Professional Documents

Culture Documents

Estate and Trust Tax Quiz

Uploaded by

angelo vasquezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estate and Trust Tax Quiz

Uploaded by

angelo vasquezCopyright:

Available Formats

Estate and Trust Quiz.

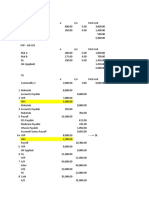

1. A died on January 2, 2016, survived by his wife and four qualified dependent children. He left a net estate of 80

million which is in the hands of an executor. In 2016, 2017, 2018, the estate had identical gross receipts of 7

million, cost of sales of 4 million and business expenses of 2,200,000. The net taxable incomes of the estate in

2016, 2017, and 2018 are?

2. A died on January 2, 2018 leaving a net estate of 4,000,000. The estate is in the hands of an executor. B, a

nephew of A, married is one of the heirs of A.

In 2019m the estate had a gross income of 800,000 and expenses of 500,000 on the properties in the estate. B,

has his own gross sales of 600,000, cost of sales of 400,000 and business expenses of 120,000. The executor

distributed to B the following:

From the properties of the estate 250,000

From the current year’s income, net of 15% CWT 85,000

For 2019, both estate of A and B do not avail the 8% income tax rate option

Required:

a. Taxable income of the estate in 2019

b. The taxable income of B in 2019

c. Income tax payable/refund of B in 2019

3. A created two trust, Trust I and Trust 2 with different trustees but withn a common beneficiary. The following

data pertain to the trusts and the beneficiary’s own account:

Trust I Trust 2 Beneficiary

Gross income 450,000 1090,000 250,000

Allowable deductions 75,000 125,000 100,000

Income distributed to beneficiary (gross of CWT) 150,000 175,000

Required: Determine the taxable income of

A. Trust 1

B. Trust 2

C. Consolidated trust

D. Beneficiary

4. In 2017, A created a trust for his daughter, B and appointed C as the trustee. A transferred a 10 door apartment

where rent income of 190,000 per month (net of 5% withholding tax) was received by the trust with cost of

revenues of 400,000 and deductible expenses of 580,000 in each of the taxable years 2017, and 2018. In both

years, 30% of the net income was given to B. Determine the income tax still due from the trust in 2017 and

2018.

5. A, a resident citizen died 2 years ago leaving a net estate of 4 million. His estate is still under administration. In

2018, the net estate, which includes an apartment, realized a total income of 2,280,000 (net of 5% tax). The

executor distributed 200,000 and 300,000 to A’s daughter and son respectively. 75% of the amount distributed

came from the income of the estate while 25% of which is a non-deductible expense. Determine the tax still due

from estate in 2018

You might also like

- 3.4.1 Answer Key - Assignment - General Principles of Income TaxDocument5 pages3.4.1 Answer Key - Assignment - General Principles of Income Taxsam imperialNo ratings yet

- Advanced Accounting Baker Test Bank Chap016 PDFDocument55 pagesAdvanced Accounting Baker Test Bank Chap016 PDFAnonymousWriter348No ratings yet

- True or False 1Document13 pagesTrue or False 1Mary DenizeNo ratings yet

- TAX Final-PB FEUDocument9 pagesTAX Final-PB FEUkarim abitagoNo ratings yet

- Tax Term Quiz TheoriesDocument6 pagesTax Term Quiz TheoriesRena Jocelle NalzaroNo ratings yet

- Introduction To Estate TaxDocument71 pagesIntroduction To Estate TaxMiko ArniñoNo ratings yet

- Taxes TransferDocument52 pagesTaxes TransferGrayl TalaidNo ratings yet

- Gross Estate Tax QuizzerDocument6 pagesGross Estate Tax QuizzerLloyd Sonica100% (1)

- Estate Tax Chapter SummaryDocument4 pagesEstate Tax Chapter SummaryPJ PoliranNo ratings yet

- Value Added TaxDocument8 pagesValue Added TaxErica VillaruelNo ratings yet

- OBLICONDocument1 pageOBLICONAngelica RoseNo ratings yet

- Chapter 11 Excise TaxDocument10 pagesChapter 11 Excise TaxAmzelle Diego LaspiñasNo ratings yet

- Business Tax Chapter 4 ReviewerDocument3 pagesBusiness Tax Chapter 4 ReviewerMurien LimNo ratings yet

- ABC Co. Started Its OperationsDocument1 pageABC Co. Started Its OperationsQueen ValleNo ratings yet

- Donation As A Mode of Acquiring Ownership: Art. 735 - 773 of The New Civil Code of The PhilippinesDocument46 pagesDonation As A Mode of Acquiring Ownership: Art. 735 - 773 of The New Civil Code of The Philippinesmoshi kpop cartNo ratings yet

- Joey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATDocument10 pagesJoey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATLeah Isabelle Nodalo DandoyNo ratings yet

- Assignment NegoDocument10 pagesAssignment Negomelbertgutzby vivasNo ratings yet

- AVERAGEDocument4 pagesAVERAGEClyde RamosNo ratings yet

- Chapter 4 EXERCISES - Estates and TrustsDocument9 pagesChapter 4 EXERCISES - Estates and TrustscathyydumpNo ratings yet

- Itemized Deductions and Optional Standard Deductions in Income TaxationDocument12 pagesItemized Deductions and Optional Standard Deductions in Income TaxationJimbo ManalastasNo ratings yet

- Yeah Yeah Yeah Yeah YeahDocument7 pagesYeah Yeah Yeah Yeah YeahMika MolinaNo ratings yet

- Partnership Notes 2Document4 pagesPartnership Notes 2Joylyn CombongNo ratings yet

- Booklet 1 Introduction To Transfer Tax - Estate TaxDocument51 pagesBooklet 1 Introduction To Transfer Tax - Estate Taxsunkist0091No ratings yet

- 1st Semester Transfer Taxation Long Quiz No. 01 (2nd Set)Document5 pages1st Semester Transfer Taxation Long Quiz No. 01 (2nd Set)James ScoldNo ratings yet

- Income Tax Test BankDocument65 pagesIncome Tax Test Bankwalsonsanaani3rdNo ratings yet

- 100 % 36 Units Per Day 50 Trucks Per Day 100 % 100 % 36 Units Per Day 40 Trucks Per Day 100 %Document6 pages100 % 36 Units Per Day 50 Trucks Per Day 100 % 100 % 36 Units Per Day 40 Trucks Per Day 100 %Cherie Soriano AnanayoNo ratings yet

- Taxation 7Document6 pagesTaxation 7Bossx BellaNo ratings yet

- Sample Problem of Corporation LiquidationDocument11 pagesSample Problem of Corporation LiquidationAnne Camille Alfonso50% (4)

- Donors Tax Quiz Answers and SolutionsDocument14 pagesDonors Tax Quiz Answers and SolutionsRalph Lawrence Francisco BatangasNo ratings yet

- What Is AccountingDocument76 pagesWhat Is AccountingMa Jemaris Solis0% (1)

- Chapter 6 - Income Tax For PartnershipDocument40 pagesChapter 6 - Income Tax For PartnershipNineteen AùgùstNo ratings yet

- IC On Petty Cash KeyDocument2 pagesIC On Petty Cash KeyLorie RoncalNo ratings yet

- Problems: Problem 4 - 1Document4 pagesProblems: Problem 4 - 1KioNo ratings yet

- Tax 2 Part 3 Estate TaxDocument25 pagesTax 2 Part 3 Estate TaxShane TorrieNo ratings yet

- PARCOR - 3Partnership-OperationsDocument31 pagesPARCOR - 3Partnership-OperationsHarriane Mae GonzalesNo ratings yet

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- Case Digest #1Document4 pagesCase Digest #1Mary Jescho Vidal AmpilNo ratings yet

- DocumentDocument2 pagesDocumentAisaka Taiga0% (1)

- Estate TaxDocument48 pagesEstate TaxBhosx Kim100% (1)

- Problem 3 Page 41Document8 pagesProblem 3 Page 41MAG MAGNo ratings yet

- PFRS of SME and SE - Concept MapDocument1 pagePFRS of SME and SE - Concept MapRey OñateNo ratings yet

- Auditing: Internal Control David N. RicchiuteDocument57 pagesAuditing: Internal Control David N. RicchiuteWaye EdnilaoNo ratings yet

- Income Tax Basic Questions and SolutionsDocument28 pagesIncome Tax Basic Questions and SolutionsbamberoNo ratings yet

- Activity-Based Costing System DesignDocument5 pagesActivity-Based Costing System Designchelsea kayle licomes fuentesNo ratings yet

- A-Standards of Ethical Conduct For Management AccountantsDocument4 pagesA-Standards of Ethical Conduct For Management AccountantsChhun Mony RathNo ratings yet

- Business and Transfer Taxation Chapter 13 Discussion Questions and AnswerDocument2 pagesBusiness and Transfer Taxation Chapter 13 Discussion Questions and AnswerKarla Faye LagangNo ratings yet

- RC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeDocument7 pagesRC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeGwyneth GloriaNo ratings yet

- Final Income TaxationDocument15 pagesFinal Income TaxationElizalen MacarilayNo ratings yet

- FAR2 CHAPTER 1 (PG 1-13)Document13 pagesFAR2 CHAPTER 1 (PG 1-13)Layla MainNo ratings yet

- TaxationDocument9 pagesTaxationGio PacayraNo ratings yet

- FIN 2 Financial Analysis and Reporting: Lyceum-Northwestern UniversityDocument7 pagesFIN 2 Financial Analysis and Reporting: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Activity Chapter 4: Ans. 2,320 SolutionDocument2 pagesActivity Chapter 4: Ans. 2,320 SolutionRandelle James FiestaNo ratings yet

- AC 510 Kimwell Chapter 5 Solutions 1Document134 pagesAC 510 Kimwell Chapter 5 Solutions 1Jeston TamayoNo ratings yet

- TRUE OR FALSE (p.179,180)Document2 pagesTRUE OR FALSE (p.179,180)Aberin GalenzogaNo ratings yet

- Taxation of Estates, Trusts and Co-OwnershipDocument10 pagesTaxation of Estates, Trusts and Co-OwnershipChryshelle Anne Marie LontokNo ratings yet

- Consumption Tax On Sales (Percentage Tax)Document32 pagesConsumption Tax On Sales (Percentage Tax)Alicia Feliciano100% (1)

- Break-Even Analysis: Cost-Volume-Profit AnalysisDocument64 pagesBreak-Even Analysis: Cost-Volume-Profit AnalysisKelvin LeongNo ratings yet

- TX2 - 1st MQ ReviewDocument10 pagesTX2 - 1st MQ ReviewJeasmine Andrea Diane PayumoNo ratings yet

- IRA No. 4 Estate Trust Co-OwnDocument2 pagesIRA No. 4 Estate Trust Co-OwnProlen AcantoNo ratings yet

- CPA Guide to Calculating Estate, Trust and Beneficiary Income TaxesDocument3 pagesCPA Guide to Calculating Estate, Trust and Beneficiary Income TaxesJadeNo ratings yet

- PFRS 8 - Operating SegmentDocument2 pagesPFRS 8 - Operating Segmentangelo vasquezNo ratings yet

- Quiz in Partnership, Joint Venture PDFDocument3 pagesQuiz in Partnership, Joint Venture PDFangelo vasquezNo ratings yet

- Quiz in Corporation PDFDocument4 pagesQuiz in Corporation PDFangelo vasquezNo ratings yet

- Corporation Quiz PDFDocument8 pagesCorporation Quiz PDFangelo vasquezNo ratings yet

- Partnership Co Owenership Joint Venture and Fringe Benefits PDFDocument9 pagesPartnership Co Owenership Joint Venture and Fringe Benefits PDFangelo vasquezNo ratings yet

- Pas 24Document7 pagesPas 24angelo vasquezNo ratings yet

- Quiz in Fringe Benefits PDFDocument3 pagesQuiz in Fringe Benefits PDFangelo vasquezNo ratings yet

- Poverty Sources 2Document11 pagesPoverty Sources 2angelo vasquezNo ratings yet

- Economic History of The PhilippinesDocument4 pagesEconomic History of The Philippinesangelo vasquezNo ratings yet

- Cost AccountinCAgADocument86 pagesCost AccountinCAgAJenifer Belangel100% (4)

- 2010 - 2015 - General Principles PDFDocument14 pages2010 - 2015 - General Principles PDFIELTSNo ratings yet

- FINMAN Chapter 1112Document37 pagesFINMAN Chapter 1112angelo vasquezNo ratings yet

- Job Cost AccountingDocument7 pagesJob Cost AccountingLady Jane CapuchinoNo ratings yet

- BOA Syllabus RFBTDocument4 pagesBOA Syllabus RFBTChrissa Marie VienteNo ratings yet

- PFRS Adopted by SEC As of December 31, 2011 PDFDocument27 pagesPFRS Adopted by SEC As of December 31, 2011 PDFJennybabe PetaNo ratings yet

- Benjamin Gomez v. Enrico PalomarDocument11 pagesBenjamin Gomez v. Enrico PalomarUlyung DiamanteNo ratings yet

- Dll-Eapp 12 Week 15Document5 pagesDll-Eapp 12 Week 15marivic franciscoNo ratings yet

- Agrasar Lecture and Demonstration Programme On Water, Food and Climate ChangeDocument20 pagesAgrasar Lecture and Demonstration Programme On Water, Food and Climate ChangeMinatiBindhaniNo ratings yet

- Impromptu SpeechDocument44 pagesImpromptu SpeechRhea Mae TorresNo ratings yet

- GENCHI INDIA PVT.LTD JOB HAZARDS ANALYSISDocument2 pagesGENCHI INDIA PVT.LTD JOB HAZARDS ANALYSISsakthi venkatNo ratings yet

- Regulatory Guide 1.71Document5 pagesRegulatory Guide 1.71Siis IngenieriaNo ratings yet

- Somatic TherapiesDocument170 pagesSomatic TherapiesDelyn Gamutan Millan100% (2)

- VISTA LAND AND LIFESCAPES INC FinalDocument9 pagesVISTA LAND AND LIFESCAPES INC Finalmarie crisNo ratings yet

- Building A HA SmartConnector Cluster-V2.0.6Document35 pagesBuilding A HA SmartConnector Cluster-V2.0.6Ranadeep BhattacahrayaNo ratings yet

- Gta 07-10-002 Advanced Infantry MarksmanshipDocument2 pagesGta 07-10-002 Advanced Infantry MarksmanshipMark CheneyNo ratings yet

- Gibbs VerBeek CorrespondenceDocument3 pagesGibbs VerBeek CorrespondenceWXMINo ratings yet

- Beyond Investment: The Power of Capacity-Building SupportDocument44 pagesBeyond Investment: The Power of Capacity-Building SupportLaxNo ratings yet

- Leta 2022Document179 pagesLeta 2022Bigovic, MilosNo ratings yet

- Adding Rows Dynamically in A Table Using Interactive Adobe FormsDocument5 pagesAdding Rows Dynamically in A Table Using Interactive Adobe Formsbharath_sajjaNo ratings yet

- The Baldur's Gate Series 1 - Baldur GateDocument125 pagesThe Baldur's Gate Series 1 - Baldur GateJustin MooreNo ratings yet

- Test Method of Flammability of Interior Materials For AutomobilesDocument17 pagesTest Method of Flammability of Interior Materials For AutomobilesKarthic BhrabuNo ratings yet

- (Separation Pay - Legal Termination Due To Authorized Causes) National Federation of Labor v. Court of Appeals, 440 SCRA 604 (2004Document6 pages(Separation Pay - Legal Termination Due To Authorized Causes) National Federation of Labor v. Court of Appeals, 440 SCRA 604 (2004Jude FanilaNo ratings yet

- Three Steps For Reducing Total Cost of Ownership in Pumping SystemsDocument13 pagesThree Steps For Reducing Total Cost of Ownership in Pumping SystemsJuan AriguelNo ratings yet

- CMNS Week 3.2 Memo AssignmentDocument2 pagesCMNS Week 3.2 Memo AssignmentPulkit KalhanNo ratings yet

- Air Pollution Modelling With Deep Learning A ReviewDocument6 pagesAir Pollution Modelling With Deep Learning A ReviewliluNo ratings yet

- Executive MBA Project - Self Help Allowance - FinalDocument55 pagesExecutive MBA Project - Self Help Allowance - FinalKumar SourabhNo ratings yet

- Sika Hi Mod Gel Msds B-1Document5 pagesSika Hi Mod Gel Msds B-1Katherine Dilas Edward CarhuaninaNo ratings yet

- NDC Format For Billing PADDocument3 pagesNDC Format For Billing PADShantkumar ShingnalliNo ratings yet

- Assignment CM Final PDFDocument9 pagesAssignment CM Final PDFRefisa JiruNo ratings yet

- Entrepreneurship 1b Make Your Idea A Reality Unit 3 Critical Thinking QuestionsDocument8 pagesEntrepreneurship 1b Make Your Idea A Reality Unit 3 Critical Thinking QuestionsNastech ProductionNo ratings yet

- Diversity of Tree Vegetation of Rajasthan, India: Tropical Ecology September 2014Document9 pagesDiversity of Tree Vegetation of Rajasthan, India: Tropical Ecology September 2014Abdul WajidNo ratings yet

- Gerry Mulligan DiscographyDocument491 pagesGerry Mulligan DiscographyIan SinclairNo ratings yet

- Measures of Position LessonDocument64 pagesMeasures of Position LessonJIMERSON RAMPOLANo ratings yet

- COT RPMS Rating Sheet For T I III For SY 2021 2022 JhanzDocument2 pagesCOT RPMS Rating Sheet For T I III For SY 2021 2022 Jhanzjhancelle golosindaNo ratings yet