Professional Documents

Culture Documents

Mergers and Acquisiotns

Uploaded by

sudhir0 ratings0% found this document useful (0 votes)

24 views1 pageM&A Practical files

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentM&A Practical files

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views1 pageMergers and Acquisiotns

Uploaded by

sudhirM&A Practical files

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

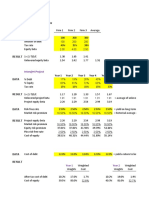

PROJECT IRISH

Weighted-Average Cost of Capital Analysis

(in millions, except per share amounts)

Assumptions

(1)

Risk-Free Interest Rate 2.87%

Market Risk Premium (2) 5.00%

(3)

Size Premium 1.50%

Marginal Tax Rate 31.0%

Target Unlevered Equity Beta (4) 1.4

Levered Market Net Debt/ Unlevered

Equity Net Value of Enterprise Enterprise Equity

Company Ticker Beta Debt Equity Value Value Beta

Actuant Corporation (AKA Enerpac) NYSE:ATU 1.5 393.7 $1,356.2 $1,749.9 22.5% 1.3

Briggs & Stratton Corporation NYSE:BGG 1.6 284.3 899.4 1,183.7 24.0% 1.3

Oshkosh Corporation NYSE:OSK 1.8 454.0 5,724.6 6,178.6 7.3% 1.7

Sun Hydraulics Corporation (AKA Helios Technologies)

NasdaqGS:SNHY 1.5 55.0 1,642.9 1,697.8 3.2% 1.5

Mean 14.3% 1.4

Median 14.9% 1.4

High 24.0% 1.7

Low 3.2% 1.3

Optimal Net Debt/Enterprise Value

14.9% 17.4% 19.9% 22.4% 24.9% 27.4%

Levered Cost of Equity (5)

12.1% 12.3% 12.5% 12.7% 12.9% 13.1%

Pre-Tax

(7) (6)

Cost of Debt Weighted-Average Cost of Capital

6.0% 10.9% 10.9% 10.8% 10.8% 10.7% 10.6%

6.5% 11.0% 10.9% 10.9% 10.8% 10.8% 10.7%

7.0% 11.0% 11.0% 11.0% 10.9% 10.9% 10.8%

7.5% 11.1% 11.1% 11.0% 11.0% 11.0% 10.9%

8.0% 11.1% 11.1% 11.1% 11.1% 11.0% 11.0%

(1) 20-year Treasury rate on 12/31/2018.

(2) The long-term, arithmetic average premium of common stock returns over the risk-free interest rate as computed by Ibbotson & Associates.

(3) Source: Ibbotson & Associates; S&P 500 benchmarks.

(4) Levered Equity Beta = Unlevered Equity Beta * [1 + (Net Debt/Market Value of Equity) * (1 - Tax Rate)].

(5) Based on the Capital Asset Pricing Model: Levered Cost of Equity = Risk-Free Interest Rate + (Levered Equity Beta * Market Risk Premium) + Size Premium.

(6) WACC = [Levered Cost of Equity * (Market Value of Equity/Enterprise Value)] + [Cost of Debt * (1 - Tax Rate) * (Net Debt/Enterprise Value)].

(7) Cost of Debt was found to be 5.77%.

You might also like

- WACC AnalysisDocument9 pagesWACC AnalysisFadhilNo ratings yet

- Company Name: Financial ModelDocument13 pagesCompany Name: Financial ModelGabriel AntonNo ratings yet

- Complete Private Equity ModelDocument16 pagesComplete Private Equity ModelMichel MaryanovichNo ratings yet

- BCP Fixed Income Presentation - 2Q20Document36 pagesBCP Fixed Income Presentation - 2Q20Diego BRNo ratings yet

- WACC Calculation Comparable Companies Unlevered Beta Capital StructureDocument1 pageWACC Calculation Comparable Companies Unlevered Beta Capital StructureIkramNo ratings yet

- PI Industries Limited BSE 523642 Financials RatiosDocument5 pagesPI Industries Limited BSE 523642 Financials RatiosRehan TyagiNo ratings yet

- Private Equity Model Template For InvestorsDocument12 pagesPrivate Equity Model Template For InvestorsousmaneNo ratings yet

- AFM Sample Model - 2 (Horizontal)Document18 pagesAFM Sample Model - 2 (Horizontal)munaftNo ratings yet

- Fund 8322 Black Rock Us Equity IndexDocument1 pageFund 8322 Black Rock Us Equity IndexMikeNo ratings yet

- Earnings Highlight - Forte Oil Nigeria PLC Fy 2017Document1 pageEarnings Highlight - Forte Oil Nigeria PLC Fy 2017LawNo ratings yet

- Equity Valuation Project: GroupDocument20 pagesEquity Valuation Project: Groupsushilgoyal86100% (1)

- Company Equity Enterprise Value Sales Gross Profit: Market Valuation LTM Financial StatisticsDocument34 pagesCompany Equity Enterprise Value Sales Gross Profit: Market Valuation LTM Financial StatisticsRafał StaniszewskiNo ratings yet

- MAD AssignmentDocument4 pagesMAD AssignmentSWETHA LAGISETTINo ratings yet

- SR - No Financial Ratios Bank Alfalah (Commerial Bank) 2020 1 Profitability RatiosDocument2 pagesSR - No Financial Ratios Bank Alfalah (Commerial Bank) 2020 1 Profitability RatiosAYYAZ TARIQNo ratings yet

- AccretionDilution AnalysisDocument14 pagesAccretionDilution AnalysisJayash KaushalNo ratings yet

- Mercer-Capital Bank Valuation AKG PDFDocument60 pagesMercer-Capital Bank Valuation AKG PDFDesmond Dujon HenryNo ratings yet

- DCF ConeDocument37 pagesDCF Conejustinbui85No ratings yet

- Financial Spreadsheet KOSONGAN FinalDocument7 pagesFinancial Spreadsheet KOSONGAN FinalDwi PermanaNo ratings yet

- DCF Modelling - WACC - CompletedDocument1 pageDCF Modelling - WACC - Completed2203037No ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Astro & Time FinancialsDocument4 pagesAstro & Time FinancialsDorcas YanoNo ratings yet

- 2019-09-21T174353.577Document4 pages2019-09-21T174353.577Mikey MadRat100% (1)

- The Fat Lady Is Singing: Spring 2021: Aswath DamodaranDocument34 pagesThe Fat Lady Is Singing: Spring 2021: Aswath DamodaranEXII iNo ratings yet

- LiquiLoans - Prime Retail Fixed Income Investment Opportunity - Oct. 2022Document25 pagesLiquiLoans - Prime Retail Fixed Income Investment Opportunity - Oct. 2022Vivek SinghalNo ratings yet

- Comparable Companies: Inter@rt ProjectDocument9 pagesComparable Companies: Inter@rt ProjectVincenzo AlterioNo ratings yet

- Dcf-Analysis Calculator (Edit Items in Blue)Document4 pagesDcf-Analysis Calculator (Edit Items in Blue)Christopher GuidryNo ratings yet

- 06 - Aditi Jhanwar IAPM Presentation PDFDocument37 pages06 - Aditi Jhanwar IAPM Presentation PDFAditi JhanwarNo ratings yet

- Profitability Ratios: Net Interest Margin Net Profit MarginDocument1 pageProfitability Ratios: Net Interest Margin Net Profit MarginAli ImranNo ratings yet

- Vanguard Global Stock Index FundDocument4 pagesVanguard Global Stock Index FundjorgeperezsidecarshotmailomNo ratings yet

- Creative Enterprise Holdings Limited SEHK 3992 FinancialsDocument32 pagesCreative Enterprise Holdings Limited SEHK 3992 FinancialsxunstandupNo ratings yet

- Cours 2 Essec 2018 Lbo PDFDocument81 pagesCours 2 Essec 2018 Lbo PDFmerag76668No ratings yet

- Project FşnanceDocument2 pagesProject FşnanceAhmet ErNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Banco Santander Chile 3Q18 Earnings Report: October 31, 2018Document32 pagesBanco Santander Chile 3Q18 Earnings Report: October 31, 2018manuel querolNo ratings yet

- The Debt Trade-Off HPDocument3 pagesThe Debt Trade-Off HP/jncjdncjdnNo ratings yet

- Enph EstimacionDocument38 pagesEnph EstimacionPablo Alejandro JaldinNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Executive Summary: S11158164 S11157500 S11157427 S11159403 S11158400Document12 pagesExecutive Summary: S11158164 S11157500 S11157427 S11159403 S11158400Navin N Meenakshi ChandraNo ratings yet

- Financial Synergy Valuation Template 1Document2 pagesFinancial Synergy Valuation Template 1Luthfi MNo ratings yet

- The Warren Buffett Spreadsheet - PreviewDocument350 pagesThe Warren Buffett Spreadsheet - PreviewbysqqqdxNo ratings yet

- Practice Exercise - Berger PaintsDocument8 pagesPractice Exercise - Berger PaintsKARIMSETTY DURGA NAGA PRAVALLIKANo ratings yet

- Air Thread Case FinalDocument49 pagesAir Thread Case FinalJonathan GranowitzNo ratings yet

- Excel Model The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument29 pagesExcel Model The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka33% (6)

- Cash Return On Invested CapitalDocument8 pagesCash Return On Invested CapitalMichael JacopinoNo ratings yet

- St. James Select Value Factsheet 202112Document4 pagesSt. James Select Value Factsheet 202112ft2qzjpzqvNo ratings yet

- Equity Fund: % Top 10 Holding As On 31st March 2019Document1 pageEquity Fund: % Top 10 Holding As On 31st March 2019Sajith KumarNo ratings yet

- Max S Group Inc PSE MAXS FinancialsDocument36 pagesMax S Group Inc PSE MAXS FinancialsJasper Andrew AdjaraniNo ratings yet

- WACC NikeDocument5 pagesWACC NikeDevia SuswodijoyoNo ratings yet

- WACC NikeDocument5 pagesWACC Nikenatya lakshitaNo ratings yet

- Pioneer Funds - Global Ecology: January 2013Document2 pagesPioneer Funds - Global Ecology: January 2013zekacNo ratings yet

- Ikhtisar Data Keuangan enDocument8 pagesIkhtisar Data Keuangan enFarisNo ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- The Warren Buffett Spreadsheet Final-Version - PreviewDocument335 pagesThe Warren Buffett Spreadsheet Final-Version - PreviewHari ganesh RNo ratings yet

- Masonite Corp DCF Analysis FinalDocument5 pagesMasonite Corp DCF Analysis FinaladiNo ratings yet

- Valiant - 4q22 - Presentation For Analysts and Media RepresentativesDocument32 pagesValiant - 4q22 - Presentation For Analysts and Media RepresentativesMiguel RamosNo ratings yet

- UPL Limited BSE 512070 Financials RatiosDocument5 pagesUPL Limited BSE 512070 Financials RatiosRehan TyagiNo ratings yet

- Stitch Fix Inc NasdaqGS SFIX FinancialsDocument41 pagesStitch Fix Inc NasdaqGS SFIX FinancialsanamNo ratings yet

- Jollibee Foods Corporation PSE JFC FinancialsDocument38 pagesJollibee Foods Corporation PSE JFC FinancialsJasper Andrew AdjaraniNo ratings yet

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Engineering and Commercial Functions in BusinessFrom EverandEngineering and Commercial Functions in BusinessRating: 5 out of 5 stars5/5 (1)

- FM McqsDocument43 pagesFM Mcqssuryakanta garnaik100% (4)

- P3-5a, p3-2b William 6081901032 FDocument13 pagesP3-5a, p3-2b William 6081901032 FWilliam Wihardja0% (1)

- What Is Free Cash Flow and How Do I Calculate It?: A Summary Provided by Pamela Peterson Drake, James Madison UniversityDocument8 pagesWhat Is Free Cash Flow and How Do I Calculate It?: A Summary Provided by Pamela Peterson Drake, James Madison UniversityNikhil GandhiNo ratings yet

- AssignmentDocument8 pagesAssignmentSameer SawantNo ratings yet

- Acquisition Wars: Prof. Ian GiddyDocument30 pagesAcquisition Wars: Prof. Ian GiddyJunaid RazzaqNo ratings yet

- Chap 002Document16 pagesChap 002Ela PelariNo ratings yet

- SMBU How To Find and Trade Stocks in Play PDFDocument17 pagesSMBU How To Find and Trade Stocks in Play PDFkabhijit04100% (3)

- Henry W. Chesbrough and Andrew R. GarmanDocument8 pagesHenry W. Chesbrough and Andrew R. GarmanNeha KumarNo ratings yet

- BlaDocument8 pagesBlaGiga KutkhashviliNo ratings yet

- Business Combination Sample Problem Answer KeyDocument2 pagesBusiness Combination Sample Problem Answer KeyLyca Mae CubangbangNo ratings yet

- 9381 - Soal Uas Akl 2Document14 pages9381 - Soal Uas Akl 2Kurnia Purnama Ayu0% (3)

- Foreign Portfolio Investment in IndiaDocument8 pagesForeign Portfolio Investment in IndiaAnkur ShuklaNo ratings yet

- Aagf 20080430 e Rapportannuel2007Document38 pagesAagf 20080430 e Rapportannuel2007AKFLABSNo ratings yet

- Mba Finance Project A STUDY ON INVESTORS ATTITUDE AND KNOWLEDGE TOWARDS INVESTMENT OPTIONS AVAILABEL IN INDIA WITH SPECIAL REFERENCE TO UAE BASED NDocument116 pagesMba Finance Project A STUDY ON INVESTORS ATTITUDE AND KNOWLEDGE TOWARDS INVESTMENT OPTIONS AVAILABEL IN INDIA WITH SPECIAL REFERENCE TO UAE BASED NRahul SinghNo ratings yet

- What Is Stock ExchangeDocument16 pagesWhat Is Stock ExchangeNeha_18No ratings yet

- What Are Mutual FundsDocument8 pagesWhat Are Mutual Fundsrushi4youNo ratings yet

- You Are Here Top Ranked FundsDocument5 pagesYou Are Here Top Ranked FundsbabaisandipNo ratings yet

- (FOREX) MTPredictor Trading Course - Part2Document396 pages(FOREX) MTPredictor Trading Course - Part2lestercedes100% (5)

- Completing The Accounting CycleDocument64 pagesCompleting The Accounting CycleThelearningHights100% (1)

- FMOD PROJECT Ouijhggfffe5Document97 pagesFMOD PROJECT Ouijhggfffe5Omer CrestianiNo ratings yet

- 21 Secrets I Wish I Knew at The Start of My Investing CareerDocument5 pages21 Secrets I Wish I Knew at The Start of My Investing Careerjohnsmith1806No ratings yet

- ICICI Prudential Mutual Fund's Performance AnalysisDocument27 pagesICICI Prudential Mutual Fund's Performance AnalysisBrojo MondalNo ratings yet

- Trading With Clouds: The Art of IchimokuDocument30 pagesTrading With Clouds: The Art of IchimokuMarcos Duvares100% (6)

- Introduction To ULIPDocument24 pagesIntroduction To ULIPPriyanka KumariNo ratings yet

- Samsung Cash Flow and Fund Flow2Document14 pagesSamsung Cash Flow and Fund Flow2Suhas ChowdharyNo ratings yet

- How To Prepare Trial BalanceDocument4 pagesHow To Prepare Trial Balancegundala_thejokarthikNo ratings yet

- Wharton Venture CapitalDocument9 pagesWharton Venture CapitalMarthy RavelloNo ratings yet

- Chart of AccountsDocument8 pagesChart of AccountsMariaCarlaMañagoNo ratings yet

- Applying The Gordon Growth ModelDocument3 pagesApplying The Gordon Growth Modelmohit25kNo ratings yet