleningandhan.sNo ratings yet

- Sukanya Samriddhi Account Excel Calculator DownloadDocument3 pagesSukanya Samriddhi Account Excel Calculator DownloadanuragpugaliaNo ratings yet

- UntitledDocument1 pageUntitledsultan altamashNo ratings yet

- Sandeeptrader Money Management With Daily TargetDocument5 pagesSandeeptrader Money Management With Daily Targethighlightsesports64No ratings yet

- E-Saving CalculatorDocument12 pagesE-Saving CalculatorsarinurkhsnhNo ratings yet

- LTB Money Management - 11Document14 pagesLTB Money Management - 11bijaya swainNo ratings yet

- NPV IrrDocument2 pagesNPV IrrchandanNo ratings yet

- WP HotelDocument4 pagesWP Hotelakbarliverpudlian88No ratings yet

- Book 1Document6 pagesBook 1LNo ratings yet

- The Beer Cafe FOFO - Business Model - JodhpurDocument1 pageThe Beer Cafe FOFO - Business Model - JodhpurTarunNo ratings yet

- ACC Cement: Reference ModelDocument21 pagesACC Cement: Reference Modelsparsh jainNo ratings yet

- Acctg. 9 Prefi Quiz 1 KeyDocument3 pagesAcctg. 9 Prefi Quiz 1 KeyRica CatanguiNo ratings yet

- Tabel MM MNCNDocument5 pagesTabel MM MNCNKhairu SyuhadaNo ratings yet

- Irr On Project and Irr On Equity: by Krigan CapitalDocument6 pagesIrr On Project and Irr On Equity: by Krigan CapitalAziz SaputraNo ratings yet

- Eltu ProjectionsDocument15 pagesEltu ProjectionscphycherryNo ratings yet

- Cogen Project: - Commitment Fees & InterestDocument6 pagesCogen Project: - Commitment Fees & Interestradhika kumarfNo ratings yet

- CF - 80012100326 - H075 - DIV A - Saurav BhandariDocument9 pagesCF - 80012100326 - H075 - DIV A - Saurav BhandariSauravNo ratings yet

- Debt Consolidation VisualDocument3 pagesDebt Consolidation VisualWku9934 9934No ratings yet

- Kangaroo Kids Limited: Particulars Amount (RS.) ParticularsDocument6 pagesKangaroo Kids Limited: Particulars Amount (RS.) ParticularsIshaan AgarwalNo ratings yet

- 3 Statements ModelDocument1 page3 Statements ModelOmar RuizNo ratings yet

- MPMG Tentative Installment PlanDocument1 pageMPMG Tentative Installment PlanAbdul Rehman CheemaNo ratings yet

- 2.0 Mba 670 GMDocument6 pages2.0 Mba 670 GMLauren LoshNo ratings yet

- Caso TeuerDocument46 pagesCaso Teuerjoaquin bullNo ratings yet

- Finicial Model: Cost of Goods Sold (COGS)Document9 pagesFinicial Model: Cost of Goods Sold (COGS)Lawzy Elsadig SeddigNo ratings yet

- Diminishing Balance MethodDocument1 pageDiminishing Balance MethodheribertNo ratings yet

- How To Budget, Save and Invest MoneyDocument18 pagesHow To Budget, Save and Invest MoneyAkramNo ratings yet

- Marketing Channel Traffic Plan 12.12 V.7 - LzadaDocument60 pagesMarketing Channel Traffic Plan 12.12 V.7 - LzadaBúp CassieNo ratings yet

- Sukanya Samriddhi Account Excel Calculator DownloadDocument3 pagesSukanya Samriddhi Account Excel Calculator DownloadTisha AroraNo ratings yet

- Scenario in ExcelDocument4 pagesScenario in ExcelAlisha ShwetaNo ratings yet

- India Retail ForecastDocument2 pagesIndia Retail Forecastapi-3751572No ratings yet

- Análisis Caso New Heritage - Nutresa LinaDocument27 pagesAnálisis Caso New Heritage - Nutresa LinaSARA ZAPATA CANONo ratings yet

- Wso Case Study For MF - PruDocument23 pagesWso Case Study For MF - Prubrentk112No ratings yet

- FM AssignmentDocument27 pagesFM AssignmentMuhammad AkbarNo ratings yet

- Description: Tags: Table-10-2005-06Document3 pagesDescription: Tags: Table-10-2005-06anon-436755No ratings yet

- SFH Rental AnalysisDocument6 pagesSFH Rental AnalysisA jNo ratings yet

- Avis and Herz CarDocument11 pagesAvis and Herz CarSheikhFaizanUl-HaqueNo ratings yet

- Vertical AnalysisDocument3 pagesVertical AnalysisJayvee CaguimbalNo ratings yet

- 미국 건설시장 동향과 진출 전략 (2017년 Kdi)Document155 pages미국 건설시장 동향과 진출 전략 (2017년 Kdi)고석범No ratings yet

- Trade Achievers To PublicDocument4 pagesTrade Achievers To Publictharun venkatNo ratings yet

- BMW Group Ten-Year Comparison: DeliveriesDocument3 pagesBMW Group Ten-Year Comparison: DeliveriesADITYA VERMANo ratings yet

- Sensitivity Analysis On Percentage of Sales 9 11 04Document12 pagesSensitivity Analysis On Percentage of Sales 9 11 04Wan Mohamad Noor Hj IsmailNo ratings yet

- Vietnam Indicator Name: Country Code: VNM Foreign Direct Investment, Net Inflows (Bop, Current Us$)Document6 pagesVietnam Indicator Name: Country Code: VNM Foreign Direct Investment, Net Inflows (Bop, Current Us$)tpqNo ratings yet

- DepreciationDocument2 pagesDepreciationhussain hasniNo ratings yet

- Interate RateDocument3 pagesInterate RatesanthoshNo ratings yet

- Tahun Bulan Modal (RP) Profit (%) Profit (RP)Document12 pagesTahun Bulan Modal (RP) Profit (%) Profit (RP)Renggana Dimas Prayogi WiranataNo ratings yet

- Depreciation - 150% and Double Declining ERATODocument2 pagesDepreciation - 150% and Double Declining ERATOJerbert JesalvaNo ratings yet

- TablesTime ValueofMoneyDocument2 pagesTablesTime ValueofMoneycNo ratings yet

- Budget Period 2016 Profit & Lost Consolidate: Statistic Room Count 97 97 97 97Document6 pagesBudget Period 2016 Profit & Lost Consolidate: Statistic Room Count 97 97 97 97Avip HidayatNo ratings yet

- 01 - Elearning Moodle - Sesi 1 - 20171206Document2 pages01 - Elearning Moodle - Sesi 1 - 20171206Via Clalue D'hatiemuNo ratings yet

- Numeric Model MetricsDocument5 pagesNumeric Model MetricsAnkit NarulaNo ratings yet

- Simulasi Angsuran Program BNI Griya Q2 - BNI ForumDocument4 pagesSimulasi Angsuran Program BNI Griya Q2 - BNI Forumindroarifianto_11871No ratings yet

- Bond PricingDocument16 pagesBond PricingAnonymousNo ratings yet

- Heritage Dolls CaseDocument8 pagesHeritage Dolls Casearun jacobNo ratings yet

- Financial Goal Planning - Ankur WarikooDocument8 pagesFinancial Goal Planning - Ankur WarikooVNo ratings yet

- As 5Document30 pagesAs 52154033039hungNo ratings yet

- Trade StrategyDocument4 pagesTrade StrategyRohma AlineNo ratings yet

- Principal Rate Time Interest A. PHP 100 B. PHP 10,000 C. PHP 200 D. PHP 5,000 E. PHP 2,000Document3 pagesPrincipal Rate Time Interest A. PHP 100 B. PHP 10,000 C. PHP 200 D. PHP 5,000 E. PHP 2,000CONSTANTINO, Ricamille R.No ratings yet

- Valuasi MYOR Dengan Metode DCFDocument7 pagesValuasi MYOR Dengan Metode DCFAqila NaufalNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

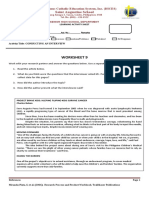

- Worksheet 9: Saint Augustine SchoolDocument2 pagesWorksheet 9: Saint Augustine SchoolShaina AragonNo ratings yet

- Worksheet 13: Saint Augustine SchoolDocument3 pagesWorksheet 13: Saint Augustine SchoolShaina AragonNo ratings yet

- Checklist of Requirements: Saint Augustine SchoolDocument1 pageChecklist of Requirements: Saint Augustine SchoolShaina AragonNo ratings yet

- Pre-Activity: Saint Augustine SchoolDocument6 pagesPre-Activity: Saint Augustine SchoolShaina AragonNo ratings yet

- Checklist of Requirements: Saint Augustine SchoolDocument1 pageChecklist of Requirements: Saint Augustine SchoolShaina AragonNo ratings yet

- Checklist of Requirements: Saint Augustine SchoolDocument1 pageChecklist of Requirements: Saint Augustine SchoolShaina AragonNo ratings yet

- Worksheet 2: Saint Augustine SchoolDocument1 pageWorksheet 2: Saint Augustine SchoolShaina AragonNo ratings yet

- Saint Augustine School: Diocese of Imus Catholic Education System, Inc. (DICES)Document3 pagesSaint Augustine School: Diocese of Imus Catholic Education System, Inc. (DICES)Shaina AragonNo ratings yet

- Saint Augustine School: Diocese of Imus Catholic Education System, Inc. (DICES)Document9 pagesSaint Augustine School: Diocese of Imus Catholic Education System, Inc. (DICES)Shaina AragonNo ratings yet

- Concept Notes 3Document11 pagesConcept Notes 3Shaina AragonNo ratings yet

- Concept Notes 5Document5 pagesConcept Notes 5Shaina AragonNo ratings yet

- Saint Augustine School: Diocese of Imus Catholic Education System, Inc. (DICES)Document8 pagesSaint Augustine School: Diocese of Imus Catholic Education System, Inc. (DICES)Shaina AragonNo ratings yet

- Saint Augustine School: Diocese of Imus Catholic Education System, Inc. (DICES)Document2 pagesSaint Augustine School: Diocese of Imus Catholic Education System, Inc. (DICES)Shaina AragonNo ratings yet

- Checklist of Requirements: Saint Augustine SchoolDocument1 pageChecklist of Requirements: Saint Augustine SchoolShaina AragonNo ratings yet

- Finals Topics: Science, Technology and SocietyDocument15 pagesFinals Topics: Science, Technology and SocietyShaina AragonNo ratings yet

- Transportation and Assignment Model-LPDocument41 pagesTransportation and Assignment Model-LPShaina Aragon100% (1)

- Types of Business According To Activities: Fabm 1Document30 pagesTypes of Business According To Activities: Fabm 1Shaina AragonNo ratings yet

- Debt-Utilization Ratios & Profitability Ratios: Cadalzo Liu Monzon Tuco VillabrilleDocument23 pagesDebt-Utilization Ratios & Profitability Ratios: Cadalzo Liu Monzon Tuco VillabrilleShaina AragonNo ratings yet

- P U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Document10 pagesP U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Shaina AragonNo ratings yet

- Sociological View of SelfDocument45 pagesSociological View of SelfShaina AragonNo ratings yet

- Parental ConcentDocument1 pageParental ConcentShaina AragonNo ratings yet

- Shy's Hidden Bean Coffee ShopDocument3 pagesShy's Hidden Bean Coffee ShopShaina AragonNo ratings yet