Professional Documents

Culture Documents

1.2 Introducing Double Entry: Suggested Activities

Uploaded by

Donatien OulaiiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1.2 Introducing Double Entry: Suggested Activities

Uploaded by

Donatien OulaiiCopyright:

Available Formats

Cambridge IGCSE and O Level Accounting

1.2 Introducing double entry

Syllabus reference: 2.1

Learning aims: 1 understand the double entry system

2 process accounting data using the double entry system

3 prepare ledger accounts

4 post transactions to the ledger accounts

Prior knowledge: Assets, liabilities and capital

Effects of transactions on elementary statements of financial position

Resources: Coursebook Chapter 2

Workbook Part 2 Section 1 Multiple choice questions 4–6

Workbook Part 2 Section 1 Structured question 8

Worksheet 1.2

You will also need:

Handout with templates of ledger accounts

Handout of short double entry exercises – capital, assets and liabilities;

expenses and incomes; sales, purchases and returns

Suggested activities

1

1 Share the learning aims and outcomes with the students and write on the board or use a

pre-prepared slide or PowerPoint

2 Explain the need for a system of recording daily transactions

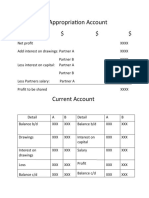

Display a pre-prepared slide or PowerPoint, or a template of a ledger account.

Explain the principles of double entry.

3 Demonstrate double entry book-keeping

Use an exercise on a handout to demonstrate the double entry required for each transaction

(capital, assets and liabilities) on a board, flip chart, slide, etc.

Use an exercise on a handout to demonstrate the double entry required for each transaction

(as above but including expenses and incomes). Individual students could be invited to make

entries on the board.

4 Practical exercise as follow-up

Students work in pairs to complete a short exercise on double entry (to include capital, assets,

liabilities, expenses and incomes).

5 Demonstrate double entry book-keeping

Use an exercise on a handout to demonstrate the double entry required for each transaction

(as above but sales, purchases and returns). Once again, individual students could be invited to

make entries on the board.

6 Practical exercise as follow-up

Students work individually to complete a short exercise on double entry (to include capital,

assets, liabilities, expenses and incomes, sales, purchases and returns).

© Cambridge University Press 2018

Cambridge IGCSE and O Level Accounting

7 Follow-up in next lesson

Demonstration of balancing ledger accounts.

Demonstration of recording carriage and drawings in the ledger.

Interpretation of ledger accounts.

Tasks for more confident students could include:

1 Preparing tables of double entry transactions for other students to complete.

2 Preparing a list of advantages of double entry book-keeping.

3 Researching three column running balance ledger accounts.

8 Homework (or class work at the start of the next lesson)

Worksheet 1.2

© Cambridge University Press 2018

You might also like

- 1.4 Introducing Three Column Cash Books: Suggested ActivitiesDocument2 pages1.4 Introducing Three Column Cash Books: Suggested ActivitiesDonatien Oulaii100% (1)

- 1.3 Introducing Trial Balances: Suggested ActivitiesDocument2 pages1.3 Introducing Trial Balances: Suggested ActivitiesDonatien Oulaii100% (5)

- 1.1 Introducing Accounting: Suggested ActivitiesDocument2 pages1.1 Introducing Accounting: Suggested ActivitiesDonatien Oulaii100% (1)

- IGCSE & OL Accounting WorksheetsDocument73 pagesIGCSE & OL Accounting Worksheetssana.ibrahimNo ratings yet

- Accounts Chapter 8Document10 pagesAccounts Chapter 8R.mNo ratings yet

- PDF Coursebook Chapter 4 Answers - CompressDocument6 pagesPDF Coursebook Chapter 4 Answers - CompressSama ZabadyNo ratings yet

- Worksheet 1.2 Introducing Double EntryDocument3 pagesWorksheet 1.2 Introducing Double EntryKenshin HayashiNo ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument5 pagesCoursebook Answers: Answers To Test Yourself QuestionsDoris Yee50% (2)

- 02 Accounting Study NotesDocument4 pages02 Accounting Study NotesJonas Scheck100% (2)

- Coursebook Chapter 5 Answers PDFDocument3 pagesCoursebook Chapter 5 Answers PDFXx Yung Wei Chin100% (1)

- Cambridge IGCSE and O Level Accouting Workbook AnswersDocument107 pagesCambridge IGCSE and O Level Accouting Workbook Answersღ꧁Lizzy X Roxiie꧂ღ100% (1)

- Coursebook Chapter 10 AnswersDocument2 pagesCoursebook Chapter 10 AnswersAhmed Zeeshan100% (4)

- Mahendra's November transactionsDocument5 pagesMahendra's November transactionsArkar.myanmar 2018100% (1)

- Chapter 5 - Book of Prime EntryDocument16 pagesChapter 5 - Book of Prime EntryHanis NailyNo ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii87% (15)

- Coursebook Chapter 9 AnswersDocument5 pagesCoursebook Chapter 9 AnswersAhmed Zeeshan92% (12)

- Coursebook Chapter 20 AnswersDocument3 pagesCoursebook Chapter 20 AnswersAhmed Zeeshan100% (11)

- Books of Prime EntryDocument23 pagesBooks of Prime Entrymartinah lokmanNo ratings yet

- Accounts Textbook AnswersDocument84 pagesAccounts Textbook AnswersVidhi Patel100% (4)

- Coursebook Chapter 15 AnswersDocument3 pagesCoursebook Chapter 15 AnswersAhmed Zeeshan80% (10)

- Accounting: IgcseDocument22 pagesAccounting: IgcsePiyush RajNo ratings yet

- Coursebook Chapter 6 AnswersDocument2 pagesCoursebook Chapter 6 AnswersAhmed Zeeshan88% (8)

- Chapter 04 - Double Entry Bookkeeping Part BDocument21 pagesChapter 04 - Double Entry Bookkeeping Part BArkar.myanmar 2018No ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument6 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii73% (11)

- Acc - Chapter 18 AmroDocument9 pagesAcc - Chapter 18 AmroWassim AlwanNo ratings yet

- Worksheet 4.1 Introducing Bank ReconciliationDocument4 pagesWorksheet 4.1 Introducing Bank ReconciliationHan Nwe Oo100% (1)

- Coursebook Chapter 11 AnswersDocument4 pagesCoursebook Chapter 11 AnswersAhmed Zeeshan100% (9)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii92% (13)

- Coursebook Chapter 8 AnswersDocument4 pagesCoursebook Chapter 8 AnswersAhmed Zeeshan100% (9)

- Accounting-Formats For Cambridge IGCSEDocument11 pagesAccounting-Formats For Cambridge IGCSEmuhtasim kabir100% (9)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument5 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii85% (20)

- Igcse Accounting Short Answer Questions: Prepared by D. El-HossDocument28 pagesIgcse Accounting Short Answer Questions: Prepared by D. El-HossGodfreyFrankMwakalinga100% (1)

- Coursebook Chapter 16 AnswersDocument3 pagesCoursebook Chapter 16 AnswersAhmed Zeeshan80% (5)

- Chapter17 Incomplete RecordsDocument24 pagesChapter17 Incomplete Recordsmustafakarim100% (1)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument2 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii83% (40)

- Coursebook Section 3 Practice Question AnswersDocument9 pagesCoursebook Section 3 Practice Question AnswersAhmed Zeeshan91% (11)

- IGCSE ACCOUNTING Syllabus Code: 0452 Scheme of Work Course OverviewDocument4 pagesIGCSE ACCOUNTING Syllabus Code: 0452 Scheme of Work Course OverviewAmin Mofreh100% (1)

- ASAL Accounting Workbook Starter PackDocument26 pagesASAL Accounting Workbook Starter Packcthiruvazhmarban100% (1)

- Coursebook Section 2 Practice Question AnswersDocument5 pagesCoursebook Section 2 Practice Question AnswersAhmed Zeeshan100% (8)

- Accounting Revision Notes (0452)Document38 pagesAccounting Revision Notes (0452)MissAditi KNo ratings yet

- Eduseeds: IGCSE Accounting 902Document21 pagesEduseeds: IGCSE Accounting 902NandaNo ratings yet

- IGCSE & OL Accounting Worksheets AnswersDocument53 pagesIGCSE & OL Accounting Worksheets Answerssana.ibrahimNo ratings yet

- Cambridge IGCSE and Cambridge O Level Accounting: Teacher GuideDocument26 pagesCambridge IGCSE and Cambridge O Level Accounting: Teacher Guidekalash parekh100% (1)

- Igcse Accounting Cash Book & Petty Cash Book: Prepared by D. El-HossDocument42 pagesIgcse Accounting Cash Book & Petty Cash Book: Prepared by D. El-HossArvind Harrah100% (1)

- Cambridge Igcse and o Level Accounting Course BookDocument8 pagesCambridge Igcse and o Level Accounting Course BookJaime0% (1)

- IGCSE Accounting O Level p1 Answers PDFDocument17 pagesIGCSE Accounting O Level p1 Answers PDFNusaibah AssyifaNo ratings yet

- Igcse and o Level Accounting Course BookDocument31 pagesIgcse and o Level Accounting Course Bookngaa100% (2)

- Clubs and Societies Chapter QuestionsDocument11 pagesClubs and Societies Chapter QuestionsRitu Singla.No ratings yet

- ch 19-Answers to textbook ques 1025243368Document4 pagesch 19-Answers to textbook ques 1025243368ayten.ayman.eleraky100% (1)

- Introduction To AccountingDocument3 pagesIntroduction To AccountingDamith Piumal Perera100% (1)

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersFrom EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersRating: 2 out of 5 stars2/5 (4)

- 0452 2010 SW 4 PDFDocument7 pages0452 2010 SW 4 PDFAbirHudaNo ratings yet

- Grade 9 Accounting Syllabus Overview 2020-2021Document5 pagesGrade 9 Accounting Syllabus Overview 2020-2021Kelvin CalvinNo ratings yet

- IGCSE Accounting 0452: Unit No 4: Accounting ProceduresDocument7 pagesIGCSE Accounting 0452: Unit No 4: Accounting ProceduresmkbawtNo ratings yet

- AP-115-Unit-4 RECORDING BUSINESS TRANSACTIONSDocument40 pagesAP-115-Unit-4 RECORDING BUSINESS TRANSACTIONSBebie Joy Urbano100% (1)

- Revision Checklist For O Level Principle of Accounts 7110 FINALDocument15 pagesRevision Checklist For O Level Principle of Accounts 7110 FINALMuhammad Hassaan MubeenNo ratings yet

- ACC 329 Course CompactDocument6 pagesACC 329 Course CompactKehindeNo ratings yet

- Complete: AccountingDocument47 pagesComplete: AccountingKamranKhan88% (8)

- Lesson Plan Double-Entry AccountingDocument4 pagesLesson Plan Double-Entry AccountingJuadjie ParbaNo ratings yet

- The Course Plan Of:: The Instructor: Dr. Rabie EidDocument3 pagesThe Course Plan Of:: The Instructor: Dr. Rabie EidAA BB MMNo ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument6 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii73% (11)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii87% (15)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii92% (13)

- 1.5 Introducing Petty Cash Books: Suggested ActivitiesDocument2 pages1.5 Introducing Petty Cash Books: Suggested ActivitiesDonatien Oulaii100% (2)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument5 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii85% (20)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument2 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii83% (40)

- 1.5 Introducing Petty Cash Books: Suggested ActivitiesDocument2 pages1.5 Introducing Petty Cash Books: Suggested ActivitiesDonatien Oulaii100% (2)

- 1.2 Introducing Double Entry: Suggested ActivitiesDocument2 pages1.2 Introducing Double Entry: Suggested ActivitiesDonatien Oulaii0% (1)

- Stock Trading Mastery - Explainer PDFDocument19 pagesStock Trading Mastery - Explainer PDFAG ShayariNo ratings yet

- Monitor Deloitte - CaseStudy - Footloose - 2019Document20 pagesMonitor Deloitte - CaseStudy - Footloose - 2019Ester SusantoNo ratings yet

- What Is Riba ? Types of Riba?Document14 pagesWhat Is Riba ? Types of Riba?Salman RasheedNo ratings yet

- 7 Themes of PRINCE2® MethodologyDocument2 pages7 Themes of PRINCE2® MethodologySocrates KontosNo ratings yet

- English Technical Writing SamplesDocument27 pagesEnglish Technical Writing Samplesabaine20% (2)

- Life Cycle Q&aDocument48 pagesLife Cycle Q&aanjNo ratings yet

- Full Report - SMA TechniquesDocument3 pagesFull Report - SMA TechniquesAirane ChanNo ratings yet

- Applicant.: January 24, 2022Document26 pagesApplicant.: January 24, 2022bryle marq coronaNo ratings yet

- Consulting - Hydrocarbon Loss NCM3 PDFDocument4 pagesConsulting - Hydrocarbon Loss NCM3 PDFFredys Anibal Barraza RojanoNo ratings yet

- 020 CHRC Quarry Business Plan Draft V1.1 26 September 2019Document105 pages020 CHRC Quarry Business Plan Draft V1.1 26 September 2019hussen seidNo ratings yet

- Li & Fung - Final PresentationDocument26 pagesLi & Fung - Final PresentationapoorvsinghalNo ratings yet

- Labour Turnover PDFDocument5 pagesLabour Turnover PDFTrinay DebnathNo ratings yet

- Indian Contract Act, 1872Document111 pagesIndian Contract Act, 1872bhishamshah70No ratings yet

- Cpe CM White Paper en v1.1Document15 pagesCpe CM White Paper en v1.1PraveenNo ratings yet

- ValuationDocument39 pagesValuationRobel WendwesenNo ratings yet

- Dun & BradstreetDocument1 pageDun & BradstreetAnonymous FnM14a0No ratings yet

- Test 10Document27 pagesTest 10Nhan DangNo ratings yet

- BarcelonaDocument15 pagesBarcelonaSyed Quasain Ali NaqviNo ratings yet

- Lean Tools - PDCA Cycle & 5SDocument19 pagesLean Tools - PDCA Cycle & 5SRathod MayurNo ratings yet

- BEST - Payroll HR Executive SummaryDocument7 pagesBEST - Payroll HR Executive SummarysimhengNo ratings yet

- Bus Tax Chap 6Document3 pagesBus Tax Chap 6yayayaNo ratings yet

- Labor Relations Termination GuideDocument15 pagesLabor Relations Termination GuideOlenFuerteNo ratings yet

- The Relationship Between Human Resource Practices and Employee RetentionDocument244 pagesThe Relationship Between Human Resource Practices and Employee RetentiontemozNo ratings yet

- The Kerala State Co-Operative Bank LTD Customer Rights PolicyDocument14 pagesThe Kerala State Co-Operative Bank LTD Customer Rights PolicyAkhilAkhilNo ratings yet

- Cengage Advantage Books Law For Business 19th Edition Ashcroft Solutions Manual DownloadDocument4 pagesCengage Advantage Books Law For Business 19th Edition Ashcroft Solutions Manual DownloadAndrew Hollis100% (32)

- Gazdasági Ismeretek Angol Nyelven EconomicsDocument7 pagesGazdasági Ismeretek Angol Nyelven Economics121CreativeCatNo ratings yet

- FALL 2012 ON CAMPUS Midterm 2Document10 pagesFALL 2012 ON CAMPUS Midterm 2UFECO2023No ratings yet

- EOS - Disney Pixar - Group 7Document9 pagesEOS - Disney Pixar - Group 7Amod VelingkarNo ratings yet

- Sedafiat SDN BHD Goes Live On Ramco ERP (Company Update)Document3 pagesSedafiat SDN BHD Goes Live On Ramco ERP (Company Update)Shyam SunderNo ratings yet

- Provident Fund (PF)Document13 pagesProvident Fund (PF)chandub6No ratings yet